The e-PAN Card is an electronic version of the Permanent Account Number (PAN) card issued by the Indian government. It's a vital financial document used for various transactions, tax filing, and identification purposes in India. In this guide, you’ll find everything you need about the e-PAN Card, from eligibility, instant & easy access, benefits, and application to download.

Instant e-PAN Card: You can quickly apply for and receive an e-PAN card within 10 minutes if you have a valid Aadhaar number. Those without a PAN card can apply for a free instant e-PAN card on the Income Tax website. To convert your ePAN to a physical PAN card, visit the TIN-NSDL or UTIITSL website.

Table of Contents:

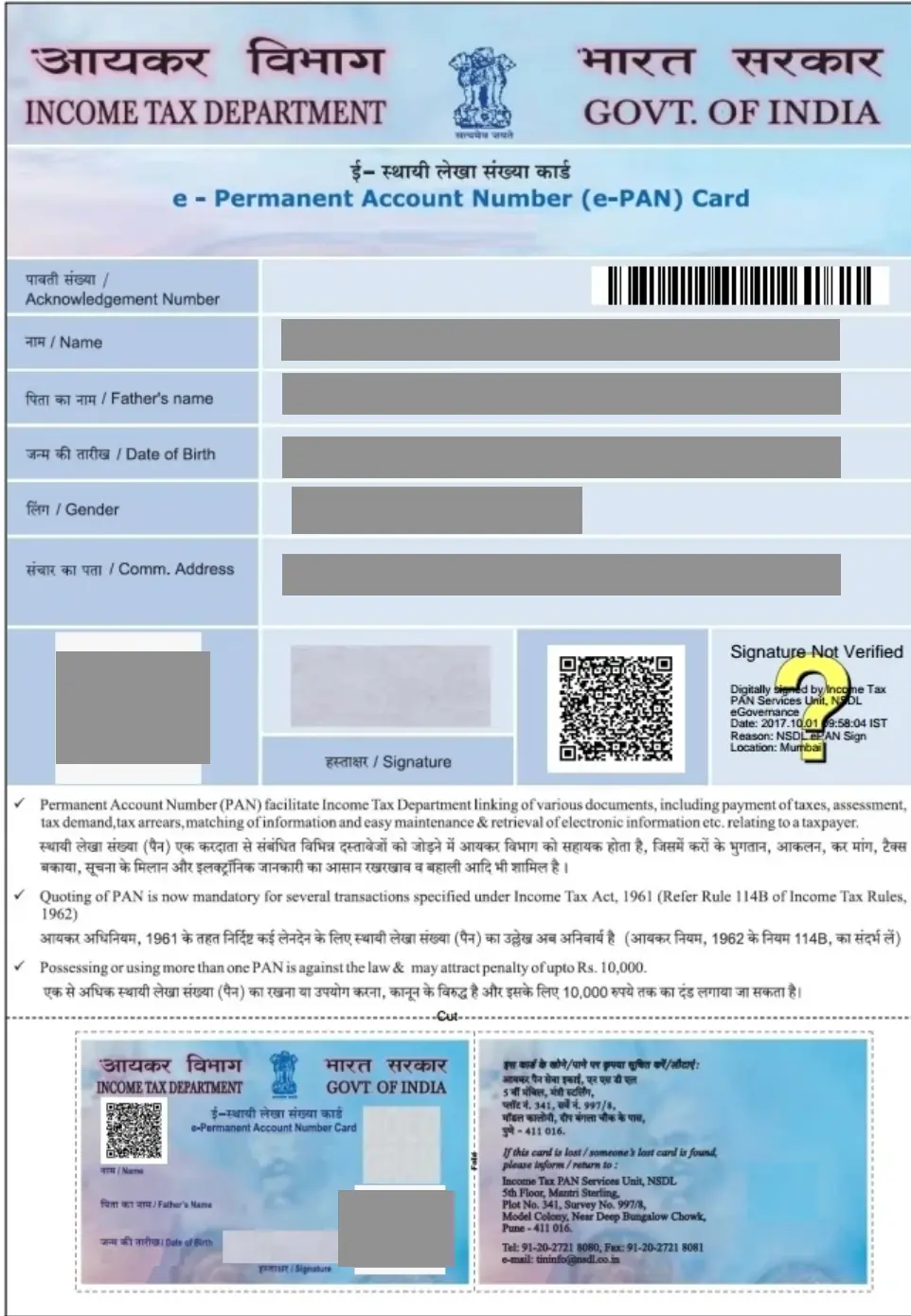

e-PAN Card Sample

Eligibility Criteria for e-PAN Card

To apply for an e-PAN Card, you must meet the following eligibility criteria:

- Indian Citizenship: Only Indian citizens are eligible to apply for an e-PAN.

- Age Limit: There is no specific age limit, but minors can apply through a guardian.

- Aadhaar Number: A valid Aadhaar number is essential for applying online.

- No Existing PAN: You must not have an existing PAN card, as having more than one PAN is illegal.

Are you looking for a personal loan?

