Before 2023, Indian taxpayers had the flexibility to choose between two tax regimes: the old tax regime and the newly introduced regime with lower tax rates. To opt for the new tax regime, taxpayers used Form 10IE, an electronic form that facilitated communication with the Income Tax Department.

Form 10IE assisted communication with the Income Tax Department regarding the chosen tax regime. It also gathered details on potential exemptions and deductions a taxpayer might be eligible for under the new system. However, most deductions and exemptions available under the old regime were no longer applicable to the new tax regime.

Table of Contents:

- ⇾ Importance of Form 10 IE for Taxpayers

- ⇾ Eligibility Criteria for Filing Form 10 IE

- ⇾ Conditions for Filing Form 10 IE

- ⇾ Step-by-Step Guide to Filling Form 10IE

- ⇾ Details Required for Form 10 IE

- ⇾ Part A: Personal Information

- ⇾ Part B: Declaration

- ⇾ Part C: Verification

- ⇾ Benefits & Drawbacks of Filing Form 10 IE

- ⇾ Common Mistakes to Avoid When Filing Form 10 IE

- ⇾ Frequently Asked Questions

Importance of Form 10 IE for Taxpayers

For taxpayers who wanted to benefit from the new tax slabs and structure, Form 10IE was mandatory before filing their Income Tax Return (ITR). The importance of Form 10 IE lies in its role in maintaining transparency and compliance with tax laws.

The table below presents the importance of Form 10 IE for taxpayers.

| Feature | Importance |

|---|---|

| Choosing Tax Regime | Form 10 IE (now replaced by Form 10 IEA) was crucial for opting for the New Tax Regime with lower tax rates. |

| Applicable Taxpayers | Only required for taxpayers with business/profession income (filing ITR-3 or ITR-4) who wanted the New Tax Regime (until FY 2022-23). |

| Not Required Anymore (New Regime Default) | From FY 2023-24, the New Regime is the default. You only need Form 10 IEA to opt out of the New Regime. |

| Submission Timing | Had to be filed electronically before filing your Income Tax Return (ITR). |

| Impact of Not Filing | Missing the deadline meant you couldn't choose the New Regime for that year. |

Are you looking for a personal loan?

Eligibility Criteria for Filing Form 10 IE

The eligibility criteria for filing Form 10 IE are important for taxpayers to understand, as they determine which individuals or entities are required or permitted to submit this document.

Here are the eligibility criteria for filling out Form 10 IE.

- Tax Regime Choice: For taxpayers who wish to choose the new tax regime can fill Form 10 IE.

- Income Source: It was applicable for individuals or HUFs because it targeted those filing ITR-3 (business income) or ITR-4 (profession income).

- Taxpayers filing ITR-1 (salary) or ITR-2 (capital gains, house property) could directly choose the new regime while filing their returns, without needing Form 10 IE.

Conditions for Filing Form 10 IE

Although Form 10IE was previously used to choose the new tax regime, the system has changed for assessment years starting from 2023-24 (financial year 2022-23).

Here are a few conditions that you should know about before filling the Form 10IE.

- Relevance: Applicable for assessment years before 2023-24.

- Tax Regime Choice: You intended to opt for the New Tax Regime.

- Income Source: You had income under the head "Profits and Gains of Business and Profession" (filing ITR-3 or ITR-4).

- This form wasn't needed for those with income from salaries, house property, capital gains, etc. (filing ITR-1 or ITR-2) to choose the new regime.

Form 10 IE is no longer used for choosing the new regime. The new regime is the default for everyone. If you want to switch to the old tax regime with its deductions and exemptions (for assessment years 2023-24 onwards), you'll need to file Form 10 IEA instead, before submitting your ITR. The eligibility criteria for Form 10 IEA are similar to the previous Form 10IE.

Steps to File Form 10 IE

Form 10 IE is used to inform the Income Tax department of your choice for the new tax regime for a particular financial year. Here is the step-by-step guide to filling out the Form 10 IE.

