A PAN card (Permanent Account Number) is a 10-digit alphanumeric identifier issued by the Income Tax Department of India. It is essential for tax filings, financial transactions, and identity verification. PAN is linked to bank accounts, credit reports, and investments, making it crucial for financial tracking. It is required for filing income tax returns, opening bank accounts, applying for loans, and high-value transactions.

The PAN card details include the cardholder’s name, PAN number, date of birth, and photograph. Keeping your PAN details updated ensures smooth financial operations and prevents discrepancies in tax-related activities or credit reports.

A PAN card contains essential details like the PAN number, cardholder’s name, date of birth, father’s name, and signature, issued by the Income Tax Department of India. To check PAN card details, visit the official Income Tax e-filing portal or NSDL website, enter your PAN number, and verify your details. Keeping PAN details updated ensures smooth financial transactions and tax compliance.

Table of Contents:

- ⇾ Importance of PAN Card

- ⇾ Check PAN Card Details by Name and Date of Birth

- ⇾ Check PAN Card Details by PAN Number

- ⇾ Search For Address on your PAN Card

- ⇾ Check PAN Details on the Income Tax Website

- ⇾ Know Your PAN Through Toll-Free Number

- ⇾ Check Your PAN Status through SMS Service

- ⇾ Retrieve PAN Card Number By Email

- ⇾ Steps to Change PAN Card Details Online

- ⇾ Check PAN Card Status Using Aadhaar Number

- ⇾ Update Your PAN Address Through Aadhaar

- ⇾ Frequently Asked Questions

Importance of PAN Card

A PAN Card is essential for various financial and non-financial transactions in India. Here are the key areas where it is required:

- Filing Income Tax Returns: It is Mandatory for all taxpayers to file their income tax returns as per government regulations.

- Opening a Bank Account: Required for opening savings or current accounts in all public, private, and cooperative banks.

- Buying or Selling a Vehicle: PAN details must be provided for vehicle transactions above ₹5,00,000.

- Credit/Debit Card Applications: Banks require PAN details to verify identity before issuing debit or credit cards.

- High-Value Jewellery Purchases: PAN is needed for jewelry purchases exceeding ₹5,00,000 to ensure tax compliance.

- Investments: Mandatory for transactions over ₹50,000 in stocks, mutual funds, bonds, and securities.

- Proof of Identity: Recognized as a valid ID for obtaining a passport, voter ID, driving license, and utility connections.

- Foreign Exchange: Required when converting Indian currency to foreign currency for international travel.

- Property Transactions: PAN must be provided for buying, selling, or renting property in India.

- Loan Applications: Essential for applying for home loans, personal loans, education loans, and business loans.

- Fixed Deposits: Required for Fixed Deposit over ₹50,000, as banks deduct TDS (Tax Deducted at Source) on interest earned.

- Large Cash Deposits: Needed for cash deposits exceeding ₹50,000 to comply with RBI regulations.

- Mobile & Telephone Connections: PAN details must be submitted to obtain new mobile or telephone connections.

- Insurance Payments: Mandatory for insurance premium payments above ₹50,000 per year.

Are you looking for a personal loan?

Check PAN Card Details by Name & Date of Birth

While there isn’t a direct way to check PAN card details using only your name and date of birth, you can verify your PAN status through the Income Tax e-Filing portal. Follow these steps to do so:

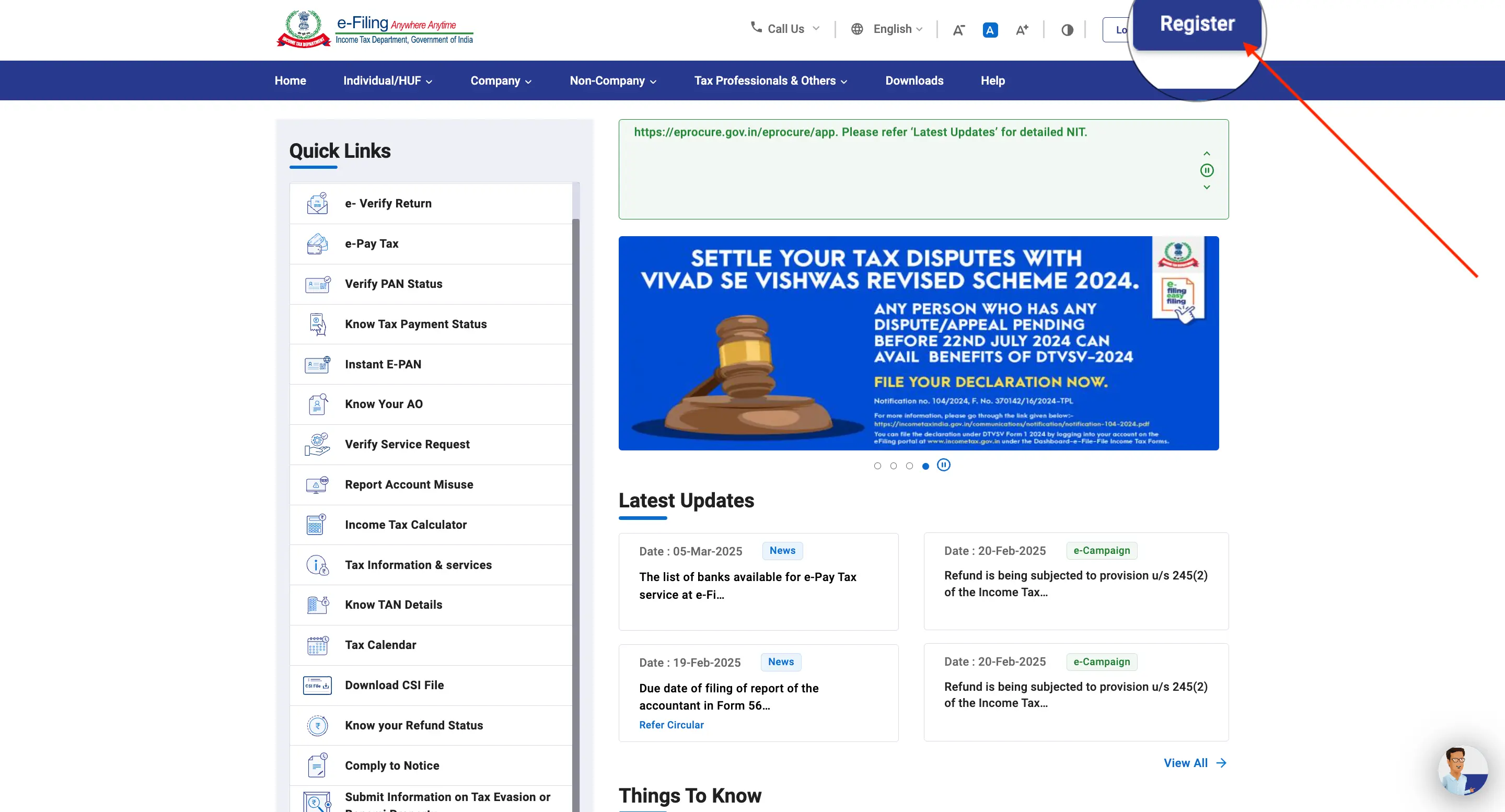

Step 1:Visit the Income Tax e-Filing page.

Step 2:Click on "Verify Your PAN" under the "Quick Links" section.

Step 3:Enter your PAN, full name, date of birth, and mobile number to proceed.

Step 4:Enter the OTP received on your registered mobile number and click "Validate".

Step 5:The next page will confirm that "Your PAN is active and details are as per PAN records."

This method ensures that your PAN is valid and correctly registered with the Income Tax Department.

Check PAN Card Details by PAN Number

Fetching PAN card details using a PAN number is essential for verifying identity, checking financial records, and ensuring compliance with tax regulations.

Step 1:Visit the Income Tax Department e-filing website.

