EPFO, or the Employees’ Provident Fund Organisation, is a statutory body under the Ministry of Labour and Employment, Government of India. It administers the Employees’ Provident Fund (EPF) and related schemes that provide retirement benefits, pensions, and life insurance to salaried employees in the organised sector.

Accessing your EPF account through the EPFO Member Login portal enables employees to manage their PF account login, track contributions, and download the EPFO member passbook online. Through a single UAN member login, users can view and operate all their linked provident fund accounts securely.

Read more to learn about various actions such as EPFO member login, contribution tracking, downloading the passbook, etc.

The EPFO stands for Employees’ Provident Fund Organisation, which is a body under the Ministry of Labour and Employment, organised under the government of India. They are in charge of the employees’ provident fund and related schemes.

They track each member using an assigned number called UAN (Universal Account Number).

Table of Contents:

- ⇾ EPFO Member Login

- ⇾ Guide to Login to EPFO Member Portal

- ⇾ Registration Process of EPFO Member Portal

- ⇾ Access Your UAN Member Portal Online

- ⇾ EPFO Portal Member Passbook Login

- ⇾ Services Offered in EPFO Member Login

- ⇾ EPFO Member Login Issues

- ⇾ EPFO Member Benefits

- ⇾ Comparison of Personal Loan Interest Rates

- ⇾ Frequently Asked Questions

Guide to Login to EPFO Member Portal

The registered employees can log in with their UAN and password via the EPFO member login interface. It is also called the unified portal for EFPO login. An ‘EPFO Member’ is usually the employee who is registered with EPFO and contributes to the Employees’ Provident Fund (EPF).

The membership begins when an employee’s salary exceeds ₹15,000/month and the employer deducts a portion of the salary as a provident fund contribution, matching it with an equal employer contribution. Each member is assigned a UAN (Universal Account Number) by EPFO.

