The West Bengal Student Credit Card Scheme is a program by the Higher Education Department of the West Bengal Government under the visionary leadership of Mamata Banerjee, aimed at providing financial assistance to students in pursuing their education. This scheme ensures students don’t face money problems while studying in India or abroad.

The WB Student Credit Card Scheme supports students at all levels of education, including secondary, higher secondary, madrasah (an educational institution in the Islamic tradition), undergraduate, postgraduate, and professional degrees. It also extends financial aid to students enrolling in coaching programs for competitive examinations like IAS, IPS, engineering, and medicine.

This webpage will help you understand more about the West Bengal Student Credit Card (WBSCC), its scheme details, eligibility, loan details, and so on.

Students in West Bengal with WB Student Credit Card can borrow up to ₹10 lakh at 4% simple interest from cooperatives or other banks. This particular credit card has Zero Annual fees making it easy for the students to afford.

Table of Contents:

- ⇾ West Bengal Student Credit Card Scheme Details

- ⇾ West Bengal Student Credit Card Eligibility

- ⇾ West Bengal Student Credit Card Loan Interest Rate

- ⇾ West Bengal Student Credit Card Limit

- ⇾ Documents Required for WB Student Credit Card

- ⇾ Apply for West Bengal Student Credit Card

- ⇾ WBSCC Student Loan Security & Insurance

- ⇾ West Bengal Student Credit Card Application Form

- ⇾ WB Student Credit Card Repayment Rules

- ⇾ West Bengal Student Credit Card Grievance Redressal

- ⇾ Frequently Asked Questions

West Bengal Student Credit Card Scheme Details

Below are the key details of the initiatives and benefits the West Bengal Government provides to support students through improved education infrastructure, scholarships, and the Student Credit Card Scheme for financial assistance.

| Highlights | Details |

|---|---|

| Loan Amount | Up to ₹10 lakhs |

| Interest Rate | 4% per year (1% concession if paid during the study period) |

| Purpose | Covers education from secondary to post-doctoral levels, including professional and vocational courses. |

| Tenure | Up to 15 years, including a moratorium/repayment holiday. |

Check the best offers & apply for a credit card!

West Bengal Student Credit Card Eligibility

Understanding the eligibility criteria for the West Bengal Student Credit Card can empower students to access financial support for their educational pursuits. Let's explore the key requirements that pave the way for this opportunity.

- Residency and Nationality:

- The student must be an Indian citizen and a resident of West Bengal for at least 10 years.

- A self-declaration confirming residency is accepted.

- Enrollment:

- The student must be enrolled in higher studies or research programs in India or abroad.

- Eligible institutions include schools, madrasahs, colleges, universities, and professional institutes like IITs, IIMs, AIIMS, NITs, IISc, and others.

- Students preparing for competitive exams (like IAS, IPS, WBCS, Engineering, Medical, or Law) through coaching centers are also eligible.

- Age Limit:

- The applicant must be 40 years or younger when applying for the loan.

- Repayment Period:

- Duration: Up to 15 years, including any moratorium or repayment holiday.

- Moratorium Period: A grace period of one year after completing the course, during which repayment is not required.

- Early Repayment: Borrowers can repay the loan before the end of the 15-year term without any penalties.

West Bengal Student Credit Card Loan Interest Rate

This scheme offers affordable education loans with concessional interest rates and additional benefits, ensuring minimal financial stress for students and their families.

WBSCC Interest Rate Details

| Category | Details |

|---|---|

| Base Interest Rate | Based on SBI’s 3-year MCLR + 1%. |

| Final Interest Rate | Fixed at sanction and remains unchanged for loans up to ₹10,00,000. |

| Girl Student Concession | Additional 0.5% concession on the interest rate. |

| State Government Subsidy | Effective interest rate capped at 4% per year for all borrowers. |

| Interest Concession | 1% additional concession for paying interest during the moratorium period. |

WBSCC Loan Agreement & Charges

| Category | Details |

|---|---|

| Interest Calculation | Simple annual interest rate. |

| Loan Agreement | Formalized between the student, parent/guardian, and the bank. |

| Application Submission | Joint submission by the student and the parent/guardian. |

West Bengal Student Credit Card Limit

The West Bengal Student Credit Card Scheme provides up to ₹10 lakh to support students in covering a wide range of educational expenses, ensuring that financial constraints do not hinder their academic aspirations.

