Everything You Need to Know About Your Credit Score!

Your credit score is a crucial factor that can open doors to various financial opportunities and help you secure the loan amount you desire. It is a three-digit numerical expression that represents a summary of your credit history.

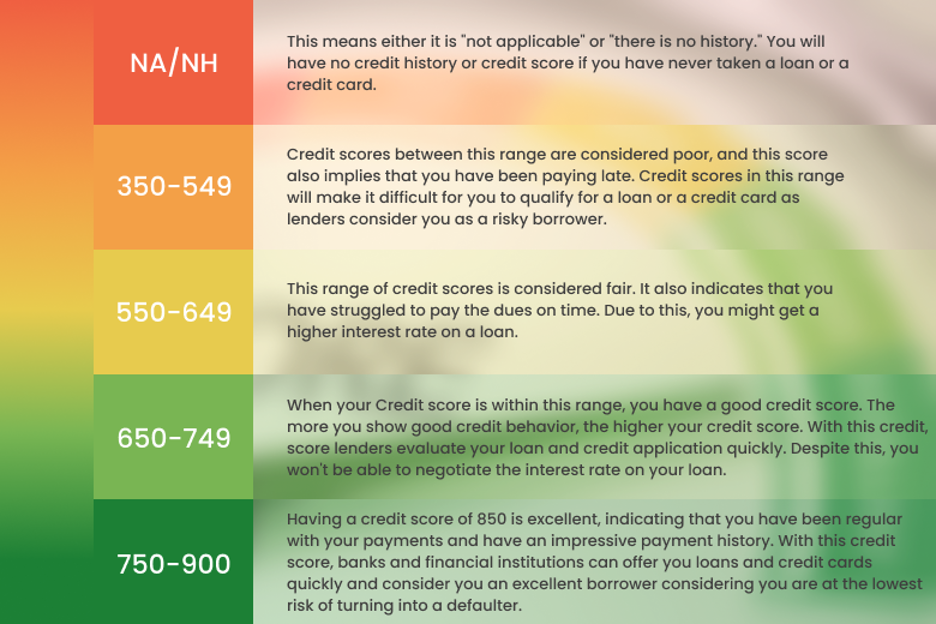

The credit score is derived from the information in your credit report, which includes details of your borrowing history, repayment behaviour, and credit utilization. The credit score scale typically ranges from 300 to 900, with a higher score indicating better creditworthiness and a lower risk for lenders.

Importance of Credit Score

Lenders and financial institutions use your credit score as a key factor in assessing your creditworthiness when you apply for loans, credit cards, or other forms of credit. A good credit score, typically above 670, can significantly increase your chances of qualifying for loans, credit cards, and mortgages. With a good credit score, you also have a better chance of securing larger loan amounts and enjoying lower interest rates.

You can check your credit score for free from Buddy Score. It provides a quick and easy way to obtain your credit score evaluation report.

By taking control of your credit score, you can open doors to better financial opportunities. Whether you're planning to apply for a personal loan, car loan, or credit card, having a solid credit score will give you the confidence to negotiate favourable terms and secure the best possible financial outcomes.

People also ask:

- It is a three-digit number ranging from 300 to 900.

- It shows the creditworthiness of a borrower.

- The credit score depends on the credit history.

- A score of more than 750 is called a good credit score.

- A score of less than 650 can be suspected and needs extra effort to get a loan.

- Credit scoring considers these factors to calculate your credit: your repayments history, types of loans you have taken, your total debts, and your credit history length.

However, a credit score has ample features, as mentioned above, but after you monitor your free cibil score for free and are aware of your credit score, you can now read further to know more about ways to

A quick credit score check has a significant influence on your finances. Also, it is often essential and the first thing a lender will consider while they check credit score to monitor your financial behaviour. If your score is usually low and your loan gets rejected, there are higher chances that the lender may not reject your loan, but they can charge you a high-interest rate.

But, on the other hand, if you find your credit score is high after you check credit score, the prospects of your loan application being approved become greater. A high credit score gives you the advantage of a better interest rate. So, you might have to pay less interest in the long run if you have a good credit score. However, you might have a good credit score and not be aware of it! Hence, click here to check your credit score now!

Also, checking credit score is not the only factor lenders consider when determining whether or not to provide you with a new credit or loan. In addition to debt-to-income ratios, employment history, and profession, lenders usually consider these factors before approving/rejecting your application. However, it is very necessary for your credit score to the above or equal to 650. After you have checked your credit score, if incase you find that your credit score to be lesser than 650 than what you should do? Thats why you should you continue to read the next to get an idea on the quick ways to improve your credit score.

Here are some quick ways to improve your credit score thats will helpful for you to get quick personal loan. Take the first step towards improving your credit score as mentioned below :

- You must always pay your invoices, credit card bills, and loan EMIs on time.

- You must never put off paying your bills.

- You should maintain a clean, rigorous, and error-free credit history.

- Don't make an excessive number of credit queries.

- It would be best to keep a healthy balance of secured and unsecured debt.

- Maintain good credit utilization ratio consumption.

- You can even apply for a loan to increase your credit score.

- You should watch the fraud, review your credit report thoroughly, and report any unauthorized activity to your bank immediately to correct your score.

