A PAN (Permanent Account Number) card is an essential document for any Indian taxpayer. It's required for various financial transactions, including filing income tax returns, buying or selling property, and opening bank accounts. If your PAN card is lost, or damaged, or you need a fresh copy, you can apply for a PAN card reprint.

This webpage provides detailed information about the process, eligibility, required documents, charges, and methods to apply for a PAN card reprint.

Eligibility For PAN Card Reprint: Anyone who has been issued a PAN card by the Income Tax Department of India is eligible to apply for a reprint, provided they have their PAN details available. This includes individuals, companies, and entities such as trusts and partnerships.

Table of Contents:

- ⇾ Reasons For PAN Card Reprint

- ⇾ Documents For PAN Card Reprint

- ⇾ Charges For PAN Card Reprint

- ⇾ Ways To Apply For PAN Card Reprint

- ⇾ 1. Through Protean or the Income Tax Department Website

- ⇾ 2. Through UTIITSL's website

- ⇾ PAN Application Contact Details

- ⇾ Surrendering Multiple / Duplicate PAN Card

- ⇾ Key Factors To Consider When Filling PAN Card Reprint Form

- ⇾ Frequently Asked Questions

Reasons for PAN Card Reprint

There are several reasons why one might need to reprint their PAN card:

- Loss or Theft: If the PAN card is lost or stolen, a reprint is necessary.

- Damage or Wear: Over time, the PAN card might get worn out, making the details unreadable.

- Updates or Corrections: If any corrections are required on the card, such as name changes or address updates, a reprint might be needed.

Are you looking for a personal loan?

Documents for PAN Card Reprint

The documents required for a PAN card reprint depend on the application method. However, generally, you'll need:

- ID proof: Aadhaar card, Voter ID, Driving License, Passport (copy self-attested)

- Address proof: Aadhaar card, Bank statement/passbook, Utility bill (copy self-attested)

- Proof of Date of birth: Birth certificate, School leaving certificate (applicable only for Individuals and Karta of HUF)

- Two recent passport-size photographs.

PAN Card Reprint Fee & Charges

The charges for reprinting a PAN card vary depending on the mode of application and the delivery address:

| Dispatch Location | Fee (inclusive of taxes) |

|---|---|

| Within India | ₹50 |

| Outside India | ₹959 |

Ways to Apply for PAN Card Reprint Online

There are multiple ways to apply for a PAN card reprint, including online and offline methods. Given below are the detailed steps to apply for a PAN card reprint online:

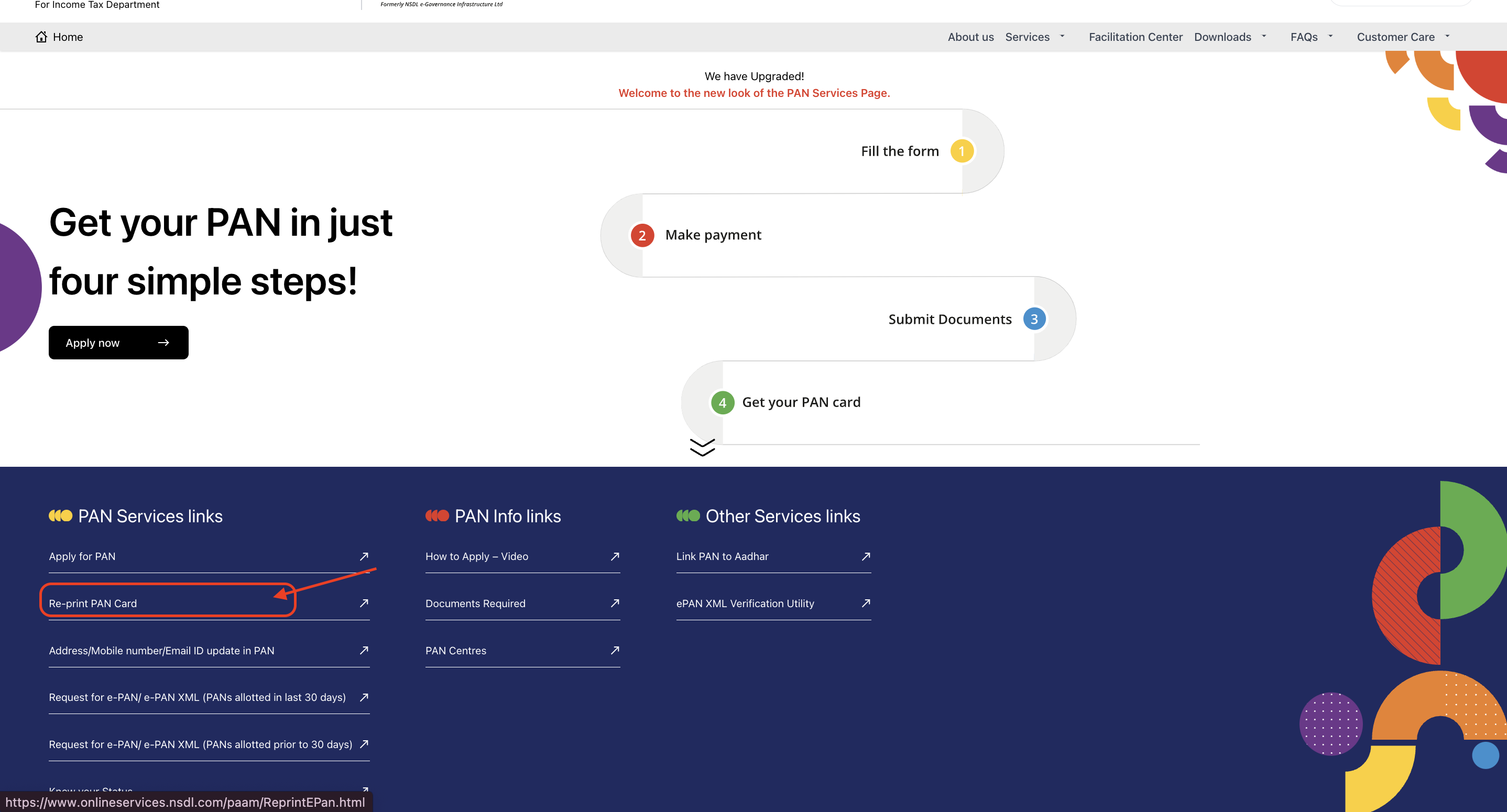

Apply through Protean or Income Tax Portal

This option is the quickest and most affordable, perfect if your most recent PAN application was processed by Protean eGov Technologies Ltd. (formerly NSDL e-Gov) or acquired through the Income Tax Department's "Instant e-PAN" service.

- Step 1: Visit the official PAN & Tax Information Network Services For the Income Tax Department website click on the ‘Re-print PAN Card’ option.

