The Employees' Provident Fund Organisation (EPFO) portal allows you to easily manage your PF account, whether you are an employee, employer, or pensioner. Logging in allows you to keep track of your PF balance through your passbook, make a withdrawal claim, track your claims and update your personal details.

The EPFO login helps you regularly access your account where you can be proactive about managing the contributions. Helping you manage your retirement savings and ensuring that it aligns with your financial goals.

Table of Contents:

Steps for EPFO Login as Employee

The EPFO employee login allows you to access your PF account in a convenient and easy way. By logging in you can access various features of your PF account, thereby, helping you manage it efficiently. The login process is easy, just follow the steps given below:

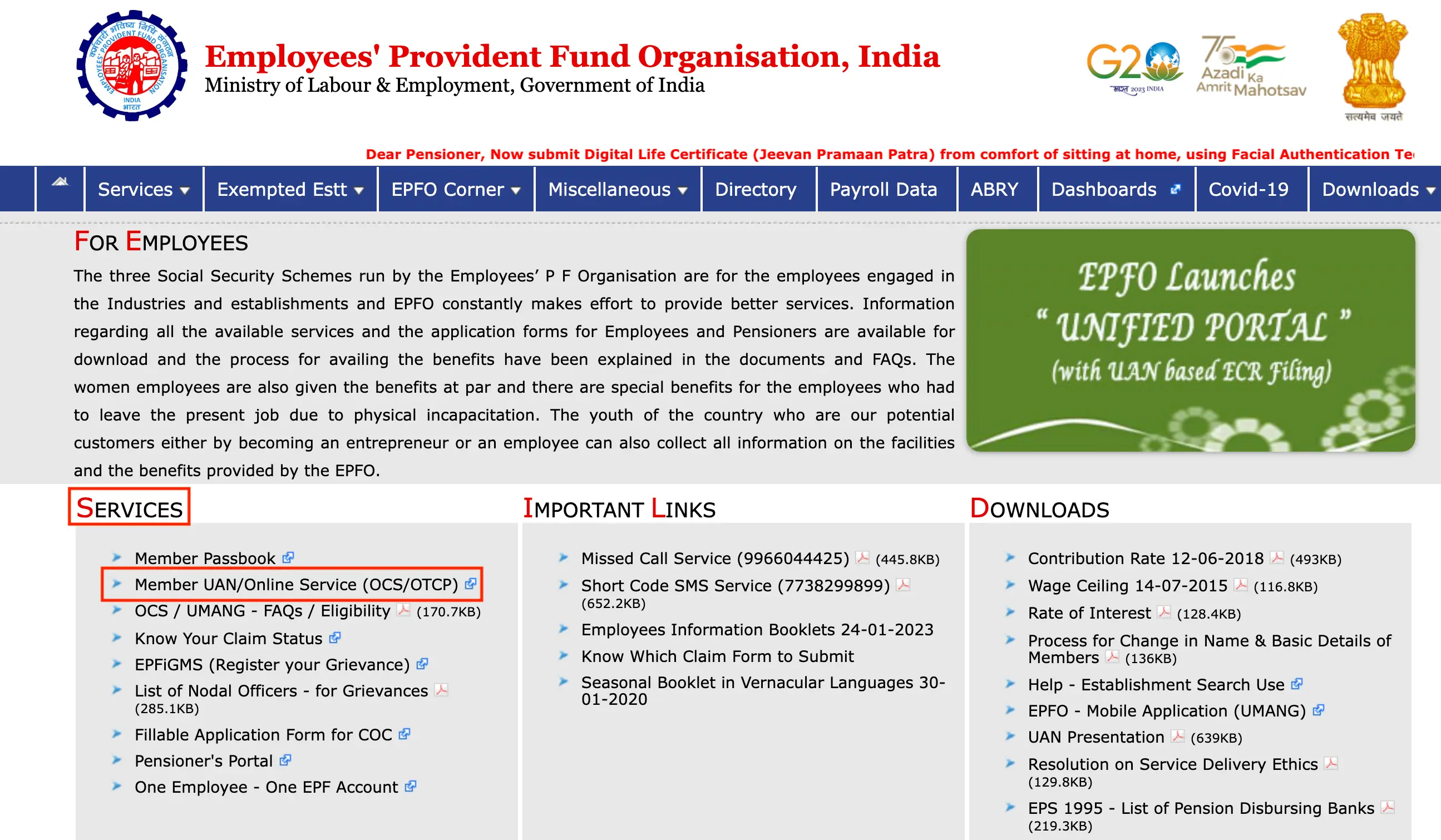

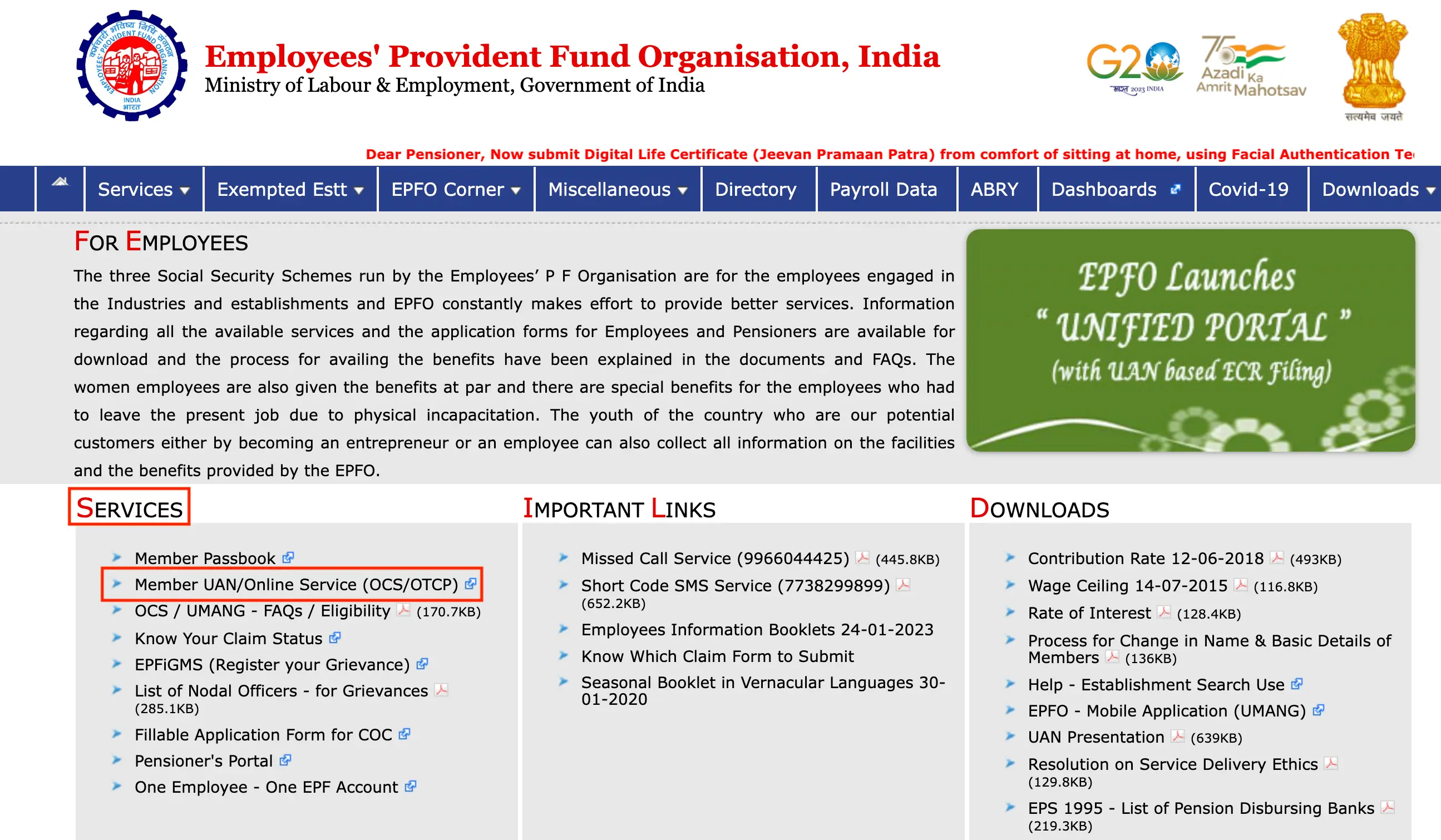

Step 1: Visit the official EPFO website - https://www.epfindia.gov.in

Step 2: Under the ‘Services’ section, you can select ‘For Employees’.

Step 3: Then you can click on ‘Member UAN/ Online Service (OCS/OTCP)’

