The LIC Bima Sakhi Yojana is an empowering initiative by the Life Insurance Corporation of India (LIC), launched to create financial independence for women and foster insurance awareness. This program aims to bring women into the insurance workforce, offering them opportunities to become LIC agents. It is part of LIC’s broader mission to promote financial literacy across communities and make insurance accessible to all. The scheme provides participants with attractive stipends, training, and incentives, making it an ideal platform for women seeking career opportunities and economic empowerment.

LIC Bima Sakhi Yojana is a women-focused initiative by LIC, offering a 3-year stipend (₹7,000/month in the 1st year) and career opportunities as agents. Eligible women aged 18–70 can apply online.

Table of Contents:

- ⇾ LIC Bima Sakhi Yojana Details

- ⇾ LIC Bima Sakhi Yojana Eligibility

- ⇾ Documents Required for LIC Bima Sakhi Yojana Registration

- ⇾ Apply Online for LIC Bima Sakhi Yojana

- ⇾ LIC Bima Sakhi Yojana Last Date

- ⇾ LIC Bima Sakhi Yojana Stipend

- ⇾ LIC Bima Sakhi Yojana Features & Benefits

- ⇾ Reasons to Choose the Mahila LIC Agent Scheme

- ⇾ Frequently Asked Questions

LIC Bima Sakhi Yojana Details

The LIC Bima Sakhi Yojana details reveal its purpose and highlights, reflecting its focus on empowering women financially while contributing to LIC's mission of increasing insurance outreach. Here are the key details:

| Aspect | Details |

|---|---|

| Objective | To provide financial independence and career opportunities to women and promote insurance literacy. |

| Target Audience | Women aged 18–70 years with at least a 10th-grade education. |

| Launch Date | December 9, 2024 |

| Duration | Three years with performance-based stipends. |

| Stipend | ₹7,000 in the 1st year, ₹6,000 in the 2nd year, and ₹5,000 in the 3rd year (based on performance). |

| Additional Earnings | Commissions on policies sold, excluding bonus commission. |

| Eligibility | Exclusively for women; not applicable to close relatives of LIC agents or employees. |

| Mode of Work | Independent agents (not salaried employees). |

| Required Documents | Age proof, address proof, educational certificate, and recent photograph. |

| Application Mode | Online application through LIC’s portal. |

Read More

Read Less

Are you looking for a personal loan?

LIC Bima Sakhi Yojana Eligibility

The LIC Bima Sakhi Yojana is exclusively for women, offering them an opportunity to work as agents under LIC’s Mahila Career Agent (MCA) scheme. The eligibility criteria ensure that candidates possess the basic qualifications required for this role.

Eligibility Requirements:

- Gender: Exclusively for women.

- Age Limit: Minimum age is 18 years, and the maximum age is 70 years (last birthday).

- Educational Qualification: Candidates must have completed at least 10th grade (Secondary School Certificate).

Note: Close relatives of existing LIC agents or employees (spouse, children, parents, siblings, or in-laws) are not eligible.

Documents Required for LIC Bima Sakhi Yojana Registration

To apply for the LIC Bima Sakhi Scheme, candidates need to submit essential documents as part of the registration process. The following documents are mandatory:

- Self-Attested Age Proof: Documents like Aadhaar card, Birth certificate, or Passport.

- Address Proof: Utility bills, Aadhaar card, or Voter ID.

- Educational Qualification Certificate: A copy of the 10th-grade certificate or mark sheet.

- Recent Passport-Sized Photograph: Must be uploaded along with the application form.

Note: Incomplete or incorrect documentation may lead to rejection of the application. Candidates are advised to double-check their submissions to ensure a smooth application process.

