Availing a personal loan is the first thing that comes to your mind when you confront unplanned or uninvited expenses. Be it a medical emergency, home renovation, traveling to a dream destination, or investing in something big, you will require funds, and an instant personal loan is a great solution to meet all these expenditures with ease and convenience. But do you know when it comes to applying for a loan, a credit score is one of the most important metrics that a lender uses to determine an individual’s creditworthiness. Having a credit score of 750 is considered good as it helps you avail of a loan quickly. However, maintaining a good credit score requires good credit habits, money management skills, and smooth cash flow to repay debts timely.

While getting a loan with a good credit score is a cakewalk but what happens when an individual holds a low or no credit score? Well, borrowers can quickly obtain a personal loan with a bad credit score, but in this case, lenders will look for the applicant’s income, debts, collateral, spending habits, etc. Having a low credit history could limit your options and lead to more expensive loan deals and offers. Before you read further on how to avail a quick personal loan with a bad credit score, know what a credit score and the importance of it is to help various credit lines.

What is Credit Score & How It is Calculated?

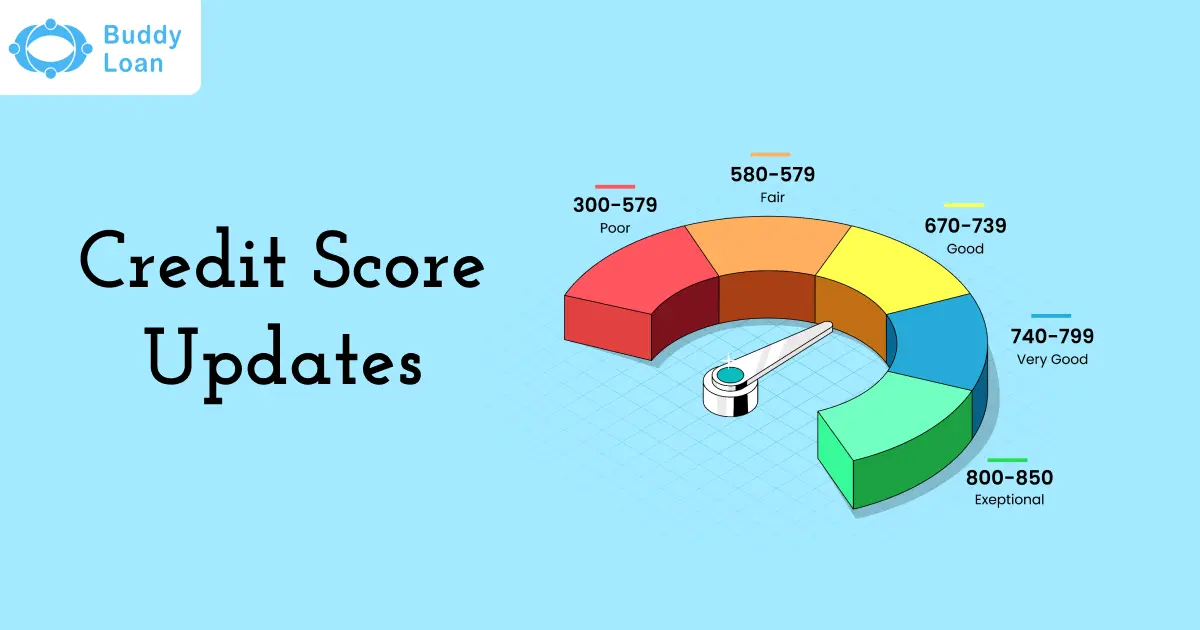

A CIBIL score is a three-digit number that ranges from 300 to 900 and expresses the creditworthiness of a borrower to the lenders. Having a credit score of 750 is considered good to secure a loan and other forms of credit without any trouble, while a low credit score lowers the chances. The CIBIL score is calculated by the credit bureaus depending on numerous factors such as credit history, the number of loans taken, outstanding credit amount, credit behavior, and credit utilization. A low credit utilization ratio timely repayments of existing loan EMIs and credit card bills ensure a clean credit history and positively enhance your credit score. But if you fail to meet any of these criteria and do not repay your pending bills on time, it can negatively impact your credit score.

It is always essential to have a good CIBIL score as most of the banks and financial institutions look for it to determine the creditworthiness, credit history, and the ability to repay the debts of the borrower. With a good score, one can avail a great deal on loan amount while bargaining on the interest rate and repayment plan. There are various online tools and CIBIL’s websites to check your credit score for free. So, it’s always suggested that you work hard on improving your credit score as it will help you get favorable loan deals shortly.

