A credit score is a number that is a number that shows how likely you are to repay loans on time. A credit report is a detailed record of your credit history which includes details of your payments, loans, credit cards, debts, etc.

In short, a credit report gives a full picture of your credit activity whereas a credit score helps analyze your eligibility for various financial products.

Now that you have an idea of what each of them is, let’s understand their importance, and the steps to check your credit score online and access a free credit report.

A credit report lets you check your financial history for accuracy and fraud. A credit score shows how likely you are to repay debt, helping you make better financial choices.

Table of Contents:

Difference Between Credit Score & Credit Report

The table below shows the key differences between credit score and credit report:

| Category | Credit Score | Credit Report |

|---|---|---|

| Definition | 3-digit number that represents the creditworthiness | Detailed record of your credit history |

| Purpose | Allows lenders to quickly assess your credit risk | Allows lenders to assess overall credit behavior |

| Range/Value | Ranges from 300-900 | No numerical value, just a history of credit activity |

| Updates | Regular based on credit activities | Updated as per credit activities occur |

Not sure of your credit score? Check it out for free now!

Importance of Credit Reports & Credit Scores

To effectively manage your finances, it is important to have a good track record of your credit score and credit report.

Here is how both credit scores and credit reports are important in your financial life:

- They serve as important tools that can help you make informed financial decisions.

- They help improve the chances of getting approved for personal loans and credit cards.

- They help access low interest rates and premium benefits.

- They promote financial responsibility and increase the quality of their lifestyle.

Suggested Read: CIBIL Score

Steps to Check Your Credit Score & Report for Free

For a free credit score check and credit report check, here are the steps to follow:

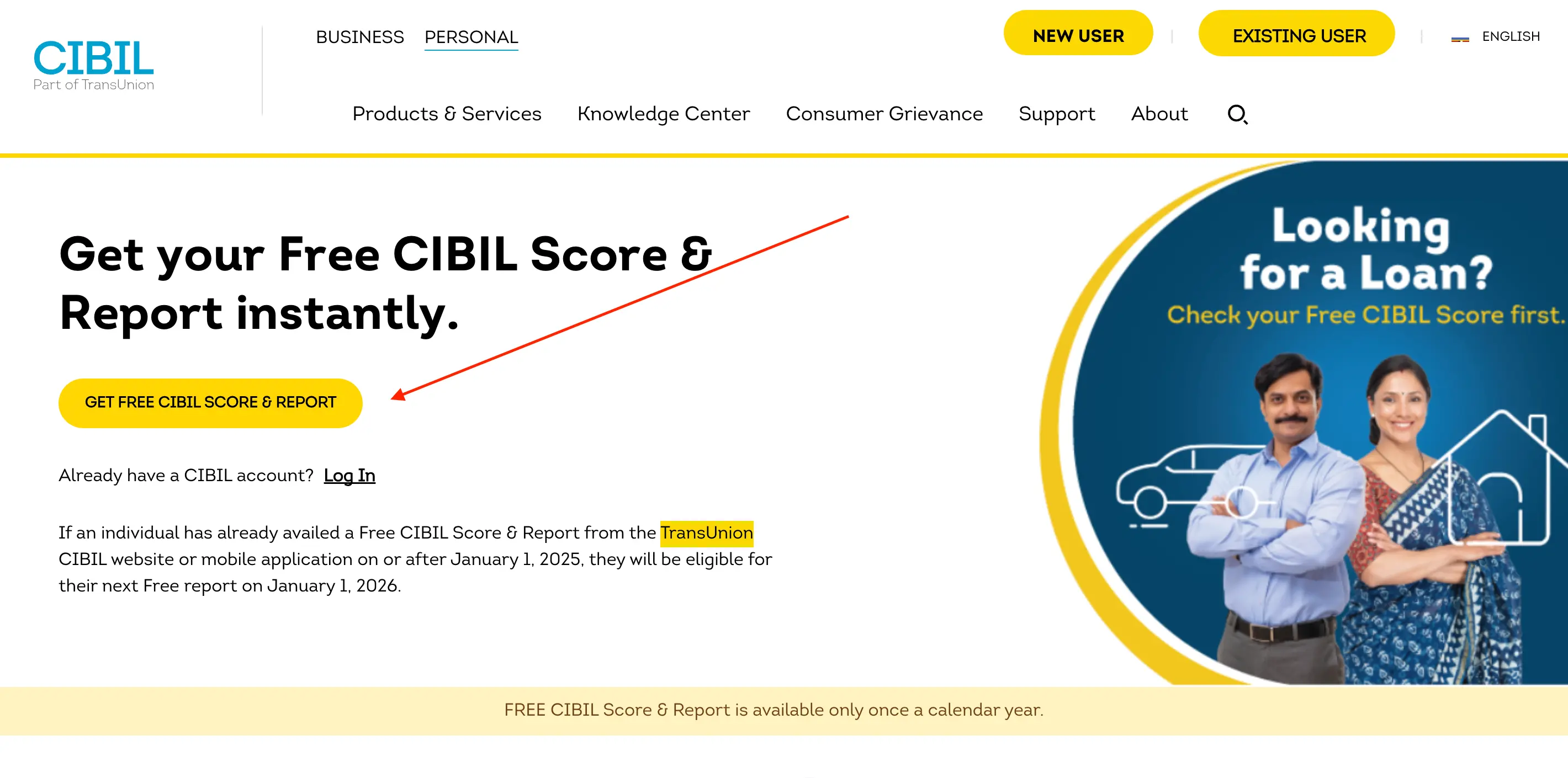

- Visit the official website of TransUnion CIBIL.

