In recent years, digital gold has emerged as a popular investment option, offering a modern twist to the traditional way of owning gold. Moreover, with the convenience of technology, digital gold allows investors to buy, sell, and store gold electronically. Therefore, this blog will explore the key benefits of buying digital gold and why it might be a smart addition to your investment portfolio.

Digital Gold

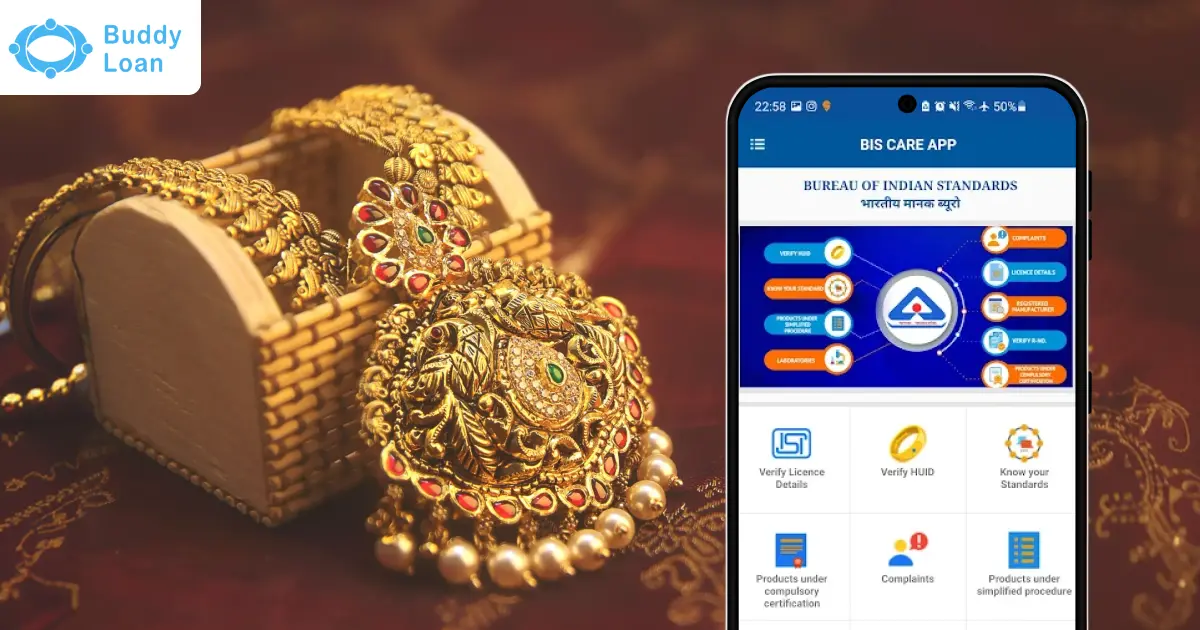

Digital gold is a modern and convenient alternative to buying physical gold. When you purchase digital gold online, we securely store an equivalent amount of physical gold in an insured vault for you. One of the biggest advantages of digital gold is its flexibility. For instance, you can sell all or part of your gold at any time, based on the current market rates. Moreover, the gold is always 24K and certified by the government, ensuring its purity and eliminating the risk of fraud.

Highlights on Digital Gold

As a result, with the growing popularity of digital assets, digital gold has quickly become a trending choice for investors who not only want the security of gold but also wish to avoid the hassle of physical storage.

| Grams | 24 Carat Gold – Yesterday | 24 Carat Gold – Today |

| 0.5 gm | ₹5,095 | ₹5,204 |

| 1 gm | ₹40,760 | ₹41,024 |

| 5 gm | ₹47,770 | ₹52,204 |

| 10 gm | ₹4,77,000 | ₹5,22,040 |

Note: Live gold prices are marked as of today and is subject to change with market fluctuations and the Country’s economic conditions

| You can start investing with as little as one rupee, making it accessible to everyone and is It’s a smart, easy, and secure way to invest in gold in today’s digital age. |

Benefits of Buying Digtial Gold

Convenience and Accessibility

One of the biggest advantages of digital gold is that people can easily purchase and manage it. Unlike physical gold, which requires storage and security measures, you can buy digital gold online with just a few clicks. You can access your investment anytime, anywhere through your smartphone or computer. Moreover, this makes it incredibly convenient for busy individuals who want to invest in gold without the hassle of handling physical assets.

Low Investment Threshold

Moreover, digital gold allows you to start investing with as little as INR 1 or its equivalent in other currencies. Consequently, this low entry barrier makes it accessible to a wide range of investors, especially those who may not have significant capital to invest in physical gold. It also enables you to accumulate gold over time by making small, regular investments, which can add up to a substantial amount.

| Gold biscuits or coins are available in the standard denominations of 10 grams. Hence, it requires a huge investment to invest in physical gold. | One can buy and sell gold by weight or by fixed worth. |

High Liquidity

Another significant benefit of digital gold is its liquidity. You can buy or sell digital gold at any time during market hours, and the transactions are processed quickly. This flexibility ensures that you can easily convert your gold into cash when needed, unlike physical gold, which may require finding a buyer or dealing with other logistical challenges.

