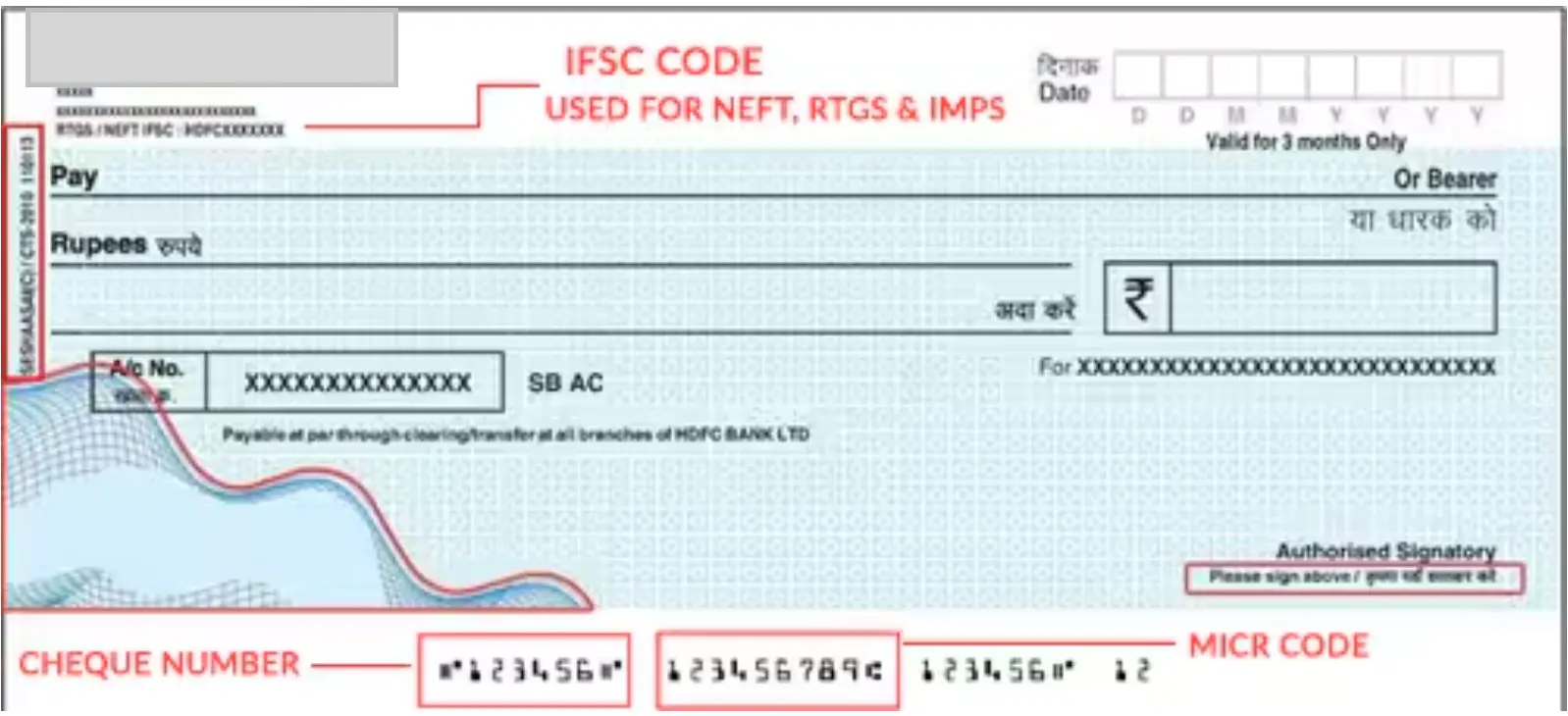

Airtel Payments Bank leads in digital banking, offering a range of financial services for seamless money management. IFSC (Indian Financial System Code) and MICR (Magnetic Ink Character Recognition) codes are crucial to secure electronic transfers through systems like NEFT, RTGS, and IMPS.

Airtel Payments Bank provides a variety of financial services such as savings accounts, fixed deposits, online fund transfers, bill payments, insurance, and loans. By utilizing advanced technology, Airtel Payments Bank offers convenient banking solutions to its customers.