The tips mentioned below should be followed digiligently for you to see quick results in your credit score.However, ensure that you have done your free cibil score check to have a better knowledge of your credit score.

A credit rating is the overall analysis of all credit risks that concerns a financial entity that is known as credit rating. It is usually provided to that entity based on their credentials, as well as the responsibility to which their financial statements are sound for the lending and borrowing has been done by the company. This rating is a form of detailed report and enables other companies or Rating Agencies to choose the solvency of that entity. These major ratings are provided by various agencies, Standard and Poor’s and ICRA etc, based on detailed analysis.

Major Difference between Credit Rating and Credit Score:

A Credit Score and credit rating somewhat has the same purpose and also are used interchangeably but there are certain significant differences. These are -

- A credit rating shows creditworthiness of a government or a business whereas a credit score includes the creditworthiness of an individual.

- A credit rating in a letter grade format , shows ratings as Triple-A ratings for those governments or corporations that have a good capacity for meeting all financial commitments, but followed by a double-A, A, Triple-B, Double-B and so on, until D for default. That can also be added to these ratings.

- Credit scores express numbers such as Fair Isaac Corporation score or FICO score. These particular scores are 3 digit numeric representations of your creditworthiness and range from 300 to 900. If their score is 900, higher is the creditworthiness of that individual.

With the understanding of credit rating and credit score, you will have a better idea of why you should go through a free cibil score check as it helps you to understand your creditworthiness better.

Now, in the next section of the article , will discuss one of these well known credit bureaus that is experian .

A credit report is necessary for approval to get loans that you need to borrow, especially, when you have a bad or weak report that can damage/reduce the prospects of the loan being provided to the company.

Credit reports companies constitute details about a company’s or an entity's credit history. These company’s credit reports provide details to the lenders about existing credit or pending dues of any outstanding amounts. Here below, this section further discusses the various types of credit information companies in India in order to know about how credit companies in India work.

List of Credit Information Companies in India:

TransUnion CIBIL Limited:

The first Credit Information Company was founded in August 2000. The company usually collects and maintains records of an individual’s repayment habits related to loans and credit cards. These records are forwarded to TransUnion CIBIL Limited by the member banks and financial institutions on a monthly basis. The information usually received from the establishment that used to create Credit Information Reports and free credit scores. Reports and credit scores are given to concerned institutions such as banks in order to help them make lending decisions.

Experian Credit Information Company of India Private Limited:

The credit report from Experian has information of an individual's credit with loan history that are bought as credit reports by various banks in India. Experian is similar to TransUnion CIBIL, but Experian collects information from the member banks and other establishments. The lenders are asked to pay a fee to obtain credit reports from Experian. However, as a user, you can track your Experian credit score for free by logging in to the Buddy Score website.

Equifax Credit Information Services Private Limited (ECIS):

The oldest credit information company in the USA, Equifax is also the largest credit reporting agency that provides credit reports for individuals and businesses. This agency has also collaborated with various banks along with institutions in India that, enables the company to make credit reports and assessing credit scores.

CRIF High Mark:

Considering one of the few credit information companies that specializes in analytics, scoring, along with credit management solutions. CRIF High Mark makes credit reports based on the information collected from banks, Income Tax Department, and other banking as well as non-banking companies. The credit reports from CRIF High Mark are available against a fee. There are many Indian banks who have tied up with CRIF High Mark to create reports and to assess their borrower's financial credibility.

One of the world’s foremost credit information services that has offered a wide range of business tools to their clients all across the globe. That is popularly known to be among the planet’s most innovative companies, this company is licensed by the Reserve Bank of India and assists clients to provide a wealth of analytical as well as data tools, that helps them manage businesses in a more intelligent manner and effective manner. Experian is also the first credit information company to be licensed by Credit Information Companies and currently operate two firms within India, namely:

- Experian Credit Information Company of India Private Ltd

- Experian Services India Private Ltd

Experian has collaborated with more than 2,900 financial institutions, also counting many public sector banks, telecom companies, micro finance institutions as well as non-banking financial companies. The company gives you as customers credit information as per guidelines issued by the Credit Information Bureau limited .

What Is An Experian Credit Score?

Experian Credit Scores is a score that can be evaluated based on your previous or existing loan or credit card repayment history. To process your loan application, banks and financial institutions can investigate it.

Features and Functions of Experian

The basic feature and function of experian are as follows :

- Enables businesses zero in on offers relating to marketing

- Enables you to manage credit risk in a more efficient manner

- Helps your business by automating your decision making procedure

- Helps clients in the prevention and circumvention of instances of fraud

- The firm also helps you to protect them against identity misrepresentation and theft, ascertainment of their credit scores, and drawing up their credit reports.

Importance of Experian CIR and Credit Score

The Experian Credit Score and Credit Information Report shows your creditworthiness and past credit history. These reports only re your eligibility to get an approval for a personal loan or credit card, home loan along with other kinds of loans. This plays a very major role for you to get a credit card and a loan approved.

What Is The Experian Range?

The Experian score varies between 300 and 850. In India, an Experian score of 800 and above is considered excellent. Banks and non-bank financial companies are more confident that you will repay a loan if you have a higher Experian score. A typically good Experian credit score ranges between 600 and 750.

Experian scores are also used by lenders such as NBFCs and banks to assess your creditworthiness. Hence having a good Experian score means a low down payment and low-interest rates.

