A CIBIL Report is a detailed record of your credit history, maintained by TransUnion CIBIL. It includes your CIBIL Score, loan details, repayment behavior, and credit inquiries. Lenders rely on your CIBIL Report to evaluate your creditworthiness before approving loans or credit cards. Accessing and downloading your CIBIL Report helps you monitor your credit health, resolve discrepancies, and improve your chances of securing loans.

You can download your CIBIL Report online without any cost by visiting www.cibil.com and completing identity verification using your PAN Card or other valid IDs like Voter ID, Passport or Driver’s License.

Table of Contents:

- ⇾ Download CIBIL Report Online for Free

- ⇾ Importance of CIBIL Report

- ⇾ CIBIL Report PDF Password

- ⇾ Recover Forgot CIBIL User ID

- ⇾ Features & Components of a CIBIL Report

- ⇾ CIBIL Score Range

- ⇾ Key Terms in a CIBIL Report

- ⇾ Types of Loans That Impact Your Credit Score

- ⇾ Benefits of Checking Your CIBIL Report Regularly

- ⇾ Steps to Check Your CIBIL Score For Free

- ⇾ Tips for Maintaining a Healthy Credit Score

- ⇾ CIBIL Customer Care

- ⇾ Frequently Asked Questions

Download CIBIL Report Online for Free

Follow these steps to download your CIBIL Report for free from the official CIBIL website:

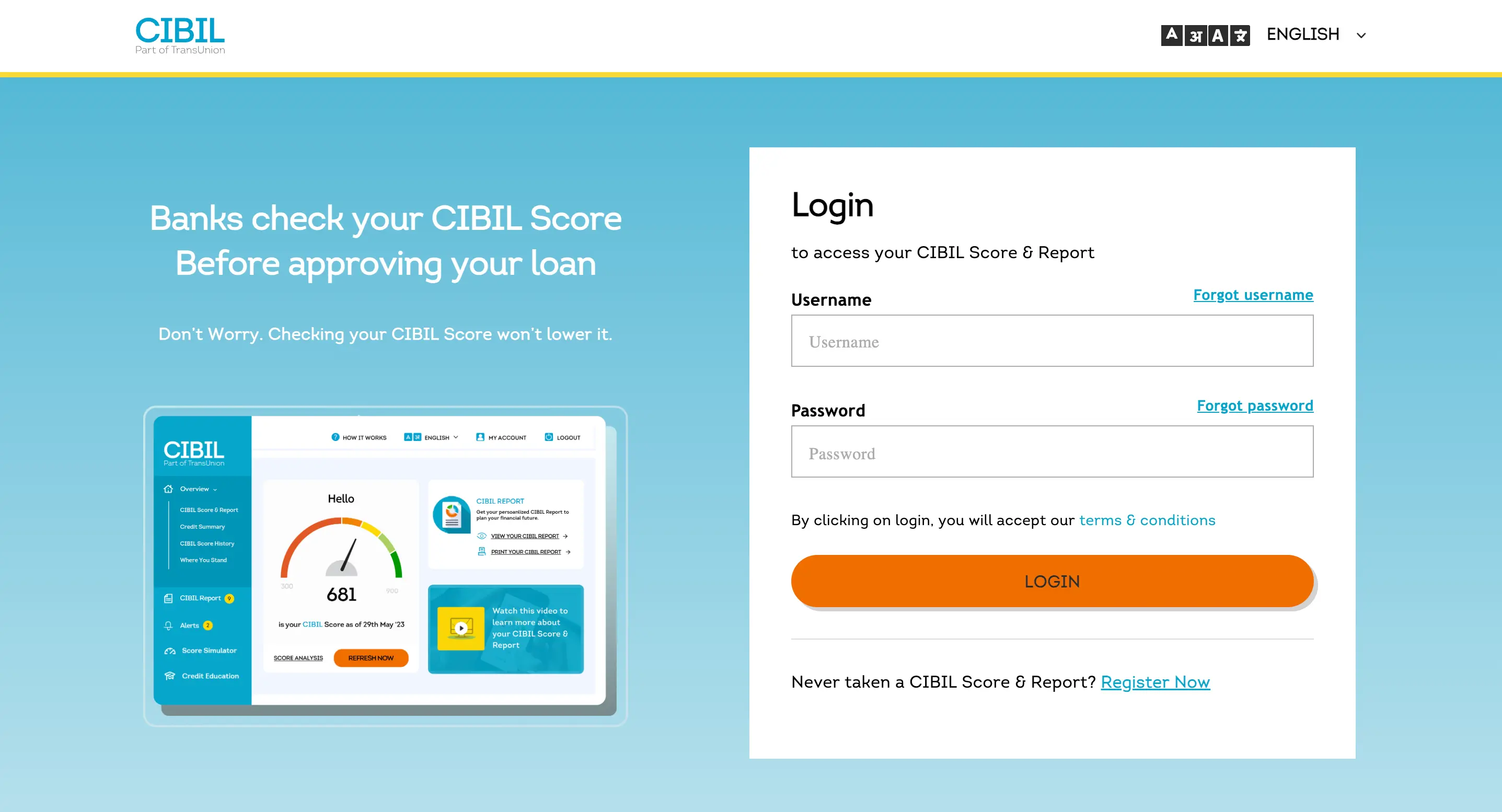

- Login to the CIBIL Website

- Visit the official CIBIL website and click on Login.

- Enter your Username and Password, then click Login.