Table of Contents:

- ⇾ Airtel Payments Bank IFSC Code

- ⇾ Steps to Transfer Money Using Airtel Payments Bank NEFT and RTGS

- ⇾ Fund Transfer Fees for Airtel Payments Bank

- ⇾ Activate Airtel Payment Bank

- ⇾ Airtel Payments Bank Branch

- ⇾ IFSC Code

- ⇾ Steps to Find Airtel Payments Bank IFSC Code

- ⇾ Importance of IFSC Code

- ⇾ MICR Code

- ⇾ Ways to Find Airtel Payments Bank MICR Code

- ⇾ Airtel Payments Bank Services

- ⇾ Frequently Asked Questions

Airtel Payments Bank IFSC Code

An IFSC code comprises 11 unique alphanumeric characters, with the first four denoting the bank name and the last six representing the branch code. Typically, the 5th character is '0'.

The IFSC code for Airtel Payments Bank is AIRP0000001. Here, 'AIRP' stands for the bank (Airtel Payments Bank), '0' is the 5th character, and '000001' signifies the branch code, referring to Gurugram.

| Bank | AIRTEL PAYMENTS BANK |

| IFSC | AIRP0000001 |

| Branch Code | 000001 (Last Six Characters of IFSC Code) |

| Branch | Airtel Payments Branch |

| City | Gurgaon |

| District | Gurgaon |

| State | Haryana |

| Address | Airtel Center, Plat No-16, Udyog Vihar, Phase-4, Gurgaon |

Are you looking for a personal loan?

Steps to Transfer Money Using Airtel Payments Bank NEFT or RTGS

To transfer money through Airtel Payments Bank using NEFT, IMPS, or RTGS, customers need to provide the following information:

- The amount transferred in Rupees (₹)

- Payee’s account details

- Name of the payee’s bank

- Payee’s name and account number

- Any remarks (if applicable)

- IFSC code of the payee’s bank branch

Fund Transfer Fees for Airtel Payments Bank

When transferring funds through Airtel Payments Bank, the fees vary depending on the type of transaction. Here’s a breakdown:

| Transfer Type | Charges |

|---|---|

| Transfer within Airtel Payments Bank (via internet or mobile banking) | No charges |

| Transfer from Airtel Payments Bank to another bank | 0.5% of the amount transferred |

Don't know your credit score? You can find out for free!

Activate Airtel Payment Bank

Individuals can activate their Airtel Payment Bank account with the Airtel Payment Bank Account Number - 9876543210. Besides, you can also activate activate Airtel Payment Bank account online with the Airtel Thanks App. For offline activation, visit the nearest ‘Airtel Banking Point’ with the required documents.

Airtel Payments Bank Branch

To make banking easier, airtel serves its customers with banking services with the ‘Airtel Payments Bank Banking Points’. Customers can activate and perform banking transactions at ‘Airtel Banking Points’. Let’s go through the Airtel Payments Bank Branch contact details from below:

| Location | Contact Number |

|---|---|

| Tikri Kalan, New Delhi | 9899314801 |

| Devram Amethi, Darbhanga, Bihar | 7808179224 |

| Surat Nagar, Gurugram, Haryana | 180023400 |

| Parshuram, Samastipur, Bihar | 7033743618 |

| Jalpaiguri, West Bengal | 9800813966 |

| Saran, Faridabad, Haryana | 7503995123 |

| Hamirpur, Kaimur, Bihar | 7091465005 |

| Kashi, Bhagalpur, Bihar | 7779994880 |

| Sector 87, Faridabad, Haryana | 8130599909 |

| Nehru Vihar, New Delhi | 9891181188 |

| Sitla, Asansol. West Bengal | 9800671821 |

| Kabir Nagar, New Delhi | 8287030876 |

| Shalimar Bagh, New Delhi | 9818239281 |

| Mohiuddinagar, Samastipur, Bihar | 7070770077 |

| Sangam Vihar, New Delhi | 9555055655 |

| Raipur, Samastipur, Bihar | 9973110879 |

| Pakriguri, Jalpaiguri, West Bengal | 8972080664 |

| Cooch Behar, West Bengal | 7029877090 |

| Bounsi, Banka, Bihar | 9931074334 |

| Amani, Khagaria, Bihar | 8051798763 |

| Digudih Para, Purulia, West Bengal | 9932406140 |

| Lal Kuan, Ghaziabad, Uttar Pradesh | 9453998329 |

| Sundarpur, Darbhanga, Bihar | 9310150922 |

| Mairwa, Siwan, Bihar | 7065235916 |

| Kailash Nagar, New Delhi | 8744888790 |

Read More

Read Less

IFSC Code

The 11-character alphanumeric IFSC code follows a specific structure:

The first four characters represent the bank's name.