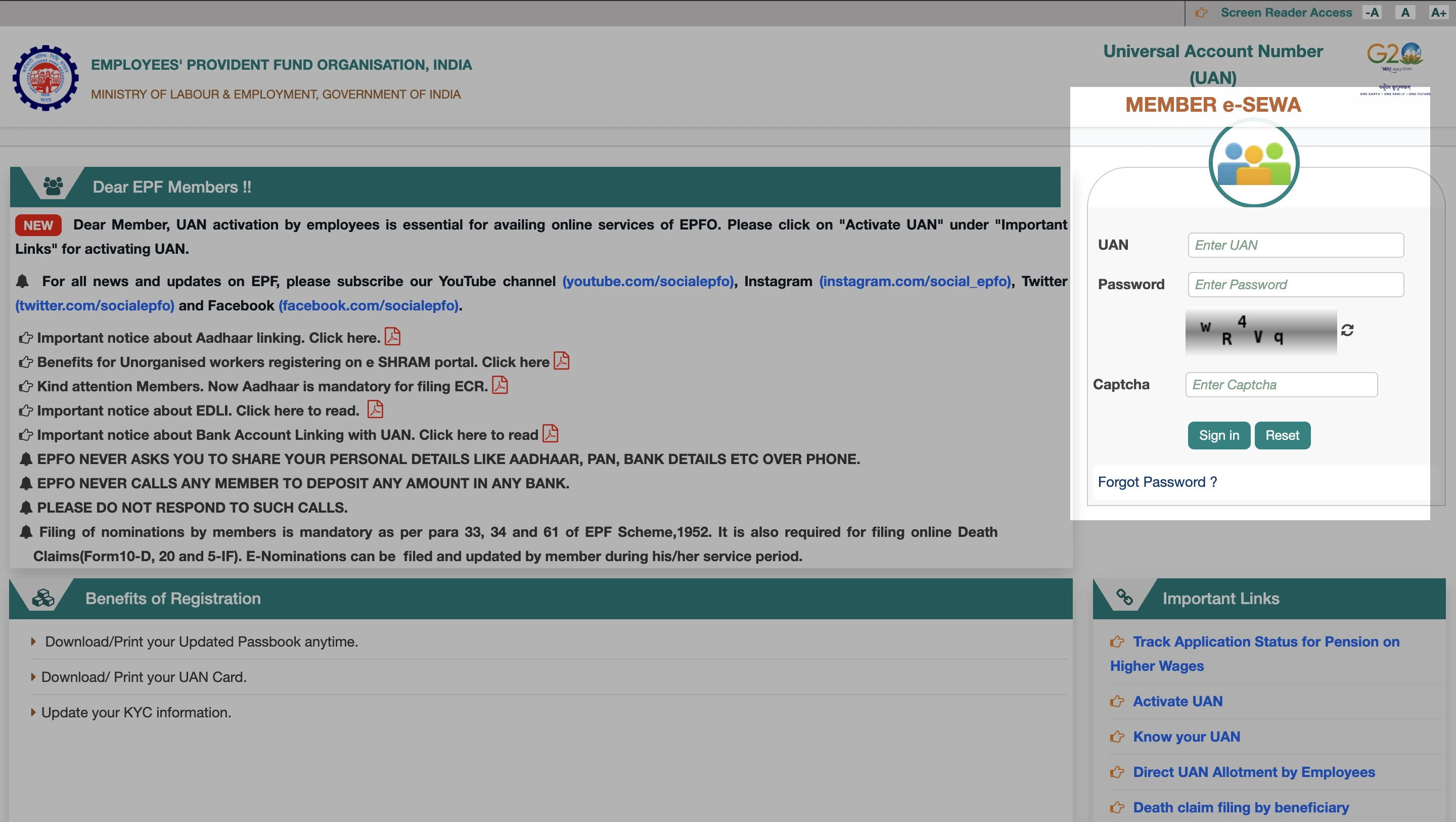

Here is a generic guide on how to log in to the EPFO portal as an employee.

- On your browser, search for EPFO and click on the link to enter the official website of EPFO.

- Click on the services option.

- Under the ‘Services’ tab, click on the ‘For Employees’ option.

- You will be redirected to a new page, where you have to choose the “Member UAN” option.

- Open your browser and search for UAN; click on the official website of UAN-EPFO.

- On the UAN-EPFO portal, you can see the space to enter your account-related details.

- Enter UAN, password, and captcha.

- Click ‘Sign In’.

This will take you to the UAN-EPFO portal. This can also be accessed by:

You can directly log into the UAN portal from the browser, instead of going through the main website, by following steps starting from step 5.

Access Your UAN Member Portal Online

After logging in, users can manage several aspects of their PF account. The portal is designed for real-time updates, online tracking, and quick access.

You can directly access the UAN member portal online by searching for the “UAN portal” in your browser or pasting “unifiedportal-mem.epfindia.gov.in/memberinterface/”.

Here are some of the key benefits of the UAN Member Portal:

- Download Passbook and track monthly employer/employee contributions.

- Update KYC details (bank account, Aadhaar, PAN).

- File PF withdrawal or transfer claims.

- Download UAN Card.

- E-nomination facility for family details.

- Track Claim Status in real time.

Access to all these services is centralised under the UAN member login, reducing dependency on offline interactions.

EPFO Portal Member Passbook Login

An EPFO member passbook is an online document that shows the contribution history of an employee’s provident fund (EPF) account. It includes both employee and employer contributions, along with interest earned for each month of service under the Employees' Provident Fund Organisation (EPFO).

The EPFO passbook login feature allows users to view transaction history with monthly contributions, interest credits, and balance summaries.

