Postal Life Insurance (PLI) is one of the oldest and most trusted life insurance schemes in India, offering financial security at affordable premiums. Managed by India Post, PLI offers various plans, including Whole Life Assurance, Endowment Assurance, and Postal Term Insurance, designed to meet different financial needs.

Here, learn more details on PLI plans, eligibility, benefits, and payment options to help you decide about securing your future with India Post Postal Life Insurance.

Postal Life Insurance was introduced in 1884 for postal and telegraph department employees, It has since expanded to cover government employees, professionals, and workers in listed companies.

Table of Contents:

- ⇾ Postal Life Insurance Interest Rate

- ⇾ Postal Life Insurance Eligibility

- ⇾ Documents Required For Postal Life Insurance

- ⇾ Features & Benefits of Postal Life Insurance

- ⇾ Types of Postal Life Insurance Schemes

- ⇾ Postal Life Insurance Scheme Bonus

- ⇾ Postal Life Insurance Calculator

- ⇾ Postal Life Insurance Login

- ⇾ Postal Life Insurance Forms

- ⇾ Pay Postal Life Insurance Online

- ⇾ Check Postal Life Insurance Policy Status

- ⇾ Postal Life Insurance Customer Guidelines

- ⇾ Postal Life Insurance Customer Care Number

- ⇾ Frequently Asked Questions

Postal Life Insurance Interest Rate

Understanding the interest rate on Postal Life Insurance (PLI) loans is important, as it affects the total repayment amount and policy benefits.

- PLI Loan Interest Rate – The interest rate on a PLI loan is 10% per year, which is calculated every six months.

- Interest Payment Schedule – Interest must be paid every six months. If a payment is missed, the unpaid interest is added to the loan amount, increasing the total due.

- Policy Impact for Missed Payments – If the policyholder fails to pay interest for three consecutive terms, the insurer may surrender the policy and use its surrender value to clear the outstanding loan and unpaid interest.

Loan Facility in Postal Life Insurance (PLI)

Postal Life Insurance (PLI) allows policyholders to avail of a loan against their policy after a minimum lock-in period. The loan facility becomes available:

- After 3 years for Endowment Assurance policies

- After 4 years for Whole Life Assurance policies

Do you need an instant loan?

Postal Life Insurance Eligibility

To qualify for Postal Life Insurance, applicants must meet specific criteria that ensure they are eligible for the coverage. Here is the table showing the eligibility criteria required for this insurance :

| Category | Eligible Individuals |

|---|---|

| Government Employees |

|

| Defense & Security Forces |

|

| Banking & Financial Sector |

|

| Education & Research Sector |

|

| Postal & Cooperative Sector |

|

Read More

Read Less

Check credit score? Check it out for free now!

Documents Required For Postal Life Insurance

To apply for Postal Life Insurance (PLI), you need the following documents:

- Identity proof (Aadhaar card, PAN card, etc.)

- Age proof (Birth certificate, Passport, etc.)

- Address proof

- Recent passport-sized photographs

- Employment details (if required)

Features & Benefits of Postal Life Insurance

2 (PLI) offers several benefits, making it a reliable and affordable life insurance option. Below are its key features and advantages:

Key Features

- Low Premium, High Returns – PLI provides life insurance at a low premium while offering high returns and bonus rates.

- Nomination Facility – Policyholders can nominate a beneficiary and update the nomination details anytime.

- Loan Facility – After 3 years for Endowment Assurance and 4 years for Whole Life Insurance, policyholders can take a loan against their policy.

- Policy Revival – If a policy lapses due to missed premium payments, it can be revived under certain conditions.

- Duplicate Policy Document – If the original policy document is lost, damaged, or destroyed, a duplicate can be issued easily.

- Easy Transfer – PLI policies can be transferred across India without any extra charges.

- Passbook Facility – Policyholders can track their PLI premium payments and loan transactions through a passbook.

Benefits

- Tax Benefits – Premiums paid under PLI are eligible for tax exemption under Section 80C of the Income Tax Act.

- Flexible Premium Payment – Premiums can be paid monthly, semi-annually, or annually.

- Advance Payment Discounts – Get a discount on premium payments:

- 1% discount for 6 months' advance payment

- 2% discount for 12 months' advance payment

- Quick Claims Process – Due to a centralized accounting system, claim settlements are fast and hassle-free.

Get a quick loan at low interest rates!

Types of Postal Life Insurance Schemes

India Post offers different Postal Life Insurance (PLI) plans to meet various financial needs. Below is a simple explanation of each plan, including its key features.

1. Whole Life Assurance (Suraksha)

This scheme pays the sum assured along with the accrued bonus either when the policyholder turns 80 years old or to their nominee or legal heir in case of their death, whichever happens first.

