SBI Net Banking is an online banking platform offered by the State Bank of India, India's largest public sector bank. It empowers you to manage your finances conveniently from anywhere. You can check account balances, transfer funds, pay bills, recharge your phone, and even apply for loans – all from the convenience of your home.

You can also use SBI Net banking to transfer money, open fixed deposits (FDs), recurring deposits (RDs), or PPF accounts. Registering for SBI Net Banking is free and can be done online or at your local branch.

Table of Contents:

- ⇾ Eligibility For SBI Net Banking

- ⇾ Documents Needed For SBI Net Banking

- ⇾ Key Features of SBI Net Banking

- ⇾ Guide to Registering/Activating for SBI Net Banking

- ⇾ Login To SBI Net Banking Account

- ⇾ Personal Banking

- ⇾ Corporate Banking

- ⇾ Steps To Open an SBI Account Through Net Banking

- ⇾ Steps to Reset SBI Net Banking Password

- ⇾ Check Balance Through SBI Net Banking

- ⇾ Steps To Transfer Money through SBI Net Banking

- ⇾ Adding Beneficiaries for SBI Net banking:

- ⇾ Transfer of Funds to Another SBI Account Holder:

- ⇾ SBI Net Banking Transaction Limits and Charges

- ⇾ SBI Net Banking Mobile App

- ⇾ Block Lost SBI ATM Card through Net Banking

- ⇾ Change SBI ATM PIN via Net Banking

- ⇾ SBI Net Banking Customer Care Number

- ⇾ Frequently Asked Questions

Eligibility For SBI Net Banking

To register for SBI net banking services online, customers need to meet the following requirements:

- Must have a savings account with SBI.

- Have their mobile numbers linked to the bank account.

- Possess a valid ATM card.

Documents Needed For SBI Net Banking

To register for SBI online banking or net banking service, you do not need to provide many documents. However, you should have the following information ready during the registration process:

- Registered Mobile Number

- SBI Account Number

- CIF Number

- SBI Branch Code

- Country Name

- SBI ATM Card Information

Key Features of SBI Net Banking

Here are the key features of SBI net banking that you can use at your convenience:

- View account details like balance, previous transactions, etc.

- Easily transfer funds between your own accounts or to third parties.

- Update your nomination and KYC details.

- Make payments for NPS, PPF, SIP, and more.

- Pay utility bills, recharge mobile/DTH, and make online payments for leisure expenses.

- Open various accounts with SBI, including RD, FD, Demat, etc.

- Pay taxes, e-verify income tax returns, and view TDS certificates and interest certificates.

- Set up standing instructions for timely payments, transfers, or auto-debits.

Are you looking for a personal loan?

Guide to Register & Activate SBI Net Banking

If you are a new user, you need to activate or register your SBI net banking account. To activate SBI net banking, follow these steps:

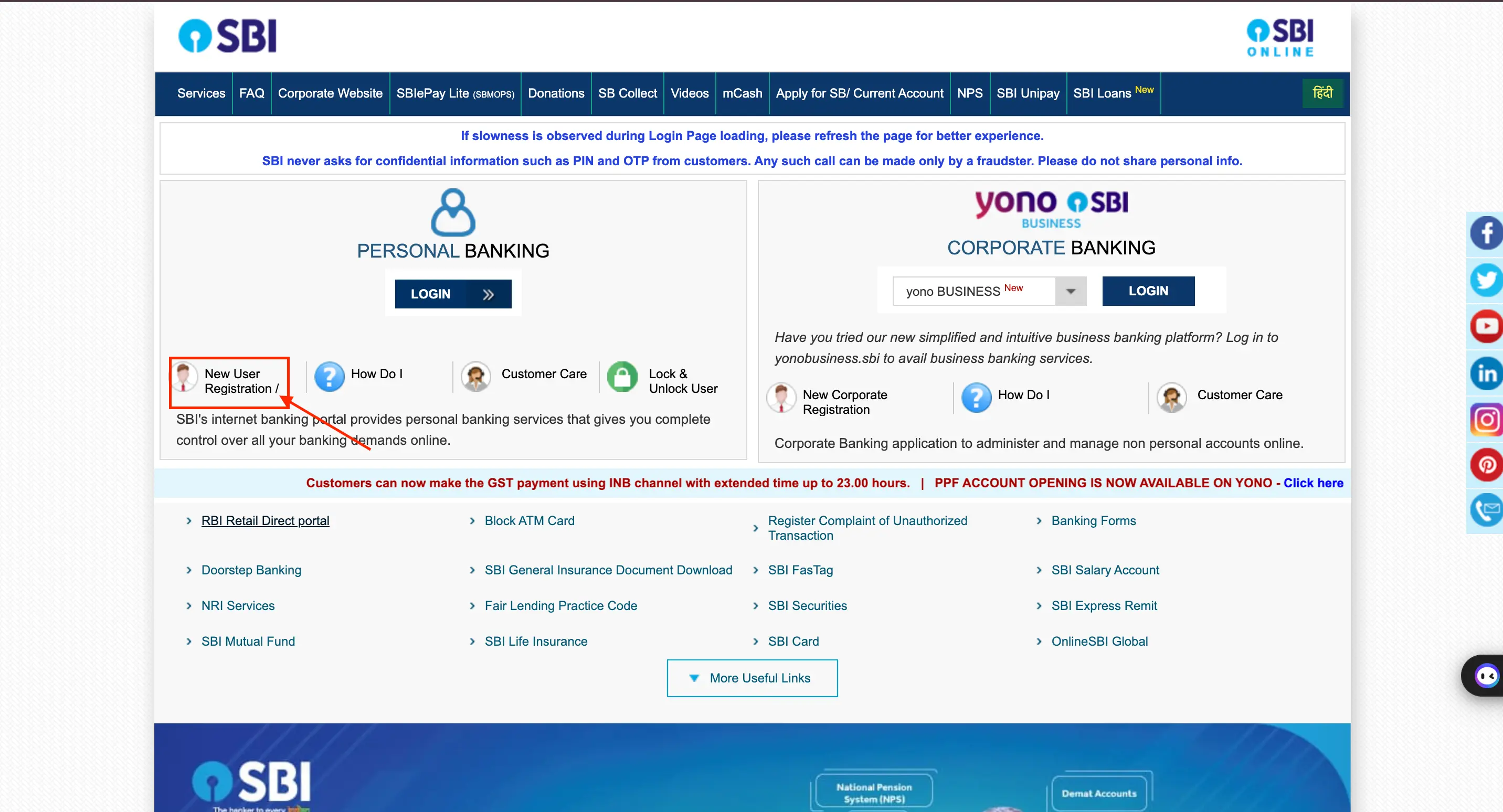

Step 1: Go to the SBI Online website.

Step 2: Click on ‘New User Registration’ in the ‘Personal Banking’ section.

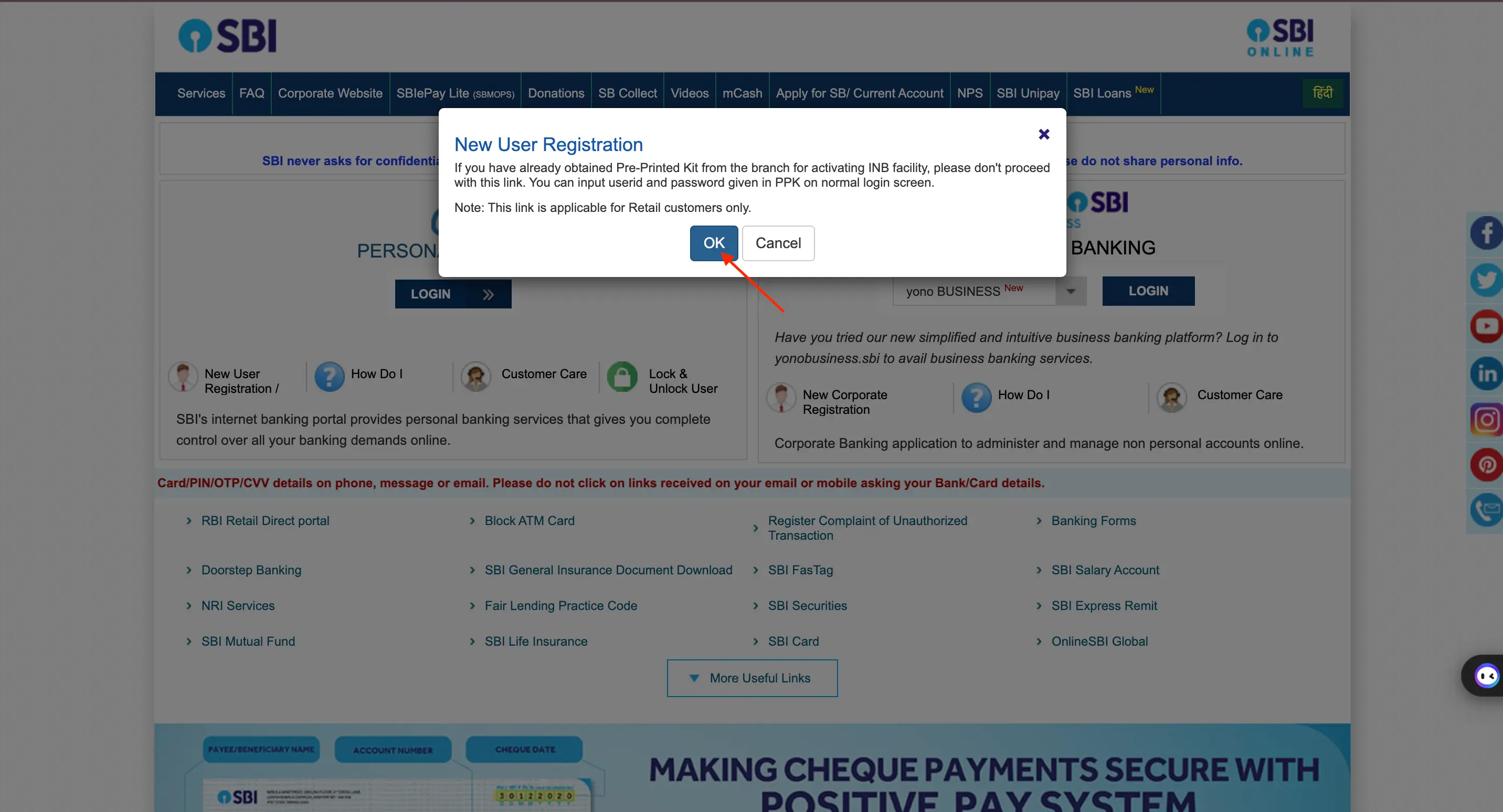

Step 3:If you haven't received an Internet banking kit, click ‘OK’ on the pop-up window.

