Credit bureaus or Credit Information Companies (CICs) are in charge of tracking your credit usage, based on which the credit score is calculated. A credit score is a numerical representation or a score of how well you have managed your credit in the past. It helps the lenders assess your profile while reviewing your application for new credit.

In India's financial system, credit bureaus like CIBIL, Experian, Equifax, and CRIF High Mark, licensed and regulated by the Reserve Bank of India (RBI), play a crucial role. They collect, analyse, and maintain credit information for individuals and businesses.

Understanding how these Indian credit bureaus operate, their impact on financial decisions like loan approvals, and how to check your credit report is essential for every Indian to maintain a healthy credit profile.

A credit bureau is a financial institution that collects, maintains, and analyses credit-related information to generate credit reports and scores for individuals and businesses. These reports help lenders assess creditworthiness before approving loans or credit cards.

Table of Contents:

- ⇾ List of Credit Bureaus in India

- ⇾ Differences Between the Credit Bureaus

- ⇾ Functions of Credit Bureaus

- ⇾ Role of Credit Bureaus

- ⇾ CIBIL Score vs Credit Score

- ⇾ Check Credit Score from Different Credit Bureaus

- ⇾ Credit Bureaus vs Credit Reporting Agencies

- ⇾ Credit Bureau Updates

- ⇾ Frequently Asked Questions

List of Credit Bureaus in India

In India, the credit score ranges from 300 to 900, making 300 being the lowest value and 900 the highest value. The 4 credit bureaus in charge of generating credit score reports are:

- CIBIL

- Experian

- Equifax

- CRIF High Mark

CIBIL is one of the oldest and widely preferred credit bureaus in India. It has a huge database and covers a large volume of retail borrowers and is used extensively by banks and large NBFCs for consumer lending decisions. CIBIL scores range from 300 to 900, and scores above 750 are generally considered good.

CIBIL also provides commercial credit reports for businesses.

Experian is widely known for its global acceptance and is part of the global Experian group. It offers consumer and business credit reports, fraud detection services, and decision analytics. It also offers a range of 300 and 900 in India and is increasingly gaining adoption among digital lenders and fintech platforms due to its flexible credit risk tools.

Equifax is mostly known for its data analytics-driven solutions and is increasingly popular among individuals and businesses in India. It is newer compared to other long-established bureaus like CIBIL and Experian.

However, it is trusted by several banks and fintech lenders in India. It also offers industry-specific insights, such as delinquency trends, and its scoring models comply with RBI regulations.

CRIF High Mark is known for its broad credit data coverage, particularly in microfinance, retail, and rural lending sectors. With a credit range between 300 and 900, its advanced analytics and inclusive database make it a valuable source for both consumers and lenders evaluating small-ticket or underserved borrowers.

Don't know your credit score? You can find out for free!

Differences Between the Credit Bureaus

They operate under the regulation of the Reserve Bank of India (RBI). Below is a simple comparison table:

| Feature | CIBIL (TransUnion CIBIL) | Experian India | Equifax India | CRIF High Mark |

|---|---|---|---|---|

| Year Established | 2000 | 2006 | 2010 | 2008 |

| Market Share | ~60% | ~20% | ~10% | ~10% |

| Credit Score Range | 300 – 900 | 300 – 900 | 300 – 900 | 300 – 900 |

| Data Sources | Banks, NBFCs, financial institutions | Banks, NBFCs, telecom & utility companies | Banks, NBFCs, and small lenders | Banks, NBFCs, and microfinance institutions |

| Report Accuracy | High (most widely used) | High (used globally) | Moderate | High (detailed microfinance data) |

| Dispute Resolution Time | 30-60 days | 30 days | 45-60 days | 30-45 days |

| Special Features | Most accepted by Indian lenders | Offers identity protection services | Strong in risk analytics | Focuses on microfinance and MSMEs |

Read More

Read Less

Although there are multiple options, CIBIL is the most reputable among Indian lenders. However, Experian is another highly preferred CIC due to its global reach and is mostly considered by international lenders.

