Parivahan Sewa is a digital platform established by the Ministry of Road Transport and Highways (MoRTH) to provide a wide array of transportation-related services to Indian citizens. The portal offers a seamless experience by streamlining processes, reducing paperwork, and enhancing overall efficiency. From vehicle registration to driving licence services, Parivahan Sewa simplifies India's transport services.

Services Available on Parivahan Sewa Portal

The Parivahan Sewa portal offers a comprehensive range of services, catering to the diverse needs and requirements of users, including but not limited to:

| Vehicle-related Services | Driving License-related Services |

|---|---|

| Vehicle Registration | Learner's license application |

| Vehicle Fitness Certificate | Permanent Driving licence application |

| Vehicle Ownership Transfer | Duplicate licence issuance |

| Hypothecation Addition/Removal | International Driving Permit Application |

| NOC for Vehicle Transfer | Driving licence renewal |

| Temporary Registration | Address Change in Driving License |

| Vehicle Tax Payment | Driving licenceSurrender |

| Fancy/Choice Number Booking | Driving licenceCorrection |

| Online RC Verification | E-challan |

| Vehicle Insurance Renewal | DL Test Slot Booking |

| Emission Certificate | DL Issue Tracking |

| Vehicle Pollution Control Certificate | DL Slot Booking for Test/Re-test |

| Vehicle Inspection Booking | DL Biometric Data Capture |

| Vehicle Scrapping | DL Improvement Test Booking |

| Vehicle Fitness Testing | DL Test Result Checking |

| Vehicle Recall | DL Appointment Booking |

| Vahan green sewa | DL Medical certificate update |

Read More

Read Less

Are You Looking For a Personal Loan?

Road Tax Payment on Parivahan Sewa Portal

Commercial vehicles must pay state vehicle taxes when entering certain states. This road tax is paid at checkpoints on state borders. Owners can make the payment online and receive a receipt to verify at the checkpoint.

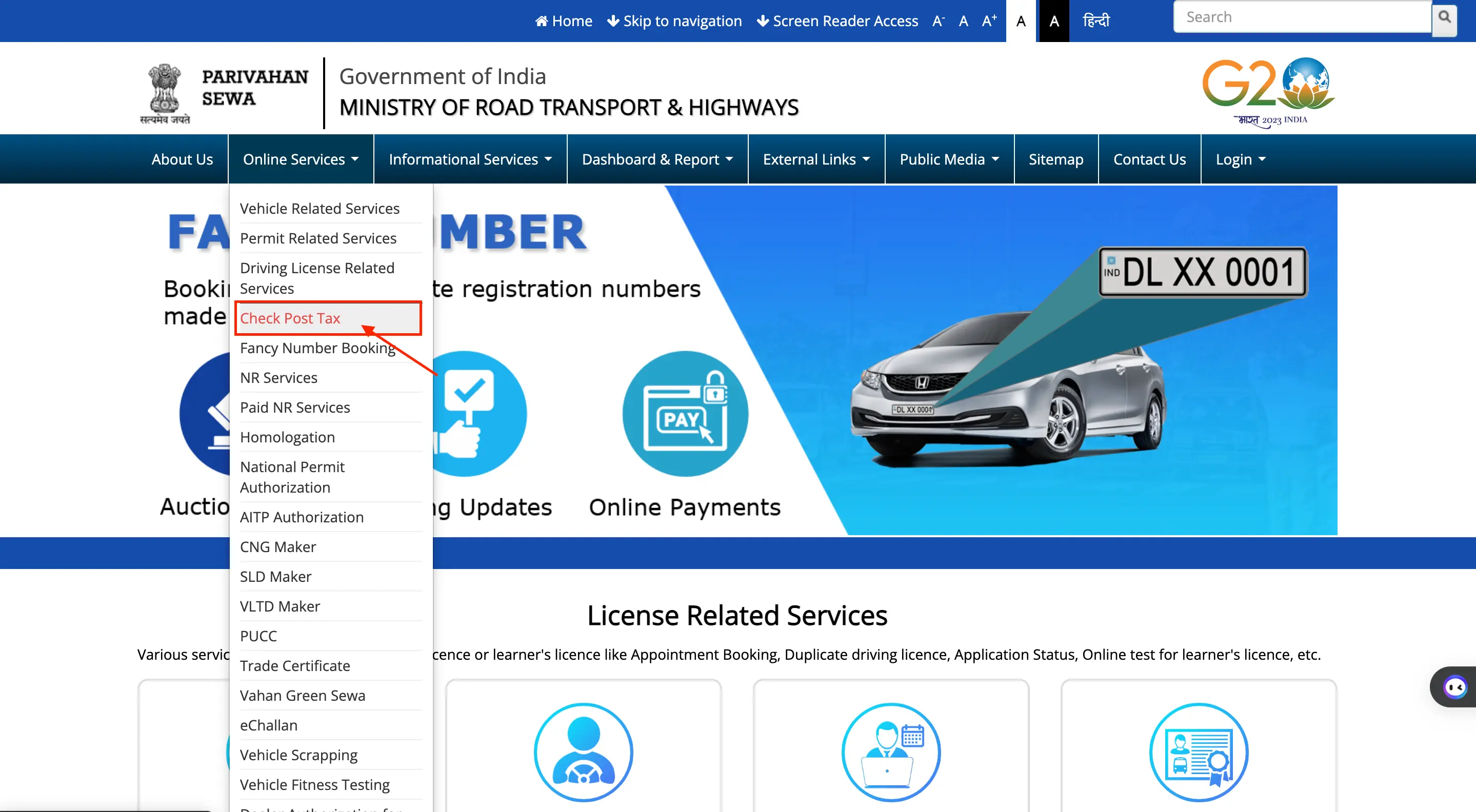

Step 1: Visit the Parivahan Sewa Portal and then proceed to the 'Online Service' tab on the homepage. From there, select the 'Check Post Tax' option.

