The Pradhan Mantri Awas Yojana Gramin (PMAY-G) is a flagship housing scheme launched by the Government of India to provide “Housing for All” in rural areas. The initiative aims to replace the Indira Awas Yojana with improved guidelines and better implementation mechanisms. By offering financial support to the economically weaker sections in rural India, the Pradhan Mantri Awas Yojana Rural ensures the construction of pucca houses with essential amenities. This scheme reflects the government’s mission to uplift rural populations by 2024.

Pradhan Mantri Awas Yojana Gramin (PMAY-G) offers up to ₹1.30 lakh in assistance to eligible rural households to help them build pucca homes with essential amenities. The last date to apply under the extended deadline is 30 December 2025.

Table of Contents:

- ⇾ About Pradhan Mantri Awas Yojana Gramin

- ⇾ PM Gramin Awas Yojana Highlights

- ⇾ Pradhan Mantri Awas Yojana Gramin Eligibility

- ⇾ Pradhan Mantri Awas Yojana Gramin Apply Online

- ⇾ PM Awas Yojana Gramin Verification Process

- ⇾ Documents Required for PM Gramin Awas Yojana

- ⇾ Check the PM Awas Gramin Beneficiary List

- ⇾ Check PM Awas Gramin Beneficiary Status

- ⇾ Benefits of PM Awas Yojana Gramin

- ⇾ PM Awas Yojana Gramin Helpline Numbers

- ⇾ PMAY Gramin Progress

- ⇾ Frequently Asked Questions

About Pradhan Mantri Awas Yojana Gramin

Pradhan Mantri Awas Yojana (PMAY) is a housing scheme by the Government of India that aims to provide affordable housing for all by 2024. It includes two major components: PMAY-Urban (PMAY-U) for urban areas and PMAY-Gramin (PMAY-G) for rural households, each offering financial support to eligible beneficiaries for building pucca homes with basic facilities.

Introduced in April 2016 under the Ministry of Rural Development, the Pradhan Mantri Gramin Awas Yojana is designed to address the housing gap in India’s rural regions. The beneficiaries are selected based on the Socio-Economic and Caste Census (SECC) 2011 data, verified by the Gram Sabha. Under the scheme, priority is given to those without housing or living in dilapidated structures. The Awas Yojana Gramin ensures that every eligible rural household receives the support needed to construct safe and sustainable homes.

Not sure of your credit score? Check it out for free now!

PM Gramin Awas Yojana Highlights

The following table summarizes the most important features and support provided under the Pradhan Mantri Awas Yojana Gramin (PMAY-G) scheme, helping rural families gain access to safe and permanent housing.

| Feature | Details |

|---|---|

| Launch Year | 2016 |

| Implementing Ministry | Ministry of Rural Development |

| Target Beneficiaries | Homeless and those living in kutcha houses |

| Scheme Duration | Construction of 2.95 crore houses from 2016–17 to 2023–24 |

| Minimum House Size | 25 sq. meters with separate cooking space and basic utilities |

| Financial Assistance | ₹1.20 lakh (plain areas), ₹1.30 lakh (hilly/difficult/IAP areas) |

| Labor Support | 90–95 days of unskilled labor under MNREGA |

| Cost Sharing (Funding Structure) | 60:40 for plain areas; 90:10 for North East and hilly states |

| Additional Support | Toilets, LPG connections, electricity, water, waste treatment (via SBM-G) |

| Beneficiary Identification | Based on SECC 2011 data, verified by the Gram Sabha |

| Technical Assistance | Guidance and oversight by NTSA and trained personnel |

| Monitoring Tools | AwaasSoft, AwaasApp, social audits, DISHA committees, national monitoring |

| Loan Facility | Up to ₹70,000 loan from banks or NBFCs |

| Fund Transfer Method | Direct Benefit Transfer to Aadhaar-linked bank or post office accounts |

Read More

Read Less

Pradhan Mantri Awas Yojana Gramin Eligibility

To ensure that the support provided under Pradhan Mantri Awas Yojana Gramin (PMAY-G) reaches the most deserving families, the government has defined clear eligibility rules. These rules prioritize the poorest and most vulnerable sections of society, while excluding relatively well-off households.

Criteria to Prioritize Beneficiaries for PM Gramin Awas

The list of eligible beneficiaries is prepared from the SECC 2011 data, focusing on households living in zero, one, or two-room kutcha houses or those without any shelter. Final selection is verified and approved by the Gram Sabha.

- Compulsory or Automatic Inclusion

- Households without shelter

- Destitute or those living on alms

- Manual scavengers

- Primitive Tribal Groups

- Legally released bonded laborers

- Multilayered Prioritization Within Eligible Groups

- Social categories: SC, ST, Minorities, and Others

- Housing condition: houseless, followed by those living in 0, 1, or 2-room kutcha houses (in that order)

- Deprivation-Based Scoring Criteria

- No adult member between the ages of 16–59

- Female-headed households with no adult male member aged 16–59

- No literate adult above 25 years

- Households with a disabled member and no able-bodied adult

- Landless families depend on manual wage labor.