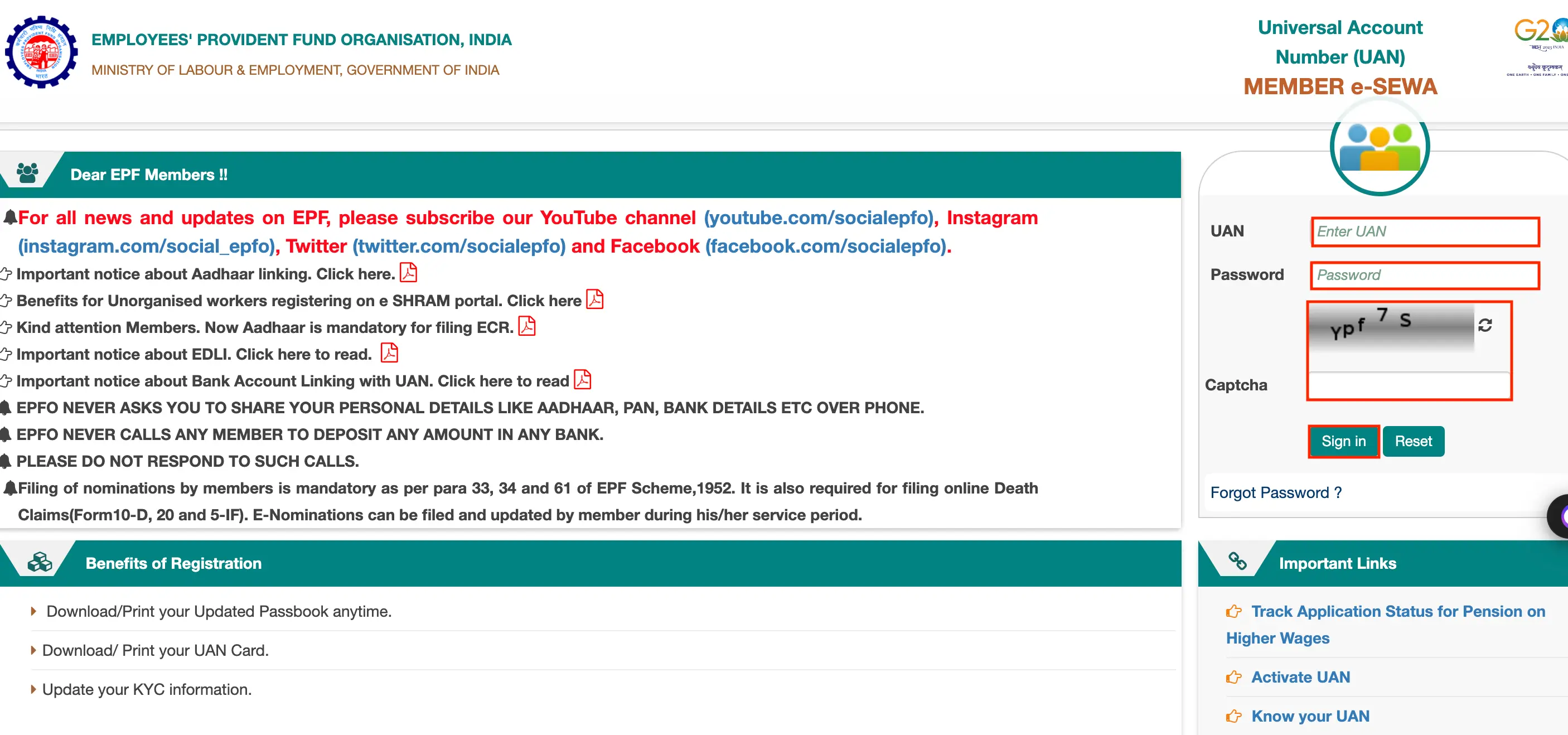

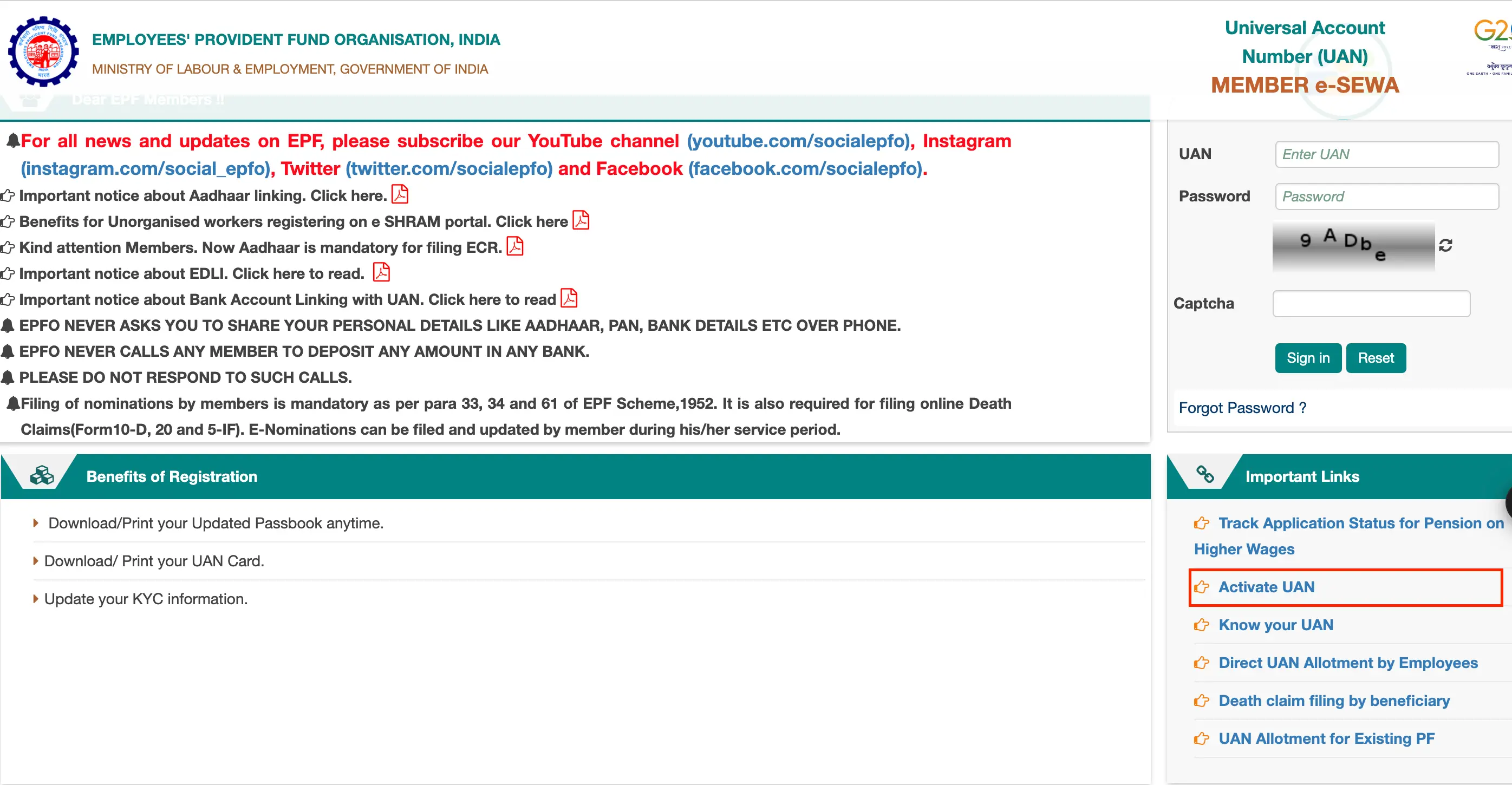

Step 4: Here you will need to enter your UAN, password and the captcha code.

Step 5: You can then click ‘Sign In’.

Are you looking for a personal loan?

Steps to Find Your UAN

In case you do not know your UAN, you can find it out through the EPFO website. Here are the simple steps you can follow to find your UAN:

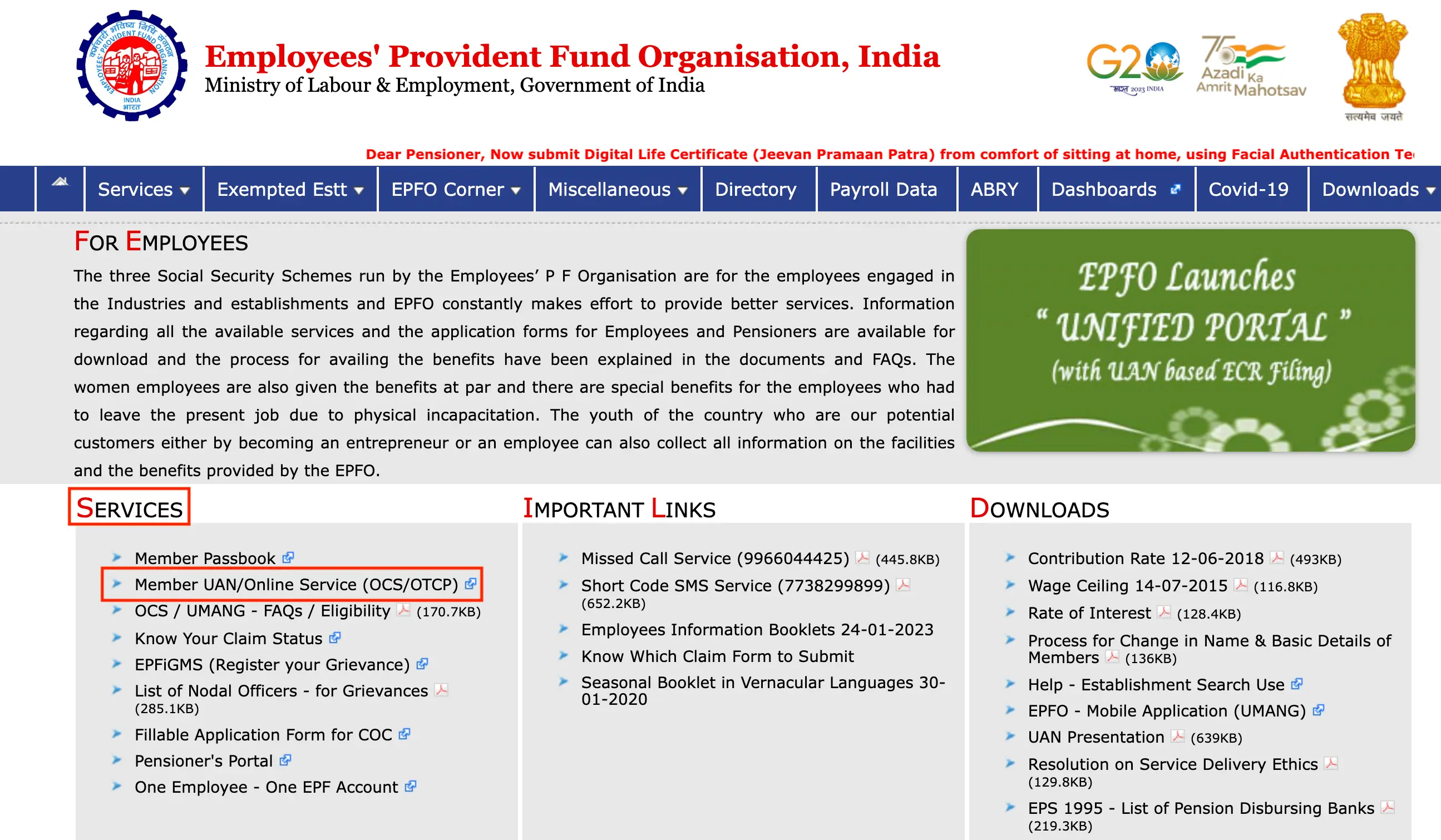

Step 1: Visit the EPFO official website - https://www.epfindia.gov.in

Step 2: Select ‘Member UAN/Online Services (OCS/OCTP)’ option from the ‘Services’ tab.