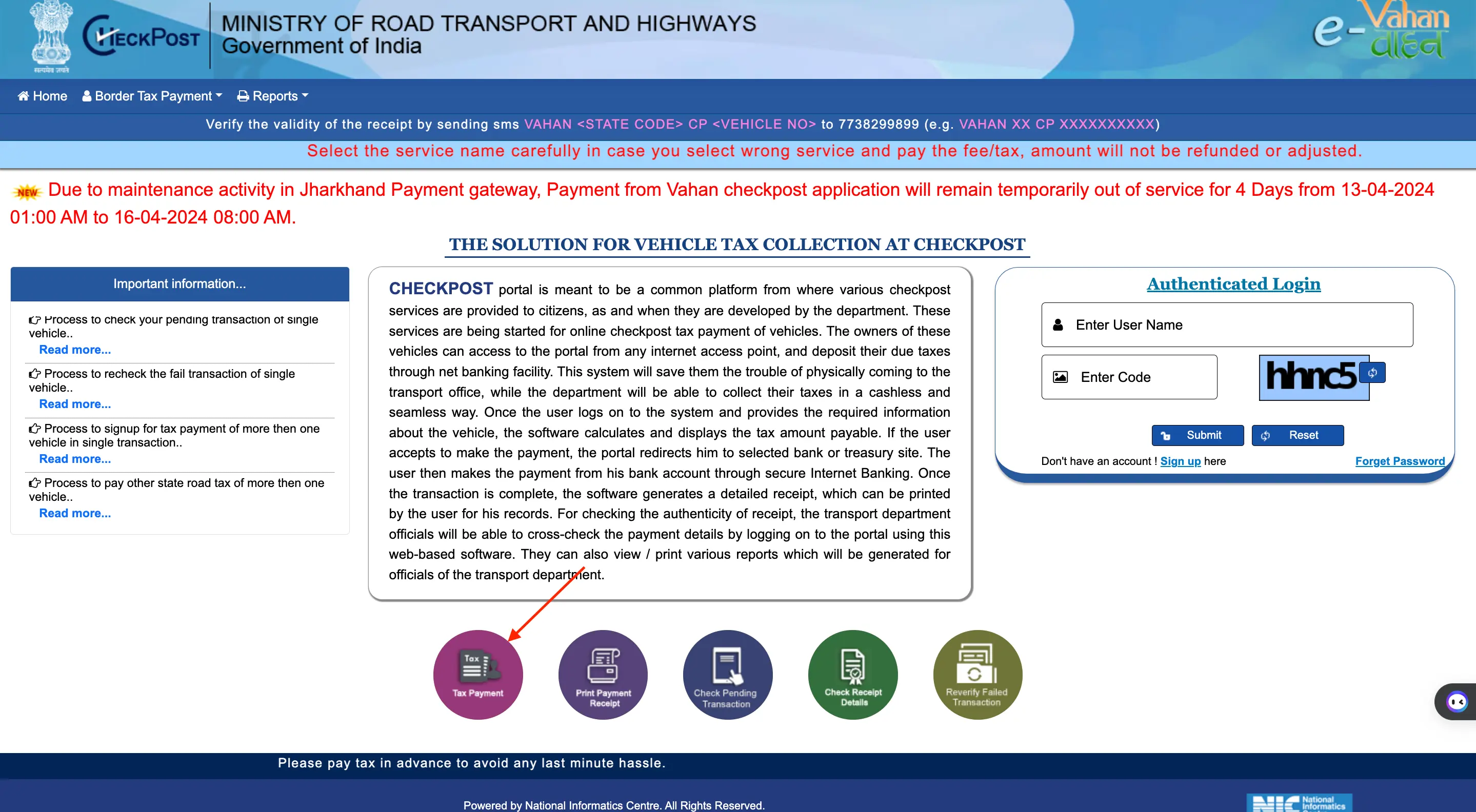

Step 2: Next, click on the 'Tax Payment' option located at the bottom of the page.

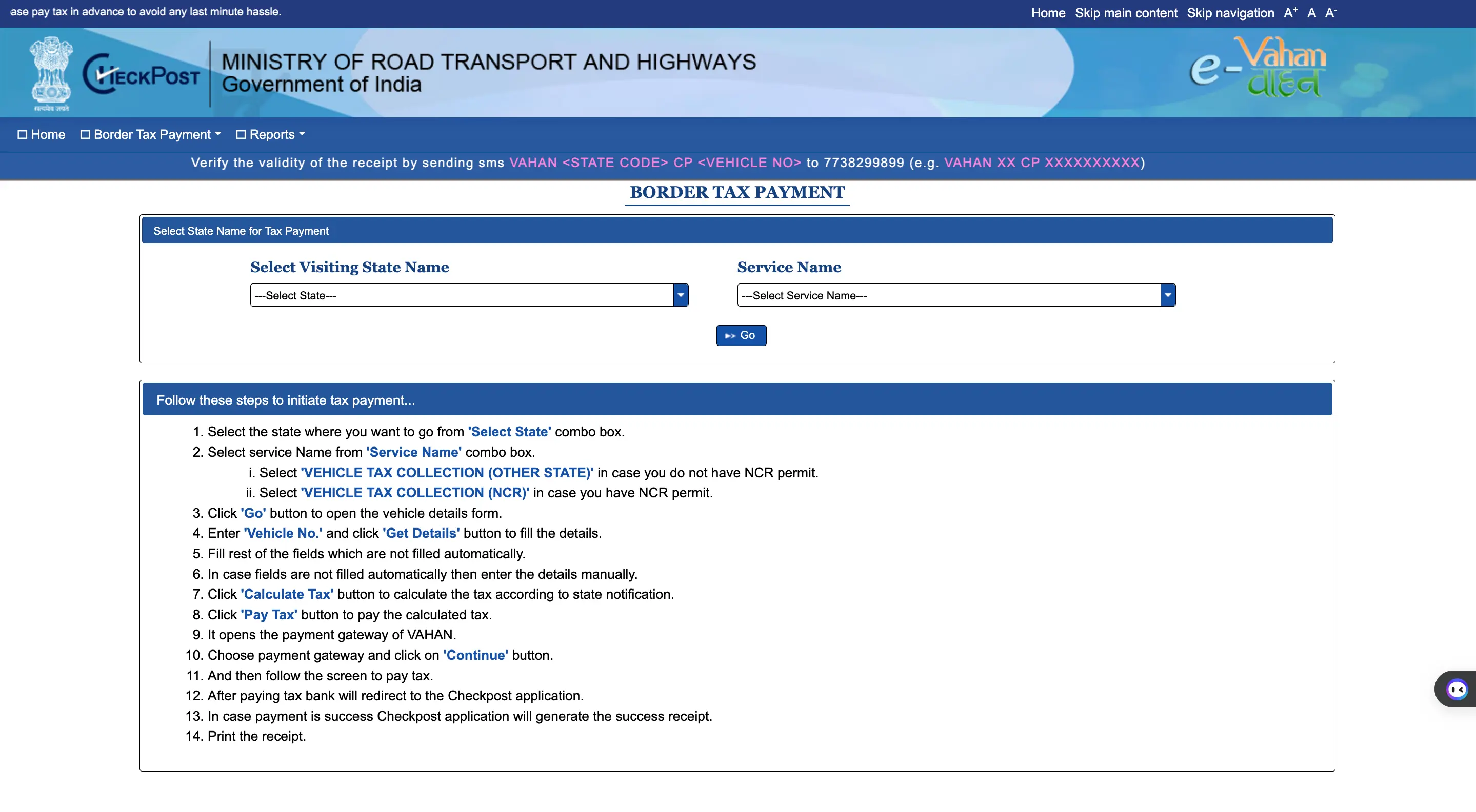

Step 3: Choose the state you wish to visit from the drop-down list under the 'Select Visiting State Name' option. Then select the 'Service Name' from the drop-down list and click on the 'Go' button.

Step 4: On the 'Border Tax Payment' application page, enter the 'Vehicle Number' and click on the 'Get Details' button next to the 'Vehicle Number' field. Some fields will be automatically filled in. Complete the remaining details that are not automatically filled in.

Step 5: Click on the 'Calculate Tax' button to determine the tax amount, and then click on the 'Pay Tax' button to proceed with payment.

