American Express Credit Cards in India come with exclusive rewards, premium benefits, and diverse spending options to enhance your lifestyle. Cardholders can earn Membership Rewards points on purchases, which are redeemable for travel, shopping, and more.

Popular cards like the Amex SmartEarn Credit Card boost rewards on everyday spending, while the Platinum Travel Credit Card offers travel perks and lounge access. To apply, you need to meet eligibility criteria which vary based on the card type.

Hence, it is important to keep reading till the end of this page to understand the key aspects of the American Express Credit Card.

American Express credit cards offer rewards points on spending, travel and dining deals, airport lounge access, and strong fraud protection. Some cards also include cashback, vouchers, and concierge services.

Table of Contents:

Top American Express Credit Cards in India

There are several categories of American Express Cards, such as Rewards Credit Cards, Travel Credit Cards, and Premium Credit Cards. Here are the top American Express Credit Cards available:

| Credit Card Type | Suitable For | Top Feature |

|---|---|---|

| American Express Platinum Card | Luxury seekers and global travelers | Welcome Gift up to ₹60,000 |

| American Express Platinum Reserve Credit Card | Lifestyle enthusiasts | Welcome Gift of 11,000 Bonus Membership Rewards Points |

| American Express SmartEarn Credit Card | Online shoppers and first-time card users | Up to ₹500 cashback as a Welcome Gift |

| American Express Membership Rewards Credit Card | Everyday spenders looking for reward value | Welcome Gift of 4000 Bonus Membership Reward Points |

| American Express Gold Card | High spenders who prefer exclusive rewards | Welcome Gift of 4000 Bonus Membership Rewards Points |

| American Express Platinum Travel Credit Card | Frequent domestic travelers | Welcome Gift of 10,000 Membership Rewards points |

Read More

Read Less

Are you looking for a personal loan?

Eligibility for American Express Credit Cards

Although the exact eligibility criteria vary based on the card type, here are some of the general requirements to qualify for the Amex Credit Card are as follows:

- The applicant must be an Indian citizen and have a permanent address.

- The applicant must be 18 years of age or older.

- The applicant must have a good credit score.

- The applicant must have an Indian or multinational savings or current account in India.

- The applicant must not have declared bankruptcy within the past 7 years.

Also read: best credit cards

Check the best offers & apply for a credit card!

How to Apply for an Amex Credit Card

Here are the steps to follow for your American Express credit card application:

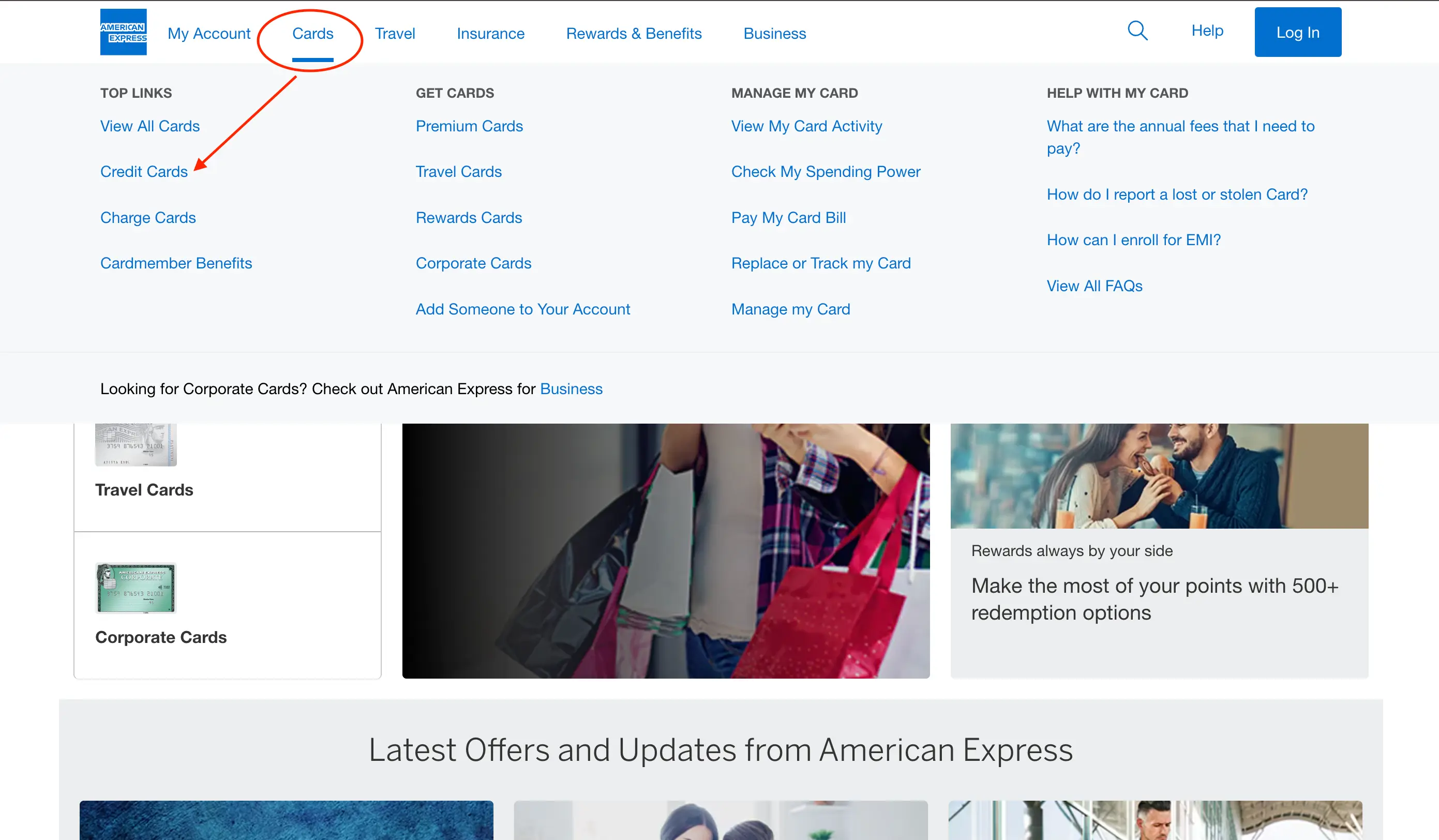

- Visit the official website of ‘American Express Credit Card.’

- Click on ‘Credit Cards’ from the ‘Cards’ section in the menu.