Hence it is suggestible to maintain your Experian credit score by paying all your bills on time and not making several inquiries. You must also keep checking your Experian credit score and report online to know your credit position.

Experian Credit Report and Credit Score Offline - Procedure

- Step 1: Go to the Experian website to download in the form

- Step 2: Ensure you have a self-attested, a photocopy of your PAN card, passport along with your voter ID. There are your identity proof documents.

- Step 3: Also provide your self-attested photocopy of telephone bill, electricity bill, rent agreement, bank account statement along with a deed of purchase as address proof documents.

- Step 4: Before making the payment of the fee for Experian CIR through either NEFT or a demand draft.

- Step 5: You might have to send the form with the required documents to Experian Credit Information Company India Pvt. Ltd.

Check The Free Experian Credit Report Online - Procedure.

To calculate your Experian Free Credit Report on Buddy score in less than 2 minutes by following the 3 simple steps shown below

- Step - To "Check free credit report, "you should log in to the website providing these details.

- - First Name.

- - Last Name.

- - Email address.

- - Your mobile number.

- - Date of birth.

- - Gender.

- - Pan card details.

- - Current Street Address.

- - City.

- - State.

- - Zipcode.

- Step - Once you have correctly provided the details mentioned above, you will receive an OTP on the number.

- Step - Now Your Experian Free credit report should display on your screen with every detail of the payment history of your credit accounts.

Hence, now that you know the ways to check free experian credit report both and offline , it is very clear that the company gives your credit information as per guidelines issued by the Credit Information Bureau limited . However in case you are confused, what are the basic differences between Cibil and Experian. Well then you can understand with the help of the table mentioned below:

CIBIL Vs Experian

| CIBIL | Experian |

|---|---|

| Cibil uses the model named Empica. | Experian uses the FICO algorithm for credit scoring purposes |

| Cibil cater to domestic money lenders | But Experian deals with an ample number of international financial entities as well. |

| Under an Indian - based establishment , CIBIL enjoys greater weightage. | Whereas, Experian is an international also a trusted organization being founded in they year 2000 |

| Cibil has better chances for to get you loans in India | Experian has better chances for you to get you loan internationally |

Credit Score Calculation by Experian - Procedure.

Like the other credit bureaus in the country, Experian has a lot of financial institutions that are its members. These institutions also provide NBFCs along with banks as they submit the credit data of the borrowers to Experian. All these submissions commenced under the guidelines of Reserve Bank of India of Credit information companies regulation act 2005.

Experian uses the information by creating your credit information report. There are a lot of the key elements of the credit history data and an algorithm that can generate your 3-digit credit score between 300 and 850..

- Credit utilization ratio

- Length of credit history

- Sum of loans and credit cards availed

- Repayment history

Hence, the 3-digit can be summarized in your credit history-Experian score. These usually affect your credit score:

Now ,that you have the idea of the credit monitoring procedure in experian, lets understand how credit monitoring is processed from Experian and Transunion

The following benefits are only available to individuals who maintain a clean and consistent payment history and have a high credit score.

-

You will receive a loan at Low-interest rates.

Having an excellent credit score can be very advantageous for you. It can make you qualify for loans that have a low-interest rate. Hence it can make it easier to repay the debt without any difficulty. You should pay attention to this because even a half percent increase in the interest rate can impact your finances.

-

You can get instant approval for a credit card and loan.

If you have a high credit score, it can demonstrate to the lenders your creditworthiness, which leads them to give you instant loan approval. Hence, borrowers that have excellent credit scores can benefit from the rapid acceptance of loans and credit cards. This is very important if you have any emergency and need a fund immediately.

Furthermore, lenders, banks, and financial institutions reject the borrowers with poor credit ratings because of their unreliable credit histories. It's also important to keep in mind that various additional factors will also be considered when you apply for a loan or purchase a credit card.

-

You can have better negotiations power with the lender

An excellent credit score gives you the power to negotiate on the lower interest rates or on a more considerable loan amount from the lenders. Thus, a good credit score can enhance the bargaining power of borrowers. Apart from all this, it can even entitle the borrower to get unique discounts, deals, and offers.

-

You have a good chance of getting a high limit on the loans.

An individual's credit score and income are used by lending institutions and banks to determine how much he or she can borrow. Banking and financial institutions are more likely to give you a good loan if your credit score is high. Your high credit score makes you an excellent borrower. However, when the borrower has a low credit score and requests a loan. The loan might be accepted, but the lender will charge higher interest rates.

-

You can quickly get a higher limit on your credit card.

Lending institutions and banks use an individual's credit score and income to determine how much they can borrow. You can get the best interest rates, rewards, deals, discounts, and cashback offers from these cards. Make sure you pay off your credit cards and loans on time when you are thinking of purchasing something extraordinary with many perks.

-

You can get the chance of getting a long tenure.

A good credit score can lead you to a higher chance of getting a longer tenure on your loan. A longer tenure lowers your monthly Emis, which can help you maintain your finances properly.

-

You can get access to utility affordability.

Sometimes credit reports and scores are checked by the utility companies to determine whether you can pay your bills on time or not. In such a case, you will need to put down a security deposit if your credit score is poor.

