The Bihar Government launched the Bihar Student Credit Card (BSCC) Scheme to help students complete their higher education by providing financial assistance. Under this scheme, students can avail of loans of up to ₹4 lakhs at low interest rates. The funds can be used to pursue courses like B.Sc, B.A, B.Tech, MBBS, or other recognized programs.

The Bihar Student Credit Card (BSCC) Scheme aims to support students in Bihar who cannot continue their education due to financial difficulties. Offering affordable loans ensures that every aspiring student gets the opportunity to achieve their academic goals without worrying about financial constraints.

Let us go through this webpage to understand more about the Bihar Student Credit Card Scheme.

Bihar Student Credit Card scheme is for every eligible student who has completed 12th grade and wants to pursue higher education can get a loan of Rs. 4 lakhs.

Table of Contents:

- ⇾ Bihar Student Credit Card Scheme Details

- ⇾ Bihar Student Credit Card Eligibility

- ⇾ Bihar Student Credit Card Limit

- ⇾ Documents Required for Bihar Student Credit Card

- ⇾ Apply for Bihar Student Credit Card

- ⇾ Bihar Student Credit Card Loan Interest Rate

- ⇾ Bihar Student Credit Card Status

- ⇾ Bihar Student Credit Card App

- ⇾ Bihar Student Credit Card Application Form

- ⇾ Bihar Student Credit Card Loan Repayment Rules

- ⇾ Bihar Student Credit Card Grievance Redressal

- ⇾ Security & Insurance for Student Loan Amount

- ⇾ Frequently Asked Questions

Bihar Student Credit Card Scheme Details

Here’s an overview of the Bihar Student Credit Card Scheme:

- Loan Amount: Up to ₹4 lakh for higher education expenses.

- Interest Rates: 4% per annum; 1% for female, transgender, and disabled students.

- Eligibility: Bihar residents, aged 18-25 (up to 30 for PG), completed Class 12, and enrolled in a recognized institution.

- Repayment: Starts after course completion and employment.

- Application: Apply online via the official portal, followed by document verification at DRCC.

- Documents Needed: Aadhaar, PAN, educational certificates, admission proof, income certificate, and more.

Get Zero Annual Fee Credit Cards in one click.

Bihar Student Credit Card Eligibility

This eligibility ensures deserving students in Bihar can access financial support for higher education. The eligibility criteria for the Bihar Student Credit Card Scheme are:

- Residency: Applicant must be a permanent resident of Bihar.

- Educational Qualification:

- Must have completed Class 12 (or Class 10 for polytechnic courses).

- Age Limit:

- 18 to 25 years for undergraduate courses.

- Up to 30 years for postgraduate courses.

- Admission Requirement:

- Must be enrolled in a higher education institution recognized by the government.

- Institution Type:

- The institution can be in Bihar or outside Bihar but must be approved by the government.

If you have questions about the Bihar Student Credit Card Yojana, you can call the helpline at 1800 3456 444. You can also email your queries to spmubscc@bihar.gov.in.

Bihar Student Credit Card Limit

Here is what you need to know about the BSCC limits / loan amount for the Bihar Student Credit Card:

| Category | Loan Amount Limit | Purpose |

|---|---|---|

| Maximum Loan Amount | ₹4 lakh | Covers tuition fees, books, laptops, etc. |

| Tuition Fees | Included in the limit | For payment of course fees |

| Educational Materials | Included in the limit | Covers the cost of books, study materials, etc. |

| Equipment/Devices | Included in the limit | Purchase of laptops or required devices |

| Other Educational Costs | Included in the limit | Miscellaneous expenses related to education |

Don't know your credit score? You can find out for free!

