For businesses, especially MSMEs (Micro, Small, and Medium Enterprises), securing loans and maintaining healthy creditworthiness is crucial for growth. You’ve likely heard of CMR in CIBIL if you’re a business owner. But what does CMR stand for, and why is it significant in banking? The full form of CMR in CIBIL is the CIBIL MSME Rank. This ranking system helps lenders assess the credit risk associated with businesses. Knowing your CMR rank is essential if you’re looking to apply for a loan or want to understand your business’s financial health. This blog will explain everything you need to know about CMR, its importance, ranking structure, and how you can improve your CMR.

More About the CMR in CIBIL

CMR stands for Company Credit Risk Rank in CIBIL. It is a credit risk assessment tool designed for MSMEs and business entities. Unlike a personal CIBIL score (which ranges from 300 to 900), CMR ranks businesses on a scale from CMR 1 to CMR 10.

- CMR 1 indicates the lowest risk of default.

- CMR 10 signifies the highest risk of default.

This ranking helps lenders determine the likelihood of a business defaulting on a loan. By analyzing the CIBIL CMR full form and the rank associated with your business, banks, and financial institutions can make informed decisions on loan approvals, interest rates, and lending limits.

CMR Ranking in CIBIL

The CMR ranking system categorizes businesses based on their credit risk. Here’s a detailed table that explains each CMR rank and what it means:

| CMR Rank | Meaning | Credit Risk Level |

| CMR 1 | Excellent credit profile | Lowest risk of default |

| CMR 2 | Very good credit profile | Very low risk |

| CMR 3 | Good credit profile | Low risk |

| CMR 4 | Fair credit profile | Moderate risk |

| CMR 5 | Average credit profile | Slightly above moderate risk |

| CMR 6 | Below-average credit profile | Moderate-to-high risk |

| CMR 7 | Poor credit profile | High risk |

| CMR 8 | Very poor credit profile | Very high risk |

| CMR 9 | Extremely poor credit profile | Severe risk |

| CMR 10 | Defaulted accounts | Highest risk of default |

For example, CMR-7 in CIBIL means that the business has a poor credit profile and poses a high risk of default, making lenders cautious about approving loans.

Parameters of MSME Ranking

Several factors influence the CMR rank of a business. These parameters provide a comprehensive view of the business’s financial health and credit behaviour:

1. Repayment History:

Timely payments of existing loans and credit lines.

Defaults, delays, or missed payments negatively impact the CMR.

2. Credit Utilization:

The percentage of credit used compared to the total available credit.

High utilization can lower the CMR rank.

3. Financial Stability:

Business revenue, profits, and financial growth over time.

Stable and growing financials contribute to a better CMR.

4. Credit Mix:

Diversity of credit (term loans, working capital loans, credit lines).

A balanced mix improves the credit profile.

5. Industry Risk:

The overall risk associated with the industry in which the business operates.

High-risk industries may negatively influence the CMR.

6. Existing Liabilities:

Total outstanding debts and financial obligations.

High liabilities increase credit risk.

Ways In Which It Can Be Useful

Understanding your CMR rank and how it impacts your business is vital for several reasons:

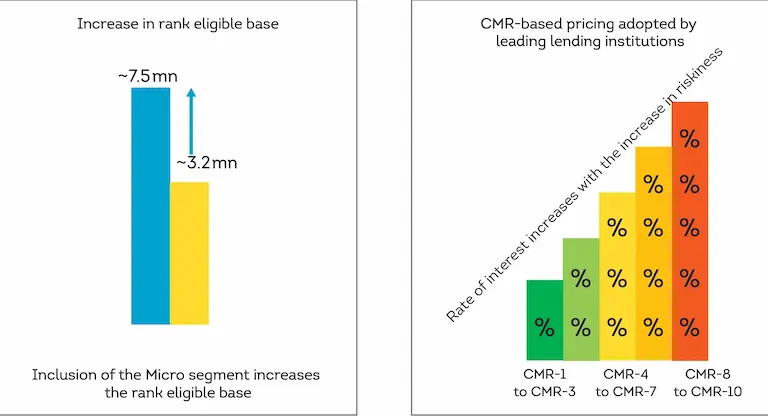

1. Loan Approvals:-

Lenders use CMR to decide whether to approve or reject a loan application.

A good CMR (CMR 1 to CMR 4) increases the chances of approval.

2. Interest Rates:

Businesses with better CMR ranks get loans at lower interest rates.

Poor CMR ranks may result in higher interest rates or stricter loan terms.