Note: If you have received the SBI Netbanking credentials/kit from your bank, you can directly log in with the provided user ID and password.

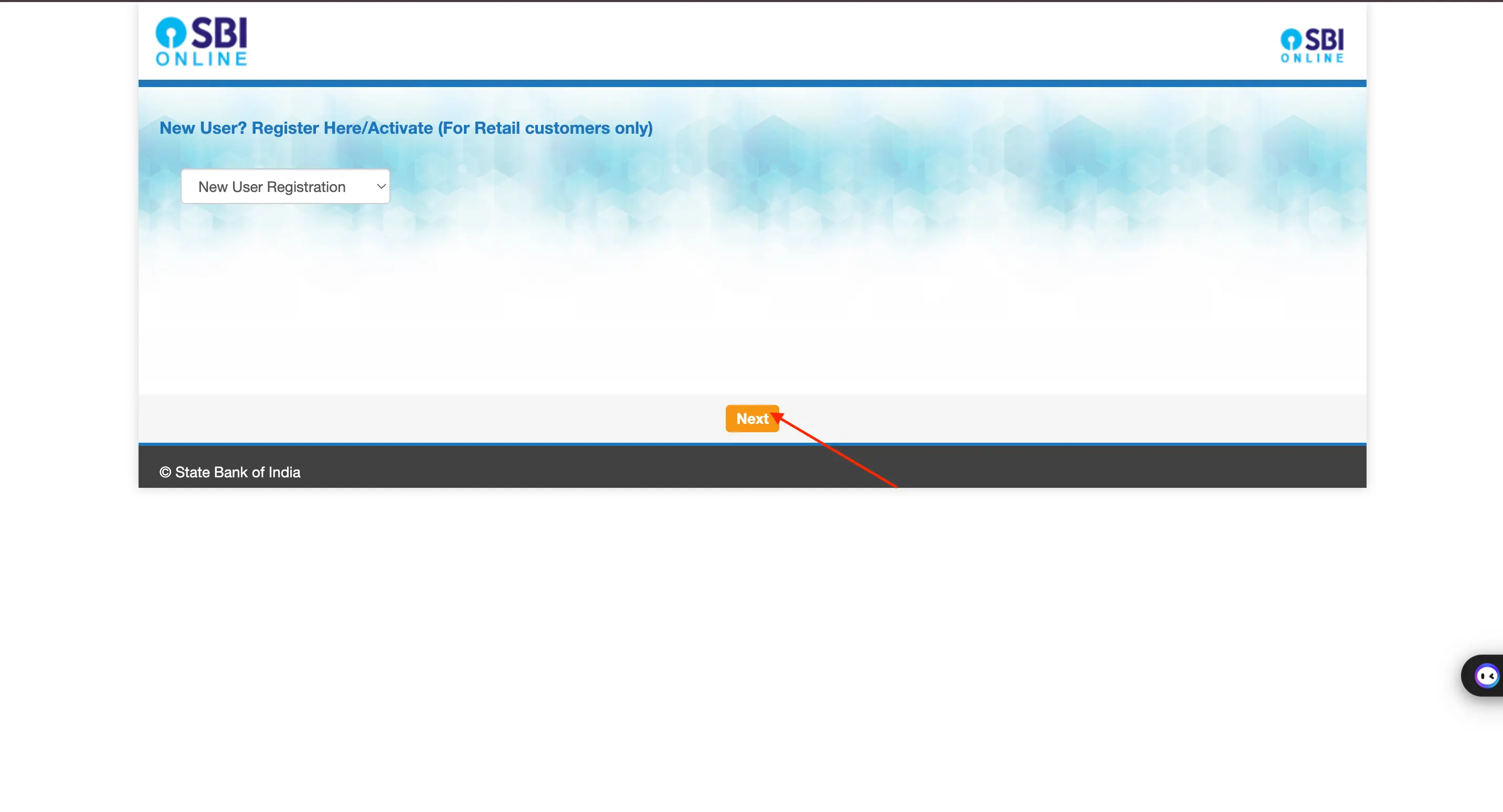

Step 4: Select ‘New User Registration’ from the drop-down menu and click ‘Next’.

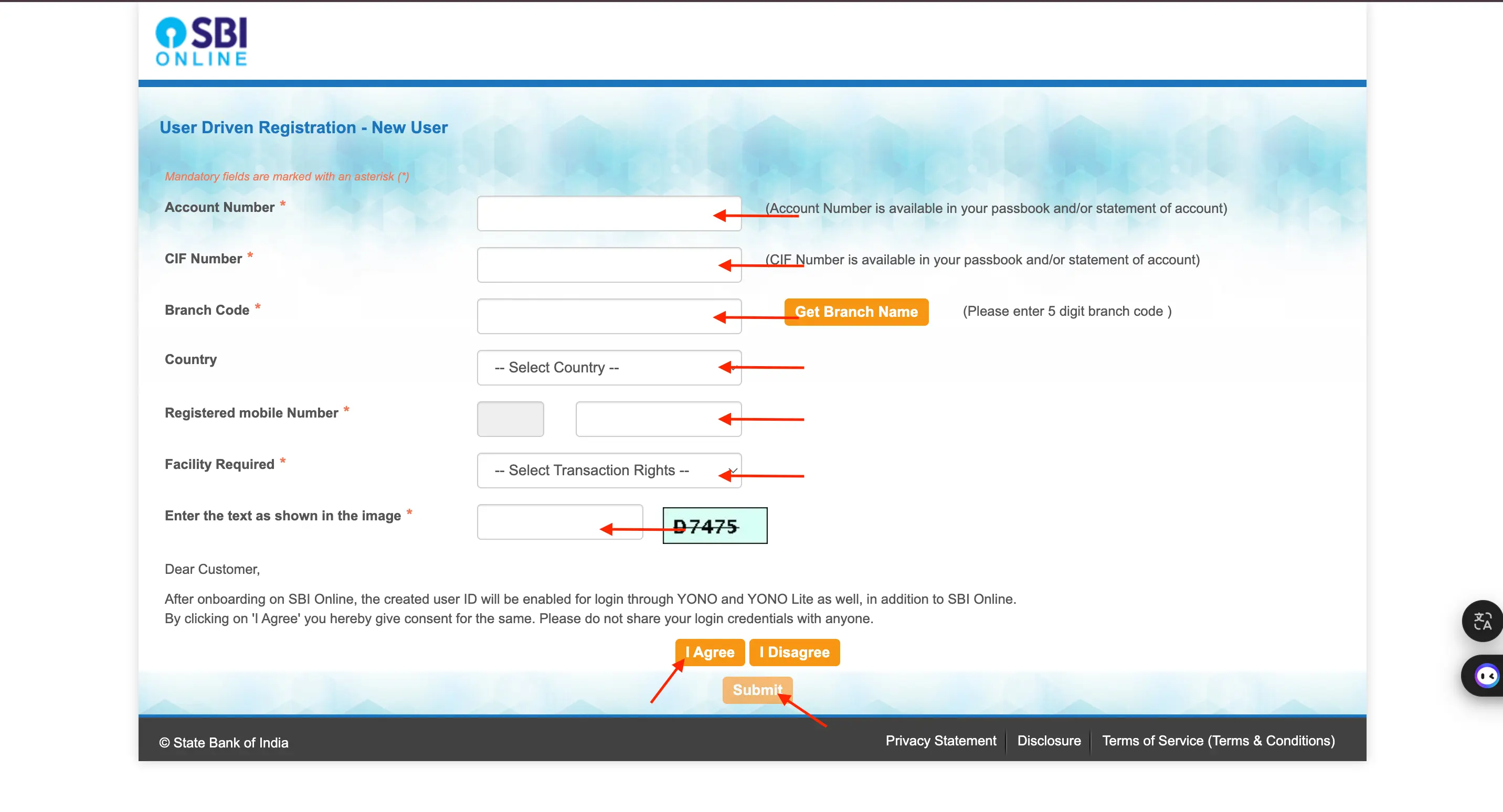

Step 5: Fill in details like account number, CIF number, branch code, country, and registered mobile number, and select the desired facility. Enter the captcha code correctly. If you're unsure of the branch code, use the ‘Get Branch Code’ option. After filling in the details, click on ‘I agree’ and then ‘Submit’.

Step 6: Enter the OTP sent to your registered mobile number and click ‘Confirm’.

Step 7: Choose ‘I have my ATM card’ and click ‘Submit’.

Step 8: Enter your ATM card details and click ‘Submit’.

Step 9: Make a note of the temporary username displayed on the screen.

Step 10: Set a password and click ‘Submit’ to complete the registration process.

Don't know your credit score? You can find out for free!

Login to SBI Net Banking Account

Below is a detailed guide on how to access both personal and corporate banking in the SBI online net banking portal.

