Tracking your HDFC credit card application status is essential to stay updated on the progress of your credit card request. Whether you are checking the status online, through mobile, or via customer care, HDFC Bank offers multiple convenient methods to help you monitor your application in real-time. With just your HDFC Bank credit card reference number, mobile number, or date of birth, you can easily perform an HDFC credit card application check from anywhere.

This webpage explains how to check your HDFC credit card's online status, explains different status messages, and provides useful resources, such as the HDFC credit card status inquiry number and HDFC credit card application status customer care number, for further assistance.

You can reach HDFC Bank customer care through multiple channels:

- Phone Support:

- For customers in India: Dial 1800 1600 or 1800 2600 (toll-free).

- For customers traveling abroad: Call 022-61606160 (standard charges apply).

- Email Support: Contact HDFC Bank by email for assistance with your queries.

Table of Contents:

- ⇾ Ways to Track HDFC Credit Card Status Online

- ⇾ Track HDFC Credit Card Status with Application ID

- ⇾ Track HDFC Credit Card Status Using Mobile Number & DOB

- ⇾ Track HDFC Bank Application Status by Email

- ⇾ Ways to Check Status of HDFC Credit Card Application Offline

- ⇾ Check HDFC Credit Card Status by Calling Customer Care

- ⇾ Track HDFC Credit Card Application by Visiting Bank Branch

- ⇾ Check HDFC Credit Card Application Status via SMS

- ⇾ HDFC Credit Card Application Tracking Updates

- ⇾ HDFC Credit Card Application Process Time

- ⇾ HDFC Credit Card Customer Care Number

- ⇾ Frequently Asked Questions

Ways to Track HDFC Credit Card Status Online

You can track your HDFC credit card application on the online portal or on the mobile banking app using the following methods:

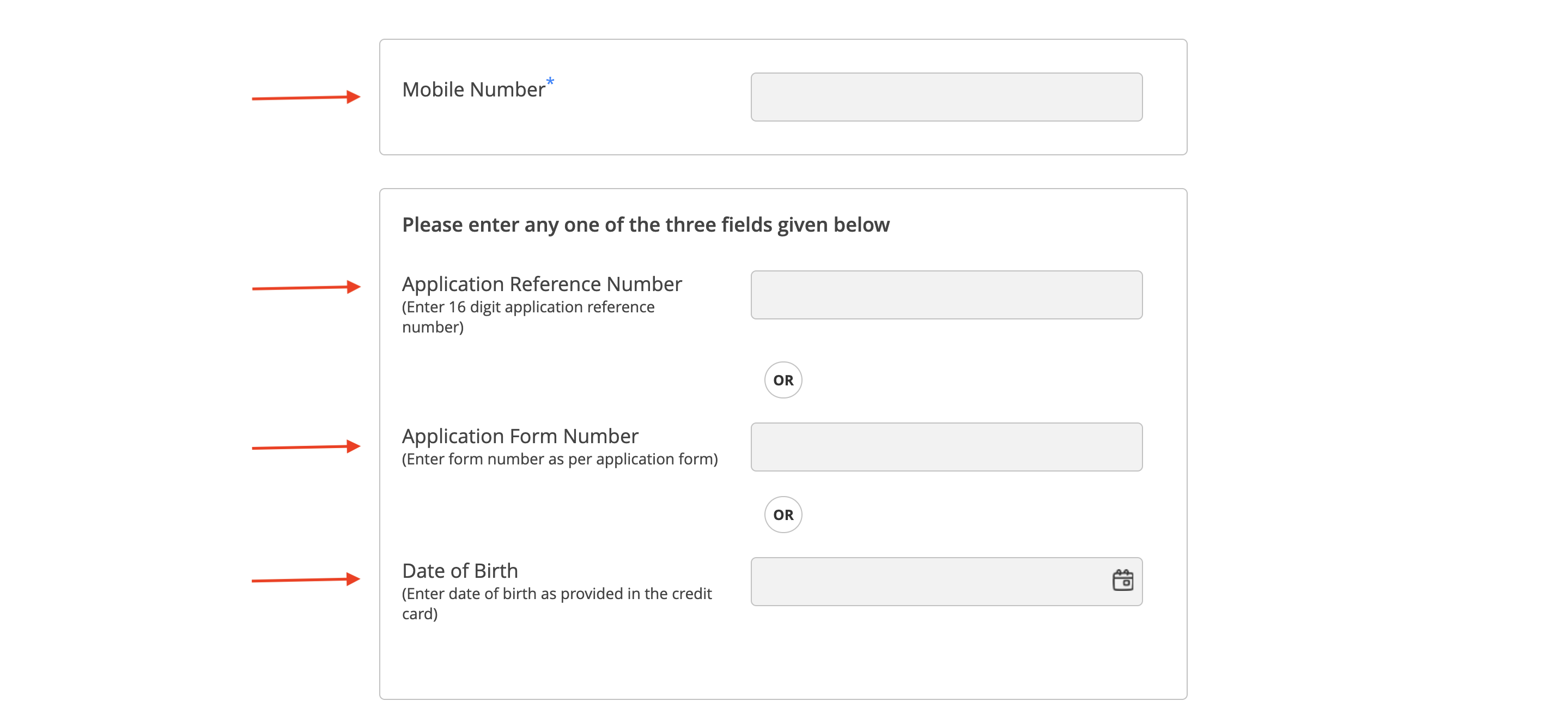

- Using Mobile Number & Application Reference Number

- With Mobile Number & Application Form Number

- Using Mobile Number & Date of Birth

The steps are as follows :

- Go to the HDFC Bank Credit Card Tracking Page

- Open the official HDFC Bank Credit Card Application Status portal.

- Enter Your Registered Mobile Number

- Input the mobile number you provided during the application process.

- Enter Any One of the Following Details

- Application Reference Number (16-digit reference number received via SMS/email)

- OR Application Form Number (as per the submitted credit card application)

- OR Date of Birth (in DD/MM/YYYY format)

- Complete the CAPTCHA Verification

- Enter the CAPTCHA code displayed on the screen to verify you're not a bot.

- Authenticate Using OTP

- Click on ‘Get OTP’ to receive a One-Time Password (OTP) on your registered mobile number.

- Enter the OTP in the designated field and click ‘Submit’.

- View Your Credit Card Status

- After successful verification, your HDFC CC application status will be displayed.

Are you looking for a credit card, Check the best offers & apply for it!

Track HDFC Credit Card Status with Application ID

You can track your HDFC credit card application status quickly using your HDFC bank credit card reference number or application ID. Follow these steps:

Step 1:Go to the official HDFC Bank website and navigate to the credit card application status page.

Step 2:Go to the official HDFC Bank website and navigate to the credit card application status page.

Step 3:Input your 16-digit HDFC application status reference number provided when you submitted your application.

Step 4:Enter your registered mobile number or date of birth for verification.

Step 5:Enter the CAPTCHA code as shown on the screen, then you will get an OTP.

Step 6:Click on the ‘Submit’ button. Your HDFC CC application status will be displayed on the screen, indicating whether it is “In Process,” “Approved,” or “Declined.”

Track HDFC Credit Card Status Using Mobile Number & DOB

If you do not have your application reference number, you can track your status using your mobile number and date of birth.

Step 1:Visit the HDFC Bank website and open the credit card status inquiry portal.

Step 2:Provide the mobile number used in your application.

Step 3:Input your date of birth (DD/MM/YYYY) as per your application.

Step 4:Enter the CAPTCHA code correctly.

Step 5:Click ‘Get OTP’, and enter the One-Time Password (OTP) sent to your registered mobile number.

Step 6:After verification, your HDFC credit card application status will be displayed on the screen.

Track HDFC Bank Application Status by Email

You can also inquire about your HDFC credit card application status via email by contacting HDFC Bank’s support team. Here’s how:

Step 1:Use your registered email ID to draft an email addressed to HDFC Bank’s customer care: customerservices.cards@hdfcbank.com.

Step 2:Include your application reference number or form number, registered mobile number, and date of birth.

Step 3:Submit your inquiry to the official HDFC credit card application status customer care number email address (e.g., customerservices.cards@hdfcbank.com).

Step 4:HDFC Bank will reply with the latest update on your HDFC CC application status, typically within 1–2 business days.

Not sure of your credit score? Check it out for free now!

Ways to Check Status of HDFC Credit Card Application Offline

If you cannot access online services, HDFC Bank offers several offline options to track your HDFC credit card application status. Below are the key methods:

Check HDFC Credit Card Status by Calling Customer Care

You can track your HDFC CC application status by contacting HDFC Bank’s customer care helpline. Here’s how:

- Dial the HDFC Credit Card Application Status Contact Number:

- Toll-Free Numbers: 1800-202-6161 or 1860-267-6161

- These helplines are available 24/7, including weekends and holidays.

