CIBIL offers detailed helpline support for its customers through the CIBIL customer care support feature, enabling you to contact and resolve issues, disputes, and complaints regarding your credit report.

Operated by TransUnion CIBIL, the CIBIL score is one of the prominent credit scoring schemes used widely in India by lenders to assess the creditworthiness of credit applicants. They generate a comprehensive report of the applicant’s past credit usage. If you notice any errors or discrepancies in your CIBIL report, you can raise a dispute and get them resolved through the tools and support options provided by CIBIL’s customer care services.

Read on to learn more about the CIBIL customer support and how to raise any issues if you have them with it.

The CIBIL customer care number is +91 22 6140 4300, which can be used to contact customer care support during the time of 10 am to 6 pm, from Monday to Saturday.

Table of Contents:

CIBIL Customer Care Number & Email Support

As a part of faster support, CIBIL offers various methods to contact the customer support feature. For quick assistance with credit reports, disputes, or score-related queries, CIBIL provides dedicated customer care through both phone and email, using which you can raise complaints online to CIBIL.

The following are the respective data and related information:

| Contact Method | Things to Keep in Mind | |

|---|---|---|

| Mobile | +91 22 6140 4300 | Monday to Friday from 10:00 AM to 6:00 PM. |

| info@cibil.com | No restrictions, as you can send the mail at any time. | |

| Online Contact | CIBIL contact | Gives you a comprehensive guide on how to use the CIBIL customer care services. |

Note: Unfortunately, CIBIL does not provide a toll-free number to contact or modern services like WhatsApp communication regarding the CIBIL scores or customer service yet.

Not sure of your credit score? Check it out for free now!

Reasons to Contact CIBIL

There can be many reasons why you should contact CIBIL customer care. Let’s go through some cases below:

- Incorrect personal details on your credit report

- Unfamiliar or unauthorised loans or accounts

- Closed accounts still showing as active

- Duplicate account entries in your report

- No update or delay in dispute resolution

- CIBIL score not updating after loan repayment

- Issues accessing your CIBIL account or report

- Discrepancy in your displayed credit score

- Clarification on how your score is calculated

- Confusion about report entries or account status

CIBIL Report-Related Queries

If you notice incorrect or outdated information in your CIBIL credit report, such as wrong personal details, duplicate accounts, or closed loans showing as active, you can raise a dispute directly through the official CIBIL website or by contacting their customer support system.

Common report-related issues include:

- Incorrect personal information (name, PAN, address, etc.)

- Duplicate or wrongly listed accounts

- Incorrect account status (e.g., "written-off" or "settled")

- Unfamiliar or unauthorised loans/credit cards

- Closed loans still showing as active

To resolve such issues, access your latest report through your CIBIL dashboard, identify the error and raise a dispute from the website.

CIBIL Score-Related Queries

Your CIBIL score is a three-digit numeric summary of your past credit usage. If you believe your score does not reflect your credit behaviour accurately, it may be due to incorrect or delayed reporting from a lender or some other reason.

Common score-related concerns include:

- Sudden drop in the core without a clear reason

- Score not updated after loan repayment

- Confusion about score calculation or range

What you can do in case of such an error is,

- Check your full report to identify if any incorrect account data is affecting your score.

- Raise a dispute through your CIBIL account if you find inaccuracies in the data affecting your score.

- Understand that the score itself is auto-generated and not manually adjustable by CIBIL.

Note: In both cases, CIBIL does not provide manual score corrections or modify data itself. Your score updates once corrected data is received from the lender.

Do you need an instant loan?

Steps to Raise a CIBIL Dispute Online

If there are any mistakes in your CIBIL report, such as incorrect account details, inaccurate payment history, or outdated personal information, they can affect your credit score and loan eligibility.

In such situations, TransUnion CIBIL offers streamlined dispute resolution support. The following are the steps to raise a CIBIL dispute online:

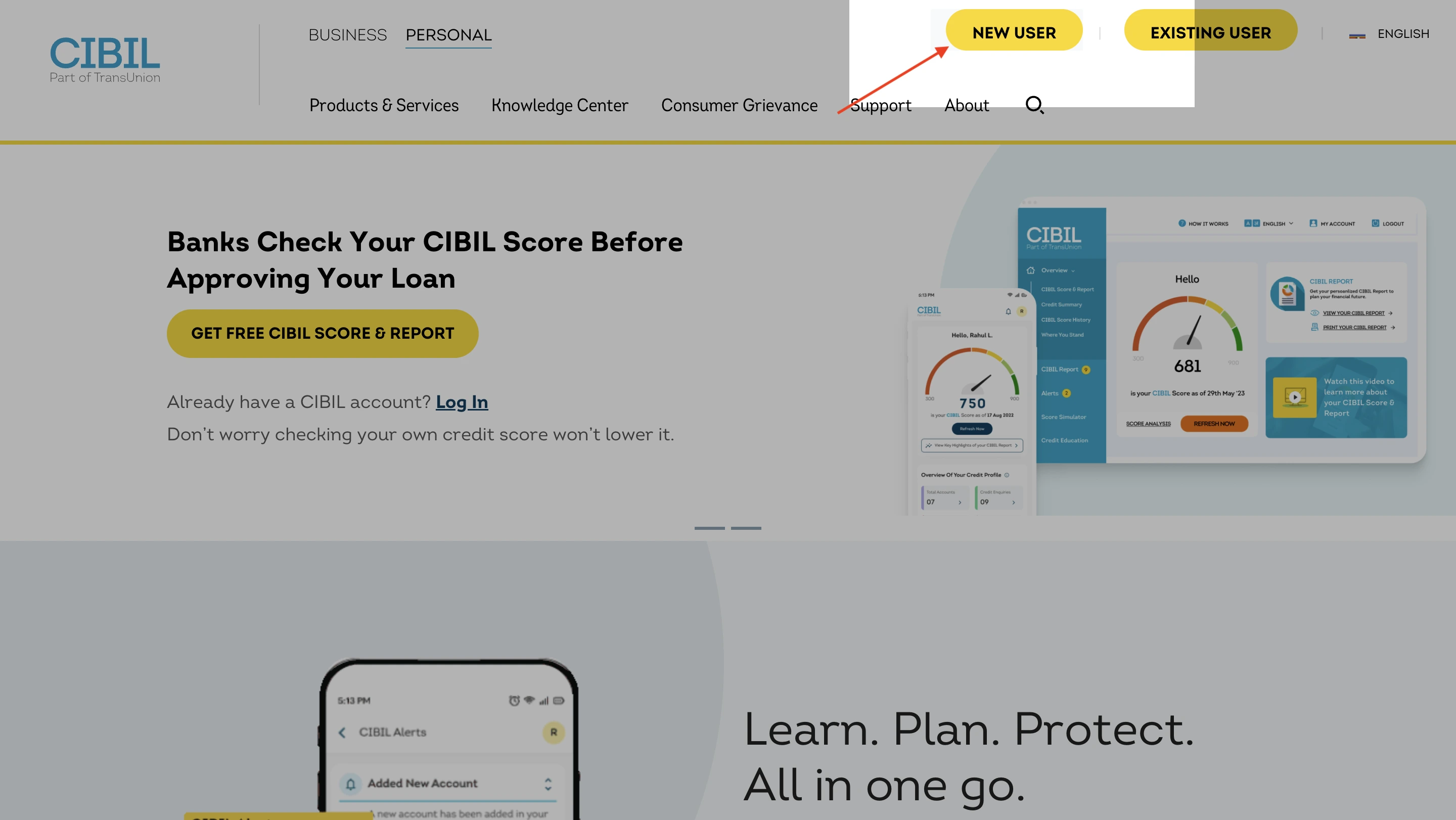

Step 1: Log in to myCIBIL (www.cibil.com) using your username and password.

Step 2: Navigate to the credit reports section. There you will find ‘dispute centre’ and click on ‘dispute an item’.

Step 3: Click on the specific section you want to dispute.

Step 4: Choose your dispute type

Step 5: If the dispute is based on data inaccuracies, enter the value in the respective field.

Step 6: Click on ‘submit’.

You will receive a dispute summary along with the field name, details of the dispute, the status of the dispute, and the dispute ID as an email confirmation.

Note: Keep the dispute ID from your confirmation email handy for quick access. You can also raise multiple disputes in a single section.

Suggested Read: Credit Score Range

Tracking Your CIBIL Dispute Status

The turnaround time for a dispute settlement is around 30 days from the date of dispute registration. The applicant will receive a status update from noreply@transunion.com on their registered email ID when the dispute is resolved.

You can follow the steps below to track our CIBIL Dispute Status:

- Visit the official website of the CIBIL score.

- Log in using your username and password.

- In the pending dispute section, enter your dispute ID.

- A dashboard will open up where you can view your updates.

Tips for Quick CIBIL Dispute Resolution

While typically a dispute resolution can take anywhere between a few days to at most 30 days, there are certain things you, as a customer, can do to help with the process.

- Accuracy in Information: Double-check all details before submitting the dispute form.

- Choose Correct Dispute Type: Choose the right category (e.g., ownership, data inaccuracy) for faster processing. Using subdivisions can narrow down your query into a simpler format.

- Attach Supporting Documents: If applicable, provide statements or ID proof to strengthen your claim.

- Track Regularly: Monitor your dispute status online using your dispute ID.

- Avoid Multiple Submissions: Raise one dispute per issue to prevent delays or rejection.

- Follow Up if Needed: If no update is received within 30 days, contact CIBIL support with your dispute ID.

Be up-to-date with your credit score. Check it out for free now!

