Gold buying in India peaks during festive seasons like Dhanteras and Diwali, making it the perfect time to take advantage of discounts, cashback offers, and festive deals. This guide explores both online options (focused on coins and bars) and offline jewellery purchases, along with current offers and smart hacks.

With gold prices climbing steadily, knowing how to buy gold wisely can make a big difference. Learn how to get the best value through coupons, jewellery store discounts, credit card offers, and digital wallets like Amazon Pay. Stay with us till the end for expert tips to buy gold smartly, online and offline, this festive season.

Understanding Gold & How Pricing Really Moves

Small differences in purity and format explain most price gaps. 24K (999/999.9) is pure investment grade, while 22K is preferred for wearability (alloyed), and 18K suits gem-set jewellery.

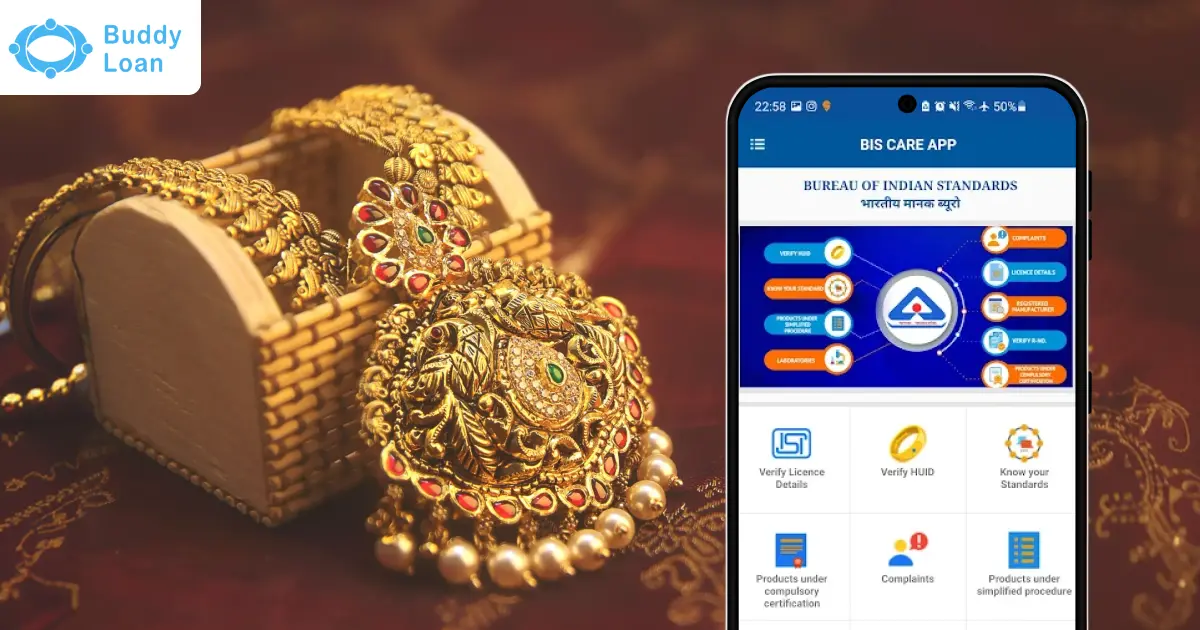

Common retail weights are 1g, 2g, 5g, 8g, 10g, 20g, 50g; per-gram premiums fall as weight rises, because packaging/assay cost is spread over more metal. BIS hallmarking with HUID is now mandatory in phases, materially reducing purity risk and easing resale verification. Coins and bars are cheaper than jewellery because making charges on coins/bars typically sits in low single digits vs jewellery’s double-digit ranges, with designer pieces reaching high teens or more.

A frequently missed edge: LBMA-accredited mint products (e.g., MMTC-PAMP) tend to hold tighter resale spreads due to standardised purity assurance.

|

Buy Gold Online in the Festive Season

Festive sales multiply discounts, but returns and reward exclusions tighten at the same time. Read platform policies before you chase a headline price, because many sites exclude gold from standard returns or cashback categories, and some bank co-brands exclude gold from their ‘5% back’ headline rates.