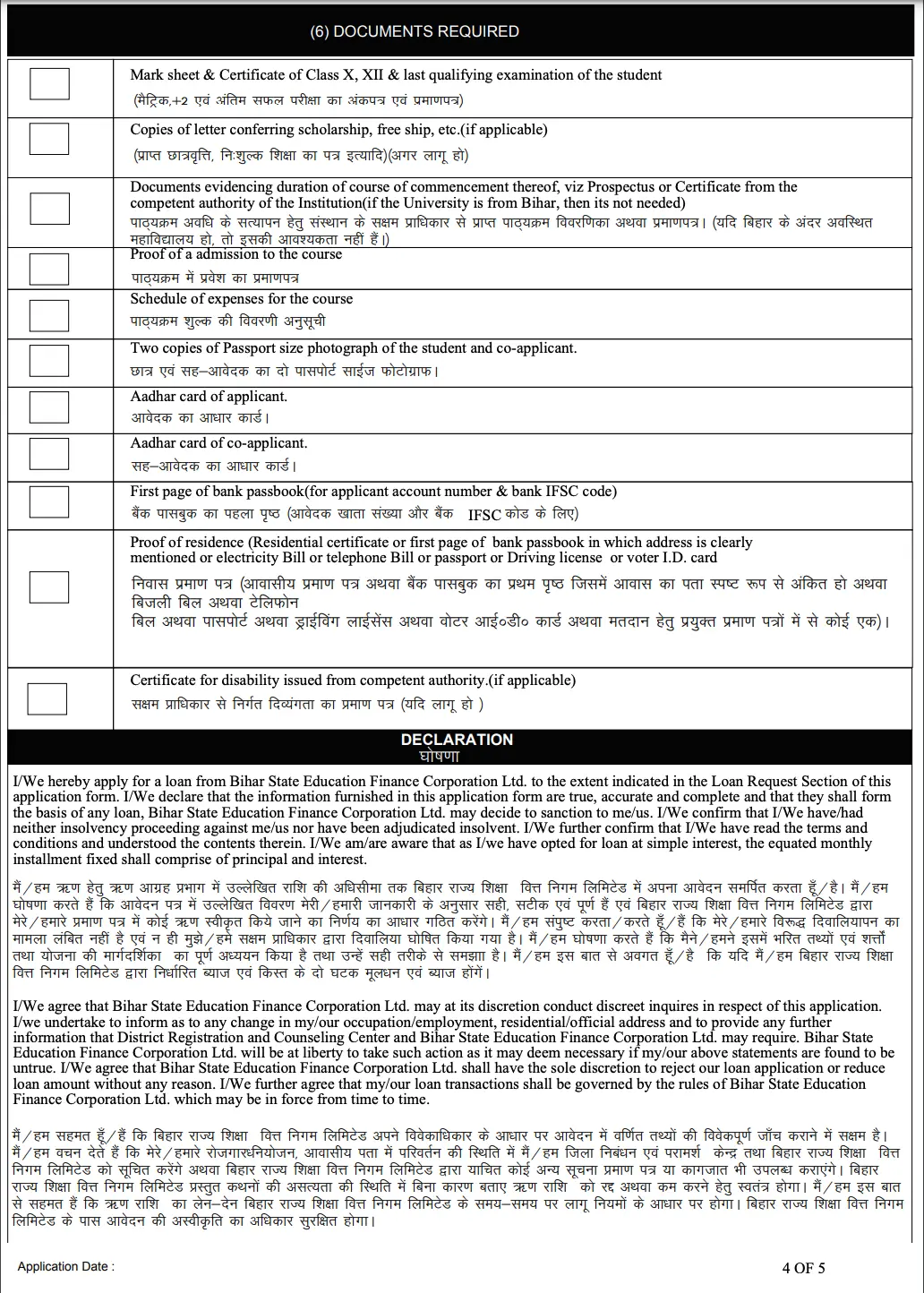

Documents Required for Bihar Student Credit Card

These are the documents you need to apply for the Bihar Student Credit Card:

- Filled Common Application Form: Required for loan application.

- Aadhaar Card: Identity verification.

- PAN Card: Financial identification.

- Class 10 and 12 Mark Sheets/Certificates: Proof of educational qualification.

- Scholarship Letter (if available): Validates eligibility for financial aid.

- Approved Course Structure: Verifies program details.

- Proof of Admission: Confirms enrollment in a recognized institution.

- Fee Schedule: Validates tuition and other expenses.

- Photographs (Passport-Sized): For application records.

- Income Certificate (Previous Year): Verifies financial need.

- Income Tax Returns (Last Two Years): Assesses financial background.

- Bank Statement (Last Six Months): Checks financial transactions and stability.

- Proof of Residence: Confirms Bihar residency (e.g., passport, voter ID).

- Tax Receipt: Additional financial verification.

Apply for Bihar Student Credit Card

Here’s how you can apply for the Bihar Student Credit Card:

- Step 1:Visit the 7nishchay Bihar Portal

- Step 2:Click the ‘New Applicant Registration’ button.