Step 6: The payment gateway page will open. Select the payment gateway and click on the 'Continue' button.

Step 7: After completing the tax payment, you will be redirected to the 'Checkpost' page.

Step 8: To obtain a receipt, click on the 'Print Payment Receipt' option located at the bottom of the page next to the 'Tax Payment' option.

Not sure of your credit score? Check it out for free now!

Steps to Check e-Challan Status on Parivahan Sewa Portal

You can check your vehicle's traffic violation status online through the e-challan service on the Parivahan Sewa Portal. Individuals can find their traffic violation history under the Motor Vehicle (MV) Act using the e-challan Parivahan service.

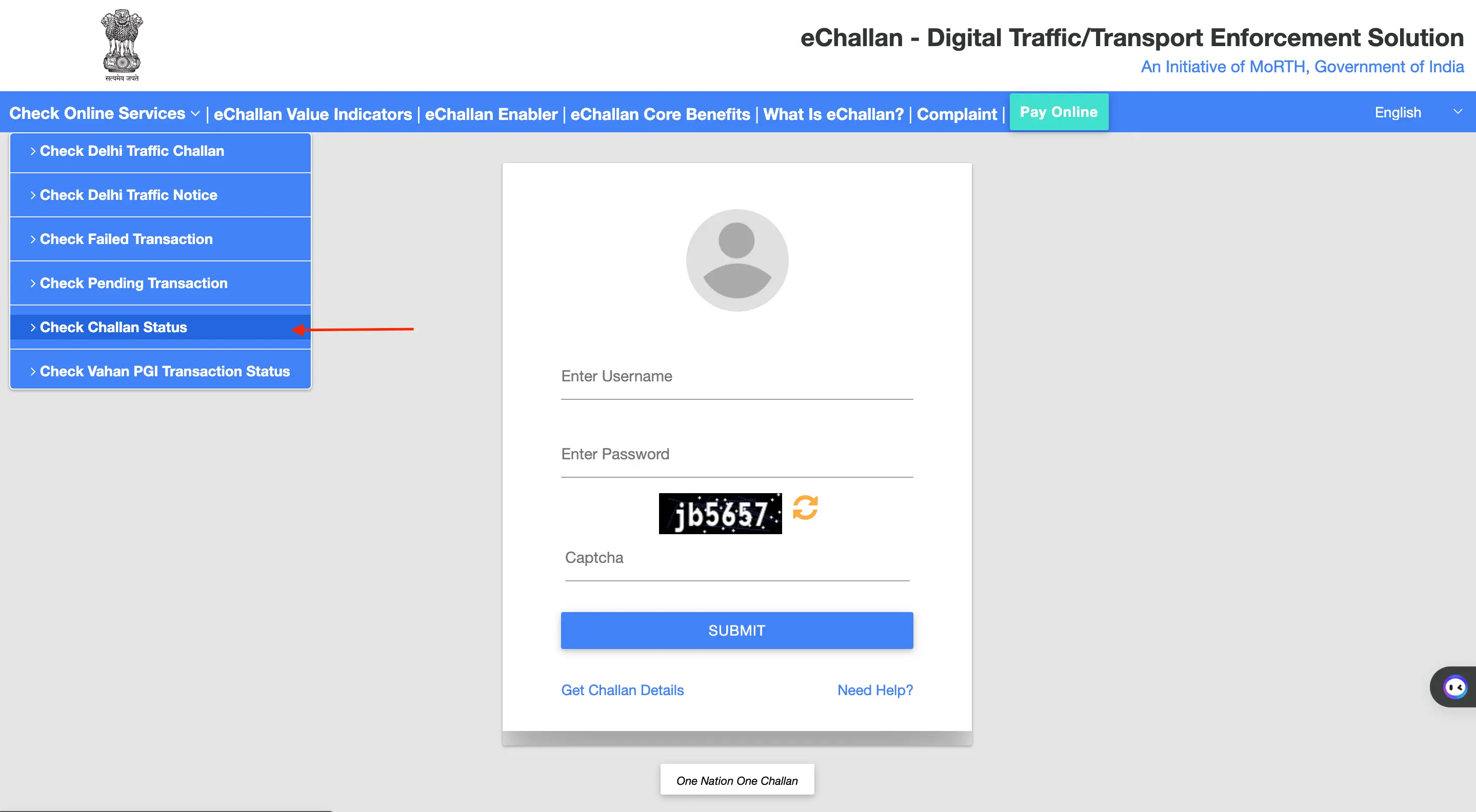

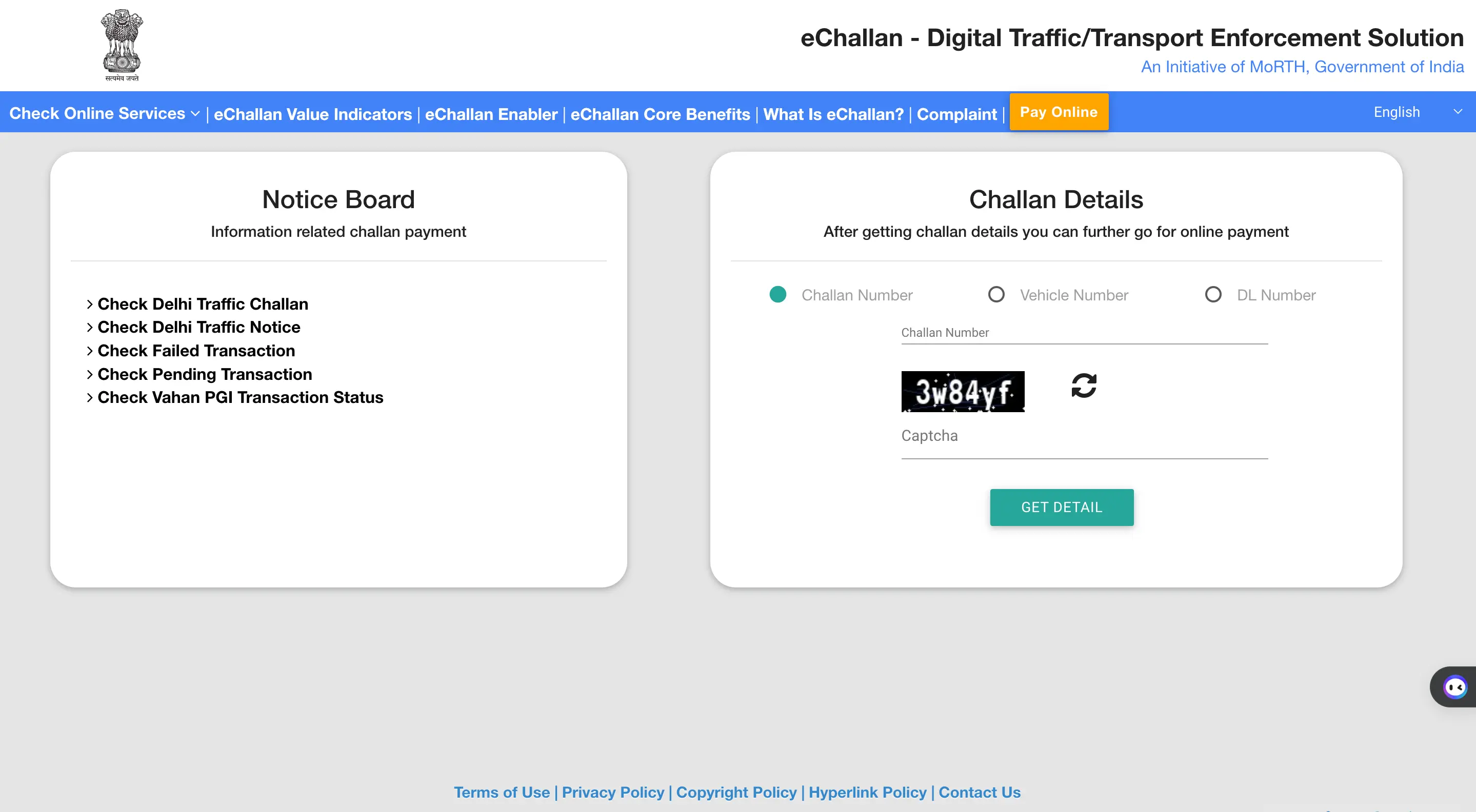

Step 1: Go to the e-challan parivahan page and select the ‘Check Online Services’. From the drop-down list, choose the ‘Check Challan Status’ option.

Step 2: Provide the ‘Challan Number’ or ‘Vehicle Number’ or ‘DL Number’, enter the captcha, and then click on the ‘Get Detail’ button.

Step 3: The details of the issued e-challan and the payment information will be displayed at the bottom of the page.

