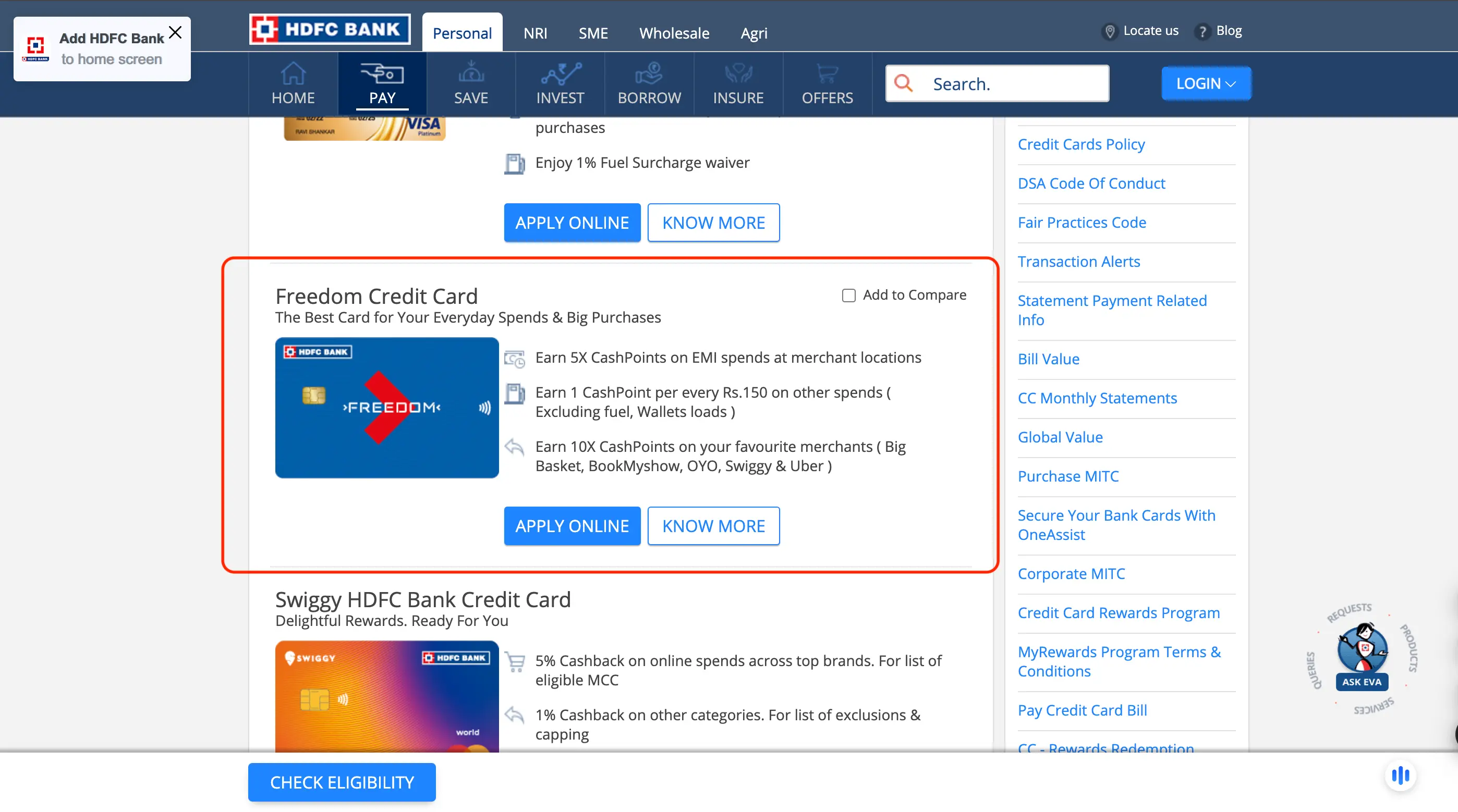

The HDFC Freedom Credit Card is packed with rewards and features for everyday spending. Earn 10X CashPoints on popular merchants like BigBasket, BookMyShow, Swiggy, Uber, and OYO, plus 1 CashPoint for every ₹150 spent (excluding EMI, fuel, wallet loads, and voucher purchases). Enjoy benefits like up to 20% discounts at partner restaurants via Swiggy Dineout, a 1% fuel surcharge waiver, and lounge access.