You should also remember that the better your credit score, the more chances you'll have to avail of maximum benefits. Hence, if you plan to apply for a loan or a credit card, regularly keep an eye on your credit score. You can check your free credit score at Buddy score to obtain your current credit position.

-

Credit Score: What factors can impact It?

When you apply for a personal loan , home loan or any credit product, the credit bureaus calculate your credit score by considering various factors. These factors depict your credit behaviour in the past and are reported to banks and NBFCs. Even having high balances on your credit card can significantly reduce your credit score.

Some of the critical factors that can hurt your credit score are:

-

Your loan Repayment History

If you make timely payments, it can enhance the growth of your credit score and help improve it significantly. If you default on your EMI or make late payments, your credit score is negatively affected. Hence, you must know that your loan repayment history can significantly impact your credit score reports.

-

The Duration Of Your Credit History

Your credit history's age can also impact your credit score. If you use your credit cards for a longer duration and keep paying your payments on time, then the lender and financial institutions can determine that you have disciplined credit behaviour. Hence the period of your credit history can have a minimum impact on your credit score.

-

The number of Hard Inquiries conducted.

Every time when you apply for a new loan or a credit card, your credit rating is checked by the lender. All such inquiries made by lenders and financial institutions are known as hard inquiries. In other words, too many hard inquiries can adversely affect your credit score and give the impression that you are credit-hungry. However, hard inquiries can have a significant impact on your credit score for a short time.

-

Your ratio of the credit utilization

The credit utilization rate is known as your credit utilization ratio. It is revolving credit used divided by total credit available. You can use it to determine how much credit you have available at the moment. To maintain a good credit utilization ratio, you should not use more than 30% of your available credit.

-

If you have a Mix of credit

Suppose you have taken different loans and paid them off responsibly, such as a personal, auto, or home loan. It will represent you as a responsible person to the lender as you can adequately handle different kinds of credit.

On the other hand, if you have taken out too many unsecured loans, like personal loans, it might also indicate that you are credit hungry and overly reliant on credit. Hence due to this your credit rating might suffer. It's also important to know that the credit mix has little impact on your credit score, and a lender is unlikely to reject you if you don't have an optimal combination of credit products.

-

If you keep increasing your credit card limit frequently.

If you keep requesting a raise in your credit card limit, it can create doubts about your creditworthiness. It can show that your debt appetite exceeds your ability to pay back. As a result, it might negatively affect your credit score. Therefore, it's best to stay within the existing credit limit and repay debts promptly. If the bank believes it's the right time, they will raise your credit limit.

-

Other Factors

Apart from the above five factors, which are primary in calculating your credit score, other factors mentioned below can also have a meagre negative impact on your credit score.

- Your credit history is shortened when you close old credit cards. So it can harm your credit score.

- If you make multiple credit card or loan applications within a short period, your credit score will plunge. Hence, it is advisable to limit the number of applications.

- In the event of late payment of credit card bills, creditors charge off the account. One of the worst incidents that can affect your credit score is to have your account charged off.

- When you have only one credit account, it will negatively impact your credit score. As a result, you should maintain a mix of debts such as loans and credit cards while making consistent payments on time.

- Your credit score can suffer if you fail to check your credit report occasionally and fix any errors. Creating credit reports is also an endeavour that is prone to error by credit reporting bureaus. Hence, if you do not keep track of your credit report, it could cost you a fortune in the future.

- When you file for bankruptcy, you can negatively impact your credit score.

- You can lose your credit score when you request to close a credit card with an outstanding balance. You would be in a similar situation if you maxed out your credit card.

If you utilize your credit up to 60-70%, it might barely affect your credit score. However, if your credit utilization ratio is high or if you frequently max out your credit limit. The lender may view you as highly reliant on credit and likely have a high repayment burden. This can negatively impact your credit score.

Check the article to know more about the factors hurt your credit score

Here are some steps you can take to improve your credit score:

- You must always pay your invoices, credit card bills, and loan EMIs on time.

- You must never put off paying your bills.

- You should maintain a clean, rigorous, and error-free credit history.

- Don't make an excessive number of credit queries.

- It would be best to keep a healthy balance of secured and unsecured debt.

- Maintain good credit utilization ratio consumption.

- You can even apply for a loan from Buddy Loan to increase your credit score.

- You should watch the fraud, review your credit report thoroughly, and report any unauthorized activity to your bank immediately to correct your score.

These are proven ways to understand ways you can improve your credit or free CIBIL score.

Experian makes credit information to the clients that is easily generable through the conversion of the present financial information such as loans, personal credit history, credit cards etc. into a set format. This is known as a credit score. Members get this financial information, which is used to get a report that assesses your creditworthiness based on past financial history.

A credit report enables a lender to have an accurate snapshot of the borrower’s detailed financial position, allowing them to make informed decisions regarding the extending of credit to these borrowers.The credit report usually incorporates the credit information from bureaus and CIBIL fetches from all the financial institutions. The detailed report has the information about an individual’s history of borrowing and repaying routine, including defaults and delays.

The major parts of this report shows how, every individual’s personal information, employment details, contact information and account details.

How is a Credit Report Calculated?

An Experian report is evaluated on certain factors that an Experian score is provided, which corresponds to the customer’s financial position. Basically , this score ranges between 300-850 points, with a higher score of a more financially sound position.