Apply Online for LIC Bima Sakhi Yojana

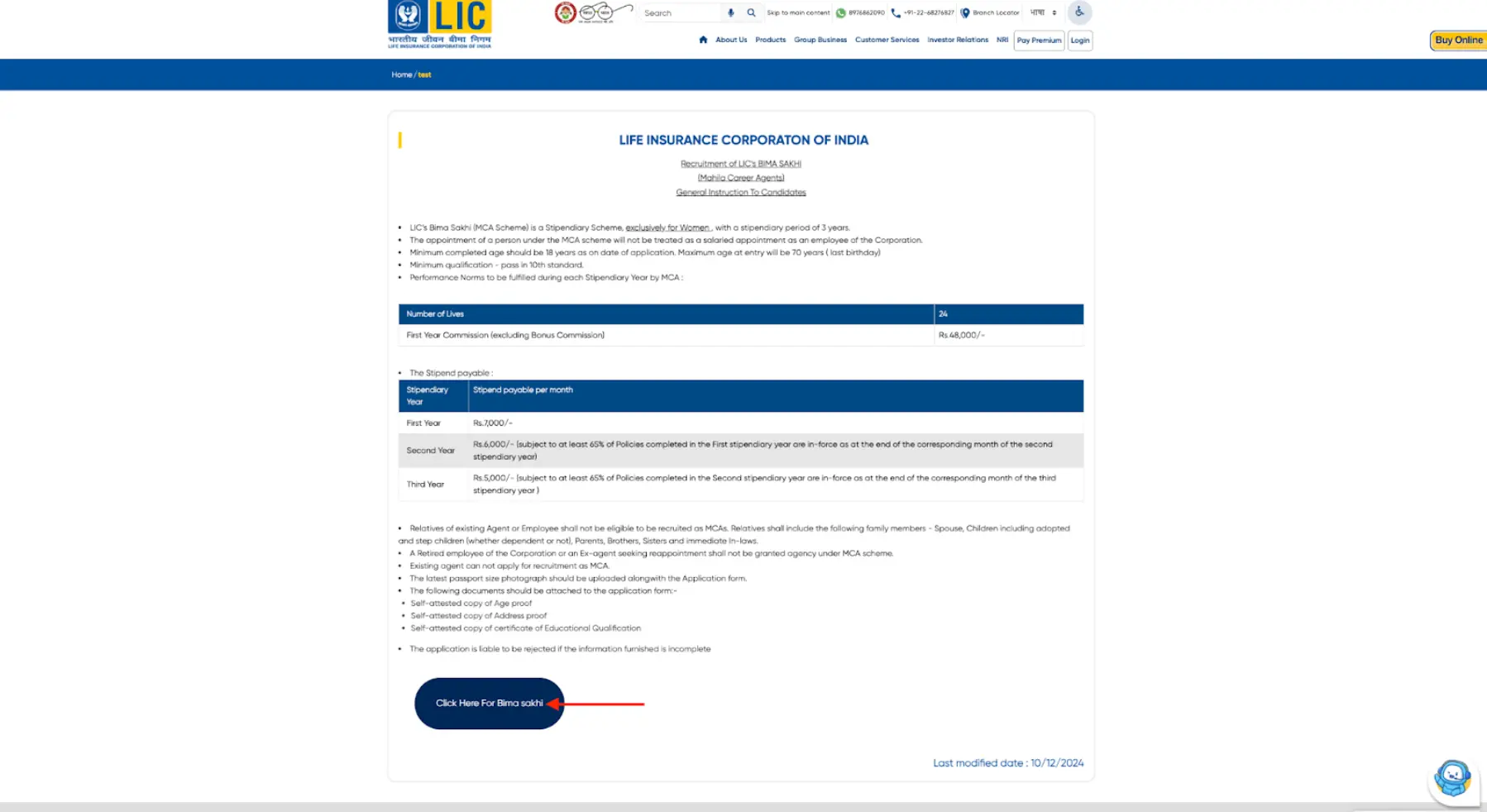

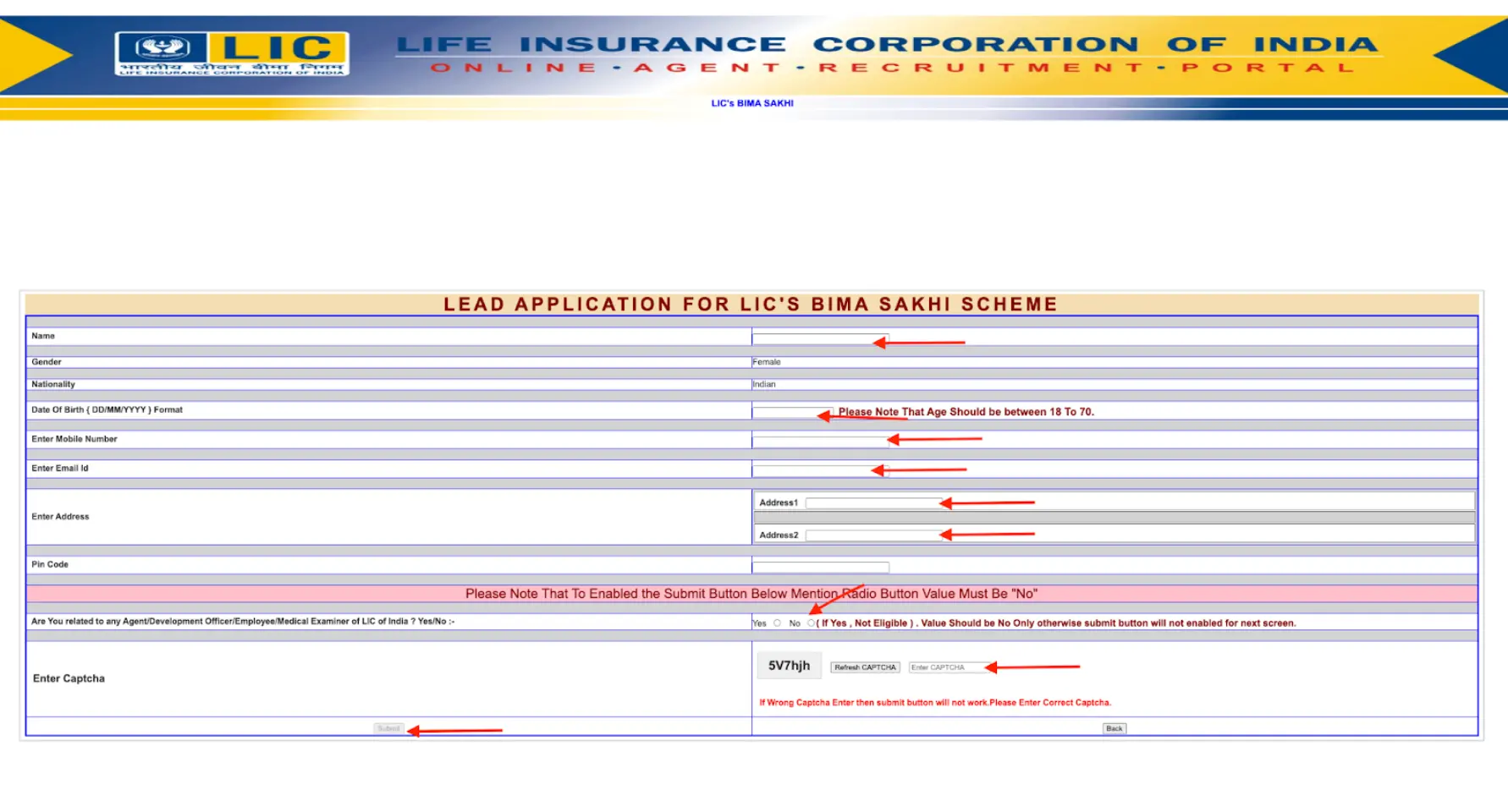

Women can apply online for LIC Bima Sakhi Yojana by visiting the official LIC website. The process is user-friendly and allows applicants to submit their information conveniently. Follow these steps to complete your application:

- Visit the official LIC application portal and Click on the ‘Click Here for Bima Sakhi’ section.

