If ICICI Bank is your everyday bank, you should take a closer look at your statement next month. Starting July 1, 2025, the bank is rolling out updates across multiple service charges—things like ATM withdrawals, IMPS transfers, debit card fees, and even how you deposit or withdraw cash at branches.

It’s nothing to be panicking about, but definitely one to prepare for—because these changes will quietly start affecting your monthly spend if you’re not paying attention.

Why Is This Happening?

Like any service, banking costs change with time. Whether it’s technology upgrades, rising operational costs, or encouraging users to go digital, banks like ICICI regularly tweak their charges.

The July update is one of those system-wide adjustments. It’s not about penalizing you—it’s about recalibrating how services are priced in a digital-first world.

The ATM Visit Price Jump

It’s not like you will be overcharged for each visit. You’ll still get your free withdrawals—although in a more controlled number—and beyond that, charges start adding up.

⇒ At ICICI ATMs: 5 free cash withdrawals per month. After that, ₹23 per transaction.

⇒ At other bank ATMs in metro cities: Only 3 free transactions, then ₹23 for cash and ₹8.50 for non-financial tasks like balance checks.

⇒ In non-metro cities: 5 free transactions still continue. After that, the same charges apply.

⇒ ATM abroad: It’s ₹125 per cash withdrawal + 3.5% conversion fee.

Senior citizens, you’re safe from these fees. For everyone else, maybe think twice before that midweek ATM run. It is best to plan ahead of time and when you visit the ATM, take the necessary amount altogether, instead of using up your free withdrawals.

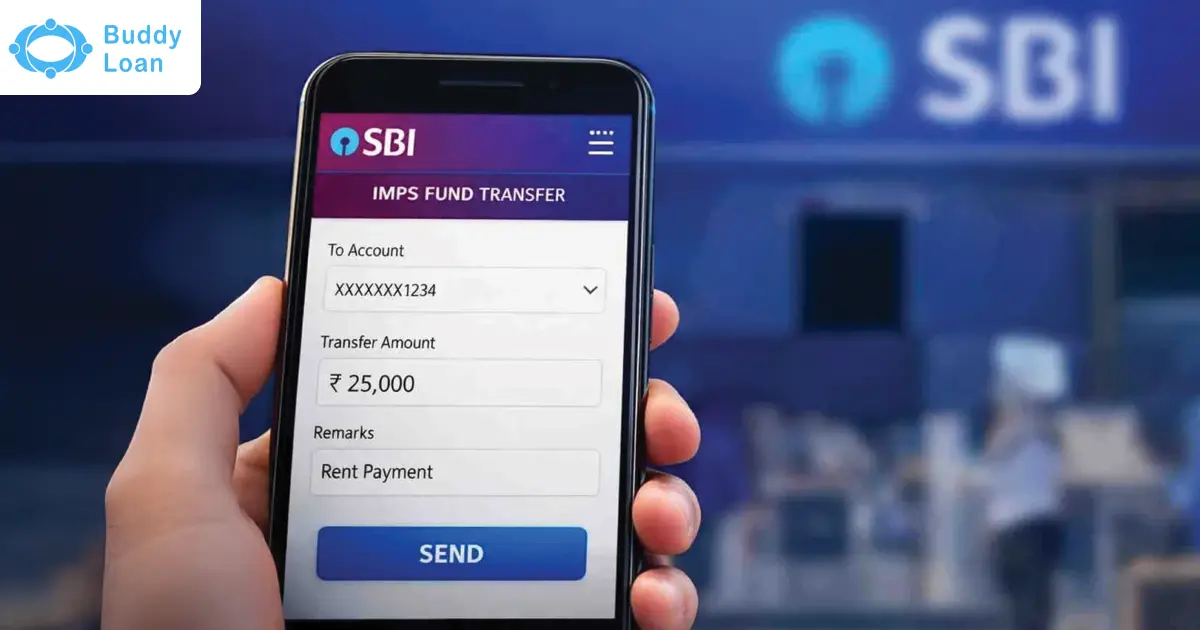

IMPS Transfers: Still Fast, Slightly Costlier

IMPS (the instant bank transfer method) is still the go-to for speed. However, there has been an increase in charges.

Here is a list of revised charges

| Amount | Charge |

| Up to ₹1,000 | ₹2.50 |

| ₹1,001 to ₹1,00,000 | ₹5 |

| Above ₹1,00,000 | ₹15 per transfer |

It’s not a big jump, but it’s something to note if you use IMPS transfer often.

Branch Cash Deposits or Withdrawals? Plan Them

With cash handling being one of the costlier operations for banks, ICICI is now reworking how much you’ll pay for over-the-counter transactions.

Here’s where it can add up quickly.

⇒ The first 3 cash transactions (deposit or withdrawal) at branches or CRMs are free.

⇒ From the 4th transaction onwards, it’s ₹150 per transaction.

⇒ If your total cash transactions exceed ₹1,00,000 in a month, you’ll be charged ₹3.5 per ₹1,000 or ₹150, whichever is higher.

⇒ Third-party cash deposits or withdrawals are capped at ₹25,000 per transaction and attract a ₹150 fee each time.

Get Personal Loan Online Up to ₹50 Lakhs

By entering your number, you're agreeing to Terms & Conditions & Privacy Policy.

Debit Card Fees: A Slight Bump

ICICI is making modest revisions to debit card fees—small enough to manage, but still worth noting. Especially if you hold multiple cards, a quick review now could save you from surprises later.

⇒ The annual fee goes from ₹200 to ₹300.

⇒ For rural users, it’s ₹150 now.

⇒ Replacing a card will cost ₹300 instead of the previous ₹200.

It’s not massive, but it’s something worth keeping in mind, especially if you’ve got multiple cards.

Demand Drafts: Flat and Simple Now

If you still use DDs or Pay Orders, the charges have changed and now work like this:

⇒ ₹2 charge per ₹1000 spent.

⇒ A minimum limit is ₹50 and the maximum is ₹15,000.

No more confusing slabs. Just a single, simple, flat calculation.

Simply Put—Small, Stacking Changes

Individually, none of these updates might feel major. But together, they can quietly nudge your banking costs up if you’re not being careful. Now’s a good time to review how often you use ATMs, rely on cash, or pay with your debit card.

While ICICI’s July charge update may not shake the ground beneath your feet, it’s definitely a signal to rethink how you use your bank account day-to-day. A few tweaks to your habits—plus the right tools and info—can go a long way.

Also, if you’re dealing with higher monthly expenses or planning a big-ticket expense, sometimes a personal loan can take the edge off. Buddy Loan helps you browse options from multiple lenders. Just a smoother way to find the loan that fits.

You can also check your credit score for free on Buddy Score, which is especially handy if you’re thinking of applying.