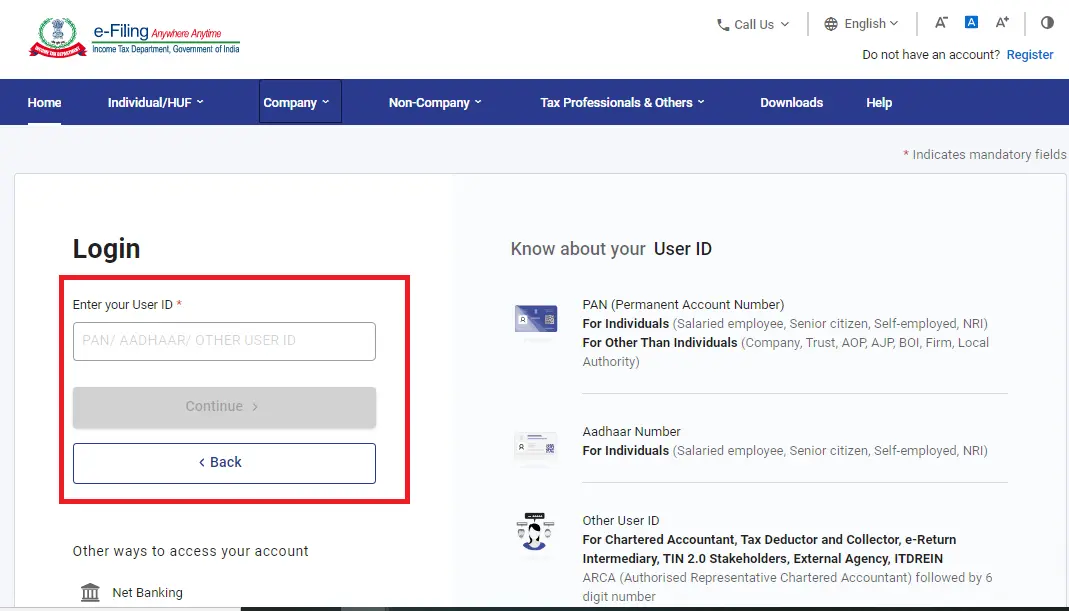

Step 1: Log in to the Income Tax e-filing portal using your credentials.

