Having a low CIBIL score can feel like a roadblock, especially when you need a loan or credit card. If your score is around 300, you might find it hard to get approved for any form of credit. But don’t worry – Increase CIBIL score from 300 to 750 is possible with the right approach and consistent effort.

Lenders rely on your CIBIL score to judge how reliable you are when it comes to borrowing money and paying it back. A score of 750 or above makes it easier to access loans, credit cards, and better interest rates. This blog will guide you through practical and achievable steps to boost your CIBIL score from 300 to 750. By following these tips and staying disciplined, you can rebuild your financial credibility and unlock better borrowing opportunities.

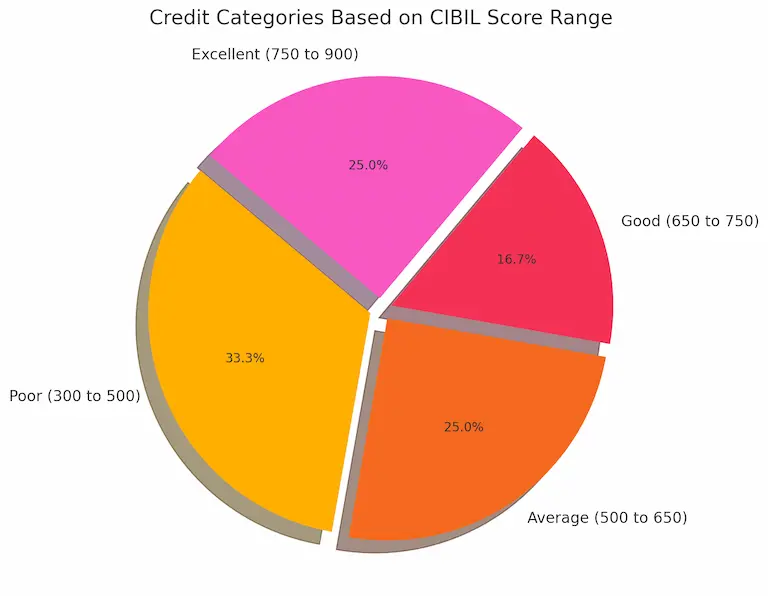

Credit Score Range

A credit score is a number that reflects your credit history and financial behaviour. It helps lenders determine how likely you are to repay borrowed money. The following pie chart shows the various credit score ranges and their percentages, making it easy to see where you stand.

Ways To Improve Your CIBIL Score From 300 To 700

Raising your CIBIL score from 300 to 750 may seem daunting, but with the right strategies and commitment, you can significantly enhance your creditworthiness here are some tips to improve your CIBIL score.

1. Clear Your Existing Debts

Paying off your existing loans and credit card balances is one of the most important steps to improve your credit score. When you have outstanding debt, you not only have to deal with interest charges, but it also lowers your credit score. Start by prioritizing high-interest debts, like credit cards, and work towards clearing them. This helps you take control of your finances and boosts your CIBIL score.

2. Pay Your Loans and Credit Card Bills on Time

Timely payments are the backbone of a good credit score. You are reliable and responsible when you consistently pay your credit card bills and loan EMIs (Equated Monthly Installments) on time. Missing payments or paying late can lead to penalties, higher interest rates, and a lower score. Set reminders for your due dates or automate your payments through your bank to avoid this. Think of it like keeping a promise – when you pay on time, you build trust with lenders and improve your score.

3. Make Full Payments, Not Just Minimum Amounts

When you get your credit card bill, paying only the minimum amount might seem tempting, but it’s not the best choice. By paying the minimum, you end up carrying forward the remaining balance, which attracts interest. Over time, this can lead to a bigger debt and hurt your credit score. To avoid this, try to pay the full amount due every month. It keeps your debt under control, helps you avoid extra charges, and shows lenders that you are managing your credit well.

4. Keep Older Credit Cards Active

Your credit history is like a report card that lenders use to judge your financial habits. The longer your credit history, the better it is for your credit score. If you have older credit cards with a good payment history, keep them active. Using these cards occasionally and paying the bills on time shows that you can manage credit responsibly over a long period. This helps build trust with lenders and boosts your score. Think of it as a long-term relationship – the longer you show good behaviour, the more reliable you appear.

5. Maintain a Healthy Credit Utilization Ratio

Your credit utilization ratio is the percentage of your available credit that you are using. For example, if your credit card limit is ₹1 lakh and you use ₹70,000, your credit utilization ratio is 70%. To keep your credit score high, try to keep this ratio below 30% (₹30,000 in this case). Using too much of your available credit can make lenders think you rely too heavily on credit, which can lower your score. To improve your score, spend within limits and pay off your balances regularly.

6. Avoid Taking on Too Much Debt at Once

Taking too many loans or using too much credit at the same time can hurt your credit score. Lenders might see this as a sign that you are struggling with money and relying heavily on borrowed funds. To keep your credit score healthy, only take loans when you truly need them and make sure you can comfortably manage the repayments. Balancing your debt ensures you can meet your financial obligations without stress and shows lenders that you are a responsible borrower.