This enables lenders to take the risks associated with lending to a particular borrower that determines if the borrower will be granted credit at all.

An Experian score is divided into certain categories, as under:

- Ranging between 300-500- The score shows that you have a poor history that can result from bad debts, payment defaults or even poor credit utilization. Having the score can put your high risk and lenders will be wary of extending credit.

- Ranging between 500-650- The score shows that you have a poor history that can result from bad debts, payment defaults or even poor credit utilization. Having the score can put your high risk and lenders will be wary of extending credit.

- Ranging between 650-750- The score shows that you have a poor history that can result from bad debts, payment defaults or even poor credit utilization. Having the score can put your high risk and lenders will be wary of extending credit.

- Ranging between 750-850- The score shows that you have a poor history that can result from bad debts, payment defaults or even poor credit utilization. Having the score can put your high risk and lenders will be wary of extending credit.

Understanding the Credit Reports - Key terms

NA or NH: As a credit card or loan borrower , there are chances that you will see an “NA or NH” on credit score. NA or NH shows there is no, little, or insufficient credit activity to make a report or to get an online credit score.

STD:ssss If the payments are made with the due dates, than you get this term on your credit report.

SMA: If you have delayed the repayments, then you get this on a credit report.

DBT: This is an indication of a doubtful situation if the credit information has been inactive for over 12 months.

LSS: This remark on card accounts will be regarded as loss, and as a defaulter for a long period of time.

DPD: This Indicates the number of days that the account didn't receive any payment.

Written Off/Settled Status: In a situation , the borrower can not complete the repayment then the settlement will indicate a written off or settle status.

Eligibility for credit report

There is another alternative way for you to receive a copy of your free credit report from the four major credit bureaus . This can be done by meeting one of the following requirements as provided in the Fair Credit Reporting Act

You can also meet one of these requirements, as you are entitled to one additional free copy of your credit report during any 12-month period:

- If you're unemployed and intend to apply for employment within 60 days

- If you are receiving public welfare assistance

- Make sure that you believe that your credit report contains inaccurate information due to fraud

- If you've are denied credit or insurance within the past 60 days

- You've made a fraud alert on your credit reports

You are also entitled to a free copy of your credit report , also if you meet these requirements:

Monitoring your credit means tracking credit history or any discrepancies or suspicious activity . You can be a victim of identity theft that can hamper your credit score and eventually your overall credit report .Also, there are several credit monitoring services that help you check your credit history more often. These services review your credit report and alerts you in case you have come across any fraudulent activities or errors. Also if you are not keen on taking the help of a credit monitoring service, you can try a few simple steps and monitor your credit by yourself. Now that you know what is actually credit monitoring , you can follow the next section that talks about how you can monitor your credit.

It is important to evaluate your credit card statement every month as you may be charged for a few unnecessary expenses. You could also be a victim of identity theft or fraud. However , if you see any kind of suspicious activity on your credit card, then you can also reach out to your bank to rectify the issue at the earliest. You should also look around for any unauthorized transactions that have been conducted via your credit card.

Get your Free Credit Report:

All the four credit bureaus in the country offer one free credit report and credit score to you in a calendar year , since the beginning of 2017. Hence, it essentially shows that you can get you four credit reports for free in a year. It is a very good and essential habit to check your credit report periodically to avoid any surprises such as fraudulent activities and unnecessary credit inquiries.

Safety of your Data:

In today’s digital age, it is very easy for your major documents to go under the hands of an unauthorized entity , so you have to be extra careful when your processing your online transactions.. Ensure to keep your usernames and passwords safe and beware of online frauds. And the next way to do this is by reducing the exposure to the unauthorized and third party websites. Providing your personal information such as your credit card numbers and pins via email or any other online medium is a thing that you should avoid intrinsically. Also, changing your net banking and credit card passwords frequently is important. All the transactions happening via your phone or desktop, it is important to store your passwords securely.

Errors in your Credit Report, that needs to be fixed:

Coming across errors in your credit report such as duplication of credit transactions, or wrong personal information, should be fixed to the earliest. You should also raise the dispute with the respective credit bureau and will resolve the error at the earliest as it can bring down your credit score.

Alerts of your Credit Expenses:

The quicker you get to know about your credit transactions, that is for you to take action in case of fraud or a discrepancy.Take measures to work on your credit score to bring it close to the 850 mark. If it is not in the ideal position that you can build by paying bills on time, limiting credit exposure, not closing old accounts, not taking multiple credit at a time, can help you improve your credit score. So, your credit score cannot change overnight and it takes time and effort to get a healthy credit score.

Credit history is a record of your ability to repay your debts along with your way of responsibility is also demonstrated . It is usually mentioned and recorded in your credit report that entails the number and types of your credit accounts, along with for how long each account has been open, amounts owed, the amount of available credit used, whether bills are paid on time, and the number of recent credit inquiries. Also your credit history contains information regarding if you have any bankruptcies, liens, collections, or judgments.

You are given guaranteed access to your credit history and are eligible for one free credit report from each credit bureau on an annual basis. It can be accessed from any government-approved website.

Usually , the information in your credit history decides whether to extend credit to you. The information in your credit history also calculates your FICO score. The creditors review your credit history. There are also different factors: recent activity, the length of time that credit accounts have been open and active, along with the patterns and regularity of repayment over longer periods of time.

