A recent ruling by the Madras High Court has shaken the aspirations of many banking job seekers across India. The court upheld the State Bank of India’s (SBI) decision to revoke a candidate’s job offer due to a poor CIBIL score, emphasizing the importance of financial discipline in the banking sector. As bank jobs become increasingly competitive, this blog highlights how a credit report can make or break a candidate’s future even after clearing exams and interviews.

Here’s how this judgment could impact candidates eyeing careers in banking and finance and why keeping your credit history clean is more important than ever.

The Case That Sparked the Debate

In 2021, a candidate was selected by SBI for the post of Circle Based Officer (CBO). He successfully cleared the written test, interview, and medicals and even received an appointment letter. However, his past loan defaults, reflected in a detailed CIBIL report, led SBI to cancel his appointment. The candidate had a history of irregular loan repayments, defaulted credit card dues, and several write-offs, which were flagged during the background verification process.

Despite his appeal to the Madras High Court to reconsider the decision, the court sided with SBI, citing the need for financial discipline in jobs that involve handling public money. On June 2, 2025, the court officially dismissed the petition and reinforced SBI’s internal hiring rules.

Why Credit Scores Matter in Banking Jobs

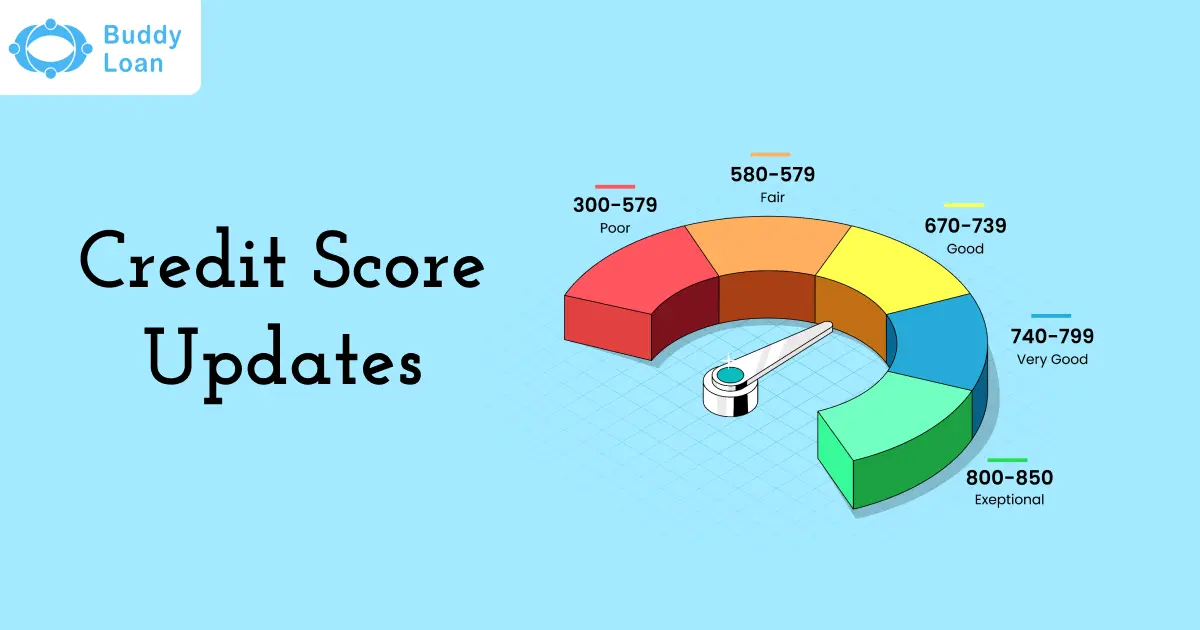

A CIBIL score (or credit score) is a numerical summary of an individual’s creditworthiness, based on past borrowings and repayment behaviour. In India, a score below 650 is generally considered poor, and such a profile raises red flags for employers, especially in the financial sector.

Banks and financial institutions often check CIBIL reports during the hiring process to assess a candidate’s financial habits. For roles that involve dealing with customers’ funds, approving loans, or managing sensitive financial data, an employee’s own financial behaviour is seen as a reflection of their trustworthiness and risk management capability.

SBI’s Hiring Policy and the Legal Backing

The judgment was rooted in SBI’s recruitment notification, specifically Clause 1(E), which clearly disqualifies candidates with a record of loan defaults or adverse reports from credit bureaus like CIBIL. The clause states that even if a candidate has repaid their dues before joining, a past history of financial indiscipline can still render them ineligible.

The Madras High Court observed that such clauses are not arbitrary but are necessary to maintain the integrity of financial institutions. Banks are custodians of public money, and hiring individuals with questionable financial records can compromise both operational efficiency and public trust.

Broader Implications for Job Seekers

This ruling sets a precedent for both public and private sector banks. Employers in the financial industry now have judicial support to reject candidates based on poor credit scores. Here’s how this could affect aspiring bankers and finance professionals:

- Stricter Background Checks: Banks may implement more rigorous credit checks as a standard part of their recruitment process.

- Long-Term Impact of Defaults: Even if loans are repaid later, a history of missed payments may haunt candidates during job screenings.

- Transparency is Crucial: Any false or omitted declarations about financial history can lead to immediate disqualification or termination.

- Private Banks May Follow Suit: Although not all banks have formal credit score policies, the verdict could encourage private institutions to adopt similar eligibility filters.

Suggested Read: Good Credit Score

Get Personal Loan Online Up to ₹50 Lakhs

By entering your number, you're agreeing to Terms & Conditions & Privacy Policy.

What Banking Aspirants Should Do

• Maintain a Healthy Credit Score: Always pay loan EMIs and credit card bills on time. Avoid excessive borrowing and limit the number of credit inquiries.

• Monitor Your Credit Report: Regularly check your CIBIL report for accuracy. Dispute any errors, and ensure updates reflect settled accounts.

• Understand Recruitment Criteria: Read every clause in job notifications thoroughly. Pay attention to disclaimers and eligibility rules regarding financial standing.

• Act Early: If your score is low, work on improving it well before applying to banks. Credit history reflects long-term behaviour, not just recent actions.

• Avoid Financial Overcommitments: Taking multiple personal loans or credit cards simultaneously can raise red flags, even if repayments are current.

Conclusion

The Madras High Court’s verdict serves as a powerful reminder that personal financial discipline is not just a private matter but a professional requirement—especially in sectors like banking and finance. This judgment doesn’t just apply to one case; it reshapes the expectations for thousands of banking aspirants across the country.

In an era where data drives decisions, your credit report is more than just a number—it’s a reflection of your reliability. For anyone aiming to build a career in banking, ensuring a clean, healthy credit history is not optional—it’s essential.

Keywords: CIBIL score for bank jobs, SBI job cancellation, Madras High Court verdict, financial discipline in banking, credit score impact on jobs, banking job eligibility criteria, credit history and employment, Circle Based Officer SBI, personal loan defaults job rejection, how CIBIL affects job offers