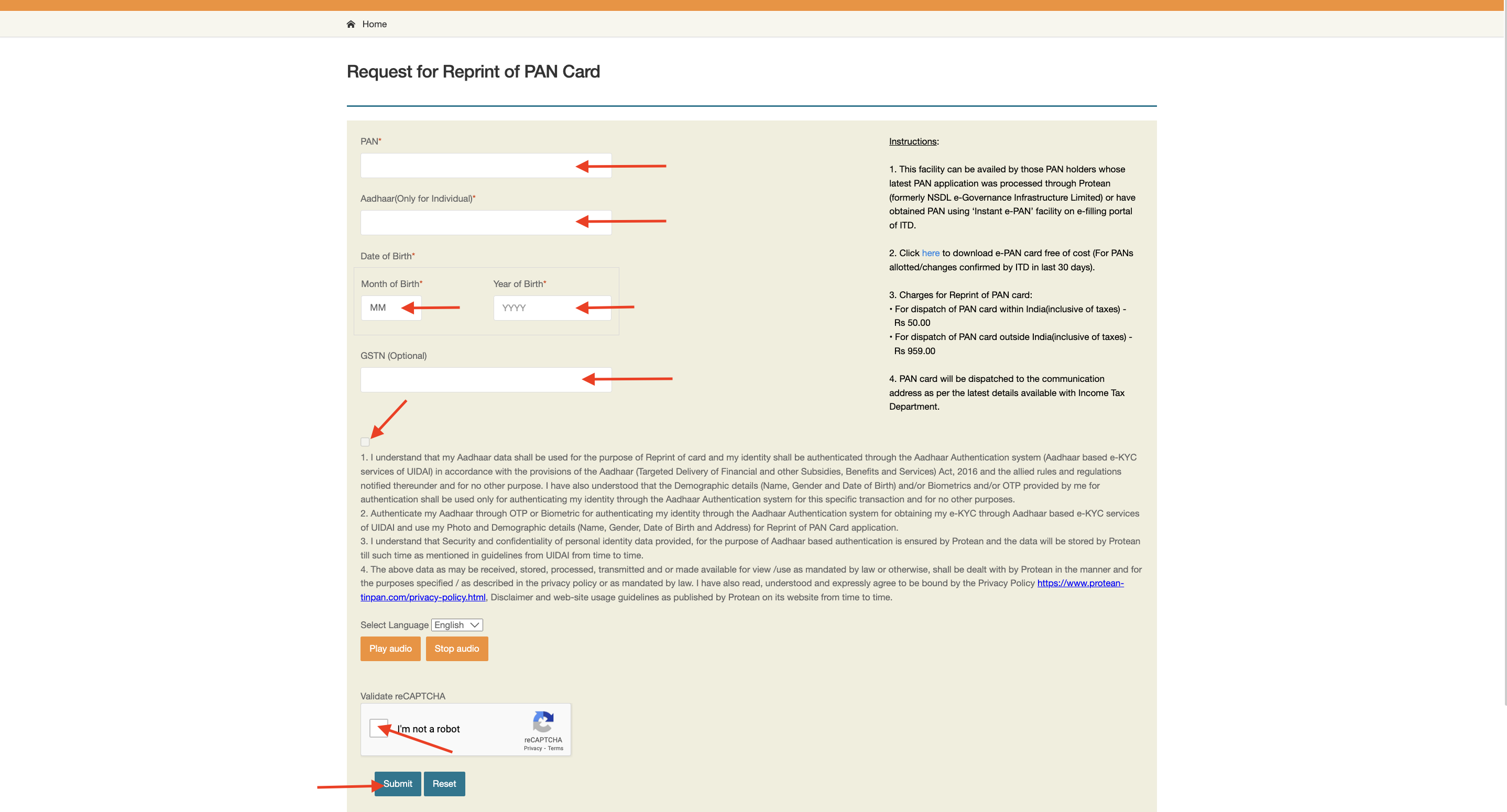

- Step 2: You will be redirected to the next page ‘Request for Reprint of PAN Card’ website.

- Step 3: Fill in the required details, including your PAN number, Aadhaar number, date of birth, and GSTN (optional).

- Step 4: Click the checkbox after reading the terms and conditions.

- Step 5: Verify the reCAPTCHA by clicking the checkbox and then Click on ‘Submit’.

- Step 6: Make the payment of ₹50 (for an Indian address) or ₹959 (for a foreign address) using debit/credit card or net banking.

- Step 7: Your reprinted PAN will be dispatched to your registered address within 15-20 working days.

