Managing your finances efficiently and effectively is easy with quick access to your bank statements. Downloading your bank statement can help you plan, whether it is for a loan application, tax purposes, or personal tracking.

Your bank statement is available in both online & offline mode. However, getting the bank statement PDF on your mobile phone is more convenient. So, let’s discuss different ways to download your Bank Statement online via mail, mobile banking app, or the bank’s NetBanking facility.

Table of Contents:

- ⇾ Download Bank Statement From Email

- ⇾ Download Bank Statement through Bank website

- ⇾ Download Bank Statements PDF on Mobile Banking App

- ⇾ Download Bank Statement from Netbanking

- ⇾ SBI Statement Download

- ⇾ HDFC Bank Statement Download

- ⇾ Axis Bank Statement Download

- ⇾ Canara Bank Statement Download

- ⇾ Kotak Bank Statement Download

- ⇾ BOI Statement Download

- ⇾ ICICI Bank Statement Download

- ⇾ PNB Statement Download

- ⇾ Bank of Baroda Statement Download

- ⇾ IndusInd Bank Statement Download

- ⇾ Benefits of Downloading Bank Statement Online

- ⇾ Things to be Careful of While Downloading Bank Statement

- ⇾ Frequently Asked Questions

You can download your bank statement directly from your mobile phone for each month or for your selected custom dates. Banks provide the statement download facility via various methods, including net banking and mobile banking, or you can have it sent to you via email.

Are you looking for a personal loan?

Download Bank Statement From Email

Accessing your bank statement through email is an easy way to keep track of your transactions. You can set up the functionality through net banking and the bank will send you the statement, periodically.

Here is how you can set up the email statement functionality:

- Open your bank’s webpage.

- Log in with your user ID and password.

- Navigate to the ‘Account’ section.

- Choose your account and look for the ‘Statement delivery option’.

- Select the option labelled as ‘Email Statement’.

- Provide your email address and verify it.

- Choose your frequency of delivery.

- Confirm your preferences and save changes.

From now on, you will receive the statement via the provided email for the set frequency.

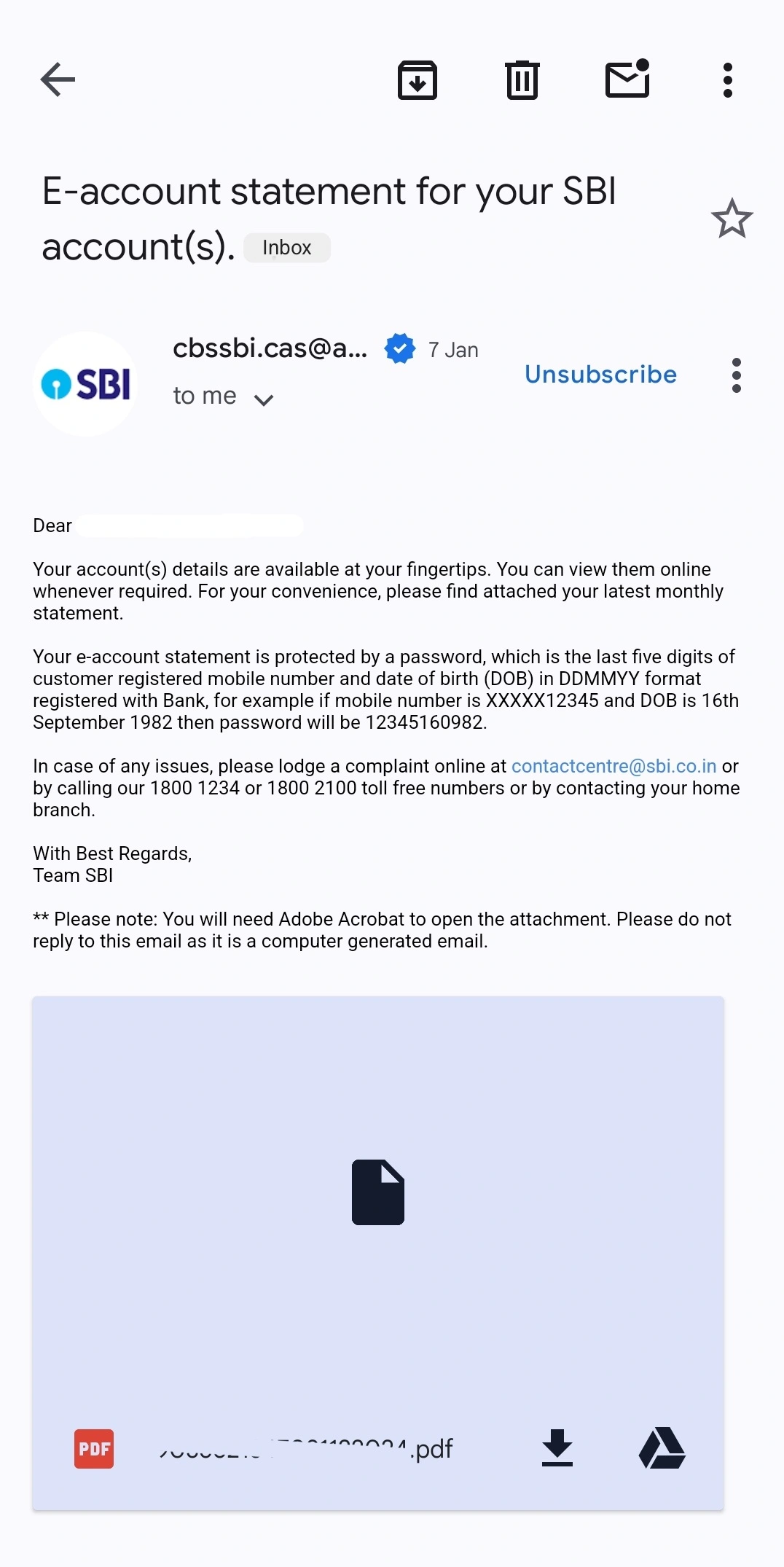

The emailed statement will be password protected, with a unique combination of the owner’s details.

For example, the following is an email statement sent by SBI:

Download Bank Statement From Net Banking Portal

Often referred to as Netbanking, one can download their statement from the official website of the bank, via a browser. Following are the simplified steps for this process:

- Log into your bank’s official portal.

- Navigate to the account summary or services tab.

- Look for an option named “account statement”.

- Select your desired period (time frame) and format (pdf, excel, etc.).

- Download the statement by selecting the download option or print option.

Download Bank Statements PDF on Mobile Banking App

Most banks provide a mobile banking application, which can be accessed anywhere as long as you have your mobile phone with the internet and a registered mobile number.

Following are the steps to access your bank statement through a mobile application:

- Download and install the mobile application on your mobile phone.

- Login into your banking application.

- Navigate to the transactions section.

- Locate your “balance statement”.

- Click download and save the file.

Bank-Wise Bank Statement Download

Net banking is a seamless and secure way of accessing and controlling your bank account through the Internet. It is a comprehensive platform to access, view and download bank statements or make any changes related to your bank account.

Following is the list of generic steps to follow by which you can access your bank statement:

SBI Statement Download

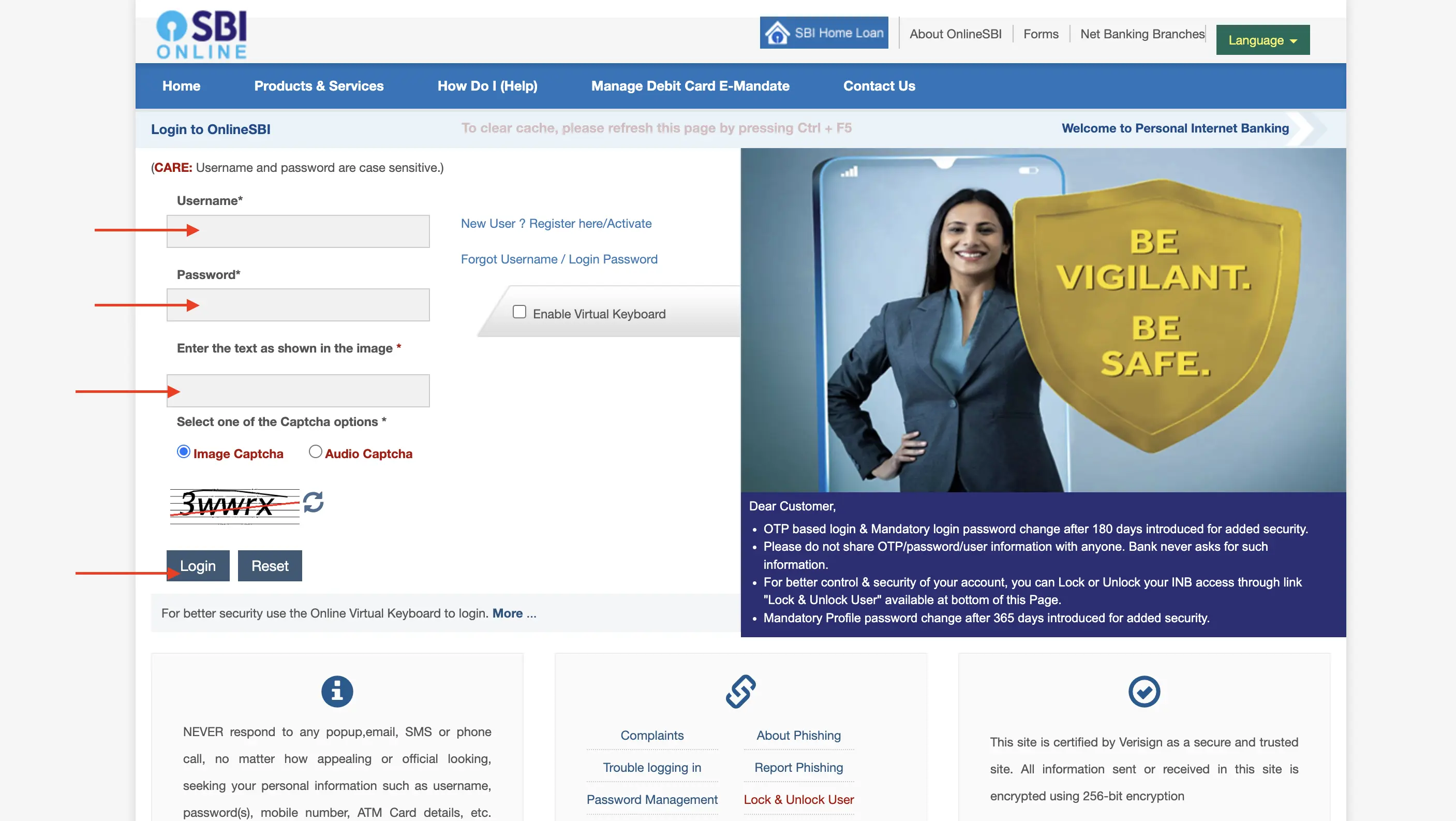

Follow the below-mentioned steps to download statement from SBI:

- Visit the Official website of SBI Net Banking.