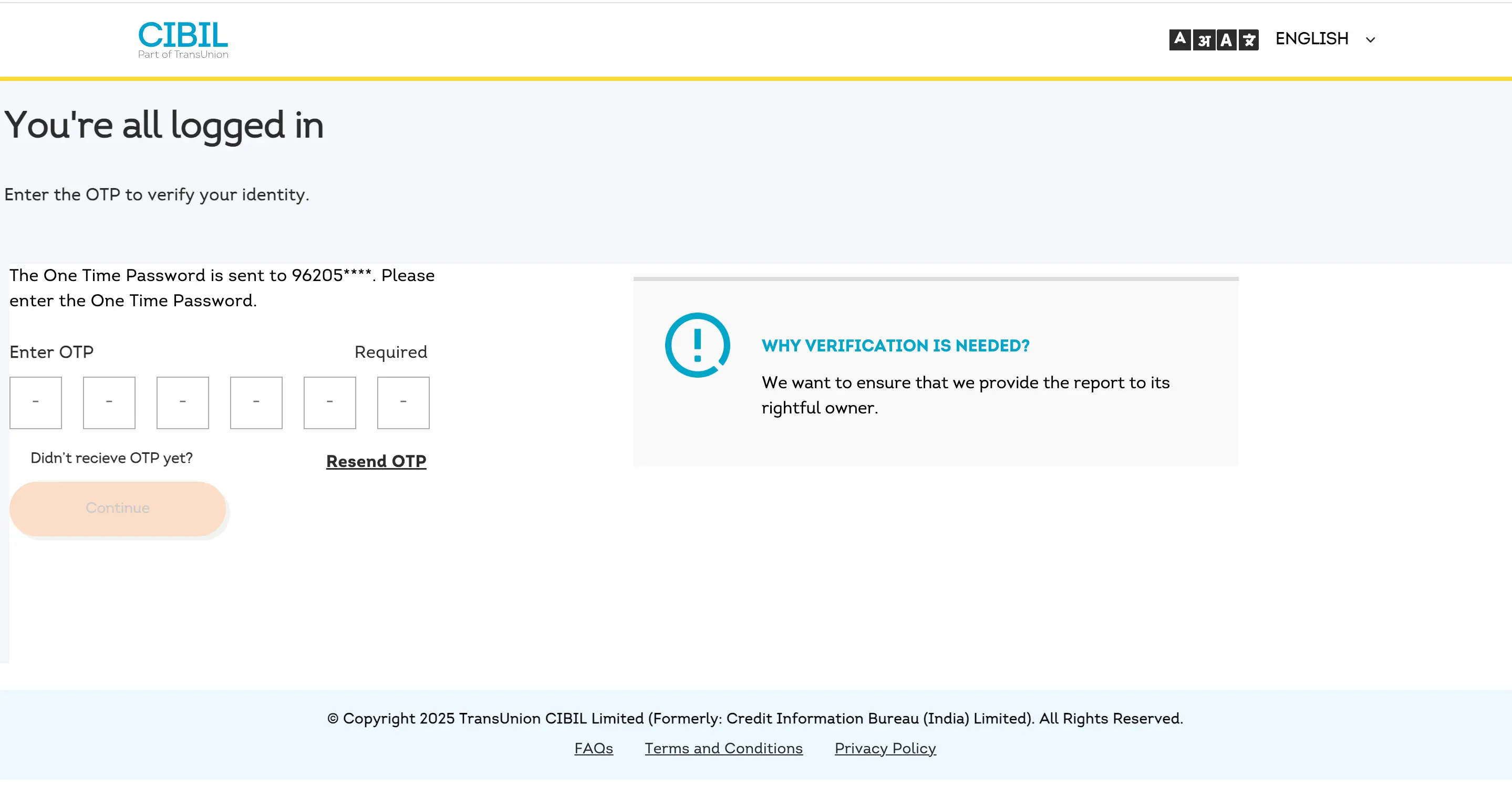

- Verify Your Identity via OTP

- An OTP (One Time Password) will be sent to your registered mobile number.

- Enter the OTP and click Continue.