- Step 3:Fill in the required details like name, email ID, mobile number, Aadhaar number, and OTP, then click ‘Submit’.

- Step 4:After successful registration, receive your username and password via email and SMS.

- Step 5:Log in to the portal using the username and password.

- Step 6:Fill out the ‘Personal Information Page’ and click ‘Submit’.

- Step 7:Select the ‘BSCC’ option from the drop-down menu and click ‘Apply’.

- Step 8:Fill in the BSCC form and submit it. A confirmation message and acknowledgment number will be displayed.

- Step 9:The District Registration and Counseling Center (DRCC) will schedule an appointment and inform you via email and SMS about the date of your visit.

- Step 10: Visit the DRCC on the scheduled date with self-attested documents and submit them for verification.

- Step 11:After verification and loan sanction, you will receive an email and SMS from the DRCC with the date to collect the Student Credit Card and sanction letter.

- Step 12:Visit the DRCC to collect the Student Credit Card and the bank’s sanction letter.

- Step 13:Go to the designated bank with the sanction letter to complete the documentation process.

- Step 14:After completing the formalities, the bank will disburse the loan and notify the DRCC.

- Step 15:Track your application status anytime on the 7nishchay Portal.

(https://www.7nishchay-yuvaupmission.bihar.gov.in/).

Check the best offers & apply for a credit card!

Bihar Student Credit Card Loan Interest Rate

The students need to know the interest rates on the Bihar Student Credit Card Loan

| Category | Interest Rate (per annum) |

|---|---|

| General Students | 4% |

| Female Students | 1% |

| Transgender Students | 1% |

| Students with Disabilities | 1% |

Bihar Student Credit Card Status

You can check your Bihar Student Credit Card status through the official website of the Bihar government’s Education Department or visit the nearest District Registration and Counselling Centre (DRCC).

Here's how to check your status online:

- Visit the Official Portal: Visit oficial website:

- Login to Your Account: Use your registration number and password to log in.

- Check Application Status: Click on the ‘Application Status’ section to view your current status—whether it is pending, under review, or approved.

www.7nishchay-yuvaupmission.bihar.gov.in

If there are delays or discrepancies, contact the DRCC or the helpline number for assistance. Ensure you keep your application ID handy for quick reference.

Bihar Student Credit Card App

The Bihar Student Credit Card App offers an easy way for students to apply for and track their credit card application. With a user-friendly interface, the app allows students to submit applications, check their application status, and receive real-time updates. Key features include an easy application process, instant notifications, and direct access to support services from District Registration and Counselling Centres (DRCC). The app ensures students can conveniently manage their applications anytime. It’s available for Android devices and can be downloaded from the official Bihar Education Department website - http://www.7nishchay-yuvaupmission.bihar.gov.in/

Check credit card offers for your credit score! Check Now!