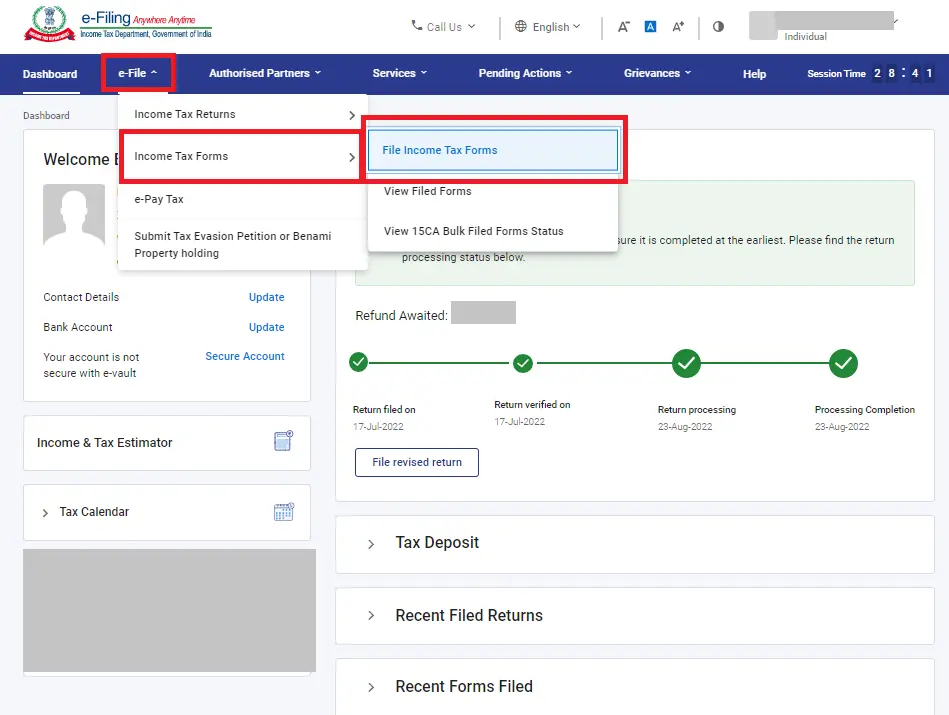

Step 2: On the dashboard, navigate to e-File > Income Tax Forms.

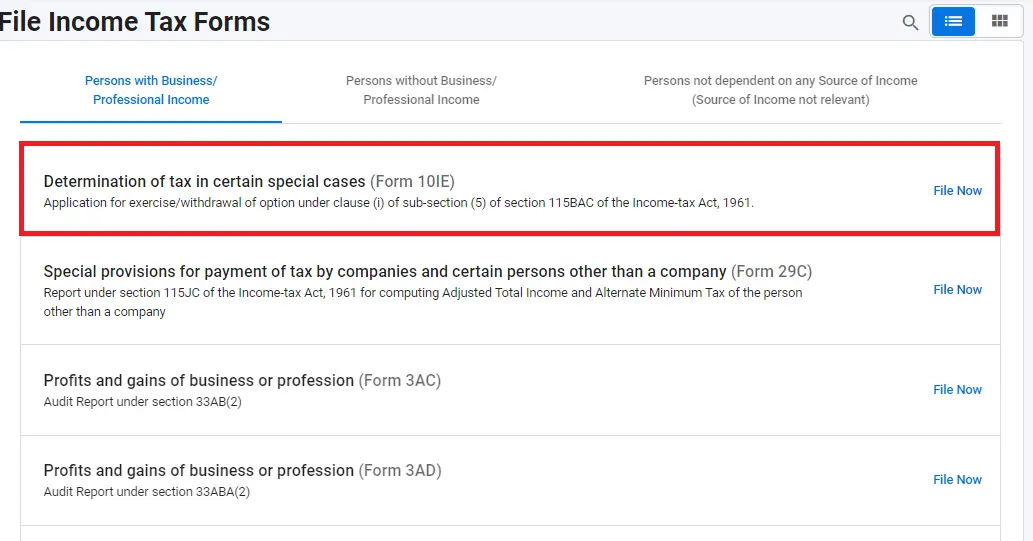

Step 3: Select Form 10IE from the list of forms.

Step 4: Enter your PAN (Permanent Account Number).

Step 5: Select the assessment year for which you are filing the form. (e.g.,

Step 6: If filing taxes for income earned in FY 2022-23, select AY 2023-24)