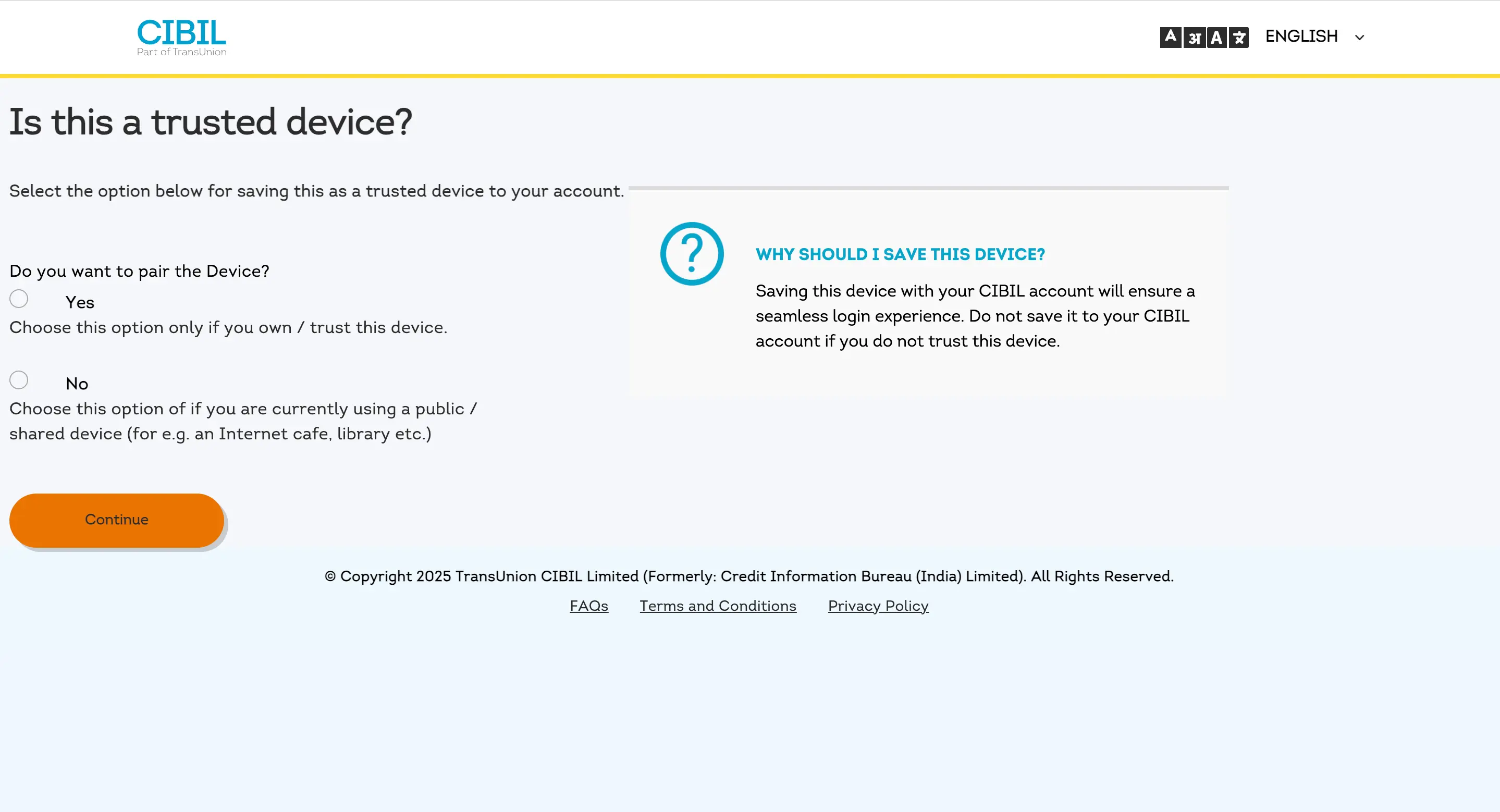

- Confirm Trusted Device (Optional)

- Select Yes if it's your personal device for faster future logins.

- Choose No if you're using a shared/public device. Click Continue.

