HDFC Current Account is a specialized banking solution designed for businesses, professionals, and entrepreneurs to manage high transaction volumes efficiently. It provides seamless banking services with exclusive benefits such as unlimited transactions, overdraft facilities, and digital banking solutions. Whether you are a startup, SME, or a large corporation, an HDFC Bank Current Account ensures smooth financial operations with flexible features and a variety of account options.

For businesses looking for a hassle-free HDFC Current Account Opening, HDFC Bank offers digital and branch-based solutions, including a zero balance current account in HDFC for eligible customers.

The HDFC Current Account offers high transaction limits, free digital banking, and benefits for businesses. With various account variants, it provides flexible cash deposit/withdrawal options, free NEFT/RTGS, and business debit card perks.

Table of Contents:

Eligibility For HDFC Current Account

To open an HDFC Current Account, individuals and businesses must meet certain eligibility criteria. You are eligible if you fall under any of the following categories:

- Resident Individual

- Hindu Undivided Family (HUF)

- Sole Proprietorship Firms

- Partnership Firms

- Limited Liability Partnership (LLP) Firms

- Private and Public Limited Companies

Note: The Regular Current Account Variant is applicable only for Non-Metro Locations. For a smooth HDFC Current Account Opening Online, ensure you have the required KYC documents such as PAN Card, business registration proof, and address verification.

Are you looking for a business loan?

Documents Required For HDFC Current Account

To open an HDFC Current Account, you must provide specific documents based on your business type. Below is the list of required documents:

1. Documents Required for Sole Proprietorship Firms

| Document Type | Accepted Documents |

|---|---|

| Government-Issued Documents | Registration Certificate from Municipal Authorities (Shop & Establishment Certificate/Trade License) |

| Registration from Professional Regulatory Authorities (Chartered Accountants, Medical Council, etc.) | |

| Registration from Food and Drug Control Authorities | Other Supporting Documents | Latest Professional Tax/GST Returns filed in the firm’s name |

| TAN Allotment Letter (if the firm’s name appears in the address) | |

| Bank Account Statement (last 6 months with satisfactory transactions) | |

| Certificate from a Chartered Accountant confirming business existence |

2. Documents Required for Limited Liability Partnership (LLP)

| Document Type | Accepted Documents |

|---|---|

| Business Registration | Incorporation Document & LLP Agreement |

| Certification | Certificate of Incorporation |

| Government Records | List of Designated Partners (DPIN) issued by the Government |

| Internal Resolutions | Board Resolution signed by Designated Partners |

| KYC Compliance | KYC of Designated Partners/Authorized Signatories |

3. Documents Required for Private & Public Limited Companies

| Document Type | Private Limited Company | Public Limited Company |

|---|---|---|

| Business Registration | Memorandum of Association (MOA) & Articles of Association (AOA) | MOA & AOA |

| Certification | Certificate of Incorporation | Certificate of Incorporation & Certificate of Commencement of Business |

| Directors List | Latest Director List signed by an authorized signatory | Latest Director List signed by an authorized signatory |

| Internal Resolutions | Board Resolution (BR) authorizing account opening | Board Resolution (BR) authorizing account operations |

| Regulatory Compliance | INC-21 & INC-20A (if applicable) | INC-21 & INC-20A (if applicable) |

4. Documents Required for Individuals

Individuals can apply for an HDFC Individual Current Account by providing proof of identity and address.

| Document Type | Accepted Documents (Any One Required) |

|---|---|

| Proof of Identity | Passport (Not Expired) |

| PAN Card | |

| Voter ID | |

| Aadhaar Card (Biometric or OTP-based e-KYC) | |

| Photo ID issued by Government or Regulatory Bodies | |

| Proof of Address | Passport (Not Expired) |

| Driving License (Not Expired) | |

| Voter ID | |

| Aadhaar Card (older than 30 days) or e-KYC | |

| Utility Bill (Electricity, Telephone, Gas - not older than 3 months) |

Not sure of your credit score? Check it out for free now!

