The EPF (Employees’ Provident Fund) Withdrawal Form is a critical document that employees use to access the funds accumulated in their EPF account. It enables individuals to withdraw their savings under various circumstances such as retirement, job change, or financial emergencies. This process plays a significant role in an employee’s financial planning by providing security and flexibility.

The EPF withdrawal form is used by employees to claim their provident fund balance upon retirement, job change, or specific needs. Key forms include Form 19 for full withdrawal, Form 10C for EPS benefits, and Form 31 for partial withdrawals.

Table of Contents:

- ⇾ Importance of EPF Withdrawal Form

- ⇾ Types of EPF Withdrawal Forms & Their Uses

- ⇾ EPF Withdrawal Form 19

- ⇾ EPF Withdrawal Form 10C

- ⇾ EPF Withdrawal Form 31

- ⇾ Eligibility for EPF Withdrawal

- ⇾ Documents Required for EPF Withdrawal

- ⇾ Steps to Fill the EPF Withdrawal Form

- ⇾ Mistakes to Avoid When Filing the EPF Withdrawal Form

- ⇾ Track Your EPF Withdrawal Status

- ⇾ Understanding EPF Tax Implications

- ⇾ Frequently Asked Questions

Importance of EPF Withdrawal Form

The EPF Withdrawal Form serves as a gateway for employees to access their provident fund savings when needed. Understanding its importance is crucial for efficient financial management. Here’s why:

- Access to Emergency Funds: Employees can withdraw partial or complete funds during financial difficulties such as medical emergencies or unexpected expenses.

- Retirement Planning: The form facilitates seamless withdrawal of accumulated funds upon retirement age, supporting post-retirement life.

- Transition Assistance: When an employee leaves a job, they can use the form to withdraw or transfer their funds to a new employer’s EPF account, ensuring continued financial stability.

- Compliance and Legal Requirements: Proper use of the EPF Withdrawal Form ensures adherence to EPFO guidelines, minimizing risks of errors and rejections.

Are you looking for a personal loan?

Types of EPF Withdrawal Forms & Their Uses

There are multiple types of EPF withdrawal forms, each serving a distinct purpose. Employees need to choose the appropriate form based on their specific requirements:

- Form 19: Utilized for complete withdrawal of the EPF balance after retiring or leaving a job.

- Form 10C: Used to withdraw benefits from the Employee Pension Scheme (EPS).

- Form 31: For partial withdrawal, allowing employees to withdraw funds for purposes such as home loans, medical expenses, or higher education.