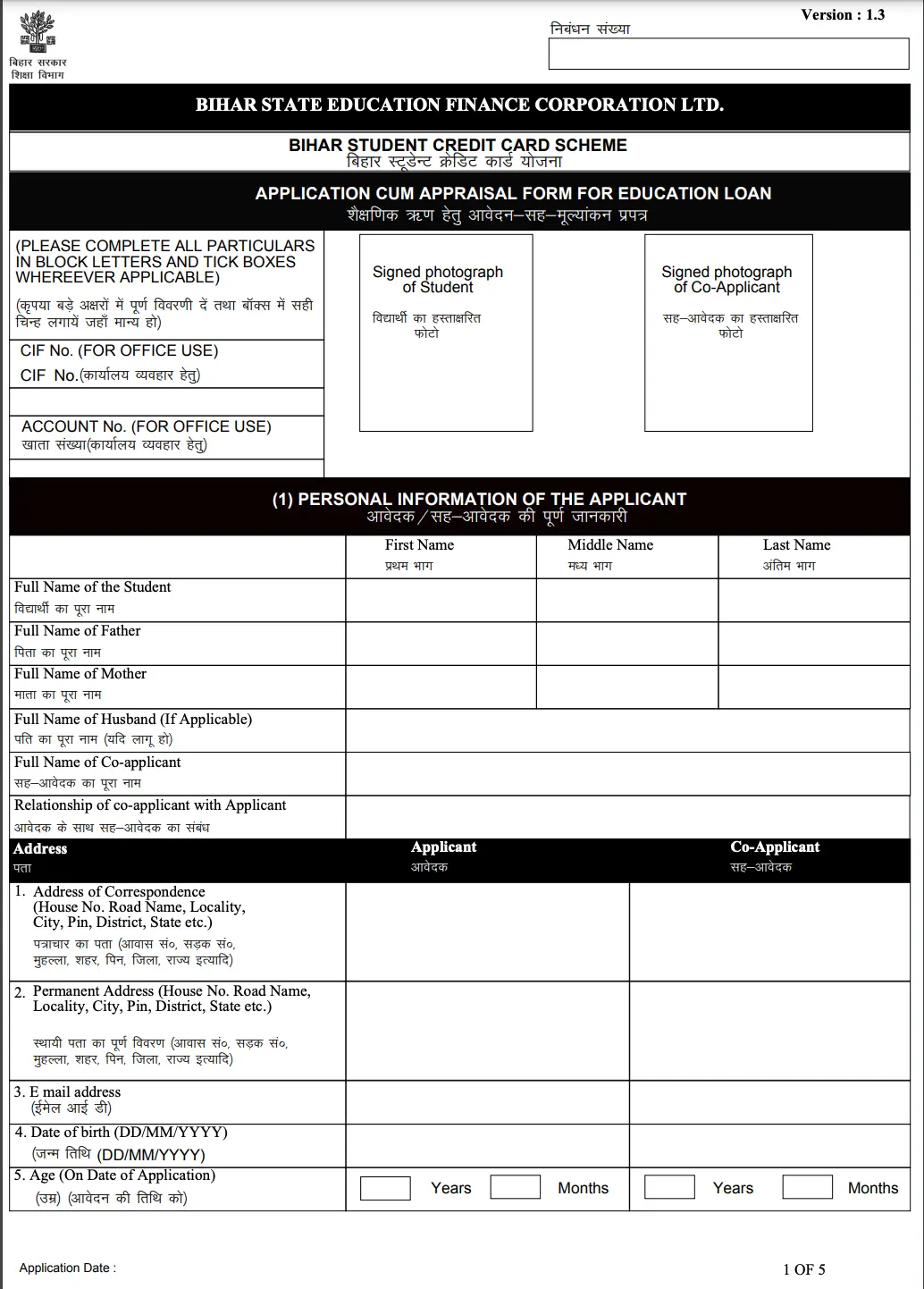

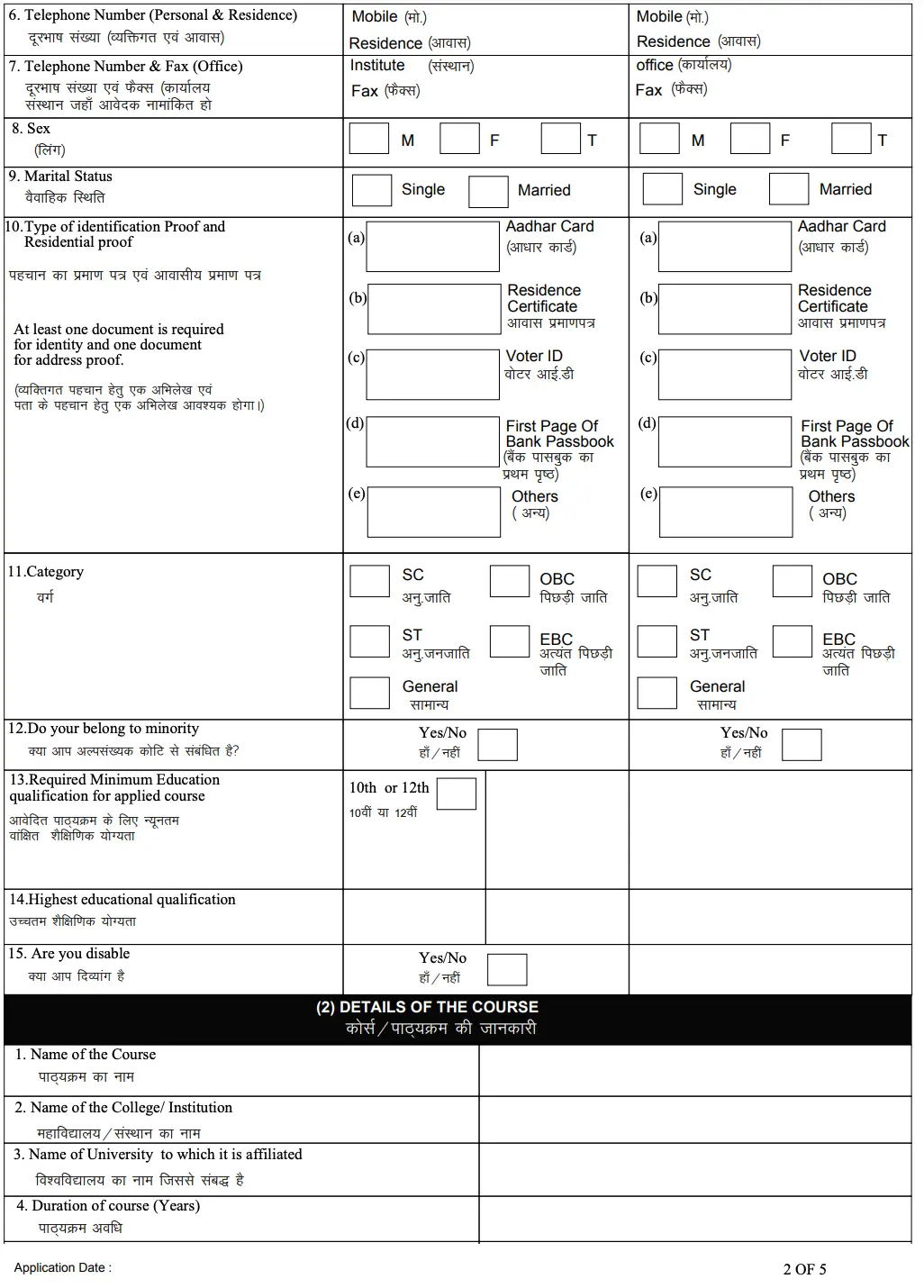

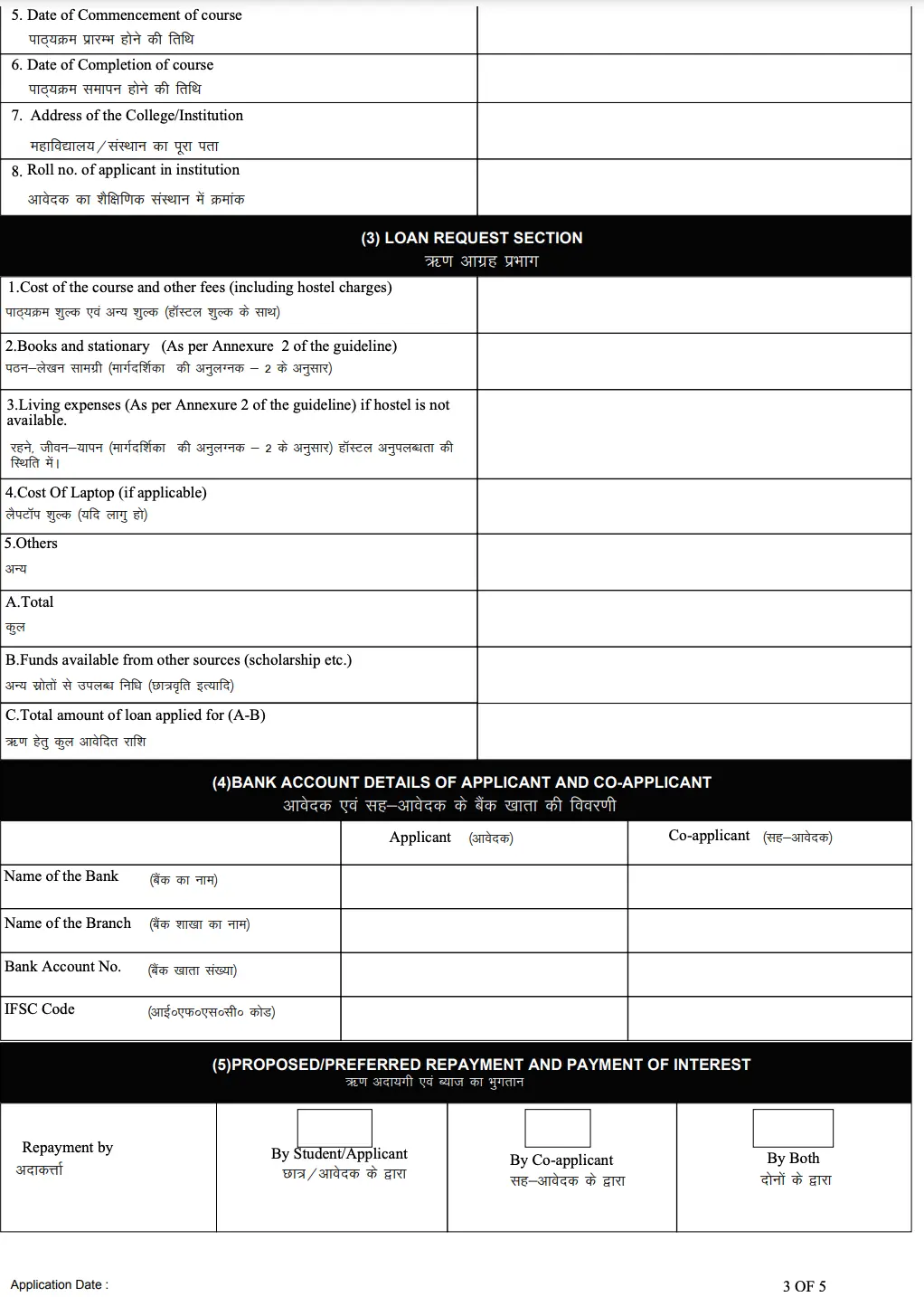

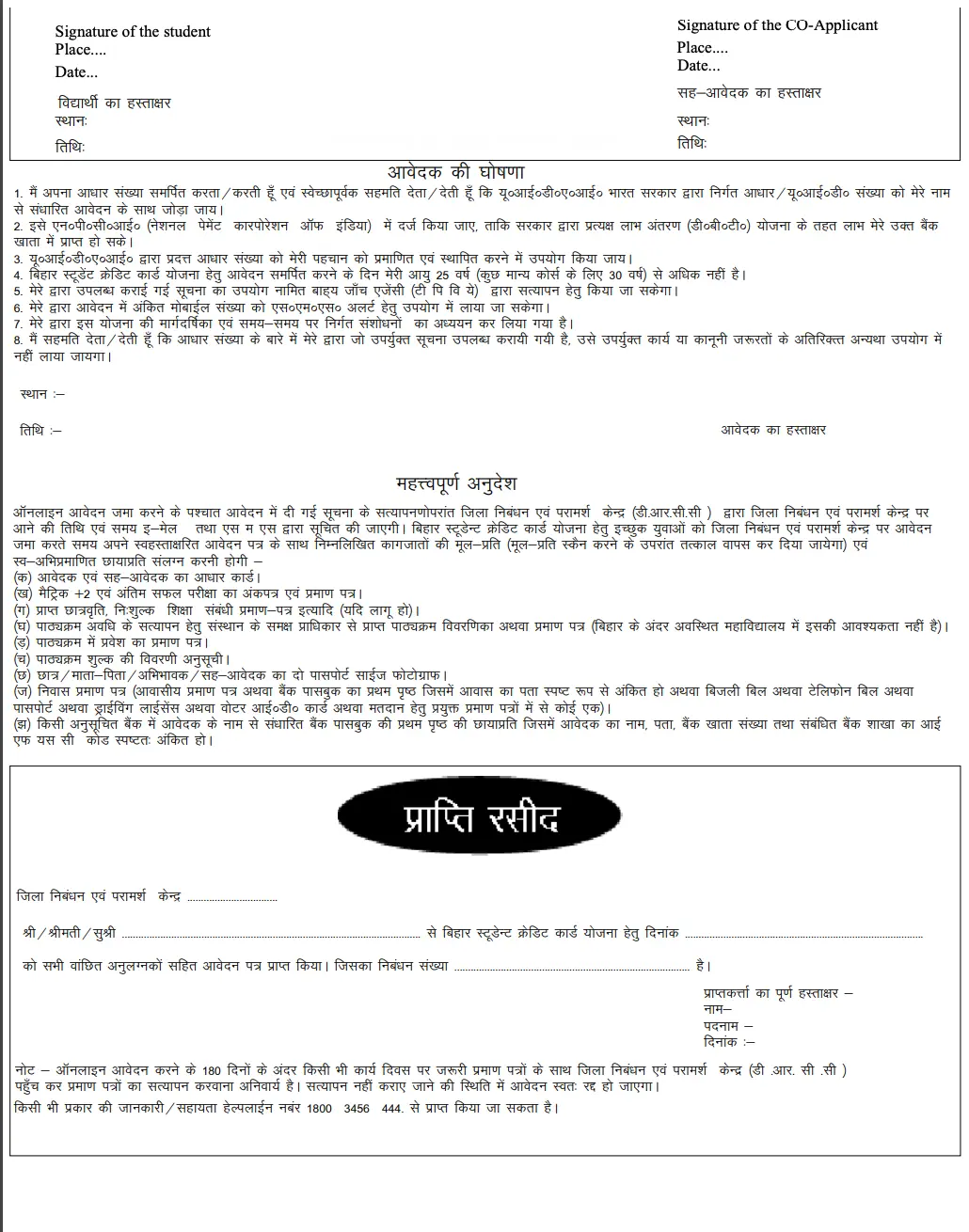

Bihar Student Credit Card Application Form

Here we explain the Bihar Student Credit Card application form, and screenshots are provided below for your reference:

Be up to date with your credit score. Check it out for free now!

Bihar Student Credit Card Loan Repayment Rules

Understanding the repayment rules for the student credit card is essential for managing your loan effectively :

- Loan Amount: Students can borrow up to Rs. 4 lakh to fund their higher education.

- Repayment Start: Students do not need to start repaying the loan while they are studying. The repayment begins after completing the course and securing a job.

- Repayment Holiday: This is a grace period where students are not required to make any payments. For example, if a student is enrolled in a three-year BSC course, they do not need to repay the loan during those three years.