7. Avoid Having Too Many Credit Cards

While credit cards offer benefits like rewards and convenience, having too many of them can be risky. If lenders see that you have multiple credit cards, they may think you are too dependent on credit. Managing a reasonable number of cards (like two or three) helps you keep your spending under control. It also makes it easier to pay your bills on time. Remember, the key is to use your credit cards wisely, not to collect as many as possible.

8. Match Your Credit Limit to Your Expenses

It’s important to have a credit limit that fits your spending habits and income. A higher credit limit can be useful, but only if you can handle it responsibly. If you have a limit that is too high and end up overspending, it can lead to debt problems. On the other hand, if your limit is too low, you might exceed it easily, which affects your credit score. Talk to your bank about setting a credit limit that matches your financial situation to avoid unnecessary debt.

9. Diversify Your Credit Portfolio

Having a mix of different types of credit, like credit cards, car loans, and home loans, shows that you can handle different kinds of debt. This helps build a stronger credit history and improves your score. Lenders like to see that you can manage both 3 month loans (like credit cards) and long-term loans (like home loans). It’s like having a balanced diet – a good mix of credit types shows financial stability and responsible borrowing habits.

10. Check Your Credit Report Regularly for Errors

Mistakes on your credit report can harm your score, even if you’ve been managing your finances well. To avoid this, check your CIBIL report regularly for any errors, like incorrect loan amounts, payments not recorded, or accounts you didn’t open. If you find a mistake, report it to the credit bureau immediately to get it fixed. Keeping an eye on your credit report helps ensure that it accurately reflects your financial history and protects your score.

Factors That Can Negatively Affect Your Credit Score

1. Payment History

Paying your credit card bills and loan EMIs on time is essential for maintaining a good CIBIL score. Late payments or defaults can significantly hurt your score. Even a single delay of 30 days can cause your score to drop by as much as 100 points. Consistent, on-time payments show lenders that you can manage credit responsibly.

2. Credit Utilization Ratio

Using too much of your available credit can lower your score. Ideally, you should use no more than 30% of your credit limit. For example, if your credit limit is ₹1 lakh, try to keep your spending below ₹30,000. A high credit utilization ratio signals to lenders that you may be relying too heavily on credit, which increases the risk of default. To keep your score healthy, avoid maxing out your credit cards.

3. Credit Type and Duration

The age of your credit history matters. This means how long you’ve had your credit accounts open. A longer credit history, especially with good repayment behavior, helps improve your score. It’s also good to have a mix of different types of credit – like secured loans (car loan or home loans) and unsecured loans (credit cards). This shows you can handle different kinds of debt responsibly. Starting early with a small credit line can help you build a solid credit history, which is useful for big purchases in the future, such as a car or house.

4. Credit Inquiries

Every time you apply for a loan or credit card, the lender checks your credit report, which is called a hard inquiry. Too many hard inquiries in a short time can lower your score, as it may seem like you’re desperate for credit. To avoid this, space out your credit applications. Only apply for loans or credit cards when you really need them.

Conclusion

Improving your CIBIL score from 300 to 750 is a journey that requires discipline, patience, and smart financial decisions. By paying off your existing debts, making timely payments, managing your credit utilization, maintaining older credit cards, and diversifying your credit profile, you can gradually rebuild and strengthen your credit score.

Regularly monitoring your credit report for errors and avoiding excessive loan applications are also key steps in this process. Remember, a high CIBIL score not only improves your chances of loan approvals but also helps you secure better interest rates and terms.

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

Q. What is a CIBIL score?

A. A CIBIL score is a three-digit numeric representation of your creditworthiness, ranging from 300 to 900, based on your credit history and financial behaviour.

Q. What are the key steps to increase my CIBIL score from 300 to 750?

A. Pay bills and EMIs punctually, keep credit utilization under 30%, limit loan applications, and rectify credit report discrepancies.

Q. How can I check my current CIBIL score?

A. Visit the official CIBIL website or platforms like Paisabazaar or BankBazaar using your PAN and basic details to check your score.

Q. Why is a CIBIL score of 750 important?

A. A score of 750+ improves the chances of loan approvals at lower interest rates, reflecting good credit health.

Q. What are the primary factors affecting my CIBIL score?

A. Factors affecting credit – payment history, credit utilization ratio, hard inquiries, and credit mix.

Q. What is the ideal credit utilization ratio?

A. The ideal credit utilization ratio is below 30%, meaning you should not use more than 30% of your credit limit.

Q. How often should I check my CIBIL score?

A. Checking your score once every three months is advisable to stay updated without negatively affecting it.

Q. How long does it take to see improvements in my CIBIL score?

A. Significant improvement may take 4–12 months depending on financial discipline and resolving errors.