Credit Score

Does Hard Credit Inquiry Harm Credit Score

Your credit score may drop slightly after applying for a loan or credit card because of a hard inquiry, which usually lowers scores by up to 10 points. Multiple hard inquiries within a short time can signal risk and affect approvals. Soft inquiries are harmless. Time your applications wisely and use pre-approval checks to protect your score and avoid unnecessary dips.

By Buddy Loan

10-Dec-2025

CIBIL Score

New Credit Score Updates – October 2025

The Reserve Bank of India (RBI) introduced sweeping changes to the CIBIL credit scoring system in 2025. These essential reforms aim to make borrowing faster, fairer, and more transparent. They represent a major shift in how lenders assess creditworthiness and how individuals can manage their financial health. For the common Indian, this means more control and increased visibility over their financial narrative. Understanding these updates is essential for anyone planning to take loans, use credit cards, or simply maintain financial trustworthiness.

By Krish

27-Oct-2025

Credit Score

Credit Score Vs Credit Remark Which Affects More

Is a good credit score always enough to get a personal loan? The credit information bureau of India maintains a record of your entire financial history. The loans you have availed, your credit card, and your repayment history are well mentioned in your credit report. Hence, credit score and credit report are significant to […]

By Buddy Loan

02-Jun-2025

Credit Score

Tips to Achieve a Good Credit Score

Nowadays, having a good credit score has become necessary for managing financial health. Hence, whether you are applying for a loan, credit card, or want to get a low-interest rate on your loan, a good credit score is essential. You must have also come across the credit score of 750 mentioned in various places, and […]

By Buddy Loan

02-Jun-2025

Credit Score

750 Credit Score, This is How I Made It!

I knew I could make money, but I didn’t know how. Soon, I realized I was in a soup between the finance market crash and my survival. Today, I am well settled with my family in the heart of Bangalore city with a credit report that characterizes my financial behavior. Currently, I hold a record […]

By Buddy Loan

02-Jun-2025

Credit Score

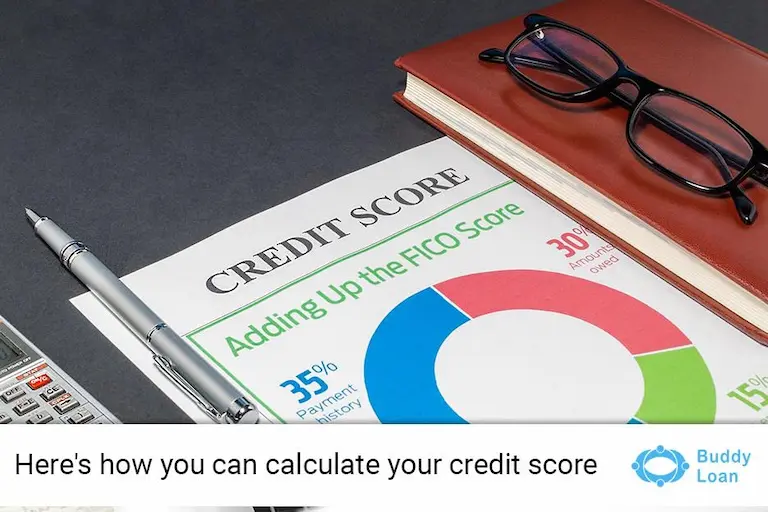

What Does A Credit Score Mean, What Factors Influence It?

A credit score is simply a metric based on the numeric representation of your current credit rating as a virtue of your past credit history and transactional behaviours you have made so far. Once you understand the importance of having a credit score, the next thing you need to do is what factors are involved […]

By Buddy Loan

02-Jun-2025

Credit Score

Essential Factors To Check In Your Credit Report

As we all know, credit scores help us get loans and credit cards quickly. You get three unique reports, one each assigned for the three prime Indian bureaus that are – Experian, Equifax and TransUnion Bureaus contain information about the borrower, that is you. However, even a minute error can cause the declination of […]

By Buddy Loan

02-Jun-2025

Credit Score

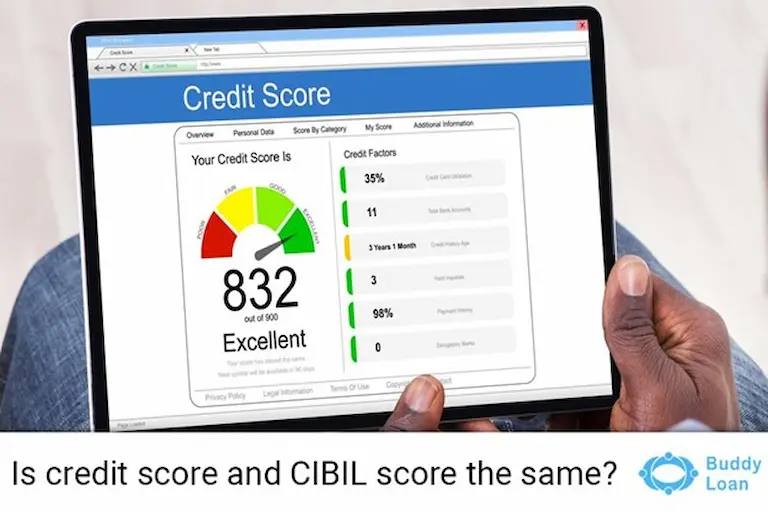

Difference Between Credit Score and CIBIL Score

Every day, while scrolling through our gadgets, we encounter many terms that might be confusing to understand. The same misunderstanding might happen between a credit score and a CIBIL score, especially when you are new to growing your credit. Even though they both sound similar, they are vastly different in terms of their work […]

By Buddy Loan

02-Jun-2025

Credit Score

Get A Personal Loan Fast With A Poor CIBIL Score

Even with a poor CIBIL score, you can secure a personal loan by exploring alternative strategies. Lenders consider income, existing debt, and repayment capacity alongside your credit score. Options include applying for smaller loan amounts, using a co-borrower or guarantor, choosing lenders with flexible eligibility, and leveraging platforms like Buddy Loan for instant personal loan offers. Regularly monitoring and improving your credit score increases your chances of fast loan approval.

By Buddy Loan

02-Jun-2025

Credit Score

Good Credit Score But Still Rejected Loan? Top 10 Reasons For Loan Rejections

In today’s world, having a good credit score increases your chances of getting instant loan approval. It also leads to the misconception that having a good CIBIL score is enough for getting a loan. Thus based on this scenario, borrowers apply for loans based on their CIBIL scores. But despite having a good score […]

By Buddy Loan

02-Jun-2025