West Bengal Student Credit Card Loan Amount

| Expense Category | Details |

|---|---|

| Maximum Loan Amount | ₹10 lakh |

- Tuition Fees: For both domestic and international institutions.

- Books and Study Materials: Laptops, software, and other learning tools.

- Accommodation: Hostel or rental expenses for students studying away from home.

- Travel Costs: For students studying abroad.

This comprehensive loan coverage ensures that students can focus entirely on their education without financial barriers.

Don't know your credit score? You can find out for free!

Documents Required for WB Student Credit Card

The below-mentioned points ensure applicants prepare all necessary documents in the correct format and size for smooth submission.

- Applicant’s Photo:

- A recent colored photo in .jpeg or .jpg format (size: 20 KB to 50 KB).

- Co-applicants/ Co- borrower's Photo:

- A recent colored photo in .jpeg or .jpg format (size: 20 KB to 50 KB).

- Applicant’s Signature:

- A scanned signature in .jpeg or .jpg format (size: 10 KB to 50 KB).

- Co-borrowers/Guardian’s Signature:

- A scanned signature in .jpeg or .jpg format (size: 10 KB to 50 KB).

- AADHAR Card:

- Applicant’s AADHAR card in .pdf format (size: 50 KB to 400 KB).

- Age Proof:

- Document showing applicant’s age in .pdf format (size: 50 KB to 400 KB).

- Address Proof of Co-borrower/Guardian:

- Address proof in .pdf format (size: 50 KB to 400 KB).

- Admission Receipt:

- Proof of admission in .pdf format (size: 50 KB to 400 KB).

- PAN Card or Undertaking:

- Applicant’s PAN card or a declaration if there is no PAN card, in .pdf format (size: 50 KB to 400 KB).

- Guardian’s PAN Card or Undertaking:

- Co-borrower’s/Guardian’s PAN card or a declaration if there is no PAN card, in .pdf format (size: 50 KB to 400 KB).

- Institution Certificate/Prospectus:

- Document from the institution listing fees like admission, examination, or hostel charges in .pdf format (size: 50 KB to 400 KB).

- Marksheet/Certificate of Last Qualifying Exam:

- The applicant’s latest marksheet or certificate in .pdf format (size: 50 KB to 400 KB).