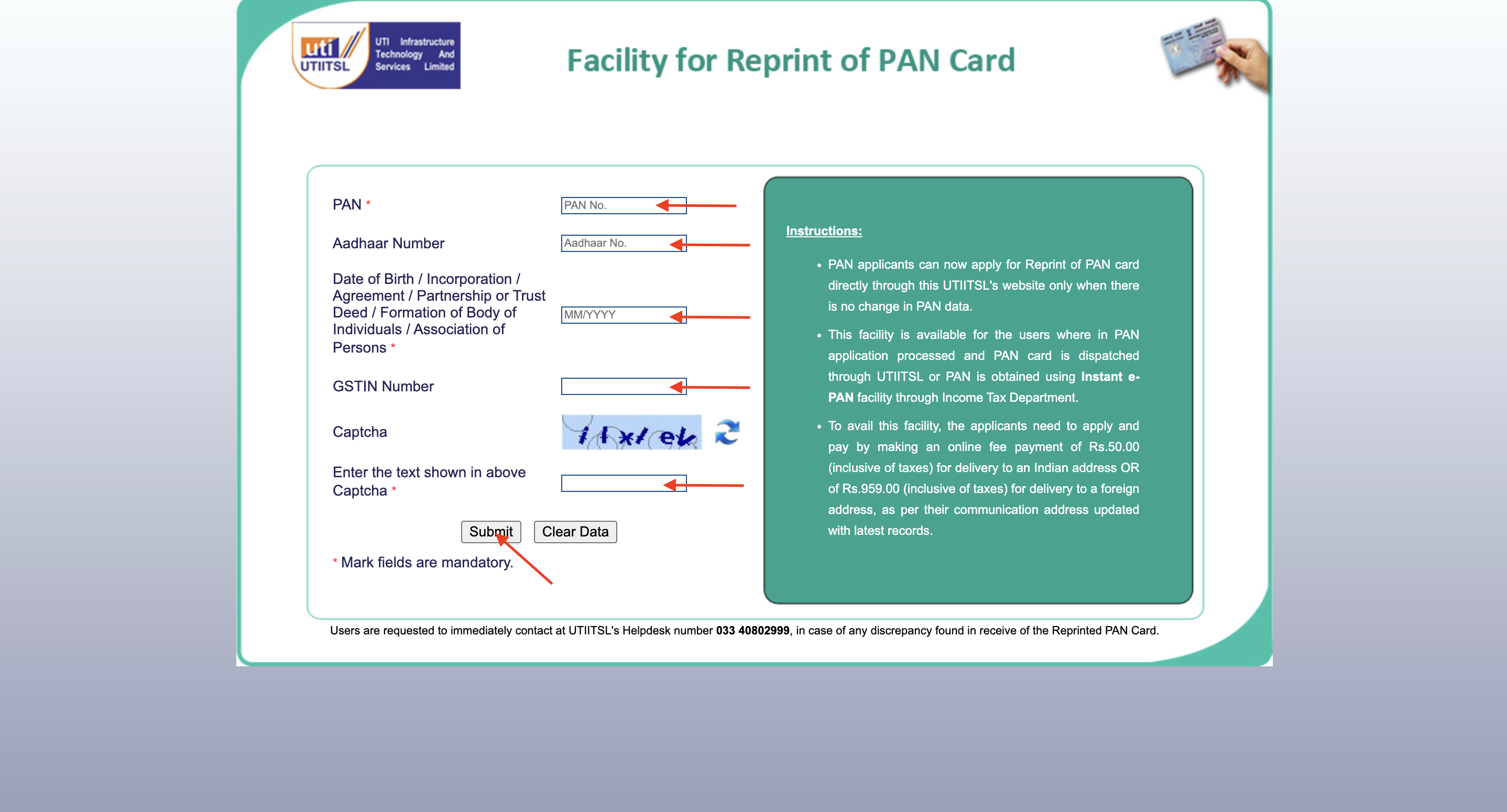

Apply through UTIITSL's Portal

Applicants for PAN can request a reprint of their card directly through the UTIITSL website as long as there are no changes to the PAN data. This service allows users to apply for a PAN card through UTIITSL or get an Instant e-PAN from the Income Tax Department. Here’s how:

- Step 1: Visit the UTIITSL website: Go to the UTIITSL website to access the PAN card reprint facility.

- Step 2: Fill in the required details: On the application form, provide the following information:

- PAN Number

- Aadhaar Number

- Date of Birth/Incorporation/Agreement/Partnership or Trust Deed/Formation of Body of Individuals/Association of Persons (MM/YY format)

- GSTIN Number (if applicable)

- Step 3: Enter the captcha code: Type the text displayed in the captcha image into the designated field.

- Step 4: Submit the application: Click on the "Submit" button to proceed with your application.

- Step 5: Make the payment: You will be directed to make an online payment of ₹50 for delivery within India or ₹ 959 for delivery to a foreign address.

