Yes, taking a gold loan will definitely improve your credit score. Paying your dues on time. As long as your interest payments are made on or before the due date, your score will improve.

Have investments in gold and want a loan but don’t know how to go about it? Buddy Loan is a loan aggregator that helps you acquire a loan against gold in a hassle-free, easy way, that too online.

A loan against gold means your investment in gold biscuits or gold jewellery for money. Gold loans are given by banks as well. However, a Buddy Loan App allows applications for such a loan online.

The Amount of Loan

A gold loan is provided depending upon the quality of the gold asset. The lender accepts gold having purity between 18 to 24 Carat and the loan amount varies from bank to bank and is typically a certain percentage of the current gold price. It is best to coordinate with the lenders directly to gauge the value and estimation of a mortgage.

The amount of the loan goes up to 80% of the gold price, however, it is subjective for each bank.

Documentation

Every bank providing a loan against gold requires specific documentation. The entire process of obtaining a gold loan becomes more comfortable with the help of Buddy Loan.

Buddy Loan helps you bring all your documents in one place, depending on the lender bank. However, every bank asks for a set of standard documents, which include passport size photograph, Voter’s ID, PAN, Aadhaar card, driver’s license, electricity bill, passport, identity proof, income proof, and address proof, etc.

Anyone Can Apply for A Gold Loan

Any person who owns gold- be it biscuits or jewellery can apply for a gold loan. There is no minimum salary limit to be eligible for the loan.

Homemakers, farmers, employees- anyone can apply for the loan as long as the gold they have possesses value

The Other Eligibility Criteria Are-

- Indian Citizen.

- The purity of gold- 18 to 24 Carat.

- 23 to 65 years of age.

Repayment Period

With a loan aggregator like Buddy Loan, the repayment period for a gold loan taken is as high as five years.

No Credit History Required

A gold loan is provided against the pledging of gold with a purity between 18 to 24 carats. This loan is granted even if you have no credit history. Via Buddy Loan, you can apply for the loan online.

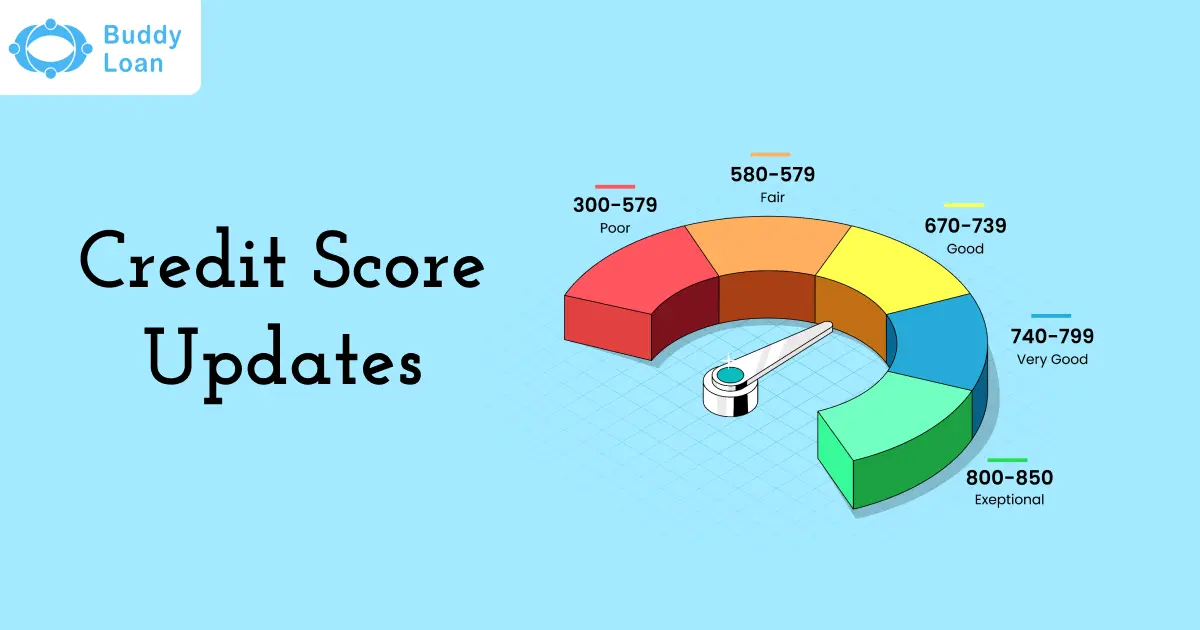

In fact, with diligent repayment of a gold loan, the borrower can build up a good credit history.