- Enter the Username, Password and Captcha and Click on ‘Login’

- Then, Click on the ‘Accounts’ tab.

- Select the ‘Account Statement’ Option from the dropdown menu.

- Choose your account.

- Select the period for which you want the transaction history.

- Choose the format and click ‘Download’.

Not sure of your credit score? Check it out for free now!

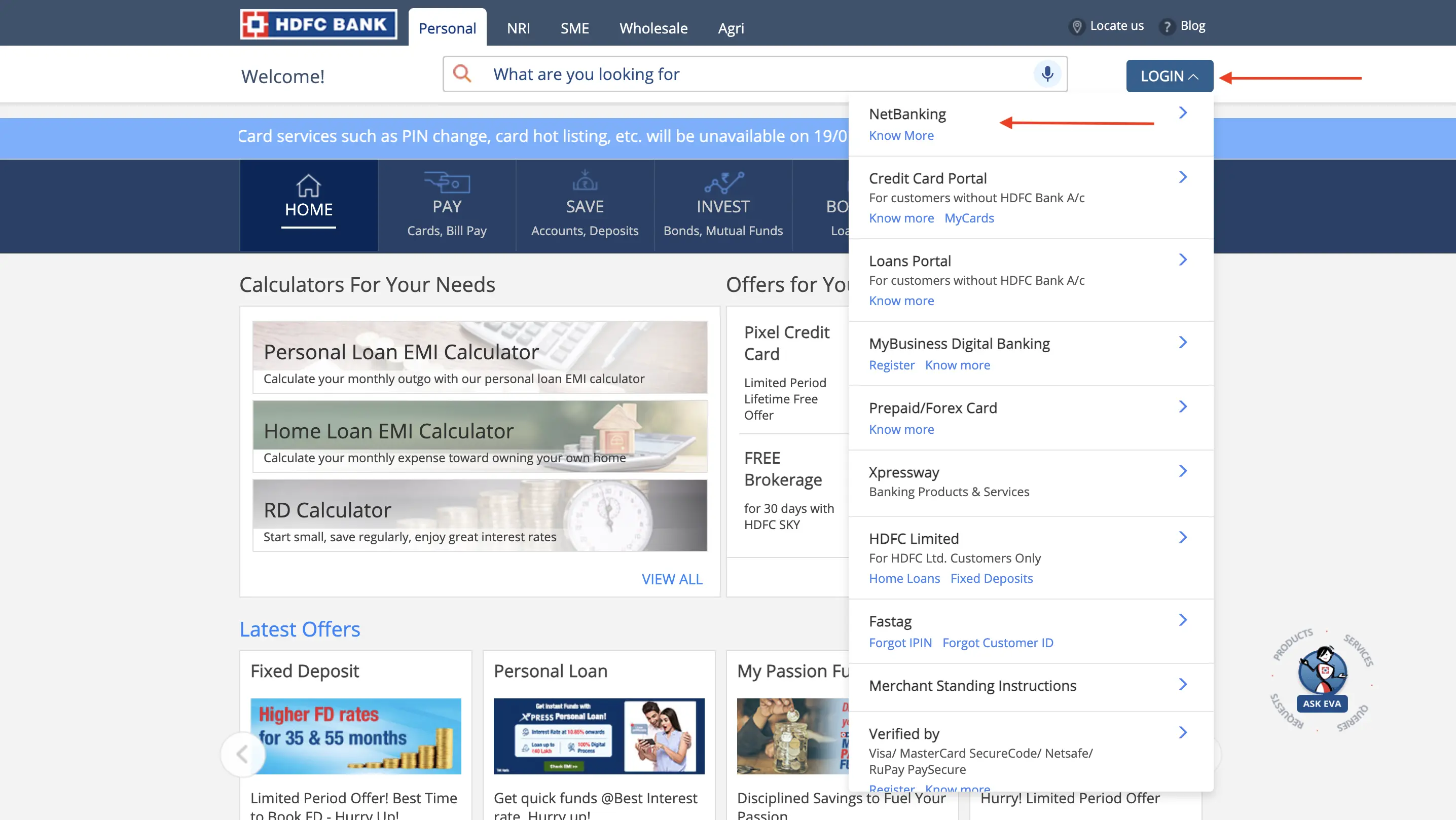

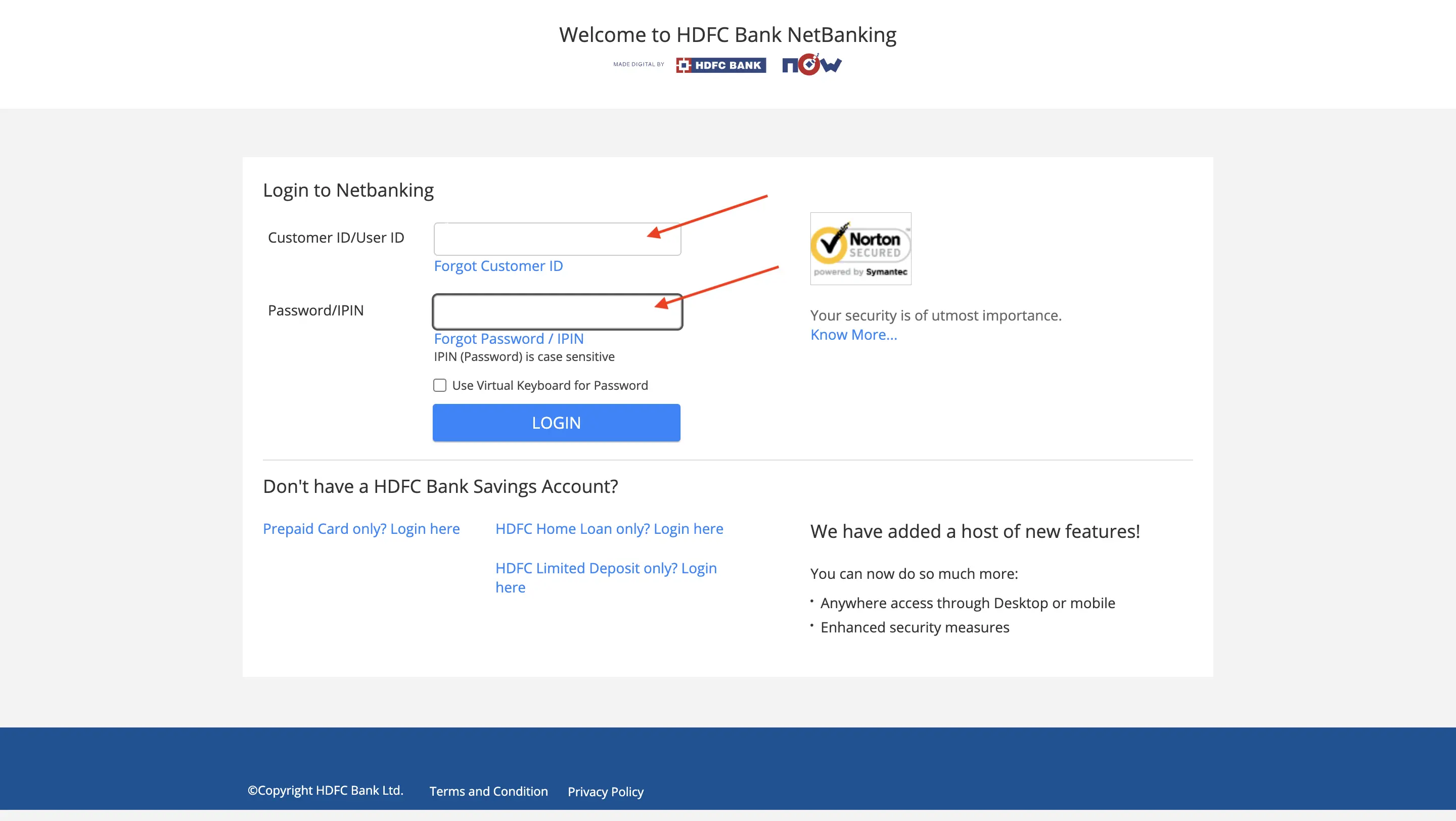

HDFC Bank Statement Download

Follow the below-mentioned steps to download statement from HDFC Bank:

- Visit the Official website of HDFC Net Banking and click login.

- Enter the Customer ID, Password and Click on ‘Login’.

- Click on the ‘Accounts’ tab.

- Select 'Enquire' and then click on 'Download Statement'.

- Choose your account.

- Select the date range.

- Download the Statement.

