The Axis Bank Neo Credit Card is a digital-first credit card designed primarily for online shoppers and young professionals. It offers a range of lifestyle benefits, including discounts on food delivery, fashion, movie tickets, and utility bill payments.

The card includes welcome vouchers, reward points on eligible spends, and access to Axis Bank’s EDGE REWARDS program. With minimal joining and annual fees—often waived under certain conditions—it’s a cost-effective option for those who frequently shop or pay bills online.

Below you will find the eligibility criteria, application process, fees, and benefits of the Axis Bank Neo Credit Card.

The Axis Bank Neo Credit Card comes with key benefits like discounts on Zomato, Myntra, and Blinkit, cashback on utility bill payments via Paytm, welcome vouchers, and EDGE REWARDS points on spends.

Table of Contents:

Eligibility Criteria for Axis Bank Neo Credit Card

The eligibility criteria for the Axis Bank Neo Credit Card include:

- The individual must be an Indian citizen or an NRI.

- The individual must be of the age between 18-70 years old.

Are you looking for a personal loan?

Application Process & Documents Required

You can apply for the Axis Bank Neo Credit Card in both online and offline:

Application Process through Online:

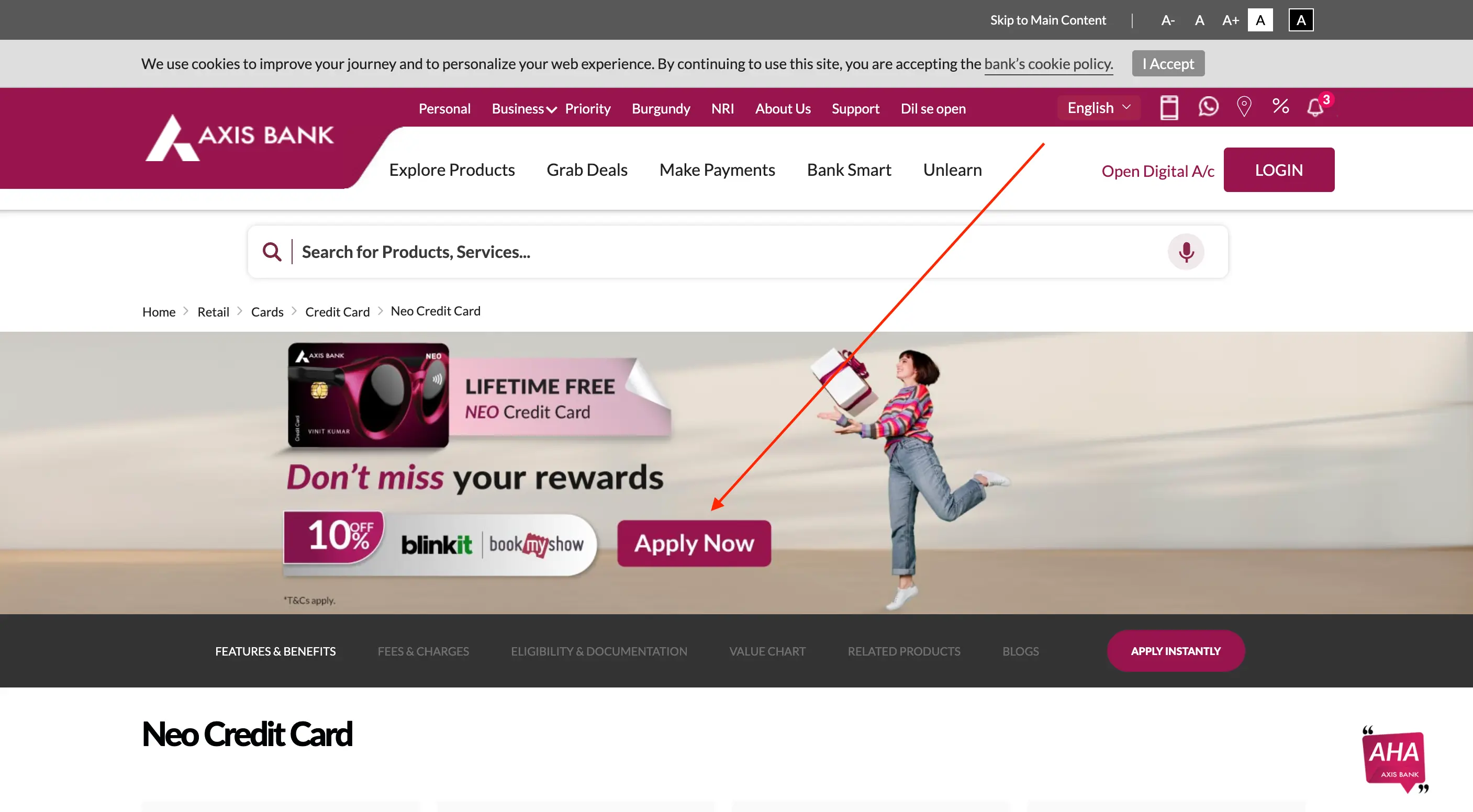

- Visit the official page of Axis Bank Neo Credit Card.

- Click on the ‘Apply Now’ button.

