AU Bank Debit Cards are designed to combine everyday convenience with premium features for a seamless banking experience. With contactless payment capability, global acceptance, and secure online transactions, these cards offer efficiency and ease.

Customers can enjoy benefits such as cashback offers, airport lounge access, and other exclusive offers. Enhanced with EMV chip technology, AU Debit Cards ensure top-notch security. Whether shopping, traveling, or daily use, they are built to match your lifestyle.

Before you apply for an AU Bank Debit Card, read till the end for an in-depth understanding of its types, features, and application process.

AU Bank Debit Cards offer contactless payments, global acceptance, and secure online shopping. Select cards also include cashback offers, lounge access, and real-time SMS alerts for added convenience and safety.

Table of Contents:

Types of AU Bank Debit Card

There are a total of 11 debit cards offered by the AU Bank Debit Card, some of which are as follows:

- AU Royale Business Debit Card: Designed for business owners needing high transaction limits, travel perks, and insurance coverage.

- AU Platinum Debit Card: Great for frequent spenders looking for higher limits, contactless payments, and added protection.

- AU Visa Gold Debit Card: Suited for regular users who want everyday convenience with moderate limits and insurance benefits.

- AU RuPay Classic Debit Card: Best for basic banking needs with low limits and essential insurance coverage.

- AU Mastercard Platinum Debit Card: Ideal for premium users seeking high limits, global usage, and enhanced safety features.

Are you looking for a personal loan?

Eligibility criteria for AU Bank Debit Card

Since there are multiple variants of the AU Bank Debit Card, the eligibility criteria vary from one another. However, some of the general requirements include:

- The applicant must have a current or savings account with the AU Bank.

- The applicant must be at least 18 years old.

- The applicant must have completed the KYC documentation procedure.

- The applicant must have a certain minimum balance based on the card type.

- The applicant can be an Indian citizen or an NRI.

Check the best offers & apply for a credit card!

Guide to applying for an AU Bank Debit Card

Typically, banks provide you with a debit card once you open a savings or current account. However, if you are looking to apply for a specific type or variant of an AU Bank Debit Card, there are online and offline methods to get it done.