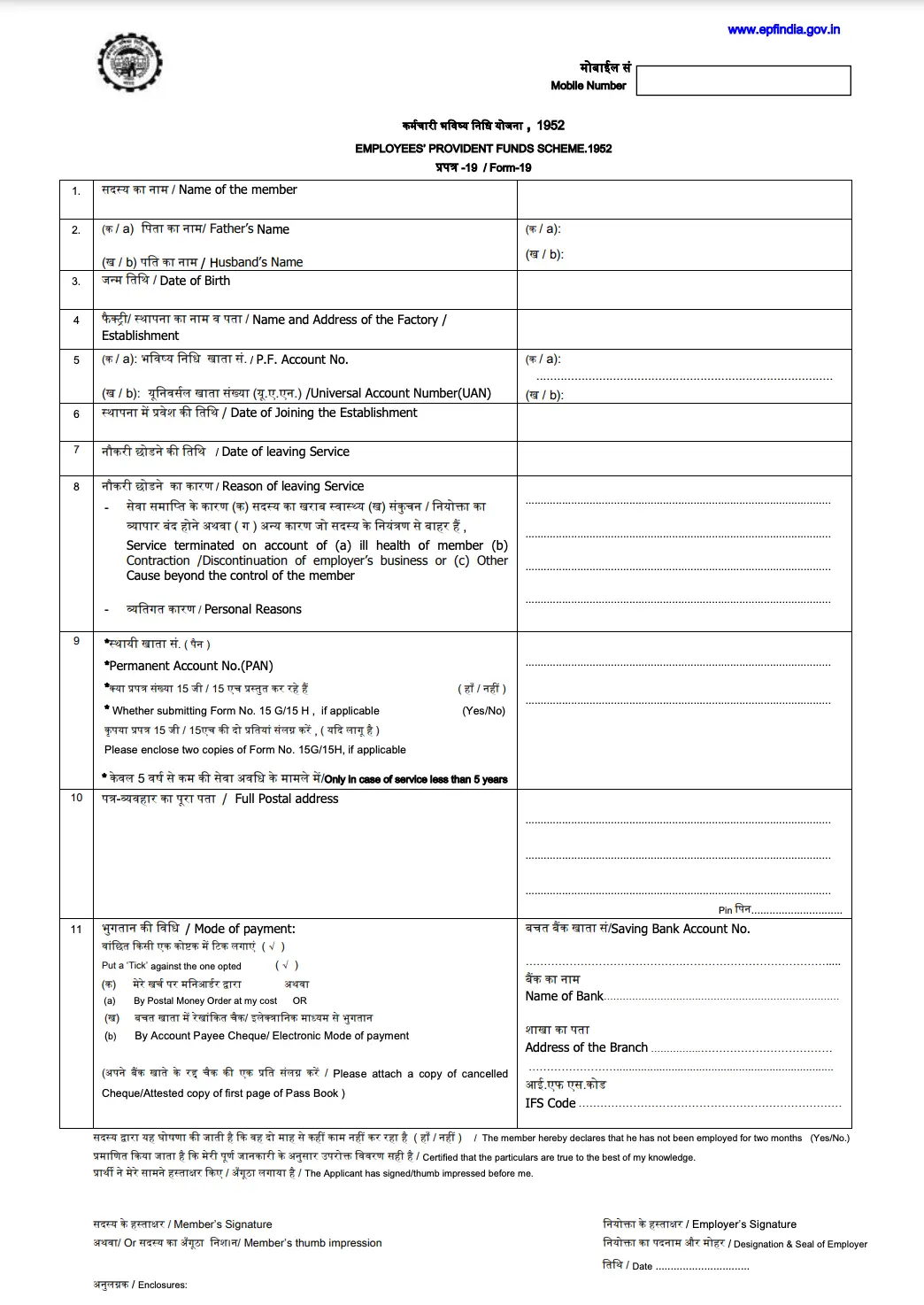

EPF Withdrawal Form 19

Form 19 is used for withdrawing the entire Provident Fund (PF) balance after an employee leaves their job, retires, is terminated, or reaches superannuation. This form plays a significant role in enabling employees to access their accumulated savings when transitioning between jobs or stepping into retirement. Importantly, no organization or employer can legally prevent an employee from withdrawing their PF balance.

Key details Required in Form 19:

To complete the withdrawal process using Form 19, employees must provide the following details:

- Name as per the payslip: Ensure the name matches the records in the EPF account to avoid discrepancies.

- Father’s or Husband’s Name: For married women, the form may require the husband’s name.

- Provident Fund Account Number: Found on the employee’s payslip and essential for identification within the EPFO.

- Reason for Leaving: State why you left the previous employment (e.g., resignation, retirement, termination).

- Date of Leaving: Mention the exact date when employment was terminated or service ended.

- Permanent Address: For correspondence and verification purposes.

- Preferred Mode of Remittance: Specify how you would like the withdrawal amount to be transferred (e.g., bank transfer).

- Name and Address of the Establishment: Details of the last employer or organization where you were employed.

- Contribution for the Current Financial Year: Include contributions made during the financial year up to the exit date.