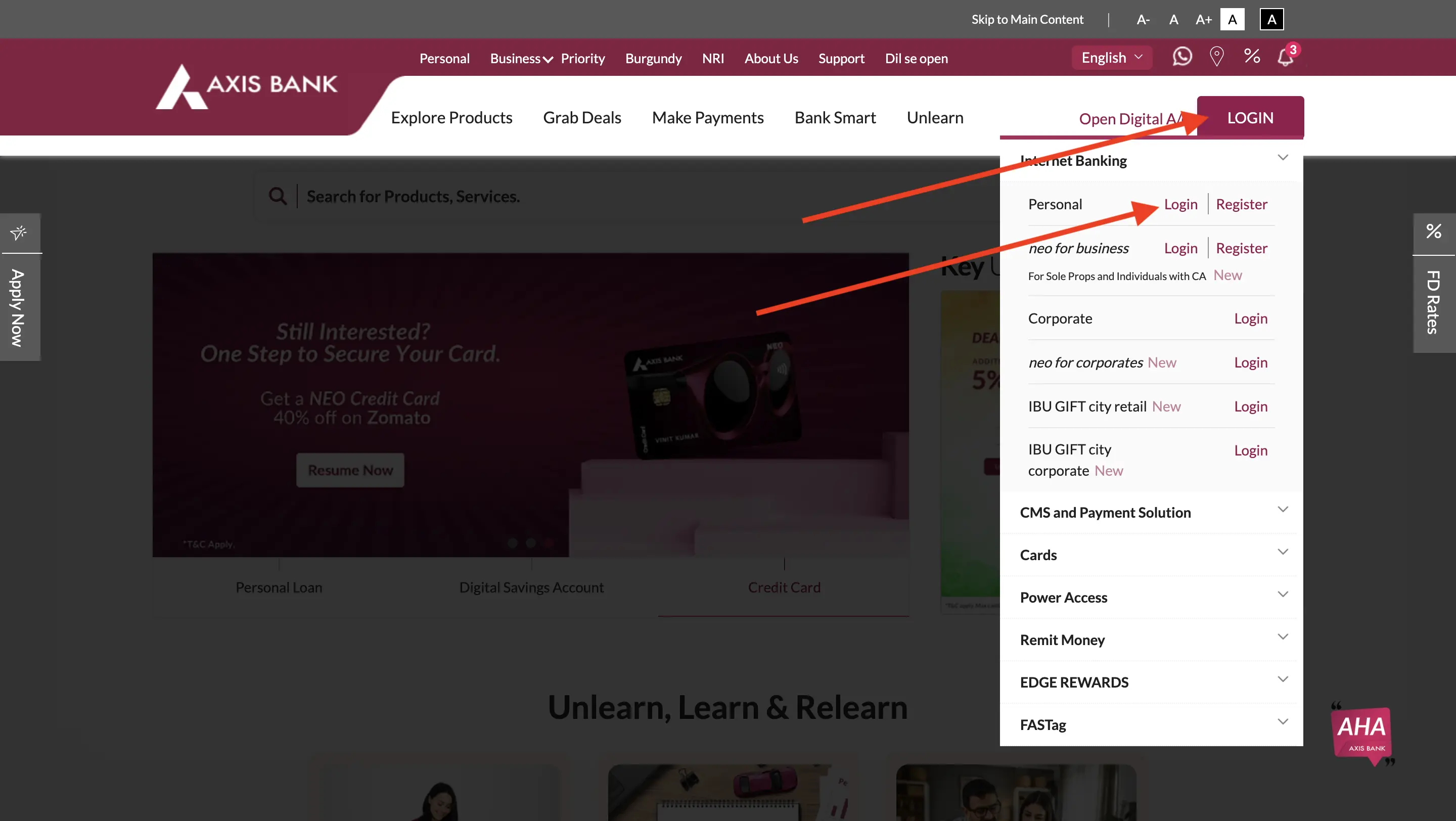

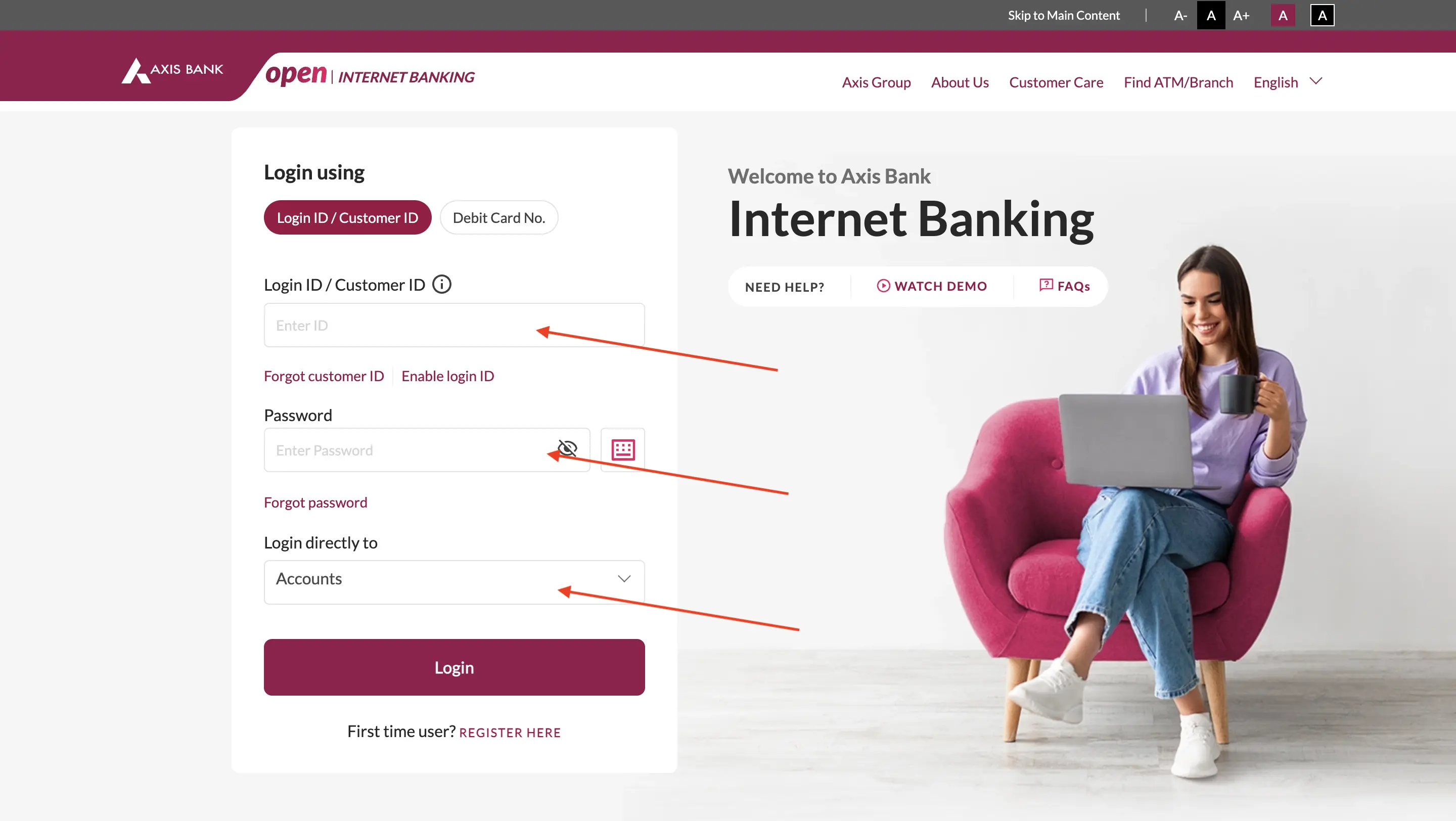

Axis Bank Statement Download

Follow the below-mentioned steps to download statement from Axis Bank:

- Visit the Official website of Axis Net Banking, and choose login option from the dropdown menu.

- Login to Axis Bank’s internet banking portal and enter your customer ID and password. Alternatively, you can use your debit card details too.

- You can login directly to ‘Accounts’ tab by choosing the option from the dropdown menu.

- Select the account statement option.

- Specify details like account, period etc.

- Select the format you want to download in.

- Choose the download or print option.