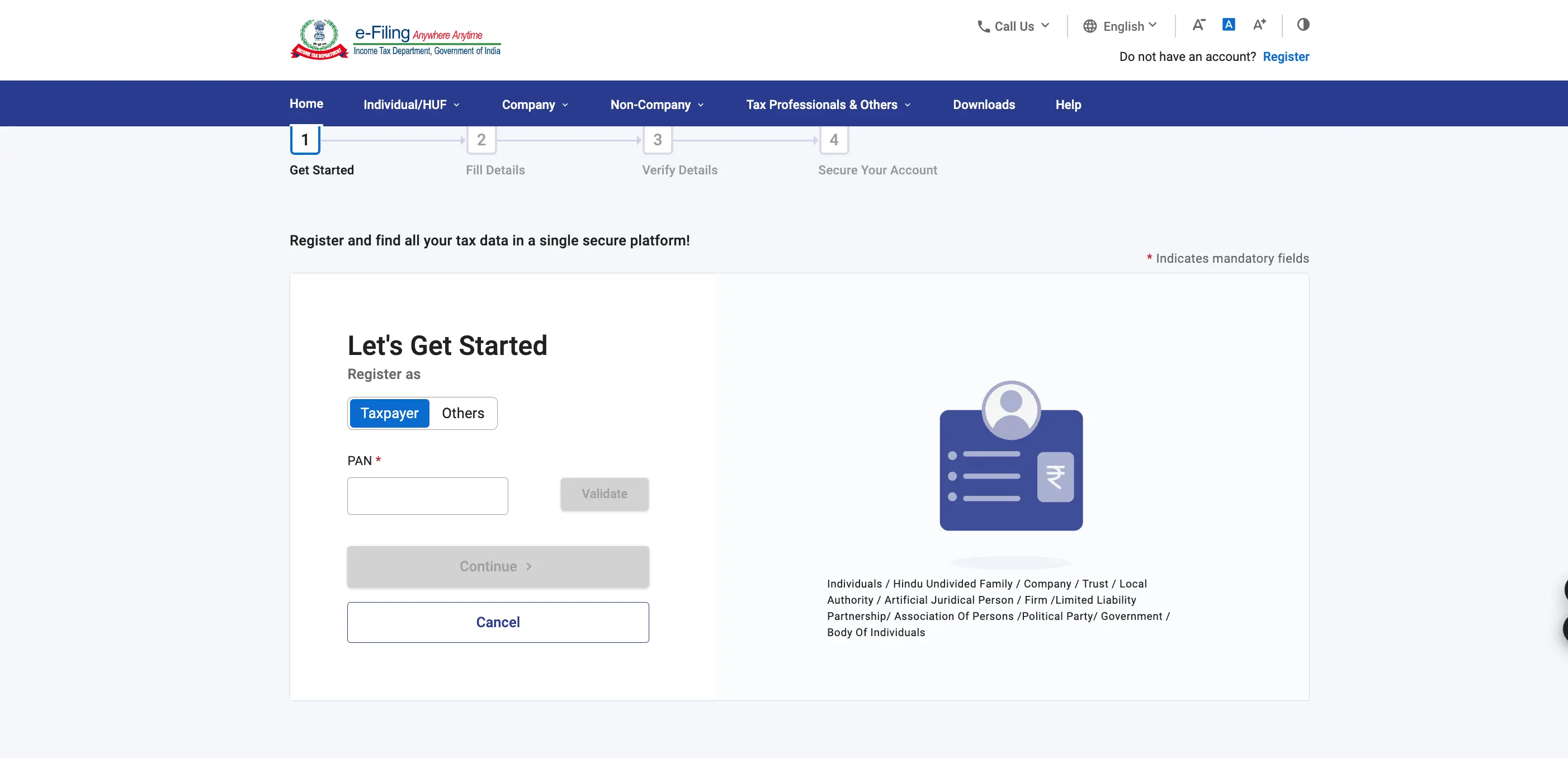

Step 2:Click "Register".

Step 3:Fill out the registration form and submit it.

Step 4:Check your email for a verification link and click on it to activate your account.

Step 5:Log in to your account at the Income Tax e-Filing portal and go to "My Account".

Step 6:Click on "Profile Settings", then select "PAN Details".

Step 7:Your PAN details (name, area code, jurisdiction, address, etc.) will be displayed.

Not sure of your credit score? Check it out for free now!

Search for Address on your PAN Card

Follow these steps to view your PAN card details, including your address:

Step 1: Visit the Income Tax Department e-filing website.

Step 2: Click on "Register Yourself".

Step 3: Select your user type and click "Continue".

Step 4: Enter your basic details as required.

Step 5: Fill out the registration form and submit it.

Step 6: Check your email for a verification link and click on it to activate your account.

Step 7: Log in to your account at the Income Tax e-Filing portal and go to "My Account".

Step 8: Click on "Profile Settings", then select "PAN Details".

Step 9: Your address and other PAN-related details will be displayed.

Check PAN Details on the Income Tax Website

Follow these steps to view your PAN card details through the Income Tax website:

Step 1: Visit the Income Tax e-Filing website.

Step 2: Click on “Register Yourself” (or “Registered User” if you already have an account).

Step 3: Select your user type and click “Continue”.

Step 4: Fill out the registration form and click “Submit”.

Step 5: Check your email for an activation link and click on it to activate your account.

Step 6: Log in to your account on the e-filing website.

Step 7: Go to “Profile Settings” and select “My Account”.

Step 8: Under "PAN Details", you will find:

- PAN Number

- Name of Assessee

- Date of Birth

- Gender

- Status

- Address

You can also view your address and contact details in separate tabs.