Apply for West Bengal Student Credit Card

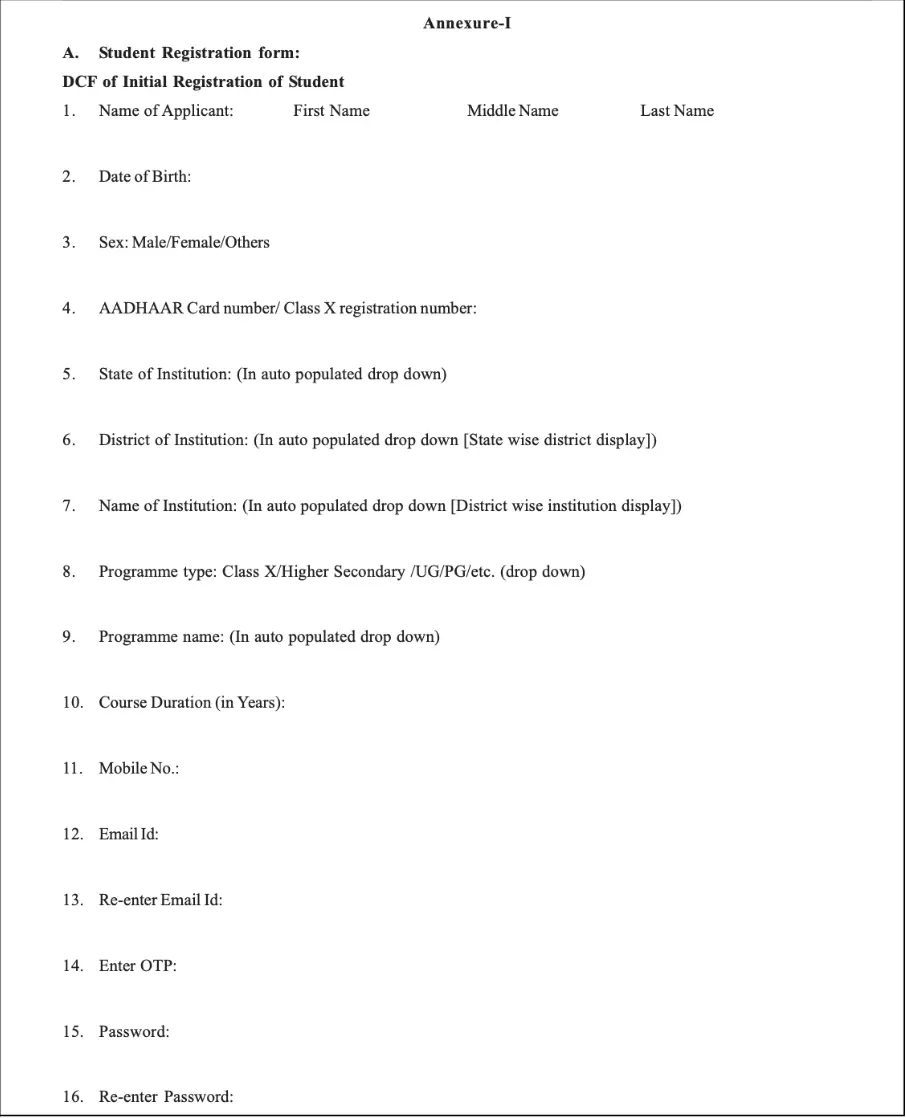

The West Bengal Student Credit Card application process has two stages: Registration and Application. Below is a step-by-step guide to help you apply easily.

Step 1: WB Student Credit Card Registration

- Visit the official website.

- Click on 'Student Registration'.

- Fill in your basic details:

- Name, gender, date of birth, and mobile number.

- Institution's name, state, and district.

- Name and type of the program you are studying.

- Create a strong password and confirm it.

- Click 'Register'.

- You will receive an OTP on your registered mobile number. Enter the OTP to verify your registration.

- Once registered, you will get a unique ID for all future communication regarding your loan.