- Entry Age: 19 to 55 years

- Sum Assured: ₹20,000 to ₹50 lakhs

- Loan Facility: Available after 4 years

- Surrender Option: After 3 years (no bonus if surrendered before 5 years)

- Conversion: Can be changed to Endowment Assurance before 59 years

- Premium Paying Age Options: 55, 58, or 60 years

- Bonus Rate: ₹76 per ₹1,000 sum assured per year

2. Convertible Whole Life Assurance (Suvidha)

Works like Whole Life Assurance but can be converted into an Endowment Assurance policy after 5 years.

- If not converted within 6 years, it remains a Whole Life Assurance policy.

- Entry Age: 19 to 50 years

- Sum Assured: ₹20,000 to ₹50 lakhs

- Loan Facility: Available after 4 years

- Surrender Option: After 3 years (no bonus if surrendered before 5 years)

- Bonus Rate:

- ₹76 per ₹1,000 per year (if not converted)

- If converted, the Endowment Assurance bonus applies

3. Endowment Assurance (Santosh)

The sum assured + bonus is paid on maturity (35, 40, 45, 50, 55, 58, or 60 years) or to the nominee in case of death.

- Entry Age: 19 to 55 years

- Sum Assured: ₹20,000 to ₹50 lakhs

- Loan Facility: Available after 3 years

- Surrender Option: After 3 years (no bonus if surrendered before 5 years)

- Bonus Rate: ₹52 per ₹1,000 sum assured per year

Be up to date with your credit score. Check it out for free now!

4. Joint Life Assurance (Yugal Suraksha)

Life cover for both husband and wife under a single premium.

- The sum assured plus the bonus is paid to the surviving spouse in case of death.

- Entry Age: 21 to 45 years (Elder spouse should not be older than 45)

- Policy Term: 5 to 20 years

- Sum Assured: ₹20,000 to ₹50 lakhs

- Loan Facility: Available after 3 years

- Surrender Option: After 3 years (no bonus if surrendered before 5 years)

- Bonus Rate: ₹52 per ₹1,000 sum assured per year

5. Anticipated Endowment Assurance (Sumangal)

Best for those who need periodic payouts instead of a lump sum on maturity

- Survival Benefits are paid at different intervals.

- If the insured passes away, the full sum assured plus the bonus is paid to the nominee, ignoring any money-back payments already made.

- Entry Age: 19 to 40 years (for 20-year policy), 19 to 45 years (for 15-year policy)

- Sum Assured: Up to ₹50 lakhs

- Bonus Rate: ₹48 per ₹1,000 sum assured per year

6. Children's Policy (Bal Jeevan Bima)

Covers up to two children of the policyholder

- The parent must have a PLI policy to apply for this plan.

- Entry Age for Child: 5 to 20 years

- Sum Assured: Up to ₹3 lakhs or equal to the parent's policy sum assured (whichever is lower).

- No Premium Payment Required after the parent's death.

- Bonus Rate: ₹52 per ₹1,000 sum assured per year

- No Loan or Surrender Facility

Are you looking for a personal loan?

Postal Life Insurance Scheme Bonus

The Postal Life Insurance Scheme offers various bonuses that enhance the value of the policy, providing policyholders with additional financial benefits and rewards for their long-term commitment to saving. Let us look at the table of the bonus scheme of this insurance:

| PLI Plan Type | Bonus Rate (per ₹1,000 Sum Assured) |

|---|---|

| Whole Life Assurance (Suraksha) | ₹76 per ₹1,000 |

| Convertible Whole Life Assurance (Suvidha) | ₹76 per ₹1,000 |

| Endowment Assurance (Santosh) | ₹52 per ₹1,000 |

| Joint Life Assurance (Yugal Suraksha) | ₹52 per ₹1,000 |

| Anticipated Endowment Assurance (Sumangal) | ₹48 per ₹1,000 |

| Children Policy (Bal Jeevan Bima) | ₹52 per ₹1,000 |

Read More

Read Less

Bonus Rules for Postal Life Insurance

- Bonuses are paid on maturity or death if no loan is taken within the first 5 years.

- Loans can be taken after 3 years, but if availed before 5 years, the policy loses all bonuses.

- If a loan is taken after 5 years, the bonus amount is reduced accordingly.

Be up to date with your credit score. Check it out for free now!

Postal Life Insurance Calculator

The Postal Life Insurance (PLI) calculator helps policyholders estimate their maturity amount based on the sum assured, policy term, and bonus rates. Since PLI follows a bonus-based return system, the formula for calculating the maturity amount is as follows:

Maturity Amount = Sum Assured + [(Sum Assured / 1000) × Bonus Rate × Policy Term]

Where:

- Sum Assured = The amount chosen by the policyholder

- Bonus Rate = Declared annually per ₹1,000 Sum Assured

- Policy Term = Number of years the policy remains active

Whole Life Assurance (Suraksha) Calculation

Maturity Amount = Sum Assured + [(Sum Assured / 10000) × 76 × Policy Term]

- Bonus Rate: ₹76 per ₹1,000 Sum Assured per year

- Policy Term: Until 80 years of age or earlier if claimed

Convertible Whole Life Assurance (Suvidha) Calculation

If NOT converted (Whole Life Assurance):