HDFC Current Account Fees & Charges

The fees and charges associated with an HDFC Current Account vary depending on the type of service and transaction. Below is a detailed breakdown:

1. Account Services

| Service | Charges |

|---|---|

| Balance Inquiry | Free |

| Cheque Status per Instance | Free |

| Balance Confirmation Certificate & Interest Certificate | ₹100 |

| Signature, Photograph Verifications | ₹100 |

| TDS Certificate & Address Confirmation | Free |

| Old Records/Copy of Paid Cheque | ₹80 per record |

| Standing Instructions (Monthly Charges) | Setting Up: Nil |

| Deliverables Returned by Courier (No Consignee/Address Issues) | ₹50 per instance |

| One-time Mandate Authorization Charges (Physical/Online) | ₹40 per mandate |

| Cardless Cash Withdrawal | ₹25 per transaction |

Read More

Read Less

2. Transactions Through Phone Banking

| Service | Charges |

|---|---|

| IVR & Non-IVR (Agent Assisted) | Free |

| Re-generation of IPIN (Physical Dispatch at Branch) | ₹40 per request |

3. Bill Pay and InstaAlert Services

| Service | Charges |

|---|---|

| Bill Pay | Free |

| Email InstaAlert | Free |

| SMS InstaAlert | Free (except for Regular & Premium Variants: 20 paise/SMS, charged monthly) |

4. Duplicate/Adhoc Statement Requests

| Request Mode | Charges |

|---|---|

| Through Direct Banking Channels (NetBanking, Mobile Banking, Phone Banking-IVR, ATM) | ₹50 per statement |

| At Branch or Phone Banking (Non-IVR) | ₹100 per statement at Branch, ₹75 through Phone Banking (Non-IVR) |

5. Doorstep Banking (Cash Pickup Limit & Charges)

| Cash Pickup Limit | Charges per Pickup |

|---|---|

| Up to ₹1,00,000 | ₹200 per pickup |

| ₹1,00,000 – ₹2,00,000 | ₹225 per pickup |

| ₹2,00,000 – ₹4,00,000 | ₹350 per pickup |

Note: Cash pickup beyond these limits can be arranged at select locations. Contact your branch for more details.

6. Debit Card Charges (For Individuals & Sole Proprietors)

| Feature | EasyShop Business Debit Card | ATM Card |

|---|---|---|

| Annual Fee per Card | ₹250 | Free |

| Daily ATM Withdrawal Limit | ₹1,00,000 | ₹10,000 |

| Daily Merchant POS Limit | ₹5,00,000 | NA |

Note: Available for partnership firms & limited company current accounts. If the Mode of Operation (MOP) is conditional, all Authorized Signatories must sign the form jointly.

Get Zero Annual Fee Credit Cards in one click.

Features of HDFC Current Account

The HDFC Current Account offers a range of banking solutions tailored for businesses, professionals, and entrepreneurs, ensuring seamless transactions, high cash deposit limits, and exclusive digital banking benefits.

- Free Non-Cash Services – Free local/intercity cheque collection, RTGS/NEFT transactions, and fund transfers within HDFC Bank.

- High Cash Deposit Limit – Deposit up to ₹2 lakhs free per month at HDFC Bank branches.

- 24/7 Digital Banking – Access account via NetBanking, Mobile Banking, and PhoneBanking with InstaAlert updates.

- Doorstep Banking – Secure cheque and cash pickup/delivery through authorized agencies.

- Business Debit Card Benefits – Up to ₹9,000 Cashback, airport lounge access, and ₹1 crore air travel insurance.

- Security & Protection – ₹10 lakh accidental insurance and ₹5 lakh online shopping protection.

HDFC Current Account For SMEs

HDFC Bank offers a variety of Current Accounts for SMEs to cater to different business needs. These accounts come with features like high cash deposit limits, free transactions, and additional benefits for specific industries. Below is a list of all SME current accounts offered by HDFC Bank.

List of HDFC SME Current Accounts

| Current Account Type | Key Features |

|---|---|

| Max Advantage Current Account | Dynamic pricing, deposit & withdrawal up to 12 times AMB, unlimited NEFT/RTGS/IMPS |

| Ascent Current Account | Cash deposit & withdrawal up to 10 times AMB, free DD/PO for 1 lac balance, AQB waiver on POS transactions |

| Activ Current Account | Same as Ascent with additional speed clearance benefits |

| Plus Current Account | Free cash deposit up to ₹10 lakhs, faster realization of outstation cheques |

| Premium Current Account | Free cash deposit up to ₹3 lakhs/month, ₹25,000 daily withdrawal at non-home branches |

| Regular Current Account | Free cash deposit up to ₹2 lakhs/month, free cheque collection & InstaAlert service |

| Startup Current Account | Zero non-maintenance charges for 4 quarters, special startup offers |

| Saksham Current Account | Zero non-maintenance charges for 2 years, deposit up to ₹50 lacs/month |

| E-Comm Current Account | Free cash deposit up to ₹3 lakhs or 6 times current month AMB, ₹10 lakh daily withdrawal |

| Current Account for Professionals | Free cash deposit up to ₹10 lakhs, free payable-at-par cheque books |

| Agri Current Account | Free cash deposits up to ₹10 lakhs, withdrawal from the home branch |

| Institutional Current Account | ₹50 lakhs cash deposit free/month, ideal for NGOs, Trusts & Societies |

| RFC - Domestic Account | Retain foreign exchange in USD, EUR, GBP |

| EEFC - Exchange Earners Foreign Currency Account | Hold foreign currency earnings, preferential conversion rates |