- Earmarking of Targets

- SC/ST households: 60% of the state/UT target (can be adjusted based on availability)

- Minorities: 15% of national-level funds allocated proportionate to state-level rural population (based on Census 2011)

- Persons with Disabilities (PwDs): States are advised to reserve at least 3% of beneficiaries for households with disabled members and no able-bodied adults.

These households get first preference:

After compulsory inclusion, the remaining eligible households are prioritized based on:

Within each group, priority is assigned based on a deprivation score. Each of the following factors carries equal weight:

Higher scores indicate greater deprivation and result in a higher ranking within the priority list.

To ensure fair representation:

Do you need an instant loan?

Tie-Breaking Criteria

If multiple households have the same deprivation score, preference is given based on the following:

- Households of widows and next-of-kin of defense, police, or paramilitary forces killed in action

- Households with members suffering from leprosy, cancer, or HIV

- Households with a single girl child

- Families covered under the Forest Rights Act, 2006

- Transgender persons

Criteria for Exclusion from PMAY Gramin Scheme

Not every rural household qualifies under PMAY-G. To maintain fairness and prevent misuse, certain exclusion criteria are strictly applied.

Step 1: Pucca House Exclusion: Households living in pucca houses or with more than 2 rooms with pucca walls or roofs are automatically excluded.

Step 2: Automatic Exclusion Criteria: Households that meet any one of the following 13 conditions are not eligible:

- Own a motorized vehicle or a fishing boat

- Have mechanized farm equipment

- Possess a Kisan Credit Card with a ₹50,000+ limit

- Any family member is a government employee

- Own a non-agricultural business registered with the government

- The monthly income of any member exceeds ₹10,000

- Pay income tax

- Pay professional tax

- Own a refrigerator

- Own a landline phone

- Own 2.5+ acres of irrigated land with irrigation equipment

- Own 5+ acres of irrigated land used for two or more crops

- Own 7.5+ acres of land with at least one irrigation system

These rules ensure that Pradhan Mantri Awas Yojana Gramin reaches those most in need of housing support and maintains transparency in beneficiary selection.

Pradhan Mantri Awas Yojana Gramin Apply Online

Eligible rural households can register and apply for the Pradhan Mantri Awas Yojana Gramin (PMAY-G) scheme online. The process is simple, structured, and uses Aadhaar-based verification to ensure transparency.

However, there is no direct application process for PMAY-G. Beneficiaries are automatically selected from the SECC 2011 data and verified by the Gram Sabha; only those listed are eligible to receive assistance under the scheme.

Follow the steps below to register online as a beneficiary:

- Visit the PMAY-G Official Website.

- Enter Personal Details such as: Gender, Mobile number, and Aadhaar number

- Upload Aadhaar Consent Form. This form is required to verify and use your Aadhaar information legally.

- Use your Aadhaar number or PMAY ID to search for your name, priority, and beneficiary status.

- If your name appears, click on "Select to Register" to proceed.

- Once selected, your basic details will be automatically filled in by the system.

- Complete fields such as Relationship details, Type of ownership, and Re-confirm Aadhaar and personal info.

- Re-upload Aadhaar Consent (if required). This is needed when applying on behalf of someone else (e.g., a family member).

- Add Bank Account Details such as the Beneficiary’s name (as in bank), Bank name and branch, Account number, and IFSC code.

- If the beneficiary wants to apply for a loan, select "Yes" and enter the loan amount (up to ₹70,000).

- Fill in: MGNREGA Job Card Number and Swachh Bharat Mission (SBM) ID (if available)

- The last part of the application will be completed and validated by local government officials or the authorized PMAY-G office.

Note: The Government of India has extended the application deadline for Pradhan Mantri Awas Yojana Gramin until 30 December 2025. Eligible beneficiaries are advised to complete their registration before this date.

Pradhan Mantri Awas Yojana Gramin Apply Offline

If you prefer not to apply online, the Pradhan Mantri Awas Yojana (PMAY) also offers an easy offline application process through government centers and partner banks. Here's how you can apply:

- Visit a nearby Common Service Centre (CSC) or a bank that supports the Pradhan Mantri Awas Yojana (PMAY).

- Ask for the PMAY application form.

- Fill out the form with your personal and housing details.

- Attach copies of ID proof, income proof, and address proof.

- Submit the completed form and documents.

- A small service fee may be charged at CSCs.

Are you looking for a personal loan?

PM Awas Yojana Gramin Verification Process

The Pradhan Mantri Awas Yojana Gramin (PMAY-G) follows a well-defined and transparent process to verify registered beneficiaries before providing housing assistance. This ensures that support reaches only the most deserving families in rural areas.