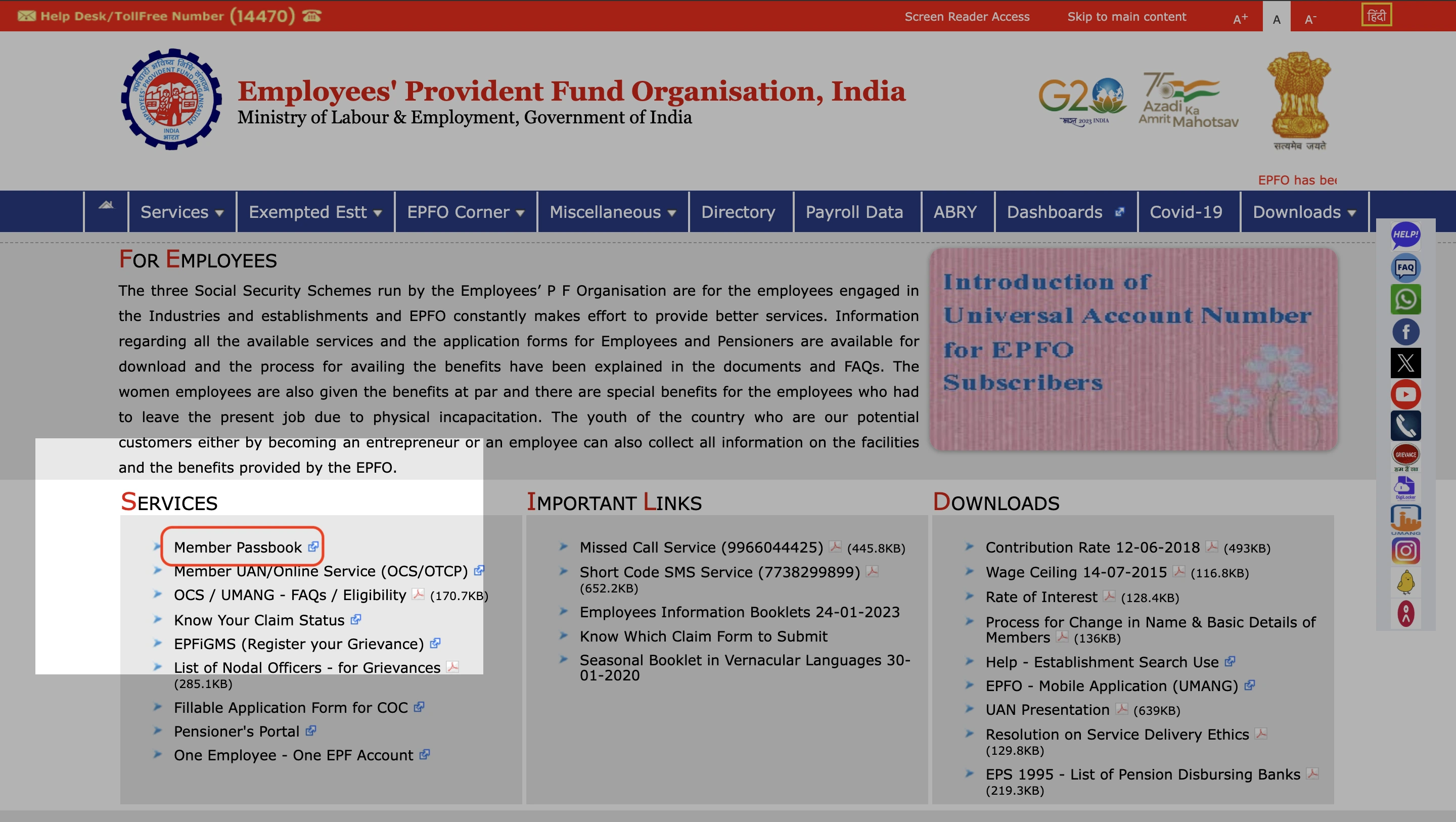

You can access your EPFO passbook by following these steps:

- Visit the official website of EPFO.

- Navigate to Employee login.

- On the services section, click on the ‘Member Passbook’ option.

- On the following page, enter your UAN and password in the respective fields.

- Solve the Captcha and hit ‘Sign In’.

- Navigate to the ‘Passbook’ section from the ‘View’ tab in the top menu.

- Select the relevant Member ID (if you have multiple member IDs) to view contributions.

Your passbook will display detailed transactions, including contributions from both the employee and the employer, interest earned, and any withdrawals.

If your Passbook is not showing, please ensure that your

- Ensure UAN is active.

- The passbook is available 6 hours after registration or update.

- The employer must have filed an Electronic Challan-cum-Return (ECR).

Services Offered in EPFO Member Login

The EPFO portal provides access to a variety of employee-friendly services under one platform. These are:

- Passbook View & Download

- PF Withdrawal & Claim Submission

- PF Transfer Between Employers

- KYC Updates

- UAN Card Download

- E-nomination

- Claim Status Tracking

- Monthly Contribution Tracking

Each service is accessible after logging in using your PF account login credentials. Physical visits or form submissions are not required for most requests.

You can track your PF account through your Mobile Phone by using the UMANG App.

You can check your balance by giving a missed call at 9966044425 from your registered mobile number or sending an SMS “EPFOHO” to 7738299899 from the registered mobile number.