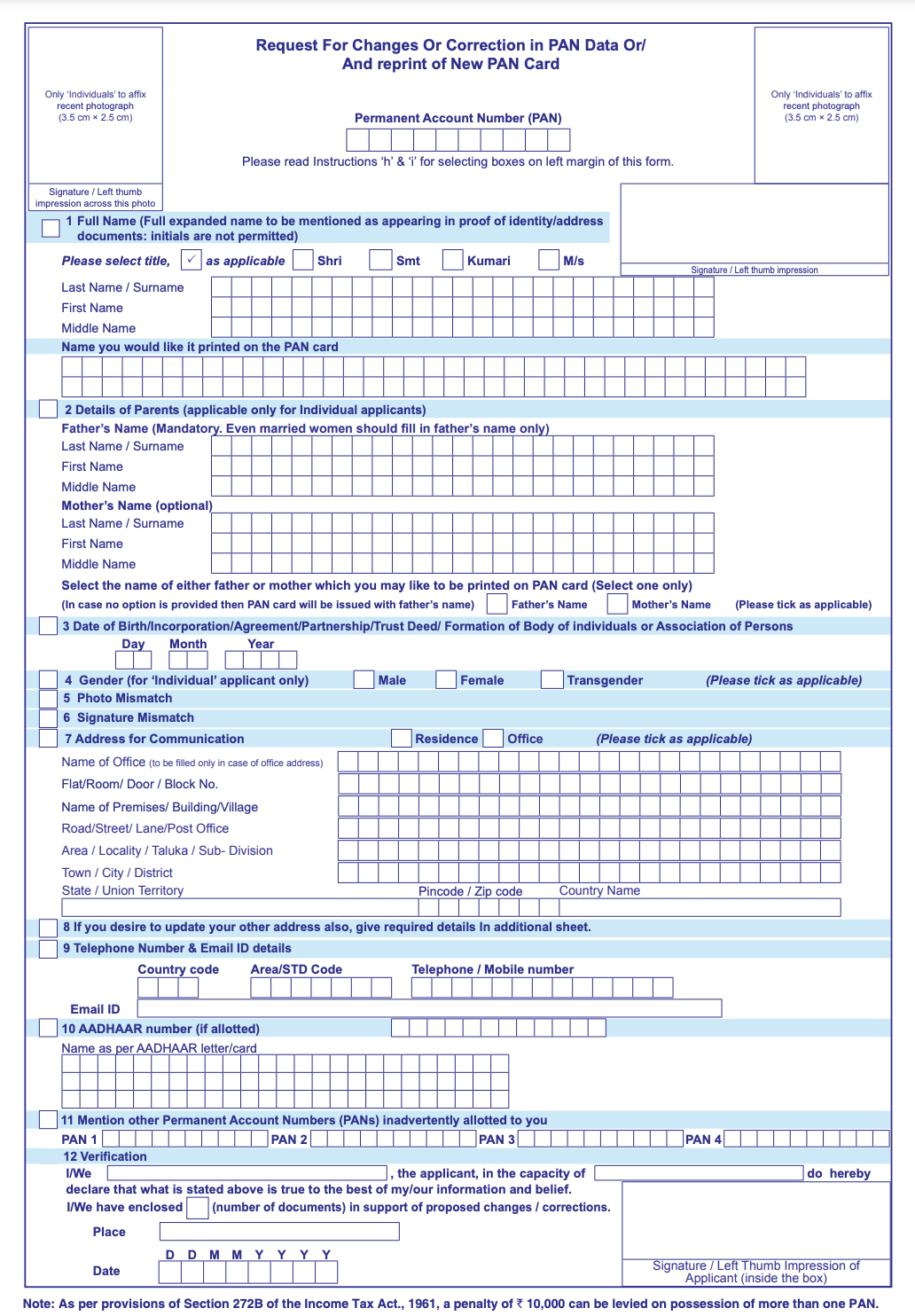

Apply for PAN Reprint Offline

- Step 1: Download the PAN Change Request Form for Correction, Addition, Deletion, or Reprint of PAN Data Form.

- Step 2: Complete the form manually with all the required details by following the instructions given in the Form.

- Step 3: Attach copies of the required documents. (The detailed documents required are mentioned in the PDF form)

- Step 4: Submit the completed form and document copies along with a demand draft payable to “Protean eGov Technologies Ltd,” at the address specified on the Form.

- Step 5: Your reprinted PAN will be delivered to the specified address within 15-20 working days.