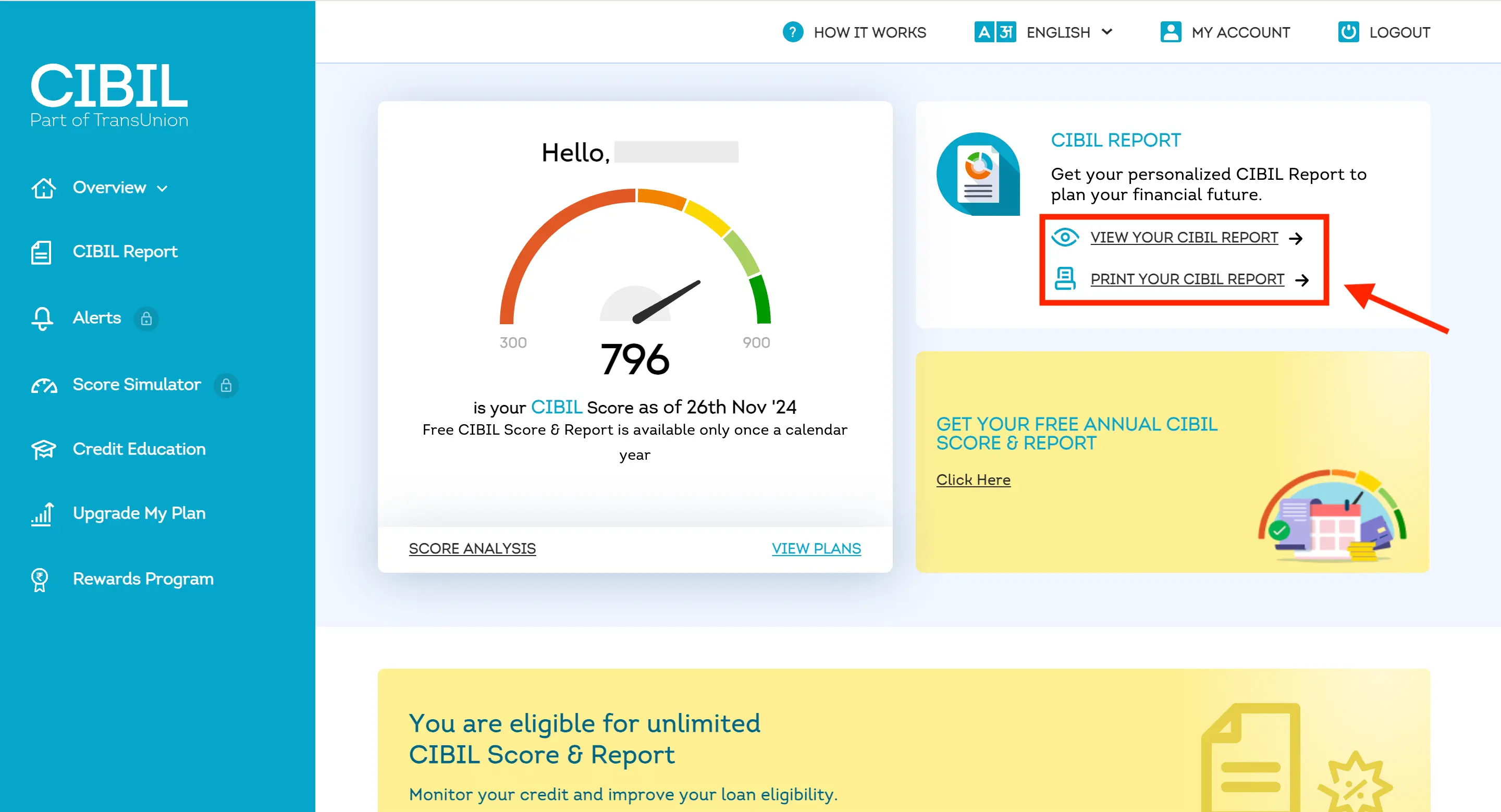

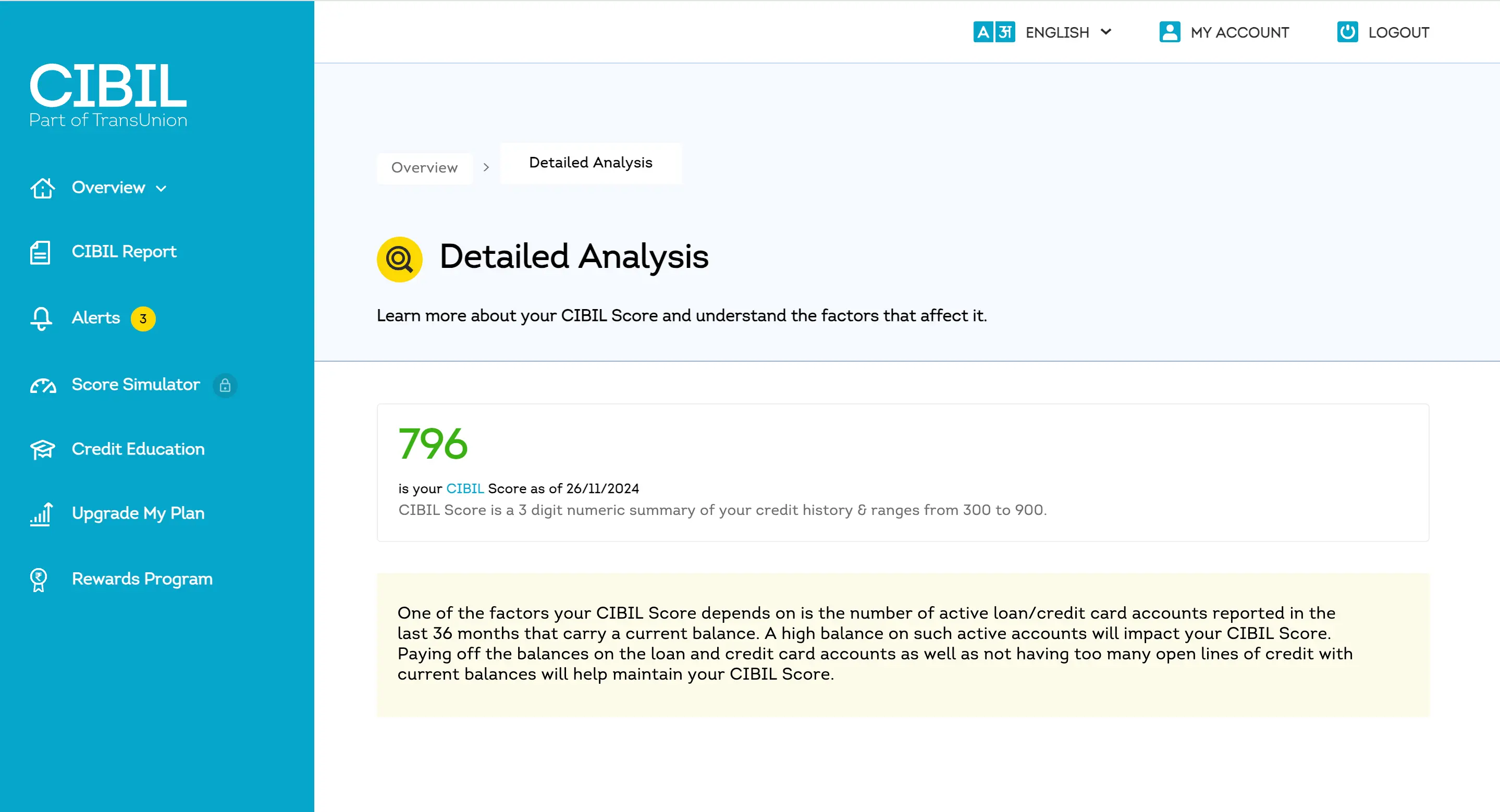

- View Your CIBIL Report: Once logged in, your CIBIL Score will be displayed on the dashboard.