Steps To Pay Challan and Fines Online Through Parivahan Seva Portal

To pay the issued challan or fines online, follow these steps:

Step 1: Go to the e-challan parivahan page and click on the ‘Check Online Services’ option at the top left of the page.

Step 2: Choose the ‘Check Challan Status’ option from the drop-down list.

Step 3: Enter the ‘Challan Number’ or ‘Vehicle Number’ or ‘DL Number’, fill in the captcha, and click on the ‘Get Detail’ button.

Step 4: The e-challan status will appear under the challan status row. Click on the ‘Pay Now’ button under the payment column.

Step 5: Select the mode of payment for the e-challan.

Step 6: Once the e-challan payment is completed, a payment confirmation message will be sent to the registered mobile number along with the transaction ID.

Do you need an instant loan?

Steps to Apply for Driving Licence on Parivahan Sewa Portal

To book a slot for the Driving license (DL) test through the Parivahan Sewa Portal, follow these steps:

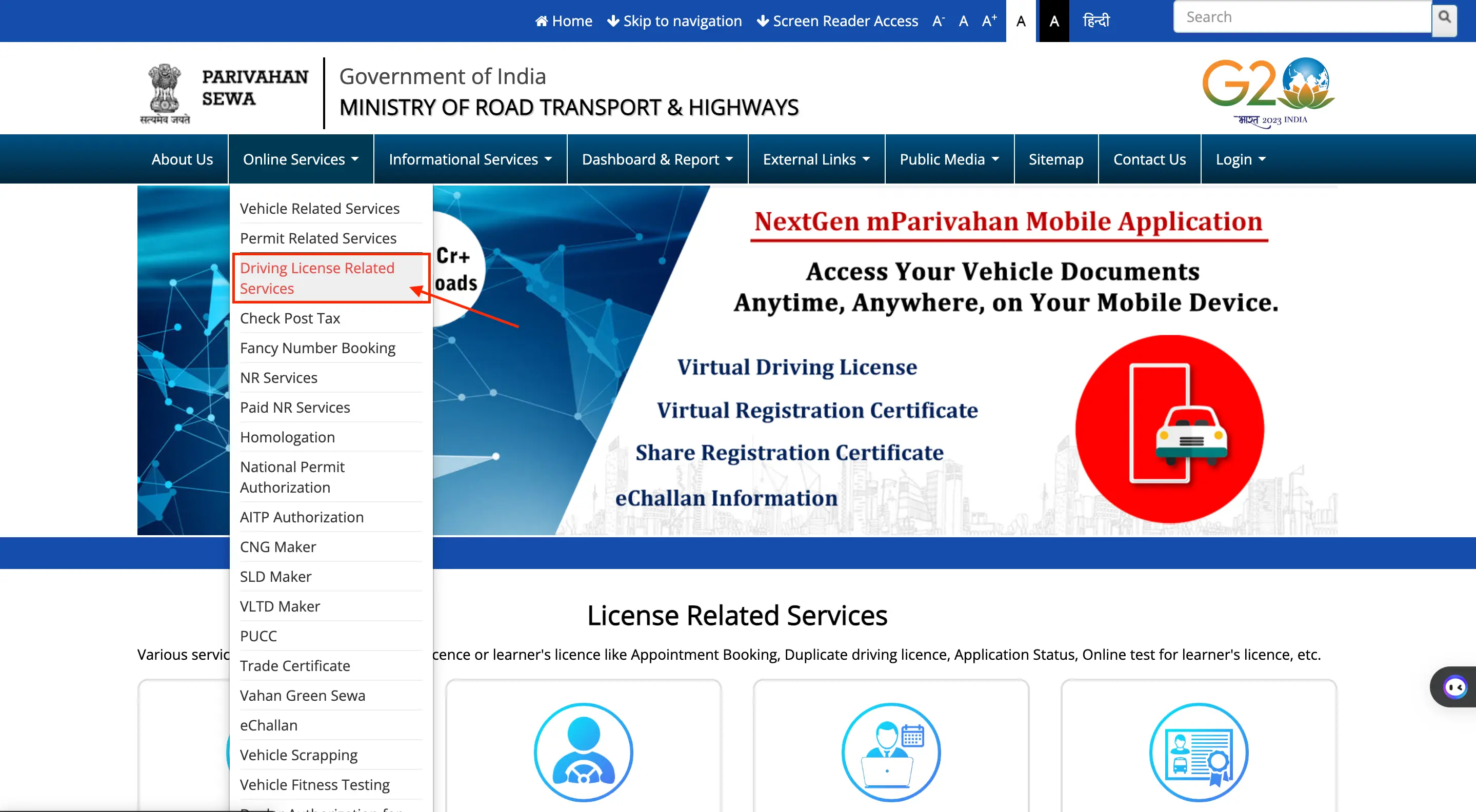

Step 1: Go to the Parivahan Sewa Portal website.

Step 2: Click on the ‘Online Service’ tab on the homepage and choose ‘Driving licenceRelated Services’.