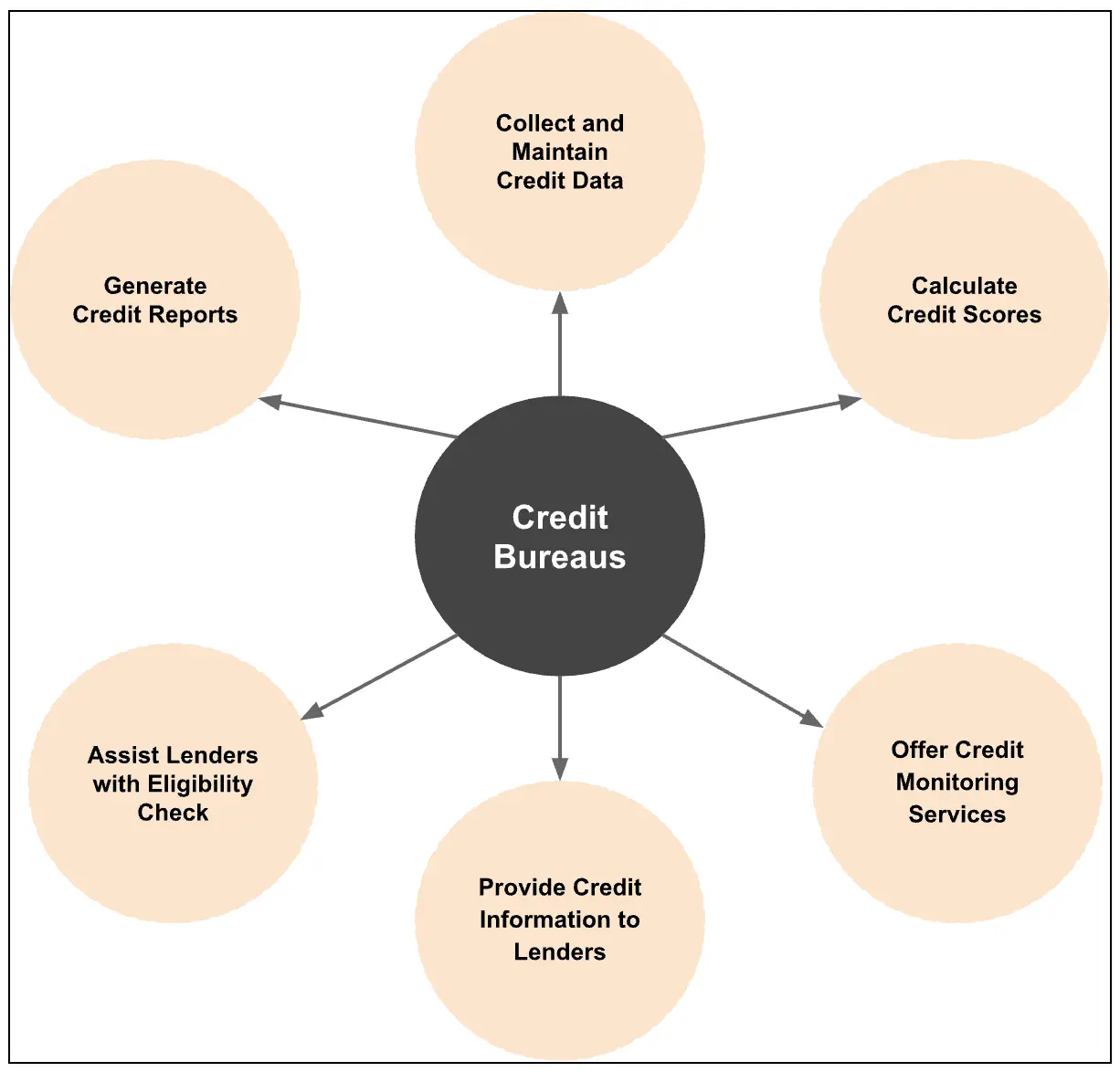

Functions of Credit Bureaus

Credit bureaus have an important role in the financial system by collecting and analysing credit-related data to help lenders make informed decisions. These institutions act as trusted resources or proofs between borrowers and lenders, ensuring transparency and accountability in credit transactions.

The credit system depends on credit bureaus for its trustworthiness. Credit bureaus gather credit information to create credit scores while building comprehensive reports about how people handle their loans and payment responsibilities. The reports lenders use to evaluate risk before extending credit. Through their services, bureaus enable consumers to access their credit information while supporting both fraud detection and regulatory compliance throughout the financial ecosystem.

Get a quick loan at low interest rates!

Role of Credit Bureaus

Credit bureaus are organisations in charge of credit-related activities—they collect, analyse, and maintain credit-related information about individuals and businesses. They play a crucial role in finance; lenders depend on them to assess the creditworthiness of borrowers.

Role of Credit Bureaus in Loan Approvals

Credit bureaus play an important role in loan approvals by providing financial institutions with accurate credit information.