Read More

Read Less

1. Max Advantage Current Account

Designed for businesses looking for cost-efficient banking with dynamic pricing benefits.

| Feature | Details |

|---|---|

| Dynamic Pricing | Ensures cost-efficiency with increased transaction volume |

| Cash Deposit & Withdrawal | Up to 12 times the Average Monthly Balance (AMB) at any HDFC branch |

| NEFT/RTGS/IMPS | Unlimited free transactions |

| AQB Waiver | On quarterly volumes through POS/SmartHub Payment Gateway |

2. Ascent Current Account

Ideal for businesses requiring high-volume transactions and cheque handling.

| Feature | Details |

|---|---|

| Transaction Benefits | Cash deposit & withdrawal up to 10 times AMB |

| Free DD/PO | 30 free per month for every ₹1 lakh balance |

| AQB Waiver | On ₹3 lakh quarterly volumes via POS/SmartHub Payment Gateway |

3. Active Current Account

It offers similar benefits to Ascent but with faster cheque clearance.

| Feature | Details |

|---|---|

| Dynamic Pricing | Ensures cost-efficiency at all times |

| Cheque Benefits | Faster realization of outstation cheques |

4. Plus Current Account

Best suited for businesses with high cash deposit requirements.

| Feature | Details |

|---|---|

| Cash Deposit Limit | ₹10 lakhs per month |

| Withdrawal Benefits | Free home branch cash withdrawal, up to ₹1 lakh at non-home branches |

| Cheque Benefits | Faster realization for outstation cheques |

5. Premium Current Account

Offers higher withdrawal and deposit limits for businesses.

| Feature | Details |

|---|---|

| Cash Deposit Limit | ₹3 lakhs per month or 25 transactions |

| Withdrawal Limit | ₹25,000 per day at non-home branches |

| Cheque Book | Free 100 leaves per month |

6. Regular Current Account

A basic business account with free transactions and cheque collection.

| Feature | Details |

|---|---|

| Cash Deposit Limit | ₹2 lakhs per month |

| Free Transactions | Free local/intercity cheque collection & payments |

| Alerts | InstaAlert service for transaction updates |

7. Startup Current Account

Ideal for new businesses and startups with zero non-maintenance charges.

| Feature | Details |

|---|---|

| Zero Charges | No non-maintenance charges for the first 4 quarters |

| Startup Offers | Exclusive benefits for startup businesses |

8. Saksham Current Account

Designed for businesses with fluctuating transaction volumes.

| Feature | Details |

|---|---|

| Zero Maintenance | No charges for 2 years |

| High Cash Deposit Limit | ₹50 lakhs per month |

9. E-Comm Current Account

Designed for e-commerce businesses with high transaction volumes.

| Feature | Details |

|---|---|

| Cash Deposit Limit | ₹3 lakhs or 6 times AMB |

| High Withdrawal Limit | ₹10 lakhs per day |

10. Current Account for Professionals

This current account is suitable for consultants, freelancers, and professionals with high deposits.

| Feature | Details |

|---|---|

| Cash Deposit Limit | ₹10 lakhs per month |

| Free Cheque Books | Payable-at-par cheque books |

11. Agri Current Account

This current account is designed for agriculture-based businesses.

| Feature | Details |

|---|---|

| Cash Deposit Limit | ₹10 lakhs per month |

| Withdrawal Benefits | Free home branch cash withdrawal |

12. Institutional Current Account

Ideal for NGOs, trusts, and societies with no minimum balance requirements.

| Feature | Details |

|---|---|

| Cash Deposit Limit | ₹50 lakhs per month |

| Zero Balance | No average balance requirement |

13. RFC - Domestic Account

This current account is suitable for businesses dealing in foreign exchange.

| Feature | Details |

|---|---|

| Multi-Currency Holding | USD, EUR, GBP |

| Preferential Conversion Rates | For local currency conversion |

14. EEFC - Exchange Earners Foreign Currency Account

This current account is designed for businesses earning in foreign currencies.