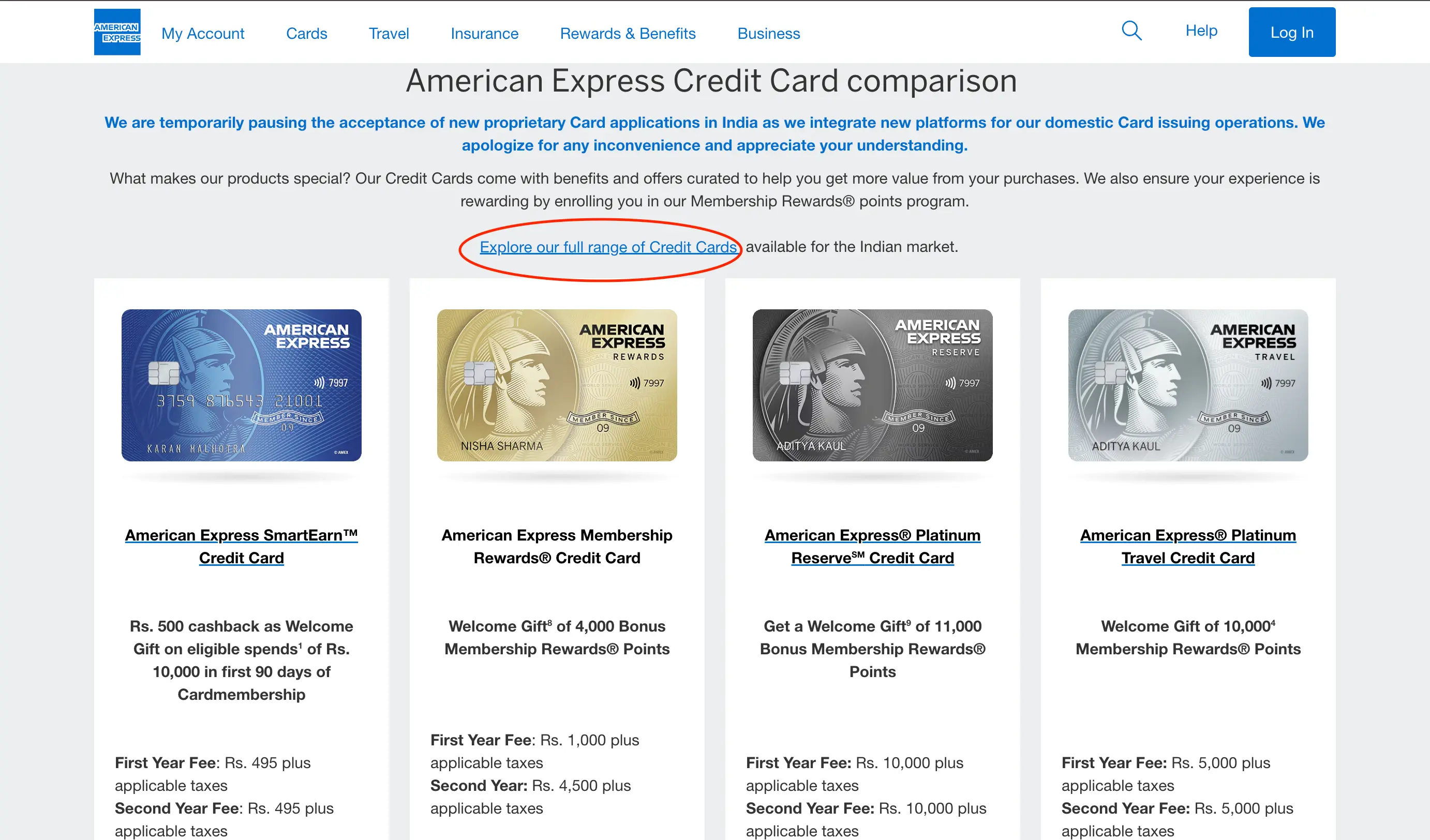

- Scroll down and under ‘American Express Credit Card’ comparison, click on ‘explore our full range of credit cards.’

- Pick the card of your choice and click on the ‘Apply Now’ button.

- Enter your personal information, such as Name, Date of Birth, Address, and so on.

- Fill in your bank details.

- Click on ‘Submit.’

Once the bank receives your application, you will be asked to submit documents such as your legal status and identity.

Also read: Best international credit cards

Not sure of your credit score? Check it out for free now!

Charges & Benefits of Amex Credit Cards

The table below provides insight into the American Express Cards and their respective charges:

| Credit Card Type | Annual Fee (₹) |

|---|---|

| American Express Platinum Card | 66,000 + taxes |

| American Express SmartEarn Credit Card | ₹495 + taxes |

| American Express Membership Rewards Credit Card | ₹1000 + taxes (first year) ₹4500 + taxes (from second year onwards) |

| American Express Platinum Reserve Credit Card | ₹10,000 + taxes |

| American Express Gold Card | ₹1000 + taxes (first year) ₹4500 + taxes (from second year) |

| American Express Platinum Travel Credit Card | ₹5000 + taxes |

Read More

Read Less

Amex Credit Cards do not have pre-set daily transaction limits. Moreover, the amount you can spend is based on your credit history, which gives you a flexible spending experience.

Now, let’s look at the key benefits of each of these Amex Credit Cards:

- American Express Platinum Card:

- Welcome Gift up to ₹60,000

- Travel & Lifestyle Concierge Services

- Renewal Benefit Voucher

- Access to over 1400 lounges globally

- Air Accident Insurance

- Overseas Medical Insurance

- Purchase Protection

- Hotel stay benefits worth up to ₹44,300

- American Express Platinum Reserve Credit Card:

- Complimentary international & domestic airport lounges across India.

- Complimentary access to leading golf courses in India.

- Complimentary Accor Plus Traveller membership.

- Complimentary Accor Plus Traveller, Taj Epicure & EazyDiner Prime membership.

- Movie or online shopping vouchers worth ₹12,000 per year.

- American Express SmartEarn Credit Card:

- Up to ₹500 cashback as a Welcome Gift

- Vouchers worth ₹500 upon reaching the spending milestones

- Earn Accelerated Membership Rewards by spending on Amazon, Flipkart, Uber, BookMyShow, Zomato, EaseMyTrip & more

- Earn 10X points on Flipkart, Uber, and select brands

- Renewal Fee Waiver on eligible spends

- American Express Membership Rewards Credit Card:

- 1000 Bonus Membership Reward Points

- 5,000 Membership Reward Points on card renewal & annual fee payment

- 1 point for every ₹50 spent (excluding fuel, insurance, and utilities)

- American Express Gold Card:

- 1000 bonus points on 6 transactions of ₹1000 or more every calendar month

- Discounts on dining, travel, shopping & car rental

- Redeem your Points from the 18 and 24 Karat Gold Collection

- Extra rewards on shopping with Flipkart, Uber, Amazon, & more

- 1 Membership Rewards Point on all expenses, including utility

- American Express Platinum Travel Credit Card:

- Welcome Gift of 10,000 Membership Rewards points

- 8 complimentary visits per year to domestic airport lounges

- Taj Experiences E-Gift Card worth Rs. 10,000 from the Taj, SeleQtions & Vivanta Hotels

- Additional 25,000 Membership Rewards points

- 15,000 Membership Rewards points upon spending ₹1.9 lakh in the Card membership year

Do you need an instant loan?