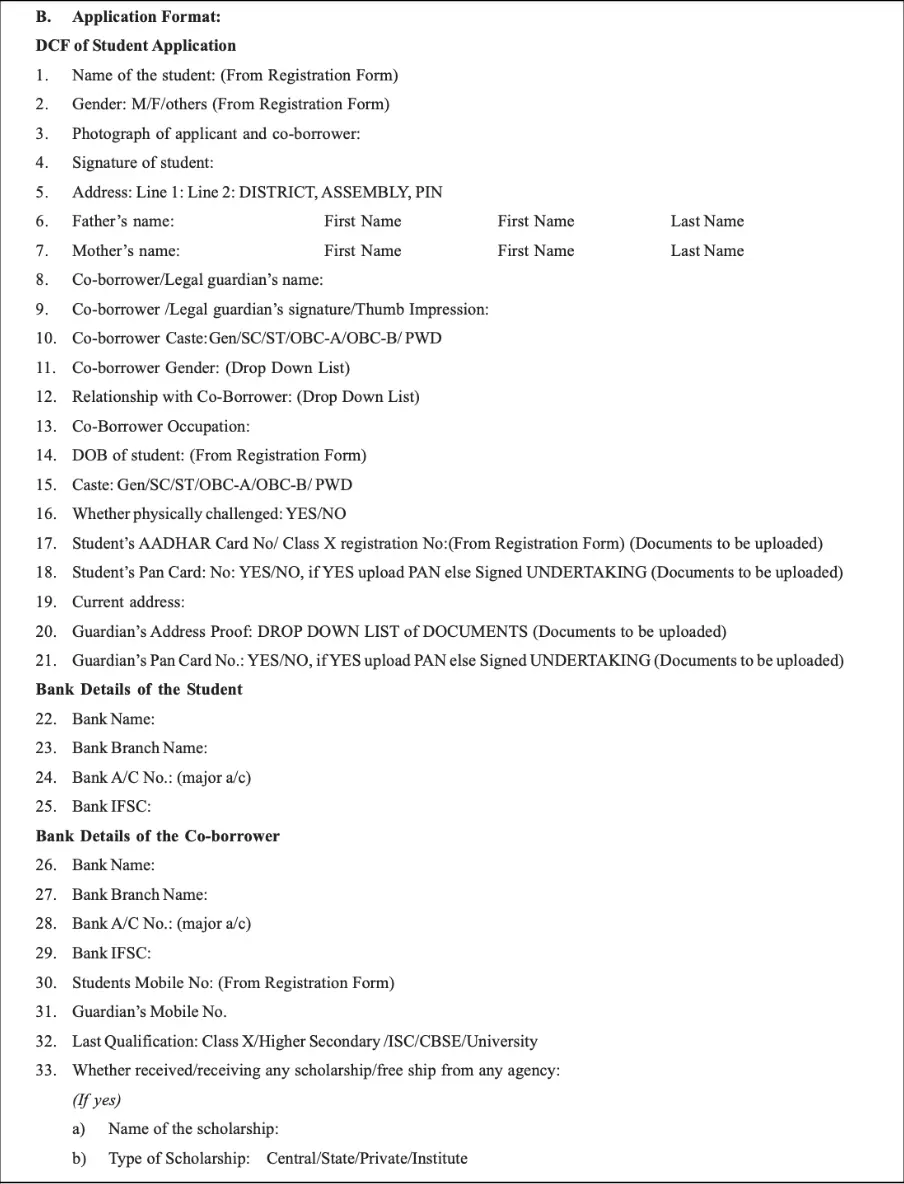

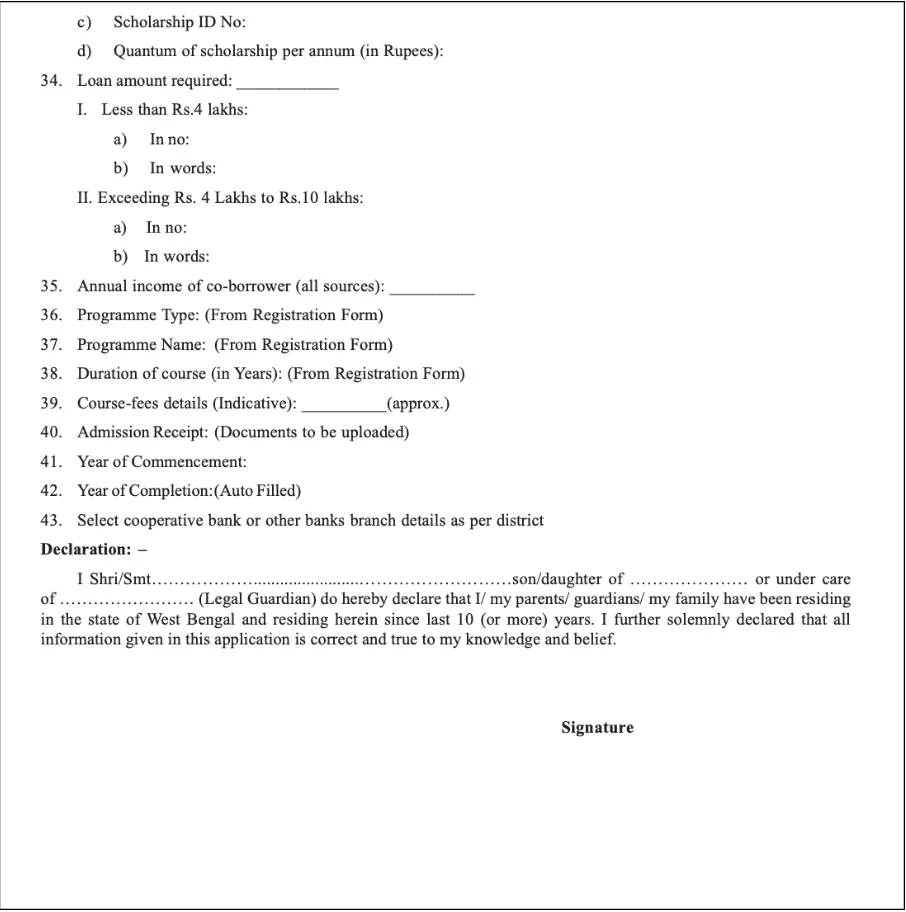

Step 2: WBSCC Application Process

- Log in to your account at the main website.

- Verify your details on the dashboard, such as name, registration number, and contact information.

- Click on 'Apply Now'.

- Fill in Personal Information:

- Your name, date of birth, and guardian/co-borrower’s name.

- If PAN or Aadhaar is Missing:

- Select "No" for both and download the Undertaking Document. Fill it out and submit it.

- Provide Co-Borrower Details:

- Enter the address, occupation, and other details of your parent/guardian.

- Add Address Details:

- Enter your current and permanent addresses.

- Course Information:

- Provide details like course fees, the year of commencement, and the loan amount required.

- Bank Details:

- Enter your bank details and those of your co-borrower.

- Edit and Save Application:

- Review your details using the 'Edit Loan Application' option.

- Click 'Save & Continue' to proceed.

- Upload Documents:

- Scan and upload all required documents.

