The Employee Provident Fund (EPF) is a mandatory retirement savings scheme in India, requiring organizations with over 20 employees to register. Both employees and employers contribute monthly to the fund, managed by the Employees' Provident Fund Organization (EPFO). It ensures financial security for employees through lump-sum payments or pensions upon retirement, disability, or death.

You can withdraw funds from your Employees' Provident Fund (EPF) account either partially or in full, but that depends on several factors such as the number of years you have contributed to the EPF, your age, and the purpose of the withdrawal. You can check the status of your withdrawal claims in various ways, such as through the EPF website, mobile app, or by contacting your EPF office.

Table of Content

- ⇾ Eligibility to Apply for EPF Claim

- ⇾ Check PF Withdrawal Status

- ⇾ Check PF Claim Status on EPFO Website

- ⇾ Check PF Withdrawal Status on UAN Member Portal

- ⇾ Check PF Claim Status on UMANG App

- ⇾ Check PF Claim Status with a Missed Call

- ⇾ Check PF Claim Status by Calling EPFO Toll Free Number

- ⇾ Check PF Claim Status Via SMS

- ⇾ Meaning of PF Claim Status

- ⇾ EPF Claim Forms

- ⇾ Frequently Asked Questions

Eligibility to Apply for EPF Claim

You can become eligible to apply for PF withdrawals under specific circumstances. Here's a breakdown.

Eligibility for 100% Withdrawal

- Retirement: Individuals aged 55 or above can claim the entire EPF corpus.

- Unemployment: Those unemployed for two or more months can claim the entire EPF corpus.

Eligibility for Partial Withdrawal

- Early Retirement: Individuals aged 54 (one year before retirement) can claim 90% of the EPF corpus.

- Short-term Unemployment: Individuals unemployed for one month can claim 75% of the EPF corpus. The remaining 25% can be claimed upon reemployment.

Are you looking for a Personal Loan?

Check PF Withdrawal Status

To withdraw from your PF account, you need to submit a request to the Employees’ Provident Fund Organisation (EPFO), a statutory body under the Ministry of Labour and Employment. After submitting your request, you can check its status through the EPFO’s online and offline methods.

Below are the 5 methods to check your EPF withdrawal claim status.