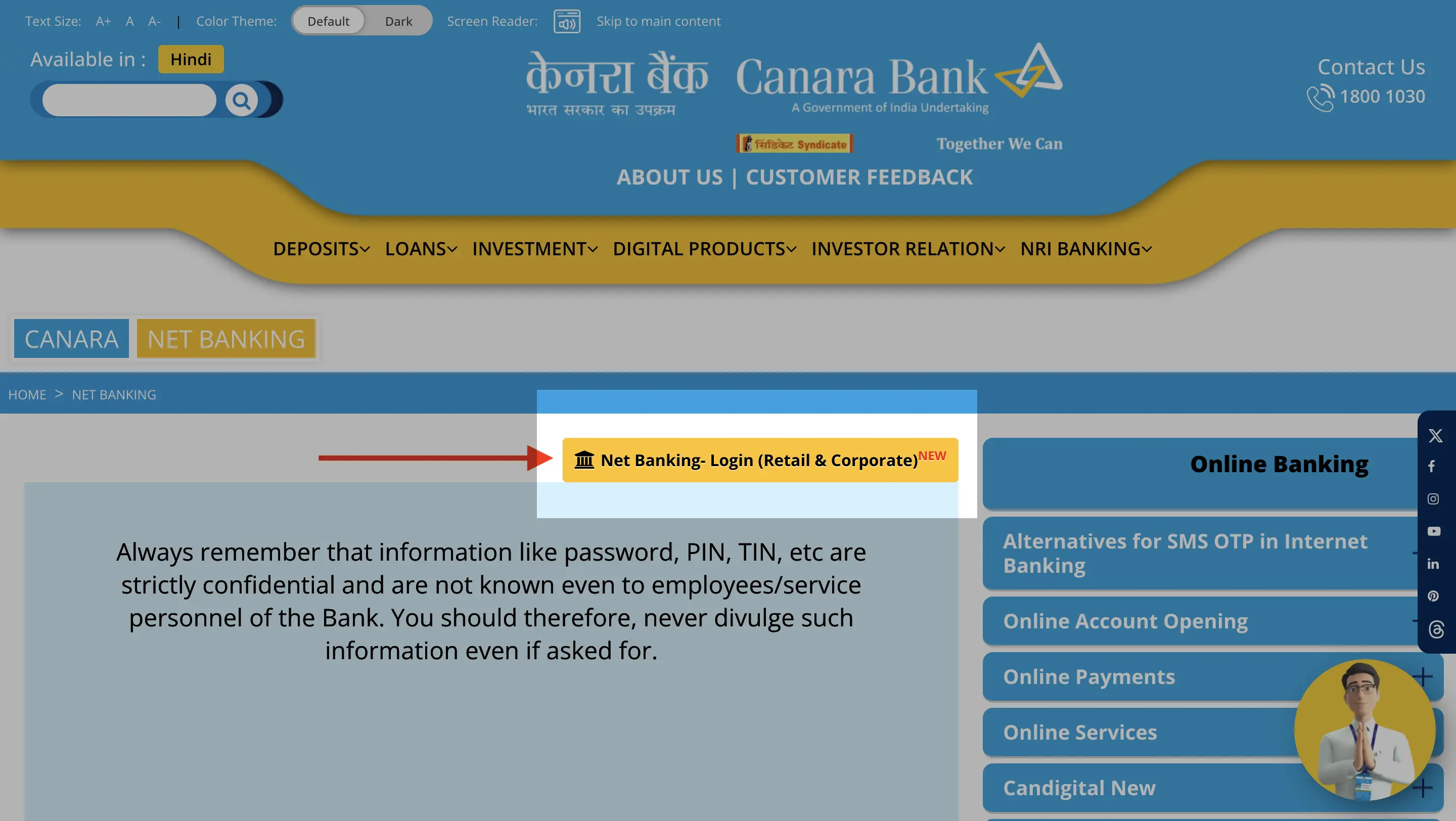

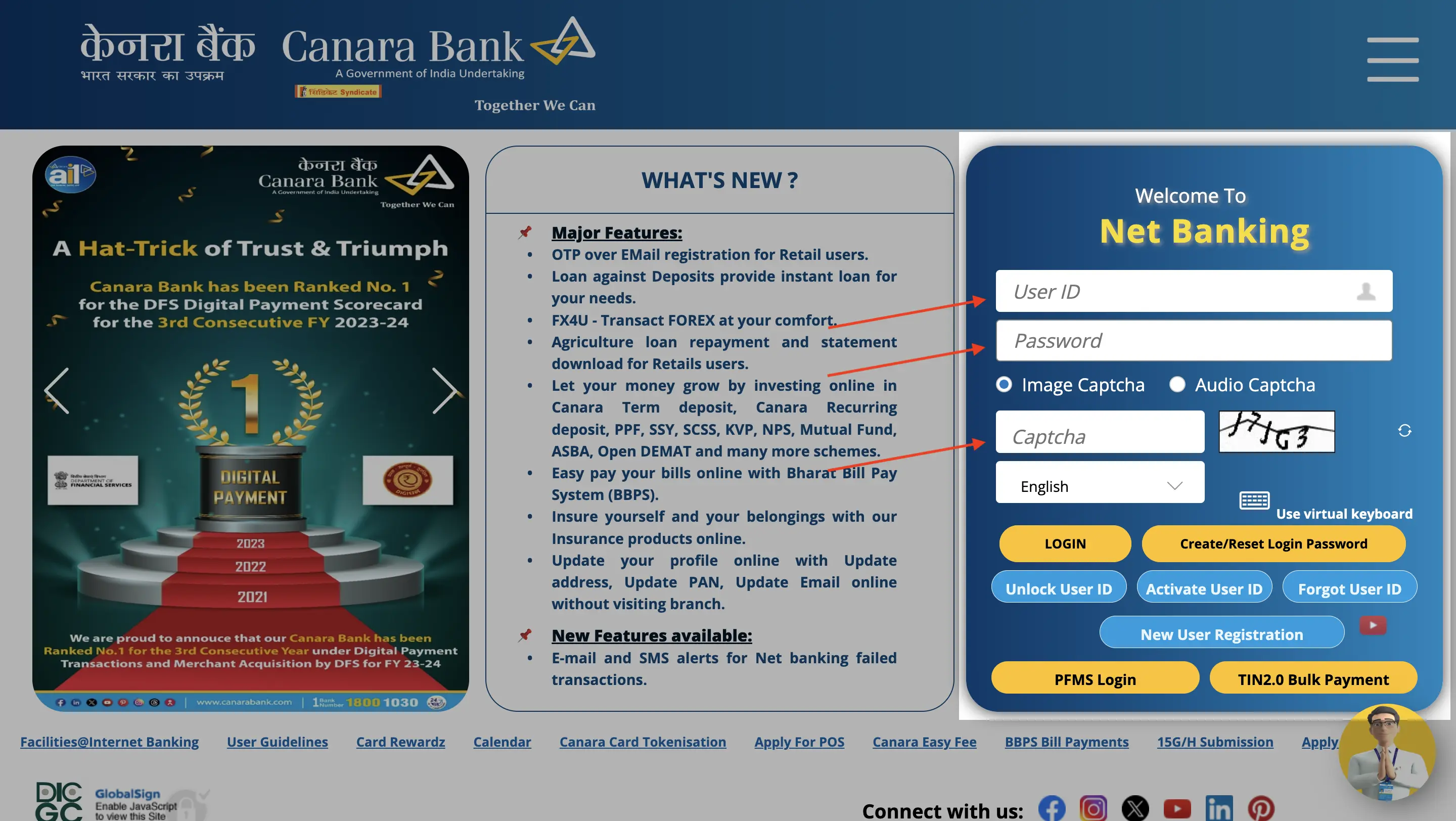

Canara Bank Statement Download

Follow the below-mentioned steps to download statement from Canara Bank:

- Visit Canara Bank’s website and click on the login button at the top right corner.

- After, select netbanking as shown in the image.

- Log in to Canara Bank’s internet banking portal using your ID and password.

- After logging in, click on the accounts tab.

- Select the account statement option from the dropdown menu.

- Choose your account type.

- Choose the duration and format of your statement for download.

- Select download or print.

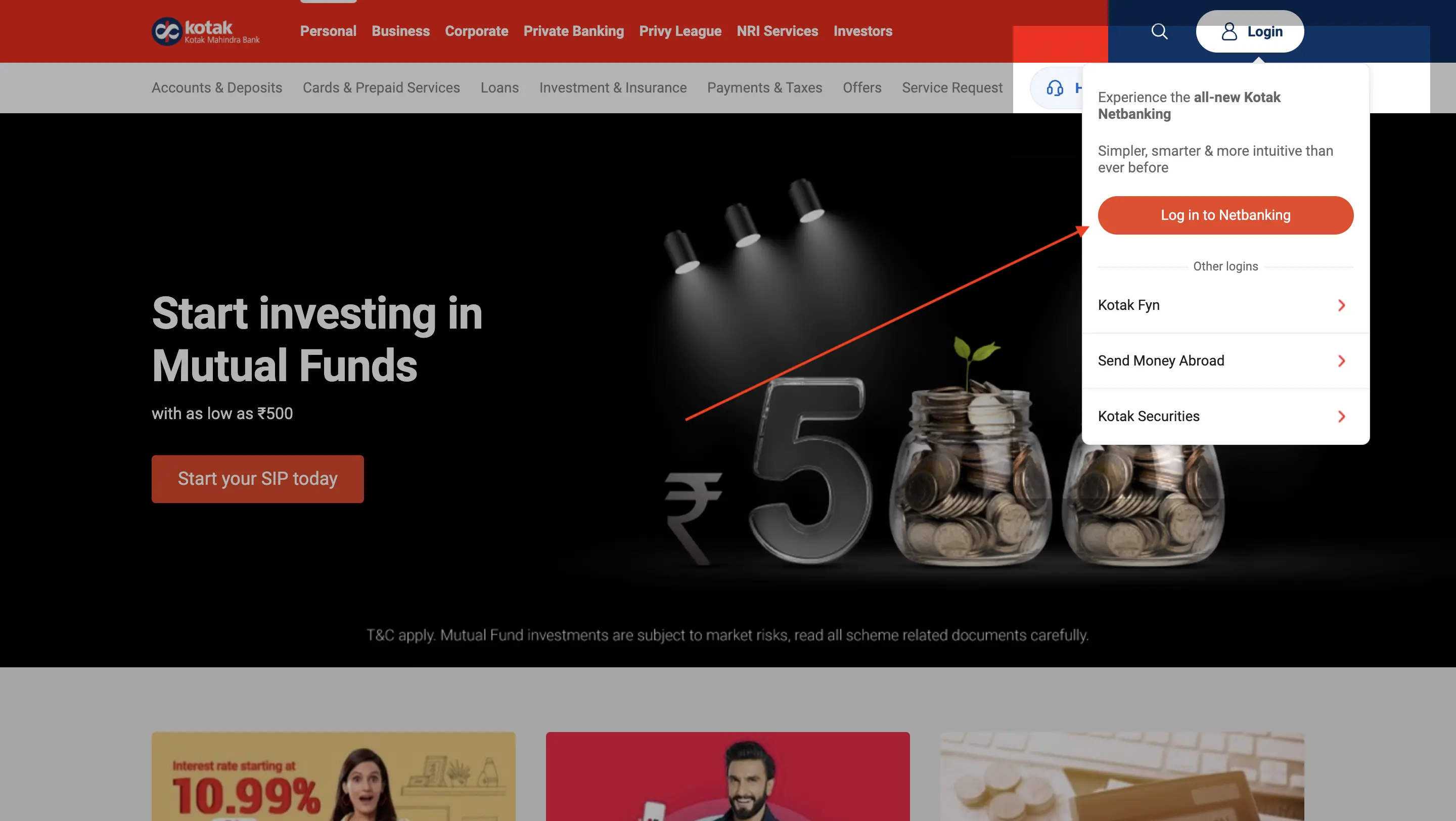

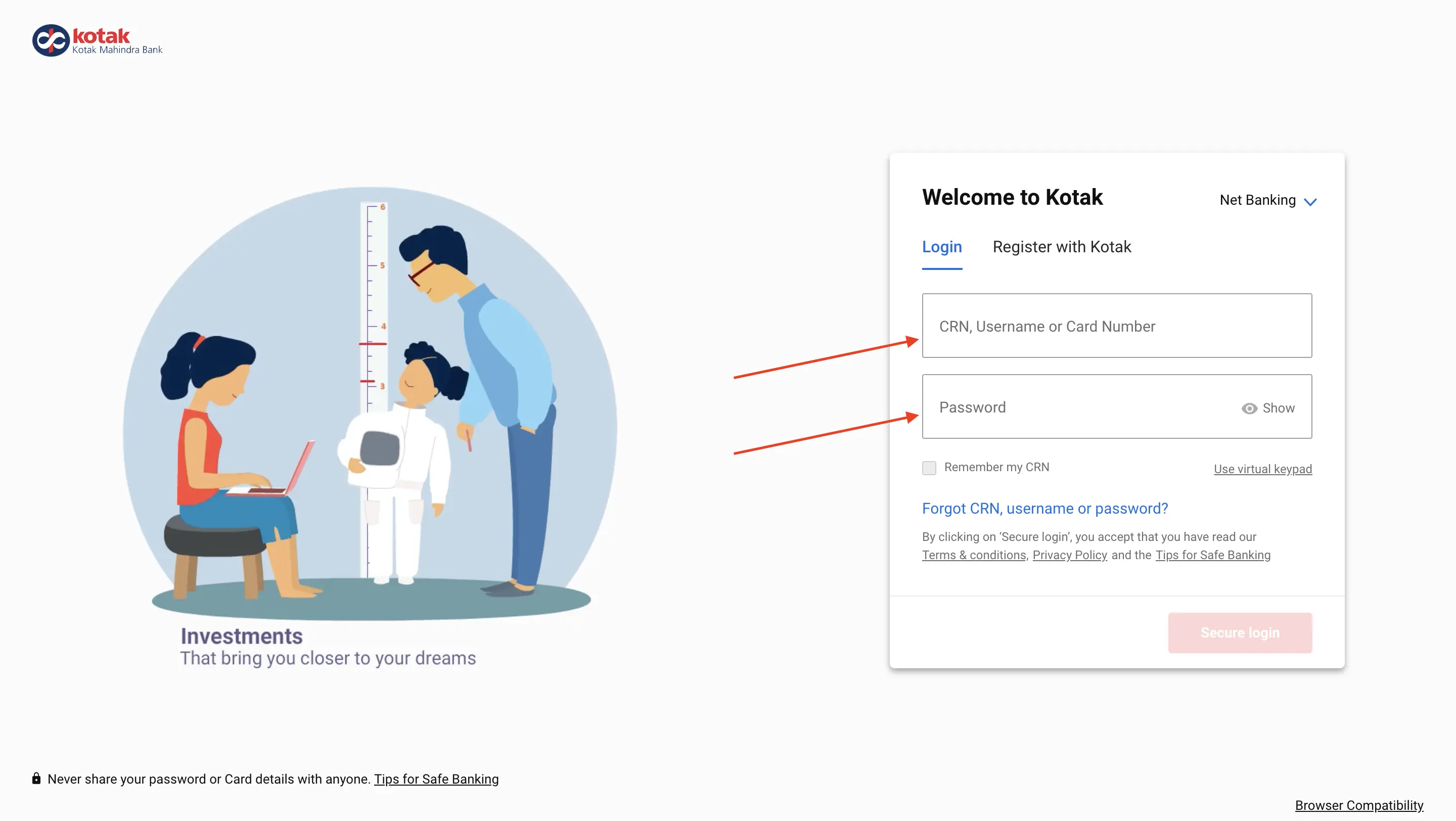

Kotak Bank Statement Download

Follow the below-mentioned steps to download statement from Kotak Mahindra Bank:

- Visit Kotak Mahindra’s website and click on login.

- Login to your net banking portal using your CRN (Customer Relationship Number).

- After logging in, click on the accounts tab.

- Select the account statement option from the dropdown menu.