Steps to Apply for ePAN Card

Applicants can apply for an e-PAN card through the NSDL or UTIITSL websites, or opt for an instant e-PAN card via the Income Tax website. Here’s a concise overview of the application process:

Apply for ePAN through NSDL or UTIITSL:

- Step 1: Visit the NSDL or UTIITSL website.

- Step 2: Choose the option to apply for an 'e-PAN card' instead of a physical PAN card during the application.

- Step 3: Fill in the required details on the PAN application form.

- Step 4: Upload the necessary documents and submit the form.

- Step 5: Pay the applicable fees and obtain the acknowledgement number.

- Step 6: The e-PAN card will be sent to the applicant’s registered email.

Apply Instant e-PAN Card on Income Tax Portal

- Step 1: Go to the Income Tax e-Filing portal and login.

- Step 2: Select the ‘Instant e-PAN’ option on the homepage.

- Step 3: Enter your Aadhaar number and the OTP received on your registered mobile number.

- Step 4: Submit the application.

- Step 5: The e-PAN card will be emailed to the applicant.

Steps to Check e-PAN Card Status

Once you have applied for the e-PAN Card, you can check the status of your application by following the steps below:

- Visit the official website: Go to the NSDL or UTIITSL website where you applied and check your status.

- Enter Acknowledgment Number: Input the acknowledgment number received during application submission.

- Submit Details: Click on 'Submit' to view the current status of your e-PAN application.

- View Status: The status will display whether your application is pending, approved, or rejected.

You can check the status of your instant e-PAN card on the Income Tax e-Filing portal by entering your Aadhaar number and OTP.

Don't know your credit score? You can find out for free!

Steps to Download e-PAN

Once the e-PAN card is processed and generated, applicants will receive it via email. If you can't find the email or have deleted it without saving the e-PAN card, you can download it directly from the NSDL or UTIITSL website. Here’s how to do it:

- Step 1: Visit the NSDL or UTIITSL website to download the e-PAN.

- Step 2: Enter the required information, such as your acknowledgement number or PAN and date of birth.

- Step 3: Input the OTP.

- Step 4: Pay the applicable fees (if downloading the e-PAN after 30 days of allotment).

- Step 5: Click on ‘Download e-PAN’.

To access the e-PAN card PDF, you need to enter a password. This password is your birthdate formatted as 'DDMMYYYY'. For example, if your birthday is January 5, 1990, you would enter '05011990' to unlock the document. Once the correct password is entered, you can view and use your e-PAN card.

Steps to Print e-PAN Card

Individuals can request a reprint of their e-PAN card to obtain a physical copy. When a reprint is requested, the printed PAN card will be delivered to the applicant's residential address. Follow these steps to reprint your PAN card:

- Step 1: Visit the NSDL or UTIITSL website.

- Step 2: Enter Required Information: Fill in your PAN, Aadhaar number, date of birth, GSTIN (if applicable), and the captcha code, then submit the form.

- Step 3: Verify Your Identity: Enter the OTP sent to your registered mobile number.

- Step 4: Make Payment: Pay the necessary fees and submit your request.

- Step 5: Receive Your Card: The printed PAN card will be sent to your address.

e-PAN Card Fees

Instant e-PAN cards from the Income Tax e-filing portal are free. However, there are fees for e-PAN cards applied through the NSDL or UTIITSL websites, as detailed below:

| Application Method | Fee (Including Taxes) |

|---|---|

| Income Tax e-filing portal | No fee |

| NSDL or UTIITSL website (online, paperless) | ₹66 |

| NSDL or UTIITSL website (physical document submission) | ₹72 |

Want to know more? Check out other PAN related topics from links below:

| Know Your PAN | PAN Card Fraud |

| Apply for PAN Card | Update PAN Card |

| PAN Card Application Status | Link PAN with Aadhaar |

| PAN Card Customer Care | Link PAN to Bank Account |

If you are looking for more information on different PAN card loans, feel free to check out the links below:

Do you need an instant loan?

Frequently Asked Questions

You can download your e-PAN card from the official income tax department website by entering your PAN number and other required details.

Yes, obtaining an e-PAN card is free of cost if you apply through the Income Tax e-filing portal.

A PAN (Permanent Account Number) card is a unique identifier issued by the income tax department for tax purposes. An e-PAN card is a digital version of the PAN card that can be downloaded online.

You can request an e-PAN by applying online through the official income tax department websites.

Typically, you need to provide proof of identity, proof of address, and a passport-sized photograph. Documents can include Aadhaar, voter ID, or passport.

You can verify your e-PAN card on the income tax department website by entering your PAN number and other required details.

Benefits include easy access to your PAN details, quick verification, and the ability to use it for various financial transactions without carrying a physical card.

You can link your e-PAN with your Aadhaar through the income tax department's website by providing your Aadhaar number and PAN details.

If you lose your e-PAN card, you can download a new copy from the income tax department's website using your PAN number.

Yes, an e-PAN card is accepted as a valid proof of identity for various purposes, including financial transactions and government services.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users