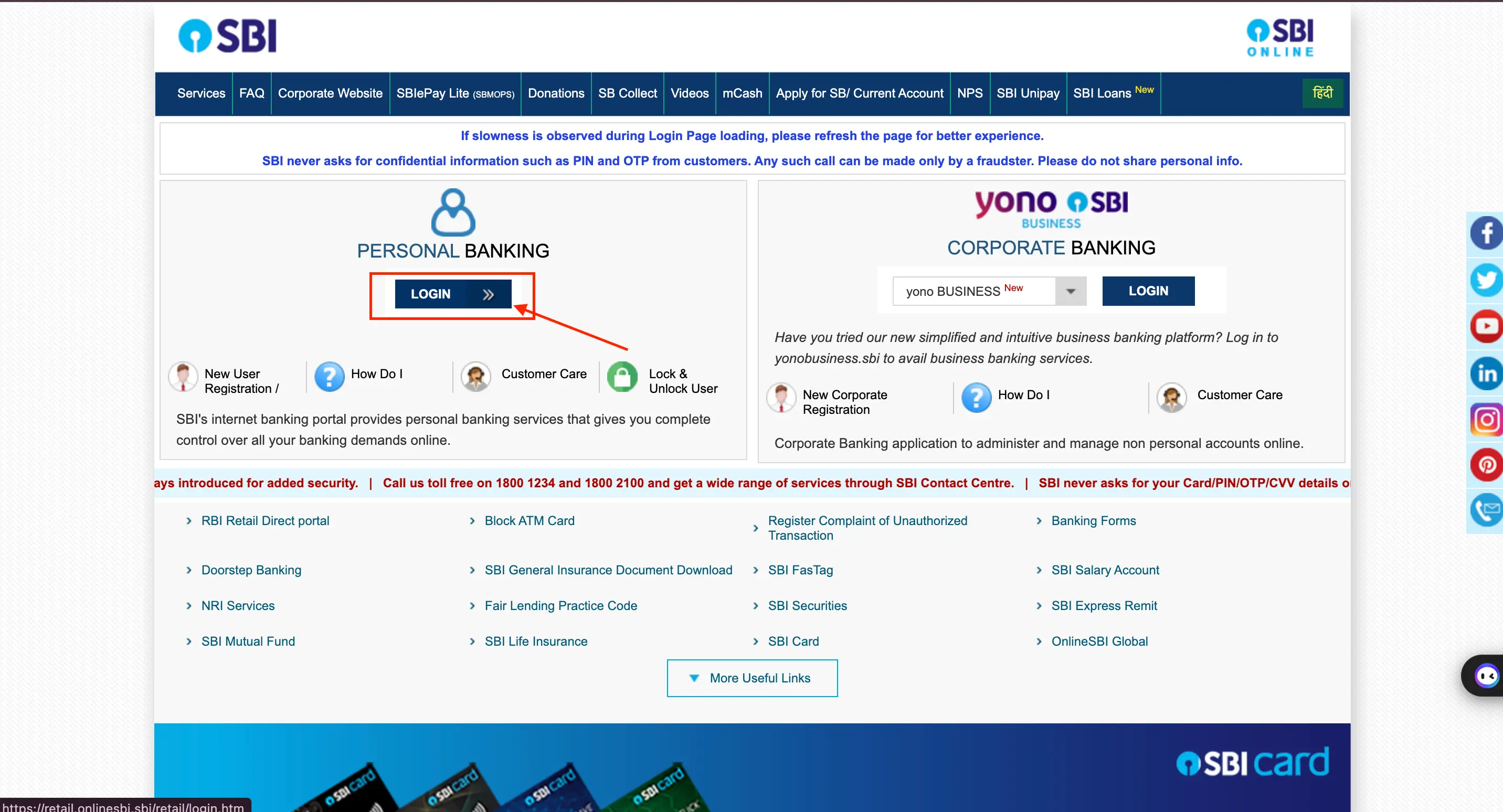

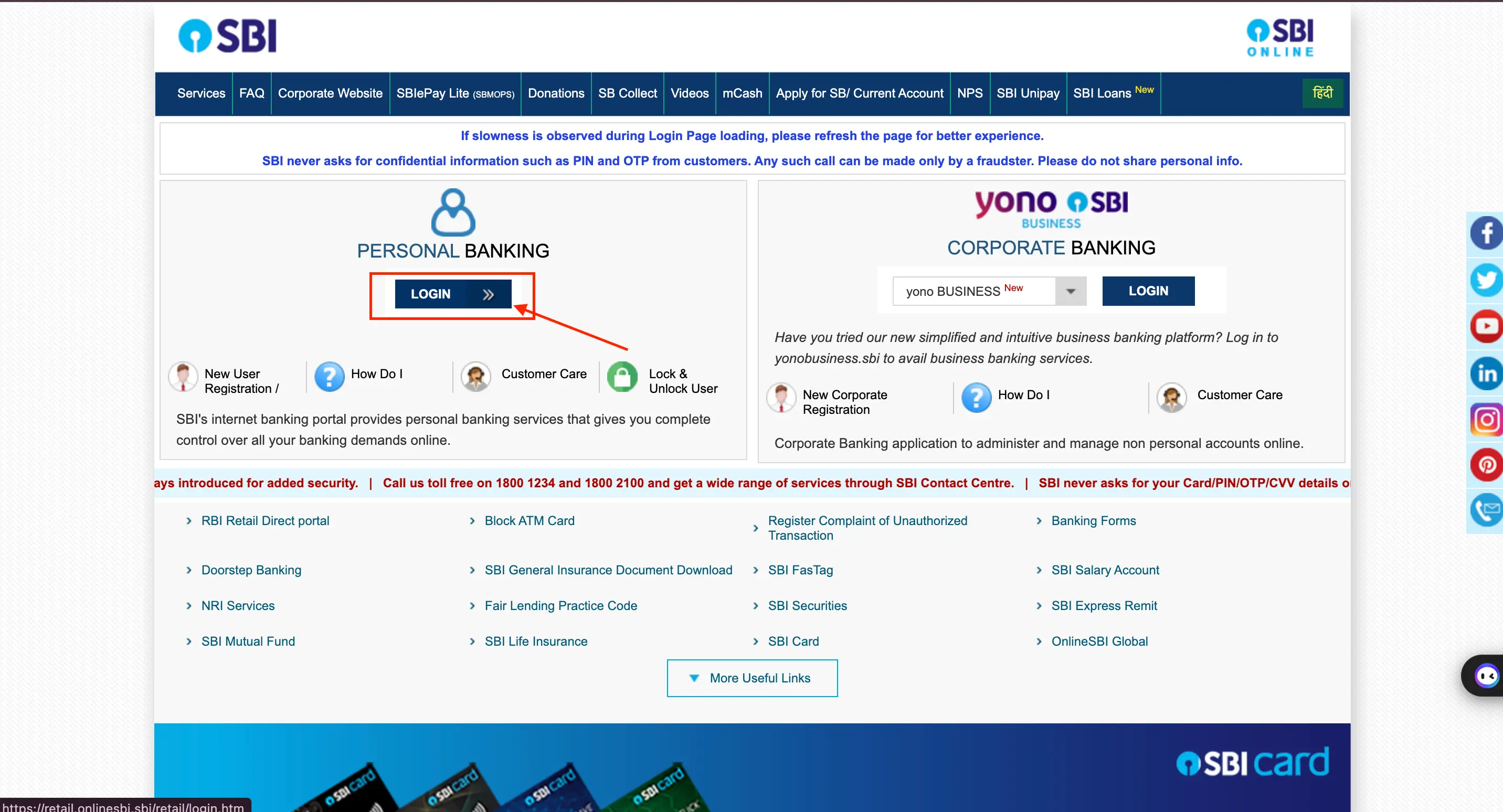

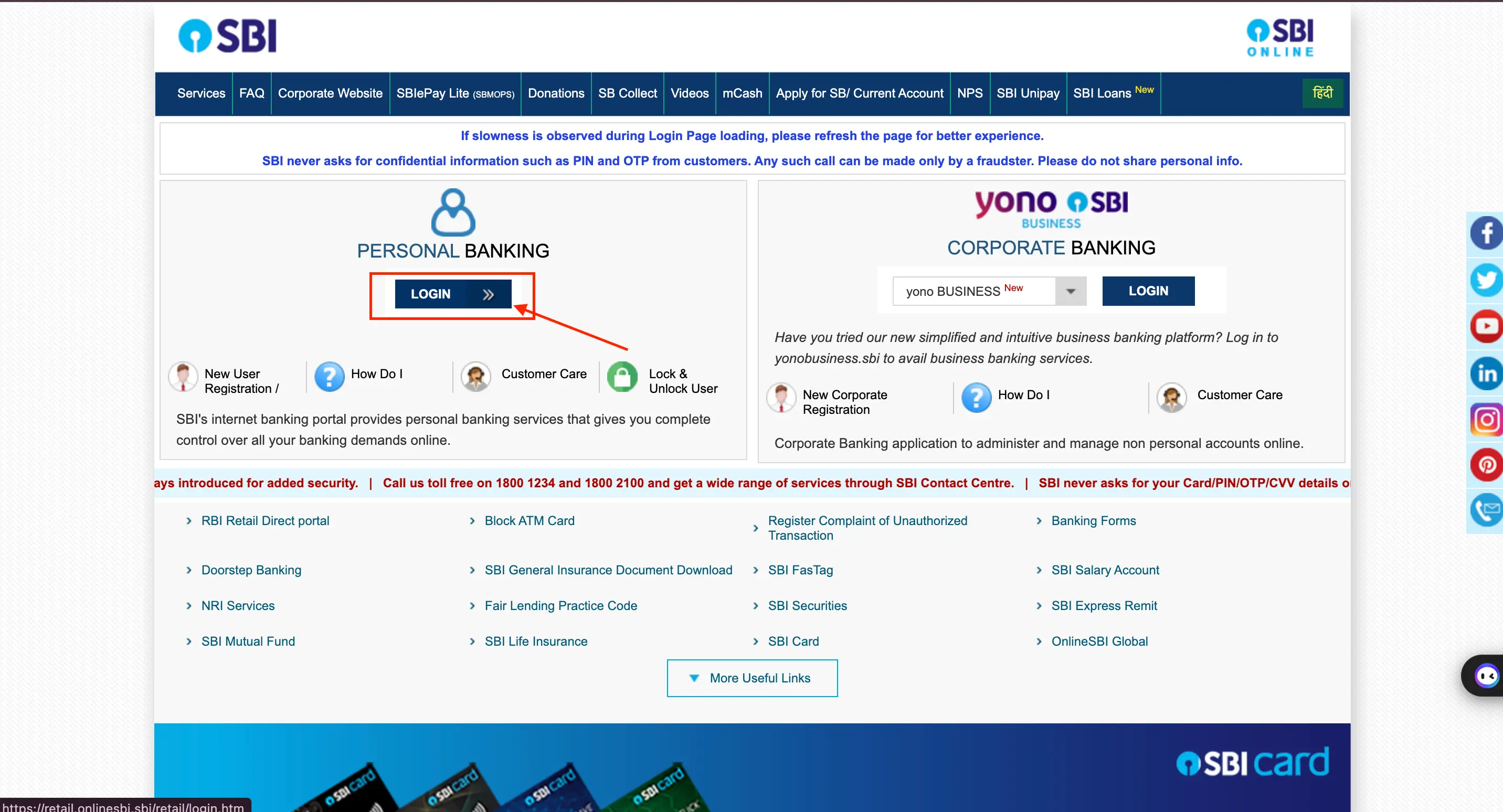

SBI Personal Banking Login

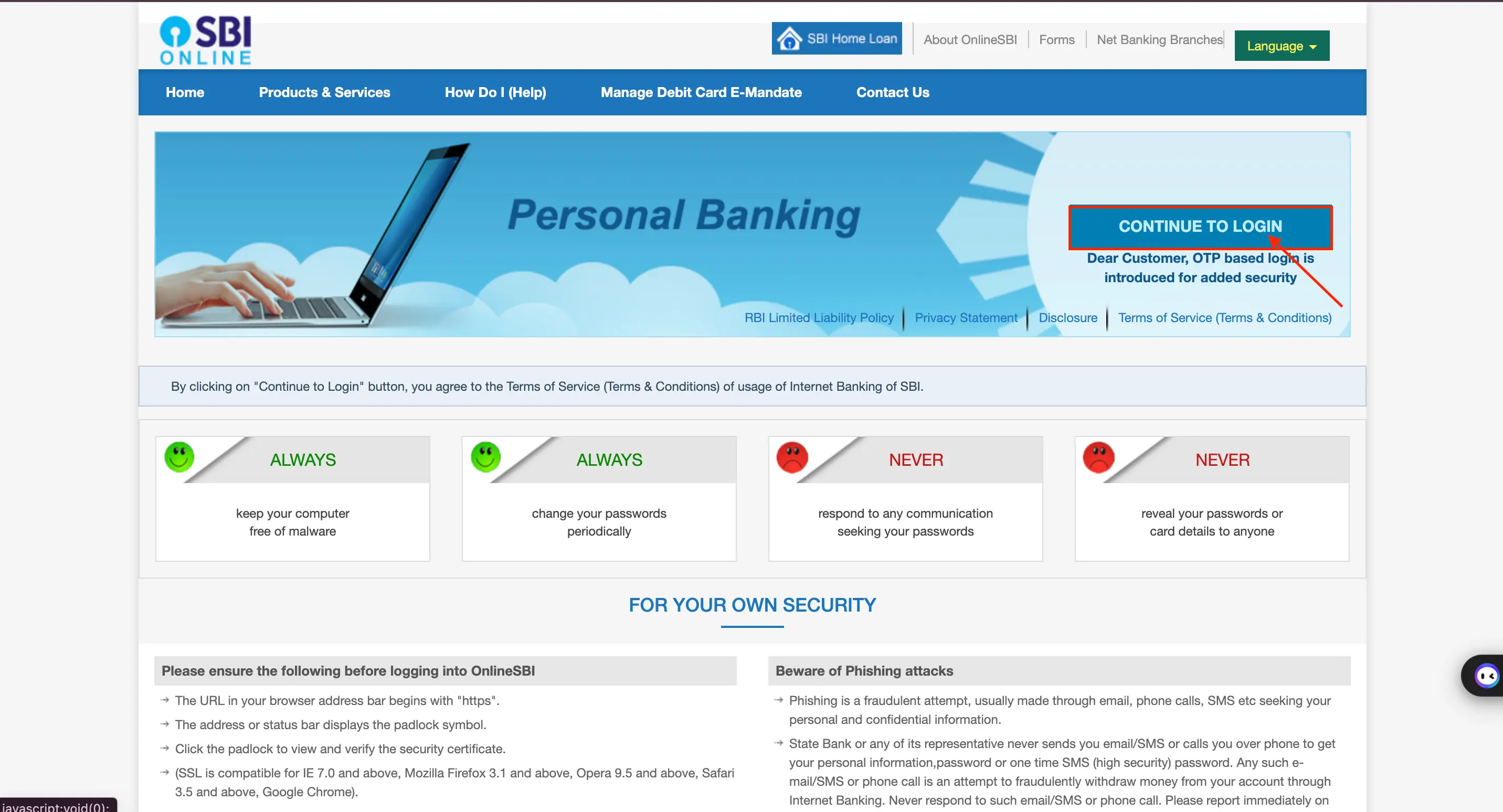

Step 1: Go to the SBI Online website.