Online

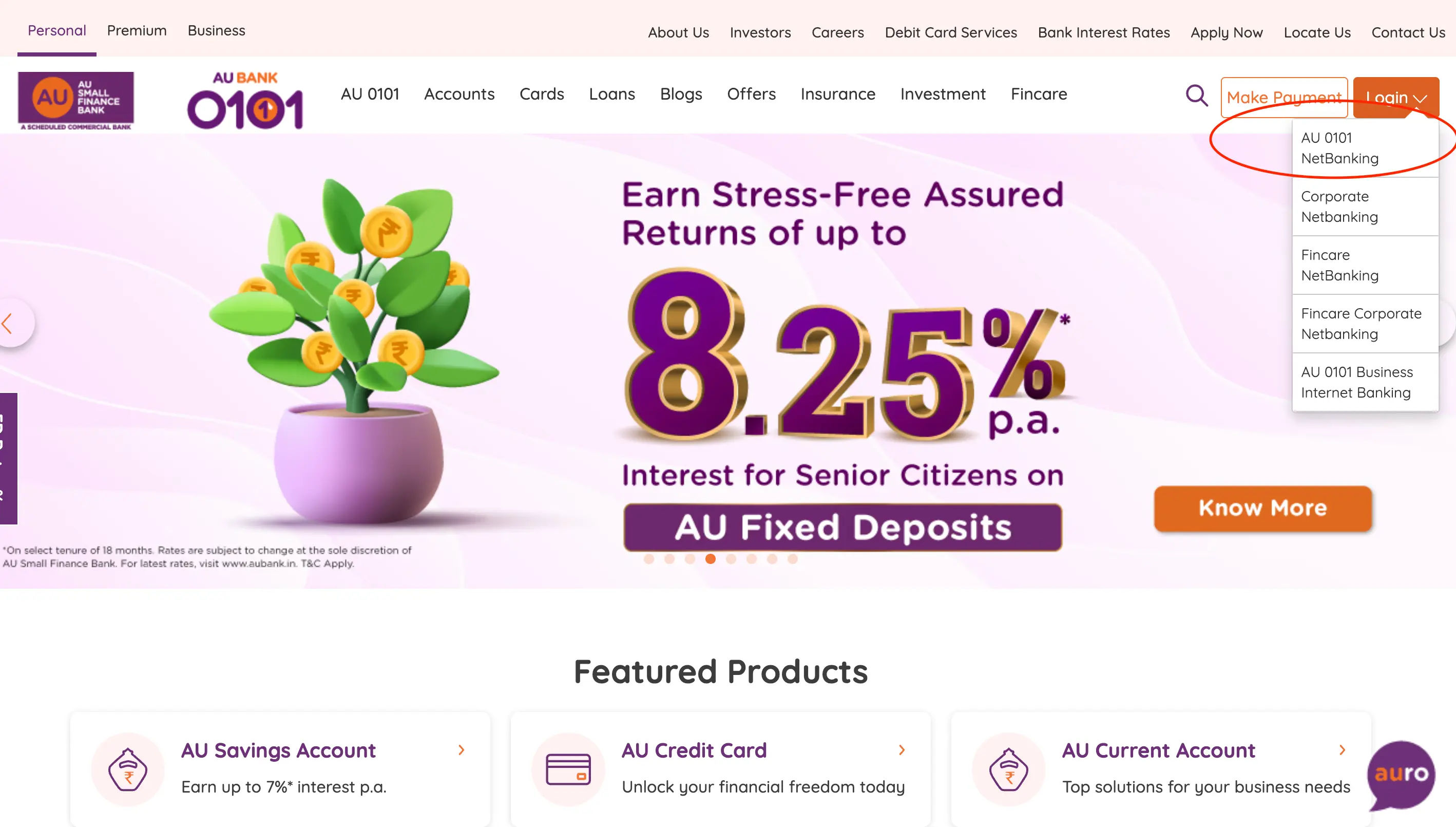

- Visit the AU Bank official website.

