Bank of Baroda provides several credit card options that cater to diverse customer needs, including shopping, travel, and reward points. Once you've applied for a credit card, it’s essential to track your application status to understand the progress and any further actions you may need to take. BOB allows you to check your BOB credit card application status through both online and offline methods, making the process transparent and easy for applicants.

You can track the BOB Credit Card status online through the official website, by calling customer care at 1800-266-5100 / 1800-266-7100 / 1800-103-1006, or by visiting a nearby branch for timely updates and smooth processing.

Table of Contents:

- ⇾ Steps To Check BOB Credit Card Application Status Online

- ⇾ Ways To Check BOB Credit Card Application Status Offline

- ⇾ Types of Bank of Baroda Credit Card Application Status

- ⇾ Benefits of a Bank of Baroda Credit Card

- ⇾ Factors to Consider When Applying for BOBCredit Card After Rejection

- ⇾ Steps to Apply For a BOB Credit Card

- ⇾ Frequently Asked Questions

Steps to Check BOB Credit Card Application Status Online

Once you have applied for a BOB credit card, you can track your BOB credit card application online. Here’s how:

Step 1:Visit the Bank of Baroda's official website dedicated to credit cards.

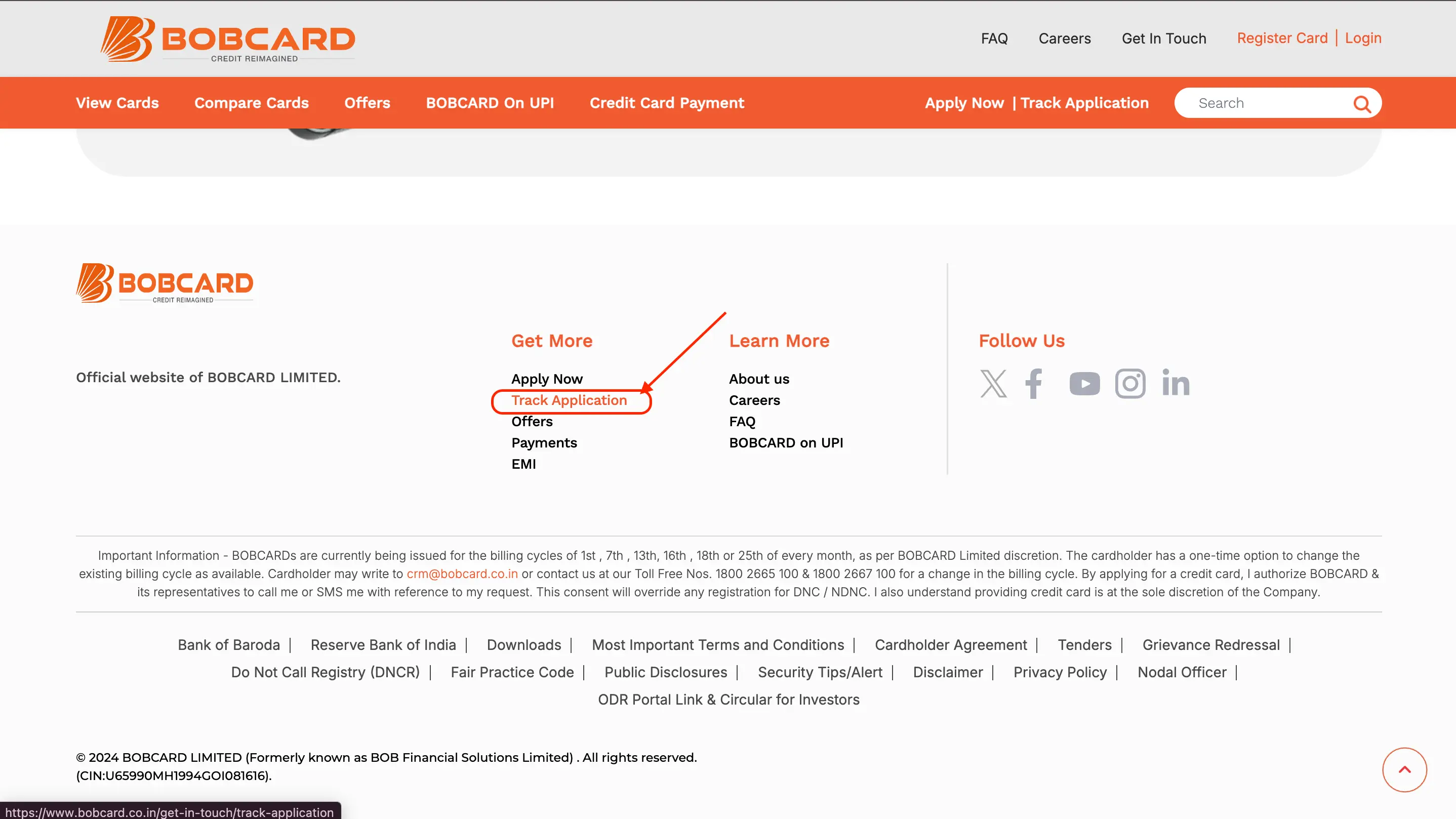

Step 2:Scroll down on the homepage until you find the 'Track Application' section and click on the link provided.

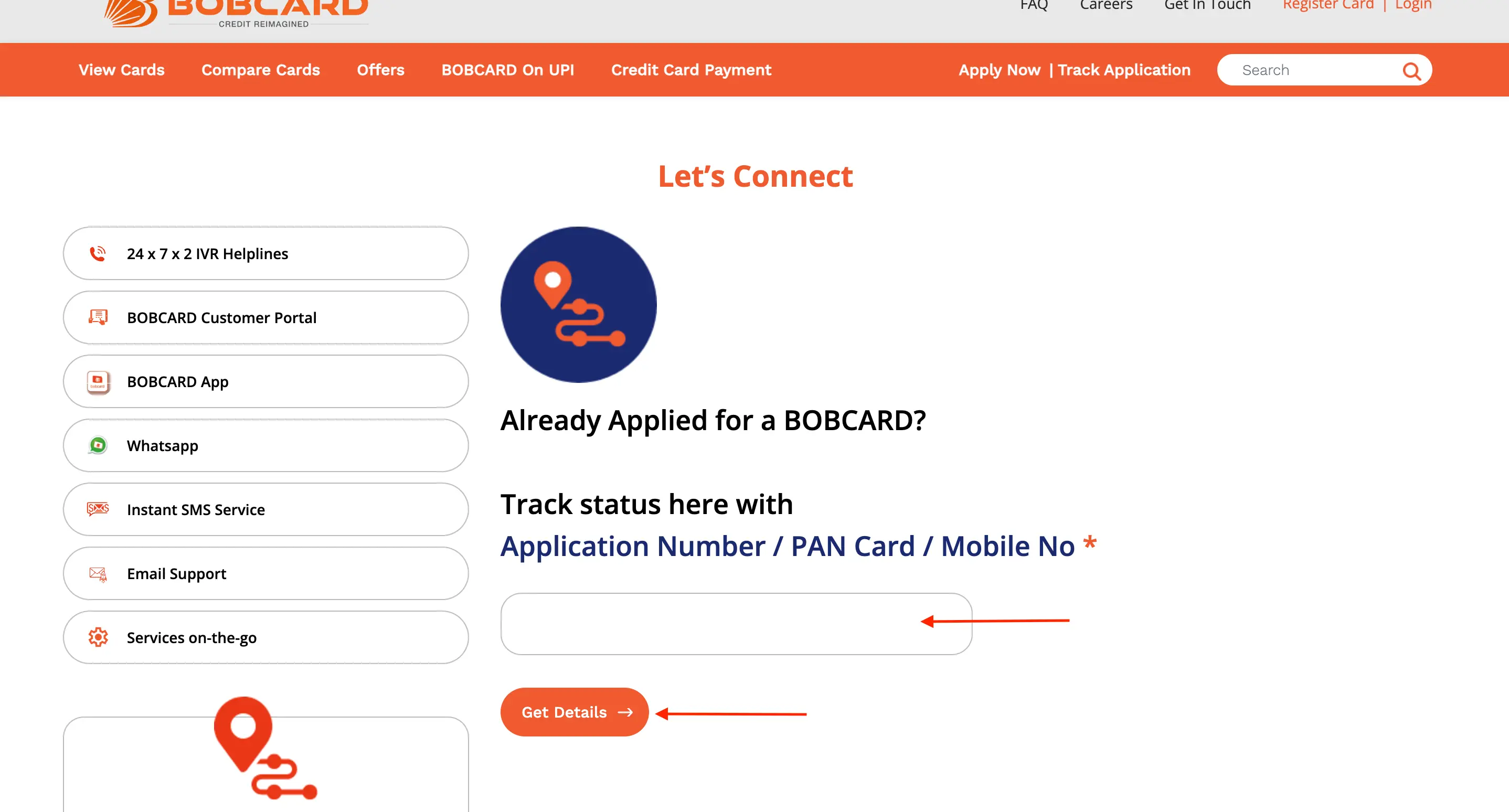

Step 3:You will be taken to the 'Track Application Status' page, where you'll need to enter your Application number/ PAN Card/ Mobile No.