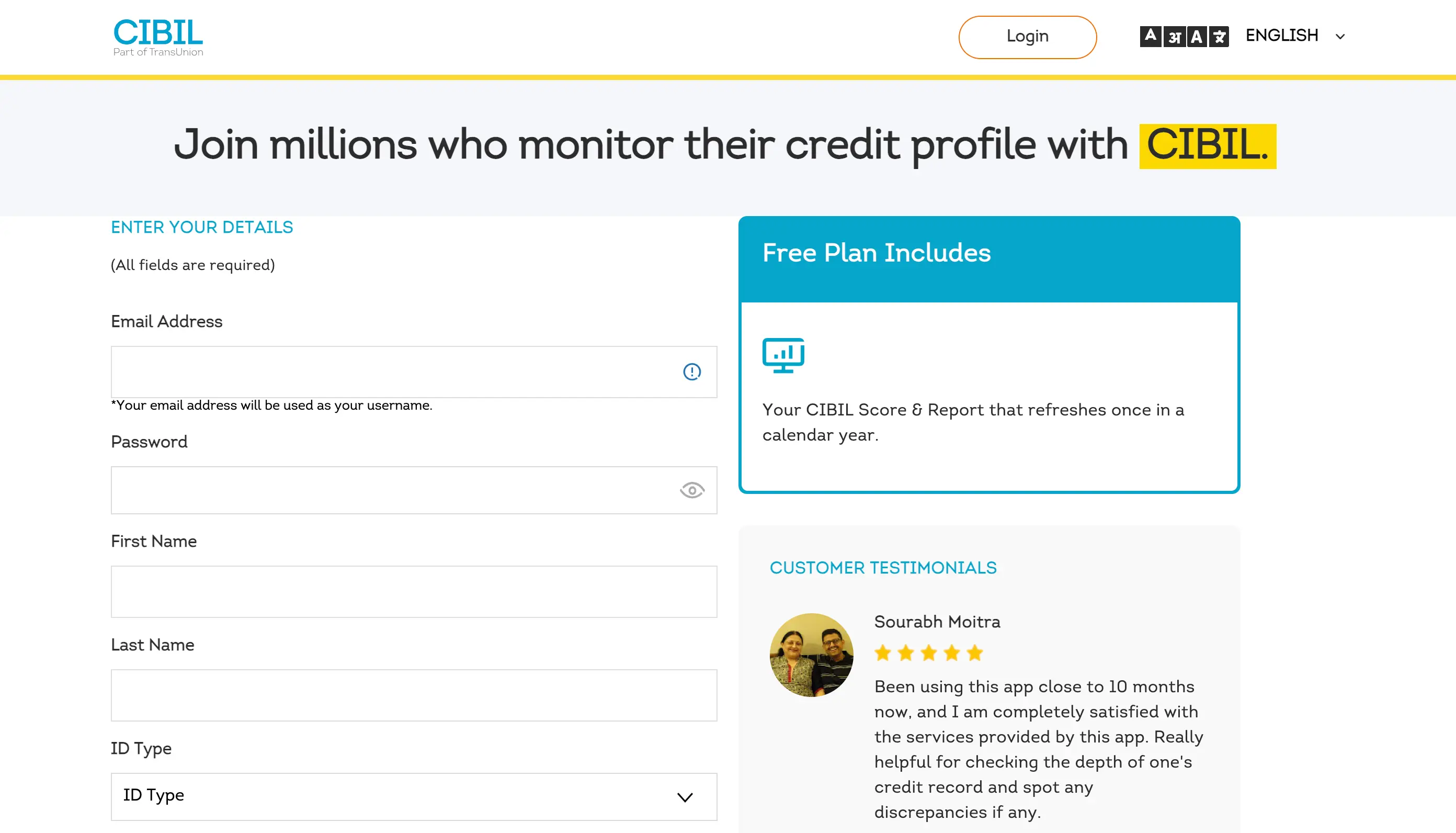

- Click on ‘Get Free CIBIL Score and Report’ and fill in the application form with your personal information.