3. Credit Limits:- Lenders may offer higher credit limits to businesses with strong CMR ranks.

4. Financial Planning:- Knowing your CMR helps you identify areas for improvement and plan better financial strategies.

5. Business Reputation:- A good CMR rank enhances your reputation with banks, suppliers, and investors.

Ways to Improve CMR Ranking

Improving your CMR rank is essential for securing better financial opportunities. Here are some practical steps to enhance your CMR:

1. Make Timely Payments:- Ensure all loans, credit lines, and bills are paid on or before the due date.

2. Reduce Credit Utilization:- Keep your credit utilization below 30% of your total available credit.

3. Clear Outstanding Debts:- Pay off any old or overdue debts to improve your creditworthiness.

4. Maintain Accurate Financial Records:- Keep accurate and updated records of your financial statements, balance sheets, and profit-and-loss accounts.

5. Diversify Credit Types:- Maintain a healthy mix of different types of credit (e.g., term loans, working capital).

6. Monitor Credit Reports:- Regularly check your business credit report for errors and rectify them promptly.

7. Avoid Multiple Loan Applications:- Applying for multiple loans in a short period can lower your CMR.

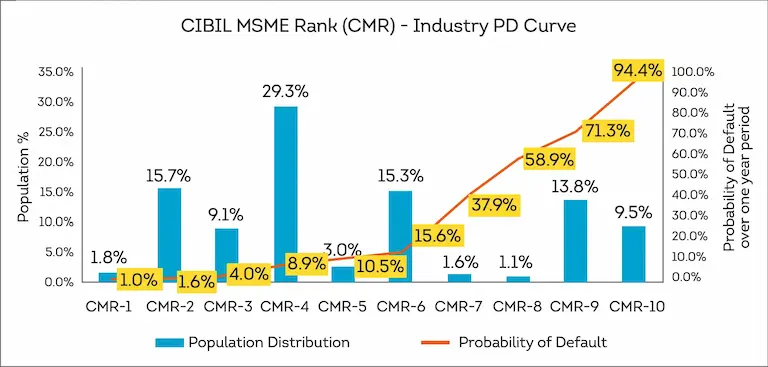

CIBIL MSME Rank Industry Probability of Default (PD) Curve

The CIBIL MSME Rank Industry Probability of Default (PD) Curve is a critical concept used in evaluating the credit risk associated with Micro, Small, and Medium Enterprises (MSMEs). It helps financial institutions and lenders assess the likelihood of a business defaulting on its credit obligations within a specific timeframe.

Probability of Default (PD)

Probability of Default (PD) is a statistical measure that represents the likelihood of a borrower (in this case, an MSME) failing to meet their debt obligations within a specified period, typically 12 months. PD is expressed as a percentage and is used by lenders to gauge the credit risk of a borrower.

For example:

If a business has a PD of 5%, it means there is a 5% chance the business will default on its loan within the next 12 months.

Conclusion

In summary, CMR full form in CIBIL stands for Company Credit Risk Rank. It plays a crucial role in determining a business’s creditworthiness. Whether you’re applying for a business loan or want to maintain a healthy financial profile, understanding your CMR rank can make a significant difference.

By knowing what CMR CIBIL full form means, how it is calculated, and how to improve it, businesses can stay financially strong and access better lending opportunities. A good CMR not only helps secure loans with favourable terms but also boosts your business reputation.

Download Personal Loan App

Get a loan instantly! Best Personal Loan App for your needs!!

Looking for an instant loan? Buddy Loan helps you get an instant loan from the best-verified lenders. Download the Buddy Loan App from the Play Store or App Store and apply for a loan now!

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

Q. What does CMR stand for in the context of CIBIL?

A. CMR stands for CIBIL MSME Rank, a ranking system by TransUnion CIBIL that assesses the creditworthiness of Micro, Small, and Medium Enterprises (MSMEs) on a scale from 1 to 10, with 1 indicating the lowest risk of default and 10 the highest. citeturn0search14

Q. Why is the CMR important for borrowers?

A. CMR provides lenders with an objective measure of an MSME’s credit risk, influencing loan approval decisions and terms. citeturn0search13

Q. How is the CMR generated?

A. CMR is calculated based on an MSME’s credit history, repayment behaviour, outstanding debt, and other financial indicators over a one-year period. citeturn0search13

Q. What information can I find in my CMR?

A. The CMR reflects your business’s creditworthiness, indicating the likelihood of default; a lower rank signifies better credit health. citeturn0search14

Q. How often is the CMR updated?

A. CMR is updated regularly as new credit information becomes available, typically on a monthly basis, reflecting recent credit activities.

Q. Can I obtain my CMR for free?

A. Access to your CMR may require a fee; it’s advisable to check with TransUnion CIBIL or authorized partners for specific details.

Q. How does the CMR affect my loan application?

A. A lower CMR (closer to 1) enhances your chances of loan approval and may secure more favourable terms, while a higher CMR indicates higher risk. citeturn0search16

Q. What should I do if I find errors in my CMR?

A. If you identify inaccuracies in your CMR, promptly contact TransUnion CIBIL to dispute and rectify the errors.

Q. How can I improve my CMR?

A. Maintain timely repayments, manage credit utilization effectively, reduce outstanding debts, and monitor your credit report regularly to improve your CMR. citeturn0search8