- Click on View Your CIBIL Report for detailed credit history.

- Download Your CIBIL Report: Click on Print Your CIBIL Report to download and save it as a PDF.

Don't know your credit score? You can find out for free!

CIBIL Report PDF Password

Your downloaded CIBIL PDF Report is protected with a password. Use the following format to unlock it:

Password Format: First four letters of your name (in uppercase) + Your birth year.

Example: If your name is Ajay Kumar and your birth year is 1990, the password is AJAY1990.

Recover Forgot CIBIL User ID

If you forget your CIBIL User ID, follow these steps to recover it:

- Go to the CIBIL login page.

- Click on ‘Forgot User ID’.

- Enter your registered email address and any requested identification details (e.g., PAN).

- Submit the details to receive your User ID via your registered email.

Importance of CIBIL Report

Your CIBIL Report serves as a comprehensive credit profile, essential for various financial purposes.

- Loan Approvals: Lenders assess your report to decide on loan approvals.

- Interest Rates: A good score helps secure loans at lower interest rates.

- Creditworthiness: Demonstrates your repayment behavior and credit responsibility.

- Dispute Resolution: Use the Dispute Center to rectify inaccuracies in your report.

- Personalized Offers: Access personalized loan and credit card offers based on your score.

- Financial Health: Helps you manage and improve your credit profile.