The verification process includes:

- Document Verification: Authorities review all submitted documents, including:

- Field Verification: Local government officials or survey teams visit the applicant’s residence. They verify the type and condition of the house (houseless/kutcha), Living standards, and infrastructure, and Cross-reference details with SECC 2011 data

- Verification of Deprivation Score: The deprivation score helps prioritize households based on vulnerability.

- Gram Sabha Review and Approval: The Gram Sabha meets annually to finalize and publicly approve the list of eligible beneficiaries. This community-based process ensures transparency and fairness in selection.

- Final Approval and Sanction: Once all verifications are complete, the applicant receives a sanction order. The approved financial assistance is directly transferred to the applicant’s Aadhaar-linked bank or post office account.

Documents Required for PM Gramin Awas Yojana

To apply for the Pradhan Mantri Awas Yojana Gramin (PMAY-G), applicants need to submit the following documents during registration:

- Aadhaar Card: Aadhaar number and a self-attested copy of the Aadhaar Card. If the applicant is illiterate, a consent letter with a thumbprint must be provided.

- Job Card: Duly registered under MGNREGA (Mahatma Gandhi National Rural Employment Guarantee Act).

- Bank Account Details: Both originals and duplicates of the bank passbook or bank account documents.

- Swachh Bharat Mission (SBM) Number: Required if the household has received sanitation support under SBM.

- Affidavit: A declaration stating that the applicant or their family does not own a pucca house.

Under PMAY-G, beneficiaries can avail of home loans up to ₹6 lakh at a concessional interest rate of 6%. Any loan amount beyond ₹6 lakh will be charged interest as per prevailing market rates.

Be up to date with your credit score. Check it out for free now!

Check PM Awas Gramin Beneficiary List

If you don’t have a registration number, you can still check the PMAY-G rural beneficiary list by following these steps:

- Visit the official PMAYG portal - http://pmayg.nic.in

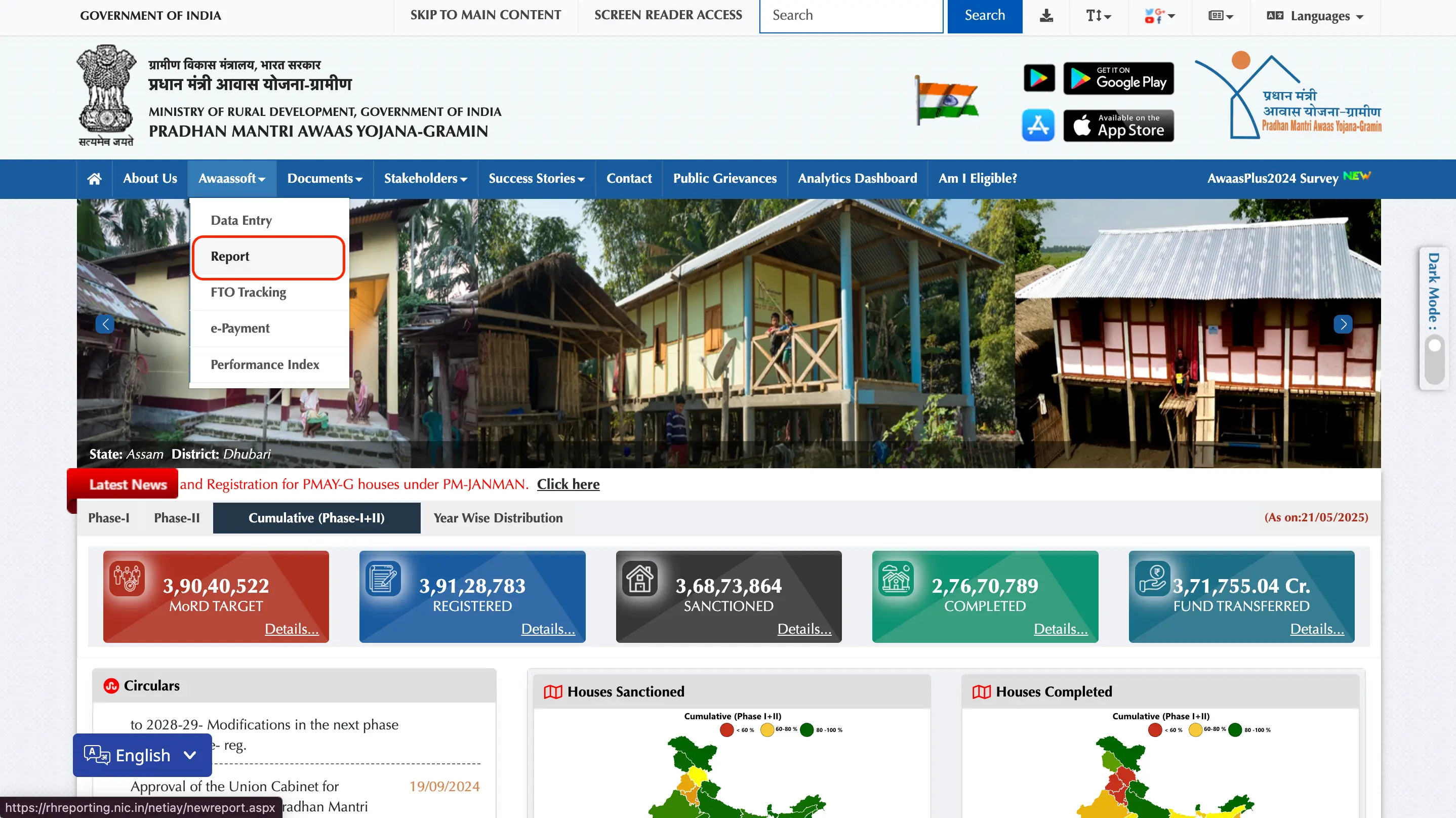

- Click on ‘AwaasSoft’ and select ‘Report’ from the top menu.

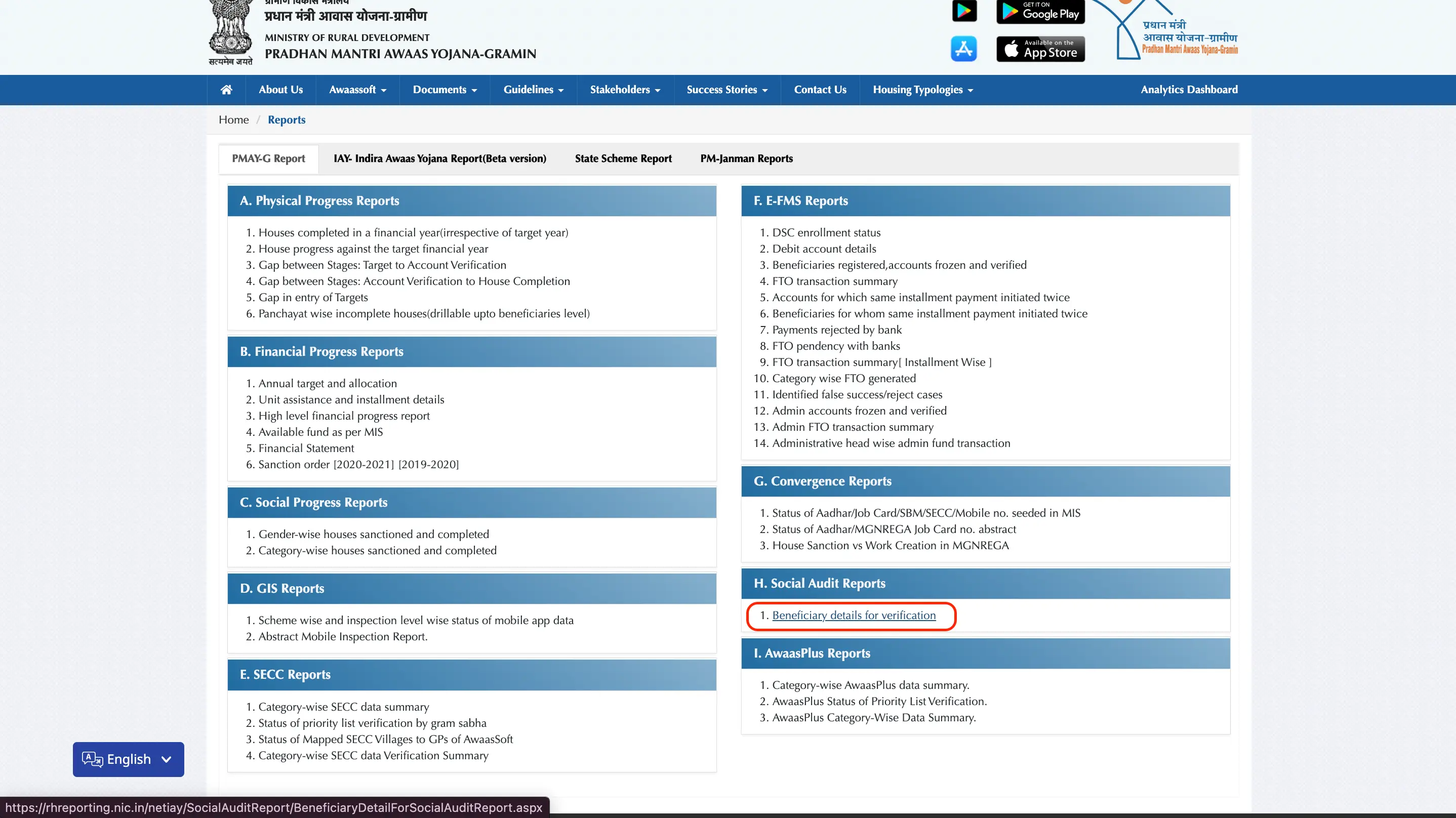

- On the new page, go to Social Audit Reports (H) and click "Beneficiary details for verification".