- Fill in Personal Details: Enter your Name, Date of Birth, Mobile Number, Email ID, and Address.

- Answer the Relationship Question: Indicate whether you are related to any existing LIC employee, agent, or officer. Select No if you are not related (mandatory to proceed with the application).

- Captcha Verification: Enter the Captcha Code displayed on the screen to verify your application. Ensure the Captcha is entered correctly; otherwise, the "Submit" button will not activate.

- Submit the Application: Review the details carefully. Click the Submit button to finalize your application.

Don't know your credit score? You can find out for free!

LIC Bima Sakhi Yojana Last Date

It is important to adhere to registration deadlines under the LIC Bima Sakhi Yojana. The application window is open for a limited time, as detailed below:

| Event | Date |

|---|---|

| Application Start Date | December 9, 2024 |

| Application End Date | Not Yet Mentioned |

Timely submission of applications ensures candidates do not miss out on this valuable opportunity.

LIC Bima Sakhi Yojana Stipend

Participants of the LIC Bima Sakhi Scheme are provided with a monthly stipend and additional incentives, which grow over time based on their performance and experience. Below is the stipend structure:

Stipend Payable Table

| Stipend Year | Stipend Payable Per Month (INR) |

|---|---|

| First Year | ₹7,000 |

| Second Year | ₹6,000 (Provided that at least 65% of the policies completed in the first stipend year are in force by the end of the second stipend year) |

| Third Year | ₹5,000 (Provided that at least 65% of the policies completed in the second stipend year are in force by the end of the third stipend year) |

LIC Bima Sakhi Yojana Features & Benefits

The LIC Bima Sakhi Yojana features and benefits are designed to provide women with financial stability, professional training, and career opportunities. Here are the major highlights:

Key Features:

- Stipend Plan: Provides a monthly stipend for three years based on performance.

- Flexible Work Hours: Ideal for homemakers and women managing families.

- Training Programs: Offers professional training to help agents learn about insurance policies and sales strategies.

- Additional Commission: Earn extra income through commissions on policies sold, excluding the bonus commission.

- No Salaried Appointment: Participants work as agents and not as salaried employees, providing flexibility and independence.

Key Benefits:

- Encourages financial independence among women.

- Boosts awareness of insurance in urban and rural areas.

- Helps participants build professional and interpersonal skills.

- Performance-based incentives ensure career growth and better earnings.

Reasons to Choose the Mahila LIC Agent Scheme

The LIC Bima Sakhi Yojana provides unique advantages for women interested in a flexible and rewarding career in the insurance sector. Below are some reasons to join this scheme:

- Economic Empowerment: Offers consistent income and attractive commissions to promote financial independence.

- Skill Development: Provides in-depth training to enhance marketing, communication, and client relationship skills.

- Nationwide Recognition: Be a part of LIC, one of the most trusted insurance companies in India.

- No Initial Investment: Women can start their careers without any financial burden.

- Work-Life Balance: The flexibility of this program allows participants to balance their personal and professional lives effectively.

- Community Impact: Agents contribute to raising insurance awareness in their communities, ensuring social and financial security for policyholders.

Are you looking for a credit card check the best offers for your needs!

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

The LIC Bima Sakhi Yojana is a women-focused initiative by LIC that offers career opportunities as agents with a 3-year stipend plan, designed to promote financial independence and insurance awareness.

The scheme duration is 3 years, during which participants receive monthly stipends based on performance.

The monthly stipend is ₹7,000 in the 1st year, ₹6,000 in the 2nd year, and ₹5,000 in the 3rd year, subject to performance conditions. Additional commissions are also earned.

Women aged 18–70 years with a minimum of 10th-grade education are eligible. However, close relatives of existing LIC employees or agents cannot apply.

The last date to apply has not yet been mentioned.

Apply online through the official LIC portal by filling out the application form and submitting the required documents.

Required documents include age proof, address proof, educational certificates, and recent passport-sized photographs.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users