Maturity Amount = Sum Assured + [(Sum Assured / 10000) × 76 × Policy Term]

- If converted after 5 years:

- First 5 years bonus at ₹76 per ₹1,000

- Remaining term bonus at ₹52 per ₹1,000

- Final payout includes the sum assured plus accumulated bonuses

Endowment Assurance (Santosh) Calculation

Maturity Amount = Sum Assured + [(Sum Assured / 10000) × 52 × Policy Term]

- Bonus Rate: ₹52 per ₹1,000 Sum Assured per year

- Policy Term: Fixed tenure of 35, 40, 45, 50, 55, 58, or 60 years

Joint Life Assurance (Yugal Suraksha) Calculation

Maturity Amount = Sum Assured + [(Sum Assured / 10000) × 52 × Policy Term]

- Bonus Rate: ₹52 per ₹1,000 Sum Assured per year

- Policy Term: 5 to 20 years

- Special Feature: Covers both spouses under one policy

Anticipated Endowment Assurance (Sumangal) Calculation

- Money-Back Policy: Periodic survival benefits are paid

- Final Maturity Amount Formula:

Final Payout = 40% Sum Assured + [(Sum Assured / 1000) × 48 × Policy Term]

- Bonus Rate: ₹48 per ₹1,000 Sum Assured per year

- Survival Benefits:

- 15-year policy → 20% payout at 6, 9, and 12 years

- 20-year policy → 20% payout at 8, 12, and 16 years

Children's Policy (Bal Jeevan Bima) Calculation

Maturity Amount = Sum Assured + [(Sum Assured / 10000) × 52 × Policy Term]

- Bonus Rate: ₹52 per ₹1,000 Sum Assured per year

- No Premium Required after parent's death

- Maximum Sum Assured: ₹3 Lakhs

Check the best offers & apply for a credit card!

Postal Life Insurance Login

Here are the steps to log in form the Postal Life Insurance:

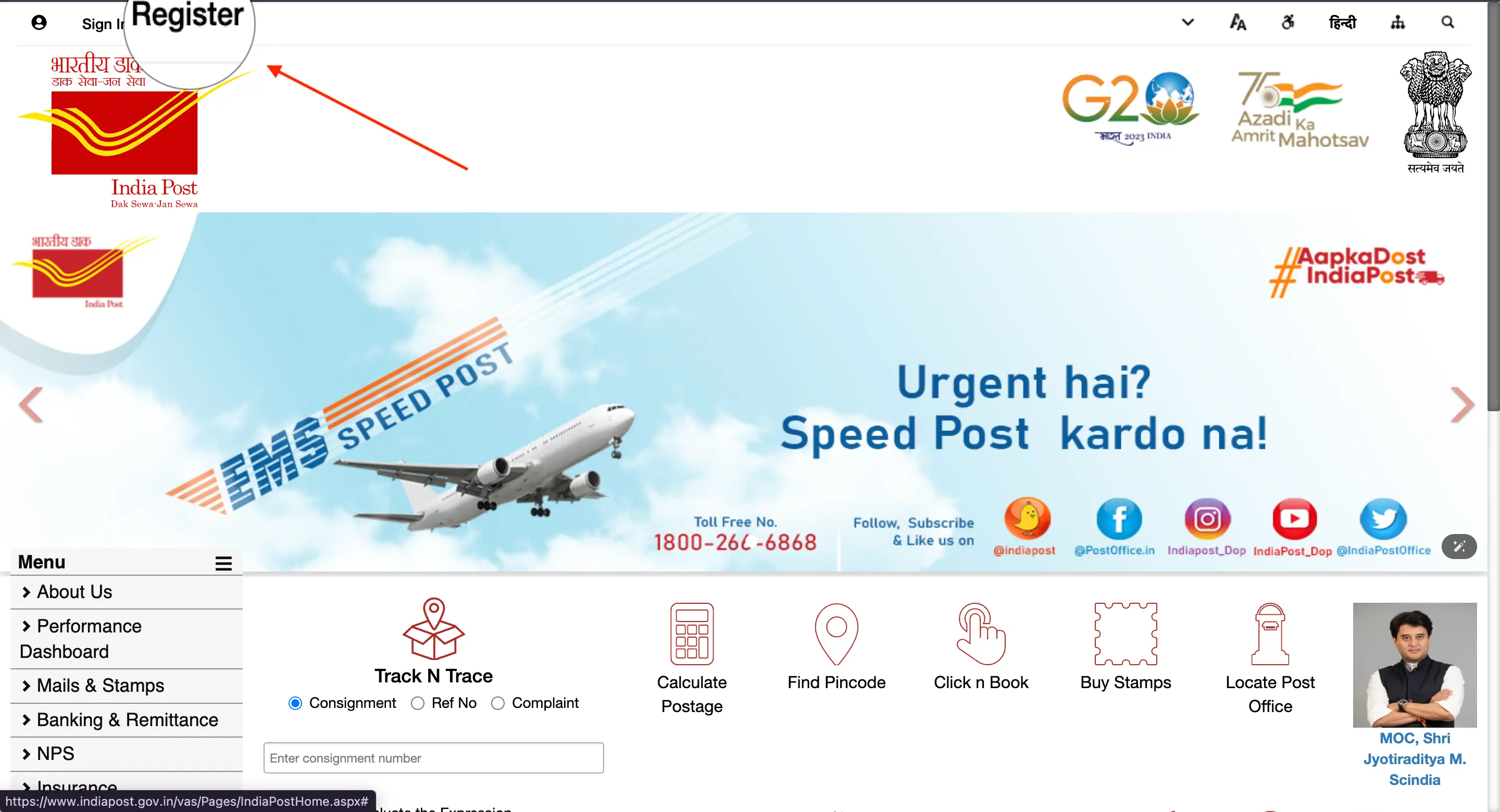

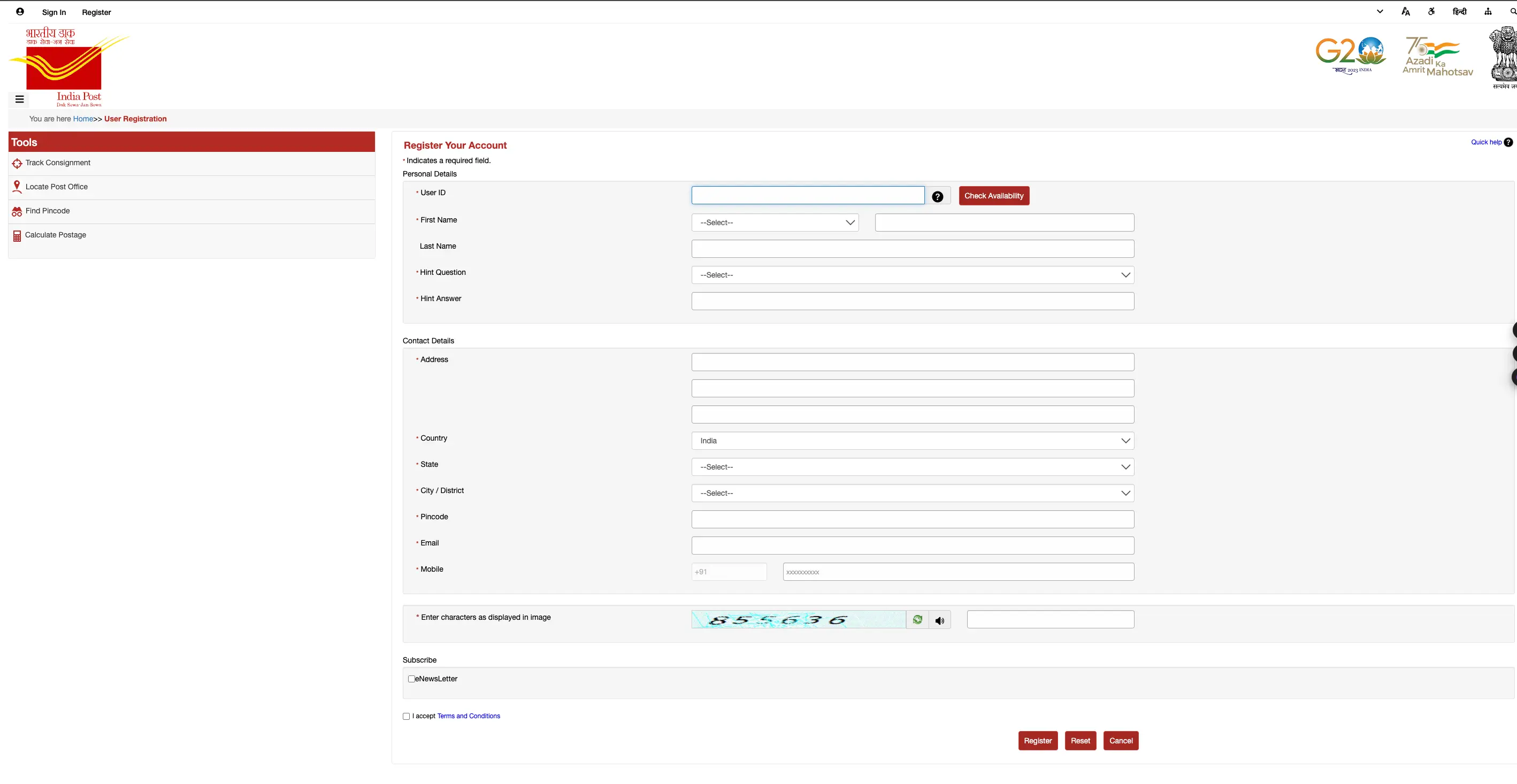

Step 1: Visit the Postal Life Insurance website.

Step 2: Click on "Register" in the top right corner.

Step 3: Select "Retail" from the dropdown menu.