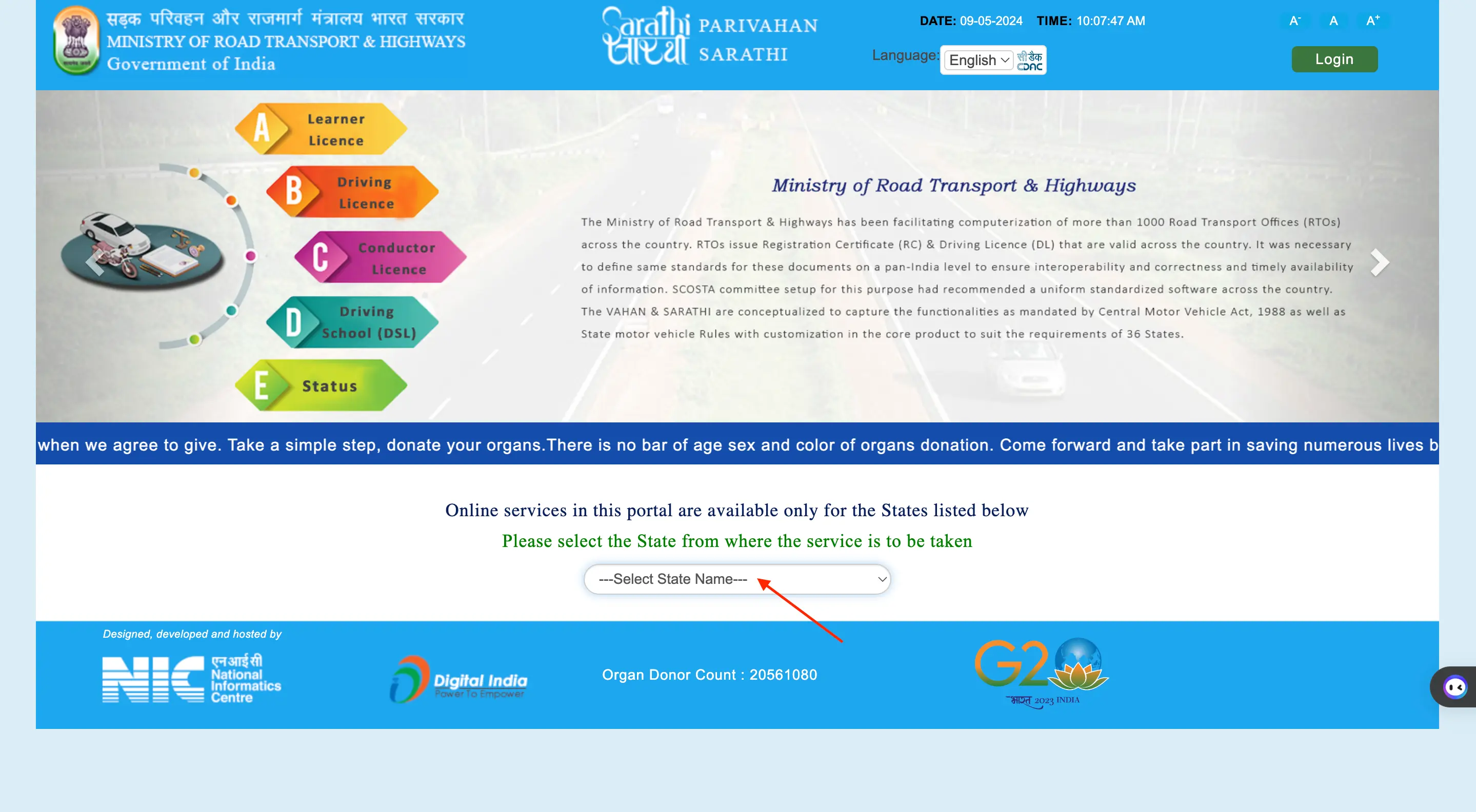

Step 3: Select the state where you want to book the DL test slot from the drop-down list.

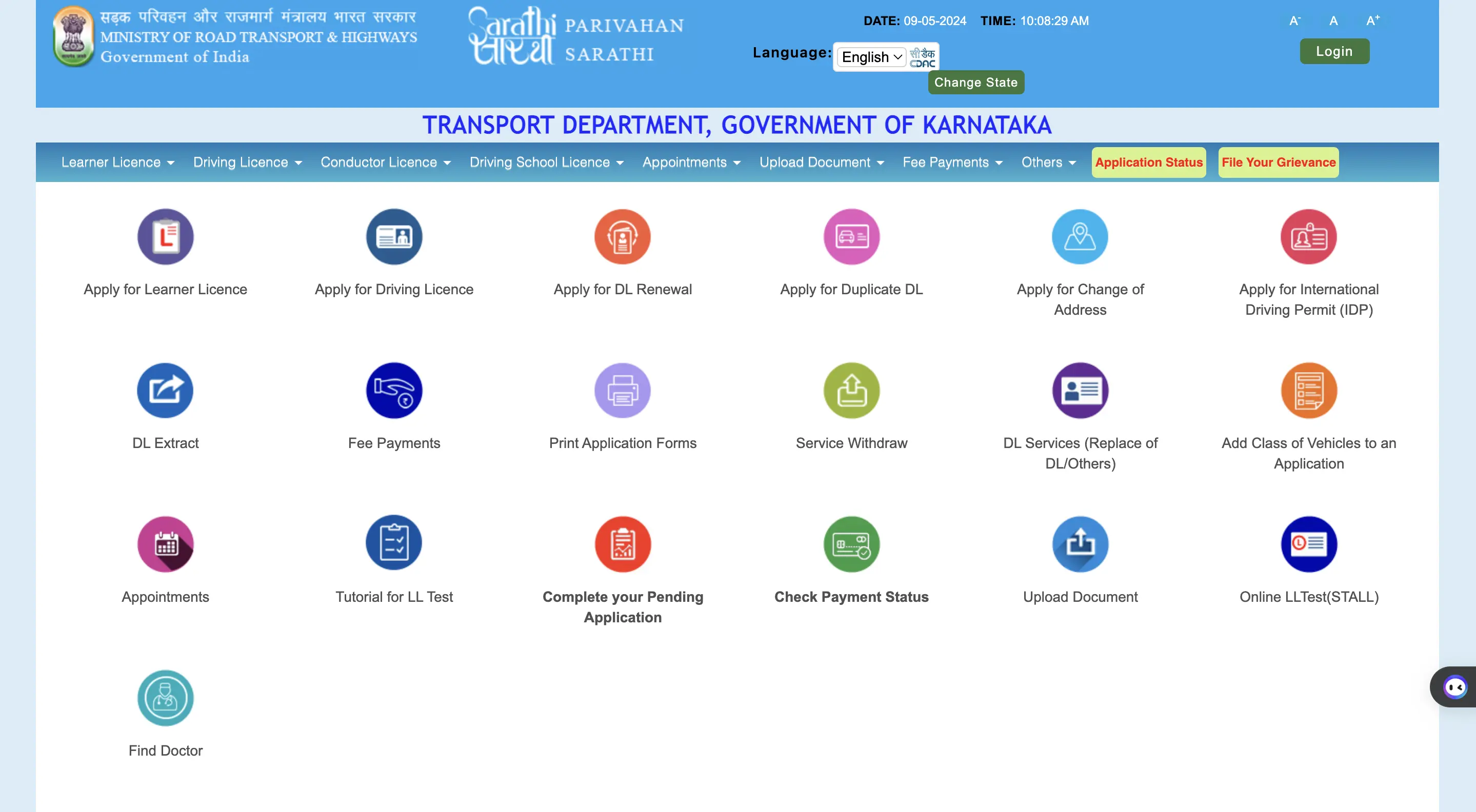

Step 4: The respective state’s transport department page will open with various options.

