Joyalukkas is a globally renowned jewelry brand that began its journey in 1987 in Thrissur, Kerala. Known for its exceptional craftsmanship, innovative designs, and commitment to quality, joyalukkas jewelry has become a trusted name in the jewelry industry. With a presence across India and several international markets, the brand offers exquisite gold, diamond, platinum, and silver jewelry. Joyalukkas is also celebrated for its customer-centric gold schemes, like the easy gold plan joyalukkas, which makes owning high-quality gold jewelry accessible and affordable for everyone. In this blog, we delve into the details of this unique scheme, its benefits, and how it stands out in helping you achieve your gold aspirations.

Easy Gold Purchase Scheme- A Glimpse

The Easy Gold Purchase Scheme is a structured savings plan designed to make owning gold jewelry more affordable. Instead of paying a lump sum upfront, customers can spread their payments over 10 months. At the end of the term, the accumulated savings can be redeemed for gold jewelry at any Joyalukkas showroom, offering the added benefit of zero or reduced making charges.

This scheme is ideal for individuals who want to plan their gold purchases, whether for a wedding, festival, or investment purpose. With its transparent terms and easy process, the scheme has become a go-to option for gold buyers across the country.

Features of the Easy Gold Purchase Scheme

Discover the unique advantages that make the Easy Gold Purchase Scheme a smart choice for your savings

| Feature | Details |

| Duration | Fixed for 10 months. |

| Monthly Contribution | Flexible and affordable, starting from a minimum amount. |

| No Making Charges | Zero-making charges on gold jewelry up to a specified percentage of the gold value. |

| Convenience | Payments can be made online or at any Joyalukkas showroom. |

| Eligibility | Open to all individuals, with no age restrictions. |

Steps to Enroll in the Easy Gold Purchase Scheme

Enrolling in the Easy Gold Purchase Scheme is a straightforward process that allows you to start your journey toward smart gold investments with ease.

1: Visit Joyalukkas

Go to your nearest Joyalukkas showroom or visit their official website or mobile app to start the enrollment process.

2: Complete the Enrollment Form

Fill out the form with your personal details and select your preferred monthly installment amount.

3: Select a Payment Method

Choose a convenient payment method such as cash, UPI, debit/credit card, or net banking.

4: Start Saving

Make regular joyalukkas monthly gold scheme online payment to grow your savings and enjoy the benefits of the scheme.

Understanding How The Easy Gold Purchase Scheme Works

Here’s a step-by-step breakdown of how you can benefit from the scheme:

1. Enrollment: Visit your nearest Joyalukkas showroom or their online portal to enroll. Provide basic details like your name, contact number, and monthly contribution amount.

2. Monthly Contributions: Make fixed monthly joyalukkas easy gold scheme payment for 10 months. The contributions are credited to your account, ensuring systematic savings towards your gold purchase.

3. Redemption: At the end of the 10-month period, use your accumulated savings to purchase gold jewelry. You can enjoy zero or reduced making charges on your purchase, maximizing the value of your investment.

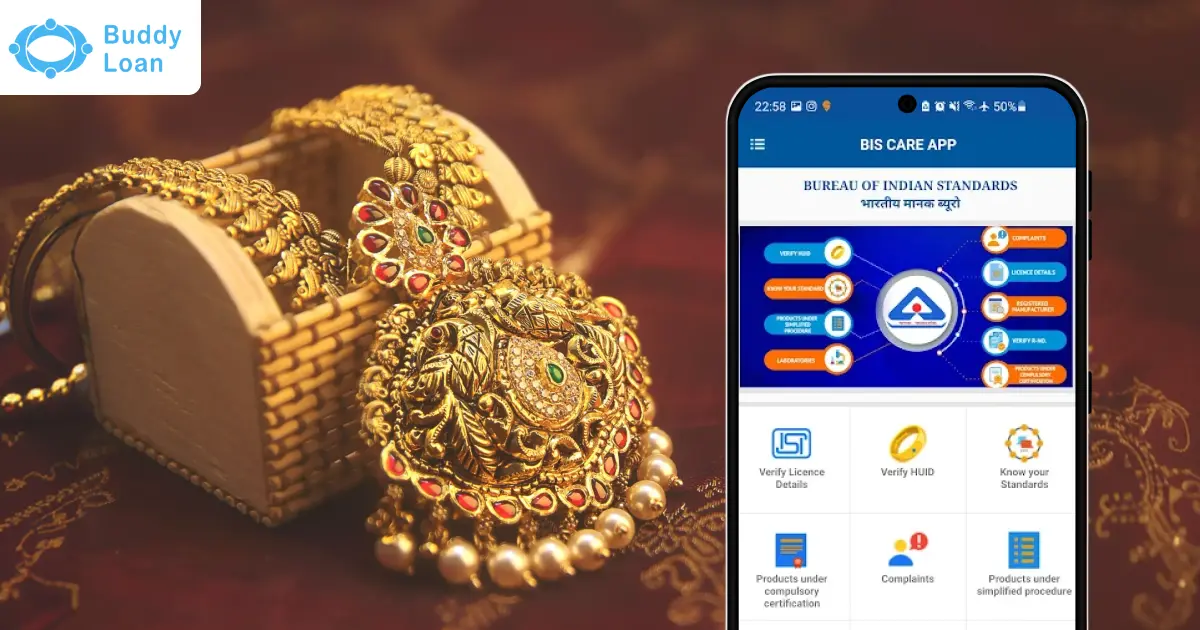

4. Purchase Options: Choose from a wide variety of BIS Hallmarked gold jewelry, ensuring purity and quality.

Joyalukkas Easy Gold Monthly Gold Scheme

| Period of Months | Monthly Amount | Total Amount | Special Discount on Gold (18% of on making charges) |

| 10 | 1,000 | 10,000 | 1,800 |

| 10 | 2,000 | 20,000 | 3,600 |

| 10 | 5,000 | 50,000 | 9,000 |

| 10 | 10,000 | 1,000,00 | 18,000 |

Joyalukkas Easy Gold Purchase Scheme Formula

Understanding the formula for the jos alukkas gold scheme is essential for making informed investment decisions. By utilizing the gold purchase calculator, you can easily determine your savings potential and plan your future purchases effectively, ensuring that you maximize the benefits of your investment