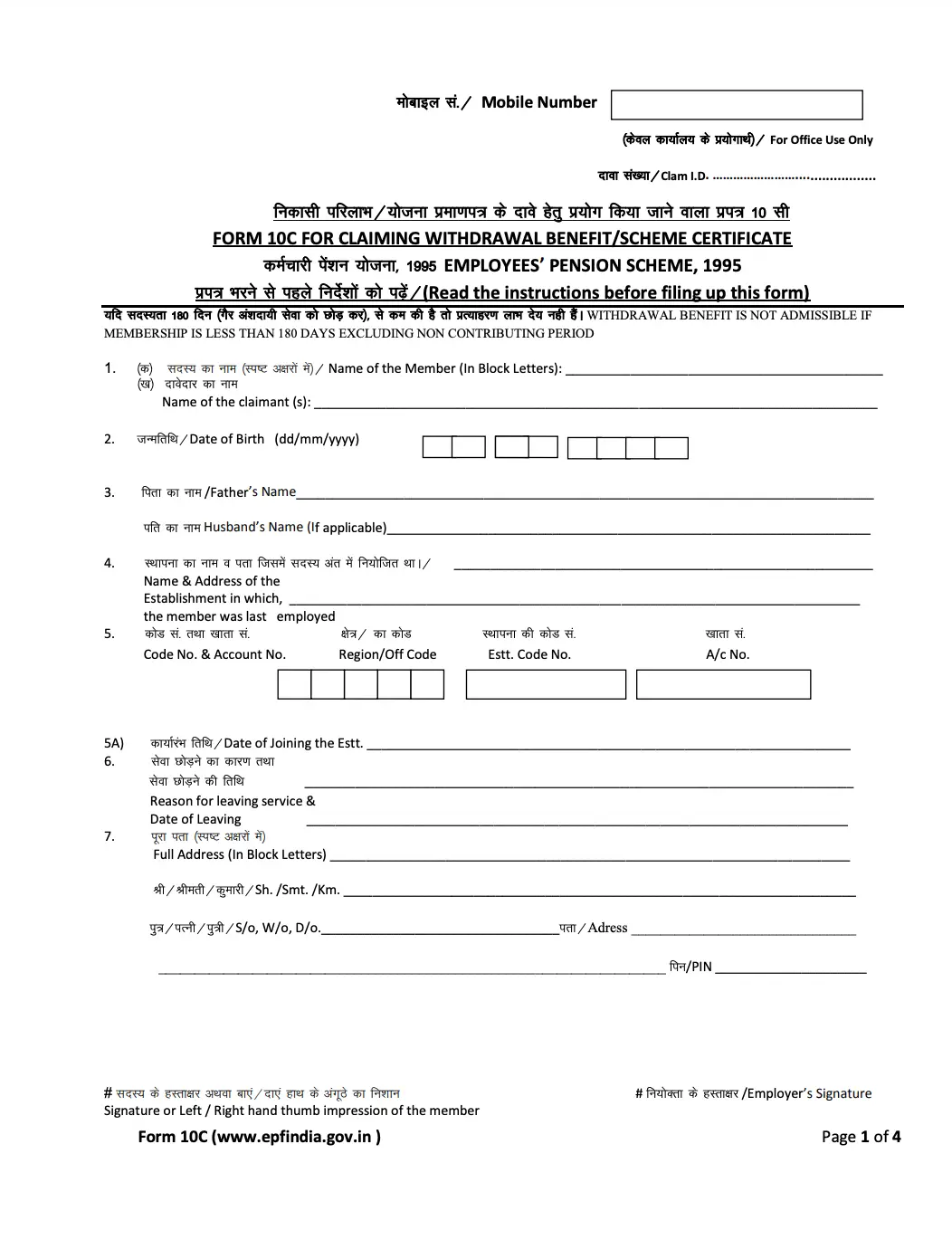

EPF Withdrawal Form 10C

Form 10C is an essential document used for withdrawing benefits from the Employee Pension Scheme (EPS). Employees who are below 50 years of age and wish to claim their EPS balance typically submit this form alongside Form 19 or Form 20. Form 10C facilitates different types of claims under the EPS, including withdrawal settlements and obtaining a scheme certificate to retain membership until the age of 58. Understanding how to correctly fill out and submit Form 10C ensures employees access their pension benefits efficiently.

Don't know your credit score? You can find out for free!