Check PF Claim Status on EPFO Website

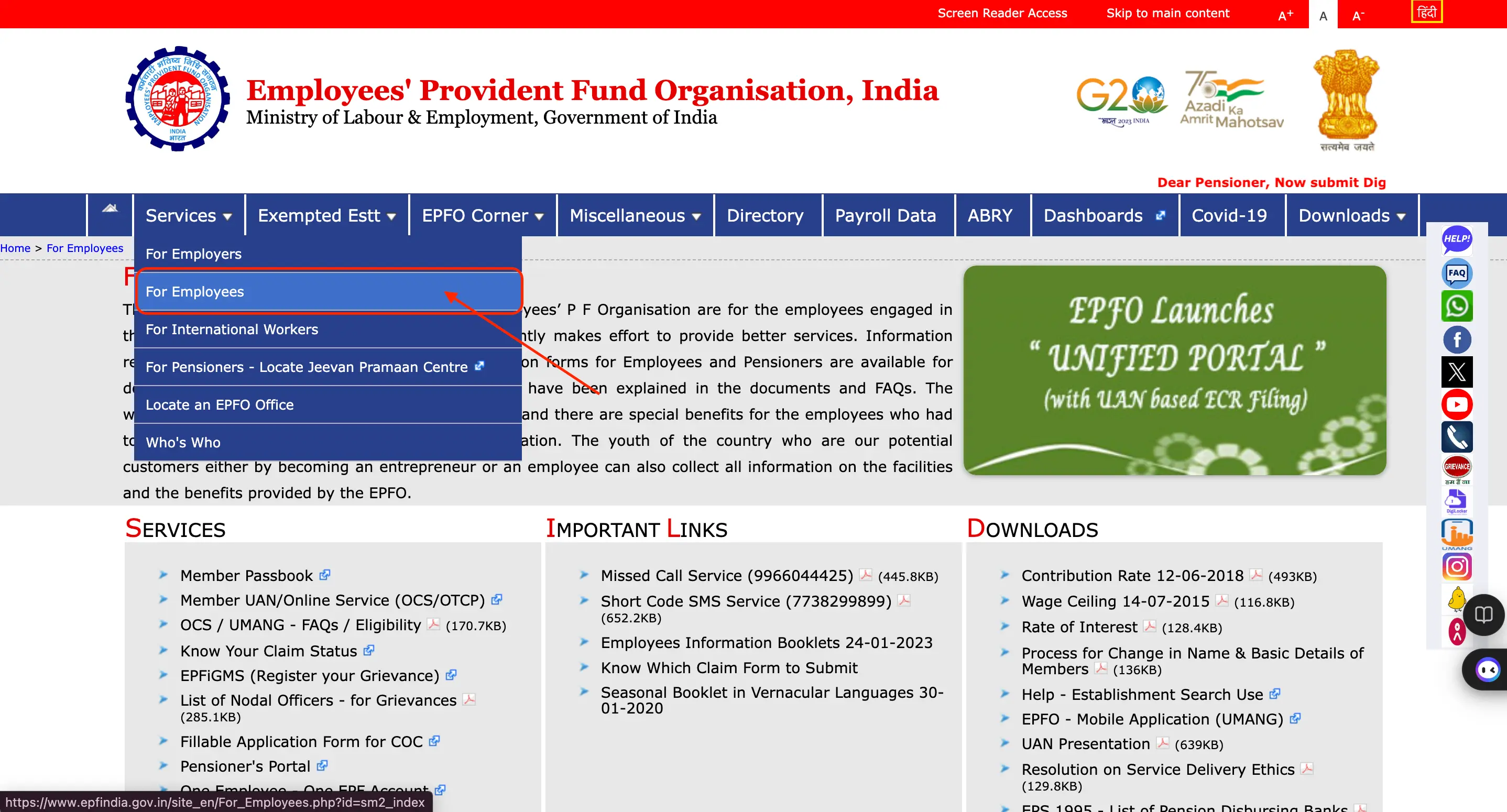

Step 1. Go to the EPFO website and click on 'Services', then select the 'For Employees' option.