- Flexibility: This rule helps students focus on their studies without worrying about loan repayments. It allows them to start their careers and become financially stable before starting to repay the loan.

- Interest Rate: The interest rate on the loan is 4% p.a.. There is a lower rate of 1% for females, transgenders, and disabled individuals.

Bihar Student Credit Card Grievance Redressal

Learn about the process for addressing any issues or complaints related to the Bihar Student Credit Card :

- How to Raise a Grievance:

- Students can submit their complaints through the official Bihar Student Credit Card portal.

- It is important to provide detailed information about the issue for a quicker resolution.

- Contact Information:

- For immediate assistance, students can call the helpline number: 1800 3456 444.

- Alternatively, they can send an email to spmubscc@bihar.gov.in.

- Response Time: The authorities are expected to respond to grievances promptly, ensuring that students receive the support they need.

- Follow-Up: Students should keep track of their complaints and follow up if they do not receive a response within a reasonable time frame.

- Documentation: It is advisable to keep copies of all communications related to the grievance for reference.

Security & Insurance for Student Loan Amount

In general, student loans offered under government schemes like the Bihar Student Credit Card Scheme typically have relaxed requirements for security and insurance. Here’s what is usually observed for such schemes:

Security Requirements:

No Collateral Security: Most government-backed education loan schemes, including this one, do not require collateral security for loans up to ₹4 lakh. The loan is granted based on the student’s eligibility and course details.

- Third-Party Guarantee: For higher loan amounts (above ₹4 lakh), some banks may request a third-party guarantor, but this is rare for government-supported schemes.

Insurance:

Loan Protection Insurance: Some banks may offer or mandate a loan insurance policy (education loan insurance). This ensures the loan is repaid in case of unforeseen circumstances such as the borrower’s death or permanent disability. The premium for this insurance is usually minimal and can be included in the loan amount.

- Not Mandatory: For government schemes like the Bihar Student Credit Card, insurance requirements are often not mandatory. However, specific banks may have their own internal policies.

Note: To confirm the exact terms regarding security and insurance, it’s best to contact the scheme’s official help desk, DRCC, or the designated bank directly.

One Click Away from the Best No Annual Fee Credit Cards

Other States too have launched credit card schemes for students, Check more on West Bengal Student Credit Card Scheme from the linked page.