Step 4: Fill out the registration form with the required details.

Step 5: Click "Register" to complete the process.

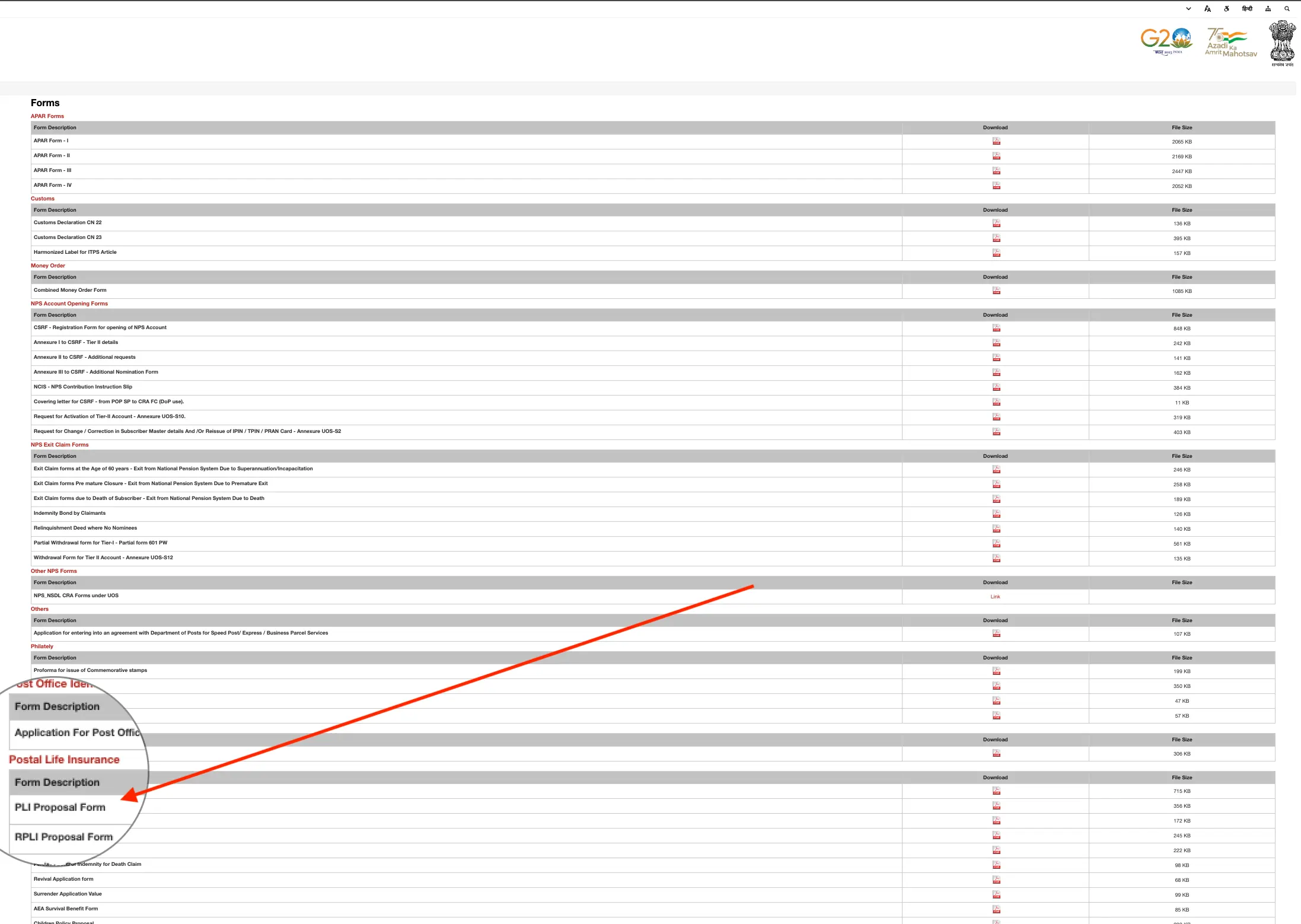

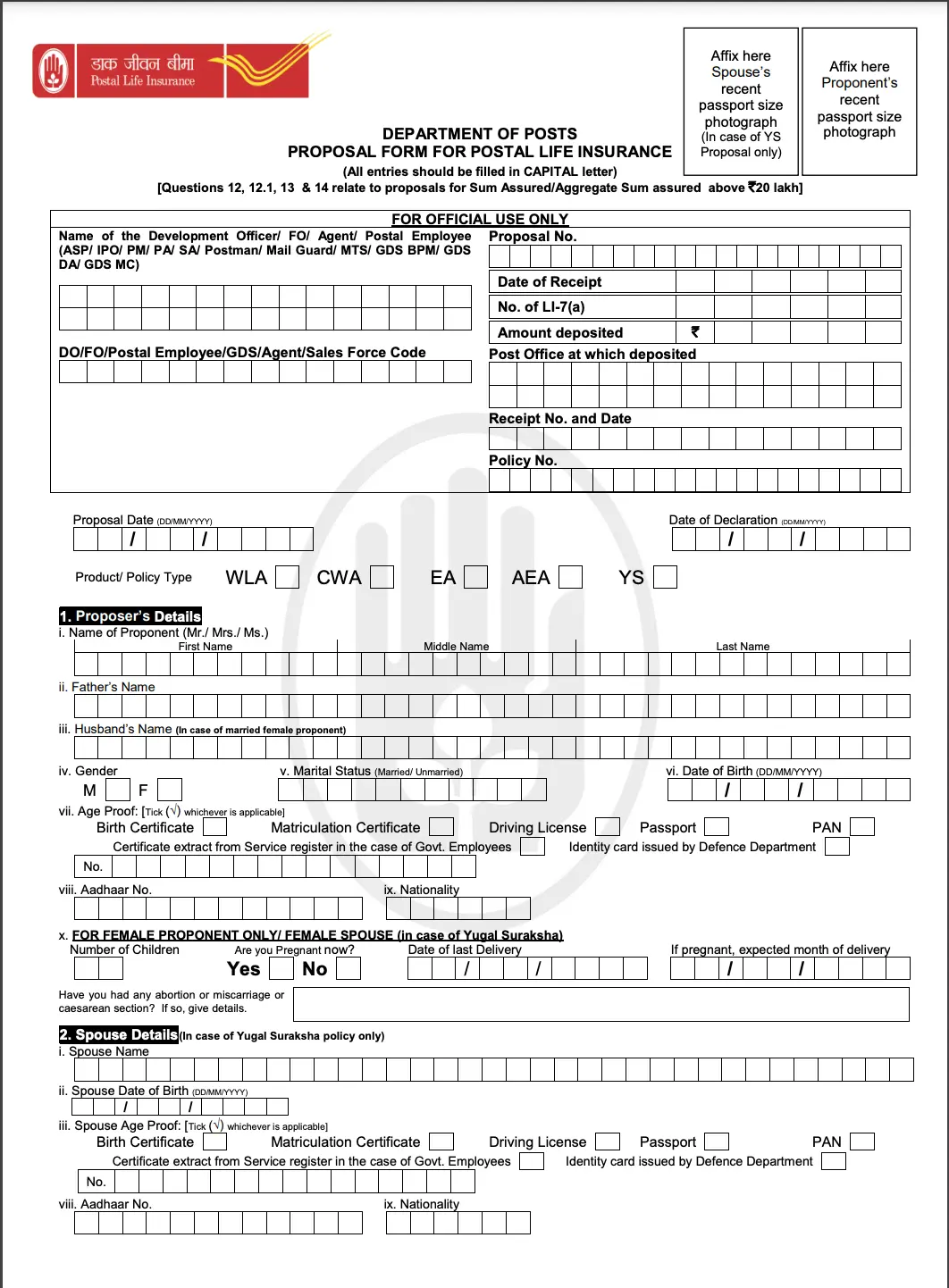

Postal Life Insurance Forms

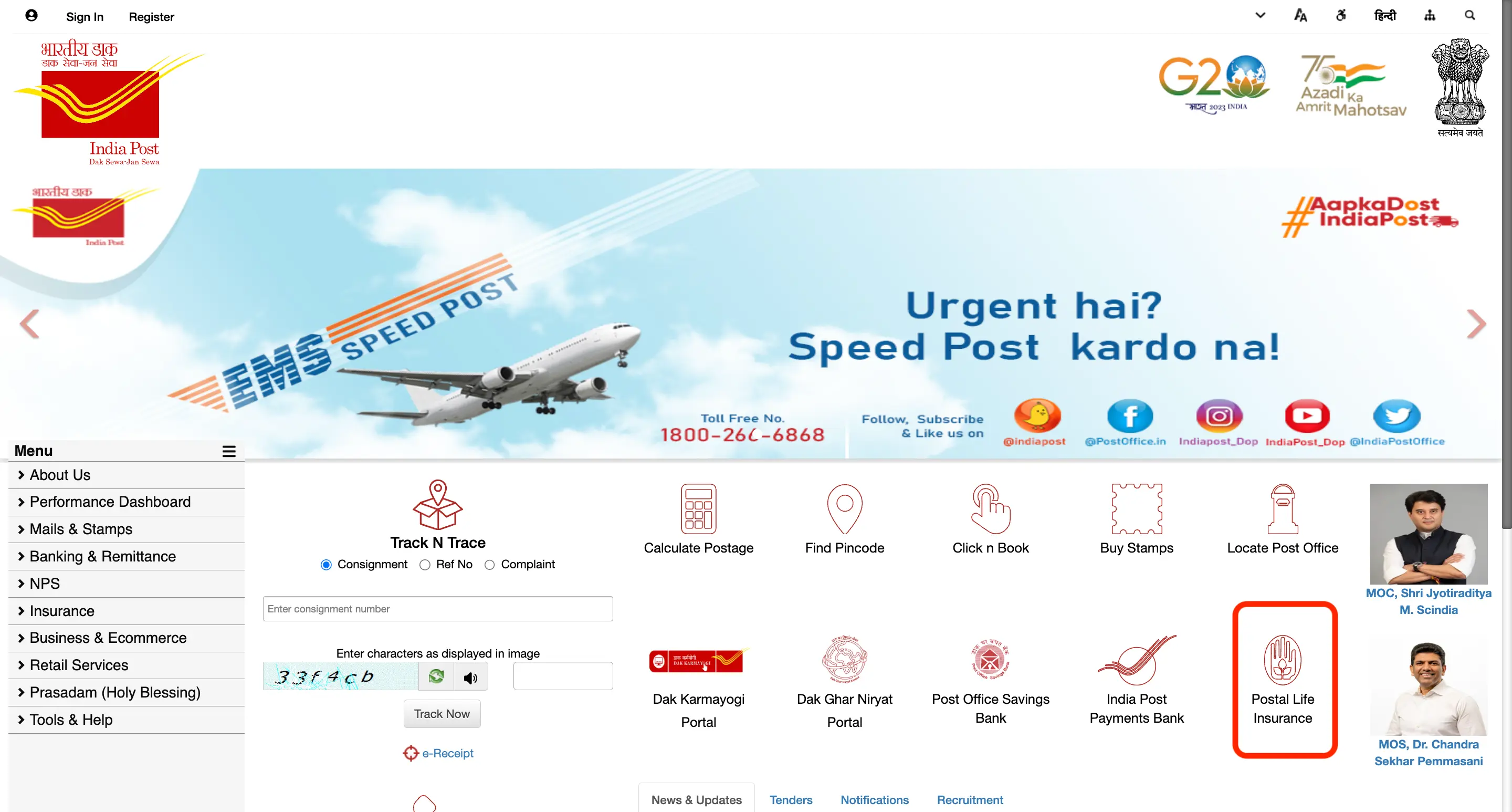

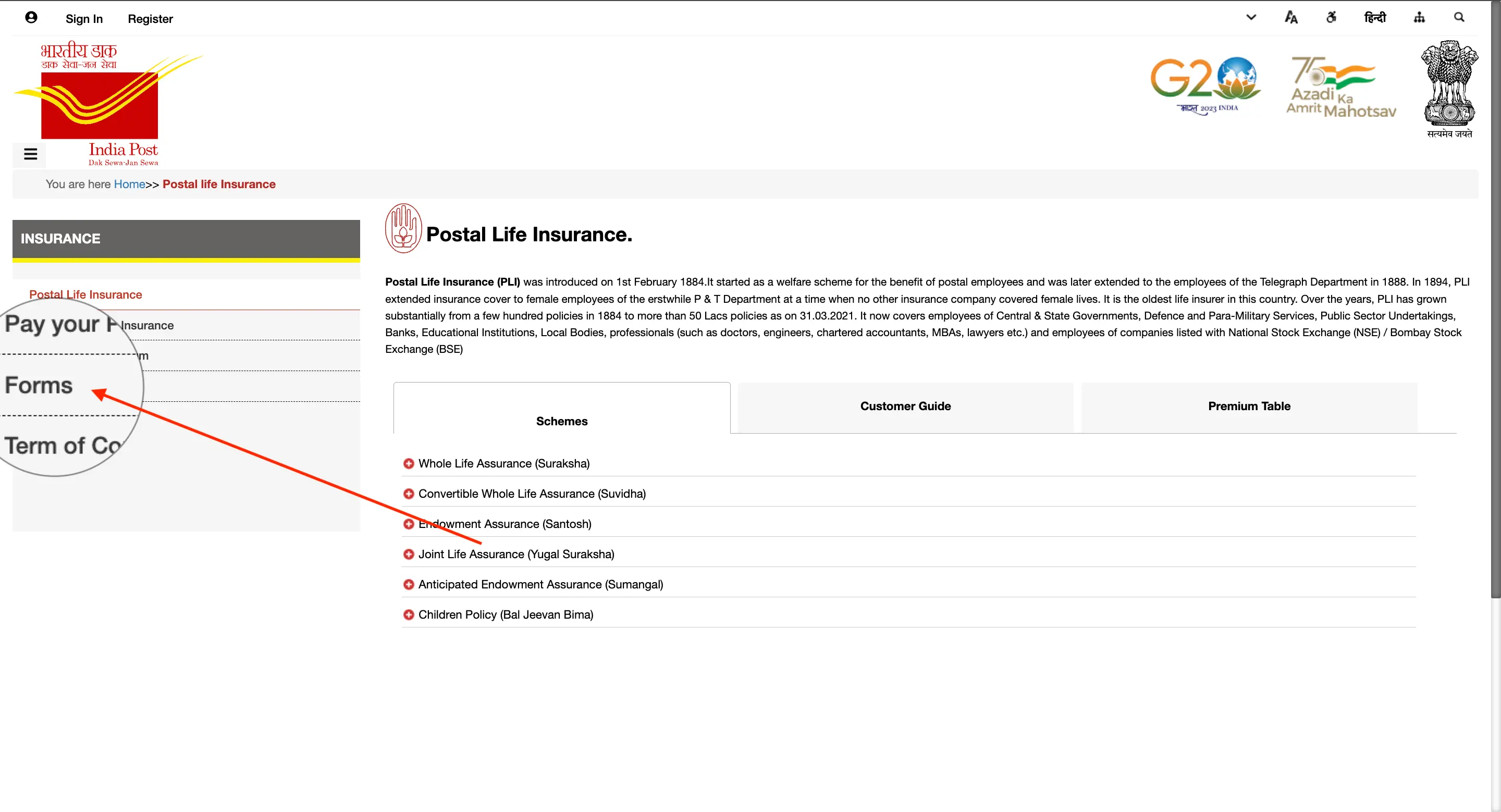

Step 1: Visit the main website and click on "Postal Life Insurance."

Step 2: On the right side, click on "PLI."

Step 3: On the left side, click on "Forms."

Are you looking for a personal loan?

Step 4: Download any Postal Life Insurance form you need, along with the proposal form.

The main form for the Postal Life Insurance would look like this :

Pay Postal Life Insurance Online

You can pay your Postal Life Insurance (PLI) premium online using different methods:

- Mobile App or Online Portal – Use the India Post Payments Bank (IPPB) app or visit the India Post online portal to make your payment.

- Net Banking – Choose the net banking option while making the payment and complete the transaction securely.

- UPI Apps – Pay using Google Pay, PhonePe, Paytm, or any other UPI app for a quick and easy transaction.

Unlock exclusive card offers from India's leading banks with just one click