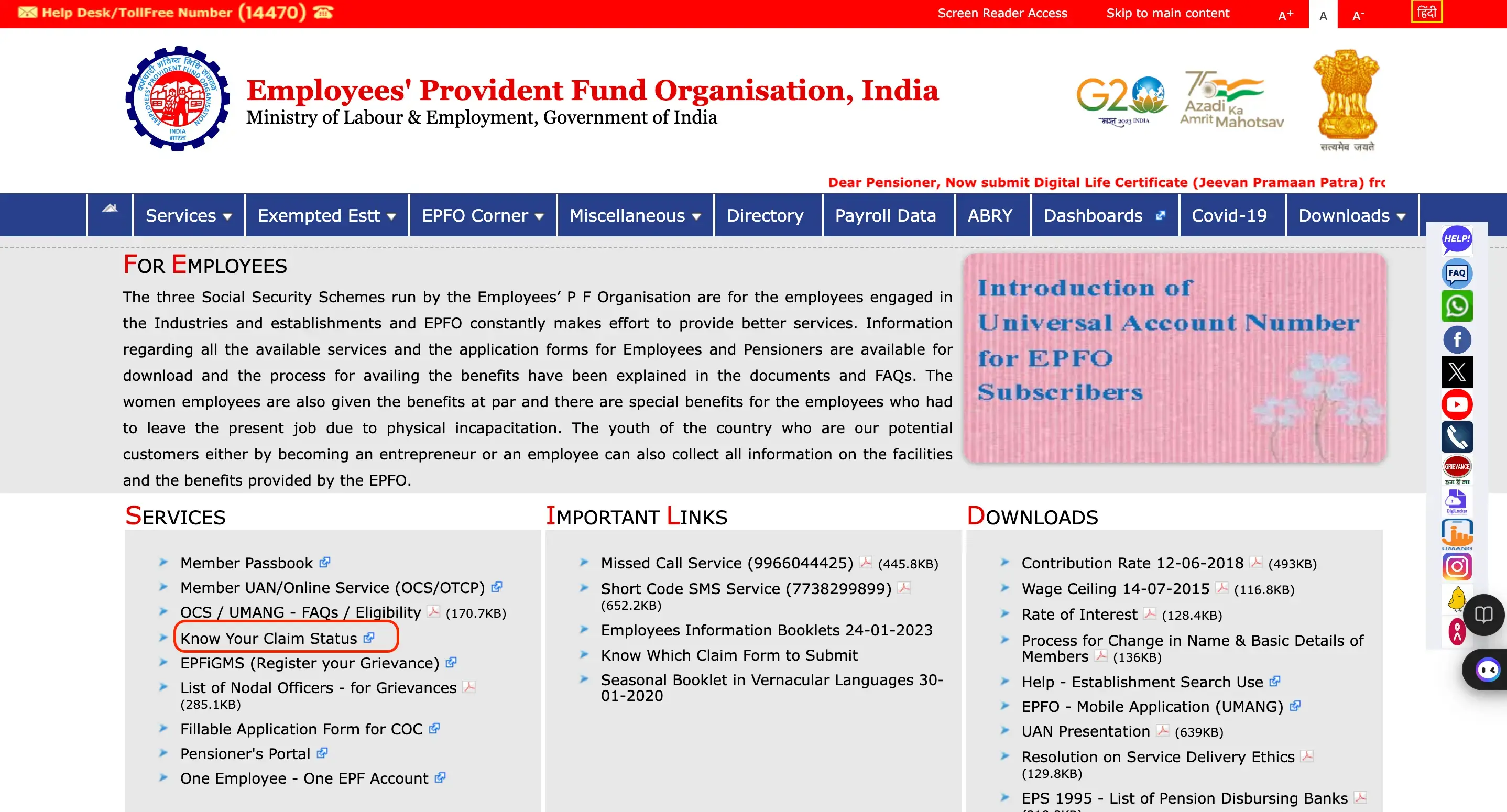

Step 2. Click on 'Know Your Claim Status'.

Step 3. Click on the link and you will be redirected to the member passbook application.