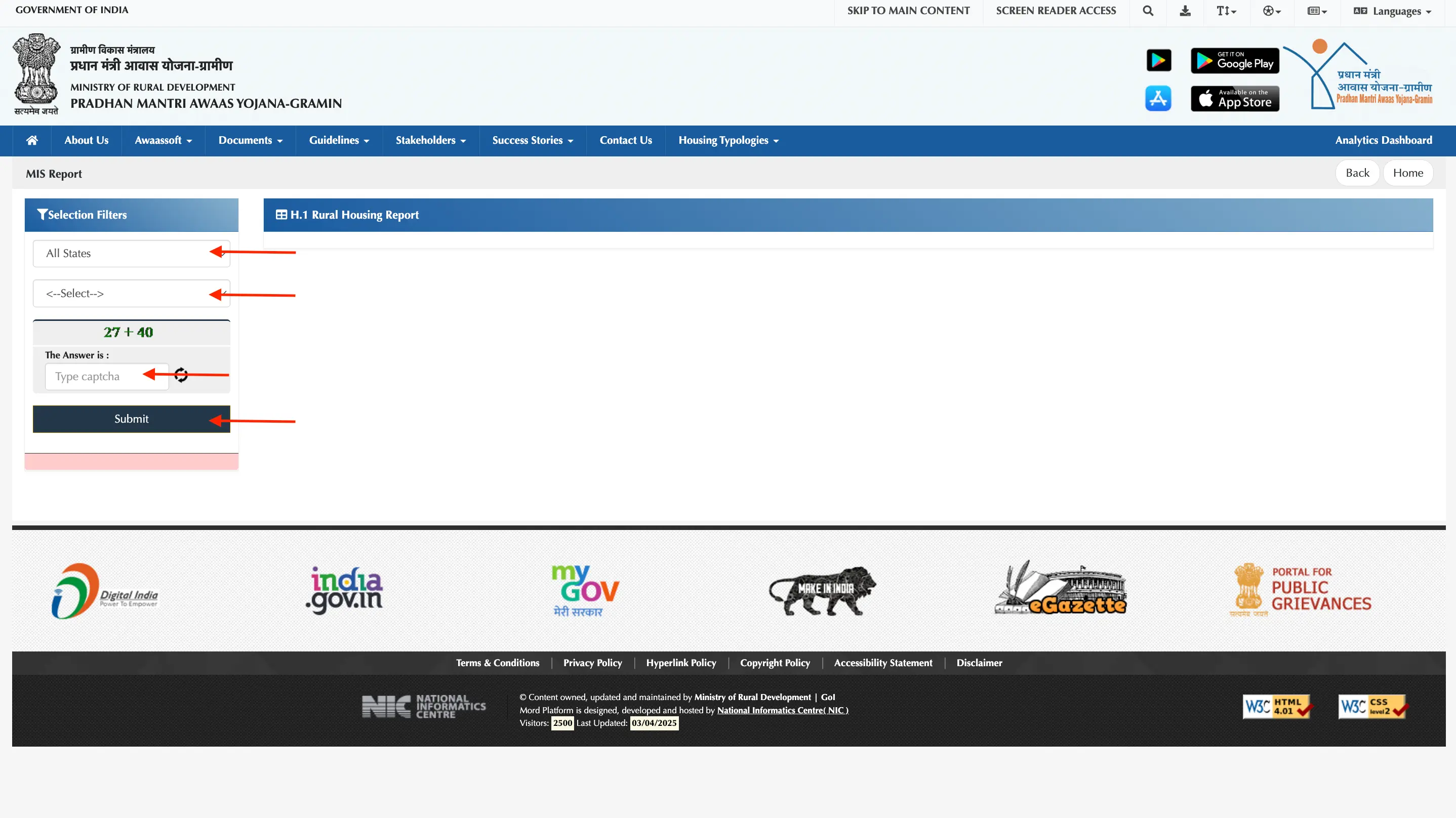

- The MIS Report page will open. Select your State, District, Block, and Village. Choose “Pradhan Mantri Awaas Yojana” under the scheme section.

- Enter the captcha code and click Submit.

- The list of beneficiaries from your village will be displayed, showing: Names, house status, and allotment progress. You can print the list if needed.

