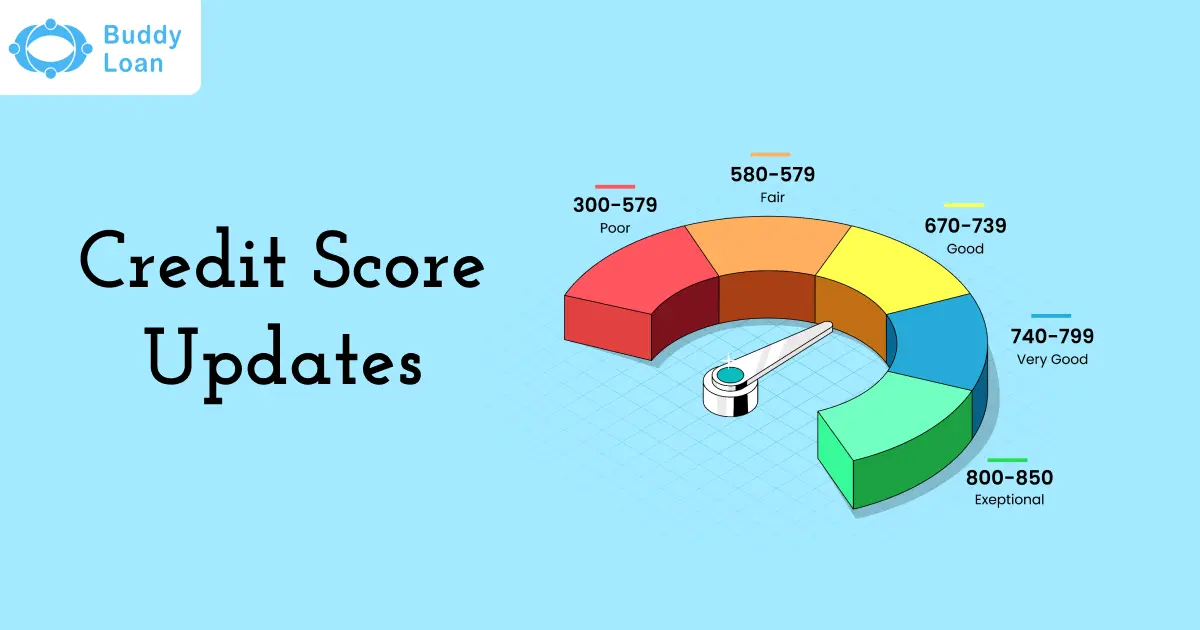

If you’ve ever applied for a loan or credit card in India, you know the steps. Your financial goals, like a new car, a dream home, or a personal loan, often depend on a three-digit number: your credit score. For years, a single error or a delayed update on your report could bring those plans to a halt, causing unnecessary frustration and delays. But as 2025 is nearing the end, these exciting new updates on credit scores can improve your financial lifestyle.

Fortunately, 2025 has ushered in a new era for credit health in India. The Reserve Bank of India (RBI) has rolled out significant new updates on the credit scoring system, making it more transparent, responsive, and fair for everyone.

These are some major fundamental changes that empower you to take greater control of your financial future. Read on to know what the latest credit score updates are and how they can work for you.

1. Faster Feedback: Credit Score Updates Every Two Weeks

One of the most powerful changes is the move from monthly to biweekly credit score updates.

Previously, if you made a positive financial move, like clearing a large credit card bill, you had to wait up to a month to see it reflected in your score. This delay could be costly if you were in the middle of a loan application.

| Now, your score will reflect your payments every 2 weeks, making the score improvement much quicker. |

Pay off your credit card bill on the 5th of the month, and that positive action can reflect in your score by the 20th, not a month later. This new rhythm rewards good financial habits almost instantly, giving disciplined borrowers a clear advantage. It strengthens your financial credibility faster and can help you secure better loan terms without the long wait.

2. A Fairer System: A Stop to Unfair Loan Rejections

Have you ever been haunted by an error on your credit report, like a loan that was paid off but still showed as active?

In the past, such mistakes could lead to immediate and wrongful loan rejections. The 2025 rules put an end to this unfair practice.

| Under the new credit score update, if a lender finds a discrepancy on your report, they must pause the loan approval process.

This gives you a protected 30-day window to identify and correct the mistake through the CIBIL portal. |

To ensure this is taken seriously, both lenders and credit bureaus will face financial penalties if they fail to resolve the issue within that 30-day timeframe. This change means that you are no longer penalised for administrative errors and allows you to take back control of your credit story.

Also Read: Good Credit Score

3. Stay in Control with Mandatory Alerts and Free Reports

To boost transparency and protect you from fraud, the latest credit score update introduces two key monitoring tools. First, you will now receive an SMS or email alert every time a lender or financial institution checks your credit score. This simple but crucial step helps you keep track of who is accessing your data and immediately spot any unauthorised enquiries.

Second, you are now entitled to one free credit report per year from each of India’s four major credit bureaus: CIBIL, Equifax, Experian, and CRIF High Mark. This gives you a complete, 360-degree view of your credit profile across all platforms.

Simply put,

|

By regularly reviewing these reports, you can proactively identify and fix potential issues long before they can impact a future loan application.