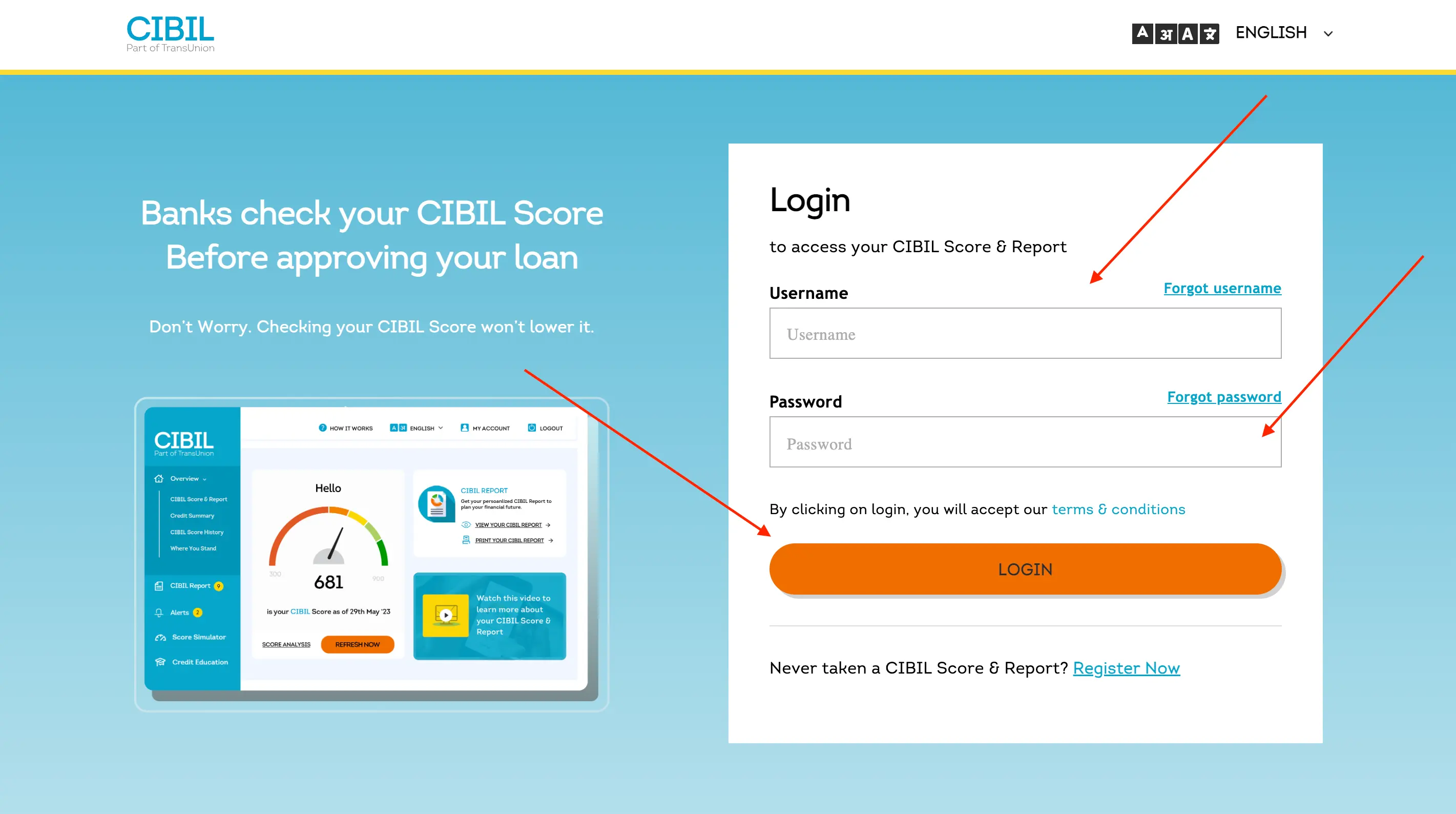

- If you already have a CIBIL account, click on the ‘Log In’ from the homepage.

- Enter your username and password.

- Click on ‘Login.’

Note that as per RBI guidelines, you will have access to one free CIBIL Score and Report every calendar year from the CIBIL website or app.

Credit Score & Reports from Different Credit Bureaus

There are various Credit Bureaus in India, such as Equifax, TransUnion CIBIL, and Experian. Although they generate accurate credit reports, sometimes there can be certain minor errors due to the data used by the bureau. These can look like incorrect balances, incorrect account details, etc.

Here are the various steps you can follow to fix these errors in your credit score and report by TransUnion CIBIL.

- Visit the official website of CIBIL.

- Login to your CIBIL account.

- Refresh your CIBIL Score and Report to view an updated report.

- Fill out the ‘Dispute Request Form’ and add your bank account details.

You will receive the response via the respective bank or NBFC.

Get a quick loan at low interest rates!