When you need a loan urgently with a repayment period exceeding 36 months, taking a loan against gold is a good option. With Buddy Loan executing this option is extremely simple and quick. More effectively, if we understand the pattern of credit score and loan accessibility the journey of payment is a cakewalk.

Credit score Vs Gold loan!

A gold loan is, in essence, a loan against gold or a loan on gold. A gold loan is available through the traditional route from a bank (gold loan bank) while an online gold loan is also available.

Buddy Loan is also available through various gold loan providers online. Gold loans are, in essence, personal loans that are taken against gold as collateral and can be utilized for a variety of purposes.

A gold loan can be availed on any day of the week if one chooses to go for the instant loans online that are available online through the various gold loan providers online. Imagine getting a gold loan on Sunday, all from the comfort of your home, at the click of a button!!!

The best gold loan is one where the rate of interest is low, and one that offers the highest value per gram. One just needs to choose from a wide variety of banks and financial institutions and choose from the best gold loan offers that are available.

Choosing a gold loan is not difficult. The most important question that a lot of people face is that of the credit score. Credit scores affect the future potential to borrow and therefore have a greater significance. Can borrowing a gold loan affect the credit score? Or does one choose from a variety of other loans that are available?

Also Read: The Highest Benefiting Personal Loan – Gold Loan

How Does Prepaying Help in Repaying My Gold Loan?

Gold loan is a loan on gold or a loan against gold as collateral or security. Therefore, a gold loan is a kind of secured loan.

Gold loans can be availed through the traditional method via banks, which could include certain formalities and could be a bit time-consuming.

Gold loans can also be availed as a Buddy Loan. A Buddy Loan can be availed via the online gold loan facility through a variety of gold loan providers that have the best gold loan offers.

In case one does decide to pre-pay a loan, the amount of the loan outstanding simply decreases, and interest is calculated on the remaining amount of the loan if any. Thus, the prepayment of the gold loan will impact the amount of interest that is to be repaid. In case a gold loan is prepaid, the amount of interest expense will be lesser in the long run.

Prepayment of the gold loan will also help in getting back the gold earlier from the bank or the financial institution, leading to greater satisfaction and peace of mind in the long run.

The Benefits of Gold Loan

With multifold benefits of the Gold loan online, maximum utility and advantage are derived from the fact that immediate financial needs are met by keeping a valuable product like gold as security to procure a Buddy Loan, which doesn’t come in everyday use. The value increases with a multitude of its uses and benefits derived from there, and investment is secure and well used.

Instant Processing:

The eligibility criterion to apply for the Buddy Loan is quite simple and effective. It does not need too much for form filling and guarantees formalities as it is a secured loan. People who are eligible for pure gold generally obtain the best gold loan in a few hours.

Low and Affordable Interest Rate:

Since gold is given as security, the interest rates are much lower. If the collateral is attached, the interest rates of the Buddy Loan further decrease and make it easier for the borrower to obtain it without much pain of repayment.

No processing fees:

Former financial institutions like Banks and NBFCs charge no processing fee. Private lenders and institutions charge a minimum of 1% as a processing fee.

No Foreclosure charges:

Again, to foreclose or a pre-payment of the Buddy Loan doesn’t fetch you any charges, and it can be done as per the convenience of the borrower without any charge

No Income/Salary Proof:

Gold loan application online needs minimum verification and documentation. An identity proof, address proof, and a few other details are required. Salary/Income or even bank statements are not required to apply for the Buddy Loan.

Credit Rating not required or affected:

With the same reason as stated above, since the employment details and income tax paid by the borrowers do not affect disbursing the loan for gold, so a credit rating will not be affected in any way. In case of any default, the rating will remain unaffected as the security.

Transparency:

Complete transparency and no hidden information between the creditor and the borrower is maintained. No hidden charges and the value of the secured product, along with the value that will be remitted is made clear at the beginning.

Using Gold Loan EMI Calculator, you can check the minimal amount of interest charged for the Buddy Loan At home and doorstep facility provided to avail the Buddy Loan.

Apply for a gold loan online, it facilitates you to not step out for it, and a doorstep facility is provided wherein the representative visits you, analyses the worth of the gold and accordingly disburses the Buddy Loan. The process is the least time-consuming.

Download Personal Loan App

Get a loan instantly! Best Personal Loan App for your needs!!

Looking for an instant loan? Buddy Loan helps you get an instant loan from the best verified lenders. Download the Buddy Loan App from the Play Store or App Store and apply for a loan now!

Having any queries? Do reach us at info@buddyloan.com