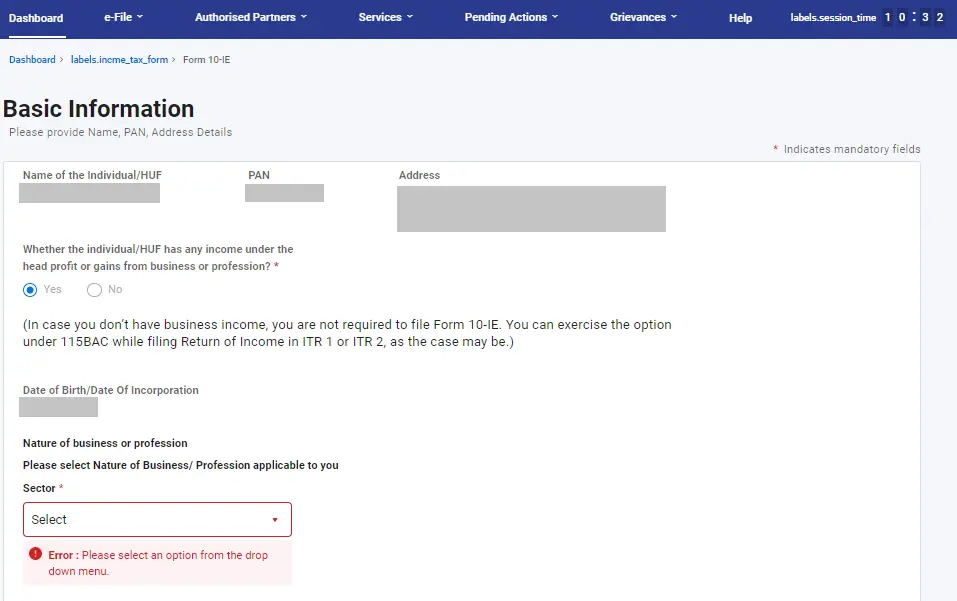

Step 7: The form will be displayed. Most of your personal details will be auto-filled.

Step 8: Part A: Personal Information (usually pre-filled)

Step 9: Part B: Declaration: Select whether you are an individual or a Hindu Undivided Family (HUF)

Step 10: Part C: Verification: You or an authorized signatory must verify the form.

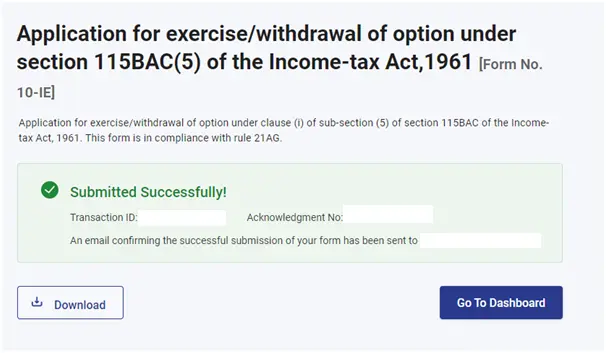

Step 11: Once you've successfully completed e-verification, you'll see a confirmation screen. This screen will show a Transaction ID and an Acknowledgement Receipt Number. A confirmation email will be sent to the address you registered with the e-filing portal.

To download the form, go to ‘e-File’, then ‘Income Tax Forms’, and finally ‘View Filed Forms’.

Don't know your credit score? You can find out for free!

Details Required for Form 10 IE

You need to be aware of certain details that Form 10 IE requires. These details are to give a clear and complete picture of the taxpayer's exempt income to the Income Tax Department.

Here are the details required for Form 10 IE.

Part A: Personal Information

- Name: Your full name as per your PAN card.

- PAN Number: Your Permanent Account Number.

- Address: Your registered address as per income tax records.

- Email ID: A valid email address for receiving updates.

- Date of Birth (Individual) / Date of Incorporation (HUF): Your date of birth if filing as an individual, or the date of incorporation for a Hindu Undivided Family (HUF).

Part B: Declaration

- Taxpayer Status: Select whether you are filing as an Individual or a Hindu Undivided Family (HUF).

- Assessment Year: Choose the financial year for which you are opting for the new tax regime (e.g., 2023-2024 for income earned in the previous year).

- Business/Profession Income: Indicate whether you have any income under the head of "Profits and Gains of Business or Profession." (Yes/No)

- IFSC Unit: Indicate if you have any unit in an International Financial Service Centre (IFSC). (Yes/No) - Optional, only applicable if relevant.

- Previous Form 10IE: (Optional) Mention if you have filed Form 10IE previously for any earlier assessment year.