| Platform | MRP Gold Price (₹/g) | Discounted Price (₹/g) | Offers / Coupons / Bank Discounts | Final Price (₹/g) Estimate |

|---|---|---|---|---|

| Amazon | ₹14,384 | ~₹13,660 | 5%–10% bank discount on gold coins & festive sale offers | ~₹13,000–₹13,600 |

| Flipkart | ₹14,536 | ~₹13,800 | Bank/card offers, Flipkart SuperCoins & festive vouchers | ~₹13,100–₹13,500 |

| Ajio | ₹14,223 | ~₹13,700 | Flat 5%–7% cashback via select cards & wallet offers | ~₹13,200–₹13,500 |

| Myntra | ₹14,211 | ~₹13,650 | Credit card cashback, PayLater & wallet-based discounts | ~₹13,100–₹13,400 |

| DigiGold | ₹14,201 | (near market) | Minimal platform premium, real-time spot-based pricing | ~₹14,200 (spot + small margin) |

| MMTC-PAMP / Bullion Sellers | ₹14,940 | ~₹14,500 | Occasional 3%–5% festive discount on bars & coins | ~₹14,200–₹14,500 |

Note: These numbers are indicative based on recent promos; gold prices fluctuate daily.

Top Platforms for Buying Gold

- Amazon partners with branded mints and offers bank promos and no-cost-EMI on eligible items; co-brand cashback often excludes gold; delivery via secure partners; return windows for coins are limited and seller-specific.

- Flipkart lists MMTC-PAMP coins/bars with secure delivery; returns vary by seller; festive bank offers can be strong. A subtlety: listings show per-gram effective rates embedded in SKUs. Check weight and purity before comparing.

- Myntra & AJIO sell precious jewellery and sometimes coins via partner brands; coins/precious categories are often non-returnable, except for damage/defect claims via support. Delivery is standard, but returns are category-gated.

- DigiGold (platforms like PhonePe/Paytm hosting MMTC-PAMP/SafeGold/Augmont rails): instant micro-purchases of 24K with limited-time cashbacks (e.g., 2% Dhanteras on PhonePe above ₹2,000); custody at partner vaults; redemption/doorstep delivery with minting/shipping fees.

- MMTC-PAMP (direct): LBMA-accredited 999.9 coins/bars; secure delivery; returns allowed only for wrong/different product; general refunds and buyback policies published separately. Direct-to-mint provenance helps resale confidence.

- Other websites & apps like ‘Jar’ and other Jwellers also provide online options to buy gold.

Overlooked insight: Per-gram math flips at heavier weights (20g, 50g bars) where mint premiums compress platforms with weaker headline discounts can still win on final ₹/g due to lower mint premium. Also, cashback-type offers don’t cut invoice value, which matters for future exchange valuations.

Offer patterns referenced (bank %-offs, cashback constructs, exclusions on coins/co-brands, DigiGold cashback.

Also note, trust signals (LBMA accreditation; BIS/HUID) still matter for resale.

Hacks to Buy Gold Online at Lower Prices

Here are some tips for buying gold at discounted price in festive season

- Buy gift vouchers / coupons with discount

Many credit cards / platforms allow you to purchase platform gift cards (e.g. Amazon Pay, Flipkart vouchers, Myntra credits) at a discount or with cashback. Use those voucher balances to make the gold purchase. Reddit users report strategies of stocking Amazon Pay vouchers to use later for gold. - Load wallet / gift cards via cards giving reward points / cashback

E.g. use a premium credit card to load Amazon Pay balance (getting points), then use that balance to buy gold. - Stack bank / card + platform offers

E.g. Amazon is offering up to 20% off on jewellery + 10% bank discount during the Great Indian Festival. - Be cautious: schemes can change / be withdrawn

For example, a “gold loot” hack using Myntra coupons was reportedly shut down. - Minimal holdings & frequent buys

Instead of buying large lumps at once, stagger purchases to average the buying price and reduce risk. - Pick the SKU with the lowest mint premium per gram first (often 10g/20g coins or 5g/10g bars)

Festive stacking is a sequence game:

Wallet strategy: load a wallet via a high-reward card category (where allowed), then pay—cashback credits post later and don’t reduce invoice value (useful if you want higher invoice for future exchange). PhonePe-style 2% DigiGold cashback can beat small bank offers on tiny tickets.

Advanced trick most buyers miss: If your card’s co-brand excludes gold from accelerated cashback, switch to a generic bank card with a higher instant discount or use a no-cost EMI where the seller gives an upfront principal discount equal to interest only GST on interest and small processing fees leak. This preserves cash flow without inflating the effective APR.

Buying Gold Offline at Jewellery Stores

Offline wins when you need rings/bangles/neckwear sizing and lifetime exchange promises. But making charges swing 3% to 30%+, depending on design and brand; a simple coin might carry 1%–9% making, while designer jewellery can hit high teens or more. Chain stores publish exchange policies with caratmeter testing and deductions—understand these before purchase.

Top Jewellery Stores and how they really differ

- Tanishq: national network, transparent karatmeter testing; exchange policies are store-only, not online; reliable after-sales.