Know Your PAN Through Toll-Free Number

You can get details about your PAN card by calling the following toll-free numbers:

| Service Provider | Toll-Free Number | Availability |

|---|---|---|

| Protean e-Gov Technologies Limited | 020 27218080 | 7:00 AM – 11:00 PM (All Days) |

| UTIITSL | +91 33 40802999, 033 40802999 | 9:00 AM – 8:00 PM (All Days) |

| Income Tax Department | 912027218080 | Office Hours |

The Permanent Account Number (PAN) card was introduced in India on July 1, 1975, by the Income Tax Department. It is a 10-digit alphanumeric identifier issued to individuals, companies, and other entities for tax purposes

Check Your PAN Status through SMS Service

Follow these steps to track your PAN card status through SMS:

Step 1: Open your messaging app and type ‘NSDLPAN’, followed by a space.

Step 2: Enter your 15-digit PAN acknowledgment number.

Step 3: Send the SMS to 57575.

Step 4: You will receive a reply with the current status of your PAN card application.

Retrieve PAN Card Number By Email

You can request your PAN card details by sending an email to the official service providers:

- Protean e-Gov Technologies Limited (NSDL): tininfo@proteantech.in

- UTI Infrastructure Technology and Services Limited (UTIITSL): utiitsl.gsd@utiitsl.com

Make sure to include your PAN acknowledgment number, full name, and registered contact details in the email for a quicker response.

Steps to Change PAN Card Details Online

Follow these steps to update or correct your PAN card details:

Step 1: Visit the NSDL website.

Step 2: Select "PAN" under the "Services" tab.

Step 3: Click on "Apply" under "Change/Correction in PAN Data".

Step 4: Fill in the required details and click "Submit".

Step 5: Upload scanned images through eSign as required.

Step 6: Enter your personal details (name, date of birth, etc.).

Step 7: Provide your contact and address details.

Step 8: Upload proof of age, residence, identity, and PAN card.

Step 9: Sign the declaration and click "Submit".

Step 10: Make the payment via demand draft, net banking, credit card, or debit card.

Step 11: Download and print the acknowledgment receipt and send it to Protean e-Gov Technologies Limited.

Please note that the correction process takes approximately 15 to 20 days after submission.

Check the best offers & apply for a credit card!

Check PAN Card Status Using Aadhaar Number

Follow these steps to track your PAN card status with your Aadhaar card:

Step 1: Visit the Income Tax Department's e-filing website.

Step 2: Scroll to ‘Quick Links’ and select ‘Instant e-PAN’.

Step 3: Click ‘Continue’ under the ‘Check Status/Download PAN’ tab.

Step 4: Enter your 12-digit Aadhaar number and click ‘Continue’.

Step 5: Enter the OTP sent to your registered mobile number and click ‘Continue. ’

Step 6: Your PAN card status will be displayed on the screen.

Update Your PAN Address Through Aadhaar

To update your PAN card address using Aadhaar, ensure your mobile number and email ID are linked to Aadhaar. Follow these steps:

Step 1 : Visit the NSDL PAN Update Portal.

Step 2: Enter your PAN number, Aadhaar number, email ID, and mobile number.

Step 3: Agree to the terms and conditions.

Step 4: Enter the captcha code.

Step 5: Click "Submit".

Step 6: Enter the OTP sent to your registered mobile number and email ID to complete the process.

Get a quick loan at low interest rates!

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

You can check PAN card details on the NSDL or UTIITSL website using your PAN number and date of birth.

No, individual details linked to a PAN number are confidential and accessible only through authorized government portals.

The 4th character of a PAN represents the taxpayer category, e.g., ‘P’ for individuals and ‘C’ for companies.

Your PAN card contains details like PAN number, name, date of birth, father's name, and a signature.

Apply for a PAN card via the NSDL or UTIITSL website by filling out Form 49A and submitting required documents.

Aadhaar card, proof of address, passport-size photo, and date of birth proof are required for PAN application.

Track your PAN card status on the NSDL or UTIITSL website using the acknowledgment number.

The PAN application fee is ₹93 (physical card) and ₹72 (e-PAN) for Indian residents; charges vary for NRIs.

Request corrections on the NSDL or UTIITSL website by submitting the correction form and supporting documents.

Apply for a duplicate PAN on the NSDL or UTIITSL website using the reprint option with your PAN details.

Link PAN with your bank account via net banking, visiting the branch, or during account opening.

Download e-PAN from the NSDL or UTIITSL website using your PAN number and Aadhaar-based authentication.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users