1. Total Amount Paid: Total Amount Paid=Monthly Installment×Number of Installments

2. Gold Discount (up to 18% on Making Charges): Gold Discount=Total Amount Paid×0.18

3. Diamond Discount (up to 50% on Making Charges): Diamond Discount=Total Amount Paid×0.50

Example (using ₹1000 Monthly Installment for 10 Months)

- Monthly Installment: ₹1000

- Number of Installments: 10

1: Total Amount Paid

Total Amount Paid=1000×10=₹10,000

2: Gold Discount

Gold Discount=10,000×0.18=₹1,800

Outputs:

Total Amount Paid: ₹10,000

Gold Discount: ₹1,800

Benefits of the Joyalukkas Easy Gold Purchase Scheme

1. Affordability: Spread the cost of your gold purchase over 10 months, making it easier on your budget.

2. Waived Making Charges: Enjoy zero or reduced making charges on your jewelry purchase, saving significantly on overall costs.

3. Convenient Payment Options: Pay your monthly installments in joyalukkas easy gold online payment, via the Joyalukkas mobile app, or at any Joyalukkas showroom.

4. High-Quality Jewelry: Redeem your savings for BIS Hallmarked gold jewelry, ensuring you receive only the finest quality.

5. Flexibility: Customize your monthly contribution amount based on your financial capability and savings goal.

6. Transparency: The scheme is designed with clear terms and no hidden charges, giving you complete peace of mind.

Comparison: Easy Gold Purchase Scheme vs Traditional Gold Investment

Explore the advantages of the Easy Gold Purchase Scheme in comparison to traditional gold investment, highlighting how modern savings strategies can enhance your financial journey.

| Feature | Easy Gold Purchase Scheme | Traditional Gold Investment |

| Payment Mode | Monthly installments | Lump sum payment |

| Making Charges | Waived or reduced up to a percentage | Fully applicable |

| Financial Planning | Structured savings over time | Requires upfront funds |

| Flexibility | Flexible monthly contributions | No structured saving mechanism |

Terms & Conditions

Familiarizing yourself with the terms and conditions ensures a clear understanding of the Joyalukkas Easy Gold Purchase Scheme, empowering you to make informed decisions.

| Aspect | Description |

| Acceptance of Terms | By using the website/mobile app, you agree to the terms, conditions, and privacy policy. |

| Content Usage | Content is for general information and can be changed without notice. |

| Accuracy Disclaimer | No guarantees on accuracy, timeliness, or suitability of content; use at your own risk. |

| Liability | Joyalukkas is not responsible for inaccuracies or errors; ensure products meet your needs. |

| Ownership of Material | Design, layout, and graphics are owned by or licensed to Joyalukkas; reproduction is prohibited. |

Conclusion

The Joyalukkas Easy Gold Purchase Scheme simplifies gold ownership by offering a flexible and systematic savings plan. With benefits like waived making charges, high-quality gold jewelry, and joy alukkas scheme payment options, this scheme is perfect for those looking to invest in gold without financial strain. Whether it’s for a special occasion or a long-term investment, this scheme ensures affordability and transparency.

Check the latest gold loan trends in India, understanding different types of gold, and discovering the reasons to invest in gold can help you choose the best banks for gold loans, especially as experts predict the gold rate will decrease.

Explore India’s top gold investment schemes for smart savings & secure your financial future

Frequently Asked Questions

How does the Joyalukkas Gold Scheme work?

You make monthly payments, and at maturity, the total amount can be redeemed to buy jewelry, often with additional bonuses or benefits.

What are the benefits of the Joyalukkas Gold Scheme?

It helps save systematically, protects against gold price volatility, and may offer discounts on making charges or other rewards at maturity.

How can I enroll in the Joyalukkas Gold Scheme?

Visit a Joyalukkas store, choose a scheme, fill out the application form, and start with your first payment.

What are the payment options for the Joyalukkas Gold Scheme?

Payments can be made via cash, cheques, bank transfers, or digital payment platforms like UPI or apps like PhonePe.

Is there a minimum investment for the Joyalukkas Gold Scheme?

The minimum monthly installment typically starts at ₹1,000, but this may vary depending on the scheme.

How to pay Joyalukkas Gold Scheme online in PhonePe?

Open PhonePe, select “Bill Payments,” search for Joyalukkas under merchants, enter your scheme details, and complete the payment.

Can I withdraw my investment from the Joyalukkas Gold Scheme?

Early withdrawal is possible, but terms may include forfeiture of benefits or bonuses.

What is the maturity period of the Joyalukkas Gold Scheme?

Schemes typically last 11 to 24 months, depending on the plan you select.

Are there any charges associated with the Joyalukkas Gold Scheme?

There may be making or wastage charges when redeeming the scheme amount for jewelry. Always check the terms upfront.

How do I redeem my gold under the Joyalukkas Gold Scheme?

Visit a Joyalukkas store after the scheme matures, and you can redeem the accumulated amount to purchase jewelry.