The term that is mostly used when it comes to credit card transactions is credit score. ̧This score is between 300 to 900 and a score above 760 is considered to be good. A healthy credit score is an indicator of your credit worthiness. Both a credit score and credit report are more or less the same entity but a credit report is a absi;utre stand alone document.

So, you with good credit reports are seen to be less risky in terms of repaying debts and hence receive loans quite easily. This credit score is derived from a particular algorithm and predicts future of the your financial stability

As a customer you also can check your credit history by procuring your Credit Report. However, you will have to apply to any one of the three credit rating agencies in India - Equifax, Experian, CRIF or CIBIL. Generally, CIBIL and Experian are the most sought after bureaus due to the fact that they are the best and the oldest credit information bureaus in India. This report will have details about your loan related transactions along with every credit card account that they have had or have currently. In simple words, it shows your financial history. Based on the information provided in the credit report, your credit score is calculated.

Steps to Check Credit History

You can understand your credit history through your credit report. This can be done by following the process given below

- You should first visit the Credit bureau’s website and then apply online for the credit report.

- You will have to provide the required documents - a proof of identity and a proof of address.

- Proof of identity can be any one of the following -

- PAN card

- Passport

- Aadhaar card

- Ration Card

- Proof of address can be any one of the following -

- Passport

- Electoral Photo Identity Card

- Utility Bills

- Aadhaar card

- The above documents should have to be scanned and uploaded.

- You will have to then pay for their report online.

- Within one day, you will receive their credit report by email, as long as the document has been verified and the payment has been received.

After you get your credit report, then you will know your credit score. This score will give you an idea about your eligibility for loans. In case their score is above 750, there is a good chance that you will receive loans without many hassles and at an interest rate that is economical. If the score is below this, your credit history is not very strong and will have to be improved at the earliest. But ,a score below 750 will result in the loan application getting rejected and scores dropping ever lower.

Once applicants receive their credit score, you must work to ensure that the score is high at all times.

Credit reports and credit scores both are important components of your credit history. The most widely used financial products in the world today are credit cards. These cards allow you to borrow a certain amount of finance against a line of credit that will have to be repaid within a certain amount of time. Credit cards provide a number of perks along with benefits such as dining offers, travel discounts, surcharge waiver and others.

A cardholders’ credit card transactions are referred to as credit history. This history is very important for you to know financial transactions. A credit report will involve information such as your ’s credit score, account information, contact information and so on.A credit report that is equally important, as a credit score. A credit report is an expression of a credit history, then a credit score is a 3 digit numeric summary of that of your credit report. Hence, this score can range above 750 is considered to be good and below that is considered low.

A credit report and a credit score are more or less like similar concepts, as there are a number of differences between the two. A credit report can also be understood as a report card, whereas a credit score is similar to a grade point average.

| Credit Report | Credit Score | |

|---|---|---|

| What is this? | It is a detailed report of your credit history that also acts as a credit reference. | Whereas credit score is a 3 digit summary of your credit report based on the information given in the credit report. |

| Who makes this? | The three credit reporting bureaus are :TransUnion, Equifax and Experian | Banks sometimes create their own score or they can refer to the scores provided by companies such as VantageScore or FICO. FICO scores are most commonly availed. |

| How many of these exist? | Three credit reports maintained by each of the above bureaus. Lenders and creditors do not have to report information on your credit history to all three bureaus, the information provided by each of them. | There are ample bank proprietary scores that exist. |

| Can it exist independently? | This is also known as a stand-alone document. | It is solely based on the information available in a credit report. |

| How does it help in judging creditworthiness? | A credit report includes all information on your credit accounts, both current and past accounts with information regarding their debts and third-party collections. Credit reports majorly have details such as current balance, loan amount, history of payment, and so on. | Credit score includes information of amount owed, history of payments, mix of credit, new credit and length of credit history. Scores above 760 are considered good and creditworthy. |

| Where can this be procured? | Customers can procure reports from any of the bureaus mentioned above. | This information and sometimes lenders give this information as well. |

Credit reports as well as credit scores used based on the requirements, such as landlords, employers, insurance companies, banks etc.

How are Credit Reports and Credit Scores Used?

These are following ways to utilize credit reports and credit scores -

-

Mortgage Lenders

Mortgage lenders see if there are any red flags that pop up, which may prevent borrowers from returning the amount that they might take as loan. Lenders also analyze credit scores from all three bureaus and take the middle score as reference.

- Auto Lenders

Mortgage lenders use credit reports to check any red flags that pop up, which can prevent any borrowers from returning the amount owed. Credit scores determine the customer’s eligibility to procure loans and their rates of interest.

- Credit Card Providers

Credit cards depend on credit scores and most applications are approved online and quite quickly. So, credit score is considered, usually the middle one.

- Insurers

Insurers take your credit report prior to approving their requests. The Credit score has a separate algorithm that is used by these providers to come up with a credit score.

- Collection Agencies

Companies use your credit report to know and decide on an account that can be paid off first. Credit scores are utilized by collection agencies to predict your paying dues back capability.

- Employers

A very common occurrence but sometimes employers check your credit report as a part of their background checks to lessen any legal liability for negligent hiring .