- SBI Personal Loan

- HDFC Personal Loan

- Axis Personal Loan

- Bank of Baroda Personal Loan

- PNB Personal Loan

- Canara Bank Personal Loan

- ICICI Bank Personal Loan

- IDFC First Bank Personal Loan

- Indian Overseas Bank Personal Loan

- IDBI Bank Personal Loan

- Citi Bank Personal Loan

- Bank of India Personal Loan

- Federal Bank Personal Loan

- UCO Bank Personal Loan

- Union Bank of India Personal Loan

- Yes Bank Personal Loan

- Central Bank of India Personal Loan

- Induslnd Bank Ltd Personal Loan

- Indian Bank Personal Loan

- RBL Bank Personal Loan

- Bandhan Bank Personal Loan

- J&K Bank Personal Loan

- Karnataka Bank Personal Loan

- Karur Vysya Bank Personal Loan

- South Indian Bank Personal Loan

- HSBC Bank Personal Loan

- Bank of Maharashtra Personal Loan

- Punjab and Sind Bank Personal Loan

- Dhanlakshmi Bank Loan

- Ujjivan Small Finance Bank Personal Loan

- SBI Personal Loan for Low Salary

- SBI Personal Loan ₹15000 Salary

- SBI Personal Loan ₹25000 Salary

- Paysense Personal Loan

- Fibe Personal Loan

- Incred Personal Loan

- Mpokket Personal Loan

- NIRA Personal Loan

- Prefr Personal Loan

- Cashe Personal Loan

- Loanbaba Personal Loan

- Pocketly Loan

- MoneyTap Personal Loan

- Zype Personal Loan

- TATA Capital Personal Loan

- Muthoot Finance Personal Loan

- Bajaj Finance Personal Loan

- Dhani Personal Loan

- L&T Finance Personal Loan

- Upwards Personal Loan

- LoanTap Personal Loan

- Phocket Personal Loan

- Faircent Personal Loan

- HDB Personal Loan

- Finnable Loan

- Aditya Birla Personal Loan

- IndiaLends Personal Loan

- IIFL Personal Loan

- Sriram Finance Personal Loan

- Stashfin Loan

- Reliance Personal Loan

- MyMoneyMantra Personal Loan

- Credy Loan

- Piramal Finance Personal Loan

- Poonawala Fincorp Personal Loan

- Flipkart Personal Loan

- Google Pay Loan

- Paytm Personal Loan

- Phonepe Loan

- Mobikwik Loan

- NBFC Personal Loan

- Rapid Rupee Personal Loan

- Rupeek Personal Loan

- Moneyview Personal Loan

- Personal Loan For Salaried

- Personal Loan for Self Employed

- Personal Loan for Startups

- Personal Loan for Government Employees

- Personal Loan for Professionals

- Personal Loan For Women

- Personal Loan For Lawyers

- Personal Loan for Doctors

- Personal Loan for Students

- Personal Loan for Teachers

- Loans for Chartered Accountants

- Loan for Housewives

- Loans for Widows

- Loans for Taxi Drivers

- Loans for Graduates

- Personal Loan for Low Cibil Score

- Types of Personal Loan

- Emergency Loan

- Insta Loan

- Top Up Loan

- Long Term Personal Loans

- Short Term Personal Loans

- Personal Loan on Aadhaar Card

- Personal Loan Hyderabad

- Personal Loan in Mumbai

- Personal Loan in Bangalore

- Personal Loan in Erode

- Personal Loan in Chennai

- Personal Loan in Delhi

- Personal Loan in Kolkata

- Personal Loan in Pune

- Personal Loan in Lucknow

- Personal Loan in Ahmedabad

- Personal Loan in Chandigarh

- Personal Loan in Navi Mumbai

- Personal Loan in Bhopal

- Personal Loan in Jaipur

- Personal Loan in Trivandrum

- Personal Loan in Noida

- Personal Loan in Gurgaon

- Personal Loan in Vadodara

- Personal Loan in Rajkot

- Personal Loan in Agra

- Personal Loan in Mysore

- Personal Loan in Dehradun

- Personal Loan in Patna

- Personal Loan in Ludhiana

- Personal Loan in Ghaziabad

- Personal Loan in Goa

- Personal Loan in Kochi

- Personal Loan in Ernakulam

- Personal Loan in Calicut

- Personal Loan in Udaipur

- Personal Loan in Kanpur

- Personal Loan in Coimbatore

- Personal Loan in Guwahati

- Personal Loan in Varanasi

- Personal Loan in Bhubaneswar

- Personal Loan in Pondicherry

- Personal Loan in Mangalore

- Personal Loan in Vellore

- Personal Loan in Surat

- Personal Loan in Thrissur

- Personal Loan in Raipur

- Personal Loan in Trichy

- Personal Loan in Visakhapatnam

- Personal Loan in Nagpur

- Personal Loan in Indore

- Personal Loan in Nashik

- Personal Loan in Vijayawada

- Personal Loan in Amritsar

- Personal Loan in Thane

- Personal Loan in Jamshedpur

- ₹50000 Personal Loan

- ₹1 Lakh Personal Loan

- ₹3 Lakh Personal Loan

- ₹5 Lakh Personal Loan

- ₹10 Lakh Personal Loan