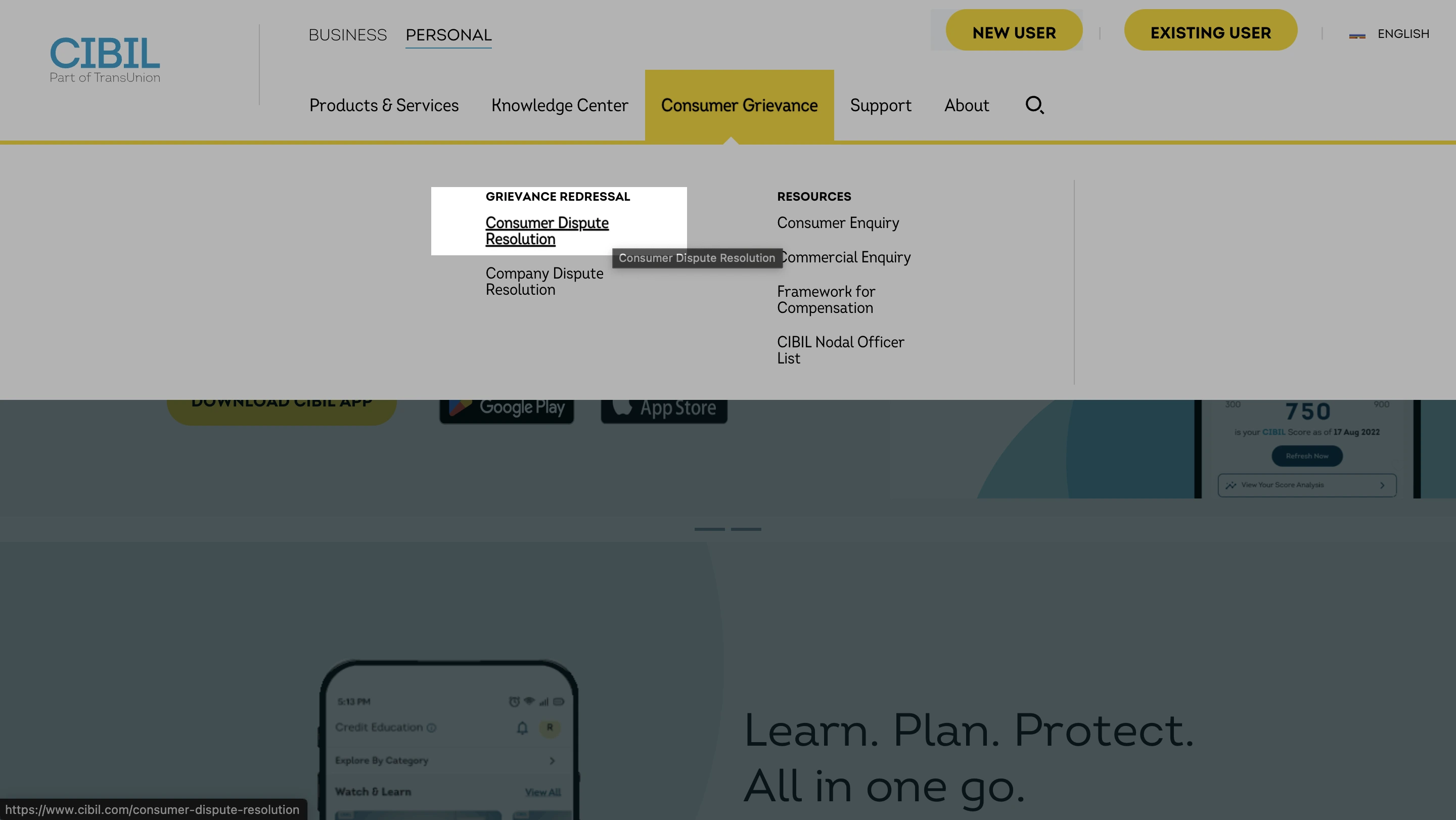

CIBIL Grievance Redressal

Grievance redressal is a form of escalation in case your disputes or queries remain unattended even after the standard period.

If your concern has not been resolved through standard customer care channels or your dispute remains unattended beyond the expected timeframe, you can escalate it through CIBIL’s formal grievance redressal process.

You can use the following data to raise escalations:

| Escalation Level | Contact Point | Email / Contact Info |

|---|---|---|

| Level 1 | CIBIL Customer Support |

Email: info@cibil.com Ph. no. 022-6638-4600 |

| Level 2 | Nodal Officer |

Email: nodalofficer@transunion.com You can also raise a complaint using this official form |

| Level 3 | Principal Nodal Officer |

Email: nodalofficer@transunion.com You can also raise a complaint using this official form |

Note: For issues that still remain unattended, it is advised to contact the RBI through their Integrated Ombudsman Scheme.

Suggested Read: Good Credit Score

CIBIL Office Address & Contact Details

For individuals who want to visit the CIBIL office and raise their concerns, CIBIL requests that they keep in mind the following details:

| Walk-in Time | Mon - Fri, 10:00 AM to 06:00 PM |

| Documents (Original or Copies) |

1. PAN card 2. Passport 3. Driving License 4. Voter ID |

| Address |

TransUnion CIBIL Limited (Formerly: Credit Information Bureau (India) Limited) One World Centre, Tower 2A, 19th Floor, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013. |

| Fax | +91 22 6638 4600 |

Get a quick loan at low interest rates!

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users