Purposes of Form 10C

Form 10C is used for the following specific claims:

- Settlement of Withdrawal: For employees seeking withdrawal under the old Family Pension Fund.

- New Employees' Pension Scheme (EPS 95): To claim benefits under this scheme.

- Scheme Certificate: For employees wanting to retain their membership in EPS until the age of 58, which can be used for pension benefits upon retirement.

Details to Fill in Form 10C

To complete Form 10C, employees must provide the following information:

- Name of the Claimant: The full name as registered in EPF records.

- Marital Status: Required for identification and verification.

- Name and Address of the Establishment: The last employer’s details.

- Code and Account Number: The PF account number for accurate record tracking.

- Date of Leaving: The exact date employment ended.

- Reason for Leaving Service: A brief explanation such as resignation, retrenchment, or other reasons.

- Scheme Certificate Option: Indicate whether the claimant wishes to accept a scheme certificate instead of withdrawing benefits.

- Advance Report: To be provided when opting for payment of withdrawal benefits via cheque.

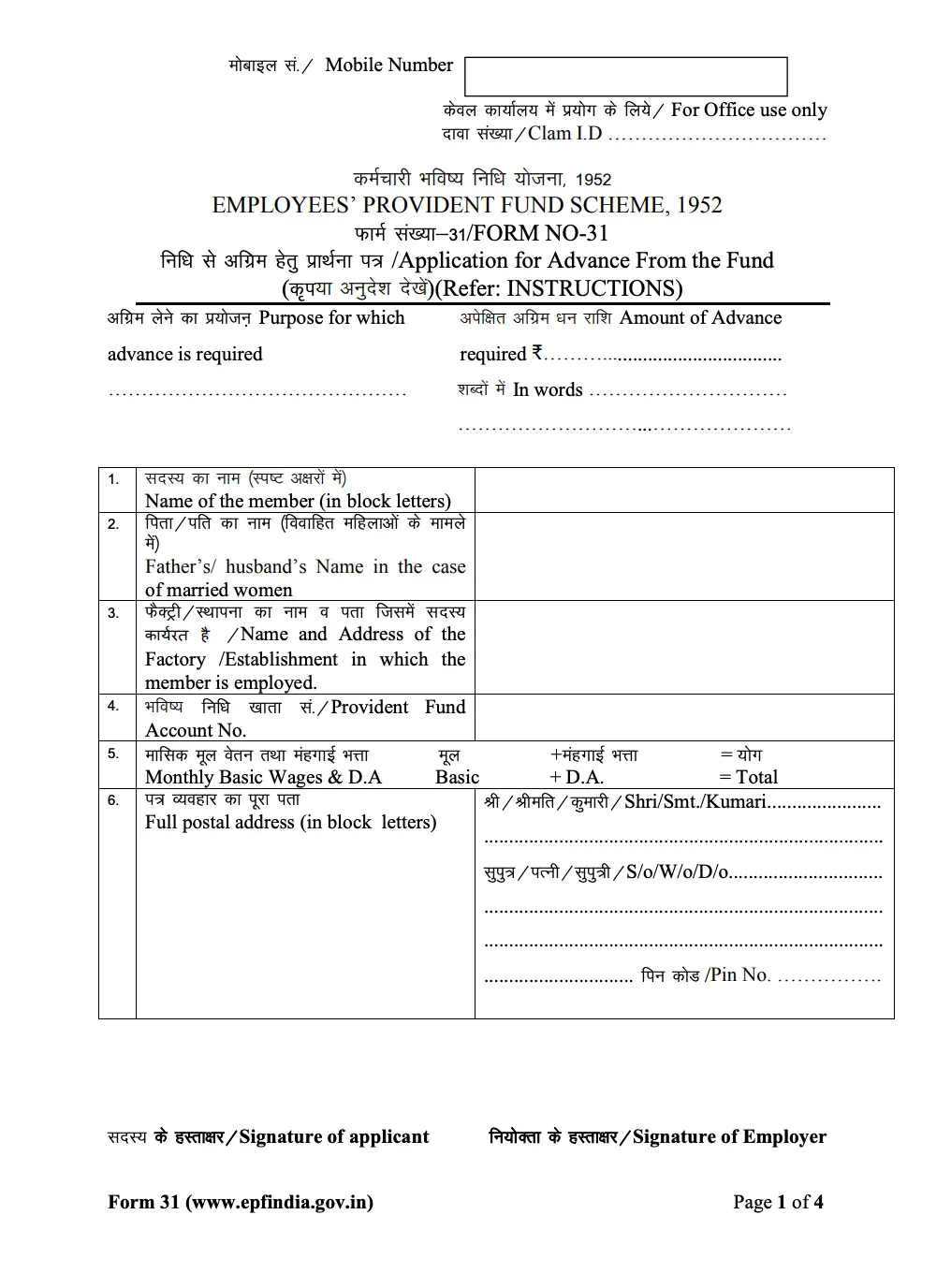

EPF Withdrawal Form 31

Form 31 is used when an employee wishes to make a partial withdrawal from their EPF account or requires an advance for specific purposes. This form allows employees to access a portion of their accumulated EPF savings while they are still employed, providing financial flexibility for various needs such as medical expenses, education, home renovation, or loan repayment.

Get a quick loan starting at 11.99% p.a.

Key Details for Form 31 Submission

To complete Form 31, the following information must be provided:

- UAN (Universal Account Number): Essential for identifying the employee’s EPF account.

- PAN (Permanent Account Number): Needed for tax compliance and verification.

- Date of Joining: The date the employee joined the organization, confirming their length of service.

- Date of Leaving (if applicable): May be required if the advance is related to an exit.

- Reason for Withdrawal: Must specify the reason, such as medical treatment, higher education, or home purchase.

- Amount Requested: The amount the employee wishes to withdraw.

Eligible Purposes for Form 31 Withdrawals

