In a significant development, the Ministry of Finance has announced that CIBIL scores are no longer mandatory for first-time borrowers seeking loans in India. This groundbreaking decision aims to foster financial inclusion by providing individuals without a credit history, such as young professionals, students and entrepreneurs, the opportunity to access loans.

In this blog, we’ll explore the implications of this decision, how it affects borrowers and answer some of the most frequently asked questions about CIBIL scores and first-time loans.

What Is a CIBIL Score and Why Was It Important?

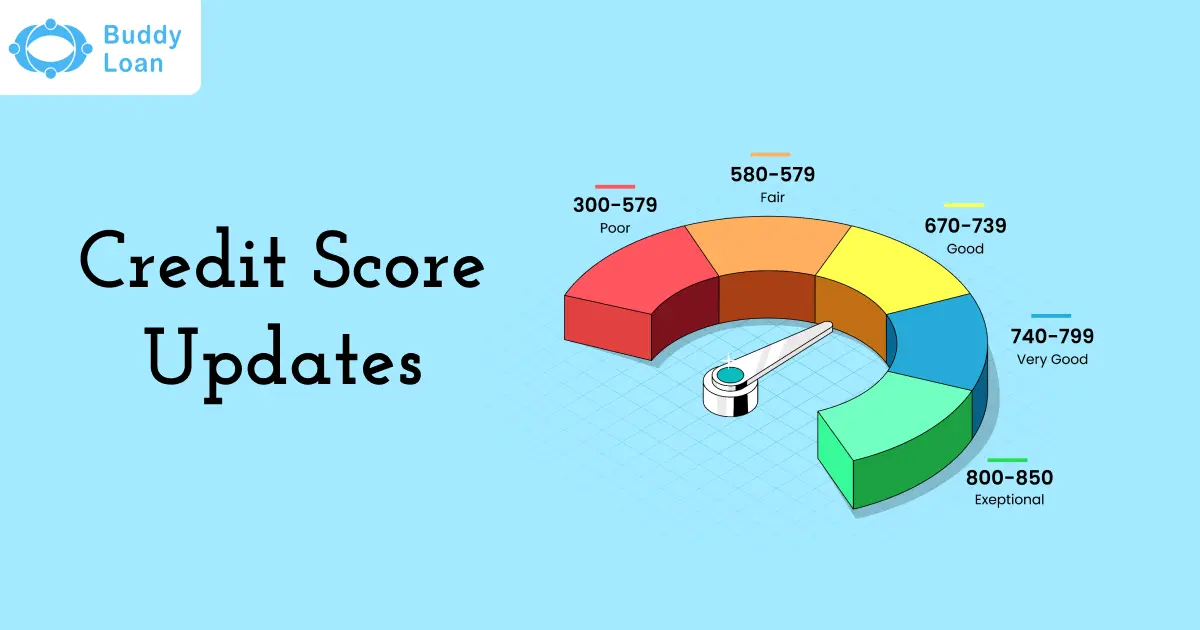

A CIBIL score is a three-digit number, ranging from 300 to 900, that reflects an individual’s creditworthiness. It is calculated based on their credit history, repayment patterns and borrowing behaviour. A higher score indicates a reliable borrower, while a lower score suggests higher risk for lenders.

For years, CIBIL scores have been a critical factor in loan approval processes. However, this created barriers for first-time borrowers, individuals who have never taken out a loan and thus have no credit history.

Why Has the Government Made This Change?

The Indian government’s decision to remove the CIBIL score requirement for first-time borrowers is aimed at increasing financial inclusion. As more young professionals and entrepreneurs enter the economy, the demand for loans has risen. Many of these individuals, however, don’t have a credit score simply because they’ve never used credit before.

The government’s move encourages financial independence by allowing these borrowers to access loans based on alternative data such as employment stability, income and banking history. It’s a step toward opening doors for millions of people to secure the credit they need.

How Will Banks Evaluate Loan Applications Without a CIBIL Score?

While CIBIL scores are no longer mandatory for first-time borrowers, banks and financial institutions will still assess loan applications carefully. Lenders will focus on factors like:

- Income and Employment Stability: A consistent income and stable employment are strong indicators of repayment ability. Lenders will assess your job history and monthly income.

- Banking History: Banks will look at your banking transactions to determine whether you have a history of responsible financial management.

- Guarantors or Collateral: In the absence of a credit score, lenders may require collateral or a guarantor (co-signer) to reduce the risk.

- Alternative Data: Utility bills, mobile phone payments and insurance premium payments can also be used as alternative data to assess your financial discipline.

Get Personal Loan Online Up to ₹50 Lakhs

By entering your number, you're agreeing to Terms & Conditions & Privacy Policy.

What Does This Mean for First-Time Borrowers?

The removal of the CIBIL score requirement for first-time borrowers is a game-changer. Here’s what it means for you:

- Greater Access to Loans: If you are a young professional, student or someone with limited borrowing experience, this policy change gives you an opportunity to apply for loans without the need for an established credit history. You’ll be evaluated based on your current financial situation rather than a score that you’ve never had the chance to build.

- Faster Loan Approvals: The absence of a CIBIL score means that lenders will have to look at alternative data like income stability, job history and transaction records. This opens the door for faster loan approvals as the lending process becomes more inclusive.

- A Chance to Build Credit: This policy enables you to start building your credit history right from the first loan. Once your first loan is approved and you start repaying it responsibly, your CIBIL score will begin to form, which will be used to evaluate you for future loans.

- Flexibility in Loan Types: You will be eligible for various loans such as personal loans, education loans and small business loans, even without a prior credit history. Lenders are now willing to consider you based on your current financial standing and repayment potential.

Will CIBIL Score Be Considered for Future Loans After First-Time Borrowing?

One of the most common questions from first-time borrowers is whether CIBIL scores will come into play for future loans.

The answer is yes. After successfully repaying your first loan, your CIBIL score will begin to form based on the data from that loan. Future lenders will look at your credit history and CIBIL score when you apply for subsequent loans. This will allow you to access larger loans, better interest rates and more favourable terms in the future.

Even though CIBIL scores are not a requirement for first-time borrowers, they will be an important factor for any future financial needs.

Conclusion

The government’s move to eliminate the CIBIL score requirement for first-time borrowers is a monumental step toward achieving financial inclusion in India. It ensures that millions of people who were previously excluded from the formal credit system now have the opportunity to secure loans based on their financial potential rather than their past borrowing history.

For those who are ready to make their first loan application, platforms like Buddy Loan provide a streamlined process. Buddy Loan connects borrowers with a network of verified lenders, offering personalized loan options based on your financial needs. It’s an excellent way for first-time borrowers to find the right loan, even without a CIBIL score.

As you build your financial history and repay your first loans responsibly, CIBIL scores will play a more important role in the future, opening the door to even greater opportunities. With this new policy change, the road to financial independence is now more accessible than ever. Take control of your financial future today!