Step 4:After entering the information, click on 'Get Details' to view your application status.

Check the best credit card offers for your needs!

Ways to Check BOB Credit Card Application Status Offline

If you prefer offline methods, Bank of Baroda offers the following options to check your credit card application status:

Option 1: Visit the Nearest BOB Branch: Head to your closest Bank of Baroda branch. At the customer service counter, provide your application reference number or personal ID to inquire about your card status.

Option 2: Call Customer Care: You can contact the BOB customer service team by dialing their toll-free numbers: 1800-266-5100 / 1800-266-7100 / 1800-103-1006. Follow the IVR instructions to reach the credit card department and provide your reference number or registered mobile number for updates.

Option 3: Send an Email: You can also email your query, including your application reference number, to the BOB support team at crm@bobcard.co.in for assistance.

Types of BOB Credit Card Status Updates

Once you've applied for a Bank of Baroda credit card, you may encounter various application statuses. Here's a table explaining the different statuses and their meanings:

| Status Type | Description |

|---|---|

| In Progress | Your application is currently being processed. Bank officials are reviewing the submitted details and documents. |

| Approved | Your application has been approved. The credit card will soon be issued and dispatched to your address. |

| Rejected | Your application has been denied due to not meeting the bank’s criteria, such as low credit score, insufficient income, or incomplete documentation. |

| Dispatched | The credit card has been dispatched and is on its way to your mailing address. It typically includes tracking details. |

| On Hold | The application is on hold due to pending documentation or additional verification required. You may need to provide further documents or confirm details. |

| No Records Found | Recheck the details and enter the correct application number. |

Read More

Read Less

Not sure of your credit score? Check it out for free now!

Benefits of Bank of Baroda Credit Card

Bank of Baroda credit cards come with numerous perks to enhance your lifestyle by offering privileges and savings across various categories. Here are some key benefits:

- Exciting Privileges: Enjoy exclusive offers on dining, travel, entertainment, and more.

- Rewards on Spends: Earn rewards points for every transaction, redeemable for gifts or discounts.

- Welcome Perks: Get exciting welcome offers and bonuses when you first use your card.

- Complimentary Services: Benefit from complimentary services like airport lounge access and other privileges.

Factors Affecting BOB Credit Card Approval

If your credit card application does not meet the bank's eligibility criteria, it will be rejected, and the status will reflect this. After a rejection, it's advisable to wait 3-6 months before reapplying. It's a good idea to contact customer care to understand the reason for the rejection so you can address any issues and be more prepared when applying again.

When reapplying for a Bank of Baroda credit card after a rejection, keep the following factors in mind:

- Credit Score: Your credit or CIBIL score plays a vital role in your eligibility. It reflects your creditworthiness, and the Bank of Baroda will assess your score through the credit bureau. Be sure to correct any errors in your credit report that may negatively affect your score. A good credit history and high score will improve your chances of approval.

- Eligibility: Make sure you meet all eligibility requirements for the Bank of Baroda credit card. Applicants must be between 18 and 65 years old.

- Spending Patterns: Different credit cards cater to various spending habits, such as travel or shopping, offering rewards like miles or cashback. Choose a card that aligns with your spending patterns for maximum benefits.

- Income Status: Managing a credit card responsibly is essential, as it can increase expenses. Assess whether you truly need another card, as having multiple cards can carry financial risks.

Steps to Apply For a BOB Credit Card

If you wish to apply for another BOB credit card, then you can do it quickly and easily. Here are the steps to apply online:

- Step 1: Complete the E-Application: Fill out the online form with your personal and financial details.

- Step 2: Aadhaar-Based E-Signature: Sign the application digitally using your Aadhaar.

- Step 3: Confirm with Video KYC: Verify your identity through a video call with a bank representative.

Avail of an instant loan in a few simple steps!