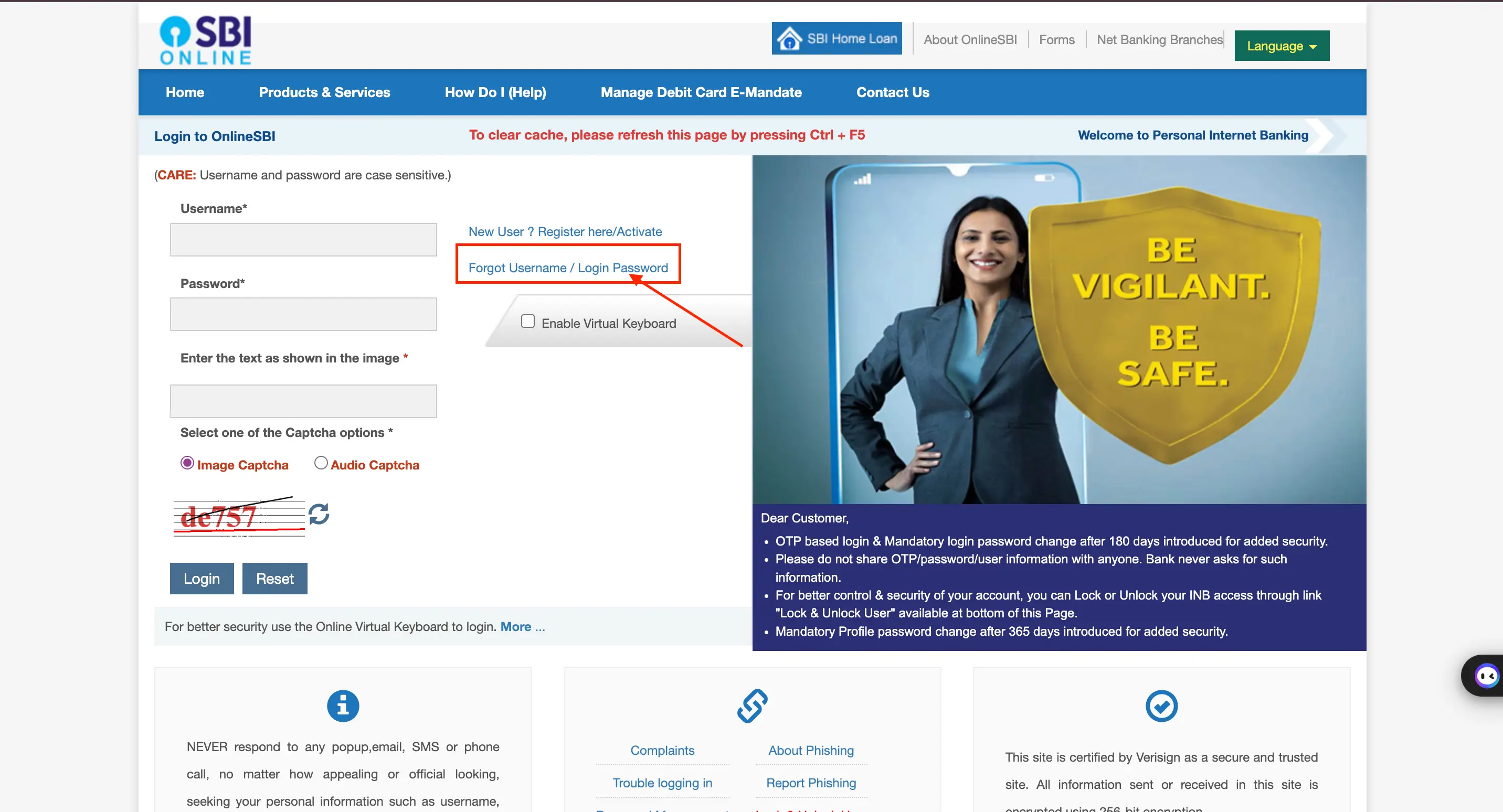

Step 2: Select the ‘Login’ button in the ‘Personal Banking’ section.

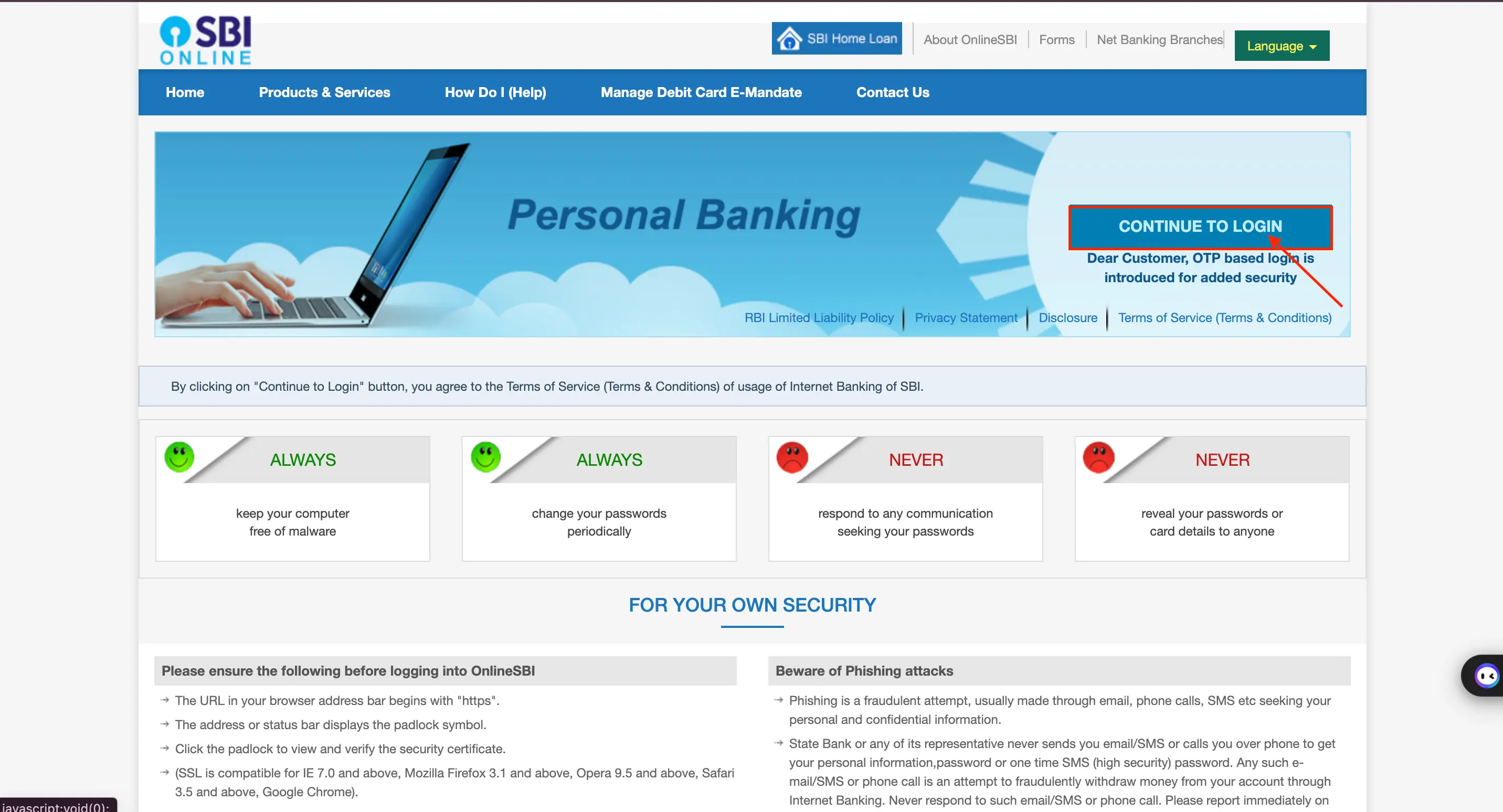

Step 3: Click on the ‘Continue to Login’ button on the next page.