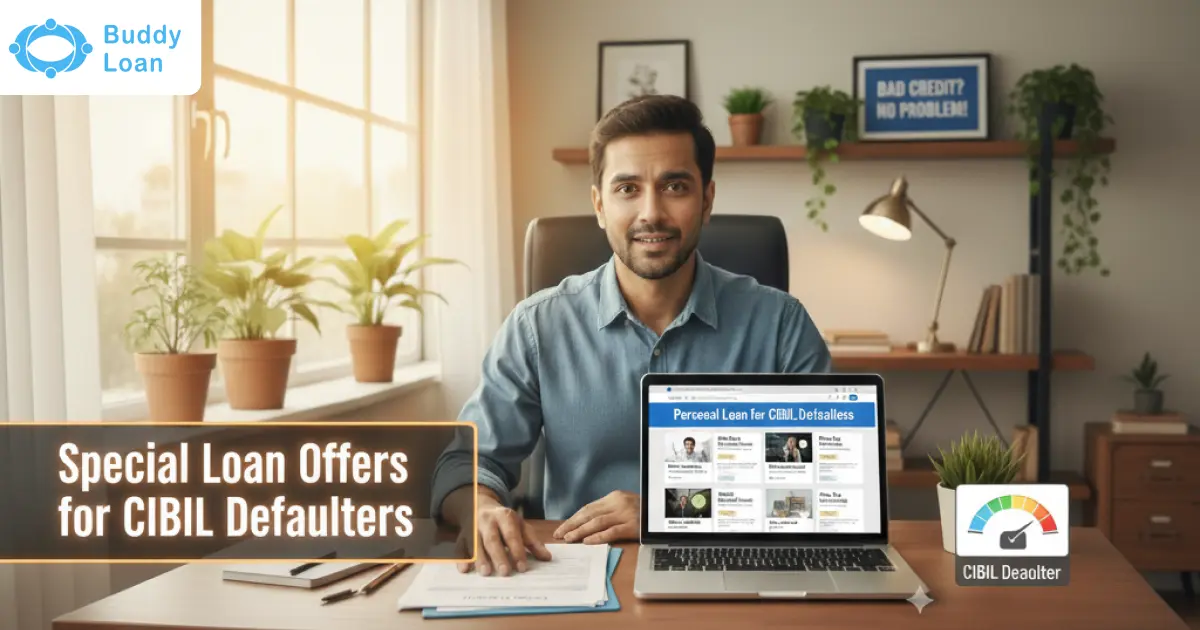

4. Good News, New Borrowers: No History, No Problem

One of the biggest challenges for young professionals, part-time economy workers, and other first-time borrowers has been the ‘no history, no loan’ condition.

Without at least six months of credit history, it was nearly impossible to get a CIBIL score, which locked many people out of the credit system entirely.

The latest credit score updates of 2025 have dismantled this barrier.

| Now, even individuals with a very limited credit history can receive a CIBIL score, opening the door to financing opportunities. |

Furthermore, if a lender rejects a loan application based on a low score, they are now required to explain the specific reasons for the rejection and offer guidance on how the applicant can improve their score.

This transparency helps new borrowers learn, adapt, and build a strong financial foundation from day one.

Suggested Read: Top 10 Tips to Increase Credit Score

5. Pre-Default Warnings Before Your Score Drops

A single missed payment can cause significant damage to a high CIBIL score. To prevent this, the RBI has introduced a protective measure: proactive default warnings.

| Under the latest credit score update, lenders are now required to alert you before a missed EMI or credit card payment is officially reported as a default to the credit bureaus. |

This warning gives you a crucial window of opportunity to address the issue, whether by making the payment, negotiating a new plan, or restructuring the debt. For anyone who has worked hard to build a good score, this safety net is invaluable.

It helps you preserve your hard-earned creditworthiness and avoid the unexpected score drops that can affect your ability to secure favourable interest rates in the future.

Get Personal Loan Online Up to ₹50 Lakhs

By entering your number, you're agreeing to Terms & Conditions & Privacy Policy.

How to Make the New Credit Score Updates Most Useful

These new rules are designed to help you succeed. To take full advantage of this fairer and more transparent system, focus on these smart financial habits:

- Make Timely Payments Your Top Priority: Consistently paying your EMIs and credit card bills on time is the single most important factor, accounting for about 35% of your score. Consider setting up auto-payments to avoid accidental misses.

- Keep Credit Utilisation Low: Aim to use less than 30% of your available credit limit on your cards. High utilisation can suggest financial stress, so keeping it low demonstrates responsible management.

- Maintain a Healthy Credit Mix: A balanced portfolio of different credit types, such as a car loan (secured) and a credit card (unsecured), can positively impact your score over time.

- Be Proactive and Act Fast: Use your free annual reports to check for errors. If you receive a default warning, contact your lender immediately to find a solution before it impacts your score.

- Always check your credit score using free credit score checker tools before applying for credit.

Also Read: Ways to Increase and Maintain a Healthy Credit Score

By embracing these strategies, you can leverage the 2025 CIBIL updates to build a stronger, more resilient financial future.

Conclusion

The latest CIBIL Score updates of 2025 can be considered as an important shift towards making credit scoring faster, fairer, and more transparent. These changes grant individuals more control and more visibility over their financial health.

Key reforms include bi-weekly updates, reflecting near real-time changes, and mandatory error resolution rules ensuring borrowers have a 30-day window to address mistakes and prevent unfair rejections. Inclusive scoring empowers first-time borrowers, while mandatory notifications protect sensitive data. Consumers are further supported by proactive default warnings and the right to request one free report per year from each of the four bureaus.

Understanding these essential rules allows borrowers to adopt disciplined habits and transform potential pitfalls into long-term financial wins.

Disclaimer: This article is strictly for informational purposes. The RBI and CIBIL guidelines mentioned are accurate as of 2025, but may be subject to change. Always consult with banks or financial advisors for guidance tailored to your individual situation.