- 15 Lakhs Personal Loan

- 20 Lakhs Personal loan

- 30 Lakh Personal Loan

- 50 Lakhs Personal Loan

- ₹4000 Personal Loan

- ₹5000 Personal Loan

- ₹10000 Personal Loan

- ₹20000 Personal Loan

- ₹25000 Personal Loan

- ₹30000 Personal Loan

- ₹40000 Personal Loan

- SBI Personal Loan Customer Care Number

- HDFC Bank Personal Loan Customer Care Number

- ICICI Bank Personal Loan Customer Care Number

- Bank of Baroda Personal Loan Customer Care Number

- PNB Personal Loan Customer Care Number

- Axis Bank Personal Loan Customer Care Number

- Canara Bank Personal Loan Customer Care Number

- IndusInd Bank Personal Loan Customer Care Number

- IDFC Bank Personal Loan Customer Care Number

- Indian Bank Personal Loan Customer Care Number

- Union Bank Personal Loan Customer Care Number

- Yes Bank Personal Loan Customer Care Number

- Indian Overseas Bank Personal Loan Customer Care Number

- IDBI Bank Personal Loan Customer Care Number

- Bank of India Personal Loan Customer Care Number

- Central Bank of India Personal Loan Customer Care Number

- Federal Bank Personal Loan Customer Care Number

- Standard Chartered Personal Loan Customer Care Number

- UCO Bank Personal Loan Customer Care Number

- Bandhan Bank Personal Loan Customer Care Number

- RBL Bank Personal Loan Customer Care Number

- Small Business Loan

- Business Loans for Women

- Startup Business Loans

- Working Capital Loan

- Unsecured Business Loan

- Cash Credit Loan

- Commercial Loans

- Commercial Vehicle Loans

- Equipment Loans

- Medical Equipment Loan

- Construction Equipment Loan

- Equipment Leasing Loan

- Corporate Loan

- Collateral Free Loans

- Business Loan for Startup

- Types of Business Loan

- Loans for Restaurants

- Loans for Private Schools

- Loans for Defence Personnel

- Loans for Construction

- Loans for Commercial Shop Purchases

- Loans for Chartered Accountants

- Loans for Buying Land

- Loan for Beauty Parlour

- Loan for Warehouse

- Cold Storage Loan

- Dairy Farm Loan

- E-Commerce Loans

- Animal Husbandry Loan

- Loan for Medical Shop

- Loan for Dental Clinic

- SBI business loan

- HDFC Bank business loan

- Axis Bank business loan

- Bank of Baroda business loan

- PNB business loan

- Canara Bank business loan

- ICICI Bank business loan

- IDFC Bank business loan

- IOB business loan

- IDBI Bank business loan

- Bank of India business loan

- Federal Bank business loan

- UCO Bank business loan

- Union Bank business loan

- Yes Bank business loan

- Central Bank of India business loan

- IndusInd business loan

- Indian Bank business loan

- RBL Bank business loan

- Bandhan Bank business loan

- mCapital Business Loan

- Ambit Finvest Business Loan

- InCred Business Loan

- TATA Capital Business Loan

- Protium Business Loan

- IIFL Business Loan

- Aditya Birla Business Loan

- IndiaLends Business Loan

- InCred Business Loan

- Mahindra Finance Business Loan

- Indifi Business Loan

- NeoGrowth Business Loan

- Bajaj Finserv Business Loan

- HDB Business Loan

- UGRO Business Loan

- Hero FinCorp Business Loan

- Shriram Finance Business Loan

- Credit Card Lounge Access

- Close Credit Card

- Credit Card Advantages and Disadvantages

- Transfer Money from Credit Card to Bank Account

- Loan on Credit Card

- Best Credit Cards for Low CIBIL Score

- Credit Cards to Improve Credit Score

- One Card

- Green PIN

- Bajaj Insta EMI Cards

- Credit Card Application Status Check

- CIBIL Score for Credit Card

- Increase CIBIL Score without Credit Card

- Kisan Credit Card

- Travel Credit Cards

- Credit Cards Without Annual Fee

- RuPay Credit Card

- West Bengal Student Credit Card

- Student Credit Card

- Student Credit Card Bihar

- Best Fuel Credit Cards

- Best Cashback Credit Cards India

- Credit Card Against Fixed Deposit

- International Airport Lounge Access Credit Card

- HDFC RuPay Credit Card

- Best Premium Credit Cards In India

- Lifetime Free Credit Card Without Income Proof

- SBI Simply Click Credit Card

- SBI Elite Credit Card

- SBI Prime Credit Card

- SBI Credit Card Reward Points

- HDFC Biz Black Credit Card

- HDFC Credit Card Net Banking

- How to Close HDFC Credit Card

- HDFC Tata Neu Plus Credit Card