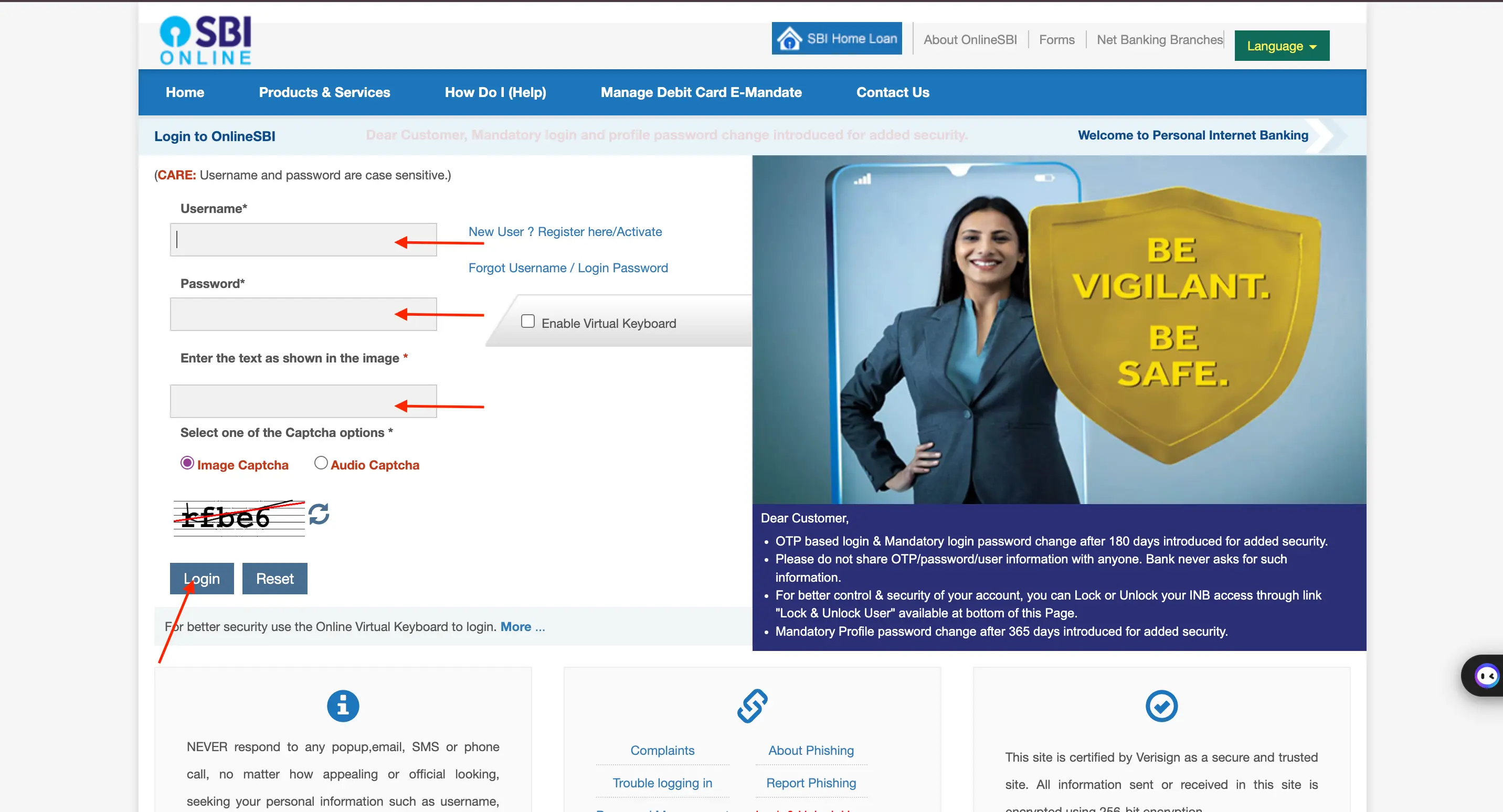

Step 4: Enter your username, password, and Captcha code, then click ‘Login’ to log in to your account.

Step 5: After logging in for the first time, you will be directed to the homepage where you can access all your account information. It is important to set the profile password during your initial login.

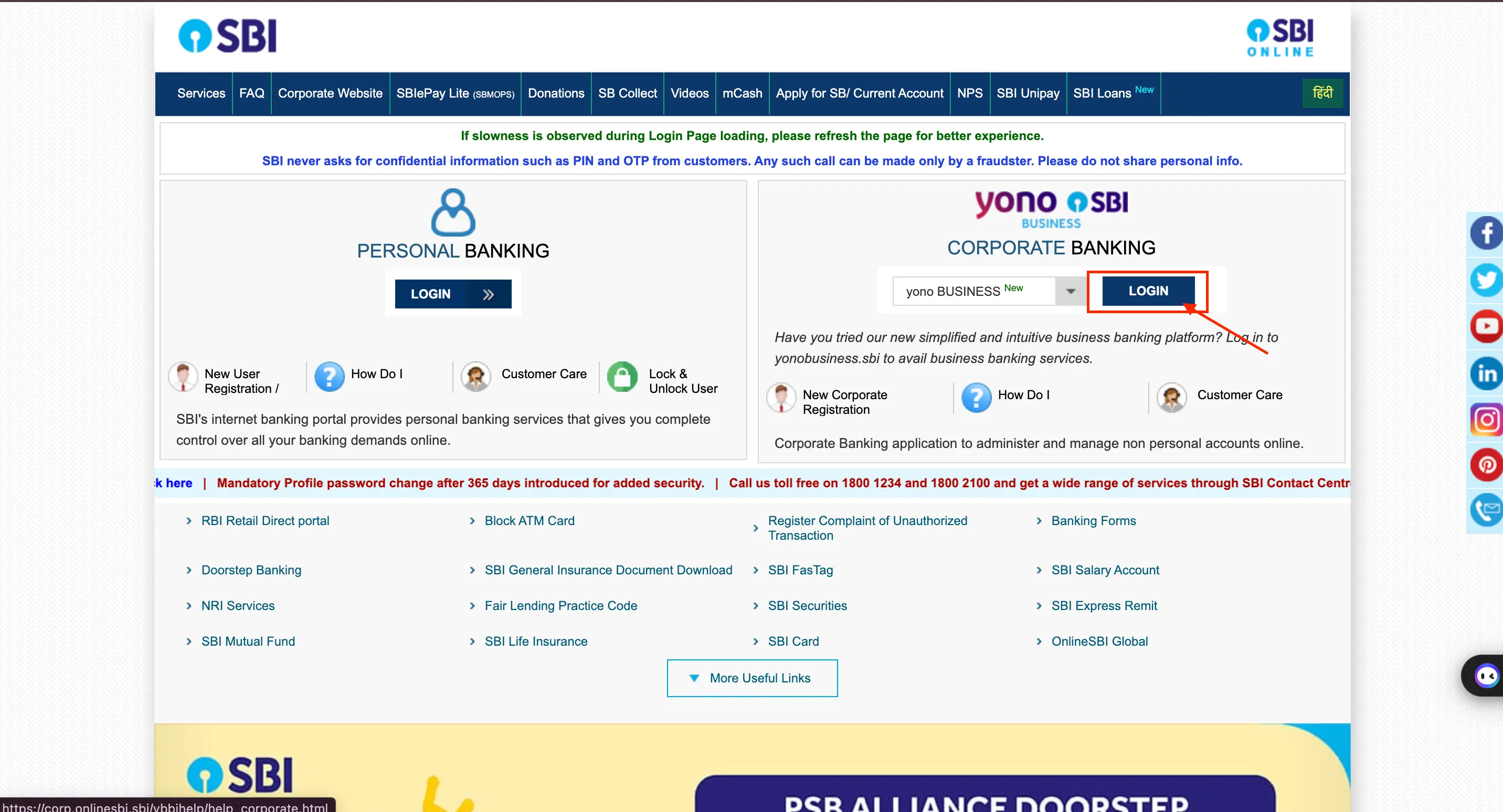

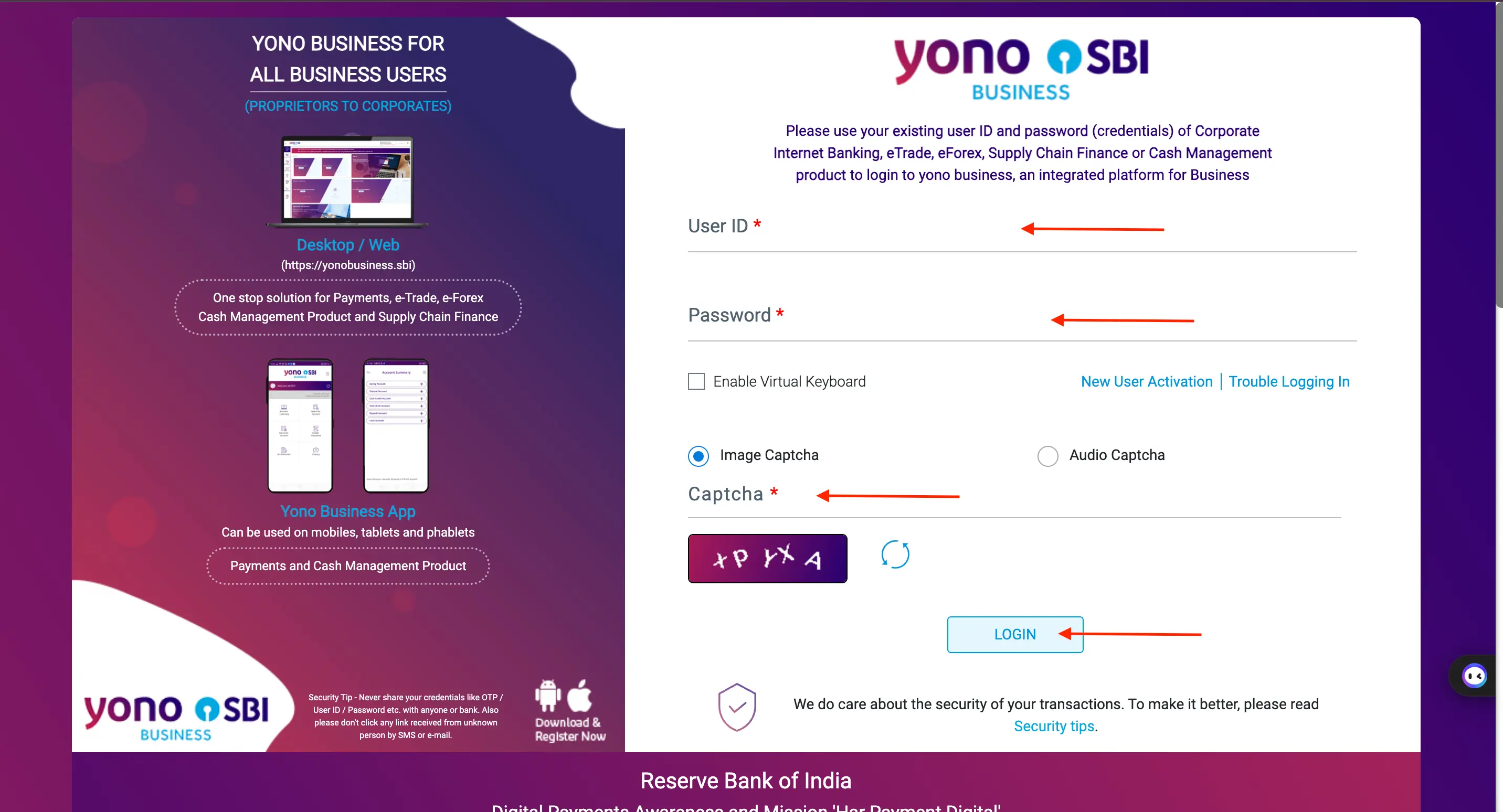

SBI Corporate Banking Login

Step 1: Go to the SBI Online website.