Transparent Pricing

Digital gold is priced based on real-time market rates, ensuring that you get the most accurate and fair value for your investment. Unlike physical gold, where the price may vary depending on the seller or additional charges like making fees, digital gold offers transparency and consistency in pricing. This helps you make informed decisions and avoid overpaying for your investment.

No Storage Worries

One of the primary concerns with buying physical gold is the need for secure storage. However, with digital gold, this worry is eliminated. Moreover, your gold is stored securely in digital vaults managed by trusted institutions, so you don’t have to worry about theft, damage, or loss. This not only provides peace of mind but also saves on storage and insurance costs.

| If you buy gold jewels or gold bars, you may need to accommodate it in a safe and secure place to prevent any theft. | The seller stores the digital gold in the investor’s name in a secure locker—no chance of theft or loss or are basically low. |

Fractional Ownership

Digital gold allows you to own a fraction of a gram of gold, making it possible to invest in gold even with limited funds. This fractional ownership is not possible with physical gold, where you would need to buy at least one gram or more. It allows for greater flexibility in how much you want to invest at any given time.

Easy Conversion to Physical Gold

While digital gold is primarily an electronic asset, many platforms offer the option to convert your digital gold into physical gold if you wish. You can either choose to have the gold delivered to your home, or alternatively, store it in a safe deposit box. Moreover, this feature provides the best of both worlds, thereby allowing you to enjoy the convenience of digital gold while still having the option to own physical gold.

Cost-Effective

Investing in digital gold often comes with lower costs compared to buying physical gold. There are no making charges, and transaction fees are minimal. Additionally, storing and insuring physical gold eliminates costs, making digital gold a more cost-effective investment option.

| If you intend to purchase gold jewelry it involves paying 20% – 30% of the gold’s total value as making charges | However, 3% GST is charged on digital gold purchases. |

Security and Trust

Physical gold stored in secure vaults backs digital gold and ensures the safety of your investment. Additionally, regulated digital gold platforms partner with trusted financial institutions, adding an extra layer of security and trust.

Portfolio Diversification

Gold has always been considered a safe-haven asset, and digital gold offers the same benefits as physical gold when it comes to portfolio diversification. By investing in digital gold, you can protect your portfolio against market volatility and inflation, while also enjoying the benefits of digital assets.

Also Read: Tanishq Gold Schemes

Conclusion

Digital gold combines the timeless value of gold with the convenience and efficiency of digital technology. Whether you’re a seasoned investor or just starting, digital gold offers a range of benefits that make it a compelling addition to any investment strategy. In addition to convenience and low entry barriers, moreover, digital gold offers high liquidity and security, making it a modern and flexible way to invest in one of the world’s most trusted assets.

Beside benefits of buying digital gold, you can also check other related topics links given below

Download Personal Loan App

Get a loan instantly! Best Personal Loan App for your needs!!

Looking for an instant loan? Buddy Loan helps you get an instant loan from the best verified lenders. Download the Buddy Loan App from the Play Store or App Store and apply for a loan now!

Having any queries? Do reach us at info@buddyloan.com

Frequently Asked Questions

Q. What are the advantages of buying digital gold?

A. Investing in digital gold not only offers convenience in managing your portfolio but also provides flexible investment options, quick conversion, secure assets, and real-time market rate updates.

Q. How does digital gold offer convenience compared to physical gold?

A. Buying digital gold online is not only convenient but also secure, thanks to instant transactions and easy management through apps or websites from home. Consequently, this approach saves you both time and effort.

Q. Is digital gold a secure investment option?

A. Digital gold is a secure investment backed by physical gold in trusted vaults. Platforms are regulated and transparent for safe investments.

Q. Can I easily sell digital gold when needed?

A. Digital gold provides high liquidity, enabling instant sales and quick bank account credits. Ideal for short and long-term investors.

Q. How does buying digital gold help with portfolio diversification?

A. By including digital gold in your investment mix, you benefit from its stability without the hassle of physical ownership, aiding in risk management during economic uncertainties.

Q. Are there any storage concerns with digital gold?

A. Digital gold offers secure storage without personal costs, eliminating the need for physical storage.

Q. What are the cost benefits of purchasing digital gold?

A. Digital gold offers cost advantages: no making charges, lower transaction fees than physical gold, and no storage costs.

Q. How does digital gold provide liquidity benefits?

A. You can swiftly trade gold at market prices, ensuring instant cash availability for financial flexibility.

Q. Can digital gold be used as collateral for loans?

A. Many financial institutions accept digital gold as collateral for loans, enabling you to leverage your gold investment without selling it, facilitating a streamlined approval process due to easy verification and valuation of digital gold.

Q. What are the tax benefits of investing in digital gold?

A. Tax benefits for digital gold: Lower taxes on gains for long-term holding and no GST when selling.