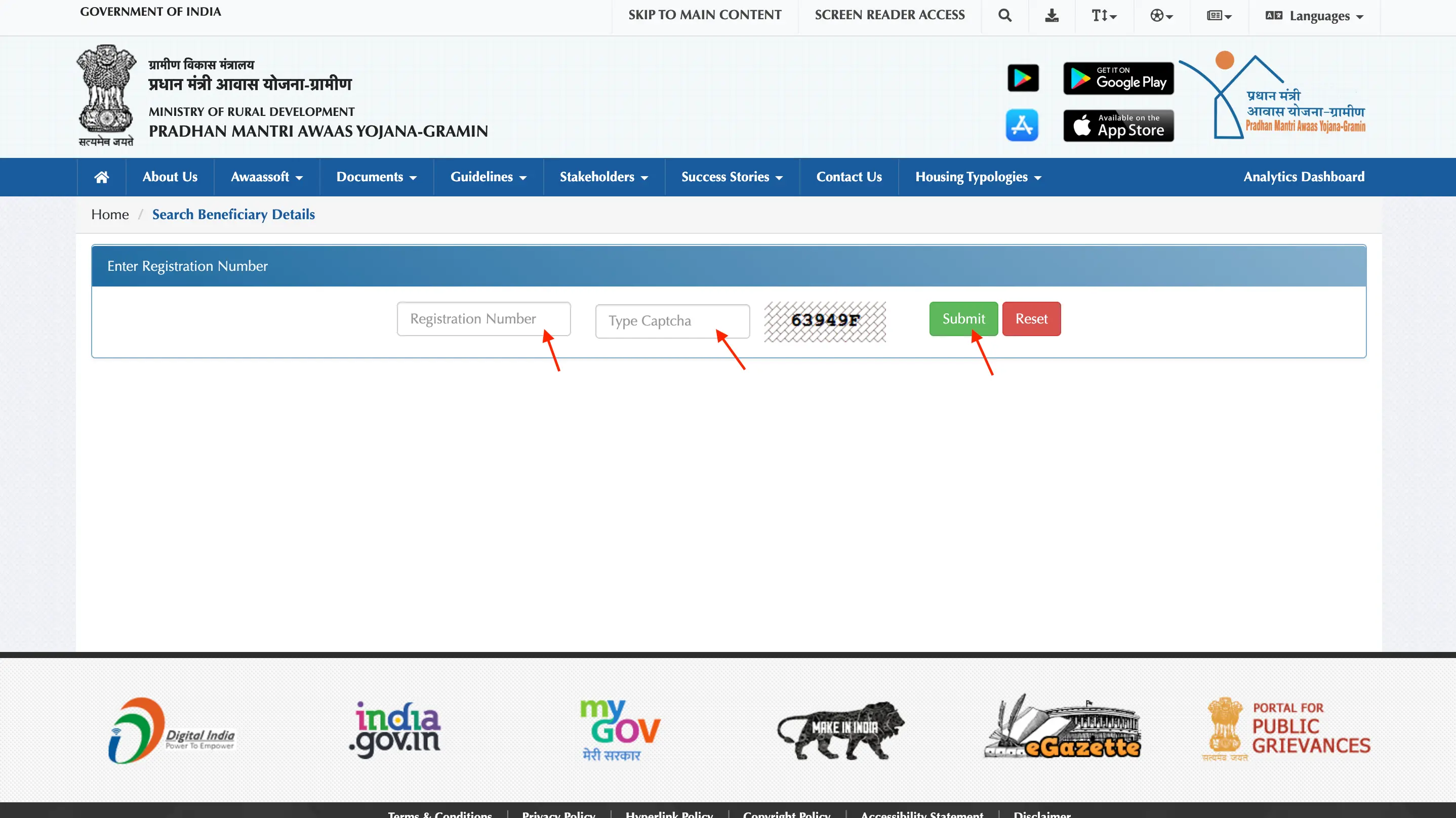

Check PM Awas Gramin Beneficiary Status

If you have applied for Pradhan Mantri Awas Yojana Gramin (PMAY-G) and want to check your application or beneficiary status, follow these simple steps:

Steps to Check Status with Registration Number:

- Visit the official PM Awas Yojana Rural Portal - http://pmayg.nic.in

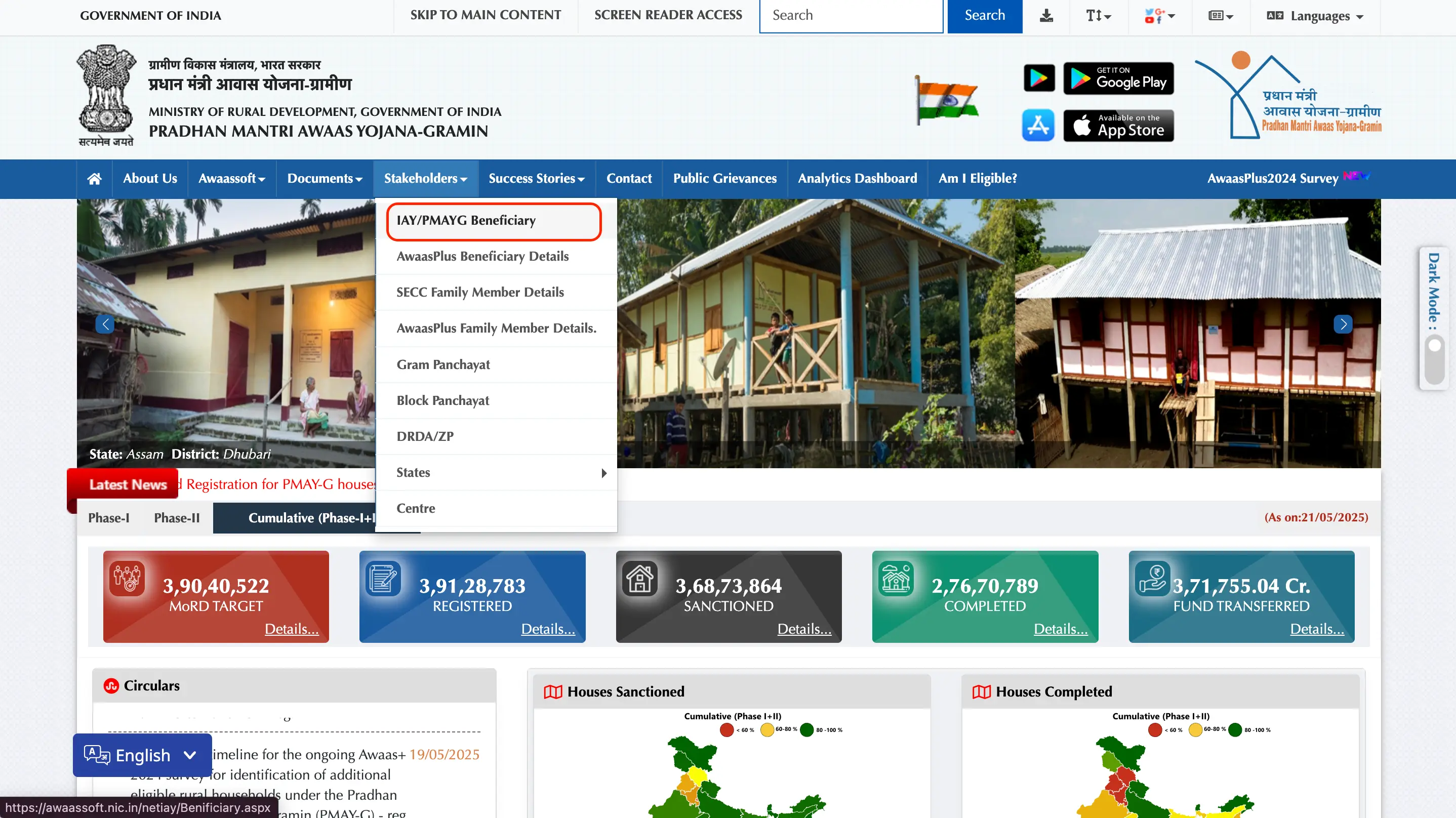

- Click on "Stakeholders" in the top menu. From the dropdown, select "IAY/PMAYG Beneficiary".

- On the new page, enter your registration number and Captcha.

- Click “Submit” to view your beneficiary details.

Get a quick loan at low interest rates!

Benefits of PM Awas Yojana Gramin

The Pradhan Mantri Awas Yojana Gramin offers several financial and support benefits to eligible rural households:

- Loan Facility: Beneficiaries can avail loans of up to ₹70,000 from approved financial institutions to build permanent houses.

- Interest Subsidy: Loans under PMAY-G offer a 3% lower interest rate compared to regular, non-subsidized loans.

- Subsidy Cap: The maximum principal amount eligible for subsidy is ₹2 lakh.

- Convergence Benefits: Beneficiaries receive additional support, like LPG connections under the Ujjwala Yojana and other essential facilities.

- Higher Assistance in Difficult Areas: Households building homes in hilly or difficult terrains are eligible for enhanced financial assistance.

PM Awas Yojana Gramin Helpline Numbers

If you need technical assistance related to PMAY-G or PFMS, you can contact the support team using the official email addresses below:

| Service | Technical Email ID |

|---|---|

| PMAY-G | support-pmayg@gov.in |

| PFMS | helpdesk-pfms@gov.in |

PMAY Gramin Progress

Pradhan Mantri Awas Yojana Gramin (PMAY-G) is making significant strides across India to provide pucca houses to eligible rural families. The scheme has recorded strong progress in terms of registration, sanctioning, and construction of houses across all states and union territories.