EPFO Member Login Issues

EPFO offers almost all the major services and accessories related to employee provident funds through their unified portal, aiming to make a better user experience and add convenience for the user.

However, users may still face login errors or account access problems. Common causes and solutions are listed below.

| Problem | Solution |

|---|---|

| Forgotten password | Use “Forgot Password” on the login page. An OTP will be sent to the registered mobile number, using which you can change your password. |

| Account temporarily locked | You would have to wait for 24 hours or contact the helpdesk via

|

| Wrong UAN or password | Ensure caps lock is off; verify UAN from the employer if needed. |

| Mobile number changed | Update via employer or regional office, as KYC needs employer approval. |

| Captcha not visible | Refresh the browser or switch to the updated browser version. |

In cases of unsatisfactory solutions, you can contact the EPFO customer care at

| Toll-free number | 14470 |

| Email ID | employeefeedback@epfindia.gov.in |

| WhatsApp helpline details | www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/WhatsApp_Helpline.pdf |

| EPFO Grievance Redressal | epfigms.gov.in |

EPFO Member Benefits

EPFO offers multiple long-term benefits that enhance social and financial security for employees. The EPFO provides a comprehensive social security net for employees, combining retirement savings, pension, insurance, and access to funds for various needs, along with tax benefits and convenient online services.

They also provide multiple schemes mentioned below:

- Retirement Savings

- Tax Benefits

- Attractive Interest Rate

- Employer Contribution

- Pension Benefits (via EPS)

- Life Insurance Coverage (via EDLI)

- Loan Facility

- Home purchase or construction

- Repayment of home loans

- Medical emergencies for self or family

- Marriage expenses for self or dependants

- Higher education expenses for children

- Partial Withdrawals:

- Medical treatment

- Marriage expenses

- Higher education

- Purchase or construction of a house

- Home loan repayment

- Renovation of a house

- Portability of Account:

- Online Access and Management:

- Check their PF balance

- Download their passbook

- Update KYC details

- Raise claims (withdrawal, transfer, etc.) online

- Track claim status

- Download their UAN card

- Financial Support During Unemployment:

- Security of Investment:

Forced savings of 12% of the employee's salary, contributed by both employer and employee, which is accumulated along with interest.

Employee contributions are eligible for tax deduction under section 80C with tax-free interest and tax-free withdrawal at maturity.

EPFO declares interest rates annually, which is competitive with other fixed investment options.

A significant benefit is the mandatory contribution made by the employer, which adds to the employee's overall savings.

As a member of EPF, you automatically become a member of the Employees' Pension Scheme (EPS), 1995, eligible for a monthly pension after completing 10 years of service and upon attaining the age of 58 years.

Pension is also admissible to dependents (widow, widower, children, and dependent parents) in case of the member's death.

The Employees' Deposit Linked Insurance (EDLI) Scheme, 1976, provides life insurance coverage to the nominee or beneficiary in case of the employee's death while in service.

EPFO members can avail loans against their EPF balance for specific purposes like:

Members can make partial withdrawals from their EPF account before retirement under specific circumstances, such as:

With the UAN, your EPF account can be easily transferred when you change jobs, ensuring continuity of your PF balance and service history.

Using the UMANG app, members can:

In case of unemployment for more than two months, members can withdraw a significant portion (up to 75%) of their EPF balance to provide financial support during the transition.

Being a government-backed scheme, EPF offers a high level of security for employees' savings.

These benefits are accessible only through a valid UAN member login and verified KYC.

Frequently Asked Questions

You can log in to the EPFO member portal using your UAN and password on the EPFO Unified Member Portal.

To register for an EPFO member login, click “Activate UAN” on the portal, enter personal and UAN details, and verify via OTP.

To reset the EPFO member login password, click on “Forgot Password”, verify your mobile via OTP, and set a new password.

To create an EPFO member login, you have to register at the portal. Login is created automatically during activation.

A maximum of 5 incorrect attempts are allowed before a temporary lock for 24 hours.

If you are not able to log in to EPFO, the reasons may include incorrect UAN/password, unregistered mobile, or inactive UAN.

Yes, UAN is the primary credential for EPFO member login.

If UAN is not activated or if the browser is outdated, the login may fail. Reset credentials or contact support to be able to log in to EPFO.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users