The card has an annual fee of ₹500, which is waived if you spend ₹50,000 or more in a year. Additionally, the card offers the flexibility to convert purchases into EMIs, making it even more convenient.

The HDFC Freedom Credit Card rewards you with 1 point for every ₹150 spent. Enjoy enhanced rewards with 25X points on your birthday, 5X points on movies, dining, groceries, railways, and taxi bookings, and 10X points for PayZapp and SmartBUY transactions. Additionally, receive 500 bonus points upon paying your renewal fee and another 500 as a welcome benefit.

Table of Contents:

- ⇾ HDFC Freedom Credit Card Features

- ⇾ Eligibility Criteria For HDFC Freedom Credit Card

- ⇾ Documents Required for HDFC Bank Freedom Credit Card

- ⇾ HDFC Freedom Credit Card Benefits

- ⇾ HDFC Freedom Credit Card Fees

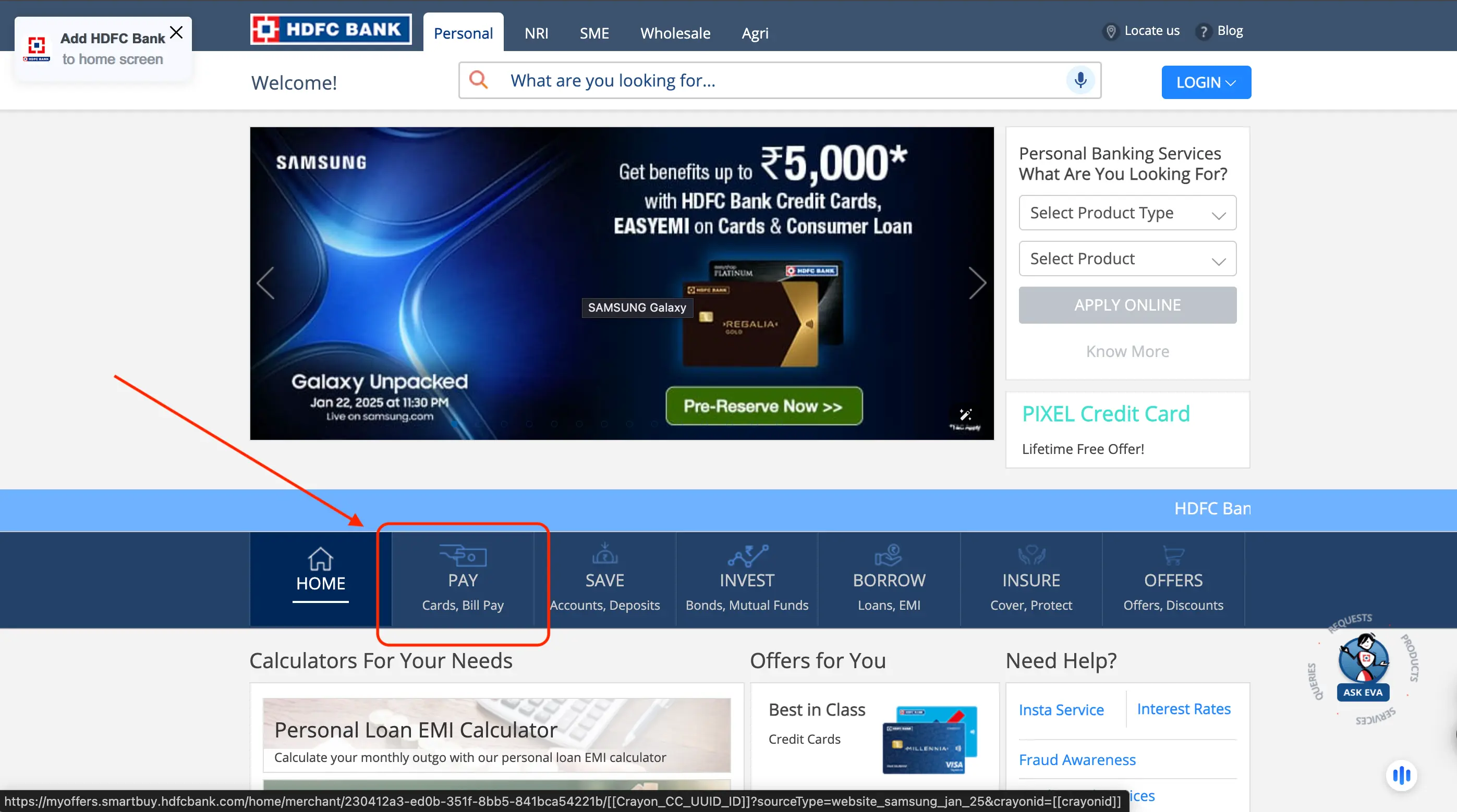

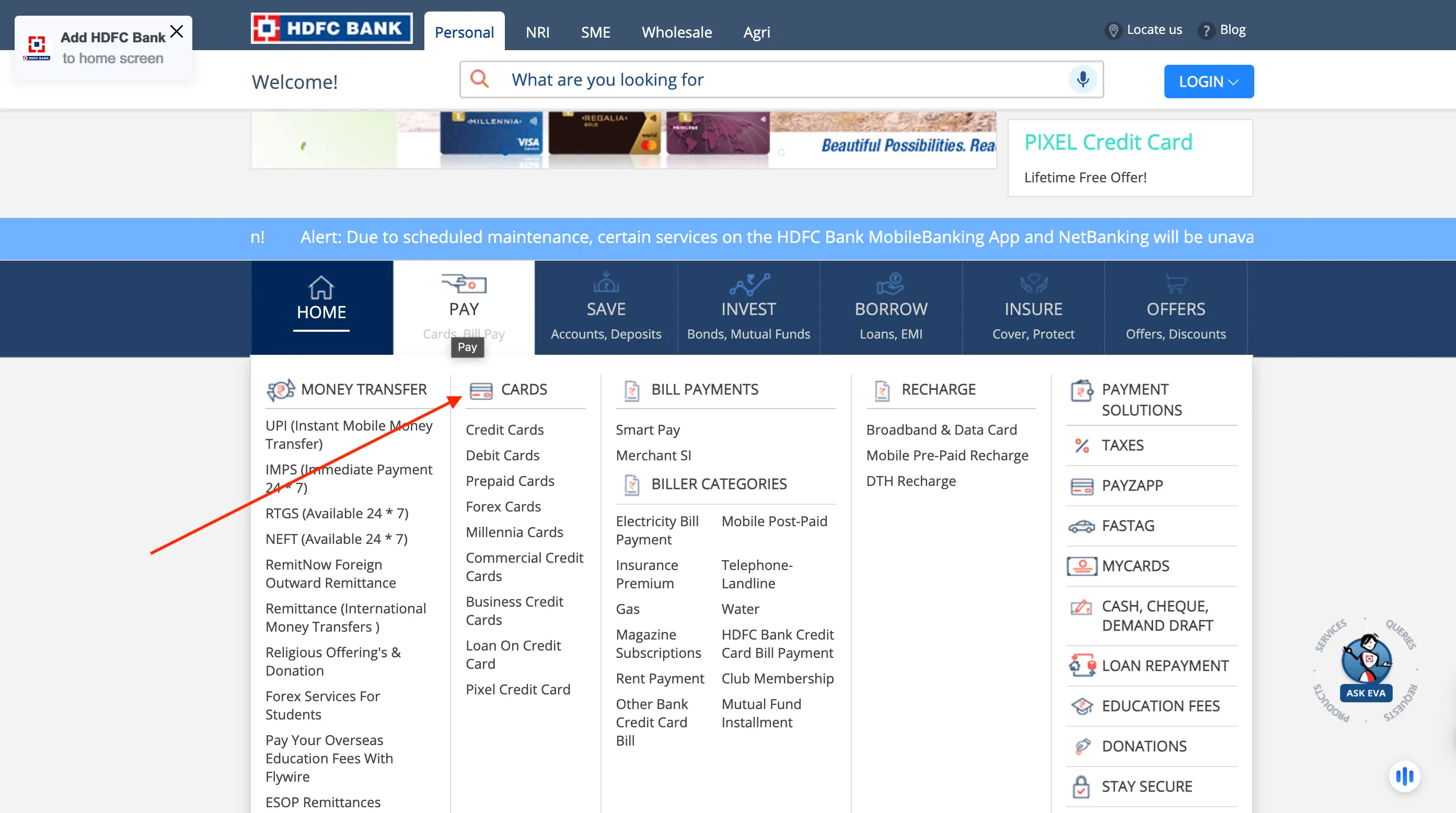

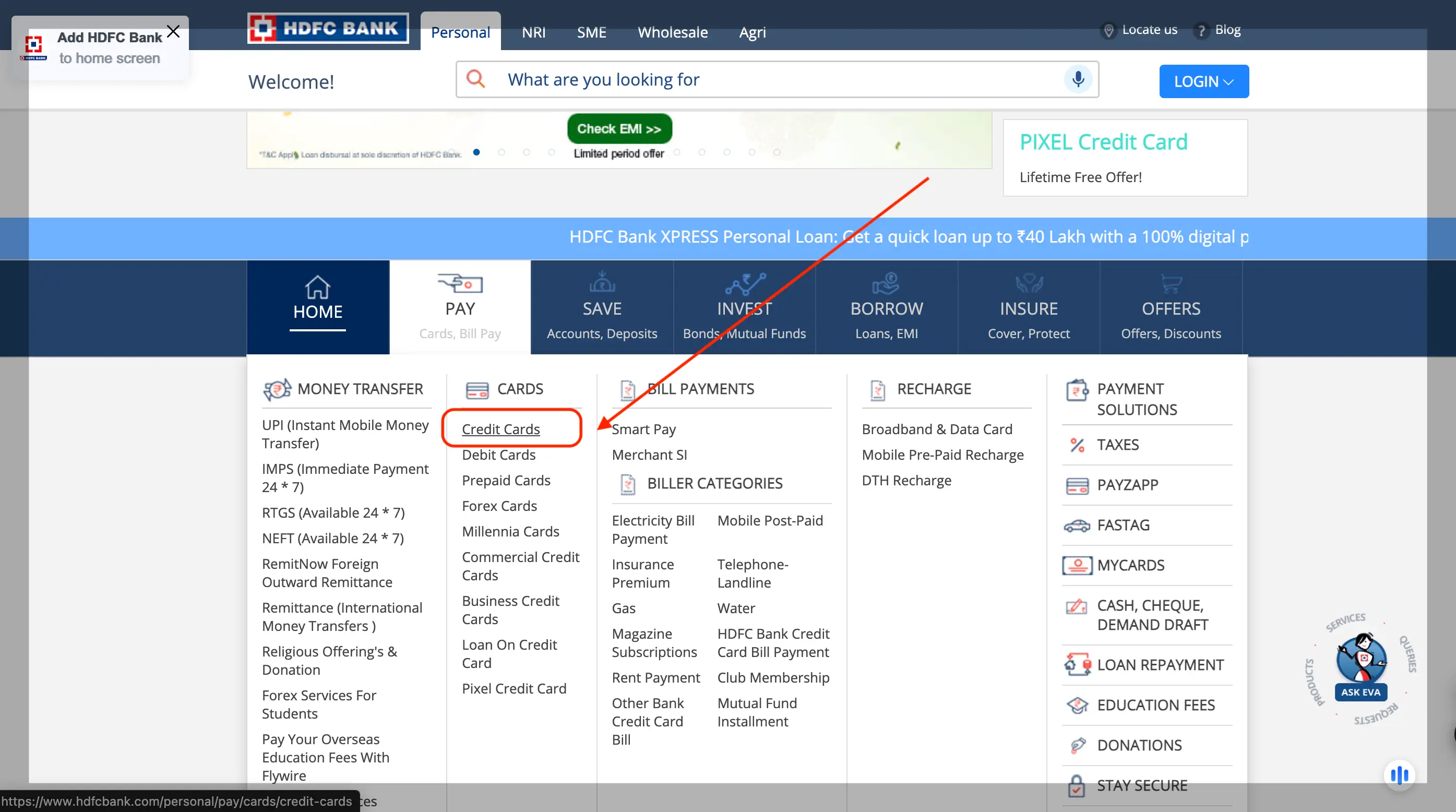