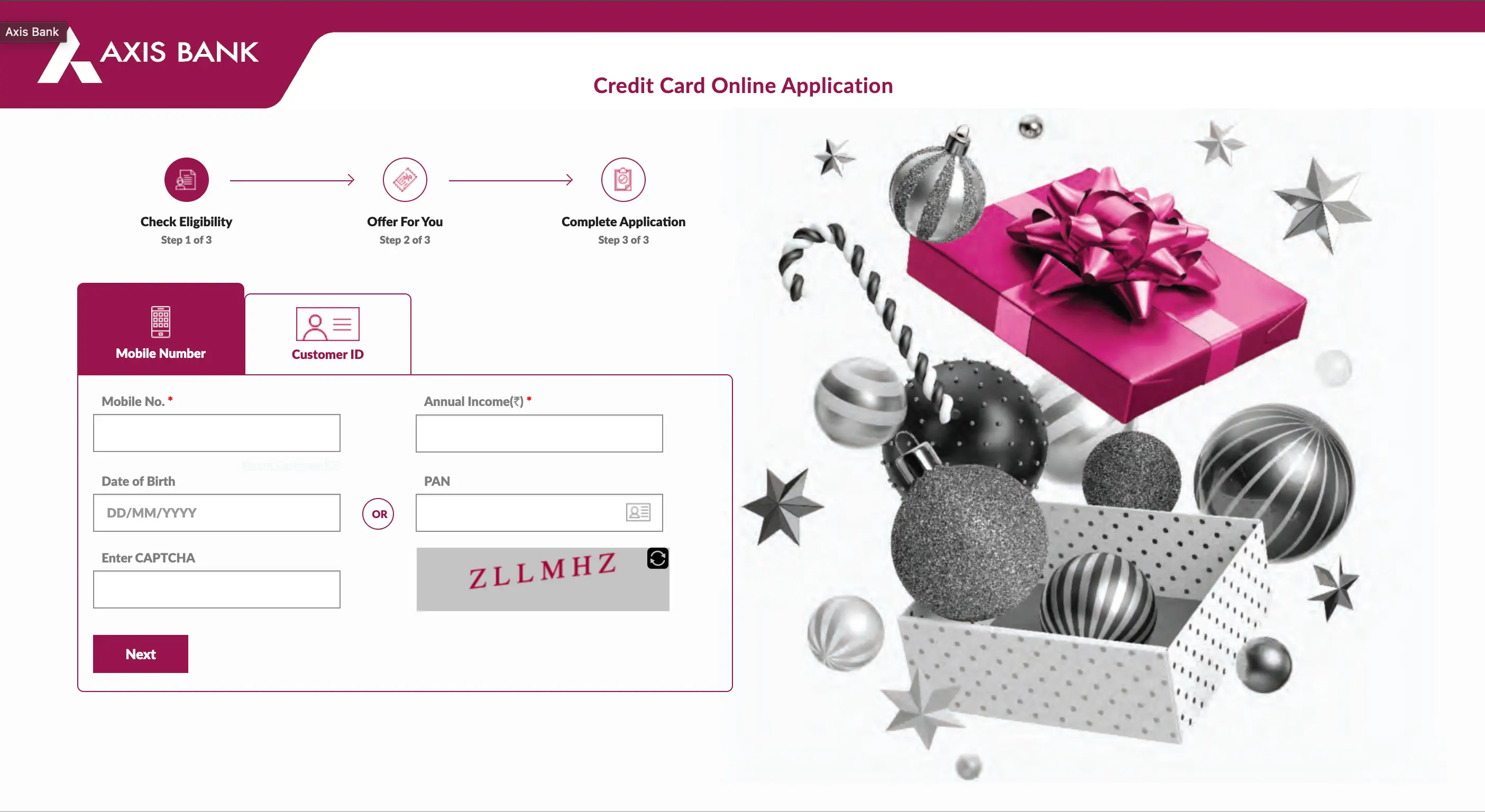

- Enter your mobile number or customer ID, date of birth, PAN, and captcha to check your eligibility.

- Click on the ‘Next’ button.

- Fill out the information as per instructions.

- Complete the application form.

Note that these steps are for existing customers of Axis Bank.