Track HDFC Credit Card Application by Visiting Bank Branch

You can also perform an HDFC credit card application check by visiting your nearest HDFC Bank branch:

- Locate the Nearest HDFC Bank Branch:

- Use the branch locator on the HDFC Bank website or mobile app.

- Request Credit Card Application Status:

- Approach the customer service desk and provide your HDFC bank card status inquiry number or application reference number.

- Receive Instant Updates:

- The bank executive will check your application status and inform you whether it is “In Process,” “Approved,” “Dispatched,” or “Declined.”

Check HDFC Credit Card Application Status via SMS

Step 1: Ensure SMS Alerts Are Enabled – You must have opted for SMS updates during your application.

Step 2: Check Your Messages – Look for status updates from HDFC Bank, such as: “In Process” , “Approved” , “Dispatched” , “Declined”.

Step 3: Contact Customer Care If No SMS Is Received – Call 1800-202-6161 or 1860-267-6161 for updates.

Step 4: Track Online If Needed – If you don’t receive an SMS, check your HDFC credit card status via the HDFC Bank tracking portal.

HDFC Credit Card Application Tracking Updates

When you track your HDFC credit card application status, you may encounter different status messages that indicate the progress of your request. Below is a detailed explanation of common status messages and their meanings:

| Status | Meaning | Next Steps |

|---|---|---|

| In Process | Application under review; documents and credit score verification ongoing. | Wait for updates. Follow up via the inquiry number if no change for several days. |

| Approved | Application accepted; card will be dispatched soon. | Track delivery using the AWB number received via SMS or email. |

| Dispatched | Credit card shipped to your registered address. | Track delivery through the courier’s website. |

| On-Hold | Processing paused due to missing documents or discrepancies. | Check SMS or email for instructions. |

| Disapproved (Declined) | Application rejected. Common reasons: Poor CIBIL score, low income, incorrect information, or unstable employment history. | Contact customer care for details. Resolve issues and reapply if necessary. |

| No Records Found | Application details not found, possibly due to submission errors or incorrect information. | Verify your reference number and registered mobile. |

Read More

Read Less

Want to know more on different HDFC credit cards? Check more on HDFC credit cards from the linked page.

If not a credit card, you can also get an instant loan!

HDFC Credit Card Application Process Time

Knowing how long HDFC takes to process your credit card application helps you manage your expectations. Here’s a detailed breakdown of the typical processing time:

| Stage | Description |

|---|---|

| Submission & Acknowledgment | Application submitted (online/offline). Acknowledgment with reference number sent via SMS/email. |

| Review & Verification | Documents and credit score verified. Status updates sent via SMS (e.g., “In Process” or “On-Hold”). |

| Approval or Decline | Application approved (SMS confirmation) or declined (with reason via SMS). |

| Dispatch & Delivery | Credit card dispatched. AWB tracking number shared via SMS for delivery tracking. |

| Total Processing Time: | Online: 7–14 days (digital verification) Offline: 14–21 days (physical verification) |

HDFC Credit Card Customer Care Number

If you need assistance with your HDFC credit card application status, delivery updates, or payment inquiries, contacting HDFC Bank’s customer care is the quickest way to get help. Below is a comprehensive guide to reaching HDFC credit card customer care.

| Contact Method | Details |

|---|---|

| Toll-Free Number (24x7) |

- 1800-202-6161 (24x7, including holidays) - 1860-267-6161 (24x7, including holidays) |

| Email for Status Enquiry |

- Email: customerservices.cards@hdfcbank.com - Subject: Credit Card Application Status Enquiry – [Your Application Number] - Details to Include: Application reference number, mobile number, and date of birth |

Get Zero Annual Fee Credit Cards in one click.