Features & Components of a CIBIL Report

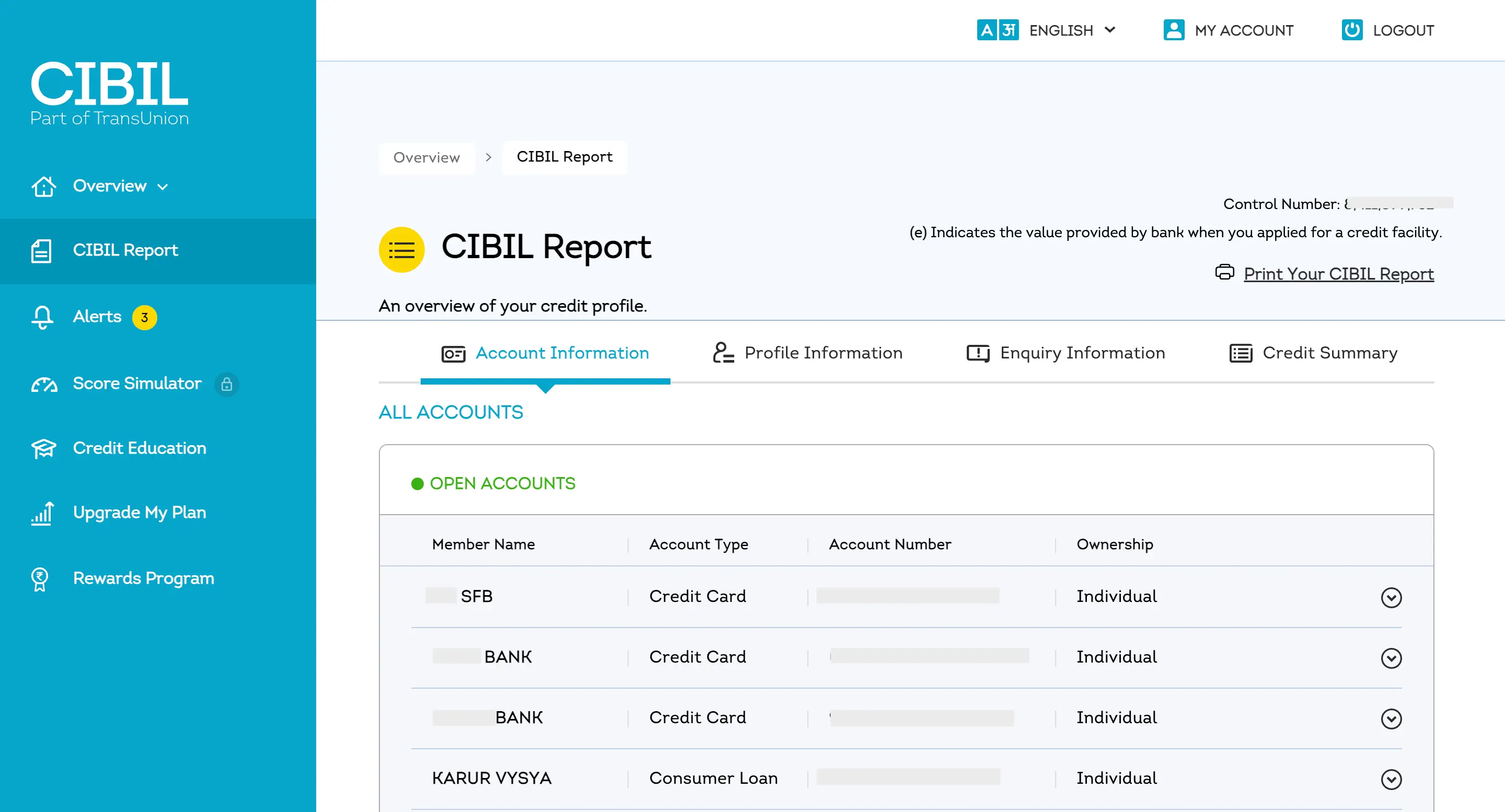

Your CIBIL Credit Report is divided into several key sections, each offering detailed insights into different aspects of your credit profile. Understanding these components helps you manage your credit health and ensures lenders can accurately evaluate your creditworthiness.

Features & Components of a CIBIL Report

| Section | Description |

|---|---|

| CIBIL Score | A 3-digit score (300-900) that reflects your creditworthiness. A higher score improves loan approval chances. |

| NA/NH Status | Indicates no credit history or recent activity. |

| Score Calculation | Based on credit accounts and inquiries. |

| Personal Information | Contains name, date of birth, gender, and identification details (PAN, passport, voter ID, etc.). Accuracy is crucial. |

| Contact Information | Lists residential, official, permanent, and temporary addresses, along with phone numbers and email addresses. |

| Employment Information | Records occupation type (salaried/self-employed) and income details provided during loan applications. |

| Credit Accounts Information |

Provides a detailed record of loans and credit cards, including:

|

| Credit Enquiry Information |

Tracks lender inquiries when applying for loans.

|

Read More

Read Less

Get Zero Annual Fee Credit Cards in one click.

CIBIL Score Range

Your CIBIL Score is a 3-digit number ranging between 300 and 900, which reflects your creditworthiness. Here’s a breakdown of the different score ranges and what they mean for your financial health.

| CIBIL Score Range | Creditworthiness |

|---|---|

| 550 and below | Bad |

| 550 - 649 | Poor |

| 650 - 699 | Average |

| 700 - 749 | Good |

| 750 - 900 | Excellent |

Key Terms in a CIBIL Report

Understanding the key terms in your CIBIL Report helps you interpret your credit information accurately. Here’s a detailed table of important terms and their meanings.

| Term | Meaning |

|---|---|

| Cash Limit | The maximum cash amount you can withdraw using your credit card. |

| Amount Overdue | The total outstanding amount that hasn’t been paid to the lender by the due date. |

| NA/NH | NA means no credit activity; NH means no credit history to be scored. Indicates inactivity for a few years. |

| DPD (Days Past Due) | The number of days a payment is overdue. Any figure above zero is negative for your credit score. |

| Written-Off Amount | Total principal and interest amount, the lender has marked as unrecoverable after 180 days of non-payment. |

| Written-Off and Settled Status | Indicates that the borrower partially paid the dues, or the lender wrote off the unpaid amount. |

| SMA (Special Mention Account) | An account flagged for potential sub-standard status due to repayment issues. |

| CN (Control Number) | A unique reference number for identifying your credit report and resolving disputes. |

| Repayment Tenure | The duration over which a loan must be repaid. |

| SUB (Sub-standard) | Loan or credit card payments overdue by more than 90 days. |

| LSS (Loss) | Accounts where the loss has been identified and deemed unrecoverable. |

| DBT (Doubtful) | Accounts that remain in sub-standard status for 12 months. |

| Actual Payment Amount | The amount actually paid to the lender, which may differ from the EMI amount. |

| Current Balance | The outstanding balance on a loan or credit card account. |

| STD (Standard) | Indicates timely credit payments or payments made within 90 days of the due date. |

Not sure of your credit score? Check it out for free now!