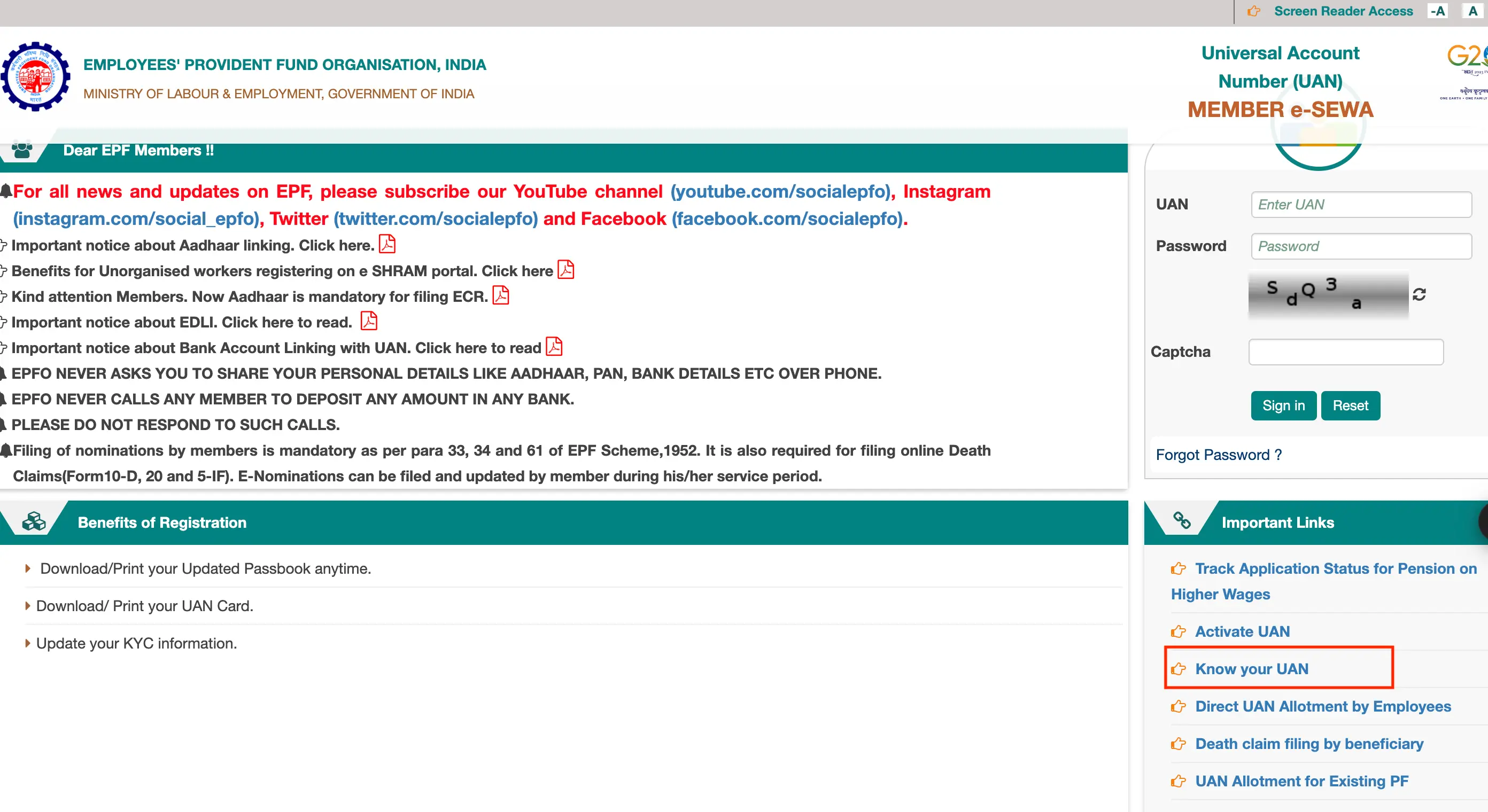

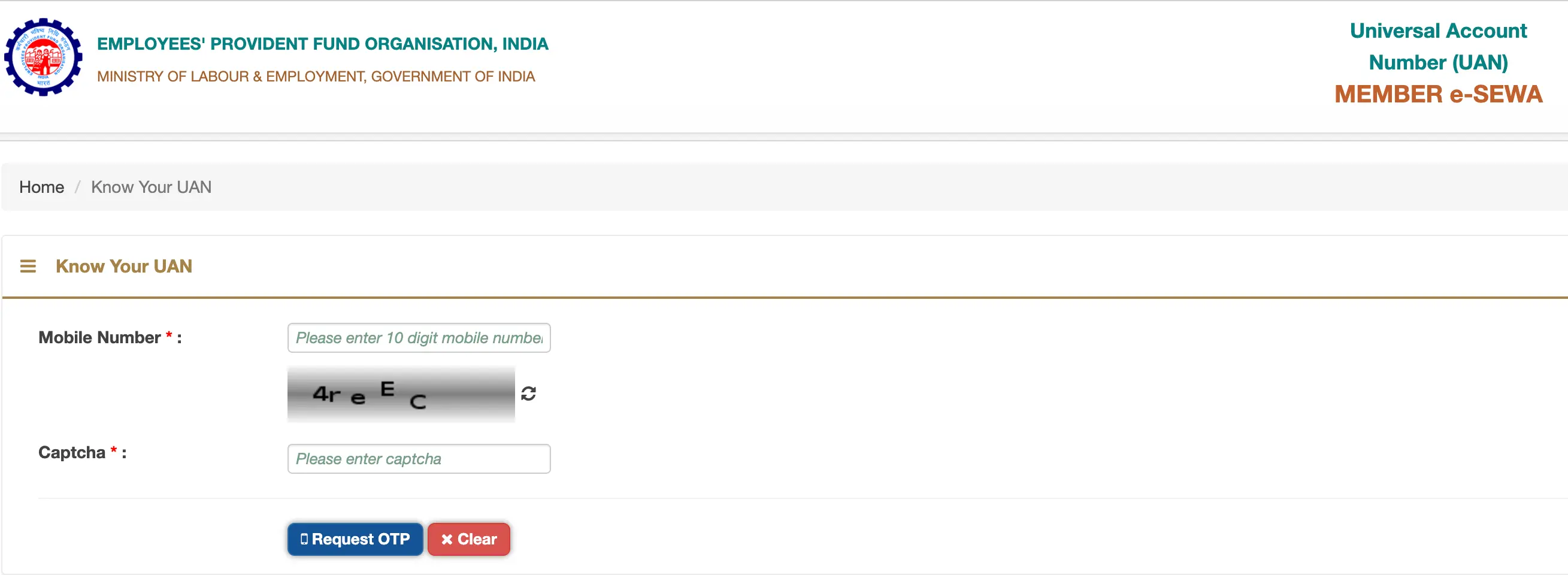

Step 3: Click on ‘Know Your UAN’ .

Step 4: Enter your mobile number and captcha code. Then enter your OTP.

Step 5: Enter your name, date of birth, select Aadhaar, PAN or Member ID option then enter the number of your selected ID.

Step 5: Enter the captcha code and click on ‘Show UAN’. It will be displayed on the screen.

Not sure of your credit score? Check it out for free now!

Steps to Activate UAN Online

After receiving your UAN, you can check if it is activated or not. To do so, you can visit the website and follow the steps given below:

Step 1: You can visit the EPFO website - https://www.epfindia.gov.in/site_en/For_Employees.php

Step 2: Under the ‘Our Services’ tab click on ‘Member UAN/Online Service (OCS/OTCP)’

Step 3: Click on ‘Activate UAN’