Their impact includes:

- Loan Eligibility Assessment: Banks and NBFCs check credit scores before approving loans.

- Interest Rate Determination: Higher credit scores lead to lower interest rates and better loan offers.

- Risk Evaluation: Lenders assess default risk based on past repayment behaviour.

- Credit Card Approvals: Determines eligibility for credit cards and higher limits.

- Credit history mapping: Credit bureaus generate the credit report, which is done upon request. This includes all your past credit usage, which is used by lenders while analysing your profile.

CIBIL Score vs Credit Score

Although CIBIL score and credit score are often misunderstood as one, it is important to know the silver lining.

The full form of CIBIL is Credit Information Bureau (India) Limited. This is the credit score provided by TransUnion CIBIL, a type of credit score widely used in India.

A credit score, on the other hand, is a much broader term, which is the representation of the credit usage of an individual. In short, the CIBIL score falls under the broader category of credit score.

Be up to date with your credit score. Check it out for free now!

Check Credit Score from Different Credit Bureaus

To monitor your credit report and financial health, it is best to check your credit scores and reports regularly.

It can be done by using the following steps:

- Visit the official website of the credit bureau (cibil.com, experian.com, equifax.com, or crifhighmark.com).

- Choose to create an account or if you already have an account, please log in.

- Enter your personal details like PAN card number, Aadhaar card, or mobile number for OTP verification.

- Request a free credit report. Please note that most credit bureaus offer one free report per year.

- You will receive the report in your registered email

You can review your credit history to check for errors, missed payments, or fraud alerts. Dispute incorrect information by raising a request with the respective bureau.

Credit Bureaus vs Credit Reporting Agencies

Credit bureaus and credit reporting agencies are often confused with one another, but they serve different purposes.

While credit bureaus collect, maintain, and analyse credit information from various financial institutions, a credit reporting agency is a broader term that includes any organisation that compiles and provides credit-related reports to lenders, businesses, and individuals.

In many cases, credit reporting agencies provide additional services that are beyond credit scoring alone.

| Feature | Credit Bureaus | Credit Reporting Agencies |

|---|---|---|

| Function | Collect and maintain credit data | Provide credit-related analytics and services |

| Regulation | Regulated by RBI in India | Independent agencies providing financial reports |

| Purpose | Generate credit reports and scores | Provide credit insights and risk assessments |

| Examples | CIBIL, Experian, Equifax, CRIF High Mark | Dun & Bradstreet, ICRA, CARE Ratings |

Although both are related to credit management, credit bureaus are more in demand in India, while credit reporting agencies are a commonly used term in countries like the USA and Canada.

Suggested Read: Different Credit Information Companies in India

Credit Bureau Updates

In January 2025, the Reserve Bank of India implemented some new regulations to enhance the accuracy and timeliness of credit reporting. Some of these include:

- Bimonthly Credit Reporting

- Standardisation for Asset Reconstruction Companies (ARCs)

- Enhanced Consumer Protection Measures

Lenders are required to update credit bureau records every 15 days. This was done monthly previously.

The ARCs have to standardise their credit bureau reporting procedure in such a way that it aligns with other financial institutions. This includes mandatory membership with all four major credit bureaus—TransUnion CIBIL, Experian, Equifax, and CRIF High Mark.

The credit bureaus are now required to send alert messages via SMS or email whenever a consumer's credit history is accessed or updated.

For consumers whose complaints are not resolved within 30 days, a compensation framework has also been established with a penalty of ₹100 per day beyond this period until resolution.

Check the best offers & apply for a credit card!

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

A credit bureau is an agency that collects and maintains credit information to generate credit reports and scores.

A credit bureau check means the chosen credit bureau assesses your credit history, including loans, repayments, and defaults, to determine creditworthiness.

The four RBI-approved credit bureaus in India are CIBIL, Experian, Equifax, and CRIF High Mark.

You can choose any of the four from the RBI-approved credit bureaus through their official website. However, it is best to look for the details and specialised focus each has to determine the one that is best suited for you.

A credit bureau tracks an individual’s credit history and provides credit scores to help lenders assess loan eligibility.

CIBIL is the most widely used in India, but Experian, Equifax, and CRIF High Mark also provide reliable reports.

To find your credit bureau, check past emails from CIBIL, Experian, Equifax, or CRIF High Mark, review bank/NBFC statements, login to bureau websites, check your credit report, and contact customer support.

Visit the bureau’s website, enter your details, and request your credit report.

A credit score above 750 is considered good for loans and credit approvals.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users