Step 5: Click on the ‘Appointments’ option at the top of the page and select ‘Slot Booking DL Test’.

Step 6: A new page for ‘DL Test Appointments’ will appear.

Step 7: Choose either ‘Application Number’ or ‘Learner licenceNumber’, enter the relevant number, date of birth, captcha, and click ‘Submit’.

Step 8: After submitting the details, select the date and time for the DL test slot and complete the booking.

Steps to Check DL Status on Parivahan Sewa Portal

To check the status of their Driving licence (DL) application, individuals who have completed the DL test and the licence procedure can follow these steps:

Step 1: Go to the Parivahan Sewa Portal and click on the ‘Online Service’ tab on the homepage and choose ‘Driving licence Related Services’.

Step 2: Select the state where the DL application was filed from the drop-down list.

Step 3: The respective state’s transport department page will open with various options.

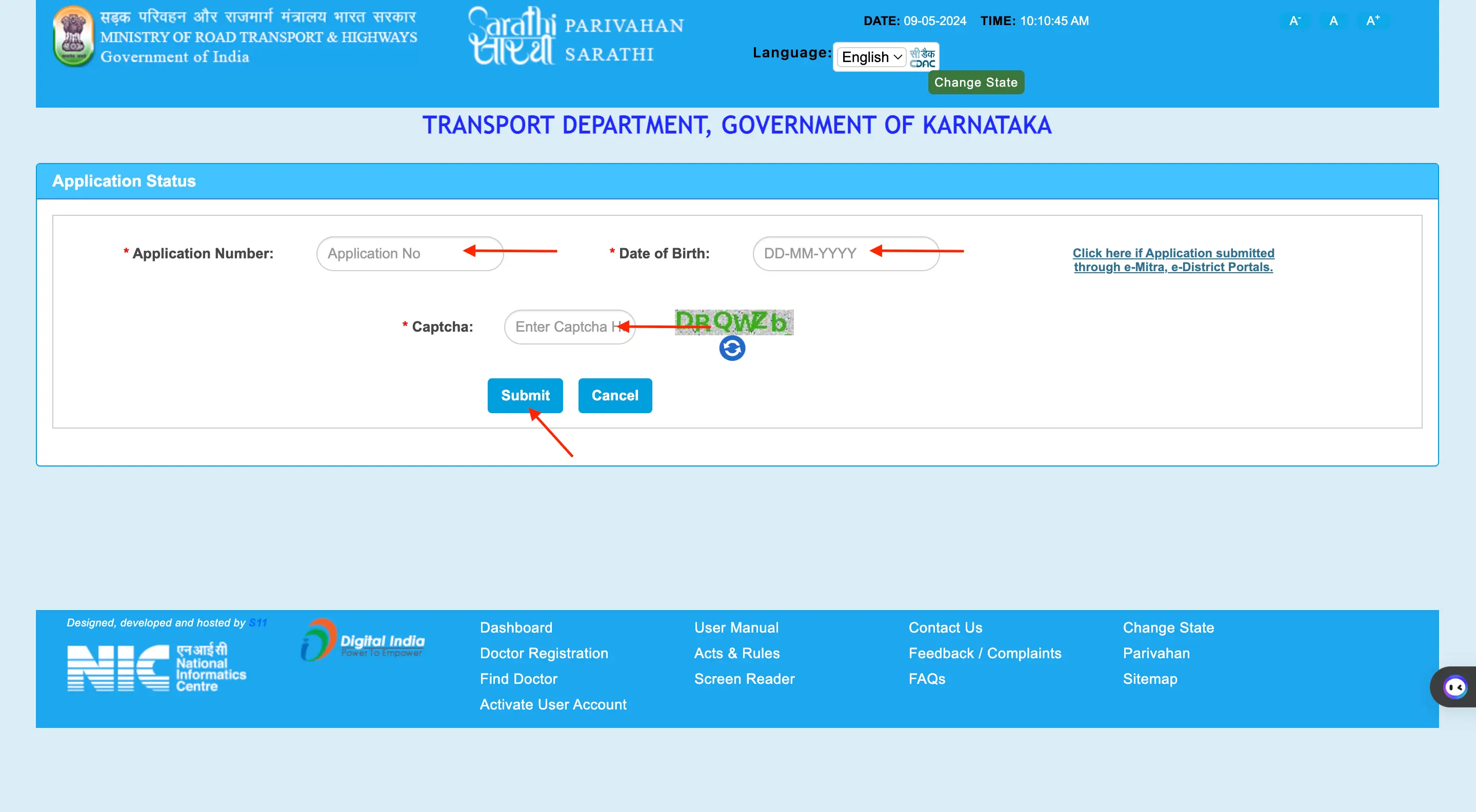

Step 4: Click on the ‘Application Status’ option from the available choices. This will open a new page.

Step 5: Enter the ‘Application Number’, ‘Date of Birth’, ‘Captcha’ and click on ‘Submit’.

Step 6: The status of the DL application will be displayed after clicking the submit button.

Apply For a Personal Loan with Low Interest Rates!

Check Status of Registration Certificate (RC) on Pariwahan Portal

To check the status of the Registration Certificate (RC) after applying for the vehicle's RC, follow these steps:

Step 1: Go to the Parivahan Sewa Portal

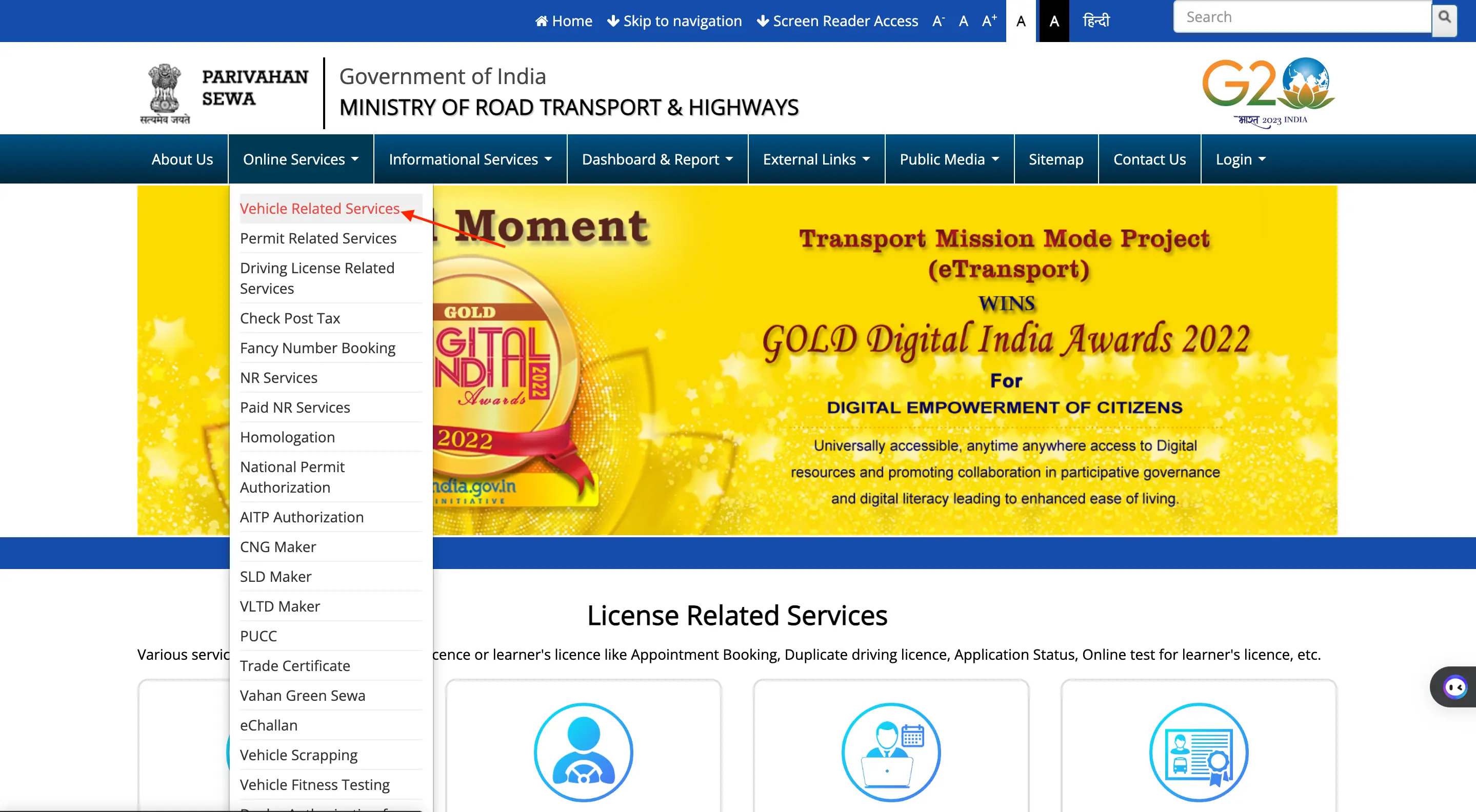

Step 2: Click on the ‘Online Service’ tab on the homepage and choose ‘Vehicle Related Services’.

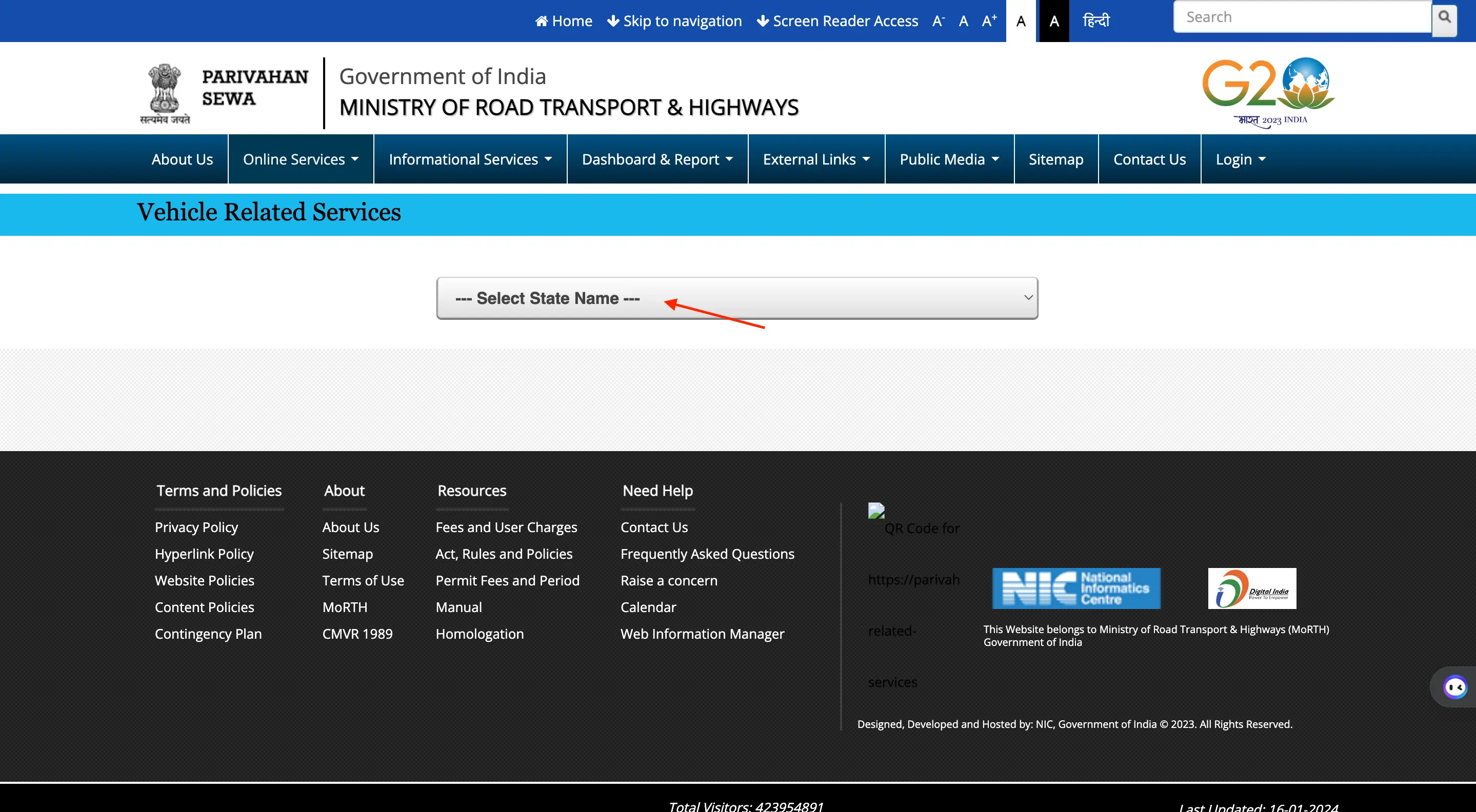

Step 3: Select the state where the RC application is made from the ‘Select State’ drop-down list.

Step 4: Choose the ‘Vehicle Registration Number’ option, enter the vehicle registration number, select the ‘State RTO’, and click ‘Proceed’.

Step 5: A page will open with multiple options. Click on ‘Status’ at the top and select ‘Know Your Application Status’.

Step 6: Enter the ‘Application Number’ (RC application number), ‘Captcha’, and click ‘Submit’ and then ‘View Report’.

Step 7: The page will show all details related to the RC application and its status.

Need a Personal Loan with Easy Approval?