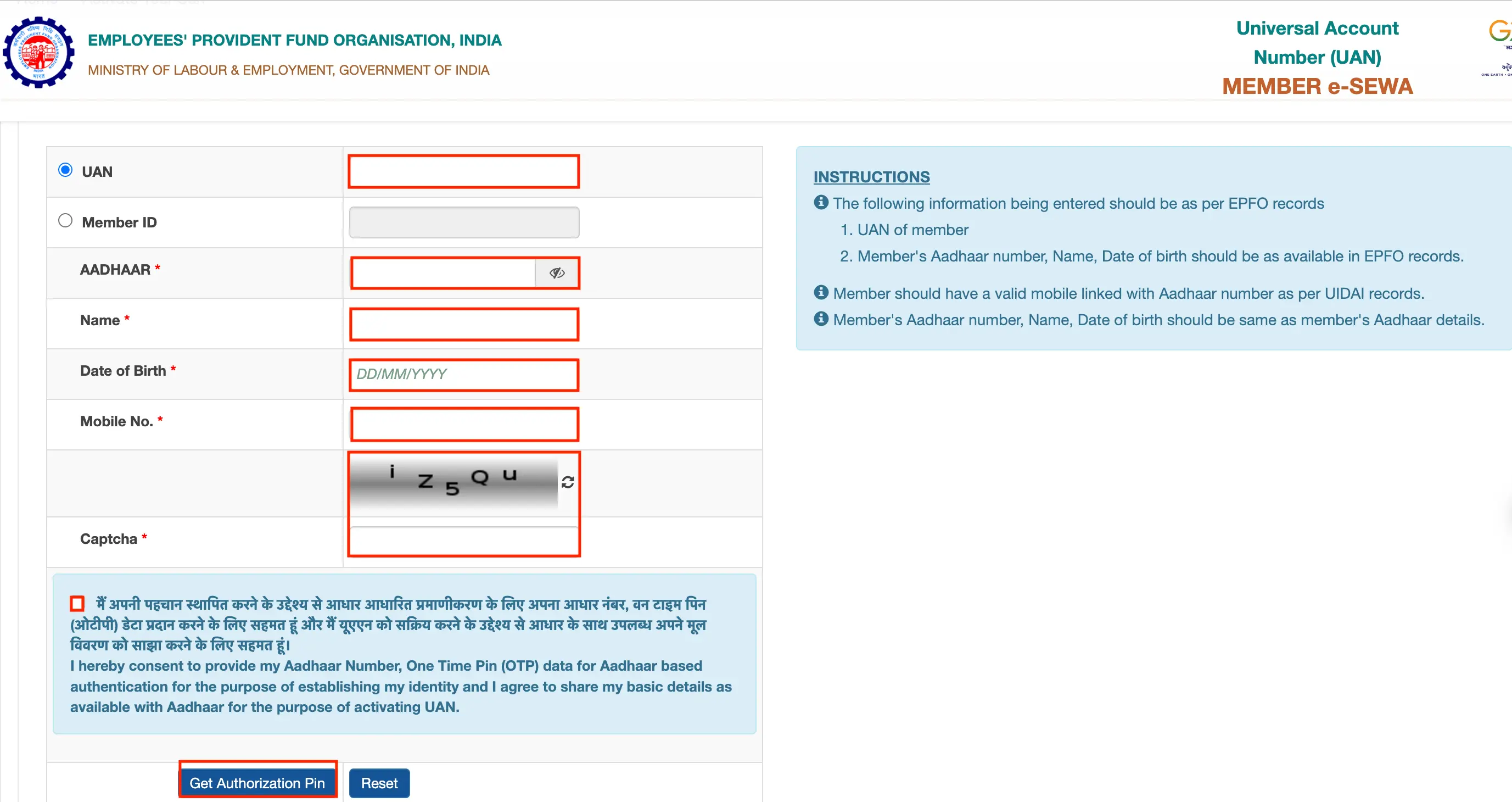

Step 4: Enter your UAN, Aadhaar, Name, Date of Birth, Mobile Number and captcha code.

Step 5: Give your consent for usage of Aadhaar for OTP generation by clicking the checkbox.

Step 6: Click on ‘Get Authorisation Pin’

Step 7: Once verified you will see the status of your UAN activation.

Do you need an instant loan?

Steps for EPFO Login as Employer

As an employer, you can manage the contributions to your employee’s provident fund through EPFO login. As an employer you can file returns, make monthly contributions, and ensure compliance with EPF regulations. Regularly logging in to your EPFO can help you maintain accurate records and stay up to date with regulatory requirements. Here are the steps you can follow for EPFO employer login:

Step 1: Visit the EPFO website - https://www.epfindia.gov.in

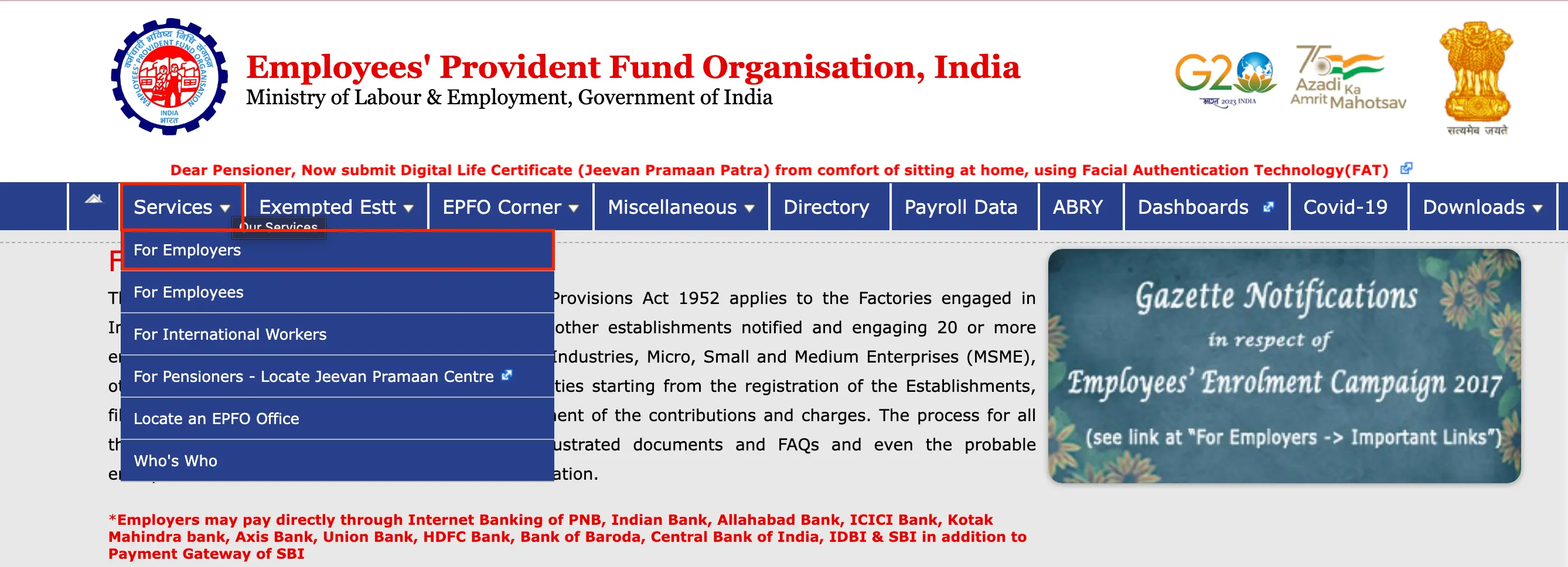

Step 2: From the ‘Services’ drop down menu, click on ‘For Employers’.