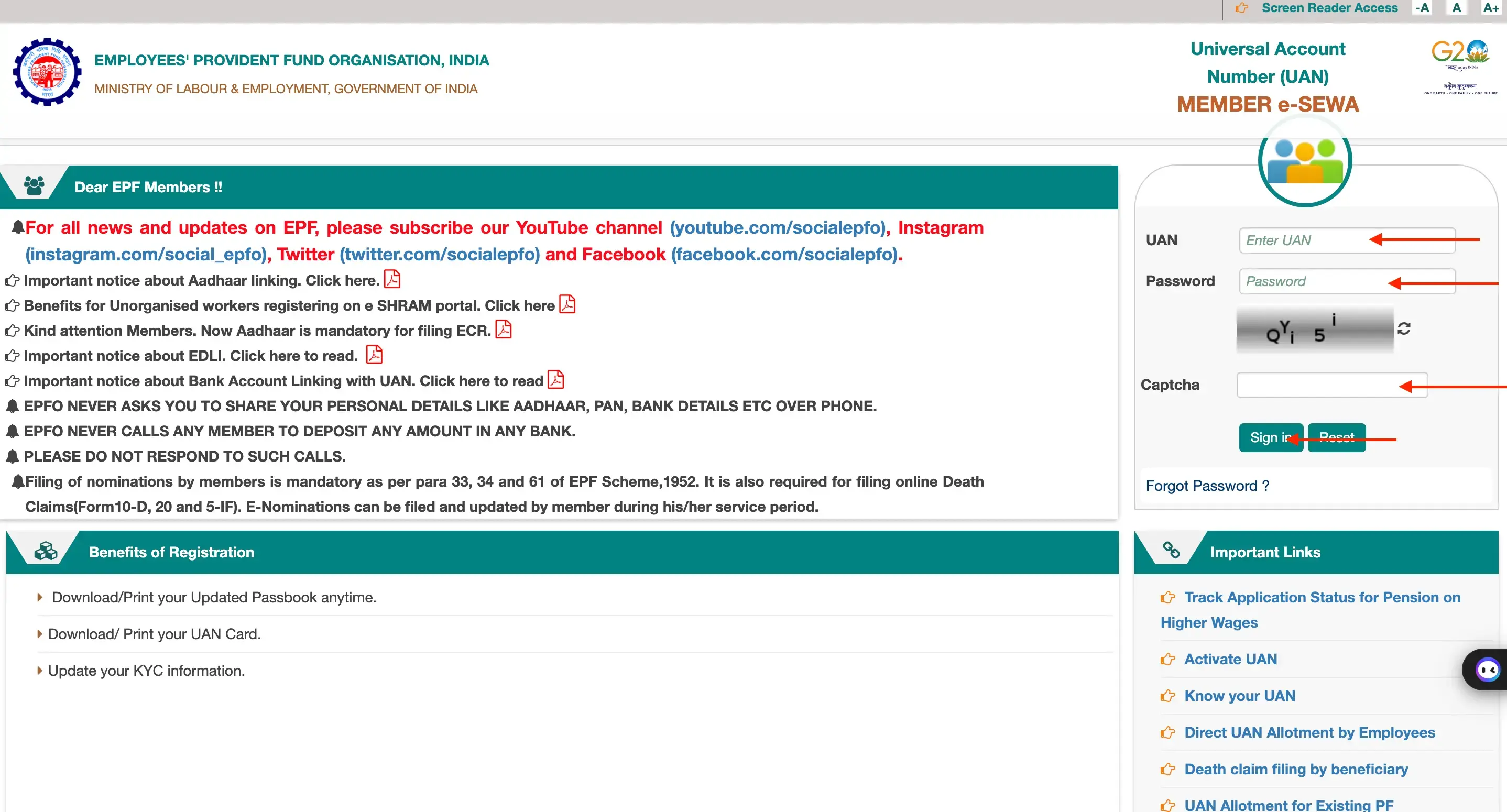

Step 4. Log in by entering the Universal Account Number (UAN), password, and captcha.

Step 5. Click on 'View Claim Status' to check the status of your claim.

Note: The Employees' Provident Fund Organisation (EPFO) provides important updates to claimants by sending SMS alerts to their registered mobile numbers. These alerts are triggered in two key situations: when a claim application is received and when funds are transferred to the claimant's bank account. It's also important to note that withdrawing EPF funds may have income tax implications under certain circumstances, so claimants should be aware of these potential financial responsibilities.

Check PF Withdrawal Status on UAN Member Portal

Here are the steps to check PF status using the UAN Member Portal.

Step 1. Log in to the UAN Member Portal using your UAN and Password.

Step 2. Select the 'Track Claim Status' option under the' Online Services' tab.

Step 3. The status of the withdrawal claim will be displayed on the screen.

Check PF Claim Status on UMANG App

Employees can monitor their PF transfer/withdrawal status online via the UMANG app. The app is accessible on iOS and Android; however, users need to ensure their mobile number is linked to their UAN.

Follow the steps below to check the claim status on UMANG.

Step 1. Download and install the UMANG app on your mobile phone using Play Store or App Store.

Step 2. Log in to your EPFO account, there will be 2 options – 'MPIN' and 'Login with OTP'.