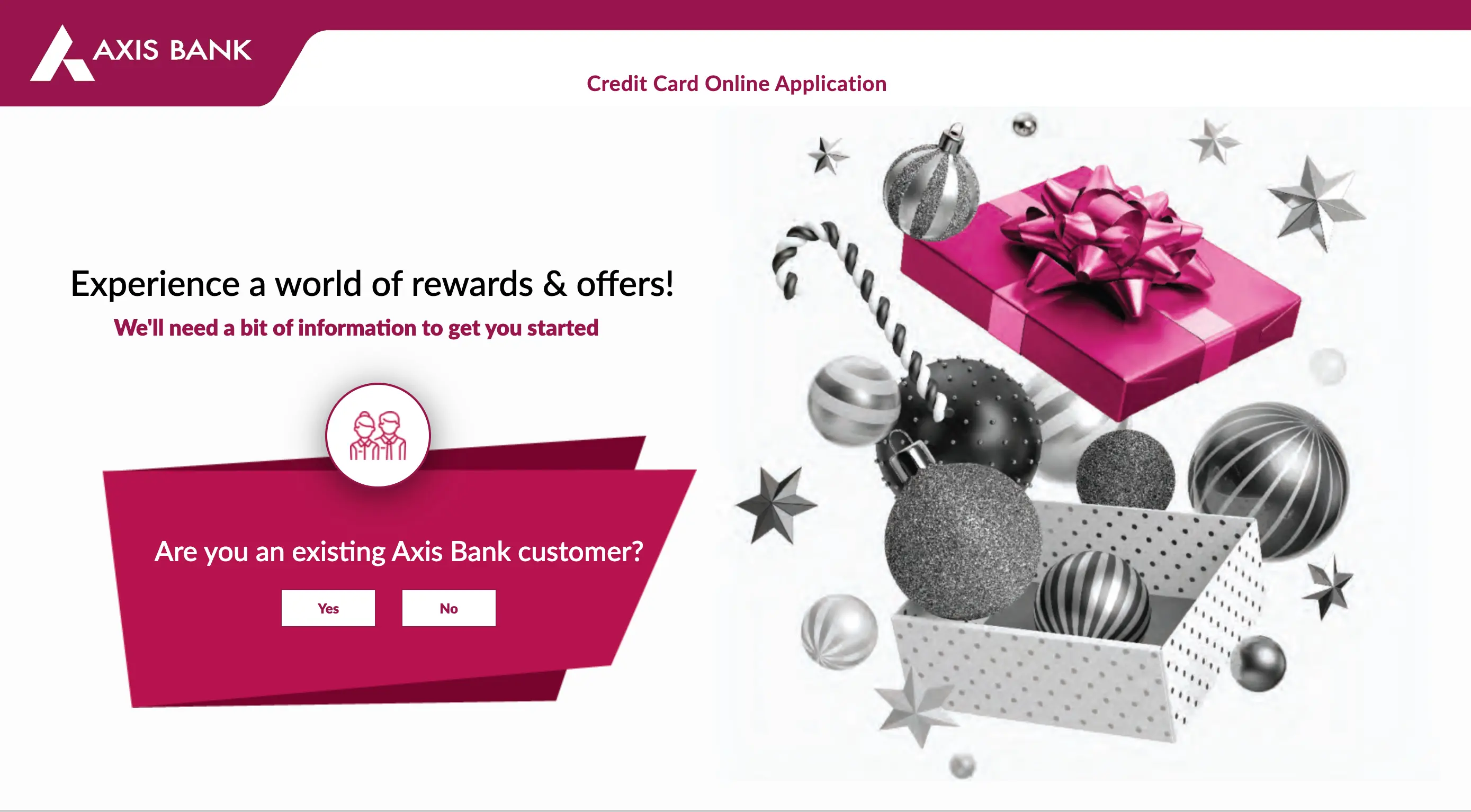

If you are a new customer of Axis Bank and want to apply for the Axis Bank Neo Credit Card, you can select from the options below and proceed with the application.

Application Process through Offline:

To apply for the Axis Bank Neo Credit Card offline, follow the steps below:

- Visit your nearest branch of Axis Bank.

- Request the credit card application form.

- Fill out the information.

- Submit the necessary documents.

Here are the documents required to apply for the Axis Bank Neo Credit Card:

- PAN Card photocopy or Form 60.

- Income Proof such as the latest payslip, Form 16, or ITR.

- Proof of Residence, such as a driving license, electricity bill, or telephone bill.

Check the best offers & apply for a credit card!

Charges & Fees of Axis Bank Neo Credit Card

The Axis Bank Neo Credit Card charges are as follows:

| Joining Fee (₹) | ₹250 |

| Annual Fee (₹) | ₹250 (from 2nd year onwards) |

| Card Replacement Fee (₹) | Nil |

| Cash Withdrawal Fees (₹) | 2.5% (minimum ₹500) of the cash amount |

Charges are subject to change.

Note that the Axis Bank Neo Credit Card is also referred to as the Axis Bank Lifetime Free Neo Credit Card, as the joining fee and annual fee are waived off when you apply via select channels.

The Axis Bank Neo Credit Card limit is offered based on the customer’s spending history and other financial information. The credit limit can be increased as well; that is, eligible cardholders will receive a Pre-Approved Credit Limit Increase Offer via SMS, email or ATM.

Also Read: Axis bank my zero credit card

Not sure of your credit score? Check it out for free now!

Benefits & Features of Axis Bank Neo Credit Card

Here are the Axis Bank Neo Credit Card benefits and features:

| 40% Off on Zomato | 15% discount at partner restaurants via Axis Bank Dining Delights |

| 100% cashback up to ₹300 on the first utility bill payment within the first 30 days of card issuance | 5% off on utility bill payments via Paytm |

| 10% off on Blinkit, ₹150 off on Myntra, & 10% off on BookMyShow tickets | Zero lost card liability |

| Protected with an EMV-certified chip & PIN system | EDGE REWARDS Points for transactions |

| Exclusive offers every Wednesday | 1 Reward Point for every ₹200 spent |

Do you need an instant loan?

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

The Axis Bank Neo Credit Card is an entry-level card designed for online shoppers, offering discounts and reward points on transactions, which can be redeemed for various rewards.

Visit the Axis Bank Application Tracker and enter your application reference number along with your registered mobile number. You can also contact the Axis Bank customer care.

To activate your Axis Bank Neo Credit Card, set your PIN using the Axis Mobile app, Internet Banking, ATM, or Phone Banking.

To close your Axis Bank Neo Credit Card, first clear any dues and redeem your reward points. Then, contact Axis Bank customer support to submit a formal closure request and obtain written confirmation of your card's cancellation.

The bill generation date for your Axis Bank Neo Credit Card depends on the billing cycle assigned to your card, which typically spans 30 days.

You can check your Axis Bank Neo credit card reward points via NetBanking, Mobile App, or customer care.

You can request an increase on the Axis Bank Neo Credit Card limit via the Axis Mobile App and Axis Internet Banking.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users