The Aadhaar e-KYC system is a significant step in India's digital transformation. It has revolutionized the way we verify our identity and has created new opportunities across various industries. With its growing adoption and rapid digitization, e-KYC has the potential to transform how we verify our identity in the future.

Aadhaar e-KYC, also known as the e-KYC Portal Aadhar, is a convenient and digital way to verify your identity and address in India. It eliminates the need for physical paperwork and offers a hassle-free alternative for identity verification.

The e-KYC system quickly verifies and authenticates your identity and address. It's widely used by banks, telecom providers, insurance companies, and e-commerce platforms. Over 2,000 organizations across India are using this system, showing its popularity and effectiveness.

Growing Adoption of e-KYC:

The number of e-KYC transactions has been steadily increasing, with over 7.5 billion transactions conducted in 2023 alone.

How to Complete Aadhaar e-KYC Process

Completing Aadhaar e-KYC verification can be done in user-friendly methods with distinct advantages and minimal technicality:

Biometric-Based e-KYC

Biometric-based e-KYC uses an individual's physical characteristics, such as fingerprints and iris scans, to verify their identity. Given below are the steps you need to know to complete your biometric-based e-KYC:

- Step 1: Initiate an e-KYC request: Select the "e-KYC" option on the service provider's platform.

- Step 2: Choose a biometric method: Select fingerprint or iris scan (depending on available options).

- Step 3: Scan your fingerprint/iris: Follow the instructions on the platform to capture your biometric data accurately.

- Step 4: Consent and verification: Review and consent to data sharing, then your biometric data will be verified with UIDAI.

- Step 5: Completion: Upon successful verification, your e-KYC is complete.

Looking for a personal loan?

Aadhaar Paperless Offline e-KYC

Aadhaar Paperless Offline e-KYC offers secure and efficient identity verification with no physical documents. Here is how you can do it:

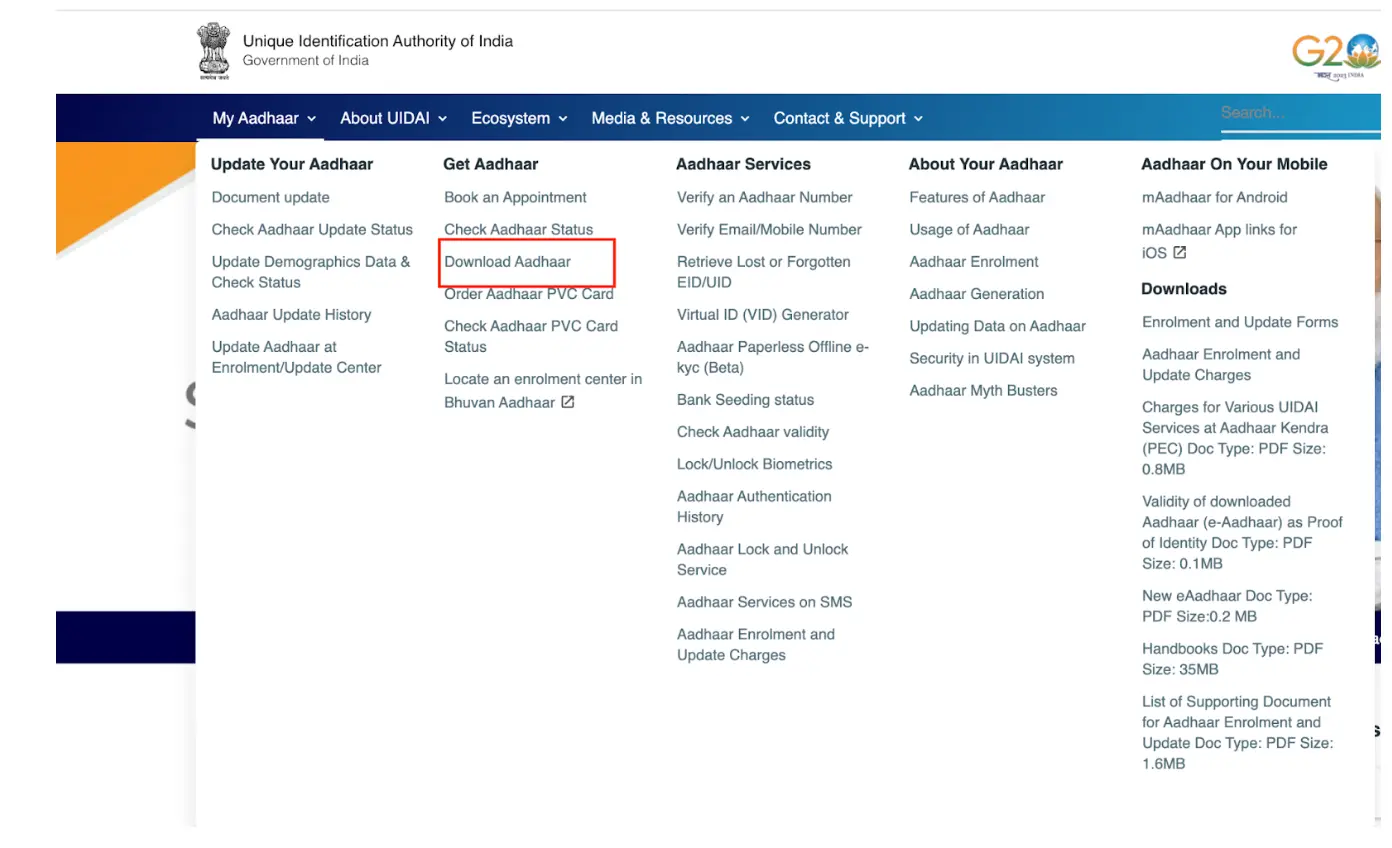

- Visit the official UIDAI website

- Navigate to the "My Aadhaar" section in the top-left corner.

- Go to the “Download Aadhaar” option under the Get Aadhaar section.