While you may have heard that with a bad credit score, it’s tough to get a personal loan; however, in recent times, many lenders are offering loans despite having low or no credit scores but at a high-interest rate.

Also Read: How To Check Your Credit Score Online For Free With Buddy Score

How to Get a Personal Loan Online with Bad Credit Score in India?

So, here are five ways you can get a personal loan with a low credit score –

Maximize Your Search

When it comes to availing of personal loans, most of the banks set strict eligibility criteria, and often hard inquiries lead your loan application towards rejection, impacting credit score. Hence, consider taking a loan from non-banking financial institutions or peer-to-peer lending (P2P) that offer loans at a low credit score with a flexible repayment policy. In this scenario, most of the lenders set a high cut-off in credit scores while approving loan applications, but there are a few lenders who offer loans with a low credit score but at a high-interest rate. So, if you are in urgent need of cash and looking for a personal loan with a poor credit report, then broaden your search and look for those lenders who provide loans with a low score, monthly income, job profile & stability, etc.

Also Read: Differences Between Credit Score and CIBIL Score

Maintain a Good Relationship with Lenders

If you have a low or bad credit score for some financial reason, then consult with the bank or lender with whom you have been connected for an extended period. Having a good relationship with them may help you avail of a loan without any hassle. Also, show your income proof to ensure job stability and good income to support loan repayments.

Apply For Secured Personal Loans

Unsecured or collateral-free loans are only available to people with high credit scores, ideally over 750. But those having a low score can opt for a secured loan by mortgaging any assets as a guarantee. Once you agree to pledge anything against the loan amount, lenders will quickly approve your loan application, as in case of defaults, they can auction the collateral to recover the outstanding loan amount. But apply for a secured personal loan only when you are in urgent need of cash.

Apply for a Loan with Guarantor

Despite having a low credit score, you can apply loan online with a co-applicant who has a good credit score. You can ask any of your family members for good income stability and a healthy credit report. Adding a guarantor increases the chances of getting a loan approval as a higher credit score reduces the credit risk for the lenders. Moreover, before approving your loan application, lenders will verify the credit history, credit report, and income details to ensure whether they can repay the loan in case of default by the primary borrower.

Opt For a Smaller Loan Amount

If you don’t have a good credit history, then opt for a smaller loan amount and repay it regularly to build a good credit score. This will not only help you generate a healthy credit report but also make you eligible to avail of more extensive personal loans in the future.

Your CIBIL score plays a significant role in determining your loan amount, interest rate, and repayment tenure. You can use a personal loan eligibility calculator to determine how much loan you can avail of and the EMIs. Also, with a low credit score, avail of a loan at high-interest rates. Consider getting a personal loan with the NBFCs for a low CIBIL score because they have more flexibility compared to banks.

When Should You Apply for a Bad CIBIL Score Personal Loan?

-

Multiple lenders rejected your loan due to low credit score; now urgently need cash.

- There are numerous financial emergencies, and you don’t have any way to manage the debts

- You want to improve your credit score by opting for a small loan amount

Also Read: How to Get a Personal Loan with Bad Credit score

Improve Credit Score Before Applying Loan Online

Consider improving your credit score before applying for unsecured credit if you desire a quick personal loan with a higher approval chance despite a low credit score. Check out the tips below to help you build a good credit report.

- Make your bills payments, including loans and credit cards, on time because falling on payments could hurt your credit report. So, set a reminder and make timely repayments to make a positive impact on your credit score.

- Consider lowering your credit card utilization that will help you boost your credit score.

- Do not apply for multiple loans within a short period.

- Consider checking your credit report often. And in case of errors, fix them immediately.

Things You Should Keep in Mind Before Applying for a Bad Credit Loan

- Do proper research and analysis before you choose a lender while applying for personal loans

- Before applying for a personal loan, make sure you are eligible for it. Otherwise, rejection will damage your credit score further

- Go through the terms & conditions and policies provided by the lenders

- Know your repayment capacity and then proceed. Because defaulting on loans will impact your credit report more

In Conclusion

Financial emergencies or cash crunches can occur at any point in life, and to deal with such situations, personal loans are the best. With a low credit score, you can avail of a personal loan following the tips mentioned above, but you may need to pay a high-interest rate. Hence, it’s evident that if you improve your CIBIL score and increase the chances of availing of personal loans at lower interest rates. Before you apply for a bad credit loan, consider consulting with the financial experts and take the right decision!

Download Personal Loan App

Get a loan instantly! Best Personal Loan App for your needs!!

Looking for an instant loan? Buddy Loan helps you get an instant loan from various lender options. Download the Buddy Loan App from the Play Store or App Store and apply for a loan now!

Having any queries? Do reach us at info@buddyloan.com