- Kalyan Jewellers: broad inventory and aggressive festive promos; watch making-charge slabs on heavier pieces.

- Malabar Gold: frequent percentage-off on making charges; good breadth in 22K jewellery; check promo applicability on stone-set items.

- Joyalukkas: wide design spread across price bands; making charge dispersion is high, negotiate on larger tickets.

- PC Jeweller: metro presence and offer cycles; confirm exchange deductions on non-diamond, non-stone plain gold.

- Bhima Jwellers: competitive on simple 22K items; store-level buyback terms vary.

Jewellery Store Rates

| Jewellery Store | Gold Rate (₹/g) | Discounts / Offers | Final Price (₹/g) Estimate |

|---|---|---|---|

| Tanishq | ₹13,980 | 5% off on select making charges | ₹13,281 |

| Kalyan Jewellers | ₹14,050 | 5% off on making + extra coupon on bill value | ₹13,347 |

| Malabar Gold & Diamonds | ₹13,970 | 5% off on making charges | ₹13,272 |

| Joyalukkas | ₹13,950 | 5% off on making charges | ₹13,252 |

| PC Jeweller | ₹13,990 | 5% off on making charges | ₹13,291 |

| Bhima Jewellers | ₹13,940 | 5% off on making charges | ₹13,243 |

- Lowest effective rate: Bhima Jewellers offers ~₹13,243/g after festive discounts — among the most affordable.

- Top-tier brands: Tanishq and Kalyan Jewellers provide strong trust and BIS certification but carry slightly higher base rates.

- Average saving: 5% reduction on making charges typically translates to ₹650–₹750 per gram in savings.

- Festive tip: During Diwali or Dhanteras, these jewellers often bundle extra cashback or loyalty bonuses, further lowering effective prices.

Reality check: Jewellery’s final ₹/g looks higher because making and wastage sit on top of metal value. If you’re investing, a bar beats a bangle every time.

Personal Loan vs Credit Card for Financing Gold

Revolving a credit card balance to ‘afford’ gold is how discounts die. Indian credit card APRs commonly range from ~24% to 45% p.a.; personal loans for prime salaried profiles start near ~10%–12% p.a. in Oct 2025. If you won’t clear the card in the grace period, a small personal loan is mathematically cheaper, even after processing fees.

| Feature | Credit Card (EMI/Revolve) | Personal Loan (Small-ticket) |

| Typical Cost | 24%–45% APR if revolving; NCEMI leaks GST on interest + fee | 10%–13% p.a. headline for prime profiles |

| Upfront Discounts | Often, the best instant bank % off at checkout | None (but you can still pay with a card to capture offers) |

| Cash-Flow Smoothness | High (EMI), but interest punitive if not prepaid | High (fixed EMI), lower rate |

| Hidden Gotchas | Gold is often excluded from co-brand accelerated rewards | Processing fee: 1%–2%; prepayment charges vary |

| Best Use Case | Only if you can clear within the grace/NCEMI tenure | If paying over >3 months for ₹50k–₹3L tickets |

Worked insight: On ₹1,00,000 of gold, a 10% ‘instant discount’ saves ₹10,000 today. If you revolve at 36% APR for 6 months, you can give back ~₹18,000 in interest—your discount is gone twice over. Take a 12% personal loan for 6 months instead; interest is roughly ~₹6,000–₹6,500 plus fees—net savings preserved.

Tips to Spot a Real Deal in This Diwali Sale

- Verify purity: Look for 999/999.9 and the BIS hallmark/HUID (for jewellery); stick to LBMA-accredited mints for coins/bars.

- Check the ‘final per-gram’. Always recompute after bank discounts, wallet cashbacks, coupon-linked reductions, GST handling, and NCEMI leakages.

- Read return/buyback terms: Many platforms mark coins as non-returnable; mints allow returns only for wrong/different items. This risk is priced into your strategy.

- Prefer heavier denominations to compress per-gram premiums—especially where offers are cashback (not invoice-cut).

- Document everything: Bill with purity, weight, and mint; keep the serialised assay packaging intact for resale.

- Time your purchase: Bank-offered calendars and wallet cashbacks don’t always coincide with spot price dips—your edge is stacking, not timing the market.

Conclusion

For investment-grade metal, buy coins/bars online where you can stack bank + wallet + coupon and pick low-premium denominations from LBMA-grade mints. For gifts/wear, shop offline chains with transparent karatmeter testing and published exchange terms. If you can’t clear a card in the grace period, don’t. A short-term personal loan protects your discount. During festivals, price is a math problem; solve for the final ₹/g and the rest follows.