- Credit Card

- Credit Card Lounge Access

- Close Credit Card

- Credit Card Advantages and Disadvantages

- Transfer Money from Credit Card to Bank Account

- Loan on Credit Card

- Best Credit Cards for Low CIBIL Score

- Credit Cards to Improve Credit Score

- One Card

- Green PIN

- Bajaj Insta EMI Cards

- Credit Card Application Status Check

- CIBIL Score for Credit Card

- Increase CIBIL Score without Credit Card

- Kisan Credit Card

- Travel Credit Cards

- Credit Cards Without Annual Fee

- RuPay Credit Card

- West Bengal Student Credit Card

- Student Credit Card

- Best Fuel Credit Cards

- Best Cashback Credit Cards India

- Credit Card Against Fixed Deposit

- International Airport Lounge Access Credit Card

- HDFC RuPay Credit Card

- Best Premium Credit Cards In India

- Lifetime Free Credit Card Without Income Proof

- SBI Simply Click Credit Card

- SBI Elite Credit Card

- SBI Prime Credit Card

- SBI Credit Card Reward Points

- HDFC Biz Black Credit Card

- HDFC Credit Card Net Banking

- How to Close HDFC Credit Card

- HDFC Tata Neu Plus Credit Card

- HDFC Tata Neu Infinity Credit Card

- HDFC Infinia Credit Card

- HDFC Freedom Credit Card

- HDFC Moneyback Credit Card

- HDFC Diners Club Credit Card

- HDFC Regalia Gold Credit Card

- Paytm HDFC Credit Card

- HDFC Credit Card PIN Generation

- HDFC Credit Card Statement

- HDFC Credit Card Payment

- Swiggy HDFC Credit Card

- HDFC Credit Card Application Status

- HDFC Millennia Debit Card

- HDFC Bank Credit Card Offers

- Kisan Credit Card

- Kisan Credit Card Application Status

- Kisan Credit Card Interest Rates

- Indian Overseas Bank Credit Card Customer Care Number

- SBI Credit Card Customer Care Number

- ICICI Bank Credit Card Customer Care Number

- Credit Card Customer Care Number

- Central Bank of India Credit Card Customer Care Number

- Union Bank Credit Card Customer Care Number

- Yes Bank Credit Card Customer Care Number

- Bank of India Credit Card Customer Care Number

- Federal Bank Credit Card Customer Care Number

- Canara Bank Credit Card Customer Care Number

- Kotak Mahindra Bank Credit Card Customer Care Number

- Indian Bank Credit Card Customer Care Number

- Induslnd Bank Credit Card Customer Care Number

- Bandhan Bank Credit Card Customer Care Number

- HDFC Credit Card Customer Care Bangalore

- HDFC Credit Card Customer Care Hyderabad

- ICICI Credit Card Customer Care Bangalore

- ICICI Credit Card Customer Care Hyderabad

- HDFC Credit Card Customer Care Number Chennai

- Kotak Mahindra Bank Credit Card Customer Care Pune

- Standard Chartered Credit Card Customer Care Number

- UCO Bank Credit Card Customer Care Number

- Karnataka Bank Credit Card Customer Care Number

- HDFC Bank Credit Card Customer Care Number

- Axis Bank Credit Card Customer Care Number

- PNB Credit Card Customer Care Number

- Bank of Baroda Credit Card Customer Care Number

- IDFC First Bank Credit Card Customer Care Number

- IndusInd Bank Credit Card Customer Care Number

- IDBI Bank Credit Card Customer Care Number

- RBL Bank Personal Loan Customer Care Number

Frequently Asked Questions

Students must be 18 years or older, enrolled in an educational institution, and provide necessary documents like ID and address proof.

You can apply online or at local bank branches with student proof and required documents like an Aadhar card and address proof.

Benefits include low fees, easy access to credit, cashback offers, and opportunities to build a credit history.

Regular and timely payments on a student credit card establish a positive credit history and improve credit scores.

Required documents include a student ID, address proof, Aadhar card, PAN card, and a letter from the institution.

Credit limits typically range from ₹10,000 to ₹25,000, depending on the issuer and eligibility.

Yes, many banks offer student credit cards with no annual fees or nominal charges.

Interest rates range between 18% and 36% annually on outstanding balances, varying by bank.

Yes, student credit cards can be used for online shopping, including e-commerce platforms and digital payments.

Missing payments can result in late fees, increased interest rates, and a negative impact on your credit score.

You can request a limit increase after consistent, timely payments and usage over a few months.

Yes, many student credit cards support international transactions if global usage is enabled.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users