Step 3. Key in your mobile number and select your preferred option.

Step 4. When you select 'Login with OTP', you will get an OTP on your registered mobile number. Enter it in the space provided and login into your EPFO account.

Step 5. You will then be redirected to the EPFO portal main page. Select 'Employee Centric Services'.

Step 6. Select 'Track Claim' and you will then be redirected to a page where you can view your claim status.

Step 7. If you have no claims, the screen will be displayed as below. In case you have claims, the screen will display your claim status details.

Check PF Claim Status with a Missed Call

Step 1. To check PF claim status, employees can give a missed call to 011-22901406 from their registered mobile number.

Step 2. Ensure your mobile number is linked with your UAN before proceeding.

Step 3. Update your PAN, Aadhaar, and bank account details on the UAN portal.

Step 4. No charges apply as the call disconnects after two rings.

Step 5. Receive claim details via SMS on your registered mobile number.

Check PF Claim Status by Calling EPFO Toll Free Number

Employees can inquire about the status of their EPF withdrawal/transfer claims by dialing the EPFO 24x7 customer care number - 1800 118 005. It is important for employees to have their PF Account Number or UAN ready as the helpline officer will require it to check the status of the claims.

Check PF Claim Status Via SMS

An employee can also check the status of a PF claim via SMS. To do this, they need to link their mobile number with the UAN portal. The SMS must be sent from that mobile number. The SMS should be sent to 7738299899, and the format must be 'EPFOHO UAN LAN', where 'LAN' indicates the language in which the employee would like to receive the details.

Don't know your credit score? You can find out for free!

Understanding PF Claim Process

When you apply for a Provident Fund (PF) claim, it's important to track its status to stay informed about the progress of your application. The status provides insights into where your claim stands in the processing cycle.

Below are the common statuses you may encounter, along with their meanings:

- Payment Under Process: The claim is currently being processed. The status will update to "Claim Settled" once the EPFO transfers the funds to your bank account.

- Settled: The claim has been accepted and processed by the EPFO. Funds have either been transferred to your bank or will be transferred shortly.

- Rejected: The claim may be rejected by the previous or current employer for various reasons, such as:

- Mismatch in details

- Signature mismatch

- The signed claim printout was not submitted within 15 days of making the online claim.

- Not Available: The claim has not yet been processed.

EPF Claim Forms

There are several Forms to claim your EPF funds. These include:

- Form 13: To transfer the accumulated EPF fund to a new account when changing jobs.

- Form 14: To pay for a LIC policy.

- Form 31: To raise a claim for advance or temporary EPF withdrawal.

- Form 10 D: To claim pension fund for account holders below 58 years leaving due to physical disability.

- Form 20: To raise a claim by a nominee of a deceased member's account.

- Form 10C: To claim withdrawal benefit or scheme certificate under the Employees' Pension Scheme.

Beside checking PF claim status, you can also check more about EPF from the table below:

| EPF Loan | PF Balance Check |

| EPF e-Passbook | EPF Withdrawal Rules |

| EPF Login | UAN Login |

| UAN | UAN Registration |

You can also check out more on different saving schemes below:

Frequently Asked Questions

You can download your PF statement by logging into the EPFO member portal using your UAN and password.

Visit the EPFO member portal, log in with your UAN, and navigate to the "Claim Status" section.

You need your UAN, member ID, or mobile number registered with the EPFO.

Yes, you can check your PF status using your UAN on the EPFO website.

PF status is typically updated monthly, but it may vary based on employer contributions.

Contact your employer for clarification or raise a grievance on the EPFO portal.

Yes, you can check your PF balance by sending SMS to 7738299899, in the format 'EPFOHO UAN LAN'.

Yes, the EPFO has a mobile app called UMANG app where you can check your PF status.

Log into the EPFO member portal and check the "Transfer Status" section using your UAN.

Review the rejection reason, rectify any issues, and reapply. You can also contact EPFO for assistance.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users