Form 31 can be used for various specified purposes, including:

- Medical Expenses: For the treatment of self or dependent family members.

- Higher Education: To fund educational expenses for the employee or their children.

- Home Construction/Renovation: For building or renovating a house.

- Loan Repayment: To pay off a home loan.

- Marriage Expenses: For the marriage of self, siblings, or children.

Eligibility for EPF Withdrawal

EPF withdrawal is subject to certain eligibility criteria set by the EPFO:

- Full Withdrawal: Allowed only after retirement, defined as age 55 or older.

- Partial Withdrawal: Permitted for specific reasons like medical emergencies, home purchase/construction, or higher education.

- Pre-Retirement: Up to 90% of the EPF balance can be withdrawn one year before retirement.

- Job Loss: EPF can be withdrawn if laid off or retrenched.

- Unemployment: Up to 75% of the corpus can be withdrawn after one month of unemployment; the remaining 25% is transferred to a new account when re-employed.

- Employer Permission: Not needed; employees can withdraw online by linking their UAN and Aadhaar to their EPF account.

Documents Required for EPF Withdrawal

To withdraw your provident fund balance, certain documents need to be submitted to ensure a smooth and verified process. The most commonly required documents include:

- Form 19: For complete EPF withdrawal.

- Form 10C: For claiming EPS benefits or pension.

- Form 31: For partial withdrawals or advances.

- Two Revenue Stamps: Required for submission paperwork.

- Bank Account Statement: Proof of the account where the funds will be transferred.

- Identity Proof: Aadhaar Card, PAN Card, or passport.

- Address Proof: Utility bills, Aadhaar, or voter ID.

- Blank and Cancelled Cheque: Must show IFSC code and account number clearly; only single account holder cheques are accepted.

Not sure of your credit score? Check it out for free now!

Steps to Fill EPF Withdrawal Form

Filling out the EPF Withdrawal Form online ensures a quicker and more convenient process for employees to access their provident fund balance. The following steps outline how to complete Form 19 for EPF withdrawal through the EPFO portal:

- Visit the EPFO website and log in using your Universal Account Number (UAN), password, and captcha code.