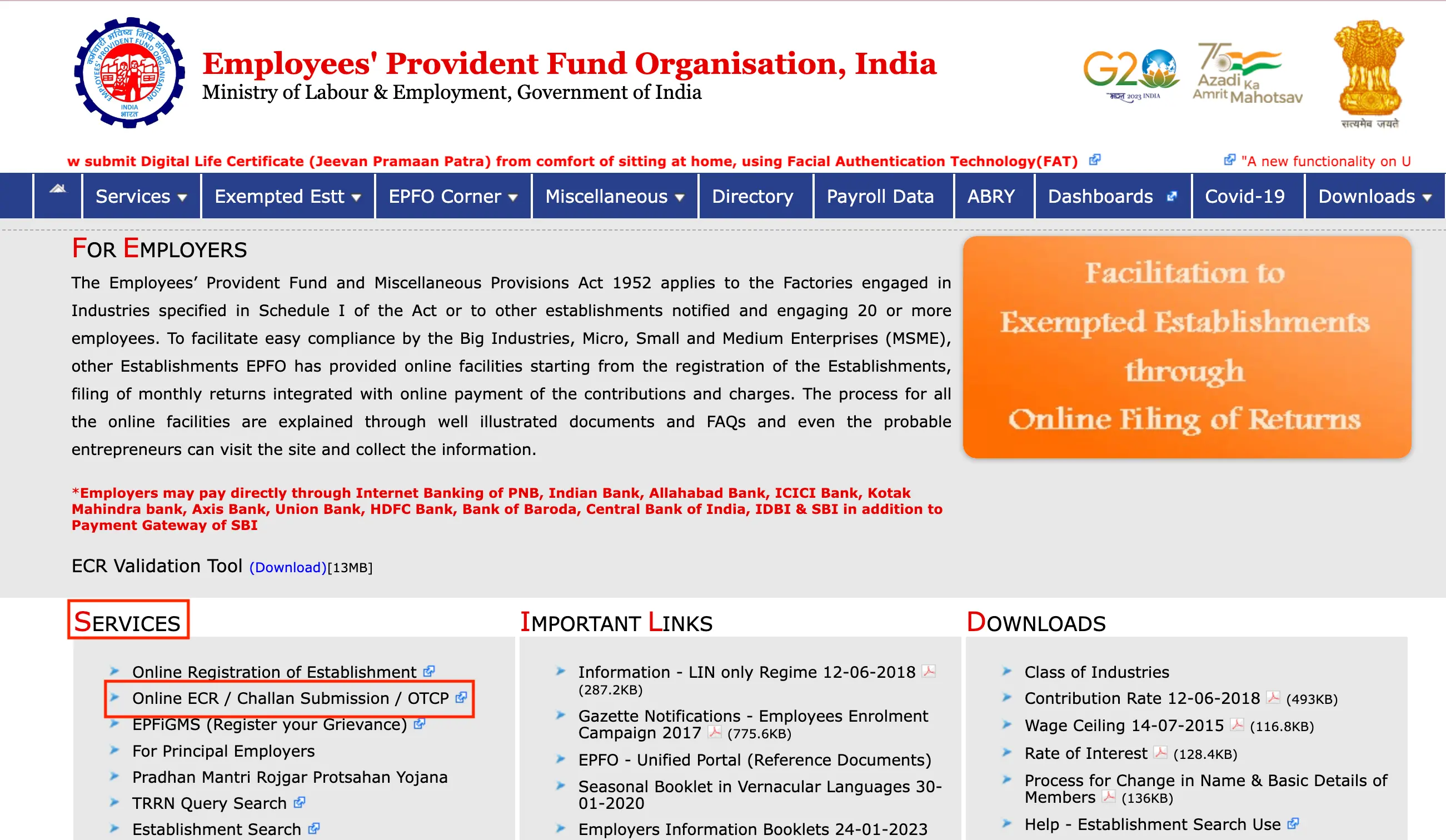

Step 3: Click on ‘Online ECR/Challan SUbmission/ OTCP’