- Choose your account type and select duration.

- Choose a format for download.

- Select download or print.

Avail an instant loan in a few simple steps!

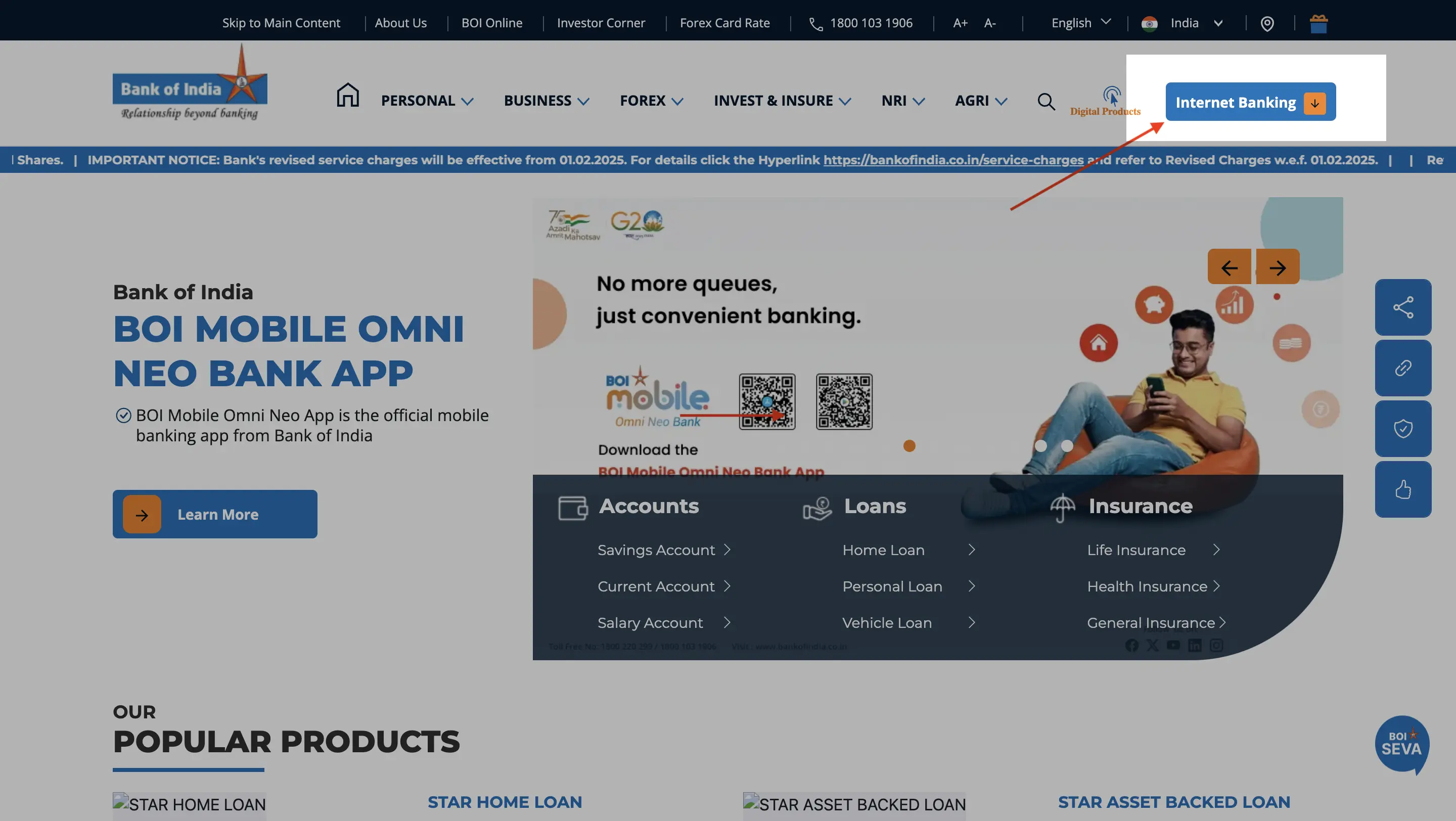

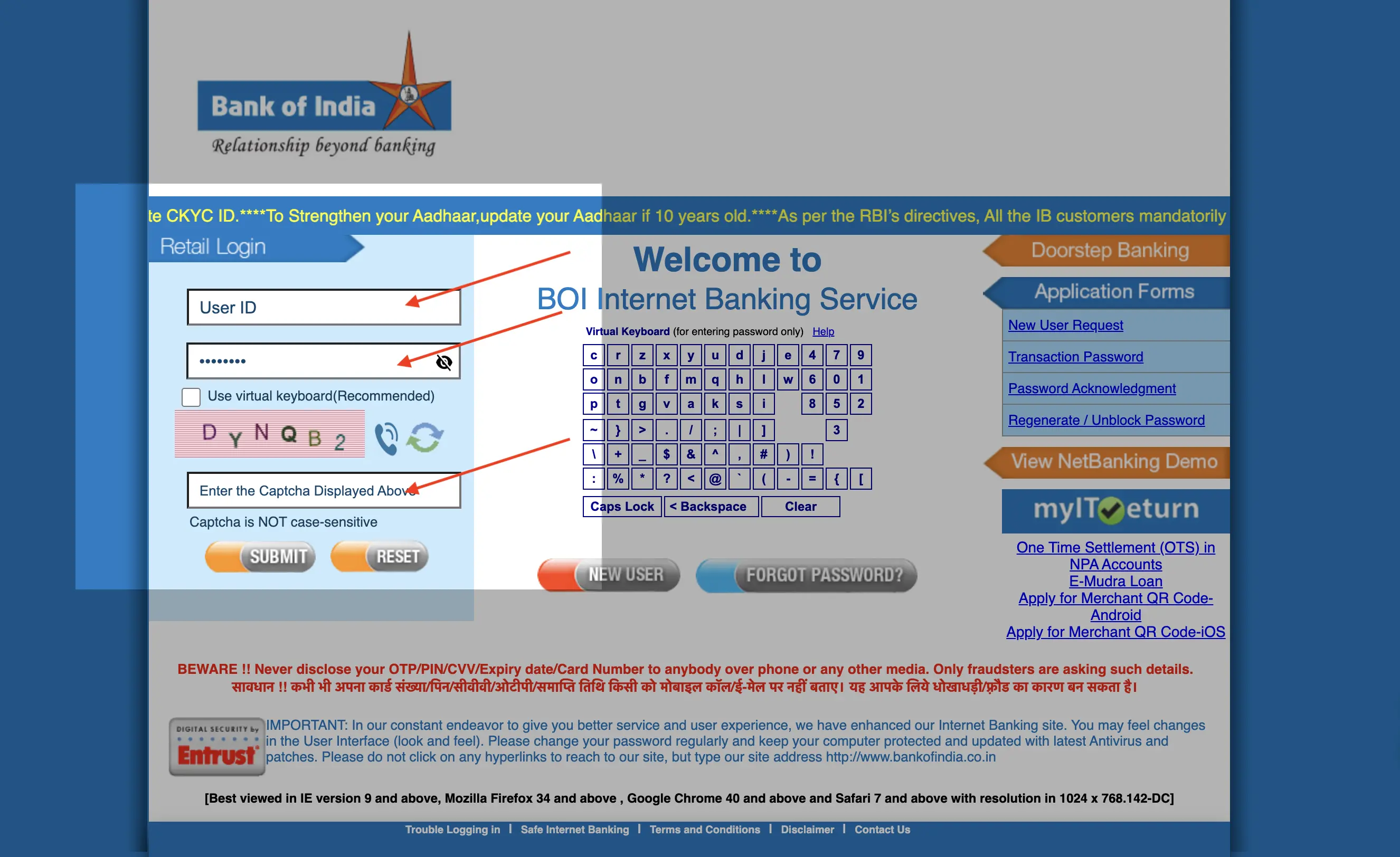

BOI Statement Download

Follow the below-mentioned steps to download statement from the Bank of India:

- Open BOI website and click on ‘Internet banking’ option, and choose ‘Personal’.

- Log in to the Bank of India's net banking portal with the user ID and transaction password.

- Go to the ‘Accounts’ tab.

- Select the ‘Account statement’ option.

- Specify the duration and downloadable file format you require.

- Click on download and save your statement.

