When you apply for a personal loan, lenders usually conduct a credit check to determine your creditworthiness and their risk when lending you money. It is called “Credit Inquiry” or “Credit Pull.” potential lenders, employers, landlords, or creditors conduct credit inquiries to assess your credit report. These inquiries help lenders determine the payment history, credit information, and the number of credit inquiries of the individual. Hence, credit inquiries play a significant role in approving or rejecting a borrower’s loan application. Read the article to know the difference between Hard vs Soft Credit Inquiries

Credit Inquiry of Two Types, Namely

- Soft Credit Inquiry

- Hard Credit Inquiry

In this article, let us see the difference between soft and hard credit inquiries.

Soft Credit Check

Soft Credit Inquiries occur when a person checks his credit report to track his credit history. It can also happen when a company conducts a credit check to know your credit behavior, and a soft inquiry does not affect your credit score.

Examples of Soft Inquiries:

- When you check your credit report.

- When your lenders and creditors check your report to ensure you have good credit behavior.

- Banks and lending institutions check your score to offer you a pre-approved loan.

- Employer conducts a credit check for background verification.

Hard Credit Check

Hard Credit Inquiries occur when a person applies for any financial product, such as personal loans, credit cards, mortgage, etc., and gives the consent to the lenders to check their credit report to assess their creditworthiness. Each time the lender conducts a credit check, a hard inquiry is generated in your credit report. The hard inquiry affects your credit score negatively and will be reflected on your credit report for two years. Hence, avoid applying for loans from multiple lenders to reduce the number of hard inquiries.

Examples of Hard Inquiries

- When you apply for mortgages, auto loans, student loans, personal loans, etc.

- When you request an increase in your credit limit.

- Application for lines of credit.

Also Read: Know The Different Types Of Credit Score

Difference Between Hard and Soft Inquiries

| Soft Inquiry | Hard Inquiry |

| It does not affect your credit score | It affects your credit score |

| Soft inquiry occurs when you/ employer/ potential lender checks your credit report. | Hard inquiry occurs when your lender conducts a credit check to approve your loan application. |

| It can be done without your consent | It requires a written consent. |

Dispute Credit Inquiries

- Check and review your credit report regularly, at least once a year. You can check your credit report using Buddy Score and get the report instantly. If you find any errors or a hard inquiry conducted without your consent, report it to your respective credit bureaus immediately.

- These errors can signify identity theft, errors in your transactions, etc. However, you have to review your report carefully to know what’s going on.

- Remember that you can dispute only the hard inquiries without your permission. If you have acknowledged a hard inquiry, it will reflect your credit report for at least two years.

Avoid a Hard Inquiry

- Do not apply for credit cards or loans when you know you won’t be eligible because it will lead to a hard inquiry and rejection of your loan application. As a result, your credit score will be affected.

- Use credit score apps like Buddy Score and check your score to track your credit behavior and potential errors.

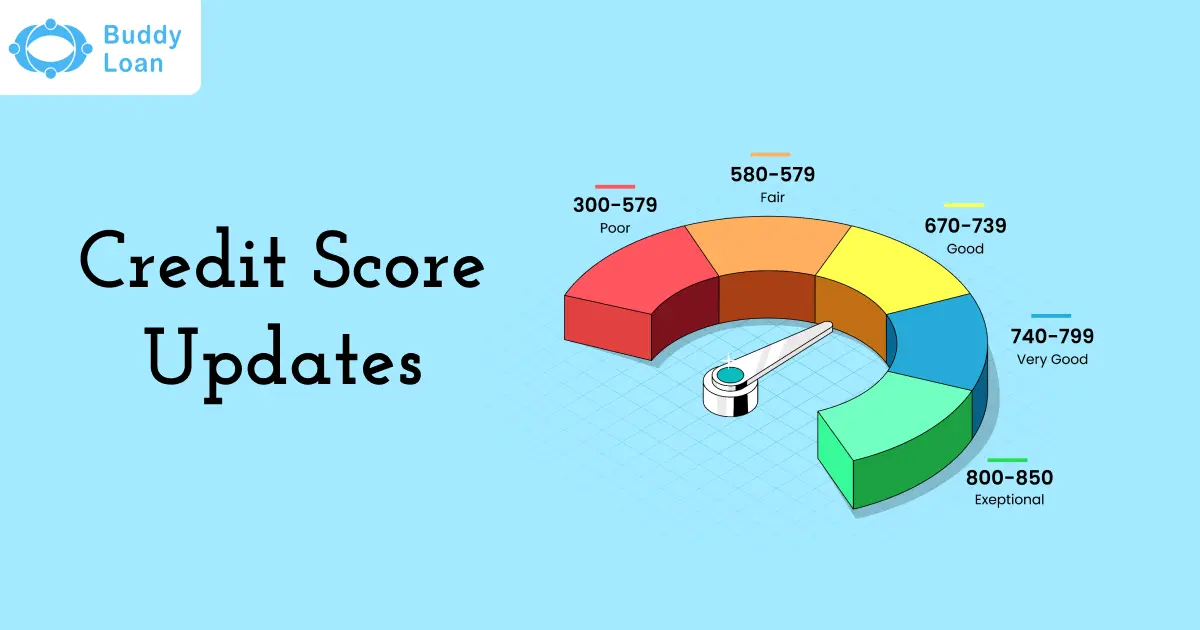

Credit Score Table

| Score Range | Credit Rating |

| 300 to 600 | Very low |

| 601 to 700 | Low |

| 701 to 760 | Fair |

| 761 to 800 | Good |

| Above 800 | Excellent |

Important to Have a Good Credit Score

- Low-interest rates: One of the benefits of having a high credit rating is that lenders will be ready to offer you loans at lower interest rates. You might also get discounts on interest rates for your loans.

- Eligibility for loans: A high score makes you eligible to apply for getting any loans. It also indicates that you are a low-risk borrower.

- Credit Cards: Having a good credit score will help you get credit cards with attractive offers and suitable deals.

- Higher loan amount: Having a good score suggests that you can handle loan repayment without defaulting. Hence, lenders might consider offering higher loan amounts.

- Quick loan approval: Lenders and banking institutions offer pre-approved loans to existing customers with a consistent and lengthy credit history. One of the most significant advantages of having a high score is that lenders approve your loan immediately without taking much time to verify.

- Adds additional value: Having a high score gives extra weight to your financial status, especially if you plan to apply for a visa.

- Benefits for the future: A high credit score comes in handy when you apply for any loans in the future. Therefore, it is always best to maintain a score of above 750 to get maximum benefits in many ways.

Check Your Score Frequently

- You can check your credit score as many times as you want. Moreover, it is good to check your score often to keep track of your history.

- You can also check months in advance before applying for a personal loan so that you will have time to fix any issues.

- It is also essential to review your credit report once a year regularly.

- You can check your free credit score to get an instant report showing your credit health.

Also Read: Here’s What You Should Know About Credit Scoring

Summing Up

Credit Inquiries contribute about 10% of the FICO score, so it is easy to think they are not a big deal. But sometimes, it is the little things that bring the most damage to your credit score. It ultimately results in higher interest rates on loans which will cost you a lot of money. Hence, it is always important to be mindful when applying for loans to avoid unnecessary hard inquiries that affect your score. One bonus tip to improve your credit score is to get a personal loan using Buddy Loan and make timely payments to increase your credibility and repayment history.

Having any queries? Do reach us at info@buddyloan.com