- Credit Card Lounge Access

- Close Credit Card

- Credit Card Advantages and Disadvantages

- Transfer Money from Credit Card to Bank Account

- Loan on Credit Card

- Best Credit Cards for Low CIBIL Score

- Credit Cards to Improve Credit Score

- One Card

- Green PIN

- Bajaj Insta EMI Cards

- Credit Card Application Status Check

- CIBIL Score for Credit Card

- Increase CIBIL Score without Credit Card

- Kisan Credit Card

- Travel Credit Cards

- Credit Cards Without Annual Fee

- RuPay Credit Card

- West Bengal Student Credit Card

- Student Credit Card

- Student Credit Card Bihar

- Best Fuel Credit Cards

- Best Cashback Credit Cards India

- Credit Card Against Fixed Deposit

- International Airport Lounge Access Credit Card

- HDFC RuPay Credit Card

- Best Premium Credit Cards In India

- Lifetime Free Credit Card Without Income Proof

- SBI Simply Click Credit Card

- SBI Elite Credit Card

- SBI Prime Credit Card

- SBI Credit Card Reward Points

- HDFC Biz Black Credit Card

- HDFC Credit Card Net Banking

- How to Close HDFC Credit Card

- HDFC Tata Neu Plus Credit Card

- HDFC Tata Neu Infinity Credit Card

- HDFC Infinia Credit Card

- HDFC Freedom Credit Card

- HDFC Moneyback Credit Card

- HDFC Diners Club Credit Card

- HDFC Regalia Gold Credit Card

- Paytm HDFC Credit Card

- HDFC Credit Card PIN Generation

- HDFC Credit Card Statement

- HDFC Credit Card Payment

- Swiggy HDFC Credit Card

- HDFC Credit Card Application Status

- HDFC Millennia Debit Card

- HDFC Bank Credit Card Offers

- Kisan Credit Card

- Kisan Credit Card Application Status

- Kisan Credit Card Interest Rates

- Indian Overseas Bank Credit Card Customer Care Number

- SBI Credit Card Customer Care Number

- ICICI Bank Credit Card Customer Care Number

- Credit Card Customer Care Number

- Central Bank of India Credit Card Customer Care Number

- Union Bank Credit Card Customer Care Number

- Yes Bank Credit Card Customer Care Number

- Bank of India Credit Card Customer Care Number

- Federal Bank Credit Card Customer Care Number

- Canara Bank Credit Card Customer Care Number

- Kotak Mahindra Bank Credit Card Customer Care Number

- Indian Bank Credit Card Customer Care Number

- Induslnd Bank Credit Card Customer Care Number

- Bandhan Bank Credit Card Customer Care Number

- HDFC Credit Card Customer Care Bangalore

- HDFC Credit Card Customer Care Hyderabad

- ICICI Credit Card Customer Care Bangalore

- ICICI Credit Card Customer Care Hyderabad

- HDFC Credit Card Customer Care Number Chennai

- Kotak Mahindra Bank Credit Card Customer Care Pune

- Standard Chartered Credit Card Customer Care Number

- UCO Bank Credit Card Customer Care Number

- Karnataka Bank Credit Card Customer Care Number

- HDFC Bank Credit Card Customer Care Number

- Axis Bank Credit Card Customer Care Number

- PNB Credit Card Customer Care Number

- Bank of Baroda Credit Card Customer Care Number

- IDFC First Bank Credit Card Customer Care Number

- IndusInd Bank Credit Card Customer Care Number

- IDBI Bank Credit Card Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

Yes, the Amex Credit Card is accepted at thousands of locations nationwide, including restaurants, supermarkets, small shops, and online retailers.

An American Express credit card works by allowing cardmembers to make purchases on credit, which must be paid back either in full or over time with interest, depending on the card type.

American Express credit card limits in India are determined based on factors such as your credit score, income, existing debt, and repayment history.

American Express credit cards in India typically carry a monthly interest rate of 3.5% on outstanding balances, which translates to an annualized rate of 42%.

American Express credit cards in India have varying annual fees based on the card type.

You can use an American Express credit card at a wide range of locations in India, including restaurants, retail stores, hospitals, fuel stations, and online platforms.

You can apply for an American Express credit card in India by visiting the official Amex India website and select the card that best suits your needs.

The best American Express credit card in India depends on your needs—travelers may prefer the Platinum Travel Credit Card for its rewards and vouchers, while everyday spenders might find value in the SmartEarn™ Credit Card with its low fee and accelerated rewards.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users