Step 2: Select the ‘Login’ option in the ‘YONO SBI Corporate Banking’ section.

Step 3: Input your User ID, password, and Captcha code, then click ‘Login’ to log in to your account.

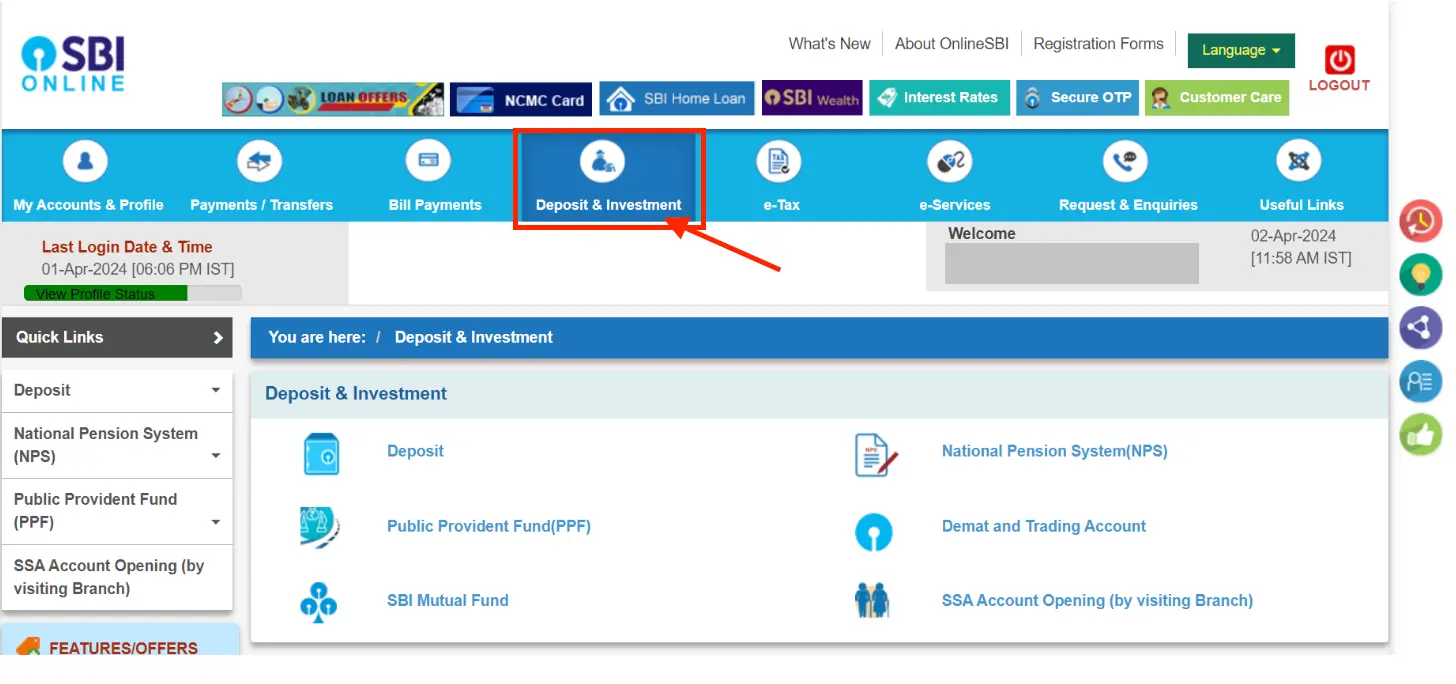

Steps to Open SBI Account Through Net Banking

To open an SBI account online (Fixed Deposit, Recurring Deposit, NPS, PPF, Demat, and SSA), follow these steps on the SBI net banking website:

Step 1. Go to the SBI Online website and click on ‘Login’.

Step 2. Enter your username, password, and Captcha code, then click ‘Login’.

Step 3. Click on the ‘Deposit & Investment’ tab.

Step 4. Choose the account you want to open, fill in the details, and click ‘Submit’.

Step 5. After submitting the form, visit an SBI branch to provide the required KYC documents.

A representative from SBI will process your account opening application and verify your documents. Once successfully verified, your bank account will be activated. This process may take around 3-5 business days.

Steps to Reset SBI Net Banking Password

You have the option to visit the bank branch and reset your password, or you can do it online on the SBI portal by providing your profile password or ATM card details. To reset your SBI Net banking password, there are three methods available:

- Visit the bank branch

- Use the profile password

- Use details of ATM card

Here are the steps to reset your SBI Netbanking password online:

Step 1:Go to the SBI Online website

Step 2:Click on ‘Login’ under the ‘Personal Banking’ section.

Step 3:Click on the ‘Continue to Login’ button.

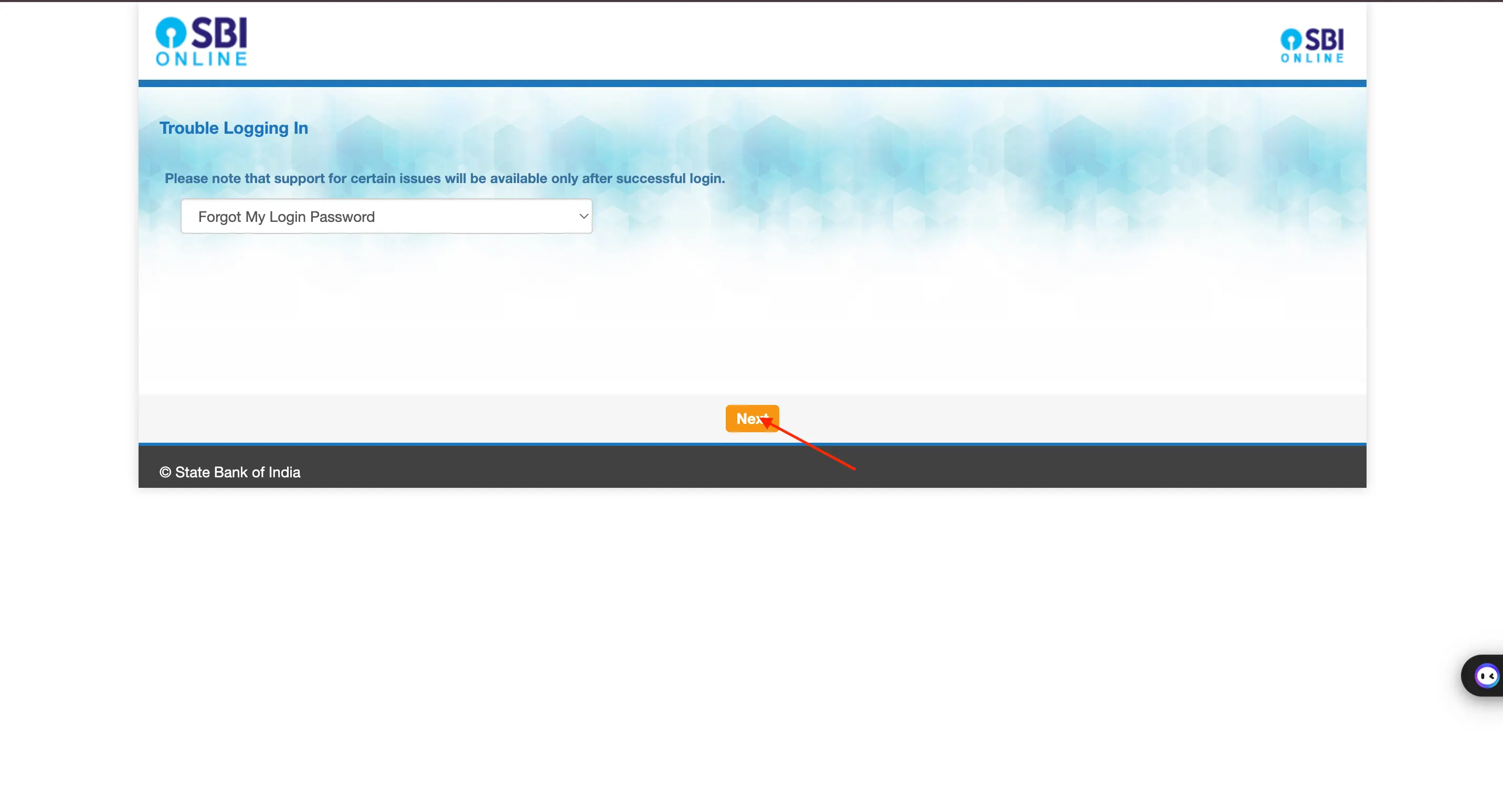

Step 4:On the login screen, click ‘Forgot Username/ Login Password’.

Step 5:A pop-up window will appear with a dropdown menu. Select the ‘Forgot My Login Password’ option and click ‘Next’.