- Final Submission:

- Review your application, click 'Submit Application', and confirm the submission.

Once submitted, the Higher Education Department will review your application and forward it to the bank, which will then approve the loan and issue a physical credit card following RBI guidelines. This straightforward process ensures that students can apply for the loan with ease and convenience.

Check the best credit card offers for your needs!

Curious to check more on different credit card offers? Check the linked page to know more!

WBSCC Student Loan Security & Insurance

The West Bengal Student Credit Card Scheme offers students in West Bengal the opportunity to secure loans up to ₹10 lakh without the need for collateral security. This means students and their families are not required to pledge any assets to obtain the loan.

Key Points:

- Collateral-Free Loans: No need for students or their families to provide any form of security or collateral to access the loan.

- Co-Obligation Requirement: While no collateral is required, the loan application must be submitted jointly by the student and a co-borrower, typically a parent or legal guardian. Both parties will agree with the bank as per banking rules.

- Life Insurance Coverage: The WBSCC scheme includes a life insurance cover for the student, up to the sanctioned loan amount. The premium for this insurance is borne by the student and is debited from the loan account.

West Bengal Student Credit Card Application Form

The application form for the West Bengal Student Credit Card helps student seasily apply for financial support. Below is a sample of the Form from the official website.

Are you looking for a personal loan?

WB Student Credit Card Repayment Rules

The West Bengal Student Credit Card, a moratorium allows students to postpone their loan repayments for a specific period after completing their studies. This gives them time to find employment and manage their finances before starting to pay back the loan. The West Bengal Student Credit Card Scheme offers educational loans with specific age and repayment terms:

- Flexible Repayment Period

- Borrowers are given a generous 15-year repayment period, including a moratorium/repayment holiday during the course of study.

- This extended timeline ensures that students can focus on their education without worrying about immediate repayments.

- Early Repayment Without Penalties

- Borrowers, including students or their parents/legal guardians, have the option to repay the loan early without any additional charges or penalties.

- This feature encourages responsible financial behavior and helps families reduce their debt burden faster.

- Interest Concession for Early Payment

- A 1% interest concession is available for borrowers who fully service the interest during the study period.

- This concession further reduces the financial load, motivating borrowers to pay the interest promptly.

- Responsibility for Repayment

- The student or the co-borrower (parent/legal guardian) is responsible for the timely repayment of the loan.

- This ensures accountability and builds financial discipline for both parties.

- Fixed and Subsidized Interest Rate

- The loan is offered at a 4% simple interest rate per annum, making it affordable for all borrowers.

- The State Government provides an interest subsidy, ensuring the effective interest rate remains capped at 4% throughout the loan tenure.

By offering a flexible repayment structure, concessions for timely interest payments, and a government-subsidized interest rate, this scheme supports students in pursuing their education without undue financial stress.

West Bengal Student Credit Card Grievance Redressal

The Public Grievance Redressal System for West Bengal Student Credit Card Scheme has been set up to help students resolve any issues related to the services under the West Bengal Student Credit Card Scheme.

- Grievance Cell:

- A senior government official manages a dedicated Public Grievance Cell to address complaints quickly and effectively.

- How to Report Complaints:

- Toll-Free Helpline: Students can call the toll-free number 1800 102 8014 for assistance.

- Email Support: Complaints can also be emailed to support-wbscc@bangla.gov.in for resolution.

- Purpose:

- The grievance redressal system ensures transparency and helps students get their issues resolved without delay.

- It provides a direct communication channel between the students and the concerned authorities.

This system is part of the government’s effort to make the West Bengal Student Credit Card Scheme more accessible and student-friendly. Students can reach out through the helpline or email for any queries or problems related to the scheme.

Check the best offers & apply for a credit card!