Steps to Apply For RC Ownership Transfer/ Change Of Address/ Hypothecation

To apply for the transfer of RC ownership, change of address, or hypothecation of a vehicle, one can do so through the Parivahan Sewa Portal by following these steps:

Step 1: Visit the Parivahan Sewa Portal

Step 2: Click on the ‘Online Service’ tab and choose ‘Vehicle Related Services’

Step 3: Select the state where the vehicle is registered

Step 4: Enter the vehicle registration number and state RTO, then click ‘Proceed’

Step 5: Choose the option for ‘Apply for Transfer of Ownership, Change of Address, Hypothecation’

Step 6: Provide the required details such as registration number, chassis number, mobile number, and verify with OTP

Step 7: Enter the new owner's details, insurance details, and vehicle details for transfer of ownership

Step 8: Make the payment for transfer fees and obtain a copy of the fee payment receipt

Step 9: Submit necessary documents, including Form 29 and Form 30, to the Regional Transport Office (RTO) either by speed post or in person.

Steps to Apply for Vehicle Fitness Certificate

To obtain a fitness certificate for a vehicle, individuals can apply online but must visit the RTO to complete the process. The application process is as follows:

Step 1: Visit the Parivahan Sewa Portal

Step 2: Click on the ‘Online Service’ tab and select ‘Vehicle Related Services’

Step 3: Enter the vehicle registration number, select the ‘State RTO’, and click ‘Proceed’

Step 4: Choose ‘Apply for Fitness Renewal/Re-Apply After Fitness Being Failed’

Step 5: Enter the registration number, last five characters of the chassis number, and mobile number, verify with OTP, and click ‘Submit’

Step 6: Review details, select a new fitness certificate or renewal, and book an appointment slot at the RTO

Step 7: Calculate fees, choose online or RTO payment

Step 8: If online payment is selected, pay the fees and download the payment challan

Step 9: Provide a copy of the payment challan to the RTO after payment

Apply for an Instant loan at best interest rates!

mParivahan App

The mParivahan App is a mobile application developed by the Ministry of Road Transport and National Highways. It is designed to provide various services related to driving licenses (DL) and vehicle registration certificates (RC).

The app offers users the ability to access basic details about their vehicle, pay road tax, and register for licence services. It covers features such as:

- Checking insurance validity, vehicle fitness, and PUC (Pollution Under Control) certificate details.

- Taking learner's license and driving licence tests, as well as renewing RCs.

- Accessing information about the nearest Regional Transport Office (RTO), traffic challans, RC status, vehicle registration details, etc.

- Facilitating the payment of road taxes.

- Locating the nearest pollution checking centers.

- The mParivahan App is available in multiple languages, including English, Hindi, and Marathi, to cater to a diverse user base.

State RTO Codes on Pariwahan Seva Portal

Every RTO under each state and Union Territory (UT) has a designated code and official website. Here is the list of State RTO codes and their respective websites:

| State or Union Territory | State Codes | Official Website |

|---|---|---|

| Arunachal Pradesh | AR | https://arunachalpradesh.gov.in |

| Andhra Pradesh | AP | https://www.aptransport.org/ |

| Assam | AS | https://transport.assam.gov.in/ |

| Bihar | BR | https://state.bihar.gov.in/transport/CitizenHome.html |

| Chhattisgarh | CG | http://www.cgtransport.gov.in/ |

| Gujarat | GJ | https://rtogujrat.com |

| Goa | GA | https://www.goa.gov.in/department/transport/ |

| Himachal Pradesh | HP | https://himachal.nic.in/index.php?lang=1&dpt_id=3 |

| Haryana | HR | https://haryanatransport.gov.in/ |

| Jharkhand | JH | http://jhtransport.gov.in |

| Jammu & Kashmir | JK | http://jaktrans.nic.in |

| http://jaktrans.nic.in | KL | https://mvd.kerala.gov.in/ |

| Karnataka | KA | https://www.karnatakaone.gov.in/Info/Public/RTO |

| Maharashtra | MH | https://transport.maharashtra.gov.in/1035/Home |

| Manipur | MN | https://manipur.gov.in/?p=757 |

| Madhya Pradesh | MP | http://www.transport.mp.gov.in/ |

| Mizoram | MZ | https://transport.mizoram.gov.in/ |

| Meghalaya | ML | http://megtransport.gov.in |

| Nagaland | NL | http://mvd.nagaland.gov.in/ |

| Orissa | OD | https://odishatransport.gov.in |

| Punjab | PB | http://www.punjabtransport.org/driving%20licence.aspx |

| Rajasthan | RJ | https://transport.rajasthan.gov.in/content/transportportal/en.html |

| Sikkim | SK | https://sikkim.gov.in/departments/transport-department |

| Tamil Nadu | TN | https://tnsta.gov.in/ |

| Telangana | TS | https://transport.telangana.gov.in |

| Tripura | TP | https://transport.tripura.gov.in/ |

| Uttar Pradesh | UP | http://uptransport.upsdc.gov.in/en-us/ |

| West Bengal | WB | http://transport.wb.gov.in/ |

| Andaman and Nicobar Islands | AN | http://db.and.nic.in/mvd/ |

| Chandigarh | CH | http://chdtransport.gov.in/ |

| Daman and Diu | DD | https://daman.nic.in/rtodaman/default.asp |

| Dadra and Nagar Haveli | DN | http://dnh.nic.in/Departments/Transport.aspx |

| Lakshadweep | LD | https://lakshadweep.gov.in/ |

| National Capital Territory of Delhi | DL | https://transport.delhi.gov.in |

| Puducherry | PY | https://www.py.gov.in/ |

| Leh-Ladakh | LA | https://leh.nic.in/e-gov/online-services/ |

Read More

Read Less

Pariwahan Seva Customer Care

Get in touch with Parivahan Sewa from the following contact details:

Any technical problems related to learner and driving licences can be addressed by phone calls between 6:00 a.m. to 10:00 p.m.

Phone: +91 120 2459169

Email: helpdesk-sarathi@gov.in

Get a personal loan with ease!

Frequently Asked Questions

At present, there is no provision to rectify details on the DL application once it has been submitted. The only option is to get in touch with the zonal office or RTO and bring the original documents to correct the error, or alternatively reapply for the application.

Yes, when paying motor vehicle tax online, you may need to fill out various forms, such as the application form for tax payment, along with supporting documents like vehicle registration details.

Motor Vehicle Tax is a tax levied by the state governments on the ownership and use of motor vehicles. The tax amount is typically based on factors like the vehicle's type, engine capacity, and the state's tax structure.

Motor Vehicle Taxes vary across different states because each state has the autonomy to set its own tax rates and policies based on factors like local infrastructure, transportation needs, and revenue generation requirements.

The procedure for payment of fees, such as for driving licenses or vehicle registration, usually involves submitting the required application form, supporting documents, and making the payment either online or offline at the designated RTO (Regional Transport Office) or authorized centers.

If a service is not availed or rejected by the RTO, you can typically apply for a refund of the fees paid. The process involves submitting a refund application along with the necessary documents to the RTO, and the refund is then processed as per the established guidelines.

Yes, in certain cases, you may be able to cancel your application and request a refund of the fees paid, subject to the RTO's policies and regulations. The process and eligibility for refunds may vary depending on the specific service and the stage of the application.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users