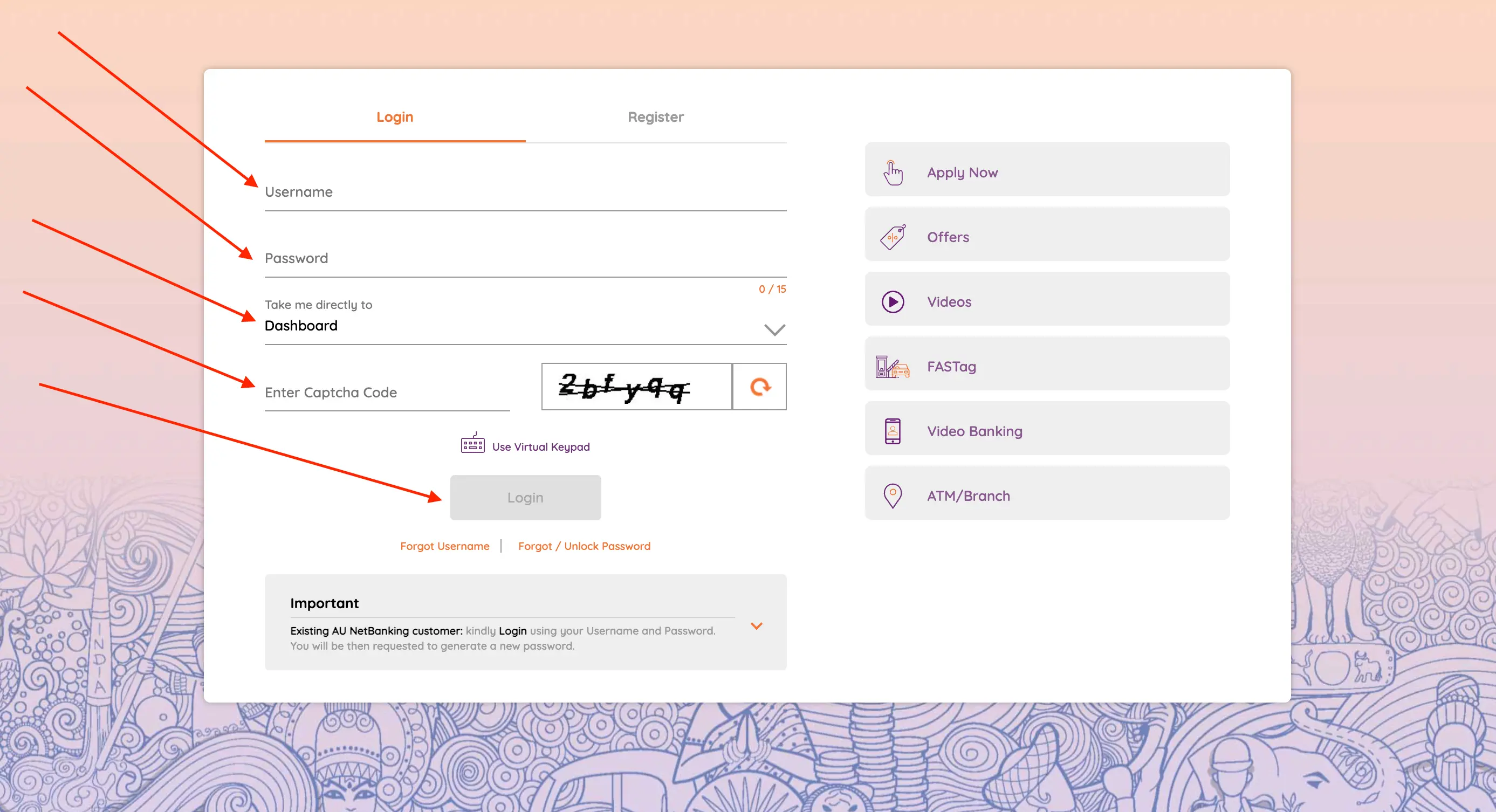

- Go to the AU 0101 NetBanking portal under the ‘Login’ button in the menu.

- Enter your username, password, and captcha code.

- Click on ‘login’.

- Go to the ‘Debit Cards/ATM Cards’ category.

- Pick the card of your choice and click on ‘Apply Now’.

Offline

Now, let’s look at the steps to apply for an AU Bank Debit Card offline:

- Visit your nearest branch of AU Small Finance Bank.

- Fill out the application form with details as per instructions.

- The debit card will be delivered to your registered address, or you can collect it from the bank.

You can also contact the AU Bank Customer Care helpline at 1800 1200 1200 or 1800 26 66677 and request a debit card. They will assist you with the whole procedure. These are toll-free numbers and are available 24x7. Note that these numbers are to address general queries or complaints or service requests.

You can also send your queries to AU Bank customer support at customercare@aubank.in.

Also read: AU Bank Personal loan

Not sure of your credit score? Check it out for free now!

AU Bank Debit Card Charges and Limits

The annual fee for AU Bank Debit Cards is ₹200. The table below shows the daily transaction limits for some of the AU Bank debit cards:

| Debit Card Type | Daily Transaction Limit (₹) |

|---|---|

| AU Royale Business Debit Card | Withdrawal & Purchase: ₹5 lakh each |

| AU Platinum Debit Card | Withdrawal: ₹50,000 Purchase: ₹2 lakh |

| AU Visa Gold Debit Card | Withdrawal: ₹25,000 Purchase: ₹75,000 |

| AU RuPay Classic Debit Card | Withdrawal & Purchase: ₹20,000 each |

| AU Mastercard Platinum Debit Card | Withdrawal: ₹50,000 Purchase: ₹2 lakh |

Charges are subject to change.

AU Bank Debit Card Features and Benefits

The AU Bank Debit Cards are designed to provide various lifestyle perks, security, and convenience. Although each card comes with its own set of features and related benefits, here is what you can expect in general:

- High Transaction Limits: Provides daily withdrawal and purchase limits of up to ₹10,00,000, which is ideal for both everyday and high-value transactions.

- Exclusive Offers & Discounts: Avail special deals on dining, travel, shopping, and more with top brands like Amazon, Swiggy, and MakeMyTrip.

- Global Acceptance: Allows you to use your card internationally with low forex markup and wide merchant acceptance.

- Contactless Payments: Tap and pay facility for purchases up to ₹5,000 securely and swiftly without entering your PIN.

- Comprehensive Insurance Cover: Access to benefits like personal accident cover, air accident insurance up to ₹1 crore, purchase protection and card liability insurance.

- Airport Lounge Access: Complimentary access at domestic and international lounges via select cards.

- Advanced Security: All cards come with EMV chip protection and can be instantly blocked via the AU 0101 App or Internet Banking.

Do you need an instant loan?

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

The AU Royale Business Debit Card is best for business users needing high limits and premium perks, while the AU Platinum Debit Card is a great choice for everyday users who want higher limits and strong security.

The annual fee for the AU Bank Debit Card is ₹200.

The AU Visa Gold Debit Card offers higher daily spending limits, easy contactless payments, and insurance benefits like purchase protection and travel cover. It's a good fit for everyday use with added safety.

AU Small Finance Bank offers several debit cards with complimentary domestic airport lounge access, such as the AU Royale Debit Card, AU Royale Business Debit Card, AU Visa Business Platinum Debit Card, and AU Royale World Debit Card.

To activate your AU Bank debit card, insert it into an AU Bank ATM or visit the official website to set your PIN using the OTP sent to your registered mobile number. You can also call 1800 1200 1200 and follow the steps to generate your PIN.

Once you have followed the steps for AU Bank Debit Card activation, you will receive a confirmation message or notification.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users