National-Level Progress Overview

| Metric | Data |

|---|---|

| MoRD Target | 3,90,40,522 |

| Registered | 3,91,28,783 |

| Houses Sanctioned | 3,68,73,864 |

| Houses Completed | 2,76,70,789 |

| Funds Transferred | ₹3,71,755.04 Crore |

| Total Beneficiaries | 4,14,68,951 |

Statewise Beneficiary Count (All Categories)

| Sl No. | State/UT | Total Beneficiaries |

|---|---|---|

| 1 | Andhra Pradesh | 5,84,620 |

| 2 | Arunachal Pradesh | 43,345 |

| 3 | Assam | 19,19,554 |

| 4 | Bihar | 65,68,439 |

| 5 | Chhattisgarh | 25,14,547 |

| 6 | Goa | 2,593 |

| 7 | Gujarat | 11,06,304 |

| 8 | Haryana | 1,54,924 |

| 9 | Himachal Pradesh | 30,568 |

| 10 | Jammu & Kashmir | 2,57,349 |

| 11 | Jharkhand | 19,28,328 |

| 12 | Karnataka | 6,28,236 |

| 13 | Kerala | 1,68,747 |

| 14 | Madhya Pradesh | 47,42,113 |

| 15 | Maharashtra | 18,39,016 |

| 16 | Manipur | 39,170 |

| 17 | Meghalaya | 83,288 |

| 18 | Mizoram | 26,599 |

| 19 | Nagaland | 34,181 |

| 20 | Odisha | 41,72,720 |

| 21 | Punjab | 1,24,507 |

| 22 | Rajasthan | 27,21,917 |

| 23 | Sikkim | 5,180 |

| 24 | Tamil Nadu | 15,84,805 |

| 25 | Tripura | 3,10,032 |

| 26 | Uttar Pradesh | 48,10,377 |

| 27 | Uttarakhand | 62,627 |

| 28 | West Bengal | 47,79,272 |

| 29 | Andaman and Nicobar | 3,155 |

| 30 | Dadra and Nagar Haveli | 9,777 |

| 31 | Daman and Diu | 333 |

| 32 | Lakshadweep | 165 |

| 33 | Puducherry | 0 |

| 34 | Telangana | 2,08,570 |

| 35 | Ladakh | 4,493 |

Total Beneficiaries Across India: 4,14,68,951

Get an instant loan now!

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

Households without a pucca house, living in kutcha houses with 0–2 rooms, and identified through SECC 2011 data. Priority is given to EWS, LIG, BPL, SC/ST, and other deprived groups.

Yes, the PMAY subsidy is available under PMAY-G and CLSS (Credit Linked Subsidy Scheme) for eligible rural households until 30 December 2025.

You can check your eligibility using SECC data or by entering your details on the PMAY-G official portal.

Go to the PMAY-G website > AwaasSoft > Report > Beneficiary details for verification. Enter your village and scheme details to view the list.

Visit the PMAY-G portal, log in as a beneficiary, and fill in the application form with Aadhaar, bank, and scheme-related details.

Households owning pucca houses, vehicles, government employees, taxpayers, or those earning above ₹10,000/month are excluded.

- Aadhaar card

- MGNREGA job card

- Bank account details

- SBM ID (if any)

- Affidavit declaring no pucca house ownership

Subsidy depends on income and loan amount. For PMAY-G, interest subsidy of up to 3% is available for loans up to ₹2 lakh.

- ₹1.20 lakh for houses in plain areas

- ₹1.30 lakh in hilly or difficult regions

- Up to ₹70,000 loan support (optional)

Interest subsidy of 3% is available on loans up to ₹2 lakh under PMAY-G for constructing a permanent house.

The extended last date to apply is 30 December 2025.

After verification by local authorities and Gram Sabha, approval may take a few weeks to months, depending on documentation and site inspection.

Go to PMAY-G Portal, Click on ‘Stakeholders’ and Select ‘IAY/PMAYG Beneficiary’. Enter your registration number, Captch,a and click ‘Submit’

Eligible beneficiaries receive ₹1.20 lakh to ₹1.30 lakh, with optional loan and additional support like toilets and LPG under linked schemes.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

The information provided above is for general informational purposes only and does not constitute an offer or solicitation to avail of any financial services or products. Buddy Loan is a Digital Fintech Marketplace that connects borrowers with lenders and is not a lender itself. While we strive to ensure that the information regarding interest rates, loan amounts, and terms provided by our partner Banks and NBFCs is accurate and up-to-date, these details are subject to change at the discretion of the respective lenders.

Before making any financial decisions, we strongly advise you to read the terms and conditions of the specific loan product and consult with the lender directly. Buddy Loan does not guarantee the approval of any loan application, as approval is subject to the lender's assessment and your creditworthiness. Buddy Loan will not be held responsible for any discrepancies or damages arising from the use of this information. Please verify all loan-related details & documents with the respective lender before proceeding.

By using our platform, you acknowledge and agree to these terms.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users