So, credit reports and credit scores are two very important aspects of your financial life. If these two aspects are not satisfactory, then it is difficult for them to avail loans in the future. Credit card providers and banks provide products to those applicants who do not pose a lot of risk in terms of finances.The chance of you repaying their dues, higher is the chance of their availing loans at a good interest rates and tenure. So, cardholders must ensure that they maintain good credit scores.

A credit report is a comprehensive understanding of your credit history and repayment behavior. The report will have personal information along with all your past as well as current credit cards and loan details. However, you can get one free copy of a credit report from the four credit bureaus in the country as mentioned in the article earlier.

Types of Errors in your Credit Report

- Errors with Personal Information:Sometimes your credit report can have errors like personal information such as name, gender, address, PAN number, mobile number and email address. However, active steps need to be taken to rectify that

- Errors with Personal Information:The important section in your credit report is the details about your credit account type, account status, ownership type, accounts opened, accounts closed, current balance. Hence, these errors directly affect your credit score in a negative way and you need to get them fixed at the earliest.

How to Rectify your Credit Report?

Step 1: First and foremost, you should possess an online dispute form the credit bureau’s official website. After filling up the necessary information in the form and sending it to the bureau.

Step 2: The agency will further verify the error report to forward it to the respective bankers, NBFCs or licensed lenders for additional investigation.

step 3: Banks will check the error report and audit the report with the agency. If no errors are found , the agency shall contact you with a revised report.

step 4: Banks shall correct and share revised details to the agency,internally if any errors are found .

step 5: After all these steps now, the credit bureau will send you an updated report.

Reasons to Check your Credit Report Periodically

- Safeguard against identity theft.

- Make the completeness along with accuracy of details

- To track your credit status along with progress

Dispute requests are raised on Company Credit Information Report (CCR) by customers. The types of disputes raised are as follows:

Company / Account Details :These disputes are raised about several details related to company name, address, company phone number, PAN number in addition to credit type and asset classification among others.

Ownership Disputes : This can be on term ownership

Duplicate Account : he same account is reflected more than once in CCR, customers can initiate a dispute request. Fields that can be disputed are company name, registered address, branch address, telephone numbers, PAN, promoter/ partner name, legal constitution, city, state and PIN Code.

Account Details: Credit type, asset classification, sanction date, sanctioned amount/ high credit, current balance, bank remark, date classified as wilful defaulter, to suit filed status, date of suit and suit amount.

A Credit score has a range between 300 and 900. Ideally, a score that is closer to 900 will help you get better deals on loans and credit cards. However, a credit score of 750 and above is considered ideal by the majority of lenders. A personal loan with a credit score of 750 and above gets very easy to avail. As per credit score data 80% of loans get approved if the score is more or equal to as expected.

Lenders expect you to have the ability to repay the sum before they approve your loan application. Your credit score enables you to assess your risk level.t. If you have a high score it suggests you will stand out as a responsible borrower and pay your credit card bills and EMIs on time. A lower score will increase your risk of defaulting on the loan. Lenders often require borrowers to have a certain credit score to qualify for a personal loan, so it's important to check credit score before applying.

Lenders usually reject the personal loan application only if the credit score is less than 550. Because a low credit score will show that you are not at all stable financially and might find it very difficult to repay the loan later. Only a few lenders provide personal loans for a low credit score. However, the interest rates will be high and you have a good stead with the lender. Also, even if you have a experian score lesser than 550, you can easily avail a personal loan . You can get a quick personal loan with the help of Buddy Loan. Buddy Loan provides you a quick instant personal loan from the most trusted lenders of India, at the best interest rates..

Factors that affect credit scores, either positively or negatively; are follows

- Factors that affect credit scores positively

- Processing timely payments towards credit cards.

- Paying loan EMI’s before or on the due date.

- Paying the minimum due as well as the entire outstanding balance.

- Factors that affect credit scores negatively

- Delayed payment of credit card bills and loan EMIs

- Maxing out credit cards by using more than 75% of the credit limit.

- Paying only the minimum due on credit cards

- To have too many lines of credit, especially unsecured forms.

Your Credit Score plays a major role in the approval of your loan application. Now lets understand your score for free in less than 3 minutes and understand its powers.

- Major Role

- When applying for a loan, your Credit Score is as important as your salary, and other eligibility factors. When your score is at least above 750. 800 is a great number

- The eligibility for loan approval is the repayment history of the applicant. How can you find it? By monitoring your Credit Score and noticing your repayment history.

- A longer processing time will put in some additional checks. However, you might not always get the best deal

- Error-Free Credit Report - Errors can make their way into a very spotless credit report and your lovely Credit Score.

Hence, make sure you remember these facts so that you don't end up hurting your credit score .

Check your Credit score:

Necessarily don't forget to check your credit health, prior to applying for a personal loan. Checking your credit score will give you an idea of where you stand in terms of your repayment ability . In case your credit score is low, then you can take time to work on it and gradually increase it by taking the correct steps.

Credit report for free:

You can visit the official website to claim your free report in case you haven't already. The RBI has made it mandatory so that all the credit bureaus in the country offer one credit report for free per year (calendar year) . Also, you can but your CIBIL report for each month , six months and a year

Search and shortlist lenders:

After you are taking a personal loan, you might have to find lenders offering good deals on their loans. Also it always suggested browsing for deals and the select one that is most favorable to you. Also, there are many banks offering good interest rates on personal loans. Looking for the best deal will provide you maximum benefits in terms of interest rate and tenure and fringe benefits such as processing fee waiver.