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

- Credit Card

- Credit Card Lounge Access

- Close Credit Card

- Credit Card Advantages and Disadvantages

- Transfer Money from Credit Card to Bank Account

- Loan on Credit Card

- Best Credit Cards for Low CIBIL Score

- Credit Cards to Improve Credit Score

- One Card

- Green PIN

- Bajaj Insta EMI Cards

- Credit Card Application Status Check

- CIBIL Score for Credit Card

- Increase CIBIL Score without Credit Card

- Kisan Credit Card

- Travel Credit Cards

- Credit Cards Without Annual Fee

- RuPay Credit Card

- Student Credit Card

- Student Credit Card Bihar

- Best Fuel Credit Cards

- Best Cashback Credit Cards India

- Credit Card Against Fixed Deposit

- International Airport Lounge Access Credit Card

- HDFC RuPay Credit Card

- Best Premium Credit Cards In India

- Lifetime Free Credit Card Without Income Proof

- SBI Simply Click Credit Card

- SBI Elite Credit Card

- SBI Prime Credit Card

- SBI Credit Card Reward Points

- HDFC Biz Black Credit Card

- HDFC Credit Card Net Banking

- How to Close HDFC Credit Card

- HDFC Tata Neu Plus Credit Card

- HDFC Tata Neu Infinity Credit Card

- HDFC Infinia Credit Card

- HDFC Freedom Credit Card

- HDFC Moneyback Credit Card

- HDFC Diners Club Credit Card

- HDFC Regalia Gold Credit Card

- Paytm HDFC Credit Card

- HDFC Credit Card PIN Generation

- HDFC Credit Card Statement

- HDFC Credit Card Payment

- Swiggy HDFC Credit Card

- HDFC Credit Card Application Status

- HDFC Millennia Debit Card

- HDFC Bank Credit Card Offers

- Kisan Credit Card

- Kisan Credit Card Application Status

- Kisan Credit Card Interest Rates

- Indian Overseas Bank Credit Card Customer Care Number

- SBI Credit Card Customer Care Number

- ICICI Bank Credit Card Customer Care Number

- Credit Card Customer Care Number

- Central Bank of India Credit Card Customer Care Number

- Union Bank Credit Card Customer Care Number

- Yes Bank Credit Card Customer Care Number

- Bank of India Credit Card Customer Care Number

- Federal Bank Credit Card Customer Care Number

- Canara Bank Credit Card Customer Care Number

- Kotak Mahindra Bank Credit Card Customer Care Number

- Indian Bank Credit Card Customer Care Number

- Induslnd Bank Credit Card Customer Care Number

- Bandhan Bank Credit Card Customer Care Number

- HDFC Credit Card Customer Care Bangalore

- HDFC Credit Card Customer Care Hyderabad

- ICICI Credit Card Customer Care Bangalore

- ICICI Credit Card Customer Care Hyderabad

- HDFC Credit Card Customer Care Number Chennai

- Kotak Mahindra Bank Credit Card Customer Care Pune

- Standard Chartered Credit Card Customer Care Number

- UCO Bank Credit Card Customer Care Number

- Karnataka Bank Credit Card Customer Care Number

- HDFC Bank Credit Card Customer Care Number

- Axis Bank Credit Card Customer Care Number

- PNB Credit Card Customer Care Number

- Bank of Baroda Credit Card Customer Care Number

- IDFC First Bank Credit Card Customer Care Number

- IndusInd Bank Credit Card Customer Care Number

- IDBI Bank Credit Card Customer Care Number

- RBL Bank Personal Loan Customer Care Number

Frequently Asked Questions

Yes, students meeting eligibility criteria can apply for the West Bengal Student Credit Card scheme.

Yes, the West Bengal Student Credit Card can be used to purchase laptops and other educational tools.

The West Bengal Student Credit Card offers a credit limit of up to ₹10 lakh.

Students aged up to 40 years pursuing education in India or abroad are eligible.

The scheme was launched on June 30, 2021.

Multiple banks offer student credit cards, but State Bank of India and West Bengal Co-operative Banks are prominent for this scheme.

The credit limit under the West Bengal scheme is ₹10 lakh with a 15-year repayment period.

Apply online through the official West Bengal Student Credit Card portal with necessary documents like ID proof and income certificate.

The interest rate is 4%, with a 1% concession for timely repayment.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

The information provided above is for general informational purposes only and does not constitute an offer or solicitation to avail of any financial services or products. Buddy Loan is a Digital Fintech Marketplace that connects borrowers with lenders and is not a lender itself. While we strive to ensure that the information regarding interest rates, loan amounts, and terms provided by our partner Banks and NBFCs is accurate and up-to-date, these details are subject to change at the discretion of the respective lenders.

Before making any financial decisions, we strongly advise you to read the terms and conditions of the specific loan product and consult with the lender directly. Buddy Loan does not guarantee the approval of any loan application, as approval is subject to the lender's assessment and your creditworthiness. Buddy Loan will not be held responsible for any discrepancies or damages arising from the use of this information. Please verify all loan-related details & documents with the respective lender before proceeding.

By using our platform, you acknowledge and agree to these terms.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users