- Credit Card

- Credit Card Lounge Access

- Close Credit Card

- Credit Card Advantages and Disadvantages

- Transfer Money from Credit Card to Bank Account

- Loan on Credit Card

- Best Credit Cards for Low CIBIL Score

- Credit Cards to Improve Credit Score

- One Card

- Green PIN

- Bajaj Insta EMI Cards

- Credit Card Application Status Check

- CIBIL Score for Credit Card

- Increase CIBIL Score without Credit Card

- Kisan Credit Card

- Travel Credit Cards

- Credit Cards Without Annual Fee

- RuPay Credit Card

- West Bengal Student Credit Card

- Student Credit Card

- Student Credit Card Bihar

- Best Fuel Credit Cards

- Best Cashback Credit Cards India

- Credit Card Against Fixed Deposit

- International Airport Lounge Access Credit Card

- HDFC RuPay Credit Card

- Best Premium Credit Cards In India

- Lifetime Free Credit Card Without Income Proof

- SBI Simply Click Credit Card

- SBI Elite Credit Card

- SBI Prime Credit Card

- SBI Credit Card Reward Points

- HDFC Biz Black Credit Card

- HDFC Credit Card Net Banking

- How to Close HDFC Credit Card

- HDFC Tata Neu Plus Credit Card

- HDFC Tata Neu Infinity Credit Card

- HDFC Infinia Credit Card

- HDFC Freedom Credit Card

- HDFC Moneyback Credit Card

- HDFC Diners Club Credit Card

- HDFC Regalia Gold Credit Card

- Paytm HDFC Credit Card

- HDFC Credit Card PIN Generation

- HDFC Credit Card Statement

- HDFC Credit Card Payment

- Swiggy HDFC Credit Card

- HDFC Credit Card Application Status

- HDFC Millennia Debit Card

- HDFC Bank Credit Card Offers

- Kisan Credit Card

- Kisan Credit Card Application Status

- Kisan Credit Card Interest Rates

- Indian Overseas Bank Credit Card Customer Care Number

- SBI Credit Card Customer Care Number

- ICICI Bank Credit Card Customer Care Number

- Credit Card Customer Care Number

- Central Bank of India Credit Card Customer Care Number

- Union Bank Credit Card Customer Care Number

- Yes Bank Credit Card Customer Care Number

- Bank of India Credit Card Customer Care Number

- Federal Bank Credit Card Customer Care Number

- Canara Bank Credit Card Customer Care Number

- Kotak Mahindra Bank Credit Card Customer Care Number

- Indian Bank Credit Card Customer Care Number

- Induslnd Bank Credit Card Customer Care Number

- Bandhan Bank Credit Card Customer Care Number

- HDFC Credit Card Customer Care Bangalore

- HDFC Credit Card Customer Care Hyderabad

- ICICI Credit Card Customer Care Bangalore

- ICICI Credit Card Customer Care Hyderabad

- HDFC Credit Card Customer Care Number Chennai

- Kotak Mahindra Bank Credit Card Customer Care Pune

- Standard Chartered Credit Card Customer Care Number

- UCO Bank Credit Card Customer Care Number

- Karnataka Bank Credit Card Customer Care Number

- HDFC Bank Credit Card Customer Care Number

- Axis Bank Credit Card Customer Care Number

- PNB Credit Card Customer Care Number

- Bank of Baroda Credit Card Customer Care Number

- IDFC First Bank Credit Card Customer Care Number

- IndusInd Bank Credit Card Customer Care Number

- IDBI Bank Credit Card Customer Care Number

- RBL Bank Personal Loan Customer Care Number

Frequently Asked Questions

You can check your BOB credit card limit through the BOB mobile banking app, internet banking, or by calling customer support.

The application process usually takes 7 to 15 working days, depending on document verification and approval time.

A credit score of 700 or above is generally required to qualify for a BOB credit card, although specific cards may have varying requirements.

You can check the status online via the BOB website, through customer care, or by visiting a BOB branch.

You will need your application number or PAN Card or your registered mobile number to track the status.

Processing typically takes around 7 to 15 working days after the submission of the application.

Yes, you can track your application status online through the official Bank of Baroda website under the 'Track Your Card Application' section.

Contact customer care to understand the reason for rejection. Address any issues and wait 3-6 months before reapplying.

You can contact customer support at 1800-266-5100, 1800-266-7100, or via email at crm@bobcard.co.in.

Currently, BOB does not offer SMS tracking for card status, but you can inquire about updates via email.

Common reasons include incomplete documentation, verification issues, or discrepancies in the application details.

Yes, you can use your registered mobile number in combination with your application number to track the status online or via customer support.

If there are no updates, contact customer support or visit a nearby BOB branch to check your application status.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users