The last six characters denote the specific branch.

The fifth character is typically a 0 (zero), reserved for future use.

The format of IFSC is as follows:

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

|---|

| Bank Code | 0 | Branch Code |

|---|

Steps to Find Airtel Payments Bank IFSC Code

Finding the IFSC code for Airtel Payments Bank is easy and can be done through several methods:

- Airtel Payments Bank Website: Visit the official Airtel Payments Bank website to locate the IFSC code.

- RBI’s IFSC Search Portal: Use the RBI’s online portal to search for Airtel Payments Bank IFSC codes.

- Bank Account Statement: Check your bank account statement, which usually lists the IFSC code of your Airtel Payments Bank branch.

Mobile Banking Application: Access the IFSC code through Airtel Payments Bank’s mobile banking app.

Importance of IFSC Code

The IFSC (Indian Financial System Code) is a crucial component in banking transactions. Here are its primary uses:

- Electronic Fund Transfers: Facilitates secure and accurate transfers through NEFT, RTGS, and IMPS.

- Identifying Bank Branches: Helps in uniquely identifying the specific branch of a bank involved in a transaction.

- Online Payments: Required for making payments and receiving funds via various online banking platforms.

- Automating Transactions: Enables the automation of financial transactions, reducing errors and processing time.

- Bill Payments: Often used in setting up automatic bill payments, ensuring timely and accurate payments.

Get a quick loan starting at 11.99% p.a.

MICR Code

The MICR code is used in banking to process checks. It has nine unique digits that identify the bank and branch for clearing checks. The MICR code includes three sections: city code, bank code, and branch code. These are printed with magnetic ink, making them easy for MICR readers to read. The MICR code is important for quick cheque processing, ensuring accuracy and security by showing the bank and branch where the cheque is issued.

Ways to Find Airtel Payments Bank MICR Code

You can locate the MICR code for Airtel Payments Bank branches through the following methods:

- Bank Account Statement: The MICR code is usually printed on your bank account statement.

- Cheque Book: The MICR code can be found at the bottom of each cheque leaf in your Airtel Payments Bank cheque book.

- Customer Support: If you're unable to locate the MICR code, you can contact Airtel Payments Bank’s customer support for assistance.

Do you need an emergency loan?

Airtel Payments Bank Services

Airtel Payments Bank provides a wide variety of financial services, including:

- Savings Accounts: Airtel Payments Bank offers convenient and secure savings accounts with benefits like easy access through mobile banking and attractive interest rates.

- Fixed Deposits: Customers can invest in fixed deposits with competitive interest rates, providing a safe and reliable way to grow their savings over time.

- Online Fund Transfers: The bank enables seamless online fund transfers through NEFT, IMPS, and RTGS, ensuring quick and secure money transfers to any bank account.

- Bill Payments and Recharges: Airtel Payments Bank simplifies bill payments and mobile recharges, allowing users to pay utility bills and recharge their mobile numbers effortlessly through the app or website.

- Insurance and Loans: The bank offers various insurance products and loan options, ensuring the financial protection of its customers.

Do you need an instant loan?

Frequently Asked Questions

The IFSC code for Airtel Payments Bank typically follows the standard structure used for identifying bank branches in electronic transactions. The specific code can vary depending on the branch.

You can find the IFSC code on your bank account statement, the Airtel Payments Bank website, RBI’s IFSC search portal, or by contacting customer support.

Yes, each Airtel Payments Bank branch has a unique IFSC code that identifies it for electronic transactions.

No, the IFSC code is branch-specific, so you must use the correct IFSC code for the branch where the account is held.

The IFSC code can be found on your bank account statement, in the Airtel Payments Bank mobile app, or printed on cheques.

You can verify the IFSC code through the Airtel Payments Bank website, RBI’s IFSC search tool, or by contacting Airtel Payments Bank’s customer support.

The IFSC code is crucial for facilitating secure and accurate electronic fund transfers like NEFT, RTGS, and IMPS.

Yes, you can easily obtain the IFSC code online through the Airtel Payments Bank website or RBI’s IFSC search portal.

Yes, the IFSC code is required for transferring money to an Airtel Payments Bank account via NEFT, RTGS, or IMPS.

You can find your Airtel Payments Bank IFSC code on your bank statement, chequebook, or through the mobile banking app.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users