ICICI Bank Statement Download

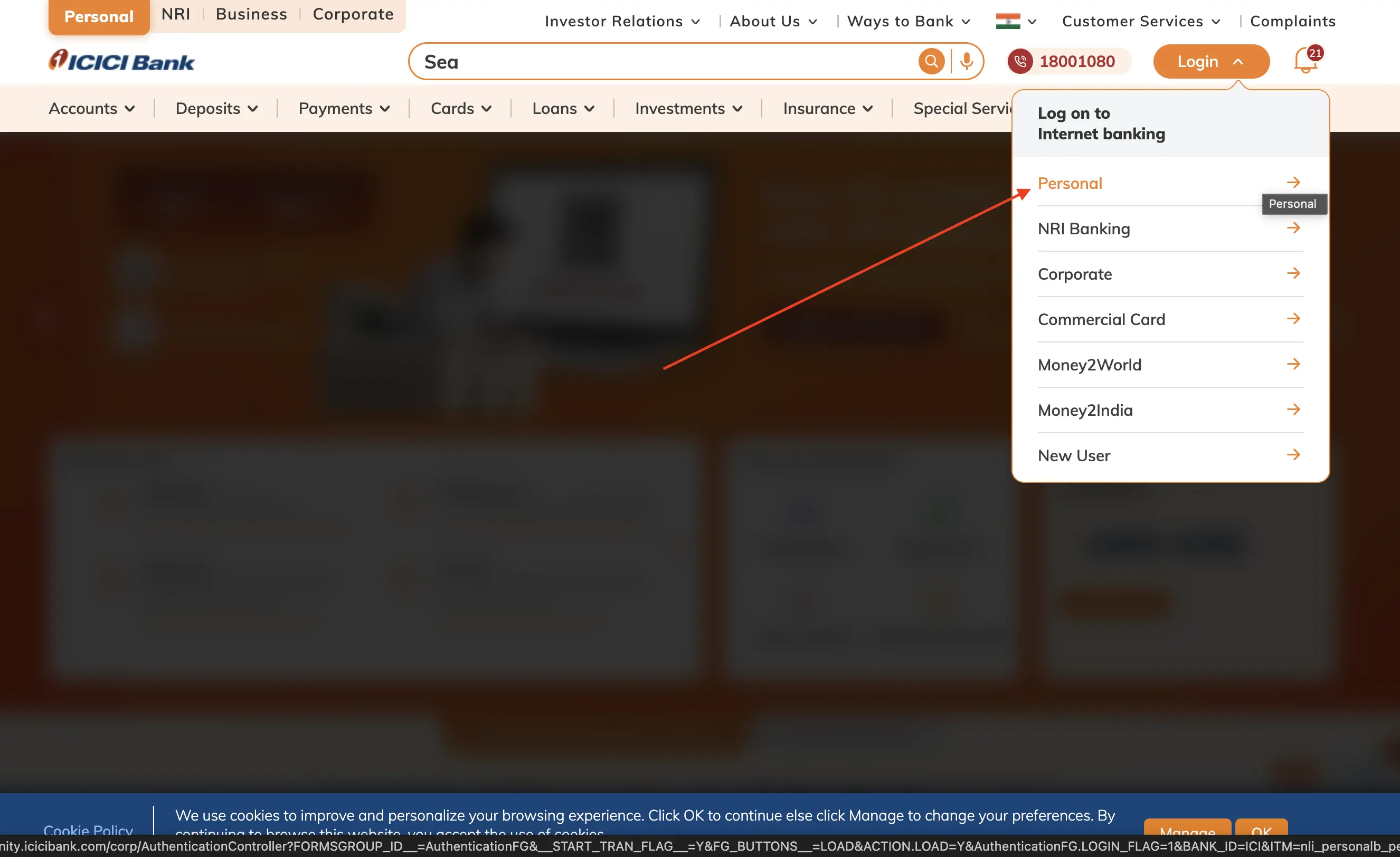

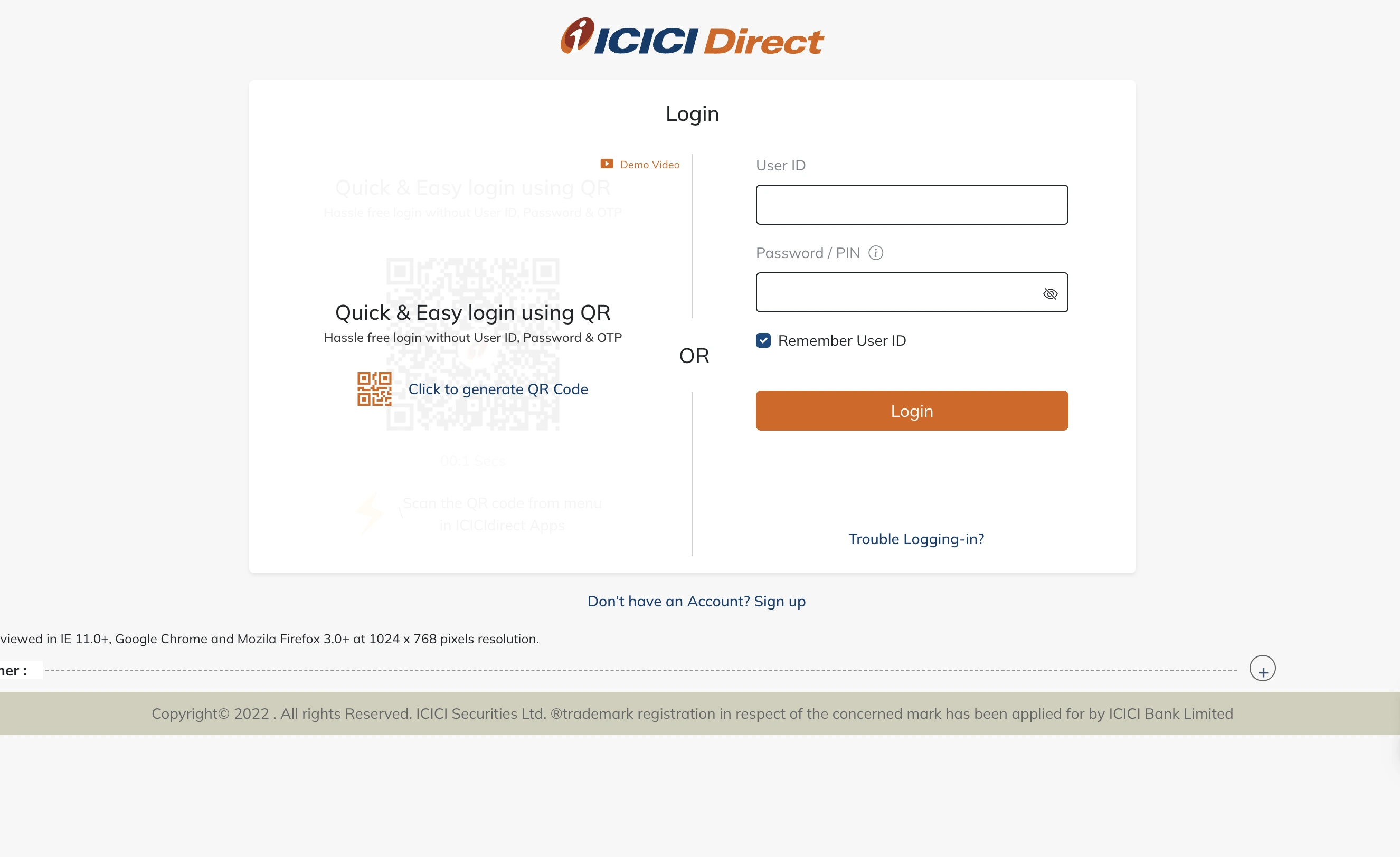

Follow the below-mentioned steps to download statement from ICICI Bank:

- Visit ICIC website, click on ‘Login’ button and choose ‘Personal’.

- Log in to the ICICI internet banking portal, using your User ID and password.

- Open the ‘Accounts’ tab.

- Choose your account.

- Choose the option of bank statement.

- Select your range and format.

- Click on download and download your file.

