Those who own a credit card or have applied for a loan must have probably heard the term ‘CIBIL Score or Credit Score’. Your CIBIL score is like your financial report card and can greatly influence whether you get approved for loans or not. To keep your finances in good shape, you should regularly check your CIBIL score and make smart choices with spending habits either to boost it if needed or maintain your score.

If you are wondering how to check CIBIL Score by Aadhar card, then this blog is for you. Here, we will walk you through how to CIBIL score check using an Aadhar card, how it works, and other ways to check CIBIL Score for free.

Check CIBIL Score Using Aadhar Card

Checking your CIBIL score using just your Aadhaar card isn’t possible right now. However, an Aadhaar card can be used as identification proof when checking your CIBIL score on the website, but that alone won’t give you your CIBIL report.

Credit bureaus offer this service, but there might be a small fee. They can show you if you are eligible for a loan and help lenders see if you’re a reliable borrower to lend money to. There are other ways to check your CIBIL score and to get a detailed report. Websites like Buddy Loan can help you check your CIBIL score for free, giving you a good idea of your financial health.

In the following, we have discussed two scenarios. First, where you can use your Aadhar card to check your credit score on CIBIL website and secondly, how to check your credit score for free with Buddy Loan.

Steps To Check CIBIL Score Through Website

The following are the steps to check your credit score through the website.

- Visit the Official CIBIL Website and click on ‘Get your Credit Score’ or anything similar.

- If you are already a member, log in using your username, password, and OTP.

- If you are a new user, you can sign up by providing your personal details, contact information, date of birth, type of ID (like PAN card, Passport, etc.), ID number, PIN code, and create your password.

- After entering your details, click ‘Accept and continue’.

- A One-Time Password (OTP) will be sent to your mobile number and email for verification, enter it.

- Once your identity is verified, you’ll be able to access your credit score in the main dashboard.

Please note that for detailed credit reports, you can read your CIBIL report through subscription services offered by CIBIL for a fee.

Check Credit Score For Free With Buddy Loan

Now that you know how to check your CIBIL score using your Aadhar card, let’s introduce you to Buddy Loan. It is one of the best platforms that allows you to check your credit score for free.

Buddy Loan is a highly reliable platform that offers you the convenience of checking your credit score by simply providing some basic information. Here’s a step-by-step guide on how you can use Buddy Loan to check your credit score for free.

Step 1: Visit the Buddy Loan website or download the user-friendly mobile application from the Play Store or Apple Store.

Step 2: Proceed to register with your mobile number and you’ll need to fill in some essential information such as your Name, Date of Birth, PAN Number, and a verified email ID.

Step 3: An OTP will be generated and sent to your registered mobile number. Use this OTP to create your account securely.

Step 4: Once you’ve successfully created your account, navigate to the credit score section within the application or website. Look for the ‘Check your Credit Score’ option and click on it.

Step 5: Tick off the declaration checkbox, indicating your consent and agreement with the terms.

Step 6: Now, your credit score will be displayed on your mobile screen, providing you with valuable insight into your financial health.

The credit score, along with a detailed free credit report, will be sent to your email address (as specified in the form). In addition, you will receive an SMS containing a password to open the credit report PDF (as mailed).

Also Read: Check Your CIBIL Score Using a PAN Card

Summing Up

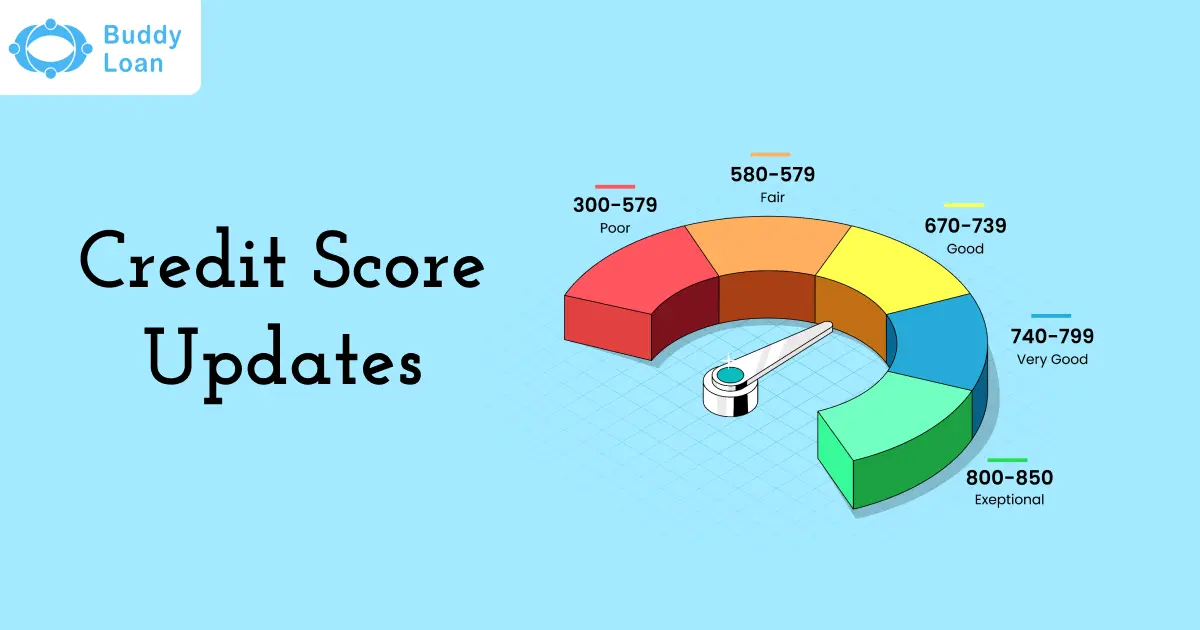

Your credit score is a valuable financial asset, and checking it regularly is a responsible financial practice. Whether you check the CIBIL Score through the official CIBIL website or opt for the user-friendly interface of Buddy Loan, you should regularly monitor your credit score. Remember, a healthy credit score opens doors for better financial opportunities and favourable loan terms.

Have a Healthy Credit-Life!

Download Personal Loan App

Get a loan instantly! Best Personal Loan App for your needs!!

Looking for an instant loan? Buddy Loan helps you get an instant loan from the best verified lenders. Download the Buddy Loan App from the Play Store or App Store and apply for a loan now!

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

Q. Can I check my CIBIL score through an Aadhar card?

A. It is currently not possible to verify your CIBIL score with just your Aadhaar Card.

Q. How can I check my CIBIL score without a PAN card?

A. You can check your CIBIL score without a PAN card by providing your Aadhaar number and other details.

Q. Can I check my CIBIL score myself?

A. Yes, you can check your CIBIL score yourself by visiting the CIBIL website or by using trusted third-party apps like Buddy Loan.

Q. Is 750 a good CIBIL score?

A. Yes, 750 is a good CIBIL score and it indicates that you are a0 reliable borrower.