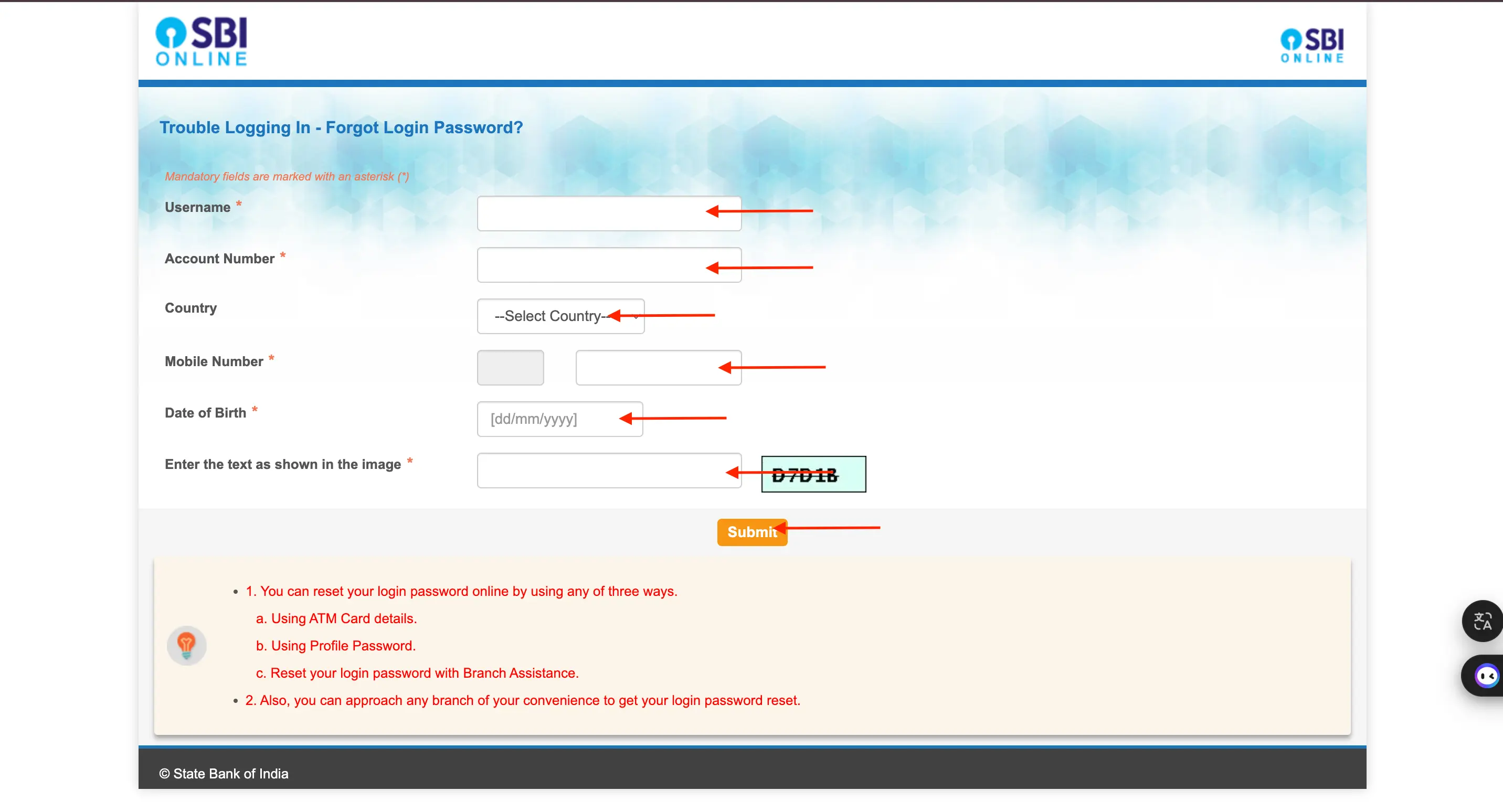

Step 6:Provide details such as username, account number, date of birth, mobile number, country, and captcha code in the following screen and click ‘Submit’.

Step 7:An OTP will be sent to your registered mobile number. Enter this OTP on the screen and click ‘Confirm’.

Step 8:You will be redirected to a page where you can reset the password. Select either ‘Using ATM Card Details’ or ‘Using Profile Password’ option and click ‘Submit’.

Step 9:Enter the required details, i.e. either your ATM card details or profile password, on the next screen and click ‘Confirm’.

Step 10: You will receive a reference number along with a link to return to the retail portal. Click on the link.

Step 11: Enter the new password and click ‘Submit’. You can now log in to SBI Netbanking using the new password.

Do you need an Emergency loan?

Check Balance Through SBI Net Banking

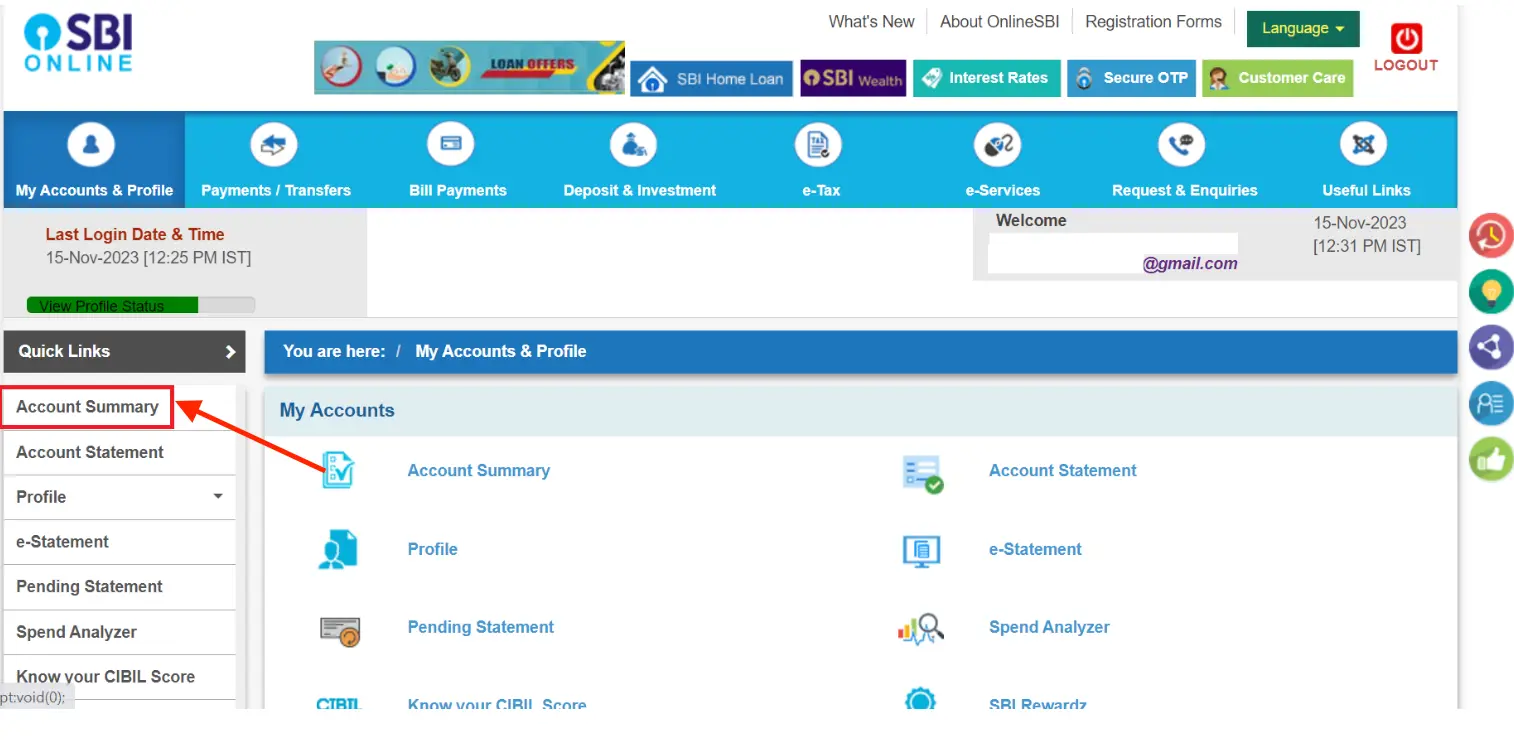

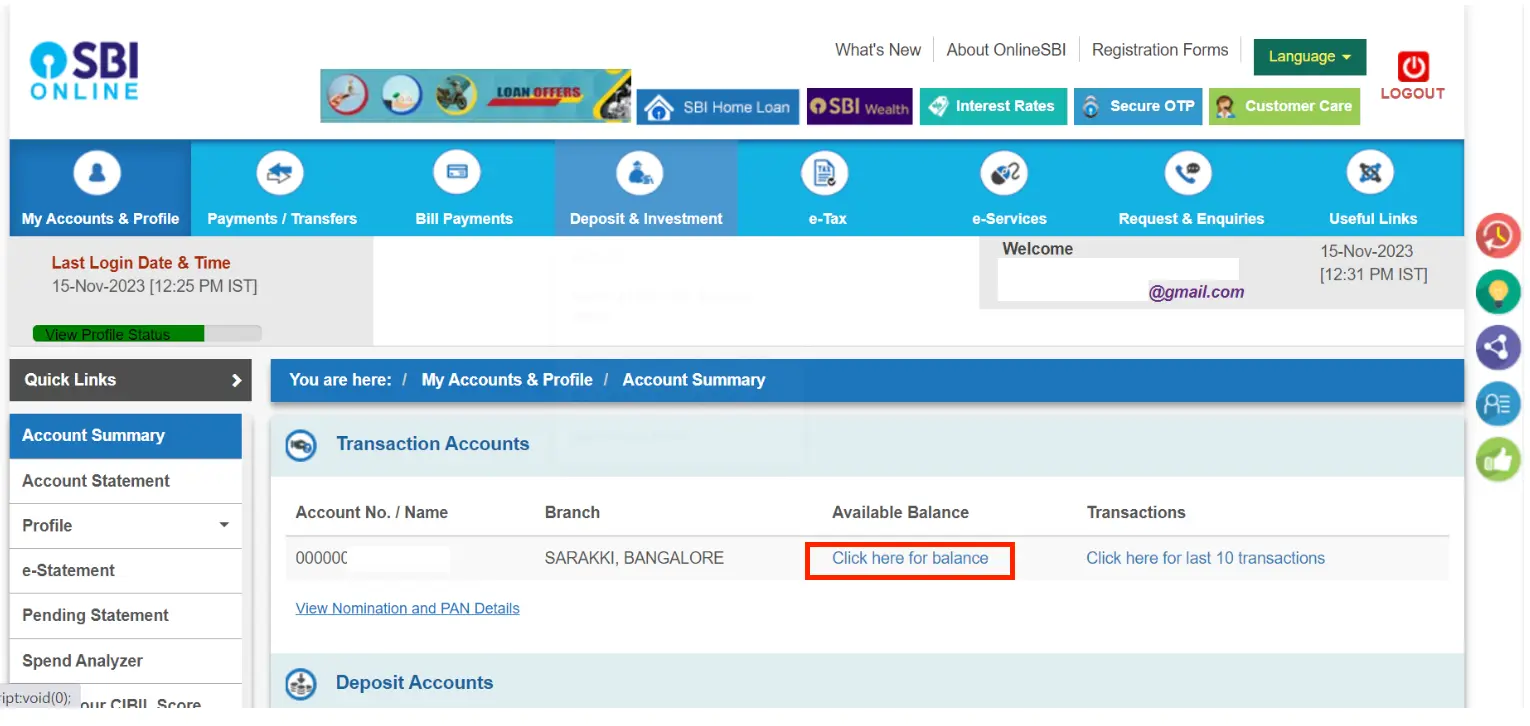

Step 1: Go to the SBI Online website and select the ‘Login’ option.