Types of Loans That Impact Your Credit Score

Different types of loans can influence your credit score in various ways. Here's a detailed breakdown:

| Loan Type | Impact on Credit Score |

|---|---|

| Home Loan | Regular repayments improve your credit score and enhance your credit mix. Being a secured loan, it demonstrates financial stability. |

| Personal Loan | As an unsecured loan, defaults can significantly damage your score. Timely repayment is essential to maintain a good score. |

| Auto Loan | Consistent payments help build and maintain your score. This secured loan reflects responsible debt management. |

| Credit Card | High utilization (above 30%) can lower your score. Timely payments and low utilization help maintain and boost your score. |

Benefits of Checking Your CIBIL Report Regularly

Regularly reviewing your CIBIL Report ensures your credit profile stays accurate and healthy.

- Identify Errors: Spot and dispute inaccuracies quickly.

- Monitor Credit Health: Keep track of your repayment behavior and outstanding debts.

- Prevent Fraud: Detect unauthorized loans or activities early.

- Plan Financial Goals: Improve your score and achieve better loan terms.

- Better Loan Offers: Higher scores qualify for lower interest rates.

Check CIBIL Score & Get Credit Report Without PAN Card

If you prefer not to use your PAN Card, you can check your CIBIL Score using other identity documents:

- Visit www.cibil.com and click on ‘Get Your Free CIBIL Score’.

- Enter your email address (which will serve as your username) and create a strong password.

- Provide your full name and select an identification document from the ‘ID Type’ drop-down menu. You can choose from the following alternatives to a PAN Card: Passport, Voter ID, Ration Card, Driver’s License

- Input the number of the identification document you selected.

- Enter your date of birth, PIN code, state, and mobile number.

- Click on ‘Accept and Continue’ to proceed with identity verification.

- Follow the on-screen instructions to verify your identity (e.g., by entering an OTP sent to your registered mobile number).

- Once verified, your CIBIL Score and report will be displayed. You can download the report for free.

Tips for Maintaining a Healthy Credit Score

Follow these tips to ensure your credit score remains strong.

- Pay EMIs on Time: Timely payments positively impact your score.

- Keep Credit Utilization Low: Use less than 30% of your credit limit.

- Maintain a Credit Mix: Balance secured (home loan) and unsecured (personal loan) credit.

- Limit Credit Applications: Too many inquiries can lower your score.

- Check Your Report Regularly: Identify and dispute errors promptly.

CIBIL Customer Care

For any queries or assistance related to your CIBIL Report, CIBIL Score, or related services, you can reach out to CIBIL Customer Care for support.

Registered Office:

TransUnion CIBIL Limited

One Indiabulls Centre, Tower 2A, 19th Floor,

Senapati Bapat Marg, Elphinstone Road,

Mumbai – 400 013.

Telephone: 022-6140-4300

Email: cibilinfo@transunion.com

Do you need an emergency loan?

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

Frequently Asked Questions

You can check your CIBIL Report for free by visiting the official CIBIL website at www.cibil.com and selecting ‘Get Free CIBIL Score’. You are entitled to one free credit report per year from CIBIL.

To download your CIBIL Report, use PAN Card or other IDs like Passport or Voter ID.

Yes, you can download your CIBIL Report for free once a year through the official CIBIL website. Additional reports within the same year may incur a fee.

You can download your CIBIL Report for free once per year. For additional downloads within the same year, you may need to subscribe to a paid plan.

No, you must register or log in on the official CIBIL website to download your CIBIL Report. Registration requires basic details like your PAN Card number, email ID, and phone number.

Visit www.cibil.com, click 'Get Free CIBIL Score,' register/login, verify, access/download report.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users