- HDFC Tata Neu Infinity Credit Card

- HDFC Infinia Credit Card

- HDFC Freedom Credit Card

- HDFC Moneyback Credit Card

- HDFC Diners Club Credit Card

- HDFC Regalia Gold Credit Card

- Paytm HDFC Credit Card

- HDFC Credit Card PIN Generation

- HDFC Credit Card Statement

- HDFC Credit Card Payment

- Swiggy HDFC Credit Card

- HDFC Credit Card Application Status

- HDFC Millennia Debit Card

- HDFC Bank Credit Card Offers

- Kisan Credit Card

- Kisan Credit Card Application Status

- Kisan Credit Card Interest Rates

- Indian Overseas Bank Credit Card Customer Care Number

- SBI Credit Card Customer Care Number

- ICICI Bank Credit Card Customer Care Number

- Credit Card Customer Care Number

- Central Bank of India Credit Card Customer Care Number

- Union Bank Credit Card Customer Care Number

- Yes Bank Credit Card Customer Care Number

- Bank of India Credit Card Customer Care Number

- Federal Bank Credit Card Customer Care Number

- Canara Bank Credit Card Customer Care Number

- Kotak Mahindra Bank Credit Card Customer Care Number

- Indian Bank Credit Card Customer Care Number

- Induslnd Bank Credit Card Customer Care Number

- Bandhan Bank Credit Card Customer Care Number

- HDFC Credit Card Customer Care Bangalore

- HDFC Credit Card Customer Care Hyderabad

- ICICI Credit Card Customer Care Bangalore

- ICICI Credit Card Customer Care Hyderabad

- HDFC Credit Card Customer Care Number Chennai

- Kotak Mahindra Bank Credit Card Customer Care Pune

- Standard Chartered Credit Card Customer Care Number

- UCO Bank Credit Card Customer Care Number

- Karnataka Bank Credit Card Customer Care Number

- HDFC Bank Credit Card Customer Care Number

- Axis Bank Credit Card Customer Care Number

- PNB Credit Card Customer Care Number

- Bank of Baroda Credit Card Customer Care Number

- IDFC First Bank Credit Card Customer Care Number

- IndusInd Bank Credit Card Customer Care Number

- IDBI Bank Credit Card Customer Care Number

- RBL Bank Personal Loan Customer Care Number

Frequently Asked Questions

A credit report is a record of your credit history, including loans and payments. A credit score is a number based on your report that shows your creditworthiness.

Yes, your credit report affects your credit score because the score is based on the information in your report, like payments and debt. Mistakes or negative marks can lower your score.

You should check your credit report at least once a year to spot errors or fraud and your credit score more often to track changes. Many experts recommend checking both before major financial decisions, like applying for a loan.

Your credit score is influenced by payment history, debt levels, credit history length, new credit inquiries, and credit mix. Your credit report records these details, along with account statuses and any public records like bankruptcies.

Yes, credit inquiries appear on your credit report and can affect your credit score. Hard inquiries or too many credit applications can lower your score slightly, while soft inquiries, like checking your score, do not impact it.

Yes, you can dispute errors on your credit report by contacting the credit bureau that issued it. If the error is confirmed, the bureau must correct or remove it.

You can improve your credit score and credit report via timely repayments, reduced debt, keeping old accounts, and avoiding too many new credit applications. Also, check your report for mistakes and fix them.

Display of trademarks, trade names, logos, and other subject matters of Intellectual Property displayed on this website belongs to their respective intellectual property owners & is not owned by Bvalue Services Pvt. Ltd. Display of such Intellectual Property and related product information does not imply Bvalue Services Pvt. Ltd company’s partnership with the owner of the Intellectual Property or proprietor of such products.

Please read the Terms & Conditions carefully as deemed & proceed at your own discretion.

Rated 4.5 on Google Play

Rated 4.5 on Google Play 10M+ App Installs

10M+ App Installs 25M+ Applicants till date & growing

25M+ Applicants till date & growing 150K+ Daily Active Users

150K+ Daily Active Users