- ⇾ Steps To Apply For HDFC Freedom Credit Card

- ⇾ Steps To Redeem Reward Points On HDFC Bank Freedom Credit Card

- ⇾ Frequently Asked Questions

HDFC Freedom Credit Card Features

Let us look at the key features that make the HDFC Freedom Credit Card a valuable choice for your spending needs:

| Feature | Description |

|---|---|

| Reward Points | Earn 10X CashPoints on select merchants (Big Basket, BookMyShow, OYO, Swiggy & Uber) up to 2,500 points per month. Earn 1 CashPoint per ₹150 spent on other purchases. |

| Bonus Rewards | Up to 20% discount on partner restaurants via Swiggy Dineout. |

| Welcome Benefits | 500 CashPoints (applicable only on payment of membership fee). |

| Fuel Surcharge Waiver | 1% waiver on fuel transactions:

|

| Contactless Payments | Enabled for fast and secure contactless transactions. |

| Airport Lounge Access | Not explicitly mentioned in the provided information. This benefit may not be available. |

| Interest-Free Credit | Not explicitly mentioned in the provided information. Terms may vary. |

| Foreign Transaction Fee | Not explicitly mentioned. Foreign transaction fees may apply. |

| Lost Card Liability | Limited liability in case of lost or stolen card. Refer to the cardholder agreement for details. |

| EMI Conversion | Convert large purchases into EMIs after purchase. |

| Card Replacement Fee | Refer to the official website for details on replacement fees. |

Read More

Read Less

Get Zero Annual Fee Credit Cards in one click.

HDFC Freedom Credit Card Eligibility

Let us understand the requirements you need to meet to qualify for the HDFC Freedom Credit Card and enjoy the Freedom Credit Card benefits.

Eligibility For Salaried Individuals:

- Age: Must be between 21 and 60 years.

- Gross Monthly Income: Should be more than ₹12,000.

Eligibility For Self-Employed Individuals:

- Age: Must be between 21 and 65 years.

- Income Tax Returns: Should be greater than ₹2 lakh per annum.

General Eligibility Criteria:

- The primary applicant can be a resident or non-resident of India.

- Add-on cardholders must be at least 15 years old.

Documents Required for HDFC Bank Freedom Credit Card

To apply for the HDFC Bank Freedom Credit Card, it is essential to have the necessary documents ready to ensure a smooth application process and help the bank verify your eligibility efficiently:

- Identification Proof:

- Aadhaar Card

- PAN Card

- Driving Licence

- Address Proof (any one of the following):

- Aadhaar Card

- PAN Card

- Passport

- Electricity Bill

- Income Proof (any one of the following):

- Latest salary slips

- Form 16

- IT Returns

- Other Documents:

- Copy of Form 60 and PAN card.

- Duly filled out the application form.

- 2 passport-sized color photographs.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users