Step 2: Input your username, password, and Captcha code, then click ‘Login’.

Step 3: Once the homepage appears, choose the ‘Account Summary’ option from the ‘Quick Links’ section.

Step 4: On the following page, click on ‘Click here for balance’ to view your balance.

Step 5: Your account balance will be displayed.

Steps to Transfer Money through SBI Net Banking

Before initiating an online money transfer, ensure that the recipient is added as a beneficiary to your net banking account.

Adding Beneficiaries for SBI Net Banking

Follow the steps below to add a beneficiary on the SBI net banking portal:

- Step 1. Log in to the SBI net banking portal using your credentials.

- Step 2. Navigate to ‘Payment/Transfer’ and select ‘Add and Manage Beneficiary’.

- Step 3. Enter the profile password and click ‘Submit’ to add a beneficiary.

- Step 4. Choose the type of beneficiary you want to add.

- Step 5. Enter the required details such as beneficiary's name, account number, transfer limit, address, and Indian Financial System Code (IFSC), then click ‘Submit’.

- Step 6. After submitting, it will take some time to activate the beneficiary account. Once activated, you can transfer money to the beneficiary.

Transfer of Funds to Another SBI Account Holder

Follow these steps to transfer funds to another SBI account holder:

- Step 1. Log in to the SBI net banking portal.

- Step 2. Go to the ‘Payments/Transfer’ section and select ‘Accounts of Others’ to transfer funds to a beneficiary with an SBI account.

- Step 3. Choose the transaction type and click ‘Proceed’.

- Step 4. Select the account for fund transfer.

- Step 5. Enter the transfer amount.

- Step 6. Select the purpose of the fund transfer and the beneficiary account.

- Step 7. Click ‘Pay Now’ to transfer money or choose ‘Standing Instruction’ to provide specific transfer instructions.

- Step 8. Agree to the terms and conditions by checking the checkbox.

- Step 9. Click ‘Submit’.

- Step 10 Review the entered details on the new page.

- Step 11 Click ‘Confirm’.

- Step 12 A high-security password will be sent to your registered mobile number. Enter the password and click ‘Confirm’.

- Step 13 A confirmation message will be displayed on the screen once the transfer is complete.

Not sure of your credit score? Check it out for free now!

SBI Net Banking Transaction Limits & Charges

The table below shows the daily limits for various types of transactions that can be carried out using SBI net banking:

| Transactions | Limit Per Day |

|---|---|

| Transfer within Self Accounts | Rs. 2,00,00,000 |

| Fixed/Recurring Deposit | Rs. 99,99,999 |

| Third-Party Transfer within SBI | Rs. 10,00,000 |

| Interbank Transfer - NEFT and RTGS | Rs. 10,00,000 |

| IMPS | Rs. 5,00,000 |

| Quick Transfer | Rs. 50,000 |

| Credit Card VISA Transfer | Rs. 1,00,000 |

| mCash | Rs. 2,202 |

| UPI | Rs. 1,00,000 |

| QR Cash Withdrawal | Rs. 4,000 |

| YONO Cash | Rs. 20,000 |

| Mobile Top Up, SBI Prepaid Cards Payment, DTH Recharge, Postpaid Bill Payment and SBI Life Premium | ₹50,000 |

Read More

Read Less

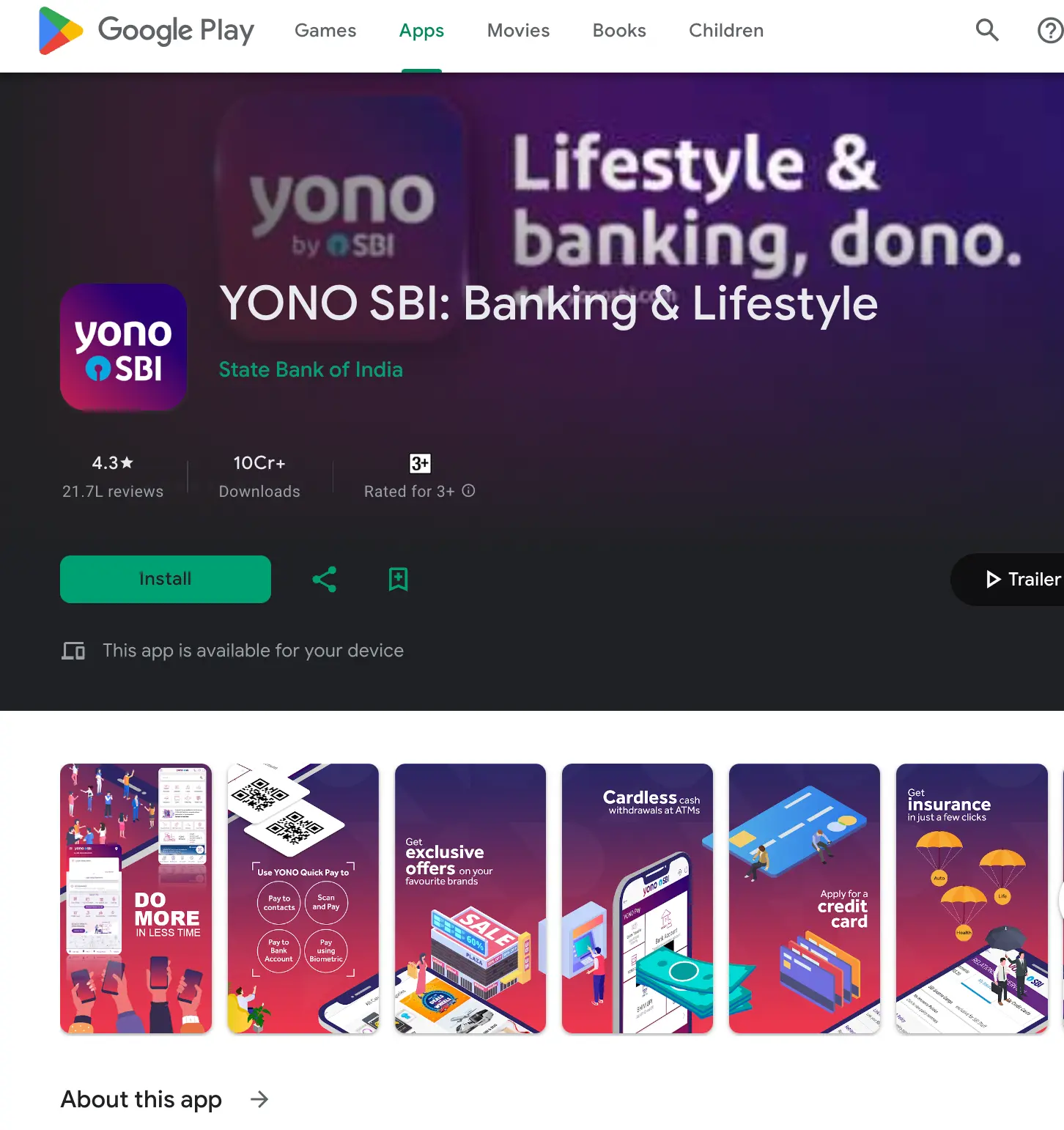

SBI Net Banking Mobile App

SBI Net Banking functionality has transitioned to their mobile app called YONO SBI. It offers all the features of traditional net banking with the added convenience of mobile access.

YONO SBI is a comprehensive mobile banking and lifestyle app developed by SBI. It combines the functionalities of SBI Net Banking with additional features for managing your daily life. You can download the YONO SBI app from the Google Play Store or Apple App Store. Existing SBI Net Banking users can log in with their existing credentials. New users can register within the app using their account details and ATM card.

SBI YONO Key Features:

- Manage Accounts: View account balances, transaction history, and statements.

- Fund Transfers: Send and receive money between SBI accounts and other banks (using NEFT, IMPS, or UPI).

- Bill Payments: Pay utility bills, recharge mobile/DTH, and make online payments.

- Investments: Invest in Mutual Funds, Fixed Deposits, Recurring Deposits, and more.

- Tax Management: Pay taxes, e-verify income tax returns, and access tax documents.

- Lifestyle Services: Book movie tickets, travel tickets, and avail shopping offers.

- Additional Features: Update KYC details, set up standing instructions, locate ATMs, and contact customer support.

Block Lost SBI ATM Card through Net Banking

To block the ATM card through Net Banking, the account holder should follow these steps:

- Step 1: Log in and select e-services

- Step 2: Choose ATM Card Services

- Step 3: Click on Block ATM Card

Change SBI ATM PIN via Net Banking

Here are the steps to change your ATM PIN via net banking:

- Step 1: Log in to the SBI net banking portal.

- Step 2: Go to the 'ATM Card Services' section.

- Step 3: Select the 'ATM PIN Generation' option.

- Step 4: You will receive an OTP on your registered mobile number.

- Step 5. Use the OTP to verify your identity and change the ATM PIN.

SBI Net Banking Customer Care Number

With SBI net banking, customers can easily perform various banking activities such as fund transfers, checking account balances, and making bill payments. You can reach out to SBI Customer Care by dialing the following toll-free helpline numbers:

- 18001234

- 18002100

- 1800112211

- 18004253800

- 08026599990

Check other pages related to SBI Bank from below:

Apply For a Personal Loan with Low Interest Rates rates

- SBI SME Loan

- SBI Mudra Loan

- SBI Commercial Vehicle Loan

- Documents Required for SBI Business Loans

- SBI Business Loan Eligibility

- SBI Corporate Loan

- SBI e Mudra PM Svanidhi Loan

- SBI MSME Loan

- SBI Working Capital

- SBI Business loan

- SBI Agriculture Loan

- SBI Small Business Loan

- SBI MSME Loan Eligibility

- SBI Commercial Loan

- SBI Startup Loan

- SBI Stree Shakti Yojana Loan

- SBI Business Loan for Women

- SBI Business Loan for Women Eligibility

- SBI Credit Card Customer Care Number

- SBI Credit Card

- SBI Simply Click Credit Card

- SBI Elite Credit Card

- SBI Prime Credit Card

- SBI Credit Card Reward Points

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users