Part C: Verification

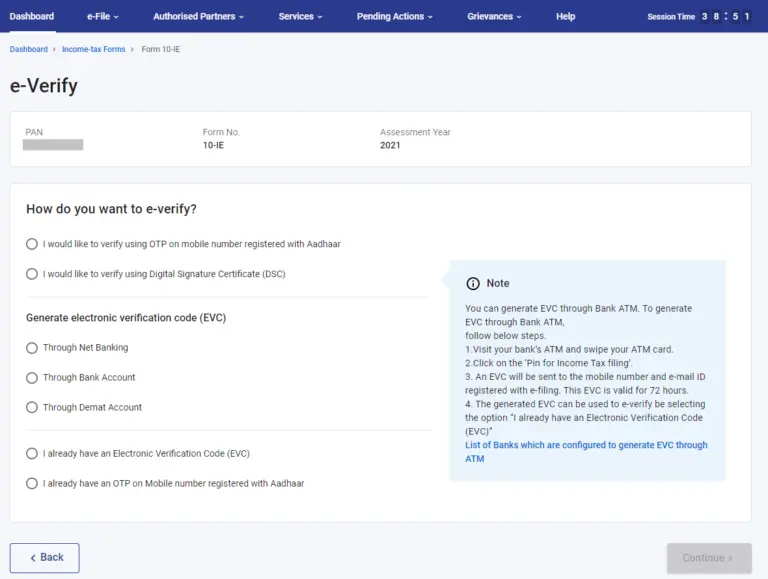

- This section requires verification of the form submission. You can use a digital signature certificate, Electronic Verification Code (EVC), or Aadhaar OTP for this purpose.

Do you need an Emergency loan?

Benefits & Drawbacks of Filing Form 10 IE

Form 10 IE is a facilitation tool to help you take advantage of the potential benefits offered by the new tax regime. The new tax regime may offer benefits depending on your specific tax situation.

Here's a potential benefit of filling out Form 10 IE.

- Lower Tax Rates: The new regime generally has lower tax rates compared to the old regime. This could translate to lower tax liability if your income falls within the beneficial brackets.

Here's a potential drawback of filling out Form 10 IE.

- Limited Deductions and Exemptions: The new regime forgoes many deductions and exemptions available under the old regime. This includes popular deductions for investments like Equity Linked Saving Schemes (ELSS), home loan interest, medical expenses, etc.

Note:The benefit of Form 10IE (opting for the new regime) depends on your individual circumstances.

Common Mistakes to Avoid When Filing Form 10 IE

You can be susceptible to errors when filing Form 10 IE which can lead to complications, delays, or even rejection of the exemption claim. Knowing the common mistakes many taxpayers make can help you avoid those mistakes and ensure a smooth submission and accurate tax filing.

- Inaccurate Personal Information: Double-check your PAN number, name, address, and date of birth (or date of incorporation for HUF) to ensure they match your PAN details exactly.

- Incorrect Assessment Year: Select the correct assessment year that corresponds to the financial year for which you're opting for the new tax regime.

- Business/Profession Income Misrepresentation: Indicate whether you have income under the head of "Profits and Gains of Business or Profession."

- Missing Verification: Verify the form electronically using a Digital Signature Certificate (DSC), Electronic Verification Code (EVC), or Aadhaar OTP. A non-verified form won't be processed.

- Not Understanding the Impact: Form 10-IEA simply allows you to opt for the new tax regime. Before submitting, understand how the new regime's lower tax rates and limited deductions will affect your specific tax liability.

Note: Any discrepancies can lead to processing delays or rejection of the form.

You can also check other related Tax Forms and Information

Ready to take the next step?

Frequently Asked Questions

The form collects basic information to determine your eligibility for the new tax regime and doesn't screen you out based on any specific answers.

You simply fill out the form with your details and it determines if it applies to you based on your income type (business/profession) and choice of tax regime.

You will simply be directed to the appropriate information or form based on your answers.

Yes, filter questions can affect the sections of the form you need to complete. If your answer triggers a filter, you may be directed to different sections based on your response.

No, there are no common filter questions in Form 10-IE. It's a straightforward form that collects basic information to confirm your eligibility for the new tax regime in India.

No, there isn't direct support for Form 10IE within the e-filing portal itself. You can consult a tax advisor or use a tax calculator to help you understand the new tax regime and its impact on your taxes.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users