If you have lost your PAN card, you need to file an FIR and then submit it to the NSDL office along with the required documents, the application form, and the reprint form.

Don't know your credit score? You can find out for free!

PAN Application Contact Details

If you need more information or want to check your PAN reprint application status, you can choose the below mentioned methods to contact. Here's how:

Income Tax Department:

- Website: https://www.incometax.gov.in/iec/foportal/

- Call Center: 1800-180-1961

Protean:

- Website: https://www.protean-tinpan.com/

- Call Center: 020-27218080

- Email: tininfo@proteantech.in

Track Application Status via SMS:

- Type "PTNPAN" followed by your 18-digit PAN acknowledgment number (e.g., PTNPAN 881010101010100).

- Send the SMS to 57575.

Income Tax PAN Services Unit Address:

INCOME TAX PAN SERVICES UNIT (Managed by Protean eGov Technologies Limited (formerly NSDL e-Governance Infrastructure Limited)) 4th Floor, Sapphire Chambers, Baner Road, Baner, Pune 411045

Surrendering Multiple / Duplicate PAN Card

Holding multiple Permanent Account Numbers (PAN) is prohibited under income tax regulations. Individuals may unintentionally receive duplicate PAN cards, whether with the same number or different ones.

Here’s how to resolve the issue of duplicate or incorrect PAN cards:

- Draft a Letter: Write to your assessing officer, including your full name, date of birth, details of the PAN card you wish to retain, and information about the PAN card you want to surrender.

- Submit the Letter: You can either send the letter via speed post or deliver it in person to the assessing officer.

- Get an Acknowledgement: Make sure to obtain an acknowledgement receipt as proof of the cancellation of the duplicate PAN card.

Key Factors to Consider When Filling PAN Card Reprint Form

When applying for a PAN card reprint, it's essential to ensure that the application process goes smoothly. Here are some key factors to keep in mind:

- Accuracy of Information: Double-check all the information you provide on the form. Any discrepancies can lead to delays or rejection of your application.

- Correct PAN Number: Ensure that you enter your existing PAN number correctly. This is crucial for retrieving your details from the database.

- Required Documents: Gather all necessary documents before starting the application. This includes identity proof, address proof, and any other relevant documents.

- Contact Information: Provide a valid phone number and email address. This will facilitate communication regarding your application status.

- Payment Method: Choose a secure and reliable payment method for online applications. Keep the transaction receipt as proof of payment.

- Online vs. Offline Application: Decide whether you want to apply online or offline. Online applications are generally faster and more convenient.

- Tracking Application Status: After submission, note down any application reference number provided. This will help you track the status of your reprint request.

Besides PAN card reprint, you can check out other PAN related topics from the links below:

| Know Your PAN | PAN Card Fraud |

| Apply for PAN Card | Update PAN Card |

| PAN Card Application Status | Link PAN with Aadhaar |

| PAN Card Customer Care | Link PAN to Bank Account |

Do you need an instant loan?

Frequently Asked Questions

You can apply for a PAN reprint online through the official websites of Protean eGov Technologies Limited or the Income Tax Department. Select the "Reprint PAN Card" option, and follow the instructions on the screen.

The required documents include proof of identity (such as an Aadhaar card or passport), proof of address (such as utility bills or bank statements), and proof of PAN (existing PAN card or PAN allotment letter).

If applied online, the reprinted PAN card is typically dispatched within 15 working days. The digital PAN card via the instant e-PAN facility can be received within minutes.

Yes, the fee for PAN reprint is approximately ₹50 for delivery within India and ₹959 for delivery outside India.

Yes, you can track the status of your PAN reprint application online using the acknowledgment number provided after submission.

If the reprinted PAN card has incorrect details, you need to apply for a correction/update by filling out the correction form available on the official PAN service websites.

Yes, you can update your address while applying for a PAN reprint. Ensure to provide the correct address proof documents.

PAN reprint is for cases where there is no change in PAN details, and only a new card is needed. PAN correction is for cases where there are changes or updates needed in the PAN details, such as name change or address update.

To get a duplicate PAN card, apply for a reprint using the same process described above. Provide your PAN details and necessary documents to get a duplicate card issued.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users