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

- Credit Card

- Credit Card Lounge Access

- Close Credit Card

- Credit Card Advantages and Disadvantages

- Transfer Money from Credit Card to Bank Account

- Loan on Credit Card

- Best Credit Cards for Low CIBIL Score

- Credit Cards to Improve Credit Score

- One Card

- Green PIN

- Bajaj Insta EMI Cards

- Credit Card Application Status Check

- CIBIL Score for Credit Card

- Increase CIBIL Score without Credit Card

- Kisan Credit Card

- Travel Credit Cards

- Credit Cards Without Annual Fee

- RuPay Credit Card

- West Bengal Student Credit Card

- Student Credit Card

- Student Credit Card Bihar

- Best Fuel Credit Cards

- Best Cashback Credit Cards India

- Credit Card Against Fixed Deposit

- International Airport Lounge Access Credit Card

- HDFC RuPay Credit Card

- Best Premium Credit Cards In India

- Lifetime Free Credit Card Without Income Proof

- SBI Simply Click Credit Card

- SBI Elite Credit Card

- SBI Prime Credit Card

- SBI Credit Card Reward Points

- HDFC Biz Black Credit Card

- HDFC Credit Card Net Banking

- How to Close HDFC Credit Card

- HDFC Tata Neu Plus Credit Card

- HDFC Tata Neu Infinity Credit Card

- HDFC Infinia Credit Card

- HDFC Freedom Credit Card

- HDFC Moneyback Credit Card

- HDFC Diners Club Credit Card

- HDFC Regalia Gold Credit Card

- Paytm HDFC Credit Card

- HDFC Credit Card PIN Generation

- HDFC Credit Card Statement

- HDFC Credit Card Payment

- Swiggy HDFC Credit Card

- HDFC Millennia Debit Card

- HDFC Bank Credit Card Offers

- Kisan Credit Card

- Kisan Credit Card Application Status

- Kisan Credit Card Interest Rates

- Indian Overseas Bank Credit Card Customer Care Number

- SBI Credit Card Customer Care Number

- ICICI Bank Credit Card Customer Care Number

- Credit Card Customer Care Number

- Central Bank of India Credit Card Customer Care Number

- Union Bank Credit Card Customer Care Number

- Yes Bank Credit Card Customer Care Number

- Bank of India Credit Card Customer Care Number

- Federal Bank Credit Card Customer Care Number

- Canara Bank Credit Card Customer Care Number

- Kotak Mahindra Bank Credit Card Customer Care Number

- Indian Bank Credit Card Customer Care Number

- Induslnd Bank Credit Card Customer Care Number

- Bandhan Bank Credit Card Customer Care Number

- HDFC Credit Card Customer Care Bangalore

- HDFC Credit Card Customer Care Hyderabad

- ICICI Credit Card Customer Care Bangalore

- ICICI Credit Card Customer Care Hyderabad

- HDFC Credit Card Customer Care Number Chennai

- Kotak Mahindra Bank Credit Card Customer Care Pune

- Standard Chartered Credit Card Customer Care Number

- UCO Bank Credit Card Customer Care Number

- Karnataka Bank Credit Card Customer Care Number

- HDFC Bank Credit Card Customer Care Number

- Axis Bank Credit Card Customer Care Number

- PNB Credit Card Customer Care Number

- Bank of Baroda Credit Card Customer Care Number

- IDFC First Bank Credit Card Customer Care Number

- IndusInd Bank Credit Card Customer Care Number

- IDBI Bank Credit Card Customer Care Number

- RBL Bank Personal Loan Customer Care Number

Frequently Asked Questions

Visit the HDFC Bank Credit Card Application Status page and enter your mobile number along with your Application Reference Number, Application Form Number, or Date of Birth to track your application status.

You'll need your registered mobile number and either your Application Reference Number, Application Form Number, or Date of Birth as provided in the application form.

Processing times may vary; for specific timelines, it's best to contact HDFC Bank customer service or refer to their official communications.

This status indicates that your application is missing the required documents. You should contact HDFC Bank customer service to provide the necessary documentation.

For assistance, call HDFC Bank customer care at 61606161/6160616, adding your area code before the number to connect with your city's customer care.

Yes, you can apply online through the HDFC Bank Credit Cards page.

Applicants should be between 21 and 65 years old, have a regular source of income, and a good credit score. Specific criteria may vary by card type.

Required documents include proof of identity (e.g., PAN card, Aadhaar card), proof of address (e.g., utility bills, passport), and proof of income (e.g., salary slips, IT returns).

To update personal details, contact HDFC Bank customer service or visit the nearest branch for assistance.

The credit limit varies based on factors like income, credit history, and the specific card type. HDFC Bank determines the limit after evaluating your application.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users