Banks with financial institutions will not announce what the perfect score for applying for a car loan would be. However, it is safe to assume that a score of over 600 is good and a score of 750 upwards is more favorable.

Do’s and Don’ts to maintain good credit score for car loan

With everything else, even your credit score and credit reports require constant maintenance. As there are certain activities that can help you in keeping credit scores looking good. Some of activities that you need to avoid in order to prevent negative effects on the credit score.

Do’s

- Simplest thing to avoid affecting your credit history is to make sure all payments are made on time.

- Keeping loans to a minimum because there are too many lines of credit can strain your income

- Ensure you check your credit score yourself, because, if too many financial organizations check it on your behalf, it lowers the score.

- Paying credit card bills is important but only paying just the minimum amount doesn’t prevent the remaining amount from being considered as overdue.

Don’ts

- Don’t take too many loans as it can lead to mismanagement of finances.

- Don’t max out credit cards as that too means that you will be unable to live within your budget. Managing personal finances is difficult.

- Defaulting on payments gets recorded in the credit history and can haunt you for a long time.

A Car Loan Without a Credit Score

Availing a car loan without a credit score has its own perks and benefits . Like many other interest rates and other benefits. However, credit scores center stage with all forms of loan and credit cards. However, it may seem impossible to think about a car loan without a credit history. Some of the financial institutions may still offer car loans at higher interest rates.

The banks are also willing to extend this offer to car loan applicants with a bad credit rating because car loans are secured with the vehicle so funded, serving as collateral. This will eventually reduce the risk lenders take by approving such loans.

You have to meet all the criteria for a car loan. A poor credit score would deny your dream car. A good or apt credit score could mean better rates. Hence, it is of importance for you to take extra care to build, maintain or rectify your credit history.

The entire article should make it easier for you to understand that it is important that you have a good CIBIL score especially when you apply for a loan or credit card. Otherwise the adverse effect will be that your application may be rejected or the interest rates will be high , when you apply for a loan with a low credit score. Any kind of rejections will lower your credit score even further. The dues should be paid on time with the right credit mix to improve your credit score. Now that you have read through the article it should be easier for you to maintain your credit score and avail the desired loan amount.

And if you havent checked your credit score yet , then click here now and check credit score now!

Frequently Asked Questions

Personal loans are given by different banks based on different types of criteria. Most banks have customers with a 700+ credit score. However, in case of debt consolidation and balance transfer requests, banks can lower their credit score expectation while compensating it with the interest charged from customers.

Under any circumstances if you don’t have a credit score then banks will be reluctant to ask your personal loan request. In this case , the only options that remain are to apply in a cooperative bank or a private lender or from some family member or friend. So, it is always advisable to build up a good credit score so that you do not have to go to private lenders and cooperative banks which do not guarantee any safety of your money. No credit score can also secure loans against securing assets like gold jewelry or property.

Applying for a personal loan with a low credit score makes them wait to improve their score before applying for credit , they can avail personal loans at a much higher rate of interest. However, the former is a much better choice than getting caught in the vicious circle of large amounts of debt.

Yes, credit score matters while applying for any kind of loan including a home loan..

No, there is no such minimum credit score assigned for a home loan.

Yes, 750 is a good credit score for a home loan and also any type of loans

No, it wont at all affect your credit score but if you can analyze your free credit score online , it might be regarded as a soft inquiry, and usually these inquiries do not impact your credit score. However, if a financial institution does a hard inquiry to check your credit score, then there may be a fall in your credit point.

A personal loan will influence your credit score in both a good way or a wrong way. Unsecured loan does not have a negative impact on your credit score by itself . But if you score negatively you will have trouble obtaining additional credit.

There are many factors that will affect your credit score. In the list of the few factors that can affect your credit score:

- You might take a high number of unsecured loans

- You will have fil in l several loan applications

- Taking out too many credit cards

- Be consistent and punctual with your EMI repayments.

- You want to Increase your credit limit

It is very easy to get an Experian free credit report, as you will just need to complete the Credit Report Application Form and forward it to Experian. Thereafter, your application is received and validated, you will then receive your Experian credit report.

Unless it is incorrect, no details can be erased from your credit report. The credit report will give an insight of your credit history and lending worthiness. Every lender vastly depends on the credit reports to assess the lending risks.

If you notice any error or wrong entries in your credit report, then you can get in touch with the credit report provided to get it corrected . The process is very simple, you can get in touch with your credit report provider through phone, email, and other ways too.

No, the Credit Information Report includes details of credit history and inquiries, CIBIL, like various other credit rating companies have their own way of calculating the score based on the information on the credit report. The Credit Information Report has the details of an individual’s credit date while the credit score indicates the credit worthiness. The credit score is derived from the information available in the Credit Information Report.

Your credit report can be accessed by you, lenders, along with government recognized regulating bodies.

The lenders will also determine your creditworthiness . As it will help the lenders or the banks to understand the risk factors in lending out money to an individual.

Yes, your credit report is accessible for you along with lenders, financial institutions and government regulatory agencies.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150k+ Daily Active Users

150k+ Daily Active Users