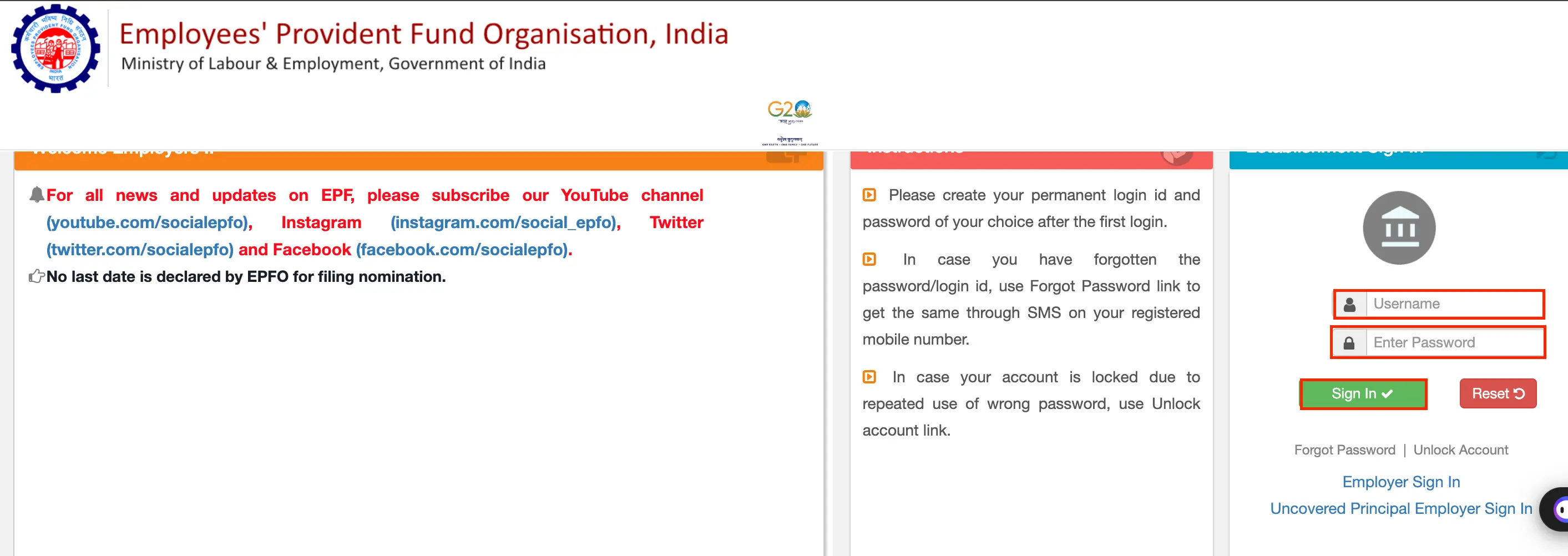

Step 4: Enter your User name, password and then click ‘Sign In’.

EPFO Services

The EPFO login portal offers a wide range of services that cater to the needs of employers, employees, and pensioners. By logging in, any individual can access specific services that help manage their PF accounts effectively.

EPFO Services for Employer

Employers have several responsibilities related to the management of their employees' provident fund accounts. The EPFO portal provides the following services to simplify these tasks:

- Electronic Challan cum Return (ECR) Filing: Employers can file ECRs online, ensuring that employee contributions are accurately recorded and timely payments are made.

- Contribution Management: The portal allows employers to view and manage the monthly EPF contributions for all employees, ensuring compliance with statutory requirements.

- Employee Data Management: Employers can update and manage employee details, including joining and exit dates, and nominee information, to ensure accurate record-keeping.

- Generate Challans for Payment: Employers can generate challans for making EPF payments online, simplifying the payment process and ensuring timely remittance.

- Compliance Reports: They can access various compliance reports that help in monitoring adherence to EPF regulations especially EPF withdrawal rules and identifying areas that require attention.

- Transfer Requests: Employers can process transfer requests for employees moving to different organisations, ensuring that their EPF accounts are properly maintained.

EPFO Services For Employee

As an employee, you can usfore EPFO portal to manage your provident fund accounts, access your savings, and ensure their retirement planning is on track:

- PF Balance Check: Employees can log in to check their current PF balance, helping you stay informed about your retirement savings.

- Download EPF Passbook: You can access and download the EPF passbook to view a detailed history of contributions, interest earned, and any withdrawals made.

- Withdrawal Claims: You can submit claims for partial or full withdrawals from your EPF account for emergencies, home loans, or retirement.

- Update Personal Details: The portal allows you to update your personal details, such as contact information, nominee details, and bank account information.

- Track Claim Status: After submitting a withdrawal or transfer claim, you can track the status of your request in real-time.

- Link UAN with Aadhaar: Easily link your Universal Account Number (UAN) with Aadhaar for quick processing of claims and easier management of your EPF account.

EPFO Services for Pensioners

Pensioners can also benefit from the EPFO portal, allowing you to manage your pension accounts and ensure the smooth disbursement of your pension benefits:

- Pension Payment Details: You can view and manage details related to your monthly pension payments, ensuring that you receive your benefits on time.

- Submit Life Certificate: You can submit your annual life certificate online through the EPFO portal to continue receiving pension payments. This helps you avoid long cues during physical submissions.

- Track Pension Status: The EPFO login allows you to track the status of your pension disbursement and resolve any issues related to delayed payments.

- Update Pensioner Details: You can also conveniently update your personal details, such as address and bank account information, to ensure accurate and timely pension payments.

Beside checking EPFO Login, you can also check more about EPF from the table below:

Do you need an emergency loan?

Besides EPFO Login, you can also check more on different saving schemes from below:

Frequently Asked Questions

EPFO (Employee Provident Fund Organization) manages India's Provident Fund, ensuring retirement savings and financial security for employees.

You can log in to the EPFO portal by using a UAN, password and captcha along with your OTP.

You don't need to create an account; use your UAN and password to log in on the EPFO portal.

There is an option called ‘Forget password’ available at the end of your log in fields. You can click on it then follow the instructions given to create a new password.

Ye, you can easily change your EPFO login passwords.

After logging in, you will find a dropdown menu. There, click on the ‘Manage’ option then ‘KYC option.

You can check your EPF balance by logging in with your UAN, click on "View" in the menu, and select "Passbook" to check your EPF balance.

The EPFO portal offers balance checks, passbook downloads, withdrawal claims, UAN-Aadhaar linking, and personal detail updates.

You can download your EPF passbook by logging in to your account and downloading it from the ‘Member’s Passbook’

After logging in, you can click on After logging in, click on "Online Services," select "Claim (Form-31, 19, 10C)" to submit your EPF claim.

Use the "Forgot Password" option on the EPFO portal to reset your password and unlock your account.

You can link your aadhaar with your EPFO account by EPFO login, clock on ‘Manage’ and select KYC. There you can link your Aadhaar card.

To update your personal details on the EPFO portal, you can log in and select “Manage’ and click on KYC to modify the details. You will need your Aadhaar card for verification.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users