Get Zero Annual Fee Credit Cards in one click.

Check Postal Life Insurance Policy Status

You can check your Postal Life Insurance (PLI) policy status using the following methods:

- Online Account: Log in to your Postal Life Insurance account on the official website to view your policy status and other details. If you don’t have an account, you can register online and access your policy anytime.

- Customer Support: Call the PLI toll-free number 1800 266 6868 to check your policy status over the phone.

Postal Life Insurance Customer Guidelines

Before choosing a Postal Life Insurance (PLI) scheme, keep these key points in mind to ensure smooth policy management:

- Keep Your Policy Bond Safe – The policy bond is essential for claim settlements and other services. Store it securely and inform your family about its location.

- Make Timely Premium Payments – Regular premium payments are necessary to keep your policy active and avoid lapses.

- Register Your Email & Mobile Number – To access your PLI account, ensure your email and mobile number are registered. You may need to visit the nearest post office for this.

- Policy Transfer Option – If you relocate for work, your PLI policy can be transferred to any location in India.

- Nominee Details Are Crucial – Always assign a nominee to your policy. You can update or change the nominee anytime to ensure a smooth claim process.

Check credit card offers for your credit score! Check Now!

Postal Life Insurance Customer Care Number

For any queries, complaints, or assistance regarding Postal Life Insurance (PLI), refer to the details below.

Customer Care Details

| Service | Contact Information | Availability |

|---|---|---|

| Toll-Free Number | 1800 266 6868 | 9:00 AM – 6:00 PM |

| IVR Facility | 1800 266 6868 | Available 24x7 |

| Complaint Email | plipg.dte@indiapost.gov.in | Office Hours |

Note: The toll-free numbers will not be available during Sundays and Gazetted holidays.

Postal Life Insurance Office Contact

| Office | Address |

|---|---|

| Directorate of Postal Life Insurance | Chanakyapuri Post Office Complex, 1st Floor, New Delhi – 110021 |

| Postal Directorate (For Escalations) | Dak Bhavan, New Delhi – 110001 |

Do you need an instant loan?

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

PLI offers lower premiums and higher returns than LIC, but LIC provides broader coverage and more investment options.

PLI offers low premiums, high bonuses, tax benefits, loan facilities, and guaranteed returns.

A ₹10 lakh PLI policy provides life coverage with affordable premiums and bonus benefits, depending on the chosen plan.

PLI follows a bonus-based system rather than a fixed interest rate, with an annual bonus declared by the government.

No, PLI is not a subsidy but a government-backed life insurance scheme for specific groups.

PLI maturity depends on the selected policy term, typically ranging from 10 to 40 years.

You can apply for PLI online via the India Post website or visit the nearest post office with the required documents.

PLI offers policies like Whole Life Assurance, Endowment Assurance, Convertible Whole Life, Anticipated Endowment, and Joint Life Assurance.

Yes, PLI premiums are among the lowest in the market, making them highly affordable.

You can track your PLI policy status online via the India Post portal or by visiting the nearest post office.

No, existing LIC or private insurance policies cannot be transferred to PLI; you need to purchase a new PLI policy.

Submit the claim form and required documents at the nearest post office or through the India Post portal.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users