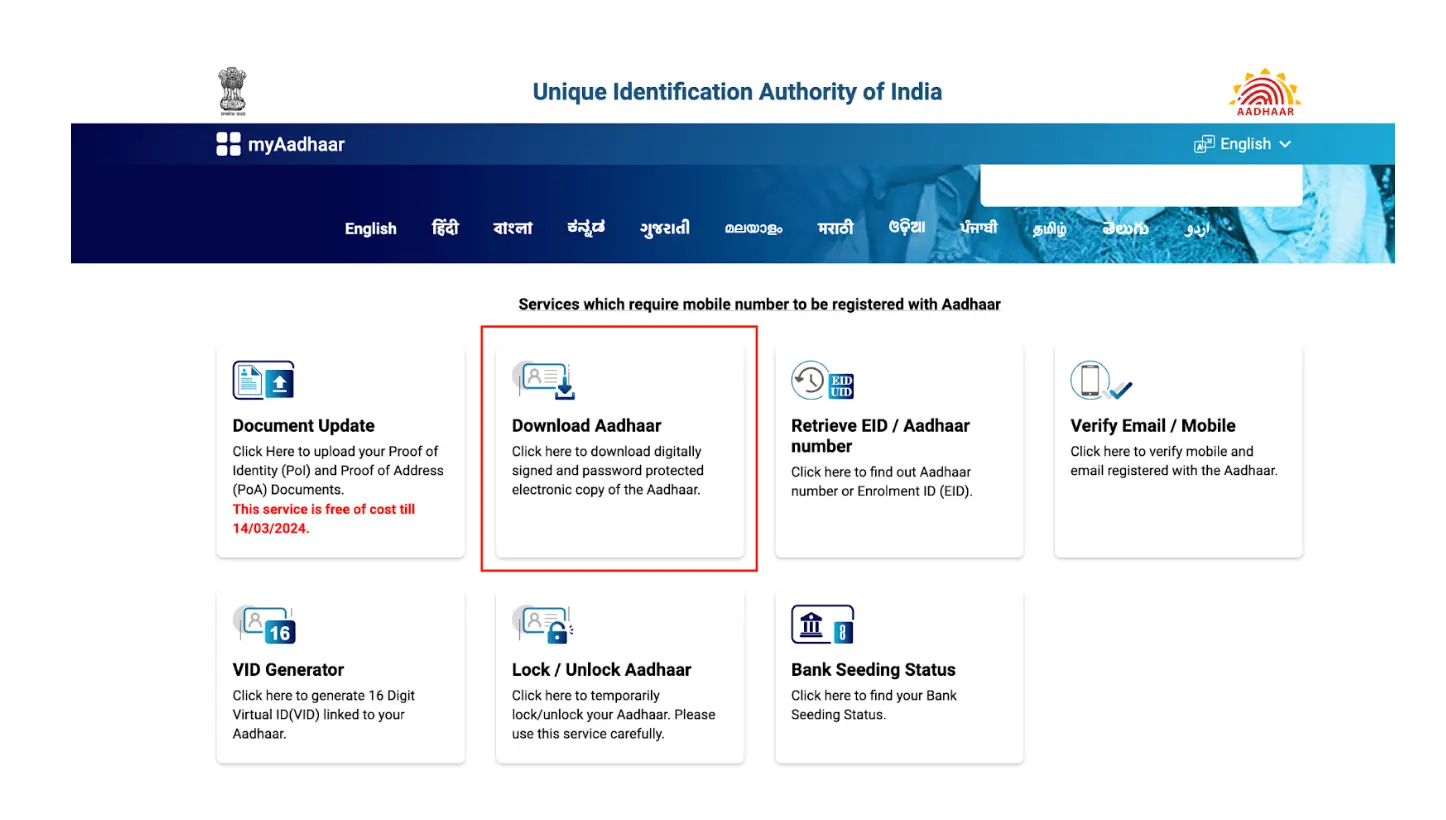

- Click on the Download Aadhaar option on the dashboard of UIDAI

- The OTP will be sent to the registered Mobile Number associated with the provided Aadhaar number or VID. It can be accessed on the m-Aadhaar mobile application by UIDAI.

- Enter the received OTP and a Share Code, which will serve as the password for the ZIP file, then click on the 'Download' button.

- The ZIP file containing the digitally signed XML will be downloaded to the device where the aforementioned steps were completed.

- Locate an authorized "Offline Verification Seeking Entity (OVSE)" offering services that accept paperless offline e-KYC.

- Provide the downloaded ZIP file with the e-KYC XML along with the Share Code for verification of authenticity.

- The OVSE will use UIDAI-approved software to verify the digital signature of the e-KYC XML, confirming its authenticity and origin from UIDAI.

Not sure of your credit score? Check it for free now!

Benefits of E-KYC Process Through Aadhaar

The E-KYC process using Aadhaar makes verifying identities easier and enhances the overall customer experience. Some benefits of doing your eKYC through Aadhaar are given below:

- Instant And Paperless Verification: Eliminate physical documents and complete e-KYC swiftly through Aadhaar.

- Remote Accessibility: Conduct verification from any location with an internet connection, eliminating the need for physical visits and lengthy queues.

- Secure Data Sharing: Aadhaar's encryption protocols ensure secure data transmission during verification.

- Expanded Financial Inclusion: Enable access to a range of financial services such as banking and investments, especially for rural individuals without formal documentation.

- Improved Efficiency: Streamline processes, saving time and resources for both service providers and customers.

Ready to take the next step?

Frequently Asked Questions

You can apply for eKYC online by visiting the UIDAI website and following the instructions.

Yes, you can complete the Aadhaar KYC process online by using the Aadhaar eKYC service.

You can check the status of your Aadhaar KYC by logging into the UIDAI portal and checking the details.

You can download your KYC Aadhaar card offline by visiting the nearest Aadhaar Enrollment Centre and following the process.

You can verify your KYC by providing your Aadhaar card details and linking it to your bank accounts, mobile numbers, or other services.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users