| Feature | Details |

|---|---|

| Multi-Currency Holding | Retain earnings in foreign currency |

| Conversion Benefits | Preferential exchange rates |

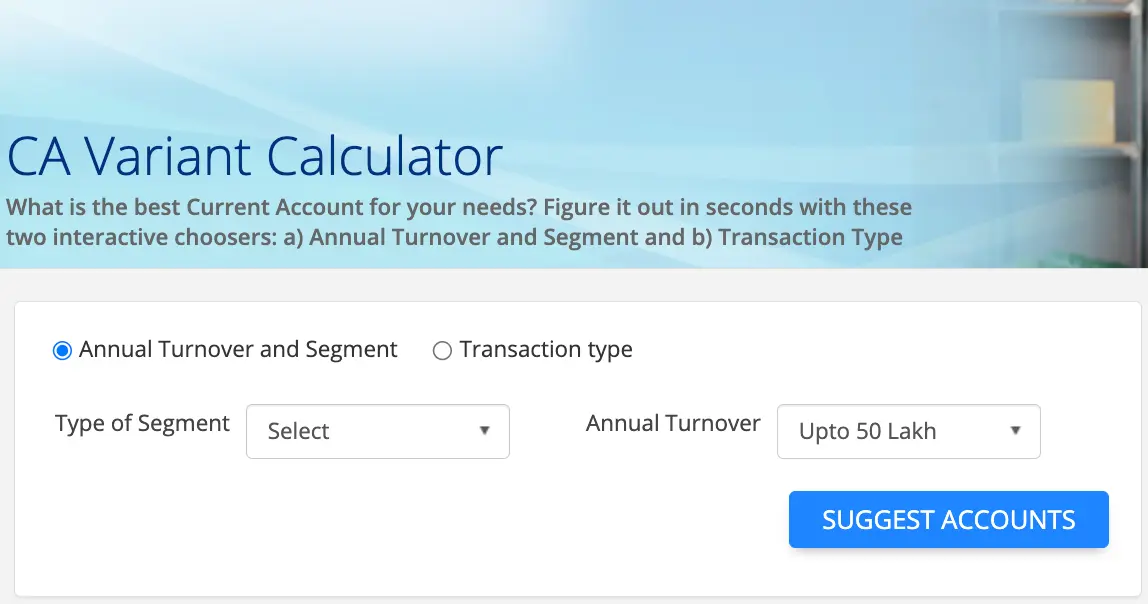

HDFC Current Account Variant Calculator

The HDFC Current Account Variant Calculator is a smart tool that helps businesses find the most suitable HDFC Current Account based on their annual turnover, industry segment, or transaction type. This interactive tool simplifies the selection process by providing instant recommendations tailored to your business needs.

Steps to Use the HDFC CA Variant Calculator

- Visit the Calculator Page: Go to the HDFC CA Variant Calculator.

- Choose Your Selection Criteria:

- Select "Annual Turnover and Segment" to get recommendations based on your revenue and industry.

- Or choose "Transaction Type" to find an account based on cash deposits, withdrawals, or digital banking needs.

- Enter Business Details:

- For Annual Turnover & Segment:

- Choose your business segment (e.g., SME, corporate, service provider).

- Select your annual turnover (e.g., Up to ₹50 lakh, ₹50 lakh - ₹5 crore, Above ₹5 crore).

- For Transaction Type:

- Select the most frequent transactions your business requires (e.g., cash deposits, withdrawals, digital transactions).

- Click on "Suggest Accounts"

- The tool will instantly display the best-suited HDFC Current Account based on your inputs.

- Apply Online: Review the recommended account variants and proceed with HDFC Current Account Opening Online or explore additional details.

Do you need an emergency loan?

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

Individuals, sole proprietors, partnerships, LLPs, private/public limited companies, trusts, and associations can open an HDFC Current Account with valid KYC documents.

The minimum balance varies by account type, ranging from ₹10,000 to ₹5,00,000. Some variants, like the Startup Current Account, offer zero balance facilities.

Yes, non-maintenance charges apply, varying by account type. Some accounts, like Saksham and Startup Current Accounts, have waived charges for a specific period.

Free RTGS/NEFT, high cash limits, business debit card benefits, digital banking access, free cheque book.

Typically, 100 free cheque leaves per ₹1 lakh balance maintained, but it varies by account type.

Cash deposit and withdrawal limits depend on the account type. Some accounts offer up to ₹10 lakhs of free deposits per month, while non-home branch withdrawals may have limits or charges.

Yes, you can start the HDFC Current Account opening online through the HDFC website.

For individuals & proprietors: PAN, Aadhaar, Voter ID, or Passport. Businesses & LLPs need incorporation certificate, MOA/AOA, GST registration, partnership deed, and board resolution.

Yes, benefits include cashback on tax payments, free airport lounge access, zero maintenance for select accounts, and digital banking perks.

Use HDFC NetBanking, MobileBanking app, or InstaAlerts for real-time transaction updates, fund transfers, and account management.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users