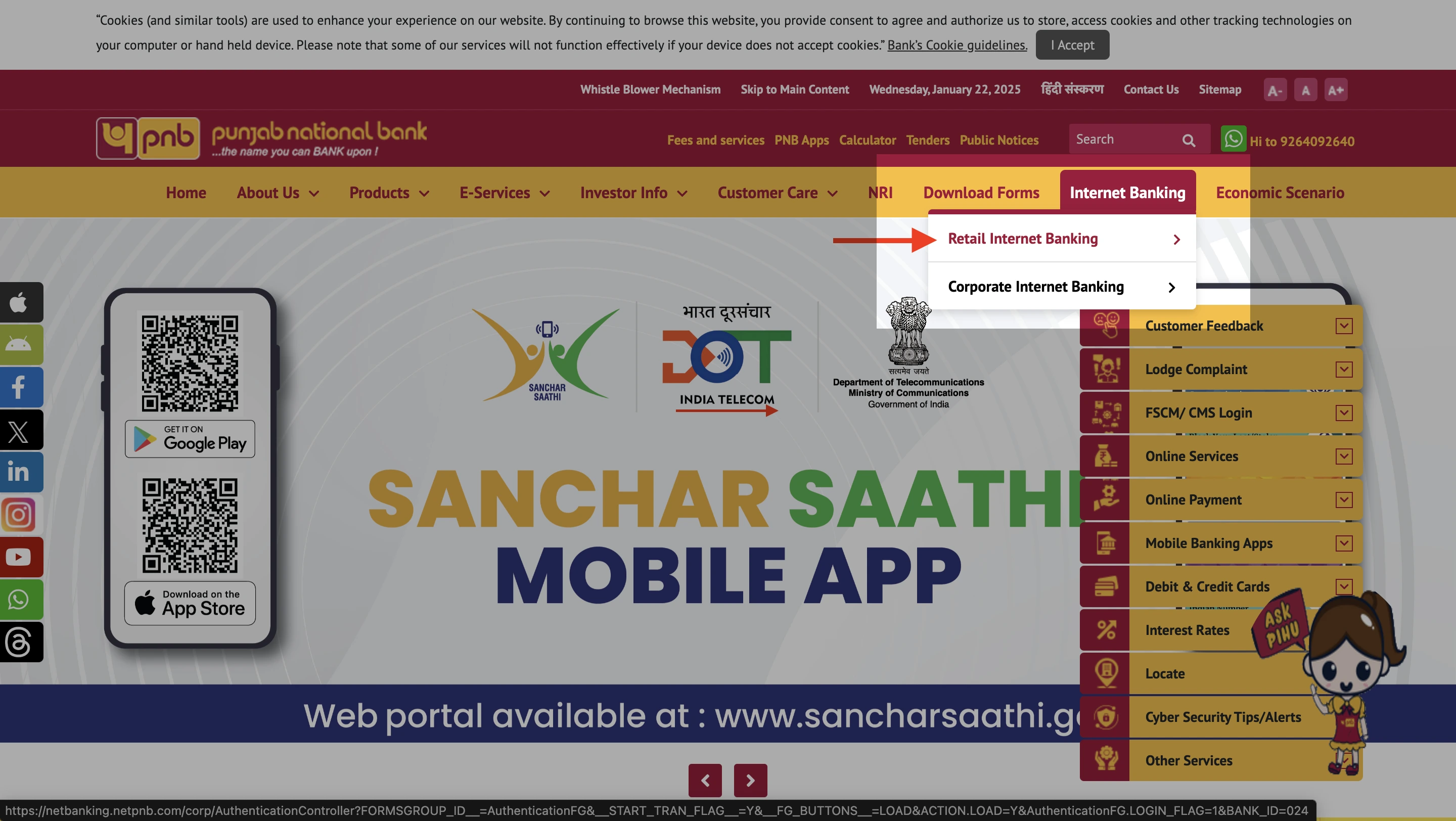

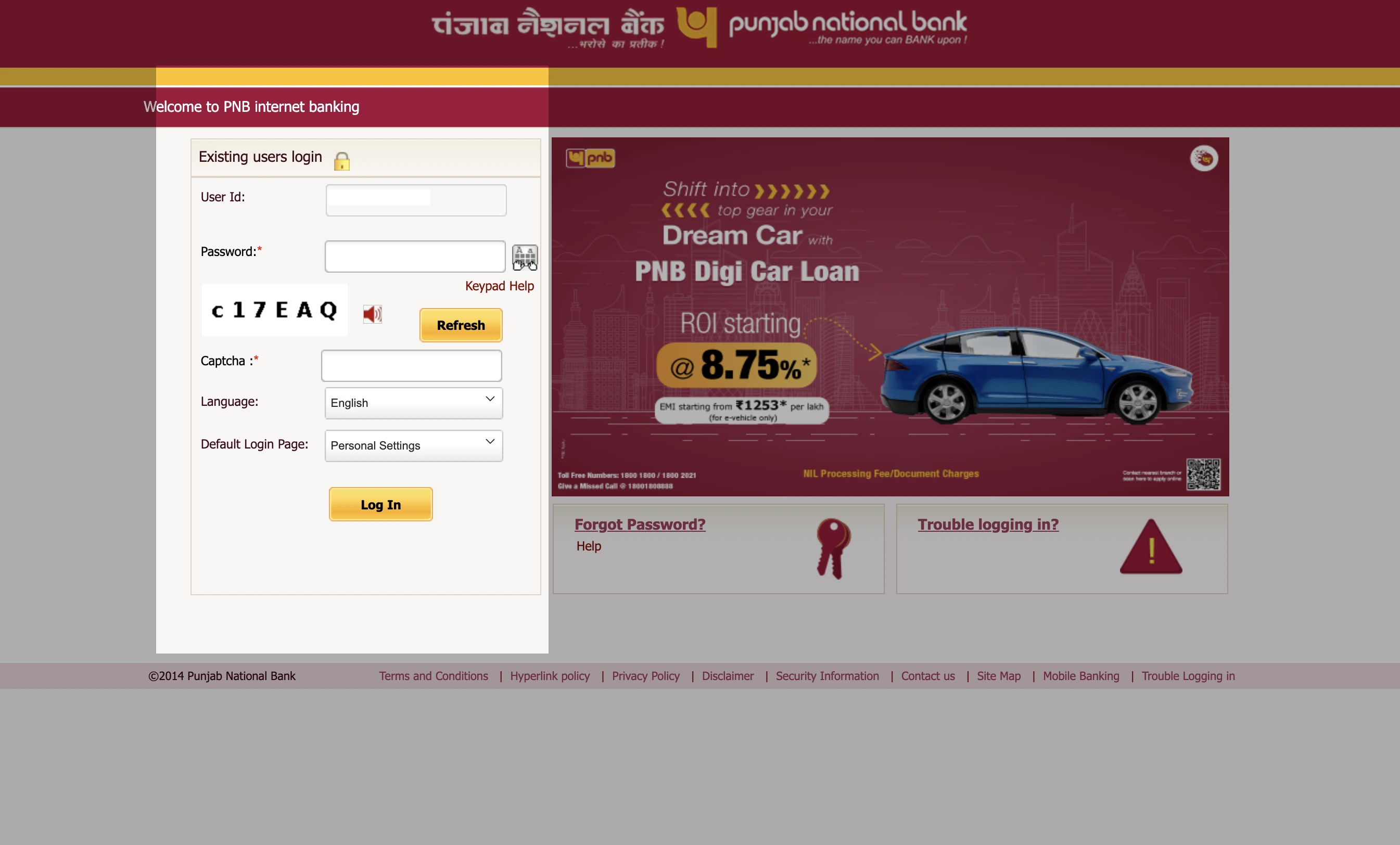

PNB Statement Download

Follow the below-mentioned steps to download statement from Punjab National Bank:

- Open the website of PNB and click on the internet banking option.

- Log in using your unique user ID and password.

- Navigate to the ‘Service Requests’ or ‘Accounts’ section.

- Choose the option of account statement.

- Specify account type and date range.

- Choose the format option.

- Click download.

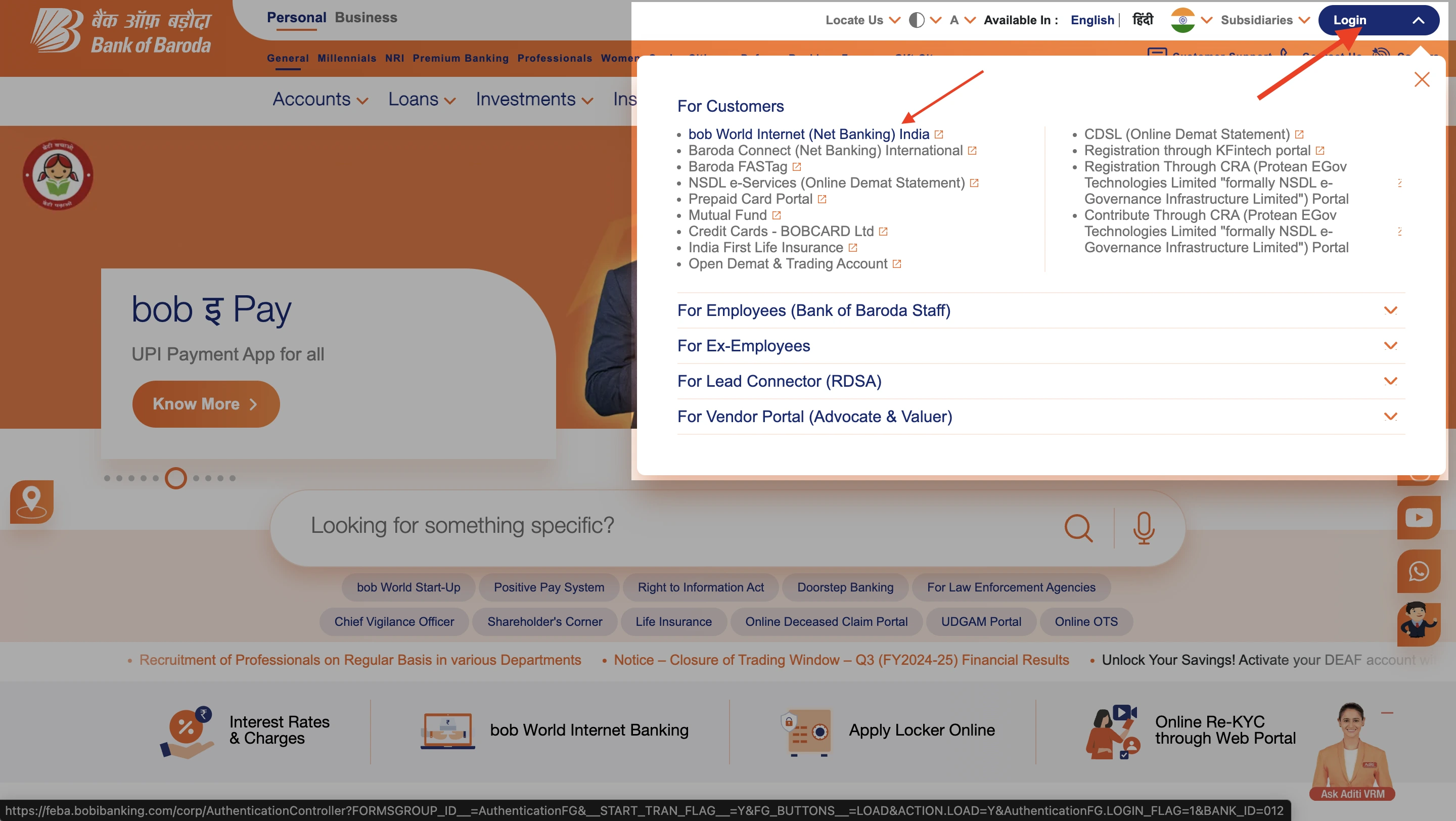

Bank of Baroda Statement Download

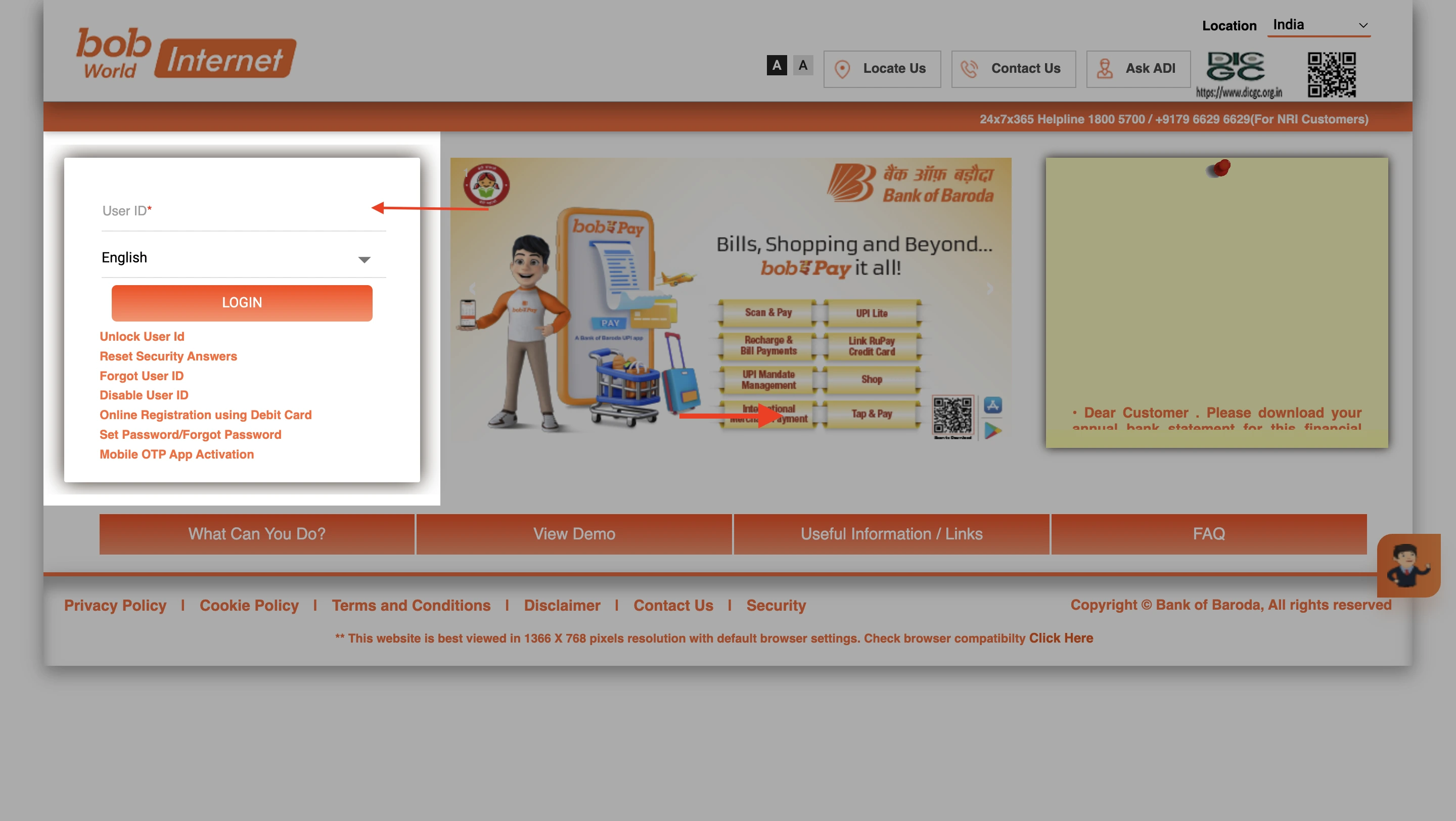

Follow the below-mentioned steps to download statement from the Bank of Baroda:

- Open Bank of Baroda webpage, click on ‘Login’ and choose ‘BOB World Internet’.

- Log in to your net banking webpage using the unique user ID and password.

- Navigate to the ‘Accounts’ section.

- Select the ‘Account statement’ option and specify the account.

- Choose your account type and date.

- Choose your file format.

- Click on download.