- Click on ‘Claim (Form-31, 19 & 10C)’ under the ‘Online Services’ tab.

- Enter the last four digits of your bank account number and click on ‘Verify’.

- A pop-up with a ‘Certificate of Undertaking’ will appear. Click on ‘Yes’ to proceed.

- Choose ‘Only PF Withdrawal (Form-19)’ from the ‘I want to apply for’ drop-down menu.

- Review the disclaimer and proceed by clicking on ‘Get Aadhaar OTP’.

- An OTP will be sent to your registered mobile number linked with Aadhaar.

- Enter the OTP details to submit the application.

- Once submitted, a reference number will be generated for tracking the status of your claim.

Mistakes to Avoid When Filing the EPF Withdrawal Form

Avoiding common errors when filing the EPF withdrawal form can prevent rejections and delays:

- Incorrect Details: Ensure that all personal and employment details match the EPF account records.

- Inconsistent Bank Information: Double-check the bank account number and IFSC code.

- Outdated KYC: Ensure all KYC documents are updated and verified on the EPF portal.

- Incomplete Form: Review the form for any missing sections or data before submission.

- Missing Documents: Make sure to attach all relevant documents, including identity and employment proofs.

Track Your EPF Withdrawal Status

After submitting a request for EPF withdrawal, it's essential to track the status to stay informed about its progress. The Employees’ Provident Fund Organisation (EPFO) provides both online and offline methods for employees to check the status of their withdrawal claims. Here is how you can track your EPF withdrawal status using the EPFO website:

- Go to the EPFO site and click on ‘Services’, then select the ‘For Employees’ option.

- Click on ‘Know Your Claim Status’.

- The link will take you to the member passbook portal.

- Enter your Universal Account Number (UAN), password, and captcha to access your account.

- Click on ‘View Claim Status’ to check the current status of your EPF withdrawal claim.

Understanding EPF Tax Implications

EPF withdrawals can be tax-free or taxable based on specific conditions:

Tax-Free Withdrawals

- After 5 Years of Service: Withdrawals after five continuous years are tax-free.

- Retirement: Withdrawals at retirement or superannuation are exempt.

- Medical Emergencies: Withdrawals for certain medical treatments are tax-free.

Taxable Withdrawals

- Before 5 Years of Service: Withdrawals are taxable and added to your income.

- TDS Deduction: Applies at 10% if PAN is provided, 30% if not, for amounts over ₹50,000.

- Forms 15G/15H: Not applicable for avoiding TDS on EPF withdrawals.

Do you need an emergency loan?

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

Yes, you can withdraw 100% of your PF amount after retirement or if you remain unemployed for more than two months.

Log in to the EPFO portal with your UAN, go to ‘Online Services’, select the claim form (Form 19/10C/31), fill out details, and submit after verifying with Aadhaar OTP.

Form 19 is for full EPF withdrawal, Form 10C is for EPS benefits, and Form 31 is for partial withdrawals.

Select ‘Only PF Withdrawal (Form-19)’ for complete withdrawal or ‘PF Advance (Form-31)’ for partial withdrawal.

Form 19 is used for complete withdrawal of EPF, while Form 10C is for claiming EPS benefits or a scheme certificate.

Form 31 is used for partial withdrawal or advances from the EPF account for specific needs like medical expenses or home construction.

Form 14 is used to authorize EPF withdrawals for financing life insurance policies.

You can withdraw 90% of your EPF one year before retirement.

Yes, if you remain unemployed for more than two months, you can withdraw the full PF amount.

The limit varies based on the purpose, such as 50% for illness and up to 90% for home purchase or construction.

The processing time for EPF withdrawal is generally 10-15 working days.

Withdrawals before 5 years of service are taxed at your income tax slab rate, with TDS at 10% (or 30% if PAN is not provided) for amounts over ₹50,000.

There is no minimum service period for partial withdrawals; however, a minimum of 5 years of continuous service is needed for tax-free withdrawals.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users