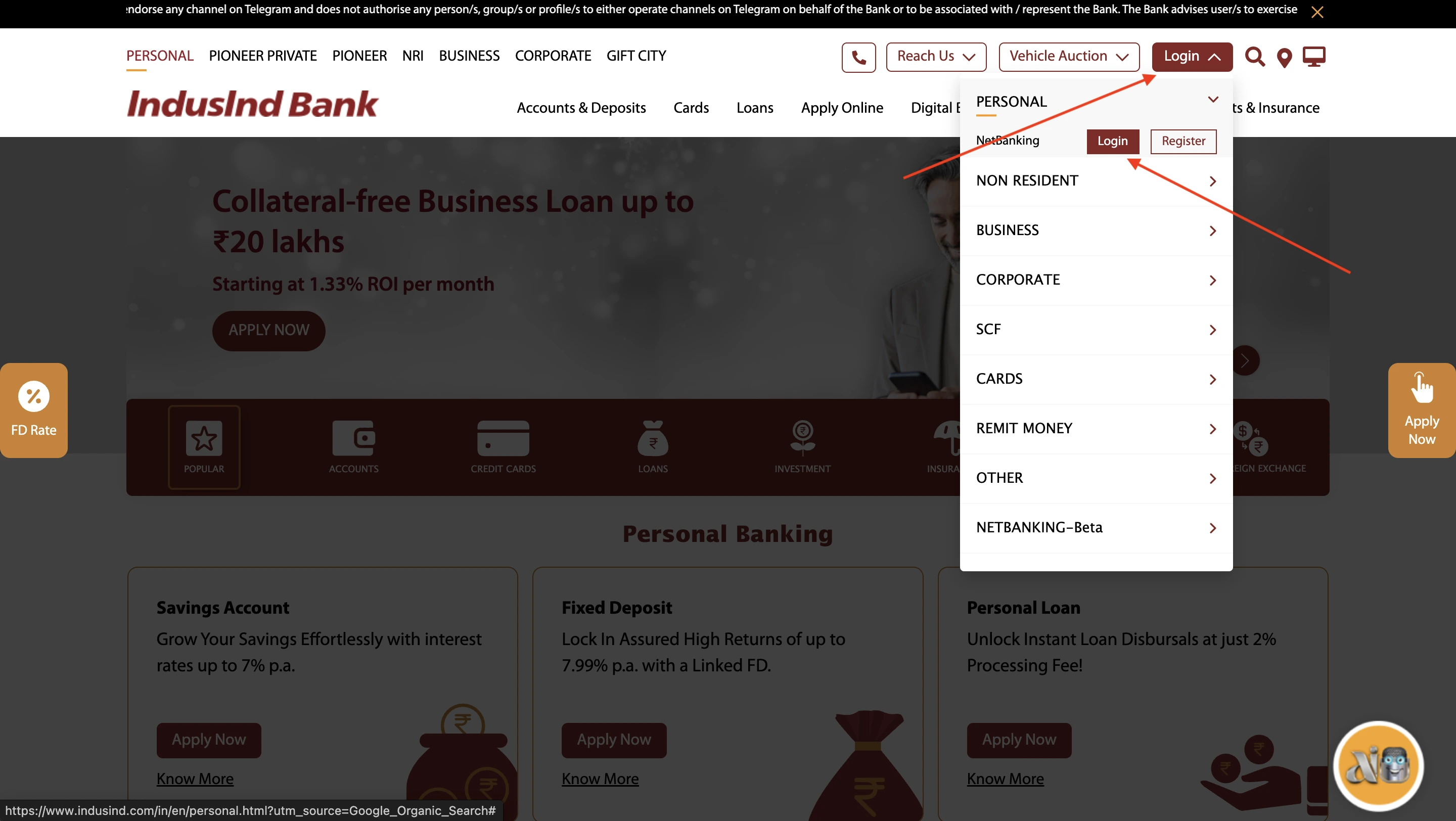

IndusInd Bank Statement Download

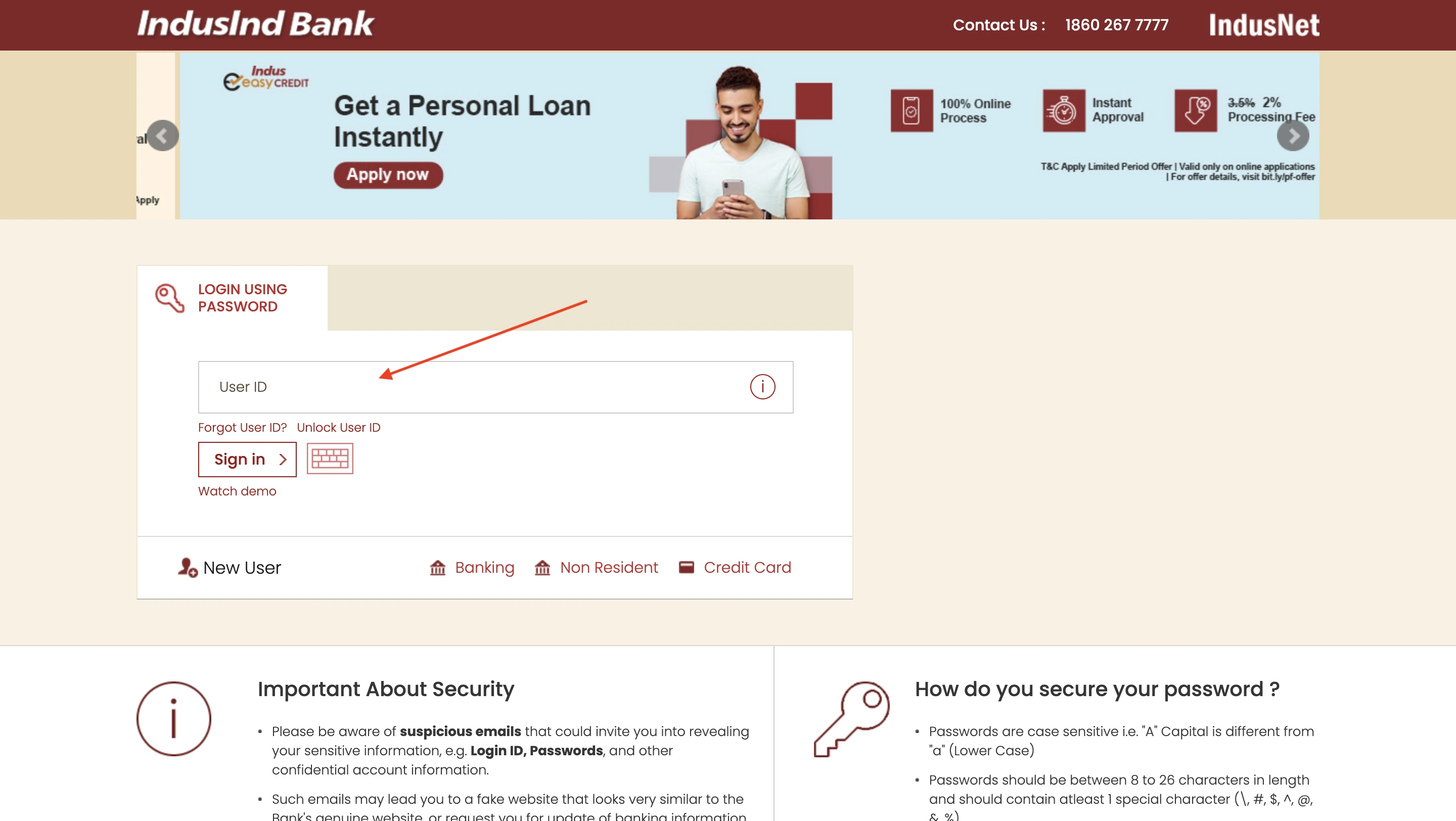

Follow the below-mentioned steps to download statement from Induslnd Bank:

- Open IndusInd Bank website, hover over ‘Login’ button on the top right corner of the website. Click on ‘Login’ button again, under the ‘Personal’ banking section.

- Log in to the IndusNet banking portal and enter your user ID and password.

- Access the account statement section.

- Select the account statement option.

- Choose your account by entering your account details.

- Select your statement period.

- Choose your delivery method (direct download or mail).

- Download your statement.

Benefits of Downloading Bank Statement Online

Your bank statement is an official document from the bank, which lists all your transactions within a chosen time frame.

Downloading your bank statement has a lot of benefits, such as:

- Instantaneous access

- All-time access

- Ease of usage

- Eco-Friendly

- Added security

- Customization and filtering

- Efficiency in production

You can access the bank statement instantly at any time with a few steps, granting a better overview of your transactions.

You can access the bank statement from anywhere without any charges, using your mobile or computer, making it convenient to access.

As a digital document, it is easy to produce and store, making it easy to keep with the user.

Keeping a digital copy is far more eco-friendly than a hard copy.

Most banks provide the balance statement in a protected format, with a password that combines the user’s details, adding additional security.

Producing your statement online lets you customise the period of transactions or transaction type you would like to include in the statement.

The process of downloading your statement is immediate and you can get the report quickly via a chosen method.

Key Details on Bank Statement PDF

- Account details

- Statement Period

- Opening and Closing Balance

- Transaction Details

- Transaction Type

- Bank Charges and Fees

- Interest Earned or Paid

- Cheque Details

- Loan or EMI Details

- Tax Deductions

Things to be Careful of While Downloading Bank Statement

Although the process is fairly simple and secure, there are certain things one must be careful of while downloading your bank statement:

- Ensure a secure connection.

- Use the correct login credentials.

- Technical issues/site under maintenance.

- Browser compatibility issues.

- Pop-up blockers/ad blockers.

- Outdated software.

- Log out after each session.

Avoid using public Wi-Fi networks; instead, use a trusted and private internet connection. Make sure there is a padlock icon on the address bar and the url begins with “https://”.

Check whether your input credentials are accurate. For example, users often confuse credentials such as profile passwords with transaction passwords.

Make sure you access the portal at a working hour or a time outside of the maintenance period. Most banks alert users about scheduled maintenance.

Make sure your bank supports net banking on your website.

Make sure your ad blocker extension or VPN is not interfering with your banking websites, as some banks do not support them; hence deny access.

Using an outdated mobile application can block you out of the bank application. So ensure your application is updated.

Always log out of your online banking session after downloading your statement. Avoid saving login credentials on shared or public devices.

Do you need an emergency loan?

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

You can directly download your bank statement from your bank’s net banking portal or mobile banking app. Banks usually send monthly statements to your registered email ID.

Banks offer a variety of formats to download depending on the bank, like pdf, excel, CSV, and even HTML.

Downloading bank statements online is generally very secure, as long as you are using the official website of the bank or the official mobile banking app.

Yes. Almost all banking applications provide a facility to download bank statements.

It might be due to one of the many reasons , check this page for more details.

Yes. Banks allow downloading of multiple bank statements at once, but it may depend on individual banks’ features, platforms, and policies.

A downloaded bank statement can contain various details related to your account such as bank account number, account holder name, address & contact details, Bank IFSC, MICR, etc

Yes, you can download a joint bank account statement like any other bank account, using the same methods. However, some banks may have some constraints, like permission of co-applicants, or only account holders with authorized access can download the statement.

The password format for a bank statement PDF can vary between banks. For many banks, the PDF statement password is often a combination of the customer’s name and their date of birth or year of birth.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users